0001016178

false

0001016178

2023-07-19

2023-07-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

July 19, 2023

CARVER BANCORP, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware |

001-13007 |

13-3904174 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission File No.) |

(I.R.S. Employer

Identification No.) |

| 75 West 125th Street, New York, NY |

10027-4512 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (212)

360-8820

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

Securities registered pursuant to Section 12(b)

of the Act:

|

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common stock, par value $0.01 per share |

|

CARV |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive

Agreement.

On July 19, 2023, Carver

Bancorp, Inc. (the “Company”) entered into an Investment Agreement (the “Investment Agreement”) with National

Community Investment Fund (“NCIF”), pursuant to which the Company sold 378,788 shares of the Company’s common stock,

par value $0.01 per share, at a purchase price of $2.64 per share (the “Common Stock”) in a private placement (the “Private

Placement”) for gross proceeds of approximately $1.0 million.

The Company intends to

use the net proceeds of the Private Placement for general corporate purposes. The Investment Agreement contains representations, warranties,

and covenants of the Company and NCIF that are customary in private placement transactions.

The Common Stock was

issued on July 19, 2023 in a private placement exempt from registration pursuant to under Section 4(a)(2) of the Securities Act of 1933,

as amended, and Regulation D of the rules and regulations promulgated thereunder.

The foregoing description

of the Investment Agreement does not purport to be complete and is qualified in its entirety by reference to the Investment Agreement,

a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity

Securities.

There were no underwriting

discounts or commissions. Additionally, the information set forth under Item 1.01 of this Current Report on Form 8-K is incorporated

by reference into this Item 3.02.

Item 9.01. Financial Statements and

Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| |

CARVER BANCORP, INC. |

| |

|

| DATE: July 20, 2023 |

By: |

/s/ Michael T. Pugh |

| |

|

Michael T. Pugh |

| |

|

President and Chief Executive Officer |

Exhibit 10.1

Execution Version

CARVER

BANCORP, INC.

INVESTMENT

AGREEMENT

July

19, 2023

CARVER

BANCORP, INC.

INVESTMENT AGREEMENT

This Investment

Agreement (this “Agreement”) is made as of July 19, 2023 by and between Carver Bancorp, Inc., a Delaware corporation

(the “Company”), and National Community Investment Fund, a charitable

trust established under the laws of the State of Illinois (the “Investor”).

The parties hereby agree as follows:

| 1. | Purchase and Sale of Common Stock. |

| 1.1 | Sale and Issuance of Common Stock. |

(a)

On the terms and subject to the conditions set forth herein, the Company agrees to issue and sell to the Investor, and the Investor

agrees to purchase from the Company, free and clear of any liens, claims or encumbrances, 378,788 shares of common stock of the Company,

par value $0.01 per share (the “Common Shares” or “Common Stock”) at a purchase price of $2.64 per

share payable by the Investor to the Company in cash, for an aggregate purchase price payable pursuant to this Section 1.1 (the

“Purchase Price”) of $1.0 million.

(b)

In connection with the purchase and sale, the Company is delivering, concurrently with the execution and delivery of this Agreement,

evidence of the shares in book- entry form, representing the Common Shares being issued and delivered to the Investor against payment

of the Purchase Price by the Investor (or its designee) by wire transfer of immediately available funds to the account provided to the

Investor by the Company prior to the execution of this Agreement.

1.2

Defined Terms Used in this Agreement. In addition to the terms defined above, the following terms used in this Agreement

shall be construed to have the meanings set forth or referenced below.

“Affiliate”

means in the case of a Person (other than an individual), another Person that, directly, or indirectly through one or more intermediaries,

controls, is controlled by or is under common control with such Person.

“Business

Day” means any day other than a Saturday, a Sunday or a holiday on which banks in New York, New York are authorized or obligated

by law to close.

“Code” means the Internal

Revenue Code of 1986, as amended.

“Company

Equity Awards” means Company Stock Options or Company Restricted Stock.

“Company

Restricted Stock” means each share of Company Common Stock that is subject to forfeiture to the Company granted under the

terms of a Company equity incentive plan or otherwise.

“Company

Stock Option” each option to purchase shares of Company Common Stock that is granted under the terms of a Company equity incentive

plan or otherwise.

“ERISA” means the Employee

Retirement Income Security Act of 1974, as amended.

“Exchange Act” means

the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“GAAP” means generally

accepted accounting principles in the United States.

“Material

Adverse Effect” means a material adverse effect on the business, financial condition or results of operations of the Company

(including its Subsidiaries taken as a whole on a consolidated basis).

“Person”

means any individual, corporation, partnership, trust, limited liability company, association or other entity.

“SEC” means the Securities

and Exchange Commission.

“Securities

Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Subsidiary”

of any Person means any other Person of which securities or other ownership interests representing more than fifty percent (50%) of the

equity or more than fifty percent (50%) of the ordinary voting power or, in the case of a partnership, more than fifty percent (50%) of

the general partnership ownership interests, or the ability to elect a majority of the board of directors or others performing similar

functions, are directly or indirectly owned, controlled or held by, or a majority of such other Person’s gains or losses is entitled

to be allocated to, the first Person or one or more Subsidiaries of the first Person.

“Voting Debt”

means any bonds, debentures, notes or other indebtedness having the right to vote on any matters on which the shareholders of the Company

may vote.

2.

Representations and Warranties of the Company. The Company hereby represents and warrants to the Investor, except

as disclosed in a correspondingly numbered section of the disclosure schedules delivered to the Investor prior to the date hereof (the

“Disclosure Schedules”), as follows:

2.1 Organization,

Good Standing and Qualification. The Company and each of its Subsidiaries (each, a “Company Subsidiary”)

(a) is duly organized, validly existing and in good standing under the laws of the state of its incorporation or formation (as

applicable) and (b) has all requisite corporate power and authority to own its assets and carry on its applicable businesses as

presently conducted or proposed to be conducted. The Company and each Company Subsidiary is duly qualified to transact business and

is in good standing in each jurisdiction in which the failure to be so qualified would have, or be reasonably expected to have,

individually or in the aggregate, a Material Adverse Effect. The Company is duly registered as a savings and loan holding company

under the Home Owners’ Loan Act, as amended.

