| | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

FORM 8-K |

| CURRENT REPORT |

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934 |

Date of Report: October 10, 2023

(Date of earliest event reported)

| | | | | | | | | | | | | | |

| Central Valley Community Bancorp |

| (Exact name of registrant as specified in its charter) |

|

CA (State or other jurisdiction of incorporation) | 000-31977 (Commission File Number) | 77-0539125 (IRS Employer Identification Number) |

|

7100 N. Financial Dr., Ste. 101, Fresno, CA (Address of principal executive offices) | | 93720 (Zip Code) |

559-298-1775 (Registrant’s telephone number, including area code) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Common Stock, no par value | | CVCY | | NASDAQ |

| (Title of Each Class) | | (Trading Symbol) | | (Name of Each Exchange on which Registered) |

| | | | |

Not Applicable (Former Name or Former Address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☒ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act o

Item 1.01 - Entry into a Material Definitive Agreement.

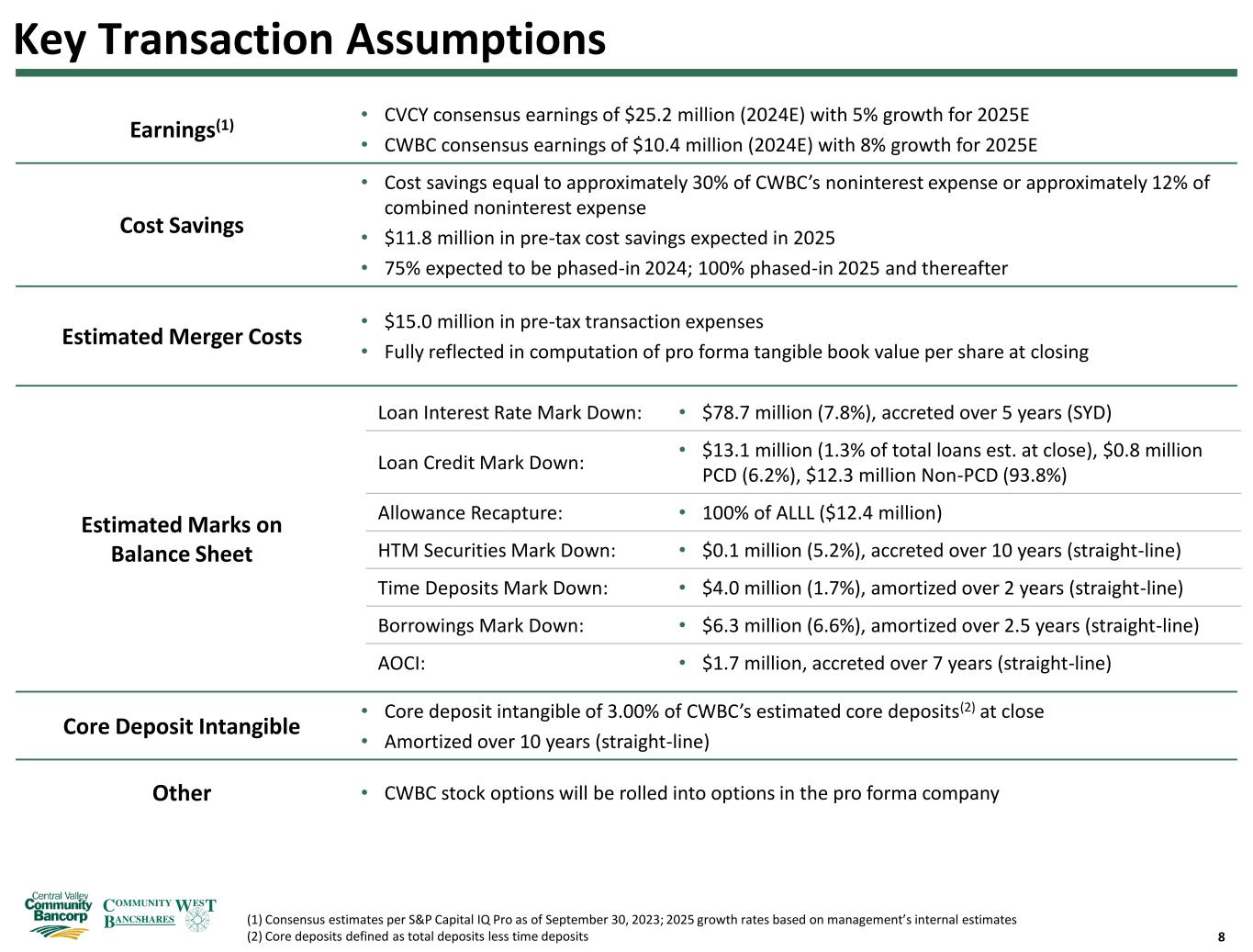

On October 10, 2023, Central Valley Community Bancorp, a California corporation (“Central Valley”), entered into an Agreement and Plan of Reorganization and Merger (the “Merger Agreement”) with Community West Bancshares, a California corporation (“Community West”), pursuant to which Community West will merge with and into Central Valley in an all stock merger (the “Merger”), with Central Valley as the surviving corporation. Promptly following the completion of the Merger, Community West Bank, N.A. a national banking association chartered by the Office of the Comptroller of the Currency and a wholly owned subsidiary of Community West (“CWB”) will merge with and into Central Valley Community Bank, a California state-chartered bank and a wholly owned subsidiary of Central Valley (“CVCB”), with CVCB as the surviving entity (the “bank merger”) and will continue the commercial banking operations of the combined bank following the bank merger. Effective with the Merger and the bank merger Central Valley and CVCB will be rebranded and change their names to “Community West Bancshares” and “Community West Bank”, respectively. The transaction is intended to qualify as a tax-free reorganization under the applicable provisions of the Internal Revenue Code of 1986, as amended (the “Code”). Although there can be no assurances, the Merger is expected to close in the second quarter of 2024. A summary of the material terms of the Merger Agreement follows.

Merger Consideration

Upon consummation of the Merger, each share of Community West common stock, no par value per share (“Community West Common Stock”), outstanding immediately prior to the effective time of the Merger will be canceled and converted into the right to receive 0.79 of a share of Central Valley common stock, no par value (“Central Valley Common Stock”) (the “per share exchange ratio”). Any fractional shares will be paid in cash equal to the product of (i) such fraction, multiplied by the closing price of Central Valley’s Common Stock reported on NASDAQ on the last trading day preceding the closing date.

Based on the closing price of Central Valley’s Common Stock on October 10, 2023, the aggregate merger consideration would be approximately $99.4 million, or $11.15 per share of Community West Common Stock, assuming 8,851,380 shares of Community West Common Stock and 601,503 Community West stock options outstanding.

Community West Options and Shares of Restricted Common Stock

Upon consummation of the Merger, each outstanding and unexercised option (whether or not vested) will cease to represent the right to acquire shares of Community West Common Stock and will instead be assumed by Central Valley and converted automatically into an option to purchase shares of Central Valley Common Stock (“assumed option”). The number of shares of Central Valley Common Stock subject to each assumed option will be equal to the number of shares of Community West Common Stock that would be issuable upon exercise of such assumed option immediately prior to the closing of the Merger multiplied by the per share exchange ratio (subject to adjustment if required to comply with federal tax laws or plan documents), provided that any fractional shares of Central Valley Common Stock resulting from such multiplication will be rounded down to the nearest whole share. The per share exercise price under each assumed option will be adjusted by dividing the per share exercise price of each assumed option by the per share exchange ratio (subject to adjustment if required to comply with federal tax laws or plan documents), provided that such exercise price will be rounded up to the nearest whole cent. Any unvested options will vest on the effective date of the Merger.

Each award of restricted shares (whether or not vested) of Community West Common Stock (the “restricted stock”) that is outstanding as of the closing of the Merger will be converted into the right to receive shares of Central Valley Common Stock. The number of shares of Central Valley Common Stock issued for each share of restricted stock will be equal to the number of shares of Community West Common Stock subject to such award of restricted stock immediately prior to the effective time of the Merger multiplied by the per share exchange ratio, provided that any fractional shares will be paid in cash. Any unvested restricted stock will vest on the effective date of the Merger.

