Consolidated Water Co. Ltd. (NASDAQ: CWCO), which develops and

operates seawater desalination plants and water distribution

systems in areas of the world where naturally occurring supplies of

potable water are scarce or nonexistent, today reported its

operating results for the year ended December 31, 2011. The Company

will host an investor conference call tomorrow -- Friday, March 16,

2012 -- at 11:00 a.m. EDT (see details below).

Total revenues for the year ended December 31, 2011 increased 9%

to approximately $55.2 million, compared with approximately $50.7

million for the year ended December 31, 2010.

Retail water revenues rose 7% to approximately $23.4 million

(42% of total revenues) in 2011, versus approximately $21.9 million

(43% of total revenues) in the previous year, reflecting a 2%

increase in base rates due to an upward movement in the consumer

price indices used to determine such rate adjustments, and higher

energy price pass-through charges, partially offset by a 3% decline

in the number of gallons of water sold by the retail segment. The

decline in gallons sold during 2011 was due to the absence of water

sales made in the first quarter of 2010 at bulk water rates to the

Water Authority-Cayman ("WAC") to replace water previously supplied

by the Red Gate plant while such plant was under refurbishment.

Excluding this water sold to the WAC, the number of gallons of

water sold by the retail segment increased by approximately 3% from

2010 to 2011.

Bulk water revenues increased 22% to approximately $30.8 million

(56% of total revenues) in 2011, compared with $25.3 million (50%

of total revenues) in 2010, reflecting a 6% increase in the number

of gallons of water sold and energy pass-through charges due to

higher energy prices. Bulk revenues in 2011 benefited from $770,000

in revenues generated in the fourth quarter from the expansion of

CW-Bahamas' Blue Hills plant.

Services revenues declined 71% to approximately $1.0 million in

2011, compared with approximately $3.5 million in 2010, reflecting

substantially lower plant sales revenues due to a lack of plant

construction activity for third parties, the expiration of the

management services contract for the Bermuda plant on June 30,

2011, and lower fees earned on the Company's management agreement

with OC-BVI (the Company's equity investment affiliate) due to the

incremental fees earned on the higher earnings generated by this

affiliate in 2010.

Net income attributable to stockholders declined 3% to

$6,113,218, or $0.42 per diluted share, for the year ended December

31, 2011, compared with net income of $6,292,025, or $0.43 per

diluted share, for the year ended December 31, 2010. A modest

increase in operating income during 2011 was more than offset by a

reduction in OC-BVI's earnings. During the year ended December 31,

2011, the Company recognized earnings on its investment in OC-BVI

of $838,652, compared with $1,235,146 in 2010.

Consolidated gross profit rose 15% to approximately $19.0

million (34% of total revenues) in 2011, versus approximately $16.6

million (33% of total revenues) in 2010. Gross profit on retail

revenues improved 3% to approximately $11.9 million (51% of

revenues) in the most recent year, compared with approximately

$11.5 million (53% of revenues) for the year ended December 31,

2010. The slight decline in retail gross profit as a percentage of

retail revenues reflected the increase in energy pass-through

charges and higher non-revenue water volumes during 2011. Gross

profit on bulk revenues increased to approximately $6.6 million

(22% of revenues) in 2011, from approximately $4.4 million (17% of

revenues) in the prior year, primarily due to improved operating

efficiencies and the increase in bulk segment revenues. A

significant portion of the bulk segment's production costs are

relatively fixed in nature and do not increase proportionately with

an increase in the volume of water sold. The services segment

recorded a gross profit of approximately $0.5 million for the year

ended December 31, 2011, compared with a gross profit of

approximately $0.7 million in 2010. The lower gross profit for 2011

in the services segment stems primarily from the decrease in

revenues discussed above.

General and administrative expenses increased 21% to $13,651,650

in 2011, versus $11,329,648 in 2010, primarily due to (i)

approximately $1,286,000 of incremental expenses related to the

project development activities of the Company's consolidated Mexico

affiliate and (ii) approximately $1,045,000 in higher employee

costs due to additional management bonuses, higher stock-based

compensation, the hiring of additional personnel, and salary

increases.