(a) As

of the date hereof, the authorized capital stock of the Company consists of: (i) 10,000,000 shares of Common Stock, of which 4,513,729

shares of Common Stock are issued and outstanding and 2,503,803 shares of Common Stock held in treasury, and (ii) 2,000,000 shares of

the Company’s preferred stock (the “Preferred Stock” and together with the Common Stock, the “Capital Stock”),

of which 11,551 shares of Preferred Stock designated as Convertible Non-Cumulative Non-Voting Participating Preferred Stock, Series D

are issued and outstanding, (iii) 3,300 are designated as Non-Cumulative Non-Voting Participating Preferred Stock, Series E (the “Series

E Preferred Stock”), of which 3,177 are issued and outstanding, and (iv) 9,000 are currently designated as Series F Preferred Stock,

of which 9,000 are issued and outstanding, and, after giving effect to the transactions contemplated hereby, there shall be 4,892,517

shares of Common Stock issued and outstanding. Except as set forth in this Section 2.2(a) or in Section 2.2(a) of the Disclosure Schedules,

there are no other shares of capital stock of the Company (including Voting Debt), or outstanding options, warrants, rights (including

conversion or preemptive rights and rights of first refusal or similar rights) or agreements, orally or in writing, for the purchase

or acquisition from the Company of any shares of its capital stock (including Voting Debt).

(b) All

of the issued and outstanding shares of the Company’s Common Stock have been duly authorized and validly issued and are fully paid,

nonassessable and free of preemptive rights. None of the outstanding shares of Common Stock, Company Equity Awards or other securities

of the Company or any of the Company Subsidiaries was issued, sold or offered by the Company or any Company Subsidiary in violation of

the Securities Act or the securities or “blue sky” laws of any state or jurisdiction. Other than shares owned by the Company,

there are no other shares of capital stock of the Company Subsidiaries (including Voting Debt) issued and outstanding, or outstanding

options, warrants, rights (including conversion or preemptive rights and rights of first refusal or similar rights) or agreements, orally

or in writing, for the purchase or acquisition from any Company Subsidiary of any shares of its capital stock (including Voting Debt).

(a) Section

2.3(a) of the Disclosure Schedules contains a true, complete and correct list of all of the Company Subsidiaries as of the date of

this Agreement.

(b) Other

than the Company Subsidiaries, the Company does not currently own or control, directly or indirectly, any interest in any other corporation,

bank, business trust, association, partnership, trust, joint venture, limited liability company, association or other business entity.

The Company is not a participant in any joint venture, partnership or similar arrangement. The Company owns, directly or indirectly,

all of the interests in each Company Subsidiary free and clear of any and all liens, claims or encumbrances.

(c) Carver

Federal Savings Bank (the “Bank”) is a federally chartered savings bank and wholly owned Subsidiary of the Company.

The deposit accounts of the Bank are insured by the Federal Deposit Insurance Corporation (“FDIC”) to the fullest

extent permitted by the Federal Deposit Insurance Act, as amended, and the rules and regulations of the FDIC thereunder, and all premiums

and assessments required to be paid in connection therewith have been paid when due (after giving effect to any applicable extensions).

The Bank has a Community Reinvestment Act rating of “satisfactory” or better.

2.4

Authorization. The Company has the corporate power and authority to execute and deliver this Agreement and to perform

its obligations hereunder. All corporate action on the part of the Company, its officers, directors and holders of capital stock necessary

for the execution and delivery by the Company of this Agreement, the performance of all obligations of the Company hereunder and the authorization,

issuance and delivery of the Common Shares to be issued hereunder has been taken, and this Agreement, when executed and delivered by the

Company (subject to the execution and delivery by the Investor) shall constitute a valid and legally binding obligation of the Company,

enforceable against the Company in accordance with its terms except (a) as limited by applicable bankruptcy, insolvency, reorganization,

moratorium, fraudulent conveyance, or other laws of general application relating to or affecting the enforcement of creditors’ rights

generally or (b) as limited by laws relating to the availability of specific performance, injunctive relief, or other equitable remedies

(the “Enforceability Exceptions”).

2.5

Valid Issuance of Common Shares. The Common Shares sold and delivered in accordance with the terms hereof for the

consideration expressed herein will be duly and validly issued, fully paid and nonassessable and free of restrictions on transfer other

than restrictions on transfer under applicable state and federal securities laws. Assuming the accuracy of the representations of the

Investor in Section 3, the Common Shares will be issued in compliance with all applicable federal and state securities laws.

(a) Assuming

the accuracy of the representations made by the Investor in Section 3, no consent, approval, notice, order or authorization of, or registration,

qualification, designation, declaration or filing with, any Governmental Authority or any other federal, state, local or foreign governmental

authority is required on the part of the Company or any Company Subsidiary or any officer, employee, agent, or representative of the

Company or any Company Subsidiary in connection with the consummation of the transactions contemplated by this Agreement, except for

filings pursuant to applicable state securities or lending laws or Regulation D of the Securities Act.

(b) The

execution, delivery and performance of this Agreement and the consummation of the transactions contemplated hereby will not result

in any such violation or be in conflict with or constitute, with or without the passage of time and giving of notice, either a

default under any such provision, instrument, judgment, order, writ, decree, law or contract or an event which results in the

creation of any lien, charge or encumbrance upon any assets of the Company or the Company Subsidiaries.

2.7

Disqualification. The Company is not disqualified from relying on Rule 506 of Regulation D (“Rule 506”)

under the Securities Act for any of the reasons stated in Rule 506(d) (each such reason, a “Disqualification Event”)

in connection with the issuance and sale of the Common Shares to the Investor. The Company has furnished the Investor, a reasonable time

prior to the date hereof, a description in writing of any matters that would have triggered disqualification under Rule 506(d) but which

occurred before September 23, 2013, in each case, in compliance with the disclosure requirements of Rule 506(e).

2.8

Litigation. Except as would not reasonably be expected to have, individually or in the aggregate, a Material Adverse

Effect, or as would not reasonably be expected to materially adversely impact the reputation of the Company, the Company Subsidiaries

or their respective investors in any material respect, there is no pending or, to the Knowledge of the Company, threatened claim, action,

suit, arbitration, complaint, charge or investigation or proceeding (each an “Action”) against the Company or any Company

Subsidiary or any of their respective assets, rights or properties, nor is the Company or any Company Subsidiary a party or named as subject

to the provisions of any order, writ, injunction, settlement, judgment or decree of any Governmental Authority.

2.9

Bank Secrecy Act; Anti-Money Laundering; OFAC; Certain Payments.

