false

0001016178

0001016178

2023-11-03

2023-11-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

November 3, 2023

CARVER BANCORP, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware |

001-13007 |

13-3904174 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission File No.) |

(I.R.S. Employer

Identification No.) |

| 75 West 125th Street, New York, NY |

10027-4512 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (212)

360-8820

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

Securities registered pursuant to Section 12(b)

of the Act:

|

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common stock, par value $0.01 per share |

|

CARV |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01. Regulation FD Disclosure.

On November 3, 2023,

Carver Bancorp, Inc. (the “Company”) issued a letter to its shareholders. A copy of the letter is attached as Exhibit 99.1

hereto and incorporated by reference.

The information contained in this Item 7.01

and Exhibit 99.1 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended,

or otherwise subject to the liability of that section, and shall not be incorporated by reference into any filings made by the Company

under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as expressly set forth by specific

reference in such filing.

Item 9.01. Financial Statements and

Exhibits.

(d) Exhibits.

Forward Looking

Statements

The

Company may from time to time make written or oral “forward-looking statements,” including statements contained in the shareholder

letter and in the Company's filings with the Securities and Exchange Commission. The forward-looking statements contained in this disclosure,

are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected in the forward-looking

statements. The Company and its operations are subject to numerous risks and uncertainties that include: changes in interest rates,

which may reduce net interest margin and net interest income; monetary and fiscal policies of the U.S. government, including policies

of the U.S. Treasury and the Board of Governors of the Federal Reserve System; the ability of the Company to obtain approval from the

Federal Reserve Bank of Philadelphia (the "Federal Reserve Bank") to distribute interest payments owed to the holders of the

Company's subordinated debt securities; the limitations imposed on the Company which require, among other things, written approval of

the Federal Reserve Bank prior to the declaration or payment of dividends, any increase in debt by the Company, or the redemption of Company

common stock, and the effect on operations resulting from such limitations; the impact of the recent bank closings of First Republic Bank,

Silicon Valley Bank and Signature Bank and the risks related to continued disruption in the banking industry and financial markets; the

market price and trading volume of our shares of common stock has been and may continue to be volatile, and purchasers of our securities

could incur substantial losses; changes in the level of trends of delinquencies and write-offs and in our allowance and provision for

credit losses; the results of examinations by our regulators, including the possibility that our regulators may, among other things, require

us to increase our reserve for credit losses, write down assets, change our regulatory capital position, limit our ability to borrow funds

or maintain or increase deposits, or prohibit us from paying dividends, which could adversely affect our dividends and earnings; national

and/or local changes in economic conditions, which could occur from numerous causes, including political changes, domestic and international

policy changes, unrest, war and weather, inflation or deflation conditions in the real estate, securities markets or the banking industry,

which could affect liquidity in the capital markets, the volume of loan originations, deposit flows, real estate values, the levels of

non-interest income and the amount of credit losses; adverse changes in the financial industry and the securities, credit, national and

local real estate markets (including real estate values); changes in our existing loan portfolio composition (including reduction in commercial

real estate loan concentration) and credit quality or changes in credit loss requirements; legislative or regulatory changes that may

adversely affect the Company’s business, including but not limited to new capital regulations, which could result in, among other

things, increased deposit insurance premiums and assessments, capital requirements, regulatory fees and compliance costs, and the resources

we have available to address such changes; changes in the level of government support of housing finance; changes to state rent control

laws, which may impact the credit quality of multifamily housing loans; our ability to control costs and expenses; the continuing impact

of the COVID-19 pandemic on our business and results of operations; the impairment of our investment securities; risks related to a high

concentration of loans to borrowers secured by property located in our market area; increases in competitive pressure among financial

institutions or non-financial institutions; unexpected outflows of uninsured deposits could require us to sell investment securities at

a loss; changes in consumer spending, borrowing and savings habits; technological changes that may be more difficult to implement or more

costly than anticipated; changes in deposit flows, loan demand, real estate values, borrowing facilities, capital markets and investment

opportunities, which may adversely affect our business; changes in accounting standards, policies and practices, as may be adopted or

established by the regulatory agencies or the Financial Accounting Standards Board could negatively impact the Company's financial results;

litigation or regulatory actions, whether currently existing or commencing in the future, which may restrict our operations or strategic

business plan; the ability to originate and purchase loans with attractive terms and acceptable credit quality; and the ability to attract

and retain key members of management, and to address staffing needs in response to product demand or to implement business initiatives.