Interest income decreased 13% to $1,200,999 for the year ended

December 31, 2011, versus $1,375,827 for the previous year.

Interest expense decreased 28.0% to $1,141,744 in 2011, from

$1,584,771 in 2010 as a result of $246,851 in interest capitalized

for the expansion of the Blue Hills plant and the prepayment on

September 30, 2010 of $1.5 million of our 7.5% bonds payable.

"We were pleased with our ability to achieve a level of net

income attributable to common stockholders comparable to that of

the prior year while incurring an incremental $1.3 million in

expenses for our Mexico joint venture and experiencing a 32%

decline in earnings from our OC-BVI affiliate," stated Rick

McTaggart, Chief Executive Officer of Consolidated Water Co. Ltd.

"The performance of our bulk water segment was particularly

gratifying given our recent efforts to improve these operations.

Margins in the Bahamas increased because of a strict cost-control

program, efficiency gains resulting from various operational

improvement programs that we have implemented over the past four

years and increased water production. In November, we commissioned

a 67% expansion in the capacity of our Blue Hills plant in Nassau.

This expansion contributed $770,000 to our revenue during the

fourth quarter of 2011, while allowing the island of New Providence

to eliminate its dependence upon the expensive barging of fresh

water from Andros Island. We expect the increased revenue resulting

from higher production at the Blue Hills plant to have a positive

impact upon the performance of our Bahamas subsidiary in 2012 and

future years."

"In our retail market on Grand Cayman Island, we continue to

produce and distribute water under the terms of our previous

license agreement, which, although it formally expired in July

2010, has been extended through June 30, 2012," noted Mr.

McTaggart. "While the government has not requested further retail

license negotiations since our last meeting in February 2011, we

believe the lack of recent license negotiations results from

government's focus on other matters, including the government's

publicly acknowledged intention to privatize certain

government-owned assets, including the Water Authority-Cayman.

Although we cannot state with any certainty when our retail license

negotiations will be completed, we are confident that our Company

and the Government can ultimately reach an agreement on terms

satisfactory to both parties."

"We strengthened our management team in September, in

anticipation of future growth opportunities, when John Tonner

joined our Company as Chief Operating Officer. John has acquired

extensive practical and engineering expertise involving all

commercially viable desalination processes during a career in the

industry that spans more than 25 years. His experience and

knowledge not only enhances our existing operations, but he

represents an extremely valuable addition to our new market

assessment capabilities."

"I am pleased to report that we have negotiated an agreement

with one of the other shareholders in our Mexican joint venture,

NSC Agua S.A. de C.V. ('NSC'), and we now control 75% of the shares

of NSC," continued Mr. McTaggart. "With the resolution of certain

internal NSC issues that delayed the project, we are again moving

forward with the development of a proposed 100 million US

gallon-per-day seawater desalination plant in Rosarito, Baja

California, Mexico. We are enthusiastic about this project and its

prospects for success given the growing need for water on both

sides of the US-Mexico border. Recent natural events, including the

earthquake in Mexicali in April 2010 and increasingly frequent

droughts on the Colorado River system, have highlighted the

fragility of existing water resources and heightened interest in

seawater desalination as a permanent solution to water problems in

the region."

"Looking forward, we have deployed full-time engineering and

management assets to Asia, where we are currently pursuing several

new projects in markets that have characteristics similar to our

traditional Caribbean market, including tourism-based economies,

stable political and economic environments and limited supplies of

potable water. We expect some of these projects to materialize soon

and hope to initiate business in Asia by the end of 2012,"

concluded Mr. McTaggart.

Investor Conference Call

The Company will host a conference call at

11:00 a.m. EDT tomorrow -- Friday, March 16, 2012. Shareholders and

other interested parties may participate in the conference call by

dialing 877-317-6789 (international/local

participants dial 412-317-6789) and requesting participation in the

"Consolidated Water Conference Call" a few minutes before 11:00

a.m. EDT on March 16, 2012. A replay of the conference call will be

available one hour after the call by dialing 877-344-7529

(international/local participants dial

412-317-0088) and entering the conference ID# 10011339, and on the

Company's website at www.cwco.com, through March 26, 2012.

