Career Education Corporation (NASDAQ: CECO) today reported total

revenue of $439.5 million, and a net loss of $120.4 million, or

($1.64) per diluted share, for the fourth quarter of 2011 compared

to total revenue of $531.6 million and net income of $12.1 million,

or $0.15 per diluted share, for the fourth quarter of 2010. For the

full year 2011, total revenue of $1.88 billion, and net income of

$18.6 million, or $0.25 per diluted share decreased from total

revenue of $2.09 billion and net income of $157.8 million, or $1.95

per diluted share, for the full year 2010.

“In the past four months, we have taken steps to help move the

company forward,” President, Chairman and CEO Steven H. Lesnik

said. “The company-wide independent review into our placement rate

practices, ordered by our Board of Directors, has been completed.

We have reported to accreditors what we should; implemented

extensive corrective measures to address any issues found; and have

now closed the door on the review.”

“While we expect a challenging business and reputational year

ahead, we have put a new strategy in place to deal with our current

challenges and position ourselves for success beyond 2012. It’s

time for Career Education to reinvent itself for the future and

resume a leadership position in higher education,” Lesnik said.

The Company believes it is useful to present non-GAAP financial

measures, which exclude certain significant items, as a means to

understand the performance of its core business. On a non-GAAP

basis, earnings per diluted share from continuing operations were

$0.31 in the fourth quarter 2011 as compared to $0.74 in the fourth

quarter of 2010. For the years ended December 31, 2011 and 2010,

earnings per diluted share from continuing operations (non-GAAP

basis) were $2.16 and $2.89, respectively. (See tables below and

the GAAP to non-GAAP reconciliation attached to this press release

for further details.)

CONSOLIDATED RESULTS

Quarter Ended December 31, 2011

- Total revenue was $439.5 million for

the fourth quarter of 2011, a 17.3 percent decrease from $531.6

million for the fourth quarter of 2010.

- An operating loss of $168.9 million was

recorded for the fourth quarter of 2011, compared to operating

income of $18.2 million for the fourth quarter of 2010.

- The loss from continuing operations for

the quarter ended December 31, 2011 was $142.3 million, or ($1.94)

per diluted share, compared to income from continuing operations of

$14.1 million, or $0.18 per diluted share, for the quarter ended

December 31, 2010.

- During the fourth quarter of 2011, the

Company recorded a $27.1 million pretax gain in connection with the

sale of its ownership interest in Istituto Marangoni. All current

and prior period results have been recast to include the results of

operations for Istituto Marangoni as a component of discontinued

operations.

- The operating results for the quarters

ended December 31, 2011 and 2010 include the following significant

items:

Significant Items(In Millions)

Earnings perDilutedShare Impact

Quarter Ended

December 31, 2011

Goodwill Impairment $ 168.4 $ 2.07 Asset Impairment 20.4

0.18

TOTAL $ 188.8 $ 2.25

Quarter Ended

December 31, 2010

Asset Impairment $ 67.8 $ 0.55 Legal Settlement 0.8

0.01

TOTAL $ 68.6 $ 0.56

- During the fourth quarter 2011, the

Company recorded goodwill impairment charges of $94.7 million and

$73.7 million in its Health Education and Culinary Arts segments,

respectively. In addition, the Company recorded $20.4 million and

$67.8 million of trade name impairment charges in 2011 and 2010,

respectively. Both trade name impairment charges relate to the Le

Cordon Bleu trade name. These impairments were a result of the fair

value calculation for each declining below their respective

carrying values.

- Excluding the significant items in the

table above, operating income was $19.9 million in the fourth

quarter 2011 compared to $86.8 million in the fourth quarter of

2010. The operating margin was 4.5 percent during the fourth

quarter 2011 as compared to 16.3 percent during the fourth quarter

2010.

Year Ended December 31, 2011

- Total revenue was $1.88 billion for the

year ended December 31, 2011, compared to $2.09 billion for the

year ended December 31, 2010.