(a)

The Company is not aware of, has not been advised of, and, to the Knowledge of the Company, has no reason to believe that any facts

or circumstances exist that would cause it or any Company Subsidiary to be deemed to be not operating in compliance, in all material respects,

with the Bank Secrecy Act of 1970, as amended, the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept

and Obstruct Terrorism Act of 2001 (also known as the USA PATRIOT Act), any order or regulation issued by the U.S. Department of the Treasury’s

Office of Foreign Assets Control (“OFAC”), or any other applicable anti-money laundering or anti-terrorist-financing

statute, rule or regulation. The Company and each of the Company Subsidiaries have adopted and implemented an anti-money laundering program

that contains adequate and appropriate customer identification verification procedures that comply with the USA PATRIOT Act and such anti-money

laundering program meets the requirements in all material respects of Section 352 of the USA PATRIOT Act and the regulations thereunder,

and they have complied in all material respects with any requirements to file reports and other necessary documents as required by the

USA PATRIOT Act and the regulations thereunder.

(b) Neither

the Company nor any of the Company Subsidiaries, nor any directors, officers, nor to the Knowledge of the Company, employees or any

of their Affiliates or any other Person who to the Knowledge of the Company is associated with or acting on behalf of the Company or

any of the Company Subsidiaries has directly or indirectly made any contribution, gift, bribe, rebate, payoff, influence payment,

kickback, or other payment in violation of any law in any material respect, including the U.S. Foreign Corrupt Practices Act of

1977, as amended, and any applicable anti-bribery or anti-corruption laws (collectively, “Bribery Laws”) to any

Person, private or public, regardless of form, whether in money, property, or services (i) to obtain favorable treatment in securing

business for the Company or any of the Company Subsidiaries, (ii) to pay for favorable treatment for business secured by the Company

or any of the Company Subsidiaries, or (iii) to obtain special concessions or for special concessions already obtained, for or in

respect of the Company or any of the Company Subsidiaries. Neither the Company nor any Company Subsidiaries has conducted any

internal investigation, made any voluntary, directed, or involuntary disclosure to any Governmental Authority, or received any audit

report, written communication from a Governmental Authority, or whistleblower or other written complaint, involving alleged

violations in any material respect of Bribery Laws on the part of the Company, any of the Company Subsidiaries, or any Person acting

on behalf of the Company or any of the Company Subsidiaries.

2.10

Compliance with Other Instruments and Law. The Company and the Bank are not, and during the past three years have

not been, in violation or default, in any material respect (a) of any provisions of their respective articles of incorporation or bylaws

(or similar governing documents), (b) of any judgment, order, writ, or decree to which it is subject or (c) of any provision of any applicable

federal or state statute, rule or regulation.

| 2.11 | Certain Governmental Matters. |

(a)

The Company and each of the Company Subsidiaries’ officers, agents, representatives and employees possesses, holds and has

all material franchises, consents, permits, licenses, approvals, bonds, deposits, authorizations, registrations, accreditations, certificates

and similar authority required to be obtained or secured from any federal, state, local or foreign governmental or quasi-governmental

bureau, registry, instrumentality, office, department, authority, body or agency (including, without limitation, the SEC) (“Governmental

Authority”) required in connection with the business and operations of the Company and the Company Subsidiaries (collectively,

“Governmental Authorizations”). The Company and the Company Subsidiaries, and to the Company’s Knowledge, their

respective officers, agents, representatives and employees are not in default under any of such Governmental Authorizations, which default(s)

would be, or be reasonably expected to be, individually or in the aggregate, material to the Company and the Company Subsidiaries (taken

as a whole)..

(b) The

Company and each of the Company Subsidiaries have timely filed all reports, registrations and statements, together with any

amendments required to be made with respect thereto, that they were required to file since January 1, 2021 with any

Governmental Authority, including any report, registration or statement required to be filed pursuant to the laws, rules or

regulations of the United States, any state, any foreign entity, or any Governmental Authority, and have paid all fees and

assessments due and payable in connection therewith, except where the failure to file such report, registration or statement or to

pay such fees and assessments, individually or in the aggregate, would not reasonably be expected to be, individually or in the

aggregate, material to the Company and the Company Subsidiaries (taken as a whole).. Except for normal examinations conducted

by a Governmental Authority in the ordinary course of business of the Company and the Company Subsidiaries, (i) no Governmental

Authority has initiated or has pending any proceeding or, to the Knowledge of the Company, investigation into the business or

operations of the Company or any of the Company Subsidiaries since January 1, 2021, (ii) there is no unresolved violation,

criticism, or exception by any Governmental Authority with respect to any report or statement relating to any examinations or

inspections of the Company or any of the Company Subsidiaries, and (iii) there has been no formal or informal inquiries by, or

disagreements or disputes with, any Governmental Authority with respect to the business, operations, policies or procedures of the

Company or any of the Company Subsidiaries since January 1, 2022, in each case of clauses (i) through (iii), which would reasonably

be expected to be, individually or in the aggregate, material to the Company and the Company Subsidiaries (taken as a whole)..

(c)

Neither the Company nor any of the Company Subsidiaries is subject to any cease-and-desist or other order or enforcement action

issued by, or is a party to any written agreement, consent agreement or memorandum of understanding with, or is a party to any commitment

letter or similar undertaking to, or is subject to any order or directive by, or has been ordered to pay any civil money penalty by, or

has been since January 1, 2021, a recipient of any supervisory letter from, or since January 1, 2021, has adopted any policies, procedures

or board resolutions at the request or suggestion of any Governmental Authority that currently restricts in any material respect the conduct

of its business or that in any material manner relates to its capital adequacy, its ability to pay dividends, its credit or risk management

policies, its management or its business (each, a “Company Regulatory Agreement”), nor has the Company or any of the

Company Subsidiaries been advised in writing or, to the Knowledge of the Company, otherwise since January 1, 2021, by any Governmental

Authority or that it is considering issuing, initiating, ordering, or requesting any such Company Regulatory Agreement.

(d)

Notwithstanding any other provision of this Agreement, no disclosure, representation or warranty shall be made (or other action

taken) pursuant to this Agreement that would involve the disclosure of confidential supervisory information (including confidential supervisory

information as defined or identified in 12 C.F.R. § 261.2(b) or 12 C.F.R. § 309.5(g)(8)) of a Governmental Authority by

the Company or any of the Company Subsidiaries to the extent prohibited by applicable law. To the extent legally permissible, appropriate

substitute disclosures or actions shall be made or taken under circumstances in which the limitations of the preceding sentence apply.