You should carefully review the risk factors described in the Form 10-K for the fiscal year ended March 31, 2023 and other documents the

Company files from time to time with the Securities and Exchange Commission. The words “would be,” “could be,”

“should be,” “probability,” “risk,” “target,” “objective,” “may,”

“will,” “estimate,” “project,” “believe,” “intend,” “anticipate,”

“plan,” “seek,” “expect” and similar expressions or variations on such expressions are intended to

identify forward-looking statements. All such statements are made in good faith by the Company pursuant to the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1995. The Company does not undertake to update any forward-looking statement,

whether written or oral, that may be made from time to time by or on behalf of the Company, except as may be required by applicable law

or regulations.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| |

|

CARVER BANCORP, INC.

|

| DATE: November 3, 2023 |

By: |

/s/ Isaac Torres |

| |

|

Isaac Torres |

| |

|

Senior Vice President, General Counsel and Corporate Secretary |

Exhibit 99.1

November 1, 2023

Dear Carver Shareholders:

|

In the four short weeks since assuming the role of Interim President & CEO of Carver Bancorp, Inc. and our

wholly-owned subsidiary, Carver Federal Savings Bank (“Carver” or the “Bank”), I have been inspired by the

passion of our people, the unwavering support of our shareholders, and our impact on the communities that we serve.

im·pact

ˈim-ˌpakt

-

… the force of impression of one thing on another;

a significant or major effect

|

In January

2023, the Bank emerged from a formal agreement with its primary regulator, concluding a period of enhanced oversight, foundation-building,

capital-raising, technology upgrades, and portfolio rationalization. Carver is now a better capitalized and more capable bank with solid

liquidity and Tier 1 Capital (12.4%), Leverage (10.1%) and Total Risk Based Capital (13.4%) ratios in excess of “well capitalized”

levels.

The Bank continues to

grow in scale, market reach and in the diversification of its suite of retail and commercial offerings, while remaining committed to

our mission to address the wealth gap by “…providing local residents with a place to save, grow businesses and

build wealth, block by block, generation to generation.” With over $720 million in assets as of June 30, 2023, the Bank has

grown organically by 28% since 2019, which was achieved through increased productivity and the use of advanced technology (assets

per employee up 33%).

This year Carver is

celebrating 75 years of providing urban communities and Minority and Women-Owned Business Enterprises (“MWBEs”) with

access to capital and competitively priced banking solutions. We lead the way in community-driven finance across the Greater New York

City region. From micro-loans to large commercial facilities, to our performance in deploying $50 million of Payroll Protection Program

loans (preserving over 5,000 jobs), Carver is recognized as a leading Community Development Financial Institution (“CDFI”)

in our market. The Bank has received ”Outstanding“ Community Reinvestment Act (“CRA”) ratings since 2004,

and in our latest evaluation, the Office of the Comptroller of the Currency determined that 90% of Carver’s loans were made

within our assessment area.

Carver has recently

broadened its commercial presence, participating in the financing of national credits and projects such as Krispy Kreme Donuts and the

new Atlanta Hawks Training Facility, which provide additional loan portfolio diversification. By leveraging our fintech partnerships,

the Bank has:

| · | Expanded

its consumer credit solutions, deployed robust mobile banking services to underbanked urban

centers, and extended its deposit-taking footprint to encompass 9 states, with additional

expansion on the horizon |

| · | Supported

over 16,000 small business loans nationwide, through a liquidity funding partnership with

a minority-owned fintech company |

Carver’s management

team and Board of Directors are also shareholders. While Carver’s stock may experience sector-driven volatility or speculation,

we firmly believe that our prospects, transparency, and ability to deliver against objectives will ultimately be reflected in Carver’s

valuation. We are executing upon a strategy to (i) fuel greater organic growth, (ii) deepen our collaboration with our strategic and

fintech partners, (iii) leverage our new technology to achieve greater scale and operating efficiencies, (iv) continue supporting a culture

of disciplined risk management, and (v) position the Bank to grow into sustainable core profitability.