- Operating income decreased to $39.2

million for the year ended December 31, 2011, from $240.9 million

for the year ended December 31, 2010. The operating margin

decreased to 2.1 percent for the year ended December 31, 2011, from

11.5 percent for the year ended December 31, 2010.

- The loss from continuing operations for

the year ended December 31, 2011, was $4.2 million, or ($0.06) per

diluted share, compared to income from continuing operations of

$162.8 million, or $2.01 per diluted share, for the year ended

December 31, 2010.

- The operating results for the years

ended December 31, 2011 and 2010 include the following significant

items:

Significant Items(In Millions)

Earnings perDilutedShare Impact

Year Ended

December 31, 2011

Goodwill Impairment $ 168.4 $ 2.04 Asset Impairment 20.4

0.18

TOTAL $ 188.8 $ 2.22

Year Ended

December 31, 2010

Asset Impairment $ 67.8 $ 0.55 Legal Settlement 40.8

0.33

TOTAL $ 108.6 $ 0.88

- During 2010, Culinary Arts recorded a

$40.8 million charge related to the settlement of a legal

matter.

- Excluding the significant items in the

table above, operating income was $228.0 million for the year ended

December 31, 2011 and $349.5 million for the year ended December

31, 2010. Operating margin was 12.1 percent and 16.7 percent for

the years ended December 31, 2011 and 2010, respectively.

CONSOLIDATED CASH FLOWS AND FINANCIAL POSITION

Cash Flows

- Net cash flows provided by operating

activities totaled $230.5 million for the year ended December 31,

2011, compared to $272.3 million for the year ended December 31,

2010.

- Capital expenditures decreased to $78.3

million during the year ended December 31, 2011, from $127.3

million for the year ended December 31, 2010. Capital expenditures

decreased to 4.1 percent of total revenue during the year ended

December 31, 2011 as compared to 6.0 percent for the year ended

December 31, 2010 due to the investments made in the Company’s

campus support center in 2010.

Financial Position

- As of December 31, 2011 and

December 31, 2010, cash and cash equivalents and short-term

investments totaled $441.2 million and $420.3 million,

respectively.

Stock Repurchase Program

During the quarter ended December 31, 2011, the Company

repurchased 1.8 million shares of its common stock for

approximately $13.4 million at an average price of $7.41 per share.

During 2011, the Company repurchased approximately 8.1 million

shares of its common stock for approximately $150.4 million at an

average price of $18.67 per share. Under the Company’s previously

authorized stock repurchase program, stock repurchases may be made

on the open market or in privately negotiated transactions from

time to time, depending on factors including market conditions and

corporate and regulatory requirements. As of December 31, 2011,

approximately $239.8 million was available under the Company’s

stock repurchase program.

During January 2012, the Company repurchased an additional

6.1 million shares of its common stock for $56.4 million at an

average price of $9.29 per share through the Company’s 10b5-1

repurchase program announced by the Company on November 21, 2011.

As a result, approximately $183.3 million was available under our

previously authorized stock repurchase program to repurchase

outstanding shares of our common stock as of January 31, 2012.

STUDENT POPULATION AND NEW STUDENT STARTS

Student Population

Total student population by reportable segment as of December

31, 2011 and 2010, was as follows:

As of December 31, % Change

2011 2010 2011 vs. 2010

Student

Population

CTU 24,900 30,900 -19 % AIU 17,100 20,000 -15 % Health Education

24,200 29,000 -17 % Culinary Arts 12,400 13,100 -5 % Art &

Design 9,300 11,500 -19 % International 11,100 10,300 8 %

Total

Student Population 99,000 114,800 -14

%

New Student Starts

New student starts by reportable segment for the quarters ended

December 31, 2011 and 2010, were as follows:

For the Quarters Ended December

31,

% Change 2011 2010 2011 vs.

2010

New Student

Starts

CTU (1) 6,810 8,740 -22 % AIU (1) 4,620 6,230 -26 % Health

Education 4,410 6,270 -30 % Culinary Arts 1,330 1,390 -4 % Art

& Design 840 1,540 -45 % International 2,150 2,480 -13 %

Total New Student Starts 20,160 26,650

-24 % (1)

In 2011, CTU and AIU implemented the

Student Orientation and Academic Readiness ("SOAR") program which

identifies students who may not be prepared for the rigor of

college studies. A student is not included as a new student start

until successful completion of SOAR.