Corporate Governance of the Combined Company

Board of Directors. Prior to the closing of the merger, Central Valley and CVCB will take all action necessary to expand the size of their respective boards of directors to fifteen (15) members and appoint six (6) current members of the Community West and CWB board of directors to the Central Valley and CVCB board of directors, effective upon the closing of the merger. Subject to its fiduciary duty, the Central Valley board of directors also will recommend that these six new members be included as director candidates for election in the Central Valley proxy statement for the 2024 annual meeting of Central Valley shareholders. Three (3) current members of the Central Valley and CVCB board of directors will retire from their positions effective upon the closing of the merger.

Executive Committee. Prior to the closing of the merger, the board of directors of Central Valley will take all action necessary to establish an executive committee of the board of directors effective on the closing of the merger. The executive committee will be initially comprised of five (5) members. The initial members of the executive committee will be Daniel Doyle (current

Chairman of the Board of Central Valley), Robert H. Bartlein, and James W. Lokey (current members of the Community West board of directors), and two (2) other current members of the Central Valley board of directors. James J. Kim, President and Chief Executive Officer of Central Valley and CVCB and Martin E. Plourd, the current President and Chief Executive Officer of Community West and Chief Executive Officer of CWB will serve as the initial advisors to the executive committee.

Executive Management Team. Following the merger, Martin E. Plourd will assume the position of President of Central Valley. James J. Kim will continue as Chief Executive Officer of Central Valley and President and Chief Executive Officer of CVCB.

Employment Agreements

Pursuant to the terms of the Merger Agreement, Central Valley has agreed to enter into an employment agreement with Martin E. Plourd which will become effective on the closing of the Merger. Mr. Plourd will join Central Valley as President of Central Valley.

Representations and Warranties

The Merger Agreement contains customary representations and warranties of Central Valley and Community West, which are qualified by the confidential disclosure schedules.

Business Pending the Proposed Transaction

Central Valley and Community West are each required under the Merger Agreement to conduct its respective business in the ordinary and usual course, consistent with past practice, to use reasonable commercial efforts to preserve its business organization, keep available the present services of its employees and preserve for itself and the combined company the goodwill of the customers of CVCB and CWB and others with whom business relations exist.

Conditions to the Merger

Completion of the Merger is subject to certain customary conditions, including (i) approval by Central Valley and Community West shareholders, (ii) regulatory approval, (iii) the absence of any governmental order or law prohibiting the consummation of the Merger, (iv) effectiveness of the Securities and Exchange Commission (“SEC”) registration statement for the Central Valley Common Stock to be issued as consideration in the Merger, and (v) the approval of such shares for listing on the Nasdaq Global Market. The obligation of each party to consummate the Merger is also conditioned upon (a) subject to certain exceptions, the accuracy of the representations and warranties of the other party, (b) performance in all material respects by the other party of its obligations under the Merger Agreement, (c) receipt by each party of a tax opinion to the effect that the Merger will qualify as a reorganization within the meaning of Section 368(a) of the Code, and (d) the absence of a material adverse effect with respect to the other party since the date of the Merger Agreement.

Termination of the Merger Agreement

Both Central Valley and Community West may mutually agree to terminate the Merger Agreement without further liability to the other. Either party may agree to terminate the Merger Agreement if (i) the Merger is not consummated by June 30, 2024 (the “End Date”) with an automatic extension of up to 90 days to obtain regulatory approval, (ii) the shareholders of Central Valley do not approve the Merger Agreement, (iii) the Community West shareholders do not approve the Merger Agreement or (iv) any governmental entity whose approval is required to consummate the Merger does not approve the Merger. Either party can terminate the Merger Agreement if the board of directors of the other party withdraws or changes its recommendation to its shareholders prior to its respective shareholder meeting held to approve the Merger Agreement. In addition, either party may terminate the Merger Agreement if the other party is in material breach of any of its representations, warranties or agreements set forth in the Merger Agreement that are not cured such that the applicable closing conditions are not satisfied.

Termination Fee

Community West must pay Central Valley a termination fee in the amount of $4 million if the Merger Agreement is terminated under certain circumstances set forth in the Merger Agreement.

The foregoing description of the Merger Agreement is qualified in its entirety by reference to the full text of the Merger Agreement, which is attached hereto as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Cooperation Agreements

Concurrently with the execution and delivery of the Merger Agreement, each director and certain executive officers of Central Valley, CVCB, Community West and CWB entered into Cooperation Agreements in their capacities as shareholders pursuant to which he or she agreed, among other things, to vote all shares of Central Valley or Community West Common Stock, as

applicable, beneficially owned by him or her in favor of adoption and approval of the Merger Agreement and any other matters required to be approved for the consummation of the Merger and transactions contemplated by the Merger Agreement at their respective shareholders meeting held to approve the Merger. These shareholders also agreed to certain restrictions on their ability to transfer their shares of Central Valley and Community West Common Stock.

In addition to the foregoing, the directors and certain executive officers of Community West and Central Valley agreed for a period of two (2) years after the effective time of the Merger, to refrain (without written consent) from soliciting or aiding in the solicitation of any existing customer or prospective customer for financial services who is an existing customer of Central Valley, CVCB, Community West or CWB prior to the effective time of the Merger or terminate such person’s relationships with, or to take any action that would be disadvantageous to, Central Valley or CVCB.

The foregoing description of the forms of Cooperation Agreements are qualified in their entirety by reference to the full text of the forms of such agreements, copies of which are attached as Exhibits A-1, A-2, B-1 and B-2 to Merger Agreement and are incorporated by reference herein.

The representations, warranties and covenants of each party set forth in the Merger Agreement have been made only for purposes of, were and are solely for the benefit of the parties to, the Merger Agreement, may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Merger Agreement instead of establishing these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors.

In addition, such representations and warranties (i) will not survive consummation of the Merger, and cannot be the basis for any claims under the Merger Agreement by the other party after termination of the Merger Agreement, except as a result of fraud or willful or intentional breach of the provisions of the Merger Agreement and (ii) were made only as of the date of the Merger Agreement or such other date as is specified in the Merger Agreement. Information concerning the subject matter of the representations and warranties may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in the parties’ public disclosures. Accordingly, the Merger Agreement is included with this filing only to provide investors with information regarding the terms of the Merger Agreement, and not to provide investors with any other factual information regarding Central Valley or Community West or their respective businesses.

Item 7.01 - Regulation FD Disclosure

Central Valley is filing an investor presentation, which provides supplemental information regarding the proposed transaction in connection with a presentation to analysts and investors and discusses certain elements of the Merger, which it intends to post on the investor relations portion of its website, which is located at www.cvcb.com. The slides are included as Exhibit 99.1 to this report.

Item 8.01 - Other Events.

Joint Press Release

On October 10, 2023, Central Valley and Community West issued a joint press release announcing the execution of the Merger Agreement. A copy of the press release is attached as Exhibit 99.2 to this Current Report on Form 8-K. For additional information about the Merger, see Item 1.01 of this Current Report on Form 8-K.

The information in Exhibits 99.1 and Exhibit 99.2 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

2.1 Agreement and Plan of Reorganization and Merger, dated as of October 10, 2023, by and among Central

Valley Community Bancorp and Community West Bancshares*

99.1 Investor Presentation dated October 10, 2023

99.2 Press release, dated October 10, 2023

*Confidential disclosure schedules omitted. The Registrant undertakes to furnish copies of any omitted schedules to the SEC upon request.

Forward-Looking Statements

This press release contains certain forward-looking information about Central Valley, Community West, and the combined company after the close of the merger and is intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking statements. Such statements involve inherent risks, uncertainties, and contingencies, many of which are difficult to predict and are generally beyond the control of Central Valley, Community West and the combined company. Central Valley and Community West caution readers that a number of important factors could cause actual results to differ materially from those expressed in, or implied or projected by, such forward-looking statements. In addition to factors previously disclosed in reports filed by Central Valley and Community West with the SEC, risks and uncertainties for each institution and the combined institution include, but are not limited to the ability to complete the merger; government approval may not be obtained or adverse regulatory conditions may be imposed in connection with governmental approvals of the merger; approval by the shareholders of Central Valley and Community West may not be obtained; the successful integration of Community West, or achieving expected beneficial synergies and/or operating efficiencies, in each case might not be obtained within expected time-frames or at all; the possibility that personnel changes/retention will not proceed as planned; and other risk factors described in documents filed by Central Valley and Community West with the SEC. All forward-looking statements included in this press release are based on information available at the time of the communication. Pro forma, projected and estimated numbers are used for illustrative purposes only and are not forecasts, and actual results may differ materially. We are under no obligation to (and expressly disclaim any such obligation to) update or alter our forward-looking statements, whether as a result of new information, future events or otherwise except as required by law.

