false

0001346830

0001346830

2023-11-13

2023-11-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

November 13, 2023

CARA THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-36279 |

|

75-3175693 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| |

|

|

|

|

|

4 Stamford Plaza

107 Elm Street, 9th Floor

Stamford, Connecticut |

|

|

|

06902 |

| (Address of principal executive offices) |

|

|

|

(Zip Code) |

| |

|

|

|

|

| Registrant's telephone number, including area code (203) 406-3700 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol |

Name

of each exchange on which registered |

| Common Stock, par value $0.001 per share |

CARA |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨.

| Item 2.02. |

Results of Operations and Financial Condition. |

On November 13, 2023, Cara Therapeutics, Inc. (the “Company”)

issued a press release announcing its financial results for the third quarter ended September 30, 2023. A copy of the press

release is being furnished to the Securities and Exchange Commission as Exhibit 99.1 to this Current Report on Form 8-K and

is incorporated by reference to this Item 2.02.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1,

shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange

Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any of

the Company’s filings with the Securities and Exchange Commission under the Exchange Act or the Securities Act of 1933, as amended,

whether made before or after the date hereof, regardless of any general incorporation language in such a filing.

| Item 9.01. |

Financial Statements and Exhibits. |

(d)

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CARA THERAPEUTICS, INC.

|

| |

By: |

/s/ RYAN MAYNARD |

| |

|

Ryan Maynard |

| |

|

Chief Financial Officer |

| |

|

(Principal Financial and Accounting Officer) |

Date: November 13, 2023

Exhibit 99.1

Cara Therapeutics Reports Third Quarter 2023

Financial Results

– Non-dilutive financing agreement with

HealthCare Royalty for up to $40 million expected to extend cash runway into 2025 –

– Key data readouts for all three late-stage

oral difelikefalin clinical programs anticipated within current financial runway –

– Topline results from Part A of

KIND 1 Phase 3 atopic dermatitis trial expected in December 2023 –

– 3Q23 total revenue of $4.9M including

collaborative revenue of $1.9M from the Company’s share of profit of KORSUVA® (difelikefalin) injection –

– Conference call today at 4:30 p.m. EST

–

STAMFORD, Conn., November 13, 2023

– Cara Therapeutics, Inc. (Nasdaq: CARA), a commercial-stage biopharmaceutical company leading a new treatment paradigm

to improve the lives of patients suffering from pruritus, today announced financial results and operational highlights for the third

quarter ended September 30, 2023.

“We are pleased to have closed our non-dilutive

financing transaction with HealthCare Royalty, which extends our cash runway into 2025,” said Christopher Posner, President and

Chief Executive Officer of Cara Therapeutics. “This financing will help us reach key clinical catalysts which we believe will validate

the potential of our oral difelikefalin pipeline.”

Mr. Posner continued, “We look forward

to releasing topline efficacy and safety data from Part A of our KIND 1 atopic dermatitis (AD) trial in December. Our other two

late-stage clinical programs for the treatment of pruritus associated with advanced chronic kidney disease (CKD) and notalgia paresthetica

(NP) are on track for key data readouts in 2024. We will continue to focus on maintaining a strong balance sheet and delivering on our

commitments across our wholly owned pipeline.”

3Q23 and Recent Highlights

| · | Entered

into Royalty Interest Purchase and Sale Agreement with HealthCare Royalty (HCRx) for up to

$40 million, extending Cara’s cash runway into 2025 |

| · | Topline

efficacy and safety data from Part A of the KIND 1 Phase 3 program in pruritus associated

with AD expected in December 2023 |

| · | Enrollment

on track in the KICK Phase 3 program in pruritus associated with advanced CKD, with topline

results expected in 2H24 |

| · | Enrollment

also on track in the KOURAGE Phase 2/3 program in NP, with readout from Part A targeted

in 2H24 and final topline results for the program in 1H26 |

| · | Findings

from the Neuropathic Itch Patient Survey (NIRVE) were reported in an oral presentation at

the EADV Congress 2023 |

| · | Centers

for Medicare & Medicaid Services issued the CY 2024 End Stage Renal Disease Prospective

Payment System final rule |

| · | Helen

M. Boudreau was appointed to the Company’s Board of Directors and will serve as Chair

of the Audit Committee |

| · | Harrison

M. Bains retired from the Company’s Board of Directors |

KORSUVA Injection U.S. Update: 3Q23

In the third quarter of 2023, KORSUVA injection

generated net sales of $4.4 million and the Company recorded collaborative revenue of $1.9 million, which represented the Company’s

share of the profit from sales of KORSUVA injection.

Wholesalers shipped 90,828 vials to dialysis

centers during the third quarter of 2023. Vial orders increased 36% quarter to quarter.

In October 2023, the Centers for Medicare &

Medicaid Services (CMS) issued a final rule for the End Stage Renal Disease Prospective Payment System (ESRD PPS) for calendar year

2024, which confirmed the TDAPA period for KORSUVA injection until March 31, 2024, and maintained the reimbursement methodology

from the June 2023 proposed rule.

Upcoming Meeting Activities

The Company expects to present at the following

upcoming investor conferences:

| · | Stifel

Healthcare Conference, November 15, 2023, at 10:55 a.m. EST |

| · | Jefferies

London Healthcare Conference, November 16, 2023, at 8:00 a.m. GMT |

| · | Piper

Sandler Healthcare Conference, November 29, 2023, at 4:30 p.m. EST |

Third Quarter 2023 Financial Results

Cash, cash equivalents and marketable securities

at September 30, 2023 totaled $83.3 million compared to $156.7 million at December 31, 2022. The decrease in the balance primarily

resulted from $74.7 million of cash used in operating activities.