CONFERENCE CALL INFORMATION

Career Education Corporation will host a conference call on

Tuesday, February 28, 2012 at 10:00 a.m. Eastern time. In addition

to discussing the results of operations for the fourth quarter and

year-to-date, the Company will address the status of the

independent review of student placement rates and other regulatory

matters, including the 90-10 Rule, on its conference call.

Interested parties can access the live webcast of the conference

call at www.careered.com in the Investor Relations section of the

website. Participants can also listen to the conference call by

dialing 800-580-9478 (domestic) or 630-691-2769 (international) and

citing code 31668922. Please log-in or dial-in at least 10 minutes

prior to the start time to ensure a connection. An archived version

of the webcast will be accessible for 90 days at www.careered.com

in the Investor Relations section of the website. A replay of the

call will also be available for seven days by calling 888-843-7419

(domestic) or 630-652-3042 (international) and citing code

31668922.

ABOUT CAREER EDUCATION CORPORATION

The colleges, schools and universities that are part of the

Career Education Corporation (“CEC”) family offer high-quality

education to a diverse student population of approximately 100,000

students across the world in a variety of career-oriented

disciplines through online, on-ground and hybrid learning program

offerings. The more than 90 campuses that serve these students are

located throughout the United States and in France, the United

Kingdom and Monaco, and offer doctoral, master’s, bachelor’s and

associate degrees and diploma and certificate programs.

CEC is an industry leader whose institutions are recognized

globally. Those institutions include, among others, American

InterContinental University (“AIU”); Brooks Institute; Colorado

Technical University (“CTU”); Harrington College of Design; INSEEC

Group (“INSEEC”) Schools; International University of Monaco

(“IUM”); International Academy of Design & Technology

(“IADT”); Le Cordon Bleu North America (“LCB”); and Sanford-Brown

Institutes and Colleges. Through its schools, CEC is committed to

providing high-quality education, enabling students to graduate and

pursue rewarding career opportunities.

For more information, see CEC’s website at www.careered.com. The

website includes a detailed listing of individual campus locations

and web links to CEC’s colleges, schools and universities.

Except for the historical and present factual information

contained herein, the matters set forth in this release, including

statements identified by words such as “anticipate,” “believe,”

“plan,” “expect,” “intend,” “project,” “will,” “potential” and

similar expressions, are forward-looking statements as defined in

Section 21E of the Securities Exchange Act of 1934, as

amended. These statements are based on information currently

available to us and are subject to various risks, uncertainties and

other factors that could cause our actual growth, results of

operations, financial condition, cash flows, performance, business

prospects and opportunities to differ materially from those

expressed in, or implied by, these statements. Except as expressly

required by the federal securities laws, we undertake no obligation

to update such factors or to publicly announce the results of any

of the forward-looking statements contained herein to reflect

future events, developments or changed circumstances, or for any

other reason. These risks and uncertainties, the outcomes of which

could materially and adversely affect our financial condition and

operations, include, but are not limited to, the following:

availability of Title IV and other student financial aid or loans

for our students; Congress’ willingness or ability to maintain or

increase funding for Title IV Programs; our ability to maintain

continued eligibility to participate in Title IV Programs,

including under the “90-10 Rule” under the Higher Education Act of

1965, as amended; the impacts of the U.S. Department of Education’s

regulations addressing certain aspects of administration of Title

IV federal financial aid programs, (including among other matters,

gainful employment, the 90-10 Rule and limits on cohort default

rates, certain compensation related to recruiting and admission of

students, more stringent state approval criteria that may affect

current state approval and licensing processes applicable to

postsecondary education institutions and distance learning

programs, and misrepresentation liability) on our business model,

marketing strategies and practices, costs of compliance, costs of

developing and implementing changes in operations, student

recruitment or enrollments, student and program mix and program

offerings; increased competition; other regulatory developments;