CWCO-E

About Consolidated Water Co. Ltd.

Consolidated Water Co. Ltd. develops and operates seawater

desalination plants and water distribution systems in areas of the

world where naturally occurring supplies of potable water are

scarce or nonexistent. The Company operates water production and/or

distribution facilities in the Cayman Islands, Belize, the British

Virgin Islands and The Commonwealth of The Bahamas.

Consolidated Water Co. Ltd. is headquartered in George Town,

Grand Cayman, in the Cayman Islands. The Company's ordinary

(common) stock is traded on the NASDAQ Global Select Market under

the symbol "CWCO". Additional information on the Company is

available on its website at http://www.cwco.com.

This press release includes statements that may constitute

"forward-looking" statements, usually containing the words

"believe", "estimate", "project", "intend", "expect", "should" or

similar expressions. These statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements inherently involve risks and

uncertainties that could cause actual results to differ materially

from the forward-looking statements. Factors that would cause or

contribute to such differences include, but are not limited to,

continued acceptance of our products and services in the

marketplace, changes in our relationships with the Governments of

the jurisdictions in which it operates, the manner in which the

disputed issues between OC-BVI and the BVI Government are resolved,

the outcome of our negotiations with the Cayman Government

regarding a new retail license agreement, our ability to

successfully secure contracts for water projects, including the

project under development in Rosarito, Baja California, Mexico, our

ability to develop and operate such projects profitably, and our

ability to manage growth and other risks detailed in our periodic

report filings with the Securities and Exchange Commission("SEC").

The staff of the Division of Corporation Finance of the SEC (the

"Staff") has recently inquired through the comment letter process

as to what consideration we have given to recognizing an impairment

of our goodwill. We have responded to the Staff that we do not

believe our goodwill has been impaired and the Staff is considering

our position. For additional information regarding this matter, see

our Form 10-K filed with the SEC on March 15, 2012.

By making these forward-looking statements, the Company

undertakes no obligation to update these statements for revisions

or changes after the date of this release.

CONSOLIDATED WATER CO. LTD.

CONSOLIDATED BALANCE SHEETS

December 31,

-------------------------

2011 2010

------------ ------------

ASSETS

Current assets

Cash and cash equivalents $ 37,624,179 $ 46,130,237

Restricted cash 7,500,000 -

Marketable securities 8,496,372 -

Accounts receivable, net 8,537,232 12,132,730

Inventory 1,451,639 1,434,811

Prepaid expenses and other current assets 1,880,105 2,294,747

Current portion of loans receivable 1,843,600 1,733,799

------------ ------------

Total current assets 67,333,127 63,726,324

Property, plant and equipment, net 64,185,110 55,923,731

Construction in progress 141,204 249,300

Inventory, non-current 3,861,470 3,538,912

Loans receivable 10,758,873 12,602,419

Investment in OC-BVI 6,634,598 7,812,523

Intangible assets, net 1,501,824 1,710,737

Goodwill 3,587,754 3,587,754

Other assets 2,855,471 3,049,866

------------ ------------

Total assets $160,859,431 $152,201,566

============ ============

LIABILITIES AND EQUITY

Current liabilities

Accounts payable and other current liabilities $ 4,617,770 $ 4,316,125

Dividends payable 1,156,081 1,152,614

Current portion of long term debt 17,531,134 1,422,991

------------ ------------

Total current liabilities 23,304,985 6,891,730

Long term debt 6,852,660 16,883,794

Other liabilities 420,430 442,919

------------ ------------

Total liabilities 30,578,075 24,218,443

------------ ------------

Equity

Consolidated Water Co. Ltd. stockholders' equity

Redeemable preferred stock, $0.60 par value.

Authorized 200,000 shares; issued and

outstanding 22,427 and 16,784 shares,

respectively 13,456 10,070

Class A common stock, $0.60 par value.