Additional Information about the Merger and Where to Find It

This Current Report on Form 8-K does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval.

Investors and security holders are urged to carefully review and consider each of Central Valley and Community West public filings with the Securities Exchange Commission (“SEC”), including but not limited to their respective Annual Reports on Form 10-K, its Proxy Statements, Current Reports on Form 8-K and Quarterly Reports on Form 10-Q. Central Valley’s documents filed with the SEC may be obtained free of charge at Central Valley’s website at www.cvcb.com or at the SEC’s website at www.sec.gov. Central Valley’s documents may also be obtained free of charge from Central Valley by requesting them in writing to Central Valley Community Bancorp, 7100 N. Financial Drive, Suite 101, Fresno, California 93720; Attention: Corporate Secretary, or by telephone at (559) 298-1775. Community West documents filed with the SEC may be obtained free of charge at Community West’s website at www.communitywestbank.com or at the SEC’s website at www.sec.gov. Community West documents may also be obtained free of charge from Community West by requesting them in writing to Community West Bancshares, 445 Pine Avenue, Goleta, California 93117, or by telephone at (805) 692-5821; Attention Corporate Secretary.

Central Valley intends to file a registration statement on Form S-4 with the SEC which will include a joint proxy statement /prospectus which will be distributed to the shareholders of Central Valley and Community West in connection with their vote on the merger. Before making any voting or investment decision, investors and security holders of Central Valley and Community West are urged to carefully read the entire joint proxy statement/prospectus, when they become available, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction. Investors and security holders will be able to obtain the joint proxy statement/prospectus free of charge from the SEC’s website or from Central Valley or Community West by writing to the address provided in the paragraph above.

The directors, executive officers and certain other members of management and employees at Central Valley and Community West may be deemed participants in the solicitation of proxies in favor of the merger from their respective shareholders. Information about the directors and executive officers of Central Valley is included in the proxy statement for its 2023 Annual Meeting of Shareholders, which was filed with the SEC on March 31, 2023. Information about the directors and executive officers of Community West is included in the proxy statement for its 2023 Annual Meeting of Shareholders, which was filed with the SEC on April 17, 2023.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Dated: | October 10, 2023 | CENTRAL VALLEY COMMUNITY BANCORP

By: /s/ James J. Kim James J. Kim President and Chief Executive Officer |

| | | | | |

| Exhibit Index |

| Exhibit No. | Description |

| 2.1 | |

| 99.1 | |

| 99.2 | |

AGREEMENT AND PLAN OF REORGANIZATION AND MERGER

DATED AS OF OCTOBER 10, 2023

BY AND AMONG

CENTRAL VALLEY COMMUNITY BANCORP

AND

COMMUNITY WEST BANCSHARES

TABLE OF CONTENTS

| | | | | |

ARTICLE I CERTAIN DEFINITIONS | |

1.1 Certain Definitions | |

ARTICLE II THE MERGER AND RELATED MATTERS | |

2.1 The Merger; Surviving Entity | |

2.2 The Bank Merger | |

2.3 Effective Time | |

2.4 United States Federal Income Tax Consequences | |

ARTICLE III CONSIDERATION AND EXCHANGE PROCEDURES | |

3.1 Effect on Capital Stock | |

3.2 Exchange Procedures; Dissenting Shares | |

3.3 Treatment of Equity Awards | |

ARTICLE IV ACTIONS PENDING THE MERGER | |

4.1 Forbearances of the Parties | |

ARTICLE V REPRESENTATIONS AND WARRANTIES | |

5.1 Disclosure Schedules | |

5.2 Representations and Warranties of CWBC | |

5.3 Representations and Warranties of CVCY | |

ARTICLE VI COVENANTS | |

6.1 Reasonable Efforts | |

6.2 Regulatory Filings | |

6.3 Registration Statement | |

6.4 NASDAQ Capital Market | |

6.5 Press Releases | |

6.6 Access; Information | |

6.7 Acquisition Proposals | |

6.8 Approval by Shareholders | |

6.9 Certain Policies and Actions | |

6.10 Notification of Certain Matters | |

6.11 Estoppel Letters, Non-Disturbance Agreements and Consents | |

6.12 Antitakeover Statutes | |

6.13 Notice to Customers | |

6.14 CWBC Financial Statements | |

6.15 CVCY Financial Statements | |

6.16 Indemnification; Directors and Officers Insurance | |

6.17 Benefit Plans | |

6.18 Rule 16b-3 | |

6.19 Corporate Governance | |

6.20 Transaction Expenses | |

6.21 Delisting | |

| | | | | |

6.22 Reorganization | |

ARTICLE VII CONDITIONS TO CONSUMMATION OF THE TRANSACTION | |

7.1 Conditions to Each Party’s Obligation to Effect the Transactions Contemplated Hereby | |

7.2 Conditions to Obligations of CWBC | |

7.3 Conditions to Obligation of CVCY | |

ARTICLE VIII TERMINATION | |

8.1 Termination | |

8.2 Liabilities and Remedies; Liquidated Damages; Expense Reimbursement | |

ARTICLE IX MISCELLANEOUS | |

9.1 Survival of Representations, Warranties and Agreements | |

9.2 Waiver; Amendment | |

9.3 Counterparts | |

9.4 Governing Law | |

9.5 Waiver of Jury Trial | |

9.6 Expenses | |

9.7 Notices | |

9.8 Entire Understanding; No Third-Party Beneficiaries | |

9.9 Severability | |

9.10 Enforcement of the Agreement | |

9.11 Waiver of Conditions | |

9.12 Interpretation | |

9.13 Assignment | |

9.14 Alternative Structure | |

EXHIBITS:

EXHIBIT A-1 Form of Director Cooperation Agreement (CWBC)

EXHIBIT A-2 Form of Director Cooperation Agreement (CVCY)

EXHIBIT B-1 Form of Executive Cooperation Agreement (CWBC)

EXHIBIT B-2 Form of Executive Cooperation Agreement (CVCY)

EXHIBIT C Form of BHC Merger Agreement

EXHIBIT D Form of Bank Merger Agreement

EXHIBIT E Form of Benefits Summary Acknowledgement

EXHIBIT F Form of Employment Agreement

AGREEMENT AND PLAN OF REORGANIZATION AND MERGER

THIS AGREEMENT AND PLAN OF REORGANIZATION AND MERGER (this “Agreement”), dated as of October 10, 2023, is hereby entered into by and among CENTRAL VALLEY COMMUNITY BANCORP, a California corporation (“CVCY”), and COMMUNITY WEST BANCSHARES, a California corporation (“CWBC”).

RECITALS

WHEREAS, the Board of Directors of CWBC (the “CWBC Board”) has unanimously (i) approved and declared advisable this Agreement and the transactions contemplated hereby, including the strategic business combination transaction provided for in this Agreement, in which CWBC will, on the terms and subject to the conditions set forth herein, merge with and into CVCY (the “Merger”), with CVCY being the surviving entity in the Merger, (ii) determined that this Agreement and such transactions are fair to, and in the best interests of, CWBC and its shareholders, and (iii) resolved to recommend that CWBC’s shareholders approve and adopt this Agreement;

WHEREAS, the Board of Directors of CVCY (the “CVCY Board”) has unanimously (i) approved and declared advisable this Agreement and the transactions contemplated hereby, including the Merger, upon the terms and subject to the conditions set forth herein, (ii) determined that this Agreement and such transactions are fair to, and in the best interests of, CVCY and its shareholders, and (iii) resolved to recommend that CVCY’s shareholders approve and adopt this Agreement;

WHEREAS, immediately after the Merger, Community West Bank, N.A. (“Community West Bank”), a national banking association chartered by the Office of the Comptroller of the Currency (the “OCC”) and wholly-owned subsidiary of CWBC, will merge with and into Central Valley Community Bank (“Central Valley Community Bank”), a California state chartered bank and wholly-owned subsidiary of CVCY, with Central Valley Community Bank as the surviving entity (the “Bank Merger”);

WHEREAS, the Parties intend that the Merger be treated for federal income tax purposes as a reorganization described in Section 368(a) of the Code and that this Agreement shall constitute a “plan of reorganization” within the meaning of Treasury Regulations Section 1.368-2(g); and

WHEREAS, as a material inducement to CVCY to enter into this Agreement, and simultaneously with the execution of this Agreement, (i) each of the directors of CWBC is entering into and delivering to CVCY an agreement substantially in the form of Exhibit A-1 for CWBC directors and Exhibit A-2 for CVCY directors attached hereto (the “Director Cooperation Agreement”), and (ii) each of the executive officers of CWBC is entering into and delivering to CVCY an agreement substantially in the form of Exhibit B-1 for CWBC executive officers and Exhibit B-2 for CVCY executive directors attached hereto (the “Executive Cooperation Agreement”), pursuant to which they shall agree, among other things, to vote their shares of capital stock of CWBC in favor of the approval and adoption of this Agreement.