the effectiveness of our regulatory compliance efforts; the outcome

of any state attorney general investigations, including those under

way in Florida, Illinois and New York; any claims, sanctions,

operational limitations or adverse accreditation or regulatory

action initiated as a result of any adverse findings from our

investigation into the determination and reporting of placement

rates at our domestic schools; our ability to successfully attract

and retain qualified personnel to fill key senior management

positions, including the positions of president and chief executive

officer; changes in the overall U.S. or global economy; any further

impairment of goodwill and other intangible assets as we continue

to redefine the company and manage our brands and marketing to

improve effectiveness and reduce costs; charges and expenses

associated with exiting excess facility space; our ability to

comply with accrediting agency requirements or obtain accrediting

agency approvals for existing or new programs; the outcome of any

reviews and audits conducted by accrediting, state and federal

agencies; our dependence on information technology systems; our

ownership or use of intellectual property; costs and impacts of

regulatory, legal and administrative actions, proceedings and

investigations, governmental regulation, and class action and other

lawsuits; our ability to manage growth; and other factors discussed

in our Annual Report on Form 10-K for the year ended

December 31, 2011, and from time to time in our current

reports filed with the Securities and Exchange Commission.

CAREER EDUCATION CORPORATION AND

SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (In thousands)

As of December 31, (1) 2011 2010

ASSETS CURRENT ASSETS: Cash and cash

equivalents $ 280,592 $ 260,644 Short-term investments

160,607 159,671 Total cash and cash

equivalents and short-term investments 441,199 420,315

Student receivables, net 60,573 62,091 Receivables, other, net

2,914 1,861 Prepaid expenses 62,399 51,380 Inventories 11,356

13,142 Deferred income tax assets, net 10,940 31,665 Other current

assets 17,769 6,089 Assets of discontinued operations 3,328

39,982 Total current assets 610,478

626,525

NON-CURRENT ASSETS:

Property and equipment, net 349,788 363,516 Goodwill 212,626

374,587 Intangible assets, net 77,186 110,222 Student receivables,

net 9,297 12,522 Deferred income tax assets, net 9,522 6,793 Other

assets, net 30,122 38,923 Assets of discontinued operations

17,101 39,872

TOTAL ASSETS $

1,316,120 $ 1,572,960

LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT

LIABILITIES: Current maturities of capital lease obligations $

844 $ 783 Accounts payable 48,408 53,115 Accrued expenses: Payroll

and related benefits 41,853 72,657 Advertising and production costs

17,717 18,846 Earnout payments 5,735 17,439 Other 61,536 96,664

Deferred tuition revenue 144,947 152,590 Liabilities of

discontinued operations 8,403 44,990

Total current liabilities 329,443 457,084

NON-CURRENT LIABILITIES: Capital lease

obligations, net of current maturities 207 1,223 Deferred rent

obligations 102,079 103,872 Earnout payments - 7,690 Other

liabilities 40,365 30,047 Liabilities of discontinued operations

37,935 38,507 Total non-current

liabilities 180,586 181,339

SHARE-BASED AWARDS SUBJECT TO REDEMPTION 110 153

STOCKHOLDERS' EQUITY: Preferred stock - - Common stock 820

812 Additional paid-in capital 590,965 576,853 Accumulated other

comprehensive loss (5,136 ) (81 ) Retained earnings 375,607 356,991

Cost of shares in treasury (156,275 ) (191 ) Total

stockholders' equity 805,981 934,384

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $

1,316,120 $ 1,572,960

(1) In November 2011, the Company sold its ownership

interest in Istituto Marangoni. As a result, all current and prior

period results have been recast to include Istituto Marangoni as a

component of discontinued operations.