2.12

Intellectual Property. The Company and the Company Subsidiaries own or possess adequate rights or licenses to use

all trademarks, service marks and all applications and registrations therefor, trade names, patents, patent rights, copyrights, original

works of authorship, inventions, trade secrets and other intellectual property rights (collectively, “Intellectual Property Rights”)

used in their businesses as conducted on the date of this Agreement, except as would not reasonably be expected to have, individually

or in the aggregate, a Material Adverse Effect. To the Knowledge of the Company, no product or service of the Company or the Company Subsidiaries

infringes the Intellectual Property Rights of others.

2.13 Reports. An

accurate copy of each final registration statement, prospectus, report, schedule and definitive proxy statement filed with or

furnished to the SEC by the Company since January 1, 2020 pursuant to the Securities Act or the Exchange Act (the “Company

Reports”), has been made publicly available on the SEC’s Electronic Data Gathering, Analysis, and Retrieval system.

No such Company Report, as of the date thereof (and, in the case of registration statements and proxy statements, on the dates of

effectiveness and the dates of the relevant meetings, respectively), contained any untrue statement of a material fact or omitted to

state any material fact required to be stated therein or necessary in order to make the statements therein, in light of the

circumstances in which they were made, not misleading, except that information filed or furnished as of a later date (but before the

date of this Agreement) shall be deemed to modify information as of an earlier date. Since January 1, 2020, as of their respective

dates, all Company Reports filed or furnished under the Securities Act and the Exchange Act complied in all material respects with

the published rules and regulations of the SEC with respect thereto. As of the date of this Agreement, no executive officer of the

Company has failed in any respect to make the certifications required of him or her under Section 302 or 906 of the Sarbanes-Oxley

Act of 2002 (the “Sarbanes-Oxley Act”). As of the date of this Agreement, there are no outstanding comments from

or unresolved issues raised by the SEC with respect to any of the Company Reports.

| 2.14 | Financial Statements; No Undisclosed Liabilities; Changes. |

(a)

The consolidated financial statements (including all related notes and schedules) of Company included in the Company Reports (the

“Financial Statements”) (i) have been prepared in accordance with GAAP applied on a consistent basis throughout the

periods indicated, except that the unaudited Financial Statements may not contain all footnotes required by GAAP and (ii) comply in all

material respects with the applicable accounting requirements and with the rules and regulations of the SEC, the Exchange Act and the

Securities Act.

(b)

The Financial Statements fairly present in all material respects the financial condition and operating results of the Company and

the Company Subsidiaries (on a consolidated basis) as of the dates, and for the periods, indicated therein, subject in the case of the

unaudited Financial Statements to normal year-end audit adjustments. Except as set forth in the Financial Statements, neither the Company

nor any Company Subsidiary has any material liabilities or obligations, contingent or otherwise, other than (a) liabilities incurred in

the ordinary course of business subsequent to March 31, 2023 and (b) obligations under contracts and commitments incurred in the ordinary

course of business and not required under GAAP to be reflected in the Financial Statements, which, in each case, individually or in the

aggregate are not material to the financial condition or operating results of the Company and the Company Subsidiaries (on a consolidated

basis).

(c)

Since March 31, 2023, there has not been (i) any change or event that has had, or would be reasonably expected to result in, individually

or in the aggregate, a Material Adverse Effect, (ii) any failure by the Company or the Company Subsidiaries to conduct their business

in the ordinary course, consistent with past practice, in all material respects, (iii) any issuance by the Company or the Company Subsidiaries

of any securities (other than equity-based awards issued prior to the date of this Agreement and described in Section 2.2(a) of the Disclosure

Schedules), (iv) any debt, obligation or liability incurred, assumed or guaranteed by the Company or any Company Subsidiary except for

those incurred in the ordinary course of business, (v) any declaration, setting aside or payment or other distribution in respect to any

of the Company’s or any Company Subsidiaries’ capital stock outside of the ordinary course, or any direct or indirect redemption,

purchase, or other acquisition of any of such stock by the Company or any Company Subsidiary or (iv) entry into any arrangement or commitment

by the Company or any Company Subsidiary to take any of the actions described in this Section 2.14(c).

2.15

Internal Controls and Procedures. The Company (i) has implemented and maintains disclosure controls and procedures

(as defined in Rule 13a-15(e) promulgated under the Exchange Act) to ensure that material information relating to the Company, including

its Subsidiaries, is made known to the chief executive officer and the chief financial officer of the Company by others within those entities

as appropriate to allow timely decisions regarding required disclosures and to make the certifications required by the Exchange Act and

Sections 302 and 906 of the Sarbanes-Oxley Act, and (ii) has disclosed, based on its most recent evaluation prior to the date hereof,

to the Company’s outside auditors and the audit committee of the Company’s board of directors (A) any significant deficiencies

and material weaknesses in the design or operation of internal control over financial reporting (as defined in Rule 13a-15(f) promulgated

under the Exchange Act) which are reasonably likely to adversely affect the Company’s ability to record, process, summarize and

report financial information, and (B) to the Knowledge of the Company, any fraud, whether or not material, that involves management or

other employees who have a significant role in the Company’s internal controls over financial reporting. The Company and the Company

Subsidiaries make and keep accurate books and records and maintain a system of internal accounting controls sufficient to provide reasonable

assurance that (i) transactions are executed in accordance with management’s general or specific authorization; (ii) transactions

are recorded as necessary to permit preparation of financial statements in conformity with GAAP and to maintain accountability for assets;

(iii) access to assets is permitted only in accordance with management’s general or specific authorization; and (iv) the recorded

accountability for assets is compared with existing assets at reasonable intervals and appropriate action is taken with respect to any

differences.

| 2.16 | Employee Benefit Plans; Labor. |

(a)

Each Company Plan has been established, operated and administered in all material respects in accordance with its terms and the

requirements of all laws, including ERISA and the Code. For purposes of this Agreement, “Company Plans” mean all employee

benefit plans (as defined in Section 3(3) of the ERISA), whether or not subject to ERISA, whether funded or unfunded, and all other material

pension, benefit, retirement, bonus, stock option, stock purchase, employee stock ownership, restricted stock, stock-based, performance

award, phantom equity, incentive, deferred compensation, retiree medical or life insurance, supplemental retirement, severance, retention,

employment, consulting, termination, change in control, salary continuation, accrued leave, sick leave, vacation, paid time off, health,

medical, disability, life, accidental death and dismemberment, insurance, welfare, fringe benefit and other similar plans, programs, policies,

practices or arrangements or other contracts or agreements (and any amendments thereto) to or with respect to which the Company or any

Company Subsidiary or by any trade or business, whether or not incorporated (an “ERISA Affiliate”), all of which together

with the Company or any Company Subsidiary would be deemed a “single employer” within the meaning of Section 4001 of ERISA,

is a party or has or could reasonably be expected to have any current or future obligation or that are sponsored, maintained, contributed

to or required to be contributed to by the Company or any Company Subsidiary for the benefit of any current or former employee, officer,

director, consultant or independent contractor (or any spouse or dependent of such individual) of the Company or any Company Subsidiary.