WHEREAS, as a material inducement to CWBC to enter into this Agreement, and simultaneously with the execution of this Agreement, (i) each of the directors of CVCY is entering into and delivering to CWBC a Director Cooperation Agreement, and (ii) each of the executive officers of CVCY is entering into and delivering to CWBC an Executive Cooperation Agreement, pursuant to which they shall agree, among other things, to vote their shares of capital stock of CVCY in favor of the approval and adoption of this Agreement.

WHEREAS, the Parties desire to make certain representations, warranties and agreements in connection with the Merger and also to prescribe certain conditions to the Merger.

NOW, THEREFORE, in consideration of the mutual covenants, representations, warranties and agreements contained in this Agreement, the Parties agree as follows:

Article I

CERTAIN DEFINITIONS

1.1Certain Definitions. The following terms are used in this Agreement with the meanings set forth below:

“Acquisition Proposal” means (i) with respect to CWBC, any inquiry, proposal or offer, filing of any regulatory application or notice (whether in draft or final form) or disclosure of an intention to do any of the foregoing from any Person relating to any (a) direct or indirect acquisition or purchase of any material assets or deposits (as applicable) of CWBC, (b) direct or indirect acquisition or purchase of more than 25% of any class of Equity Securities of CWBC, or (c) merger, consolidation, business combination, recapitalization, tender offer, stock purchase, liquidation, dissolution or similar transaction involving CWBC, other than the transactions contemplated by this Agreement, and (ii) with respect to CVCY any inquiry, proposal or offer, filing of any regulatory application or notice (whether in draft or final form) or disclosure of an intention to do any of the foregoing from any Person relating to any (a) direct or indirect acquisition or purchase of any material assets or deposits (as applicable) of CVCY, (b) direct or indirect acquisition or purchase of more than 25% of any class of Equity Securities of CVCY, or (c) merger, consolidation, business combination, recapitalization, tender offer, stock purchase, liquidation, dissolution or similar transaction involving CVCY, other than the transactions contemplated by this Agreement.

“Affiliate” means, with respect to a Person, any Person that, directly or indirectly, controls, is controlled by or is under common control with such Person; for purposes of this definition, “control” (including, with correlative meanings, the terms “controlled by” or “under common control with”), as applied to any Person, means the possession, directly or indirectly, of (i) ownership, control or power to vote twenty-five percent (25%) or more of the outstanding shares of any class of voting securities of such Person, (ii) control, in any manner, over the election of a majority of the directors, trustees or general partners (or individuals exercising similar functions) of such Person or (iii) the power to exercise a controlling influence over the management or policies of such Person; provided, however, neither CWBC nor any of its Affiliates shall be deemed an Affiliate of CVCY or any of its Affiliates for purposes of this Agreement prior to the Effective Time and neither CVCY nor any of its Affiliates shall be deemed an Affiliate of CWBC or any of its Affiliates for purposes of this Agreement prior to the Effective Time.

“Aggregate Merger Consideration” means the number of CVCY Common Stock calculated by multiplying the number of CWBC Diluted Shares by the Exchange Ratio.

“Agreement” has the meaning set forth in the preamble and includes any amendments or modifications made effective from time to time in accordance with Section 9.2.

“Applicable CWBC Employee” has the meaning set forth in Section 6.17(d).

“ASC 740” has the meaning set forth in Section 5.2(t).

“Assumed Option” has the meaning set forth in Section 3.3(a).

“Bank Merger” has the meaning set forth in the recitals to this Agreement.

“Bank Merger Agreement” has the meaning set forth in Section 2.3(b).

“Bank Merger Effective Time” has the meaning set forth in Section 2.3(b).

“Bank Secrecy Act” means the Bank Secrecy Act of 1970, as amended.

“Benefit Plan” or “Benefit Plans” with respect to CVCY means the CVCY Benefit Plans and with respect to CWBC means the CWBC Benefit Plans.

“BHCA” means the Bank Holding Company Act of 1965, as amended.

“BHC Merger Agreement” has the meaning set forth in Section 2.3(a).

“Burdensome Condition” has the meaning set forth in Section 7.1(a).

“Business Day” means Monday through Friday of each week, except a legal holiday recognized as such by the United States government or any day on which banking institutions in the State of California are authorized or obligated to close.

“Cause” means the employee’s gross negligence or misconduct in the performance of employee’s duties, breach of fiduciary duty or duty of loyalty, commission of an act of fraud, embezzlement, misappropriation or theft in the course of employee’s employment, or the violation of any Law (other than traffic violations or similar minor offenses that do not harm the reputation of CVCY or CWBC).

“Central Valley Community Bank” has the meaning set forth in the recitals to this Agreement.

“Certificate” has the meaning set forth in Section 3.2(b).

“CFC” means the California Financial Code.

“CGCL” means the California General Corporation Law.

“Change in Recommendation” has the meaning set forth in Section 6.7(e).

“Closing” has the meaning set forth in Section 7.1.

“Closing Allowance” means the CWBC allowance for loan losses as of the final day of the month immediately preceding the month in which the Closing Date occurs (unless the Closing Date occurs during the first week of the month, in which event it shall be determined as of the final day of the month that is two months immediately preceding the Closing Date) predetermined in accordance with GAAP.

“Closing Date” means the date on which the Effective Time occurs.

“Code” means the Internal Revenue Code of 1986, as amended.

“Community West Bank” has the meaning set forth in the recitals to this Agreement.

“Confidentiality Agreement” has the meaning set forth in Section 6.7(e).

“Confidentiality Policies” has the meaning set forth in Section 5.2(y)(iii).

“Consents” has the meaning set forth in Section 6.11.

“Cooperation Agreements” means the Executive Cooperation Agreements together with the Director Cooperation Agreements of a Party to this Agreement.

“CRA” means the Community Reinvestment Act of 1977, as amended.

“Cure Period” has the meaning set forth within the definition of Good Reason.

“CVCB Board” means the board of directors of Central Valley Community Bank.

“CVCB Bylaws” means the bylaws of Central Valley Community Bank, as amended and restated.

“CVCY” has the meaning set forth in the preamble to this Agreement.

“CVCY Articles” means the articles of incorporation of CVCY, as amended and restated.

“CVCY Benefit Plans” has the meaning set forth in Section Error! Reference source not found..

“CVCY Board” has the meaning set forth in the recitals to this Agreement.

“CVCY Bylaws” means the Bylaws of CVCY, as amended and restated.

“CVCY Common Stock” means shares of CVCY common stock, no par value.

“CVCY Disclosure Schedule” has the meaning set forth in Section 5.1.

“CVCY Equity Incentive Plans” means the Central Valley Stock Purchase Plan dated June 1, 2017, the Central Valley Community Bancorp 2015 Omnibus Incentive Plan dated May 20, 2015, the Central Valley Community Bancorp 2005 Omnibus Incentive Plan adopted May 18, 2005, the Central Valley Community Bancorp 2000 Stock Option Plan adopted on November 15, 2000 and amended on December 20, 2000, the Folsom Lake Bank 2007 Equity Incentive Plan adopted by the board of directors of Folsom Lake Bank on April 19, 2007, approved by its shareholders on May 9, 2007, and assumed by CVCY in connection with the merger of Folsom Lake Bank with and into Central Valley Community Bank effective October 1, 2017, and the Clovis Community Bank Senior Management Incentive Plan dated January 1, 1999.

“CVCY Financial Statements” shall mean (i) the audited consolidated statements of financial condition of CVCY and its Subsidiaries as of December 31, 2020, 2021, and 2022, and the related consolidated statements of operations, of comprehensive income, of changes in shareholders’ equity, and of cash flows for the years ended December 31, 2020, 2021, and 2022, in each case including the related notes and accompanied by the audit report of its auditors; and

(ii) the unaudited consolidated statements of financial condition of CVCY and its Subsidiaries as of June 30, 2023 and the related unaudited consolidated statements of operations, of comprehensive income, of changes in shareholders’ equity and of cash flows for the period ended June 30, 2023, in each case including the related notes the unaudited statements of financial condition (including related notes and schedules, if any).