CAREER EDUCATION CORPORATION AND SUBSIDIARIES UNAUDITED

CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per

share amounts and percentages)

For the Quarters Ended December 31, (1)

2011

% of TotalRevenue

2010

% of TotalRevenue

REVENUE: Tuition and registration fees $ 430,607 98.0

% $ 515,600 97.0 % Other 8,909 2.0 % 15,968

3.0 % Total revenue 439,516 531,568

OPERATING EXPENSES: Educational services and

facilities 156,223 35.5 % 161,191 30.3 % General and administrative

241,401 54.9 % 261,270 49.2 % Depreciation and amortization 21,949

5.0 % 19,460 3.7 % Goodwill and asset impairment 188,848

43.0 % 71,475 13.4 % Total operating expenses

608,421 138.4 % 513,396 96.6 %

Operating (loss) income (168,905 ) -38.4 % 18,172

3.4 %

OTHER INCOME (EXPENSE): Interest income

627 0.1 % 452 0.1 % Interest expense (443 ) -0.1 % (286 ) -0.1 %

Miscellaneous income (expense) 4 0.0 % (119 )

0.0 % Total other income 188 0.0 % 47

0.0 %

PRETAX (LOSS) INCOME (168,717 ) -38.4 % 18,219

3.4 % (Benefit from) provision for income taxes

(26,436 ) -6.0 % 4,141 0.8 %

(LOSS) INCOME

FROM CONTINUING OPERATIONS (142,281 ) -32.4 % 14,078 2.6 %

Income (loss) from discontinued operations, net of tax

21,832 5.0 % (1,976 ) -0.4 %

NET

(LOSS) INCOME $ (120,449 ) -27.4 %

$ 12,102 2.3 %

NET (LOSS) INCOME PER

SHARE - DILUTED: (Loss) income from continuing operations $

(1.94 ) $ 0.18 Income (loss) from discontinued operations

0.30 (0.03 ) Net (loss) income per share $ (1.64 ) $

0.15

DILUTED WEIGHTED AVERAGE SHARES

OUTSTANDING 73,429 79,776

(1)

In November 2011, the Company sold its

ownership interest in Istituto Marangoni. As a result, all current

and prior period results have been recast to include Istituto

Marangoni as a component of discontinued operations.

CAREER EDUCATION CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except

per share amounts and percentages)

For the Years Ended December 31,

(1) 2011

% of TotalRevenue

2010

% of TotalRevenue

REVENUE: Tuition and registration fees $ 1,827,164

97.0 % $ 2,007,903 96.1 % Other 57,341 3.0 %

81,270 3.9 % Total revenue 1,884,505

2,089,173

OPERATING EXPENSES: Educational

services and facilities 632,593 33.6 % 626,254 30.0 % General and

administrative 936,714 49.7 % 1,080,148 51.7 % Depreciation and

amortization 84,512 4.5 % 70,043 3.4 % Goodwill and asset

impairment 191,524 10.2 % 71,829 3.4 %

Total operating expenses 1,845,343 97.9 %

1,848,274 88.5 % Operating income 39,162 2.1 %

240,899 11.5 %

OTHER INCOME (EXPENSE):

Interest income 1,376 0.1 % 1,138 0.1 % Interest expense (563 ) 0.0

% (381 ) 0.0 % Miscellaneous income (expense) 1,972

0.1 % (484 ) 0.0 % Total other income 2,785

0.1 % 273 0.0 %

PRETAX INCOME 41,947

2.2 % 241,172 11.5 % Provision for income taxes

46,146 2.4 % 78,401 3.8 %

(LOSS)

INCOME FROM CONTINUING OPERATIONS (4,199 ) -0.2 % 162,771 7.8 %

Income (loss) from discontinued operations, net of tax

22,772 1.2 % (4,998 ) -0.2 %

NET

INCOME $ 18,573 1.0 %

$

157,773 7.6 %

NET (LOSS) INCOME PER SHARE -

DILUTED: (Loss) income from continuing operations $ (0.06 ) $

2.01 Income (loss) from discontinued operations 0.31

(0.06 ) Net income per share $ 0.25 $ 1.95

DILUTED WEIGHTED AVERAGE SHARES OUTSTANDING

74,498 80,850

(1)

In November 2011, the Company sold its

ownership interest in Istituto Marangoni. As a result, all current

and prior period results have been recast to include Istituto

Marangoni as a component of discontinued operations.