(b) None

of the Company and the Company Subsidiaries nor any of their respective ERISA Affiliates has, at any time during the last six years,

contributed to or been obligated to contribute to any plan that is (i) subject to Title IV or Section 302 of ERISA or Section 412 or

4971 of the Code or (ii) a “multiemployer plan” within the meaning of Section 4001(a)(3) of ERISA (a

“Multiemployer Plan”) or a plan that has two or more contributing sponsors at least two of whom are not under

common control, within the meaning of Section 4063 of ERISA (a “Multiple Employer Plan”); and none of the Company

and the Company Subsidiaries nor any of their respective ERISA Affiliates has incurred any liability to a Multiemployer Plan or

Multiple Employer Plan as a result of a complete or partial withdrawal, as those terms are defined in Part I of Subtitle E of Title

IV of ERISA from such Multiemployer Plan or Multiple Employer Plan.

(c)

There are no strikes, work stoppages, slowdowns, labor picketing lockouts, material arbitrations or material grievances, or other

material labor disputes pending or, to the Knowledge of the Company, threatened against or involving the Company or any Company Subsidiary,

nor have there been any in the past year. There is no unfair labor practice or labor arbitration proceeding pending or, to the Knowledge

of the Company, threatened against the Company or any of the Company Subsidiaries, except as would not reasonably be expected to result,

individually or in the aggregate, a Material Adverse Effect.

(d)

Neither the Company nor any Company Subsidiary has any material unfunded liabilities existing under or in connection with any Company

Plan, and each such Company Plan has been established and administered in all respects in accordance with its terms, and in compliance

with applicable law, except where failure to be in compliance would not reasonably be expected to result in, individually or in the aggregate,

a Material Adverse Effect.

(e)

To the Knowledge of the Company, in the last five (5) years, (i) no allegations of sexual harassment or misconduct have been made

against (A) an officer of the Company or any of the Company Subsidiaries, (B) a member of the board of directors of the Company or any

of the Company Subsidiaries, or (C) an employee of the Company or any of the Company Subsidiaries with a total annual compensation opportunity

in excess of $75,000, and (ii) neither the Company nor any of the Company Subsidiaries has entered into any settlement agreements related

to allegations of sexual harassment or misconduct by (A) an officer of the Company or any of the Company Subsidiaries, (B) a member of

the board of directors of the Company or any of the Company Subsidiaries, or (C) an employee of the Company or any of the Company Subsidiaries

with a total annual compensation opportunity in excess of $75,000.

2.17 Tax

Returns, Payments and Elections. The Company and the Company Subsidiaries have prepared and timely filed (taking into

account any extension of time within which to file) all material tax returns required to be filed by any of them and all such tax

returns are complete and accurate. The Company and the Company Subsidiaries have paid all material taxes that are required to be

paid by any of them. As of the date of this Agreement, there are not, pending or threatened in writing, any audits, examinations,

investigations or other proceedings in respect of U.S. federal income tax matters. There are no material liens for taxes on any of

the assets of the Company or Company Subsidiaries. None of the Company or any of the Company Subsidiaries has been a

“controlled corporation” or a “distributing corporation” in any distribution occurring during the two-year

period ending on the date hereof that was purported or intended to be governed by Section 355 of the Code (or any similar provision

of state, local or foreign Law). The Company and each Company Subsidiary is, and has been since the date of its formation, a

corporation for U.S. federal income tax purposes, and neither the Company nor any Company Subsidiary has elected pursuant to the

Code to be treated as a Subchapter S corporation or a collapsible corporation pursuant to Section 1362(a) of the Code, nor has it

made any other elections pursuant to the Code (other than elections that relate solely to methods of accounting, depreciation or

amortization) that would have, or be reasonably expected to result in, individually or in the aggregate, a Material Adverse

Effect.

2.18 Brokers and Finders. Neither the Company, any Company Subsidiary nor any of their respective officers, directors,

employees or agents has employed any broker or finder or incurred any liability for any financial advisory fees, brokerage fees, commissions

or finder’s fees, and no broker or finder has acted directly or indirectly for the Company or any Company Subsidiary in connection

with this Agreement or the transactions contemplated hereby.

2.19

Investment Company. The Company is not an “investment company” as defined under the Investment Company

Act of 1940, as amended.

2.20

Affiliate Transactions. No officer, director, five percent (5%) shareholder or other Affiliate of the Company (or

any Company Subsidiary), or any individual who, to the Knowledge of the Company, is related by marriage or adoption to or shares the same

home as any such Person, or any entity which, to the Knowledge of the Company, is controlled by any such Person, is a party to any contract

or transaction with the Company (or any Company Subsidiary) which pertains to the business of the Company (or any Company Subsidiary)

or has any interest in any property, real or personal or mixed, tangible or intangible, used in or pertaining to the business of the Company

(or any Company Subsidiary). The foregoing representation and warranty does not cover deposits at the Company (or any Company Subsidiary)

or loans of $250,000 or less made in the ordinary course of business in compliance with applicable law.

2.21

Data Privacy.

(a)

The Company and the Company Subsidiaries have taken reasonable steps consistent with customary industry practices to protect the

confidentiality, integrity, availability and security of the computers, servers, workstations, routers, hubs, switches, circuits, networks

and other information technology equipment owned or controlled by them or by any third party and material to the Company and the Company

Subsidiaries (the “Company IT Assets”) (and all information and transactions stored or contained therein or transmitted thereby)

against any unauthorized use, access, interruption, modification or corruption, and there has been no unauthorized use, access, interruption,

modification or corruption of the Company IT Assets.