I am

encouraged by the following results:

| · | Asset

Growth – strong organic loan growth (8.7% 4-Year CAGR thru FY-2023) and

a 95% Loan-to-Deposit ratio, vs. 74% for our peer group, indicating a more profitable asset

mix. |

| · | Portfolio

Diversification – commercial and industrial loans (“C&I”) now comprise

over 28% of the portfolio; notwithstanding portfolio growth and diversification, over 80%

of our lending still supports businesses, investors, non-profit organizations, and individuals

in our urban communities. |

| · | Deposit

Growth – Carver’s deposit growth (5.8% 4-Year CAGR thru FY-2023) has

been driven by “sticky” institutional deposits, reducing our reliance on external

leverage and expensive brokered deposits. |

| · | Fintech

Partnerships – through our fintech partnerships, Carver has expanded its ability

to grow loans and deposits, and enhance its commercial and retail offerings, including cash

management and credit cards. |

| · | Charge-offs

– The Bank has achieved significant asset growth while maintaining a strong underwriting

and portfolio management discipline. Annual net charge-offs of 0.09%, among the lowest in

our peer group. |

| · | Net

Interest Margin – Carver’s YTD FY-2024 net interest margin, at 3.14%, is

comparable to our peer group and has been sustained by the support of our core relationship

deposit accounts. |

| · | Rising

Efficiency – loan assets per employee, a general indicator of efficiency, has increased

for four consecutive years at a 7.4% CAGR. Carver is completing more loans by volume

and reducing cycle time with the advent of new technologies and best practices. |

| · | Capital-Raising

– since 2019, Carver has taken in over $40 million of net capital additions, primarily

driven by direct institutional investor placements and at-the-market common stock offerings. |

| · | Investment

in Technology – The Bank has invested over $3 million since 2019 to upgrade our

technology, power a more robust mobile banking platform, and enhance operating efficiency. |

Carver’s path

to sustainable core profitability hinges on well-learned lessons in portfolio diversification, capital adequacy, and risk and liquidity

management, which will enable:

| · | Continued

growth of C&I lending fueled by our (i) new SBA initiative, (ii) healthcare finance partnership,

(iii) progress in Green Energy and contractor financing, and (iv) measured exposure to broadly

syndicated loans |

| · | Ongoing

expansion of our digital deposit footprint and mobile banking capabilities |

| · | Growth

in consumer lending via our fintech partnerships |

| · | Strategic

partnerships to expand product/service offerings (e.g., wealth management, estate planning) |

| · | Continued

focus on leveraging technology, operating efficiency, and fixed cost management |

On behalf of our management

team and Board of Directors, thank you for holding us accountable on this journey to create enduring value for our shareholders, and

for enabling Carver to have “a significant or major effect” on the communities that we serve…impact.

Sincerely,

Craig C. MacKay

Interim President &

CEO

Carver Bancorp, Inc.

ABOUT CARVER FEDERAL

SAVINGS BANK

Carver was founded

by a consortium of faith and business leaders in Harlem in 1948 to address the banking needs of the predominantly African American and

Caribbean communities whose residents, businesses, and institutions had limited access to mainstream financial services and business

capital. Carver remains headquartered in Harlem today, with a branch and 24/7 ATM network that serves the traditionally low-to-moderate-income

neighborhoods of the five boroughs of New York City and surrounding areas. As the neighborhoods that we serve have evolved, so has Carver,

which today proudly serves as a vehicle of wealth accumulation, finance, and commerce for communities with increasingly diverse income,

ethnicity, and socio-economic profiles.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

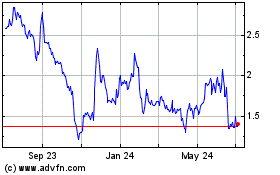

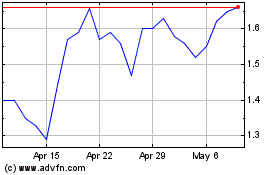

Carver Bancorp (NASDAQ:CARV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Carver Bancorp (NASDAQ:CARV)

Historical Stock Chart

From Apr 2023 to Apr 2024