“CVCY Insurance Policies” has the meaning set forth in Section 5.13(l).

“CVCY Loan Property” has the meaning set forth in Section 5.13(u).

“CVCY Material Contracts” has the meaning set forth in Section 5.13(r)(i).

“CVCY SEC Documents” has the meaning set forth in Section 5.2(s).

“CVCY Shareholder Approval” means the affirmative vote for approval of this Agreement and the transactions contemplated hereby, including, without limitation, the Mergers and the shares of CVCY Common Stock issuable in connection with the Merger to be authorized for listing on NASDAQ, by the holders of a majority of the outstanding shares of CVCY Common Stock.

“CVCY Shareholders Meeting” has the meaning set forth in Section 6.8(a).

“CWB Board” means the board of directors of Community West Bank.

“CWB Bylaws” means the bylaws of Community West Bank, as amended and restated.

“CWBC” has the meaning set forth in the preamble to this Agreement.

“CWB Charter” means the charter of CWBC, as amended and restated.

“CWBC Articles” means the articles of incorporation of CWBC, as amended and restated.

“CWBC Benefit Plan” has the meaning set forth in Section 5.2(s)(i).

“CWBC Board” has the meaning set forth in the recitals to this Agreement.

“CWBC Bylaws” means the bylaws of CWBC, as amended and restated.

“CWBC Change of Control Agreements” has the meaning set forth in Section 6.17(d).

“CWBC Common Stock” means the common stock of CWBC.

“CWBC Diluted Shares” means the aggregate number of shares of CWBC Common Stock issued and outstanding immediately prior to the Effective Time.

“CWBC Disclosure Schedule” has the meaning set forth in Section 5.1.

“CWBC Dissenting Shares” has the meaning set forth in Section 3.2(g).

“CWBC Equity Incentive Plan” has the meaning set forth in Section 3.3(a).

“CWBC Financial Statements” shall mean (i) the audited consolidated statements of financial condition of CWBC and its Subsidiaries as of December 31, 2020, 2021, and 2022, and

the related consolidated statements of operations, of comprehensive income, of changes in shareholders’ equity, and of cash flows for the years ended December 31, 2020, 2021, and 2022, in each case including the related notes and accompanied by the audit report of RSM US LLP; and (ii) the unaudited consolidated statements of financial condition of CWBC and its Subsidiaries as of June 30, 2023 and the related unaudited consolidated statements of operations, of comprehensive income, of changes in shareholders’ equity and of cash flows for the period ended June 30, 2023, in each case including the related notes the unaudited statements of financial condition (including related notes and schedules, if any).

“CWBC Insurance Policies” has the meaning set forth in Section 5.2(cc).

“CWBC Loan Property” has the meaning set forth in Section 5.2(s).

“CWBC Material Contract” or “CWBC Material Contracts” has the meaning set forth in Section 5.2(o)(i).

“CWBC Proposal” has the meaning set forth in Section 8.2(c)(ii).

“CWBC Restricted Share Award” has the meaning set forth in Section 3.3(b).

“CWBC SEC Documents” has the meaning set forth in Section 5.2(s).

“CWBC Shareholder Approval” means the affirmative vote for approval of this Agreement and the transactions contemplated hereby by the holders of a majority of the outstanding shares of CWBC Common Stock.

“CWBC Shareholders Meeting” has the meaning set forth in Section 6.8(a).

“CWBC Stock Option” has the meaning set forth in Section 3.3(a).

“D&O Insurance” has the meaning set forth in Section 6.16(d).

“Derivatives Contracts” means any swap transaction, option, warrant, forward purchase or sale transaction, futures transaction, cap transaction, floor transaction or collar transaction relating to one or more currencies, commodities, bonds, equity securities, loans, interest rates, credit-related events or conditions or any indexes, or any other similar transaction or combination of any of these transactions, including collateralized mortgage obligations or other similar instruments or any debt or equity instruments evidencing or embedding any such types of transactions, and any related credit support, collateral or other similar arrangements related to such transactions.

“DFPI” means the Department of Financial Protection and Innovation of the State of California.

“Disclosure Schedules” has the meaning set forth in Section 5.1.

“Dissenting Shares” has the meaning set forth in Section 3.2(g).

“DOL” has the meaning set forth in Section 5.2(q)(i).

“Effect” has the meaning set forth in the definition of Material Adverse Effect.

“Effective Time” has the meaning set forth in Section 2.3.

“Employee Pre-Closing Agreement” has the meaning set forth in Section 6.17(d).

“End Date” has the meaning set forth in Section 8.1(b)(i).

“Environmental Laws” has the meaning set forth in Section 5.2(s).

“Equal Credit Opportunity Act” means the Equal Credit Opportunity Act, as amended.

“Equity Investment” means (a) an Equity Security, and (b) an ownership interest in any company or other entity, any membership interest that includes a voting right in any company or other entity, any interest in real estate, and any investment or transaction which in substance falls into any of these categories even though it may be structured as some other form of investment or transaction.

“Equity Security” means any stock, certificate of interest or participation in any profit-sharing agreement, collateral-trust certificate, preorganization certificate or subscription, transferable share, investment contract, or voting-trust certificate; any security convertible into such a security; any security carrying any warrant or right to subscribe to or purchase any such security; and any certificate of interest or participation in, temporary or interim certificate for, or receipt for any of the foregoing.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended.

“ERISA Affiliate” means any entity, trade or business (whether or not incorporated) that is a member of a group described in Section 414(b), (c), (m) or (o) of the Code or Section 4001(b)(1) of ERISA that includes CWBC, or that is a member of the same “controlled group” as CWBC pursuant to Section 4001(a)(14) of ERISA.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Exchange Agent” has the meaning set forth in Section 3.2(a).

“Exchange Ratio” has the meaning set forth in Section 3.1(a).

“Excluded Shares” means shares of CWBC Common Stock owned by CWBC or CVCY, in each case not held (i), directly or indirectly, in trust accounts, managed accounts and the like, or otherwise held in a fiduciary or agency capacity, that are beneficially owned by third Parties or (ii) in respect of a debt previously contracted.

“Executive Committee” has the meaning set forth in Section 6.19(b).

“Fair Housing Act” means the Fair Housing Act, as amended.

“FDIC” means the Federal Deposit Insurance Corporation.

“Federal Reserve Board” means the Board of Governors of the Federal Reserve System.

“FHLB” means the Federal Home Loan Bank of San Francisco.

“Former CWBC Employees” has the meaning set forth in Section 6.17(c).

“GAAP” means generally accepted accounting principles and practices as in effect from time to time in the United States.

“Good Reason” means (i) any reduction in base salary in excess of ten percent (10%) from that paid or made available immediately prior to the Closing Date; or (ii) being required to be based at any office or location more than thirty (30) miles from where the individual was based on the date immediately preceding the Closing Date, except for travel reasonable required in the performance of such employee’s responsibilities. Notwithstanding the foregoing, “Good Reason” shall not exist unless (a) the employee provides written notice of the basis for Good Reason to CVCY or Central Valley Community Bank within ninety (90) days after the initial occurrence of the event constituting Good Reason; (b) the employee cooperates in good faith with CVCY and Central Valley Community Bank’s efforts, for a period not less than thirty (30) days following such notice (the “Cure Period”), to remedy the condition; (c) notwithstanding such efforts, the Good Reason condition continues to exist; and (d) the employee terminates his or her employment within sixty (60) days after the end of the Cure Period.

“Governmental Authority” means any federal, territorial, state, local or foreign court, administrative agency or commission or other governmental authority or instrumentality or self-regulatory organization.

“Hazardous Substance” has the meaning set forth in Section 5.2(s).

“Home Mortgage Disclosure Act” means the Home Mortgage Disclosure Act, as amended.

“Indemnified Parties” has the meaning set forth in Section 6.16(a).

“Investment Securities” means any equity securities or debt securities defined in Accounting Standards Codification Topic 320.

“IRS” has the meaning set forth in Section 5.2(q)(i).

“IT Assets” has the meaning set forth in Section 5.2(y)(iv).

“Janney” has the meaning set forth in Section 5.3(d)(ii).

“Joint Proxy Statement” has the meaning set forth in Section 6.16(a).