(b) In

connection with their receipt, purchase, collection, securing, safeguarding, storage, transfer (including any transfer across

national borders), disclosure, destruction/disposal, and/or use or other processing of any Personal Information, each of the Company

and the Company Subsidiaries, is and has been, in material compliance with all Privacy Laws, their respective privacy policies and

the requirements of any contract or codes of conduct to which any of the Company or the Company Subsidiaries is a party. The privacy

policies of the Company are customary for the industry in which the Company operates in, and no privacy policies of the Company or

Company Subsidiaries have been inadequate, inaccurate, misleading or deceptive in any material respect. The Company and the Company

Subsidiaries have commercially reasonable and appropriate physical, technical, organizational, and administrative security measures

and policies in place designed to protect all Personal Information collected by them or on their behalf from and against

unauthorized access, use, interruption, modification, corruption, and/or disclosure. The Company and the Company Subsidiaries have

binding written agreements obligating (in accordance with Privacy Laws (as applicable)) all third parties collecting, accessing,

receiving, storing or processing Personal Information on behalf of the Company and the Company Subsidiaries to (i) comply with all

applicable Privacy Laws, (ii) take commercially reasonable and appropriate steps to protect and secure such Personal Information

from and against unauthorized access, use interruption, modification, corruption, and/or disclosure which are no less stringent than

those applied by the Company and the Company Subsidiaries and (iii) promptly notify the Company and the Company Subsidiaries of any

unauthorized access, use interruption, modification, corruption, and/or disclosure of Personal Information or Company IT Assets

processing Personal Information. The Company and the Company Subsidiaries are, and in the last three years have been, in compliance

in all material respects with all Privacy Laws and any other applicable Laws in all relevant jurisdictions relating to data loss,

theft and breach of security notification obligations. None of the Company or any of the Company Subsidiaries has during the last

three years experienced a material breach of its information technology systems or a data loss or theft as defined by the Laws in

all relevant jurisdictions. None of the Company or any of the Company Subsidiaries has been charged with, or received any notice of

any claims of, the violation in any material respect of any Privacy Laws or any of their respective privacy policies. The

consummation of the transactions contemplated hereby will not breach or otherwise cause any violation of any Privacy Law.

(c)

For the purposes of this Section 2.21: (i) “Personal Information” means, in addition to any definition provided by

applicable law or by the Company and the Company Subsidiaries in any of their respective privacy policies, contracts, or other public-facing

statements for any similar term (e.g., “personally identifiable information” or “PII”), all information identifying,

regarding or capable of being associated with an individual person or device. Personal Information may relate to any individual, including

a current, prospective or former client (or a client’s customer or end user) or employee of any Person, and includes information

in any form, including paper, electronic and other forms; and (ii) “Privacy Laws” means all applicable laws, legal requirements,

and self-regulatory guidelines and principles relating to privacy, data security, and Personal Information and similar applicable consumer

protection laws, including with respect to the receipt, collection, compilation, use, storage, processing, sharing, safeguarding, security,

disposal, destruction, disclosure or transfer of Personal Information and any and all applicable laws governing breach notification in

connection with Personal Information. As used in this Agreement, “Privacy Laws” shall include the California Consumer Privacy

Act, General Data Protection Regulation and the rules and regulations promulgated thereunder, and applicable state laws.

3.

Representations and Warranties of the Investor. The Investor hereby represents and warrants to the Company as follows:

3.1

Organization. The Investor is duly organized, validly existing and in good standing under the laws of the state of

its incorporation, is duly qualified to transact business and is in good standing in each jurisdiction in which the failure to be so qualified

would, or would reasonably be expected to, materially and adversely impair or delay its ability to perform its obligations under the Agreement

or to consummate the transactions contemplated hereby.

3.2

Authorization. The Investor has the corporate power and authority to execute and deliver this Agreement and to perform

its obligations hereunder. All corporate action on the part of the Investor, its officers, directors and holders of capital stock necessary

for the execution and delivery by the Investor of this Agreement, the performance of all obligations of the Investor hereunder and the

purchase of the Common Shares to be issued hereunder has been taken, and this Agreement, when executed and delivered by the Investor (subject

to the execution and delivery by the Company) shall constitute a valid and legally binding obligation of the Investor, enforceable against

the Investor in accordance with its terms, except as limited by the Enforceability Exceptions.

3.3

Purchase Entirely for Own Account. The Common Shares to be acquired by the Investor will be acquired for investment

for the Investor’s own account, not as a nominee or agent, and not with a view to the resale or distribution of any part thereof,

and the Investor has no present intention of selling, granting any participation in, or otherwise distributing the same. The Investor

does not have any contract, undertaking, agreement or arrangement with any Person to sell, transfer or grant participations to such Person

or to any third Person, with respect to any of the Common Shares.

3.4

Financial and Business Sophistication. The Investor has such knowledge and experience in financial and business matters

that it is capable of evaluating the merits and risks of the prospective investment in the Common Shares. The Investor has relied solely

upon its own knowledge of, and/or the advice of its own legal, financial or other advisors with regard to, the legal, financial, tax and

other considerations involved in deciding to invest in the Common Shares.

3.5

Ability to Bear Economic Risk of Investment. The Investor recognizes that an investment in the Common Shares involves

substantial risk, including risks related to the Company’s business, operating results, financial condition and cash flows, which

risks it has carefully considered in connection with making an investment in the Common Shares. The Investor has the ability to bear the

economic risk of the prospective investment in the Common Shares, including the ability to hold the Common Shares indefinitely, and further

including the ability to bear a complete loss of all of its investment in the Company.

3.6 Information.

The Investor acknowledges that: (a) it is not being provided with the disclosures that would be required if the offer and sale

of the Common Shares were registered under the Securities Act, nor is it being provided with any offering circular, private

placement memorandum or prospectus prepared in connection with the offer and sale of the Common Shares; (b) it has conducted

its own examination of the Company and the terms of this Agreement and the Common Shares to the extent it deems necessary to make

its decision to invest in the Common Shares; (c) it has availed itself of publicly available financial and other information

concerning the Company to the extent it deems necessary to make its decision to purchase the Common Shares and (d) it has not

received nor relied on any form of general solicitation or general advertising (within the meaning of Regulation D) from the Company

in connection with the offer and sale of the Common Shares. The Investor has had a reasonable opportunity to review the information

set forth in the Company Reports. The foregoing, however, does not limit or modify the representations or warranties of the Company

in Section 2 or the right of Investor to rely thereon.

3.7

Disclosure of Information. The Investor has had an opportunity to discuss the Company’s business, management,

financial affairs and the terms and conditions of the offering of the Common Shares with the Company’s management. The Investor

understands that such discussions, as well as any other written information delivered by the Company to the Investor, were intended to

describe the aspects of the Company’s business which the Investor believes to be material. The foregoing, however, does not limit

or modify the representations or warranties of the Company in Section 2 or the right of Investor to rely thereon.

