Comstock Homebuilding Companies, Inc. (NASDAQ: CHCI) ("Comstock" or

the "Company") today announced net income for its third quarter

ended September 30, 2009 of $2.3 million or $.13 per share basic

and $.12 diluted on total revenue of $12.6 million compared to a

net loss of $2.2 million or $(.13) per share basic and diluted on

total revenue of $13.1 million for the three months ended September

30, 2008. For the nine months ended September 30, 2009, the Company

reported a net loss of $28.1 million or ($1.60) per share basic and

diluted on total revenue of $21.1 million, compared to a net loss

of $12.3 million or ($0.70) per share basic and diluted on total

revenue of $41.5 million for the nine months ended September 30,

2008. In connection therewith, the Company filed a Form 10-Q with

the Securities and Exchange Commission including its unaudited

results for the three and nine months ended September 30, 2009.

Additional highlights of the Company's 2009 third quarter

results and Form 10-Q filing are provided below:

Due to the extended nature of the economic conditions affecting

the home building industry the Company, in early 2009, formulated

and began implementing its Strategic Realignment Plan, a strategy

for eliminating debt and settling obligations of the Company with

the goal of refocusing the Company's operations on key projects in

its core market of Washington, DC and Raleigh, NC while reaching

amicable agreements with all of the Company's major creditors

before year end 2009 in order to position the Company for improved

operating results in 2010 and beyond.

As previously reported, and as detailed herein, the Company has

made significant progress in that regard. As of September 30, 2009

the company had successfully negotiated settlements with most of

its secured lenders regarding a majority of the loans guaranteed by

the Company and had reduced the outstanding balance of overall debt

from $102.8M at December 31, 2008 to $83.4M at September 30, 2009.

In most cases the Company was released from the obligations under

each subject loan in return for its agreement not to contest the

foreclosure of the real estate assets that it wished to dispose of

and that secured each subject loan. In certain cases the Company

provided the lender a non-interest bearing deficiency note in an

amount equal to a small fraction of the original debt with a term

of three years. Due to the time required to complete the requisite

foreclosures on certain real estate assets, the foreclosure actions

were not all complete at September 30, 2009 and will occur in

future periods.

The Company reported that management and the Company's board of

Directors are continuing their effort to complete the Company's

Strategic Realignment Plan and expects that once fully implemented

the Company will benefit from:

1) Improved cash flow from key projects retained by the Company,

2) Enhanced shareholder equity,

3) Reduced debt service costs,

4) Reduced overall debt (secured and unsecured),

5) Reduced operating costs,

6) Improved operating margins.

Following is a summary of certain key accomplishments of the

Company in connection with its Strategic Realignment Plan so far in

2009:

July 2009 - The Company executed a settlement agreement with

Belmont Bay, L.C., the developer of the Belmont Bay project in

Woodbridge, Virginia, whereby the parties released each other from

pending litigation against each other and the Company was released

from all liability associated with a $1.7 million unsecured loan in

connection with the Belmont Bay project. The settlement agreement

also provided for the Company to release its claims to a $250,000

contract deposit posted in connection with the project

August 2009 - The Company executed agreements with Wachovia Bank

which provided the Company the ability to deliver certain backlog

units in the Raleigh, NC and Washington, DC markets, dispose of

multiple unwanted projects through friendly foreclosures, eliminate

approximately $17.8 million of debt, and eliminate past due

interest and other charges associated with the subject debts. In

connection with the agreement with Wachovia the Company entered

into an unsecured, non-interest bearing three year promissory note

in the original principal amount of approximately $1.8 million

which was subsequently reduced to $.2 million.

September 2009 - The Company executed agreements with Guggenheim

Corporate Funding which provides the Company the ability to

generate significantly increased cashflow for operations from its

existing Penderbrook project in Fairfax, Virginia through reduced

principal payments to Guggenheim as units are settled. Certain

conditions apply to the Company's ability to continue to benefit

from the reduced principal payment schedule, including maintaining

specified sales pace and securing agreement to settle certain other

unsecured debts of the Company. Based on sales achieved at

Penderbrook to date, the Company has met the sales pace requirement

through year end 2009.

September 2009 - The Company executed a settlement agreement

with Cornerstone Bank whereby Cornerstone and the Company each

released all pending litigation against each other and Cornerstone

released the Company from liability under a $5.2 million project

loan on the Gates of Luberon project in Atlanta, GA. In connection

with the agreements with Cornerstone, the Company entered into an

unsecured, non-interest bearing three year promissory note in the

original principal amount of approximately $400,000.