“Key Employees” means the following employees of CWBC: (i) the President and Chief Executive Officer, Martin E. Plourd; (ii) the Executive Vice President and Chief Financial Officer, Richard Pimentel; (iii) the Executive Vice President, Chief Operating Officer and Chief Risk Officer, T. Joseph Stronks; and (iv) the President of Community West Bank, William Filippin.

“Knowledge” means (i) with respect to CVCY, the knowledge of any member of the CVCY Board or CVCY or Central Valley Community Bank senior management team, and (ii) with respect to CWBC, the knowledge of any member of the CWBC Board or any of the Key Employees. An individual’s knowledge shall include information actually known to that person and information of which the individual is aware following a reasonably diligent inquiry of other persons employed or retained by CWBC or CVCY, as applicable, who would be expected to have information responsive the topic of the inquiry.

“Law” shall mean any federal, state or local constitution, statute, code, regulation, ordinance, rule, or common law, publicly available written regulatory guidelines and policies, orders or legally enforceable requirements enacted, issued, adopted, promulgated, enforced, ordered or applied by any Governmental Authority applicable to a Person.

“Letter of Transmittal” has the meaning set forth in Section 3.2(b).

“Liens” means any charge, mortgage, pledge, security interest, restriction, claim, lien or encumbrance.

“Loans” has the meaning set forth in Section 4.1(s).

“Material Adverse Effect” shall mean with respect to any Party, any fact, event, change, condition, occurrence, development, circumstance, effect, or state of facts (each, an “Effect”) that either (i) prevents, materially delays or materially impairs the ability of such Party to perform its obligations under this Agreement or to consummate the Mergers, or (ii) individually or in the aggregate, has been, or would reasonably be expected to be, material and adverse to the business, properties, assets, liabilities, financial condition, or results of operations of such Party and its Subsidiaries, in each case taken as a whole; provided, however, that no Effect to the extent resulting from any of the following shall be considered in determining whether a Material Adverse Effect has occurred or is in existence: (a) changes, after the date hereof, in Law, rules, and regulations of general applicability, or of general applicability to banks or their holding companies, or interpretations thereof, by any Governmental Authority, including any change in GAAP or regulatory accounting requirements; (b) changes in the economy or financial markets, generally, in the United States; (c) changes in economic, business, political, regulatory, market, or financial conditions generally affecting the banking industry; (d) the entry into or announcement of this Agreement or the transactions contemplated hereby or compliance by such Party or its Subsidiaries with the terms of this Agreement, including without limitation, the completion of each of the contemplated transactions; or (e) a decline in the trading price of such Party’s common stock (it being understood that the facts and circumstances giving rise to such decline may be deemed to constitute, and may be taken into account in determining whether a Material Adverse Effect has occurred or is in existence if such facts and circumstances are not otherwise described in clauses (a) through (d) of this definition); provided, further, that with respect to clauses (a), (b) and (c) of this definition, such Effects shall be taken into account in determining whether a Material Adverse Effect is in existence to the extent any such Effects materially and disproportionately adversely affect a Party and its Subsidiaries, taken as a whole, compared to other bank holding companies with assets of between $1.0 and $5.0 billion, operating primarily the same lines of business and geographic locations in which such Party and its Subsidiaries operate.

“Material Contract” with respect to CVCY shall mean a CVCY Material Contract and with respect to CWBC shall mean and CWBC Material Contract.

“Maximum Amount” has the meaning set forth in Section 6.16(d).

“Merger” has the meaning set forth in the recitals to this Agreement.

“Mergers” means the Merger and the Bank Merger.

“Merger Consideration” has the meaning set forth in Section 3.1(a).

“NASDAQ” means the Nasdaq Stock Market, Inc.

“National Labor Relations Act” means the National Labor Relations Act, as amended.

“OCC” has the meaning set forth in the recitals to this Agreement.

“Option Exchange Ratio” means the Exchange Ratio, unless the Exchange Ratio would result in a modification of an option within the meaning of Code section 424 or 409A or result in

a CVCY Stock Option being less favorable to the CWBC Stock Option holder, in which case the Option Exchange Ratio shall be adjusted to the minimum extent necessary to satisfy the substitution requirements set forth in Code section 424 and section 1.424-1 of the Treasury Regulations, or to ensure the CVCY Stock Option is at least as favorable to the CWBC Stock Option holder, as applicable, while being as close as possible to the Exchange Ratio.

“OREO” means other real estate owned.

“Party” shall mean each of CVCY and CWBC and “Parties” shall mean CVCY and CWBC.

“Permitted Encumbrances” shall mean (i) Liens for current taxes and assessments not yet due and payable and for which adequate reserves have been established in accordance with GAAP; (ii) Liens set forth in policies for title insurance of such properties delivered to CVCY that (A) have been accepted in writing by CVCY or (B) do not affect the use or enjoyment of such property or have a material detrimental effect on the value thereof or its present use; (iii) statutory Liens of landlords, or (iv) Liens of carriers, warehousemen, mechanics, materialmen and repairmen incurred in the ordinary course of business consistent with past practice and not yet delinquent.

“Person” means any individual, bank, corporation, partnership, association, joint-stock company, business trust, limited liability company or unincorporated organization.

“Piper Sandler” has the meaning set forth in Section 5.2(e)(ii).

“Previously Disclosed” with regard to a Party means only that information set forth on such Party’s Disclosure Schedule.

“Professional Expenses” means the fees and expenses of legal counsel, financial advisors and independent accounting firm incurred in connection with or in contemplation of this Agreement and the transactions contemplated herein.

“Proprietary Rights” has the meaning set forth in Section 5.2(y).

“Registration Statement” has the meaning set forth in Section 6.3(a).

“Regulatory Actions” has the meaning set forth in Section 7.3(i).

“Related Parties” has the meaning set forth in Section 8.2(d).

“Representatives” has the meaning set forth in Section 6.7(a).

“Requisite Regulatory Approval” has the meaning set forth in Section 6.2(a).

“Requisite Shareholder Approvals” means the CWBC Shareholder Approval and the CVCY Shareholder Approval.

“Rights” means, with respect to any Person, warrants, options, rights, convertible securities and other arrangements or commitments of any character that obligate the Person to sell, purchase, issue, or dispose of any of its capital stock or other ownership interests or other securities representing the right to purchase or otherwise receive any of its capital stock or other ownership interests.

“Sarbanes-Oxley Act” has the meaning set forth in Section 5.2(h).

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations thereunder.

“Share” or “Shares” has the meaning set forth in Section 3.1(a).

“Shareholder” and “Shareholders” have the meaning set forth in Section 3.2(b).

“Shareholders Meetings” has the meaning set forth in Section 6.8(a)(i).

“Subsidiary” has the meaning ascribed to such term in Rule l-02 of Regulation S-X of the SEC.

“Superior Proposal” means any bone fide written Acquisition Proposal to CWBC or any of its Subsidiaries which the CWBC Board concludes in good faith to be more favorable from a financial point of view to its shareholders than the Merger and the other transactions contemplated by this Agreement, (i) after receiving the advice of its financial advisor (who shall be a regionally recognized investment banking firm), (ii) after taking into account the likelihood of consummation of such transaction on the terms set forth therein (as compared to, and with due regard for, the terms herein), and (iii) after taking into account all legal (after consultation with its legal counsel), financial (including the financing terms of any such proposal), regulatory and other aspects of such proposal and any other factors permitted under applicable Law.

“Tax” and “Taxes” mean (i) any federal, state, local, or foreign income, gross receipts, license, payroll, employment, excise, severance, stamp, occupation, premium, windfall profits, environmental (including taxes under Code Section 59A), custom duties, capital stock, franchise, profits, net worth, margin, capital production, withholding, social security (or similar excises), unemployment, escheat or unclaimed property, disability, ad valorem, real property, personal property, sales, use, transfer, registration, value added, alternative or add-on minimum, estimated, or other tax of any kind whatsoever, including any interest, penalty, or addition thereto, whether or not disputed, by any Governmental Authority responsible for imposition of any such tax (domestic or foreign), (ii) in the case of CWBC, liability for the payment of any amount of the type described in clause (i) as a result of being or having been on or before the Closing Date a member of an affiliated, consolidated, combined or unitary group, or a party to any agreement or arrangement, as a result of which liability of CWBC to a Governmental Authority is determined or taken into account with reference to the liability of any other Person, and (iii) liability of CWBC for the payment of any amount as a result of being party to any tax sharing agreement or with respect to the payment of any amount of the type described in (i) or (ii) as a result of any existing express or implied obligation (including an indemnification obligation).