CAREER EDUCATION CORPORATION AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF OPERATING INCOME (LOSS) BY

QUARTER (In thousands)

For the 2011 Quarters Ended, (1)

March 31 June 30 September 30

December 31 Full Year REVENUE: Tuition

and registration fees $ 509,454 $ 469,683 $ 417,420 $ 430,607 $

1,827,164 Other 22,246 15,195 10,991

8,909 57,341 Total revenue 531,700

484,878 428,411 439,516 1,884,505

OPERATING EXPENSES: Educational services and

facilities 165,631 158,012 152,727 156,223 632,593 General and

administrative 237,061 224,605 233,647 241,401 936,714 Depreciation

and amortization 20,133 20,274 22,156 21,949 84,512 Goodwill and

asset impairment - 2,676 - 188,848

191,524 Total operating expenses 422,825

405,567 408,530 608,421

1,845,343

OPERATING INCOME (LOSS) $ 108,875

$ 79,311 $ 19,881 $

(168,905 ) $ 39,162

For the 2010 Quarters Ended, (1) March

31 June 30 September 30 December 31

Full Year REVENUE: Tuition and registration

fees $ 498,411 $ 499,142 $ 494,750 $ 515,600 $ 2,007,903 Other

19,845 18,595 26,862 15,968

81,270 Total revenue 518,256 517,737

521,612 531,568 2,089,173

OPERATING

EXPENSES: Educational services and facilities 155,618 153,795

155,650 161,191 626,254 General and administrative 260,694 253,040

305,144 261,270 1,080,148 Depreciation and amortization 16,267

16,849 17,467 19,460 70,043 Goodwill and asset impairment -

- 354 71,475 71,829 Total

operating expenses 432,579 423,684 478,615

513,396 1,848,274

OPERATING INCOME

$ 85,677 $ 94,053 $

42,997 $ 18,172 $ 240,899

(1)

In November 2011, the Company sold its

ownership interest in Istituto Marangoni. As a result, all current

and prior period results have been recast to include Istituto

Marangoni as a component of discontinued operations.

CAREER EDUCATION CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands)

For the Years Ended December 31, 2011

2010 CASH FLOWS FROM OPERATING ACTIVITIES: Net

income $ 18,573 $ 157,773 Adjustments to reconcile net income to

net cash provided by operating activities: Goodwill and asset

impairment 191,524 71,829 Depreciation and amortization expense

85,367 71,624 Bad debt expense 55,721 106,324 Compensation expense

related to share-based awards 14,831 17,318 Gain on sale of

business (27,085 ) - (Gain) loss on disposition of property and

equipment (1,711 ) 457 Deferred income taxes 14,226 (17,007 )

Changes in operating assets and liabilities Accrued expenses and

deferred rent obligations (74,075 ) (25,055 ) Deferred tuition

revenue 2,595 (12,653 ) Student receivables, net of allowance for

doubtful accounts (51,749 ) (98,920 ) Other operating assets and

liabilities 2,233 569 Net cash provided

by operating activities 230,450 272,259

CASH FLOWS FROM INVESTING ACTIVITIES: Purchases of

available-for-sale investments (189,258 ) (291,864 ) Sales of

available-for-sale investments 188,322 332,445 Purchases of

property and equipment (78,333 ) (127,283 ) Acquisition of the

rights to the Le Cordon Bleu brand (16,355 ) (16,852 ) Proceeds on

the sale of assets 6,259 - Proceeds on the sale of business, net of

cash divested 16,670 - Business acquisition, net of acquired cash

(9,851 ) (6,194 ) Other (40 ) 88 Net cash used

in investing activities (82,586 ) (109,660 )

CASH FLOWS FROM FINANCING ACTIVITIES: Purchase of treasury

stock (150,445 ) (154,913 ) Issuance of common stock 4,370 3,109

Tax benefit associated with stock option exercises 376 223 Payments

of assumed loans upon business acquisition - (4,279 ) Payments of

capital lease obligations (989 ) (1,013 ) Net cash

used in financing activities (146,688 ) (156,873 )