March through September 2009 - The Company entered into multiple

agreements with Manufacturers Traders and Trust Company (M&T

Bank) which provided the Company the ability to deliver certain

backlog units in the Washington, DC market, dispose of an unwanted

project in Woodbridge, Virginia through a friendly foreclosure that

will result elimination of approximately $6.1 million of debt, and

eliminate past due interest and other charges associated with the

released debt. In addition the agreements with M&T Bank

provided for the extension through January 31, 2011 of the $1.1

million project loan in connection with the Cascades project

located in Sterling, Virginia. In connection with the agreements

with M&T Bank the Company entered into a non-interest bearing

three year promissory note in the original principal amount of

approximately $496,000 secured by the Cascades project.

October 2009 - The Company executed agreements with Key Bank

which provides the Company the ability to generate significantly

increased cashflow for operations from its existing Eclipse project

in Arlington, Virginia and its planned Station View project in

Ashburn, Virginia through reduced principal payments to Key Bank as

condominium units are settled at the Eclipse and as the Station

View land is sold. Certain conditions apply to the Company's

ability to continue to benefit from the reduced principal payment

schedule, including maintaining specified sales pace and securing

agreement to settle certain other unsecured debts of the Company.

Based on sales achieved at the Eclipse project to date, the Company

has met the sales pace obligation through year end 2009.

Additionally, the Company has secured a contingent contract to sell

the Station View land, which it expects to settle in the first

quarter of 2010.

November 2009 - The Company executed agreements with Fifth Third

Bank which provides the Company the ability to dispose of an

unwanted project through friendly foreclosures in the Raleigh, NC

market, eliminate approximately $1.3 million of debt, and eliminate

past due interest and other charges associated with the subject

debt. In connection with the agreement with Fifth Third the Company

agreed to provide Fifth Third an unsecured, non-interest bearing

three year promissory note in the original principal amount of

approximately $25,000 provided that Fifth Third completes the

foreclosure proceeding no later then February 28, 2010, unless

extended pursuant to the terms of the agreement.

September 2009 - The Company completed the trial phase of

litigation between the Company and Balfour Beatty regarding certain

construction deficiencies alleged by the Company to be the

responsibility of Balfour Beatty and certain contract breaches by

Balfour Beatty, regarding construction services provided by Balfour

Beatty at the Company's Eclipse project. The Company is awaiting

the court's ruling on claims brought by the Company against Balfour

Beatty and counter claims brought by Balfour Beatty against the

Company and expects to receive the ruling in the first quarter of

2010.

On September 23, 2009 the Company presented its plan for

regaining compliance with all NASDAQ listing requirements to the

NASDAQ Listing Qualifications Panel and requested transfer from the

NASDAQ Global Markets to the NASDAQ Capital Markets. As of

September 30, 2009 the Company has reported shareholder equity of

$2.6 million, slightly exceeding the minimum requirement for

listing on the NASDAQ Capital Markets. However, on November 12,

2009 the Company received notice from NASDAQ Stock Market Listing

Qualifications indicating that the Company's closing bid-price was

under $1.00 for the thirty trading days ended November 11, 2009. As

a result, NASDAQ issued a notice of non-compliance related to this

requirement and providing the Company until May 11, 2010 to regain

compliance. To regain compliance the closing bid-price must remain

over $1.00 for a minimum of ten consecutive trading days prior to

May 11, 2010.

Additionally, in keeping with the primary goals of the Company's

Strategic Realignment Plan, (the elimination of debt and settlement

of obligations of the Company to enable the Company to refocus its

operations on its core markets and to reposition the Company for

improved operating results in 2010 and beyond), on November 13,

2009, the Company caused certain subsidiaries previously operating

in the Atlanta, Georgia market, Parker Chandler Homes, LLC

(formerly known as Comstock Homes of Atlanta, LLC), Buckhead

Overlook, LLC, and Post Preserve, LLC (collectively, "Parker

Chandler Homes"), to file bankruptcy petitions in the United States

Bankruptcy Court, Northern District of Georgia. The Chapter 7

Petitions by Parker Chandler Homes were filed in furtherance of the

Company's Strategic Realignment Plan that includes the liquidation

of Parker Chandler Homes and the winding down of all operations in

the Atlanta market.