“Tax Returns” means any return (including any amended return), declaration or other report (including elections, declarations, claims for refund, schedules, estimates and information returns) with respect to any Taxes (including estimated taxes).

“Termination Fee” means $4,000,000.

“Trading Day” means a day that CVCY Common Stock is traded on the NASDAQ Capital Market as reported on the website of www.nasdaq.com.

“Transaction Expenses” has the meaning set forth in Section 6.20.

“USA PATRIOT Act” means the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001, as amended.

Article II

THE MERGER AND RELATED MATTERS

1.1The Merger; Surviving Entity.

(a)The Merger. Upon the terms and subject to the conditions set forth in this Agreement, and pursuant to the applicable provisions of the CGCL, at the Effective Time, CWBC shall be merged with and into CVCY, with CVCY as the surviving corporation in the Merger.

(b)Surviving Entity. Upon the consummation of the Merger, the separate corporate existence of CWBC shall cease and CVCY shall continue as the surviving entity under the laws of the State of California. Effective at the Effective Time, the name of “Central Valley Community Bancorp” as the surviving entity of the Merger shall change to “Community West Bancshares.” From and after the Effective Time, CVCY, as the surviving entity of the Merger, shall possess all of the properties and rights and be subject to all of the liabilities and obligations of CWBC. CVCY shall use commercially reasonable efforts to change the ticker symbol of CVCY to “CWBC” effective at the opening of the first trading day immediately following the Effective Time.

(c)Articles of Incorporation and Bylaws of the Surviving Entity. With the exception of the name change set forth in the BHC Merger Agreement, at the Effective Time, the articles of incorporation of CVCY, as in effect immediately prior to the Effective Time, shall be the Articles of Incorporation of CVCY, as the surviving corporation of the Merger, until thereafter amended in accordance with applicable Law. At the Effective Time, the CVCY Bylaws shall be the Bylaws of CVCY, as the surviving corporation of the Merger, until thereafter amended in accordance with applicable Law.

(d)Directors and Officers of the Surviving Entity. Subject to Section 6.19, the directors and officers of CVCY immediately prior to the Effective Time shall be the directors and officers of CVCY, as the surviving corporation of the Merger, until their respective successors shall be duly elected and qualified or otherwise duly selected.

1.2The Bank Merger.

(a)The Bank Merger. Upon the terms and conditions of this Agreement, and pursuant to the provisions of the CFC, the CGCL and the National Bank Act and, to the extent applicable, the rules and regulations promulgated by the DFPI, FDIC and OCC, immediately following the Effective Time, Community West Bank shall be merged with and into Central Valley Community Bank in the Bank Merger. Central Valley Community Bank shall be the surviving entity in the Bank Merger and, following the Bank Merger, the separate corporate existence of Community West Bank shall cease, and each outstanding share of stock of Community West Bank shall be cancelled. Effective as of the Bank Merger Effective Time (defined below) the name of “Central Valley Community Bank” as the surviving entity of the Bank Merger shall change to “Community West Bank.” Prior to the effective time of the Bank Merger, CVCY and CWBC shall cause Central Valley Community Bank and Community West Bank, respectively, to execute such certificates, agreements and such other documents and certificates as are necessary to effectuate the Bank Merger immediately following the consummation of the Merger.

(b)Articles of Incorporation and Bylaws of the Surviving Bank. With the exception of the name change set forth in the Bank Merger Agreement, at the Effective Time, the articles of incorporation of Central Valley Community Bank, as in effect immediately prior to the Effective Time, shall be the Articles of Incorporation of Central Valley Community Bank, as the surviving corporation in the Bank Merger, until thereafter amended in accordance with applicable Law. At the Effective Time, the CVCB Bylaws, as amended in accordance with Section 6.19(a), shall be the Bylaws of Central Valley Community Bank, as the surviving corporation of the Bank Merger, until thereafter amended in accordance with applicable Law.

(c)Directors and Officers of the Surviving Bank. Subject to Section 6.19, the directors and officers of Central Valley Community Bank immediately prior to the Bank Merger shall be the directors and officers of Central Valley Community Bank, as the surviving corporation of the Bank Merger, until their respective successors shall be duly elected and qualified or otherwise duly selected.

1.3Effective Time.

(a)The Merger. As soon as practicable, but in no event later than the tenth (10th) calendar day after which each of the conditions set forth in Article VII hereof has been satisfied or waived (other than those conditions that by their nature are to be satisfied at Closing) or such other time as the Parties may agree, CVCY and CWBC will file, or cause to be filed, with the California Secretary of State an agreement of merger in substantially the form of Exhibit C to this Agreement (“BHC Merger Agreement”) effecting the Merger. The Merger shall become effective upon (i) the filing of the BHC Merger Agreement with the California Secretary of State, or (ii) such later date and time as may be specified therein (the “Effective Time”).

(b)The Bank Merger. Prior to the Effective Time, CVCY and CWBC shall cause Central Valley Community Bank and Community West Bank to enter into an agreement and plan of merger (the “Bank Merger Agreement”) in substantially the form of Exhibit D to this Agreement, providing for the Bank Merger in accordance with applicable Law and the terms of the Bank Merger Agreement concurrently with or as soon as reasonably practicable after consummation of the Merger. The Bank Merger shall become effective at the time that the Bank Merger Agreement has been filed with the DFPI as provided in Section 4887(b) of the CFC (the “Bank Merger Effective Time”).

1.4United States Federal Income Tax Consequences. It is intended that the Merger shall constitute a “reorganization” as that term is used in Section 368(a) of the Code (“Reorganization”), and that this Agreement shall constitute a “plan of reorganization” as that term is used in Sections 354 and 361 of the Code. Until the Closing, each Party shall use its best efforts to cause the Merger to so qualify, and will not knowingly take any action, cause any action to be taken, fail to take any action or cause any action to fail to be taken which action or failure to act could prevent the Merger from qualifying as a Reorganization. CVCY and CWBC each agrees to prepare and file all U.S. federal income Tax Returns in accordance with this Section 2.4 and shall not take any position inconsistent herewith in the course of any audit, litigation, or other proceeding with respect to U.S. federal income Taxes; provided that nothing contained herein shall prevent CVCY or CWBC from settling any proposed deficiency or adjustment by any Governmental Authority based upon or arising out of such treatment, and neither CVCY nor CWBC shall be required to litigate before any court any proposed deficiency or adjustment by any Governmental Authority challenging such treatment.

Article III

CONSIDERATION AND EXCHANGE PROCEDURES

1.1Effect on Capital Stock. At the Effective Time, as a result of the Merger and without any action on the part of any Person:

(a)CWBC Common Stock. Subject to Section 3.1(b), each share of CWBC Common Stock (each, a “Share” and collectively, “Shares”) issued and outstanding immediately prior to the Effective Time (other than Excluded Shares and CWBC Dissenting Shares) shall be converted into the right to receive 0.7900 of a share (the “Exchange Ratio”) of CVCY Common Stock (the “Merger Consideration”), without interest thereon. At the Effective Time, all Shares shall no longer be outstanding and shall automatically be cancelled and retired and shall cease to exist, and each holder of a certificate or book-entry account statement that immediately prior to the Effective Time represented any Shares shall cease to have any rights with respect thereto, except the right to receive the Merger Consideration, as well as any cash in lieu of fractional shares which such holder has the right to receive pursuant to Section 3.1(b); provided, however, that any holders of CWBC Dissenting Shares shall be entitled to their rights as such under applicable Law.

(b)No Fractional Shares. No fraction of a share of CVCY Common Stock will be issued, but in lieu thereof, each CWBC shareholder who would otherwise be entitled to a fraction of a share of CVCY Common Stock (based on the aggregate number of Shares held by such shareholder) shall be entitled to receive from CVCY an amount of cash (rounded to the nearest whole cent) equal to the product of (i) such fraction, multiplied by (ii) the closing price of CVCY Common Stock reported on NASDAQ on the last Trading Day preceding the Closing Date.

(c)Adjustments. If, between the date of this Agreement and the Effective Time, the outstanding shares of CVCY Common Stock shall have been increased, decreased, changed into or exchanged for a different number or kind of shares or securities as a result of a reorganization, recapitalization, reclassification, stock dividend, stock split, reverse stock split or other similar change in capitalization, an appropriate and proportionate adjustment shall be made to the Exchange Ratio.

