false000181998900018199892023-12-162023-12-160001819989cifr:CommonStockParValuePointZeroZeroOnePerShareMember2023-12-162023-12-160001819989cifr:WarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtAnExercisePriceOfElevenPointFiveZeroPerWholeShareMember2023-12-162023-12-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 16, 2023 |

CIPHER MINING INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39625 |

85-1614529 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1 Vanderbilt Avenue Floor 54 Suite C |

|

New York, New York |

|

10017 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (332) 262-2300 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 per share |

|

CIFR |

|

The Nasdaq Stock Market LLC |

Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per whole share |

|

CIFRW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On December 16, 2023, Cipher Mining Inc. (the “Company”), through its wholly-owned subsidiary Cipher Mining Infrastructure LLC, a Delaware limited liability company, entered into a fully executed Future Sales and Purchase Agreement (the “Agreement”) with Bitmain Technologies Delaware Limited (“Bitmain”) to purchase 37,396 Antminer T21 miners (the “2025 Miners”), which will be delivered in one batch in April 2025. The Company also has the option, but not an obligation, under the Agreement to purchase 45,706 additional Antminer T21 miners (“the 2024 Miners”), which it may exercise in whole or in part, in one or more transactions, in 2024.

The purchase price for the 2025 Miners under the Agreement is $99,473,360, representing a $14/T unit price (the “2025 Miners Purchase Price”) with (i) 10% of the 2025 Miners Purchase Price paid on December 12, 2023 (ii) 40% of the 2025 Miners Purchase Price due 180 days prior to delivery, and (iii) the remaining 50% of the purchase price due 7 days prior to delivery. The purchase price for the 2024 Miners under the Agreement is $121,577,960, representing a $14/T unit price (the “2024 Miners Purchase Price”) with (i) 10% of the 2024 Miners Purchase Price due within seven days of execution of the Agreement (ii) 40% of the 2024 Miners Purchase Price of each batch due 180 days prior to each delivery, and (iii) the remaining 50% of the 2024 Miners Purchase Price of each batch due 7 days prior to each delivery.

Item 7.01 Regulation FD Disclosure.

On December 18, 2023, the Company issued a press release announcing the entry into the Agreement. A copy of the press release is furnished with this Current Report on Form 8-K as Exhibit 99.1, and is incorporated herein by reference.

The information furnished pursuant to this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Cipher Mining Inc. |

|

|

|

|

Date: |

December 18, 2023 |

By: |

/s/ Tyler Page |

|

|

|

Tyler Page

Chief Executive Officer |

Exhibit 99.1

Cipher Mining Purchases 7.1 EH/s of New Miners and Option to Purchase an Additional 8.7 EH/s of Latest Generation Miners from Bitmain

Purchases 7.1 EH/s of latest generation Bitmain T21 miners for $99.5 million, representing a unit price of $14/TH

Secures option to purchase up to an additional 8.7 EH/s at the same fixed price terms

Full purchase order and option would bring total hashrate in operation and under contract to 24.2 EH/s and overall potential fleet efficiency to 22.6 J/TH

Purchase order and option provides a path to the initial buildout at Black Pearl and other near-term expansion opportunities in 2024

NEW YORK, December 18, 2023 (GLOBE NEWSWIRE) - Cipher Mining Inc. (NASDAQ: CIFR) (“Cipher”), a leading developer and operator of bitcoin mining data centers, announced today that it has entered into an agreement with Bitmain to purchase 37,396 units of the latest generation Antminer T21 miners, representing 7.1 EH/s of self-mining capacity to be delivered in the first half of 2025. Cipher has also purchased the option to acquire an additional 45,706 miners, representing 8.7 EH/s in 2024.

Tyler Page, CEO of Cipher, commented, “We are very excited to continue our track record of investing opportunistically during lulls in the bitcoin mining cycle. By acquiring 7.1 EH/s of Bitmain’s T21 mining rigs, we can build out the first 135 MW at our newly acquired Black Pearl site. We also have an option to acquire up to an additional 8.7 EH/s of T21s in 2024. Cipher’s custom software and operations stack, combined with the attractive pricing dynamics in the ERCOT market, will allow us to fully utilize the unique qualities of the T21’s energy modes to maximize profits at Black Pearl. Furthermore, by locking in our price for mining rigs at a very attractive $14/TH, we are controlling our biggest potential capital expense and locking in favorable terms ahead of what we believe will be a bull market for bitcoin.”