"We are committed to taking the steps necessary to return

Comstock Homebuilding to profitability and we look forward to the

opportunities that lay ahead," said Christopher Clemente,

Comstock's Chairman and Chief Executive Officer. "We are pleased

with the progress we have made in the past several months in terms

of executing our Strategic Realignment Plan and we are encouraged

by signs that market conditions are beginning to improve."

Additional results for the three months ended September 30, 2009

include:

-- At September 30, 2009, the Company's reported shareholder

equity was $2.6 million.

-- Gross profit on all revenue was $0.9 million, representing a

gross margin of 7.3% on all revenue, compared to $1.8 million or

13.4% for the three months ended September 30, 2008.

-- Gross profit from homebuilding revenue was $0.7 million

representing a gross margin of 6.6%, compared to gross profit from

homebuilding of $1.3 million or 10.6% for the three months ended

September 30, 2008.

-- SG&A decreased by $3.1 million or 73.3% to $1.1 million,

compared to $4.2 million for the three months ended September 30,

2008.

-- Operating loss decreased to $.7 million, as compared to an

operating loss of $4.7 million for the three months ended September

30, 2008.

Additional results for the nine months ended September 30, 2009

include:

-- Gross profit on all revenue was $2.4 million, representing a

gross margin of 11.3% on all revenue, compared to $5.2 million or

12.6% for the nine months ended September 30, 2008.

-- Gross profit from homebuilding was $1.5 million representing

a gross margin of 8.4%, compared to gross profit from homebuilding

of $4.5 million or 11.3% for the nine months ended September 30,

2008.

-- SG&A decreased by $6.2 million or 53.1% to $5.5 million,

compared to $11.7 million for the nine months ended September 30,

2008.

-- Operating loss increased to $29.8 million as compared to an

operating loss of $24.7 million for the nine months ended September

30, 2008.

Company reported the following orders, cancellations and backlog

for the three and nine months ended September 30, 2009:

Three months ended September 30, 2009

-------------------------------------------

Washington North

Metro Area Carolina Georgia Total

---------- --------- --------- ----------

Gross new orders 29 2 - 31

Cancellations 2 5 - 7

Net new orders 27 (3) - 24

Gross new order revenue $ 8,995 $ 252 $ - $ 9,247

Cancellation revenue $ 460 $ 1,220 $ - $ 1,680

Net new order revenue $ 8,535 $ (968) $ - $ 7,567

Average gross new order price $ 310 $ 126 $ - $ 298

Settlements 39 1 - 40

Settlement revenue -

homebuilding $ 11,116 $ 108 $ - $ 11,224

Average settlement price $ 285 $ 108 $ - $ 281

Backlog units 6 3 - 9

Backlog revenue $ 1,541 $ 977 $ - $ 2,518

Average backlog price $ 257 $ 326 $ - $ 280

Nine months ended September 30, 2009

-------------------------------------------

Washington North

Metro Area Carolina Georgia Total

---------- --------- --------- ----------

Gross new orders 63 15 - 78

Cancellations 7 11 1 19

Net new orders 56 4 (1) 59

Gross new order revenue $ 19,999 $ 2,571 $ - $ 22,570

Cancellation revenue $ 2,128 $ 2,314 $ 386 $ 4,828

Net new order revenue $ 17,871 $ 257 $ (386) $ 17,742

Average gross new order price $ 317 $ 171 $ - $ 289

Settlements 53 7 - 60

Settlement revenue -

homebuilding $ 17,053 $ 1,033 $ - $ 18,086

Average settlement price $ 322 $ 148 $ - $ 301

Backlog units 6 3 - 9

Backlog revenue $ 1,541 $ 977 $ - $ 2,518

Average backlog price $ 257 $ 326 $ - $ 280

Three Months Ended Nine Months Ended

September 30, September 30,

-------------------- --------------------

2009 2008 2009 2008

--------- --------- --------- ---------

Revenues

Revenue - homebuilding $ 11,224 $ 12,270 $ 18,086 $ 39,645

Revenue - other 1,400 803 3,025 1,807

--------- --------- --------- ---------

Total revenue 12,624 13,073 21,111 41,452

Expenses

Cost of sales - homebuilding 10,484 10,968 16,565 35,168

Cost of sales - other 1,216 356 2,166 1,069

Impairments and write-offs - 2 22,938 14,580

Selling, general and

administrative 1,126 4,211 5,480 11,684

Interest, real estate taxes

and indirect costs related

to inactive projects 454 2,199 3,808 3,615

--------- --------- --------- ---------

Operating loss (658) (4,663) (29,846) (24,664)