(d)No Effect on CVCY Common Stock. The Merger shall have no effect on the capital stock of CVCY. Each share of CVCY Common Stock that is issued and outstanding immediately prior to the Effective Time shall remain issued and outstanding and shall not be affected by the Merger.

(e)Cancellation of Excluded Shares. Each Excluded Share shall, as a result of the Merger and without any action on the part of the holder thereof, cease to be outstanding, be cancelled without payment of any consideration therefor and cease to exist at the Effective Time.

1.2Exchange Procedures; Dissenting Shares.

(a)Exchange Agent. At least ten (10) Business Days prior to the Effective Time, CVCY shall designate Computershare Shareholder Services, Inc. or another Person reasonably acceptable to CWBC to act as Exchange Agent (the “Exchange Agent”) in the Merger.

(b)Exchange Procedures. Subject to CWBC’s timely delivery of all information necessary therefor, within a reasonable period of time (but not more than five (5) Business Days) after the Closing, CVCY shall cause to be mailed to each holder of record (each a “Shareholder” and collectively, the “Shareholders”) of a certificate or certificates (each, a “Certificate”, it being understood that any reference herein to “Certificate” shall be deemed, as appropriate, to include reference to book-entry account statements relating to the Shares, and it

being further understood that provisions herein relating to Certificates shall be interpreted in a manner that appropriately accounts for book-entry shares, including that in lieu of a Certificate and letter of transmittal as specified herein, shares held in book-entry form may be transferred by means of an “agents message” to the Exchange Agent or such other evidence of transfer as the Exchange Agent may reasonably request), which immediately prior to the Effective Time represented the Shares, (i) a form of letter of transmittal in such form as mutually agreed to by CVCY and CWBC (the “Letter of Transmittal”) and (ii) instructions for use in effecting the surrender of the Certificates in exchange for the Merger Consideration payable in exchange therefor. Following the Effective Time and delivery to the Exchange Agent of a duly completed and validly executed Letter of Transmittal, together with surrender of a Certificate (or Certificates) for cancellation, each Shareholder shall be entitled to receive in exchange therefor the Merger Consideration to which such Shareholder is entitled pursuant to Section 2.2 at the times set forth in this Article III and the Certificate(s) so surrendered shall be canceled. Certificates shall be appropriately endorsed or accompanied by such instruments of transfer as CVCY may reasonably require.

(c)CVCY to Provide Aggregate Merger Consideration to Exchange Agent. On or before the date of the Closing, CVCY shall deposit with the Exchange Agent, for payment in accordance with this Section 3.2, a number of shares of CVCY Common Stock equal to the Aggregate Merger Consideration plus an additional amount of cash sufficient to deliver to the Shareholders any cash in lieu of fractional shares payable pursuant to Section 3.1(b) as determined by CVCY. Any shares of CVCY Common Stock and any deposited cash remaining with the Exchange Agent on the 12-month anniversary of the Closing Date shall be remitted to CVCY and thereafter any Shareholder shall direct any claims for payment hereunder to CVCY.

(d)No Further Rights. At the Effective Time, holders of Certificates shall cease to have rights with respect to CWBC Common Stock previously represented by such Certificates, and their sole right (other than the holders of Certificates representing Dissenting Shares) shall be the right to receive the Merger Consideration and cash in lieu of fractional shares into which the shares of CWBC Common Stock represented by such Certificates have been converted pursuant to this Section 3.2, as well as any dividends to which holders of CWBC Common Stock become entitled in accordance with Section 3.2(e). After the Effective Time, there shall be no further transfer of Certificates on the records of CWBC, and if such Certificates are presented to CVCY for transfer, they shall be canceled against delivery of the Merger Consideration in respect of the shares represented thereby. CVCY shall not be obligated to deliver any merger consideration pursuant to this Article III to any former holder of CWBC Common Stock until such holder surrenders the Certificates as provided herein. Neither CVCY nor any Affiliate thereof shall be liable to any holder of CWBC Common Stock represented by any Certificate for any merger consideration paid to a public official pursuant to applicable abandoned property, escheat or similar laws. CVCY shall be entitled to rely upon the stock transfer books of CWBC to establish the identity of those persons entitled to receive merger consideration specified in this Agreement, which books shall be conclusive with respect thereto. In the event of a dispute with respect to ownership of stock represented by any Certificate, CVCY shall be entitled to deposit the Merger Consideration in respect thereof in escrow with an independent third party and thereafter be relieved with respect to any claims thereto.

(e)No Dividends or Other Distributions. No dividends or other distributions with respect to CVCY Common Stock shall be paid to the holder of any unsurrendered Certificate with respect to the shares of CVCY Common Stock represented thereby, in each case unless and until the surrender of such Certificate in accordance with this Section 3.2. Subject to the effect of applicable abandoned property, escheat or similar laws, following surrender of any such Certificate in accordance with this Section 3.2, the record holder thereof shall be entitled to

receive, without interest, (i) the amount of dividends or other distributions with a record date after the Effective Time theretofore payable with respect to the whole shares of CVCY Common Stock represented by such Certificate and paid prior to such surrender date, and/or (ii) at the appropriate payment date, the amount of dividends or other distributions payable with respect to shares of CVCY Common Stock represented by such Certificate with a record date after the Effective Time (but before such surrender date) and with a payment date subsequent to the issuance of the CVCY Common Stock issuable with respect to such Certificate.

(f)Lost, Stolen or Destroyed Certificates. In the event any Certificates shall have been lost, stolen or destroyed, the Exchange Agent shall issue in exchange for such lost, stolen or destroyed Certificates, upon the making of an affidavit of that fact by the holder thereof, the Merger Consideration in respect of the shares represented by those Certificates required pursuant to Section 3.2 at the times set forth in Article III; provided, that the owner of such lost, stolen or destroyed Certificates shall deliver, if requested by CVCY, at the owner’s expense, a non-refundable bond in such amount as CVCY may determine and provide an indemnity acceptable to CVCY against any claim that may be made against CVCY, CWBC, or the Exchange Agent with respect to the Certificates alleged to have been lost, stolen or destroyed and make any processing fee payments to the Exchange Agent.

(g)Dissenting Shares. Any shares of CWBC Common Stock and CVCY Common Stock held by a Person who dissents from the Merger in accordance with the provisions of applicable Law shall be herein called “Dissenting Shares.” Notwithstanding any other provision of this Agreement, any Dissenting Shares shall not, after the Effective Time, be entitled to vote for any purpose or receive any dividends or other distributions and shall be entitled only to such rights as are afforded in respect of Dissenting Shares pursuant to applicable Law. The Merger Consideration for any Dissenting Shares held by CWBC shareholders (“CWBC Dissenting Shares”) shall be paid over to CVCY pending the determination as to the rights of any CWBC Dissenting Shares for consideration under applicable Law. CWBC shall give CVCY (a) prompt notice of any written demands for fair market value, attempted withdrawals of such demands and any other instruments served pursuant to applicable Law relating to shareholders’ demands for fair market value and (b) the opportunity to direct all negotiations and proceedings regarding the Dissenting Shares; provided that CVCY shall act in a commercially reasonable manner in directing any such negotiations or proceedings. CWBC shall not, except with the prior written consent of CVCY or as otherwise required by applicable Law, voluntarily make any payment for any demands for the purchase of CWBC Common Stock or offer to settle or settle any such demands.

1.3Treatment of Equity Awards. Unless otherwise agreed to in writing by the Parties after the date hereof:

(a)CWBC Stock Options. At the Effective Time, each option to purchase shares of CWBC Common Stock (a “CWBC Stock Option”) under either the 2006 Stock Option Plan, the 2014 Stock Option Plan, or the 2020 Omnibus Equity Incentive Plan (each, an “CWBC Equity Incentive Plan” and together, the “CWBC Equity Incentive Plans”), outstanding immediately prior to the Effective Time, whether vested or unvested, shall accelerate as a result of the Merger and shall survive the Merger without cancellation and, following the Effective Time, shall represent a stock option to acquire that number of whole shares of CVCY Common Stock (rounded up to the nearest whole number) equal to the product of: (i) the number of shares of CWBC Common Stock subject to such CWBC Stock Option; and (ii) the Option Exchange Ratio, at the exercise price per share of CVCY Common Stock (rounded down to the nearest whole cent) equal to the quotient obtained by dividing: (A) the exercise price per share of the CWBC Stock Option as of immediately prior to the Effective Time; by (B) the Option Exchange Ratio (such CWBC Stock Option after the Effective Time, an “Assumed Option”) provided that the exercise price and the number of shares of CVCY