Authorized 24,655,000 shares; issued and

outstanding 14,568,696 and 14,555,393 shares,

respectively 8,741,217 8,733,236

Class B common stock, $0.60 par value.

Authorized 145,000 shares; none issued or

outstanding - -

Additional paid-in capital 81,939,211 81,349,944

Retained earnings 38,030,943 36,289,706

------------ ------------

Total Consolidated Water Co. Ltd. stockholders'

equity 128,724,827 126,382,956

Non-controlling interests 1,556,529 1,600,167

------------ ------------

Total equity 130,281,356 127,983,123

------------ ------------

Total liabilities and equity $160,859,431 $152,201,566

============ ============

CONSOLIDATED WATER CO. LTD.

CONSOLIDATED STATEMENTS OF INCOME

Year Ended December 31,

----------------------------------------

2011 2010 2009

------------ ------------ ------------

Retail water revenues $ 23,356,338 $ 21,864,252 $ 23,239,756

Bulk water revenues 30,757,874 25,302,093 25,905,077

Services revenues 1,040,280 3,542,209 8,874,684

------------ ------------ ------------

Total revenues 55,154,492 50,708,554 58,019,517

------------ ------------ ------------

Cost of retail revenues 11,496,598 10,361,302 9,812,434

Cost of bulk revenues 24,127,488 20,907,981 20,149,969

Cost of services revenues 508,339 2,828,776 5,058,037

------------ ------------ ------------

Total cost of revenues 36,132,425 34,098,059 35,020,440

------------ ------------ ------------

Gross profit 19,022,067 16,610,495 22,999,077

General and administrative

expenses 13,651,650 11,329,648 10,101,257

------------ ------------ ------------

Income from operations 5,370,417 5,280,847 12,897,820

------------ ------------ ------------

Other income (expense):

Interest income 1,200,999 1,375,827 917,330

Interest expense (1,141,744) (1,584,771) (1,698,084)

Other income 283,656 136,113 168,584

Equity in earnings (loss) of

OC-BVI 838,652 1,235,146 (1,025,968)

Impairment of investment in

OC-BVI - - (4,660,000)

------------ ------------ ------------

Other income (expense), net 1,181,563 1,162,315 (6,298,138)

------------ ------------ ------------

Net income 6,551,980 6,443,162 6,599,682

Income attributable to non-

controlling interests 438,762 151,137 501,111

------------ ------------ ------------

Net income attributable to

Consolidated Water Co. Ltd.

stockholders $ 6,113,218 $ 6,292,025 $ 6,098,571

============ ============ ============

Basic earnings per common share

attributable to Consolidated

Water Co. Ltd. common

stockholders $ 0.42 $ 0.43 $ 0.42

============ ============ ============

Diluted earnings per common share

attributable to Consolidated

Water Co. Ltd. common

stockholders $ 0.42 $ 0.43 $ 0.42

============ ============ ============

Dividends declared per common

share $ 0.300 $ 0.300 $ 0.280

============ ============ ============

Weighted average number of common

shares used in the determination

of:

Basic earnings per share 14,560,259 14,547,065 14,535,192

============ ============ ============

Diluted earnings per share 14,596,013 14,597,894 14,588,144

============ ============ ============

For further information, please contact: Frederick W. McTaggart

President and CEO (345) 945-4277 David W. Sasnett Executive Vice

President and CFO (954) 509-8200 info@cwco.com or RJ Falkner &

Company, Inc. Investor Relations Counsel (800) 377-9893

info@rjfalkner.com

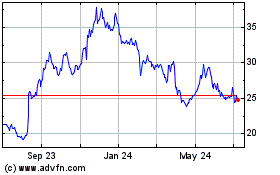

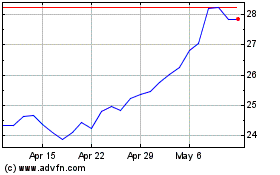

Consolidated Water (NASDAQ:CWCO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Consolidated Water (NASDAQ:CWCO)

Historical Stock Chart

From Jul 2023 to Jul 2024