Gain on troubled debt

restructuring (2,803) (1,194) (2,803) (9,519)

Other (income) loss, net (134) (1,268) 1,063 (2,865)

--------- --------- --------- ---------

Total pre tax loss 2,279 (2,201) (28,106) (12,279)

Income taxes expense - 5 2 5

--------- --------- --------- ---------

Net (loss) income 2,279 (2,206) (28,108) $ (12,284)

Net (loss) income attributable

to noncontrolling interest - (4) - (7)

--------- --------- --------- ---------

Net (loss) income attributable

to Comstock Homebuilding

Companies, Inc 2,279 (2,202) (28,108) (12,277)

========= ========= ========= =========

Basic loss per share $ 0.13 $ (0.13) $ (1.60) $ (0.70)

Basic weighted average shares

outstanding 17,618 17,475 17,575 17,431

========= ========= ========= =========

Diluted loss per share $ 0.12 $ (0.13) $ (1.60) $ (0.70)

Diluted weighted average shares

outstanding 19,467 17,475 17,575 17,431

========= ========= ========= =========

September 30, December 31,

2009 2008

------------ ------------

ASSETS

Cash and cash equivalents $ 872 $ 5,977

Restricted cash 3,432 3,859

Receivables 15 -

Real estate held for development and

sale 87,783 129,542

Inventory not owned - variable interest

entities - 19,250

Property, plant and equipment, net 279 829

Other assets 2,145 1,402

------------ ------------

TOTAL ASSETS $ 94,526 $ 160,859

============ ============

LIABILITIES AND SHAREHOLDERS' EQUITY

Accounts payable and accrued

liabilities $ 8,533 $ 8,232

Obligations related to inventory not

owned - 19,050

Notes payable - secured by real estate 66,181 90,086

Notes payable - unsecured 17,236 12,743

------------ ------------

TOTAL LIABILITIES 91,950 130,111

------------ ------------

Commitments and contingencies (Note 9)

SHAREHOLDERS' EQUITY

Class A common stock, $0.01 par value,

77,266,500 shares authorized,

15,608,433 and 15,608,433 issued and

outstanding, respectively 156 156

Class B common stock, $0.01 par value,

2,733,500 shares authorized,

2,733,500 issued and outstanding 27 27

Additional paid-in capital 157,216 157,058

Treasury stock, at cost (391,400 Class

A common stock) (2,439) (2,439)

Accumulated deficit (152,384) (124,277)

------------ ------------

TOTAL COMSTOCK HOMEBUILDING

COMPANIES, INC SHAREHOLDERS'

EQUITY 2,577 30,525

Noncontrolling interest - 223

------------ ------------

TOTAL EQUITY 2,577 30,749

------------ ------------

TOTAL LIABILITIES AND SHAREHOLDERS'

EQUITY $ 94,526 $ 160,859

============ ============

About Comstock Homebuilding Companies, Inc.

Established in 1985, Comstock Homebuilding Companies, Inc. is a

publicly traded, diversified real estate development firm with a

focus on a variety of for-sale residential products. The company

currently actively markets its products under the Comstock Homes

brand in the Washington, D.C. and Raleigh, N.C. metropolitan areas.

Comstock Homebuilding Companies, Inc. trades on NASDAQ under the

symbol CHCI. For more information on the Company or its projects

please visit www.comstockhomebuilding.com.

Cautionary Statement Regarding Forward-Looking Statements

This release contains "forward-looking" statements that are made

pursuant to the Safe Harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements involve

known and unknown risks and uncertainties that may cause actual

future results to differ materially from those projected or

contemplated in the forward-looking statements. Additional

information concerning these and other important risks and

uncertainties can be found under the heading "Risk Factors" in the

Company's most recent Form 10-K, as filed with the Securities and

Exchange Commission on March 31, 2009. Comstock specifically

disclaims any obligation to update or revise any forward-looking

statements, whether as a result of new information, future

developments or otherwise.

Contact: Jeff Dauer 703.883.1700

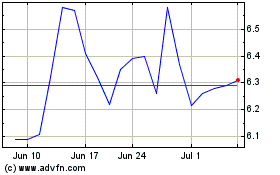

Comstock Holding Companies (NASDAQ:CHCI)

Historical Stock Chart

From Sep 2024 to Oct 2024

Comstock Holding Companies (NASDAQ:CHCI)

Historical Stock Chart

From Oct 2023 to Oct 2024