3.8

Restricted Securities. The Investor understands that the Common Shares have not been, and will not be, registered

under the Securities Act, by reason of a specific exemption from the registration provisions of the Securities Act which depends upon,

among other things, the bona fide nature of the investment intent and the accuracy of the Investor’s representations as expressed

herein. The Investor understands that the Common Shares are “restricted securities” under applicable U.S. federal and state

securities laws and that, pursuant to these laws, the Investor must hold the Common Shares indefinitely unless they are registered with

the U.S. Securities and Exchange Commission and qualified by state authorities, or an exemption from such registration and qualification

requirements is available. The Investor further acknowledges that if an exemption from registration or qualification is available, it

may be conditioned on various requirements including, but not limited to, the time and manner of sale, the holding period for the Common

Shares, and on requirements relating to the Company which are outside of the Investor’s control, and which the Company is under

no obligation and may not be able to satisfy.

3.9

Legends. The Investor understands that the Common Shares may bear one or all of the following legends:

(a)

“THE SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AND HAVE BEEN ACQUIRED FOR

INVESTMENT AND NOT WITH A VIEW TO, OR IN CONNECTION WITH, THE SALE OR DISTRIBUTION THEREOF. NO SUCH SALE OR DISTRIBUTION MAY BE EFFECTED

WITHOUT AN EFFECTIVE REGISTRATION STATEMENT RELATED THERETO OR AN OPINION OF COUNSEL IN A FORM SATISFACTORY TO THE COMPANY THAT SUCH REGISTRATION

IS NOT REQUIRED UNDER THE SECURITIES ACT OF 1933.”

(b)

Any legend required by the securities laws of any state to the extent such laws are applicable to the shares represented by the

certificate so legended.

3.10

Accredited Investor. The Investor is an accredited investor as defined in Rule 501(a)(1), (2), (3), or (7) of Regulation

D promulgated under the Securities Act.

4.1

Regulatory Filings. The Company shall make all filings pursuant to any applicable state securities laws and Regulation

D of the Securities Act that are required to be made in connection with the transactions contemplated by this Agreement.

4.2

Use of Proceeds. The proceeds to the Company from the sale of the Common Shares contemplated hereunder will be used

for growth of the Company’s business in a manner consistent in all material respects with the capital deployment plan provided by

the Company to the Investor prior to the execution of this Agreement.

4.3

Further Assurances and Cooperation. The Company and the Investor each agree to execute and deliver, or cause its

respective Affiliates to execute and deliver, such further documents and instruments and to take such further actions after the date hereof

as may be necessary or desirable and reasonably requested by the other party to give effect to the transactions contemplated by this Agreement.

5.1

Survival of Warranties and Covenants. Unless otherwise set forth in this Agreement, the representations and warranties

of the Company and the Investor contained in or made pursuant to this Agreement shall survive the execution and delivery of this Agreement

for a period of one (1) year following the date hereof, and the covenants of the Company and the Investor contained in or made pursuant

to this Agreement shall survive in accordance with their terms.

5.2

Indemnification. The Company and the Investor shall defend, indemnify and hold harmless the Investor and its Affiliates

or the Company and its Affiliates, as applicable, from and against any loss, liability, claim, damage, injury, or expense (including reasonable

attorney’s fees) incurred in connection with any third party claim against the Company or the Investor resulting or arising from

or in connection with (a) any inaccuracy in or breach by the Company or the Investor, as applicable, of any of its representations or

warranties contained in this Agreement, or (b) the non-performance and/or breach by the Company or the Investor, as applicable, of any

of its covenants contained in this Agreement. For the avoidance of doubt, nothing in this Agreement shall limit the right of the Investor

to pursue any claim against the Company resulting or arising from or in connection with (x) any inaccuracy in or breach by the Company

of any of its representations or warranties contained in this Agreement, or (y) the non-performance and/or breach by the Company of any

of its covenants contained in this Agreement.

5.3 Publicity.

The Company will not make any public statements or issue press releases in connection with the transactions contemplated by this

Agreement that reference the Investor or its Affiliates without the Investor’s prior written approval; provided, however,

that the foregoing shall not be applicable to any regulatory filings or registrations, notifications or disclosures required by any

federal, state or other law or Governmental Authority, including filings pursuant to Regulation D of the Securities Act, so long as

the Company provides prior written notice to the Investor of any such filings, registrations, notifications or disclosure

requirements; provided, further, that the Company may not use any names, trademarks, service marks or trade names of

the Investor or its Affiliates in any form of advertising and publicity or public statements without the Investor’s prior

written consent. For the avoidance of doubt, and notwithstanding anything in the Confidentiality Agreement, dated as of July 7,

2023, by and between the parties (the “Confidentiality Agreement”), to the contrary, the Investor or any of its

Affiliates may make public statements (including by press release) in connection with the transactions contemplated by this

Agreement noting the fact and size of its investment.

5.4

Transfer; Successors and Assigns. The terms and conditions of this Agreement shall inure to the benefit of and be

binding upon the respective successors and assigns of the parties. Nothing in this Agreement, express or implied, is intended to confer

upon any party other than the parties hereto or their respective successors and assigns any rights, remedies, obligations, or liabilities

under or by reason of this Agreement, except as expressly provided in this Agreement.

5.5

Governing Law. This Agreement and all acts and transactions pursuant hereto and the rights and obligations of the

parties hereto shall be governed, construed and interpreted in accordance with the laws of the State of Delaware applicable to agreements

made and to be performed entirely within the State of Delaware, without regard to any applicable conflicts of law considerations.

5.6

Counterparts. This Agreement may be executed in two or more counterparts, each of which shall be deemed an original

and all of which together shall constitute one instrument.

5.7 Interpretation.

The titles and subtitles used in this Agreement are used for convenience only and are not to be considered in construing or interpreting

this Agreement. As used in this Agreement, the phrase “to the Knowledge of the Company” (or any variant thereof) shall

mean the actual knowledge of Michael T. Pugh, Christina L. Maier and Isaac Torres.

5.8

Notices. All notices or other communications required or permitted hereunder shall be in writing and shall be delivered

personally, by email or sent by certified, registered or express air mail, postage prepaid, and shall be deemed given and delivered when

so delivered personally, or if sent by email upon such transmission, or if mailed by overnight courier service guaranteeing next day delivery,

one Business Day after deposited with such service, or if mailed in any other way, then three Business Days after mailing, as follows:

If to the Company:

Carver Bancorp, Inc.