EFFECT OF FOREIGN CURRENCY EXCHANGE RATE CHANGES

ON CASH AND CASH EQUIVALENTS: (10,066 ) (1,316 )

NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS

(8,890 ) 4,410

DISCONTINUED OPERATIONS CASH ACTIVITY INCLUDED

ABOVE: Add: Cash balance of discontinued operations, beginning

of the year 28,838 26,824 Less: Cash balance of discontinued

operations, end of the year - 28,838

CASH AND CASH EQUIVALENTS,

beginning of the year 260,644 258,248

CASH AND CASH EQUIVALENTS, end of the year $ 280,592

$ 260,644

CAREER EDUCATION

CORPORATION AND SUBSIDIARIES UNAUDITED SELECTED SEGMENT

INFORMATION (In thousands, except percentages)

For the Quarters Ended December 31, 2011 2010

REVENUE: CTU (1) $ 100,985 $ 123,236 AIU (1) 77,111

98,647 Health Education 100,658 119,352 Culinary Arts 65,554 94,003

Art & Design (1) 48,005 59,125 International (2) 47,257 37,337

Corporate and Other (54 ) (132 )

Total $

439,516 $ 531,568

OPERATING (LOSS)

INCOME: CTU (1) $ 25,610 $ 39,603 AIU (1) 6,354 22,905 Health

Education (3) (101,012 ) 16,594 Culinary Arts (4) (95,725 ) (63,546

) Art & Design (1) (5,584 ) 6,510 International (2) 16,017

9,623 Corporate and Other (14,565 ) (13,517 )

Total

$ (168,905 ) $ 18,172

OPERATING MARGIN: CTU

25.4 % 32.1 % AIU 8.2 % 23.2 % Health Education -100.4 % 13.9 %

Culinary Arts -146.0 % -67.6 % Art & Design -11.6 % 11.0 %

International 33.9 % 25.8 %

Total

-38.4 % 3.4 %

(1)

Prior period financial results have been

reclassified to report CTU, AIU and Art & Design as individual

segments due to a change in organizational structure beginning in

January, 2011. Previously, these results were reported on a

combined basis as the University segment.

(2)

In November 2011, the Company sold its

ownership interest in Istituto Marangoni. As a result, all current

and prior period results have been recast to include Istituto

Marangoni as a component of discontinued operations.

(3) Fourth quarter 2011 includes a $94.7 million

goodwill impairment charge.

(4)

Fourth quarter 2011 includes a $73.7

million goodwill impairment charge and a $20.4 million trade name

impairment charge. The prior year quarter results include a $67.8

million trade name impairment charge.

CAREER EDUCATION CORPORATION AND SUBSIDIARIES

UNAUDITED SELECTED SEGMENT INFORMATION (In thousands, except

percentages)

For the Years Ended December 31,

2011 2010 REVENUE: CTU (1) $ 431,588 $

465,315 AIU (1) 365,203 448,581 Health Education 428,987 441,608

Culinary Arts 314,272 387,884 Art & Design (1) 218,967 245,395

International (2) 125,887 101,013 Corporate and Other (399 )

(623 )

Total $ 1,884,505

$ 2,089,173 OPERATING INCOME

(LOSS): CTU (1) $ 112,626 $ 133,881 AIU (1) 72,738 118,959

Health Education (3) (89,633 ) 52,028 Culinary Arts (4) (64,984 )

(66,813 ) Art & Design (1) 15,043 29,173 International (2)

24,746 16,334 Corporate and Other (5) (31,374 )

(42,663 )

Total $ 39,162 $

240,899 OPERATING MARGIN: CTU 26.1 %

28.8 % AIU 19.9 % 26.5 % Health Education -20.9 % 11.8 % Culinary

Arts -20.7 % -17.2 % Art & Design 6.9 % 11.9 % International

19.7 % 16.2 %

Total 2.1 %

11.5 %

(1)

Prior period financial results have been

reclassified to report CTU, AIU and Art & Design as individual

segments due to a change in organizational structure beginning in

January, 2011. Previously, these results were reported on a

combined basis as the University segment.