“If we choose to exercise our full purchase option, we will have enough mining rigs for another 165MW of infrastructure. We are considering many near-term attractive opportunities for expansion with these rigs at sites in 2024, as well as the continued buildout of Black Pearl in 2025. By securing favorable pricing on rigs, we have now built the foundation for our massive upcoming expansion,” added Mr. Page.

|

|

|

|

|

|

|

|

|

|

Total Hash Rate (EH/s) |

Efficiency (J/TH) |

Cipher's Current Operating Fleet |

7.2 |

31.2 |

Cipher's Current & Contracted Fleet + Full Purchase Option |

24.2 |

22.6 |

About Cipher

Cipher is an emerging technology company focused on the development and operation of bitcoin mining data centers. Cipher is dedicated to expanding and strengthening the Bitcoin network's critical infrastructure. Together with its diversely talented team and strategic partnerships, Cipher aims to be a market leader in bitcoin mining growth and innovation. To learn more about Cipher, please visit https://www.ciphermining.com/

Forward Looking Statements

This press release contains certain forward-looking statements within the meaning of the federal securities laws of the United States. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and includes this statement for purposes of complying with these safe harbor provisions. Any statements made in this press release that are not statements of historical fact, including statements about our beliefs and expectations regarding our future results of operations and financial position, business strategy, timing and likelihood of success, potential expansion of or additional bitcoin mining data centers, expectations regarding the operations of mining centers, and management plans and objectives, are forward-looking statements and should be evaluated as such. Forward-looking statements include information concerning possible or assumed future results of operations, including descriptions of our business plan and strategies. These forward-looking statements generally are identified by the words “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “seeks,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “strategy,” “future,” “forecasts,” “opportunity,” “predicts,” “potential,” “would,” “will likely result,” “continue,” and similar expressions (including the negative versions of such words or expressions).

These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Cipher and our management, are inherently uncertain. Such forward-looking statements are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied by such forward looking statements. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: volatility in the price of Cipher’s securities due to a variety of factors, including changes in the competitive and regulated industry in which Cipher operates, variations in performance across competitors, changes in laws and regulations affecting Cipher’s business, and the ability to implement business plans, forecasts, and other expectations and to identify and realize additional opportunities. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of our Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on March 14, 2023, and in Cipher’s subsequent filings with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Cipher

assumes no obligation and, except as required by law, does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Contacts:

Investor Contact:

Josh Kane

Head of Investor Relations at Cipher Mining

josh.kane@ciphermining.com

Media Contact:

Ryan Dicovitsky / Kendal Till

Dukas Linden Public Relations

CipherMining@DLPR.com

v3.23.4

Document And Entity Information

|

Dec. 16, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 16, 2023

|

| Entity Registrant Name |

CIPHER MINING INC.

|

| Entity Central Index Key |

0001819989

|

| Entity Emerging Growth Company |

true

|

| Entity File Number |

001-39625

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

85-1614529

|

| Entity Address, Address Line One |

1 Vanderbilt Avenue

|

| Entity Address, Address Line Two |

Floor 54

|

| Entity Address, Address Line Three |

Suite C

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10017

|

| City Area Code |

(332)

|

| Local Phone Number |

262-2300

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Common Stock Par Value Point Zero Zero One Per Share Member |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

CIFR

|

| Security Exchange Name |

NASDAQ

|

| Warrants Each Whole Warrant Exercisable For One Share Of Common Stock At An Exercise Price Of Eleven Point Five Zero Per Whole Share Member |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per whole share

|

| Trading Symbol |

CIFRW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=cifr_CommonStockParValuePointZeroZeroOnePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=cifr_WarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtAnExercisePriceOfElevenPointFiveZeroPerWholeShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

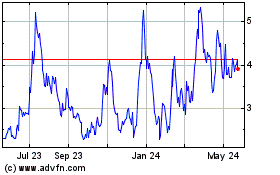

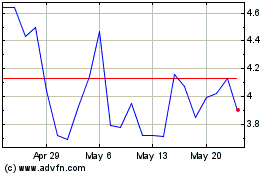

Cipher Mining (NASDAQ:CIFR)

Historical Stock Chart

From Apr 2024 to May 2024

Cipher Mining (NASDAQ:CIFR)

Historical Stock Chart

From May 2023 to May 2024