75 West 125th Street

New York, NY 10027

| |

Attention: |

Isaac

Torres, General Counsel |

| |

Email: |

Isaac.torres@carverbank.com |

with a copy (which shall not constitute

notice) to:

Luse Gorman PC

5335 Wisconsin Avenue

NW, Suite 780

Washington,

DC 20015

| |

Attention: |

Lawrence

M. F. Spaccasi |

| |

Email: |

lspaccasi@luselaw.com |

If

to the Investor:

National

Community Investment Fund

135

S. LaSalle Street, Suite 3025

Chicago,

Illinois 60603

| |

Attention: |

Saurabh

Narain |

| |

Email: |

snarain@ncif.org |

with

a copy (which shall not constitute notice) to:

Wiggin

and Dana LLP

Two Stamford Plaza

281 Tresser Boulevard

Stamford, CT 06901

| |

Attention: |

Mark

S. Kaduboski |

| |

Email: |

mkaduboski@wiggin.com |

or

to such other address as any party hereto shall notify the other parties (as provided above) from time to time.

5.9

Amendments and Waivers. Any term of this Agreement may be amended or waived only with the prior written consent of

the Company and the Investor.

5.10

Severability. If one or more provisions of this Agreement are held to be unenforceable under applicable law, the

parties agree to renegotiate such provision in good faith. In the event that the parties cannot reach a mutually agreeable and enforceable

replacement for such provision, then (a) such provision shall be excluded from this Agreement, (b) the balance of this Agreement shall

be interpreted as if such provision were so excluded and (c) the balance of this Agreement shall be enforceable in accordance with its

terms.

5.11

Expenses. Each of the parties shall be responsible for its own expenses in connection with the transactions contemplated

by the Agreement; provided, that, at the Closing, the Company shall reimburse Investor for Investor’s reasonable and documented

out of pocket costs and expenses incurred in connection with the negotiation and execution of this Agreement and the transactions contemplated

hereby, up to $30,000 in the aggregate.

5.12 Delays

or Omissions. No delay or omission to exercise any right, power or remedy accruing to any party under this Agreement, upon

any breach or default of any other party under this Agreement, shall impair any such right, power or remedy of such non-breaching or

non- defaulting party nor shall it be construed to be a waiver of any such breach or default, or an acquiescence therein, or of or

in any similar breach or default thereafter occurring.

5.13

Entire Agreement. The Agreement, together with the Confidentiality Agreement, constitute the entire agreement among

the parties pertaining to the subject matter hereof, and any and all other written or oral agreements relating to the subject matter hereof

existing between the parties are expressly canceled.

5.14

Dispute Resolution. The parties (a) hereby irrevocably and unconditionally submit to the jurisdiction of the state

and federal courts of the State of Delaware for the purpose of any suit, action or other proceeding arising out of or based upon this

Agreement, (b) agree not to commence any suit, action or other proceeding arising out of or based upon this Agreement except in the state

or federal courts of the State of Delaware, and (c) hereby waive, and agree not to assert, by way of motion, as a defense, or otherwise,

in any such suit, action or proceeding, any claim that it is not subject personally to the jurisdiction of the above-named courts, that

its property is exempt or immune from attachment or execution, that the suit, action or proceeding is brought in an inconvenient forum,

that the venue of the suit, action or proceeding is improper or that this Agreement or the subject matter hereof may not be enforced in

or by such court.

5.15

WAIVER OF JURY TRIAL. EACH PARTY HEREBY WAIVES ITS RIGHTS TO A JURY TRIAL OF ANY CLAIM OR CAUSE OF ACTION BASED UPON

OR ARISING OUT OF THIS AGREEMENT, THE COMMON SHARES OR THE SUBJECT MATTER HEREOF OR THEREOF. THE SCOPE OF THIS WAIVER IS INTENDED TO BE

ALL-ENCOMPASSING OF ANY AND ALL DISPUTES THAT MAY BE FILED IN ANY COURT AND THAT RELATE TO THE SUBJECT MATTER OF THIS TRANSACTION, INCLUDING,

WITHOUT LIMITATION, CONTRACT CLAIMS, TORT CLAIMS (INCLUDING, WITHOUT LIMITATION, NEGLIGENCE), BREACH OF DUTY CLAIMS, AND ALL OTHER COMMON

LAW AND STATUTORY CLAIMS. THIS SECTION HAS BEEN FULLY DISCUSSED BY EACH OF THE PARTIES AND THESE PROVISIONS WILL NOT BE SUBJECT TO ANY

EXCEPTIONS. EACH PARTY HERETO HEREBY FURTHER WARRANTS AND REPRESENTS THAT SUCH PARTY HAS REVIEWED THIS WAIVER WITH ITS LEGAL COUNSEL,

AND THAT SUCH PARTY KNOWINGLY AND VOLUNTARILY WAIVES ITS JURY TRIAL RIGHTS FOLLOWING CONSULTATION WITH LEGAL COUNSEL.

[Signature Pages Follow]

The parties have executed this Investment

Agreement as of the date first set forth above.

| |

CARVER

BANCORP, INC. |

| |

|

| |

|

| |

By: |

/s/

Michael T. Pugh |

| |

|

(Signature) |

| |

|

| |

Name: |

Michael

T. Pugh |

| |

Title: |

President

and Chief Executive Officer |

[Signature Page to Carver Investment Agreement]

The parties have executed this Investment

Agreement as of the date first set forth above.

| |

NATIONAL COMMUNITY INVESTMENT FUND |

| |

|

| |

|

| |

By: |

/s/

Saurabh Narain |

| |

|

(Signature) |

| |

|

| |

Name: |

Saurabh Narain |

| |

Title: |

President

and Chief Executive Officer |

[Signature Page to Carver Investment Agreement]

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

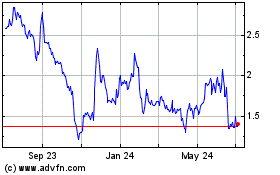

Carver Bancorp (NASDAQ:CARV)

Historical Stock Chart

From Mar 2024 to Apr 2024

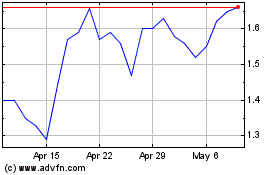

Carver Bancorp (NASDAQ:CARV)

Historical Stock Chart

From Apr 2023 to Apr 2024