(2)

In November 2011, the Company sold its

ownership interest in Istituto Marangoni. As a result, all current

and prior period results have been recast to include Istituto

Marangoni as a component of discontinued operations.

(3)

2011 expenses include a $94.7 million

goodwill impairment charge and $5.1 million of impairment and

amortization charges associated with accreditation rights.

(4)

2011 expenses include goodwill and trade

name impairment charges of $73.7 million and $20.4 million,

respectively. 2010 includes a $67.8 million trade name impairment

charge, a $40.8 million charge related to the settlement of a legal

matter and additional bad debt expense for increases in reserve

rates related to our student extended payment plans.

(5) During 2011, a $7.0 million insurance recovery

was recorded related to previously settled legal matters.

CAREER EDUCATION CORPORATION AND SUBSIDIARIES

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ITEMS

(1) (In millions, except per share amounts)

For the Quarters Ended December 31,

2011 2010

Operating (Loss)Income

Earnings perDiluted Share

(2)

Operating Income

Earnings perDiluted Share

(2)

As Reported $ (168.9 ) $ (1.94 ) $ 18.2 $ 0.18

Reconciling Items: Goodwill Impairment (3) 168.4 2.07 - - Asset

Impairments (4) 20.4 0.18 67.8 0.55 Legal Settlement (5) -

- 0.8 0.01

Adjusted to

Exclude Significant Items $ 19.9 $

0.31 $ 86.8 $ 0.74

Diluted Weighted Average Shares Outstanding

73,429 79,776 For the Years

Ended December 31, 2011 2010

Operating Income

Earnings perDiluted Share

(2)

Operating Income

Earnings perDiluted Share

(2)

As Reported $ 39.2 $ (0.06 ) $ 240.9 $ 2.01

Reconciling Items: Goodwill Impairment (3) 168.4 2.04 - - Asset

Impairments (4) 20.4 0.18 67.8 0.55 Legal Settlement (5) -

- 40.8 0.33

Adjusted to

Exclude Significant Items $ 228.0 $

2.16 $ 349.5 $ 2.89

Diluted Weighted Average Shares Outstanding

74,498 80,850

(1) The Company believes it is useful to

present non-GAAP financial measures which exclude certain

significant items as a means to understand the performance of its

core business. As a general matter, the Company uses non-GAAP

financial measures in conjunction with results presented in

accordance with GAAP to help analyze the performance of its core

business, assist with preparing the annual operating plan, and

measure performance for some forms of compensation. In addition,

the Company believes that non-GAAP financial information is used by

analysts and others in the investment community to analyze the

Company's historical results and to provide estimates of future

performance and that failure to report non-GAAP measures could

result in a misplaced perception that the Company's results have

underperformed or exceeded expectations. Non-GAAP financial

measures when viewed in a reconciliation to corresponding GAAP

financial measures, provides an additional way of viewing the

Company's results of operations and the factors and trends

affecting the Company's business. Non-GAAP financial measures

should be considered as a supplement to, and not as a substitute

for, or superior to, the corresponding financial results presented

in accordance with GAAP.

(2) Earnings per share is

based on (Loss) Income from Continuing Operations.

(3) Fourth quarter 2011 includes goodwill impairment charges

totaling $168.4 million applicable to Health Education ($94.7) and

Culinary Arts ($73.7).

(4) The fourth quarters 2011

and 2010 include trade name impairment charges of $20.4 million and

$67.8 million, respectively, within Culinary Arts.

(5) In 2010, a $40.8 million charge was recorded in Culinary

Arts related to the settlement of a legal matter; of which $0.8

million was recorded in the fourth quarter.

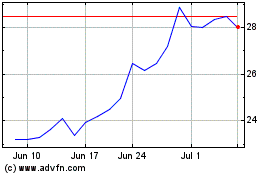

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From May 2024 to Jun 2024

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Jun 2023 to Jun 2024