For the third quarter of 2023, net loss was $28.0

million, or $(0.52) per basic and diluted share, compared to net loss of $23.2 million, or $(0.43) per basic and diluted share, for the

same period in 2022.

Revenues: Total revenue was $4.9 million

and $10.8 million for the three months ended September 30, 2023 and 2022, respectively. Revenue consisted of:

| · | $1.9

million and $7.4 million of collaborative revenue related to our share of the profit from

CSL Vifor’s sales of KORSUVA injection to third parties during the three months ended

September 30, 2023 and 2022, respectively. In addition, $0.5 million of collaborative

revenue was recognized during the three months ended September 30, 2023. This amount

relates to an allocated portion of the regulatory milestone payment we earned in September 2023

from Maruishi Pharmaceuticals Co. Ltd, or Maruishi, for the marketing approval in Japan for

KORSUVA injection; |

| · | $1.3

million and $3.4 million of commercial supply revenue related to sales of KORSUVA injection

to CSL Vifor during the three months ended September 30, 2023 and 2022, respectively; |

| · | Approximately

$167,000 of royalty revenue related to our royalties on the net sales of Kapruvia in Europe

during the three months ended September 30, 2023. There was no royalty revenue during

the three months ended September 30, 2022; and |

| · | $0.9

million of license and milestone fees revenue related to the remaining allocated portion

of a regulatory milestone payment we earned in September 2023 from Maruishi for the

marketing approval in Japan for KORSUVA injection. There was no license and milestone fees

revenue during the three months ended September 30, 2022. |

Cost of Goods Sold: Cost of goods sold

was $1.6 million and $3.1 million during the three months ended September 30, 2023 and 2022, respectively, related to commercial

supply revenue for KORSUVA injection sales to CSL Vifor.

Research and Development (R&D) Expenses:

R&D expenses were $25.5 million for the three months ended September 30, 2023 compared to $24.7 million in the same period

of 2022. The slightly higher R&D expenses in 2023 were primarily due to increases in clinical trial costs related to our three late-stage

development programs, partially offset by a decrease in stock-based compensation expense. R&D expenses for the three months ended

September 30, 2022 included $5.0 million related to a milestone payment due to Enteris Biopharma, Inc.

General and Administrative (G&A) Expenses:

G&A expenses were essentially flat at $6.8 million for the three months ended September 30, 2023 compared to $6.9 million

in the same period of 2022.

Other Income, net: Other income, net was

approximately $866,000 for the three months ended September 30, 2023 compared to approximately $665,000 in the same period of 2022.

The increase in other income, net was primarily due to an increase in interest income resulting from a higher yield on our portfolio

of investments during the three months ended September 30, 2023.

Financial Guidance

Cara expects that our current unrestricted cash

and cash equivalents and available-for-sale marketable securities, including the proceeds from our recently announced royalty financing

and the collaborative revenue from our share of the profit from KORSUVA injection, will be sufficient to fund our currently anticipated

operating plan into 2025.

About Cara Therapeutics

Cara Therapeutics is

a commercial-stage biopharmaceutical company leading a new treatment paradigm to improve the lives of patients suffering from pruritus.

The Company’s KORSUVA® (difelikefalin) injection is the first and only FDA-approved treatment for moderate-to-severe pruritus

associated with chronic kidney disease in adults undergoing hemodialysis. The Company is developing an oral formulation of difelikefalin

and has Phase 3 programs ongoing for the treatment of pruritus in patients with advanced chronic kidney disease and atopic dermatitis.

In addition, the Company has an ongoing Phase 2/3 program of oral difelikefalin for the treatment of moderate-to-severe pruritus in patients

with notalgia paresthetica. For more information, visit www.CaraTherapeutics.com and follow the company on X (Twitter),

LinkedIn and Instagram.

Forward-looking Statements

Statements contained in this press release regarding

matters that are not historical facts are "forward-looking statements" within the meaning of the Private Securities Litigation

Reform Act of 1995. Examples of these forward-looking statements include statements concerning the Company’s and its partners ongoing

commercialization of and ability to successfully commercialize KORSUVA injection and Kapruvia, future revenue and profit share from sales

of KORSUVA and Kapruvia, planned future regulatory submissions and potential future regulatory approvals, future product launches, the

performance of the Company’s commercial partners, including CSL Vifor, expected timing of the initiation, enrollment and data readouts

from the Company’s planned and ongoing clinical trials, the potential results of ongoing clinical trials, timing of future regulatory

and development milestones for the Company’s product candidates, the potential for the Company’s product candidates to be

alternatives in the therapeutic areas investigated and the potential for oral difelikefalin to address additional pruritic indications,

the size and growth of the potential markets for pruritus management, the receipt of potential milestone payments pursuant to the Purchase

and Sale Agreement with HealthCare Royalty and the Company’s expected cash reach. Because such statements are subject to risks

and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. These risks

and uncertainties include the risks inherent in the launch of new products, including that our commercial partners, including CSL Vifor,

may not perform as expected, risks inherent in the clinical and regulatory development of pharmaceutical products, and the risks described

more fully in Cara Therapeutics’ filings with the Securities and Exchange Commission, including the “Risk Factors”

section of the Company’s Annual Report on Form 10-K for the year ending December 31, 2022 and its other documents subsequently

filed with or furnished to the Securities and Exchange Commission, including its Form 10-Q for the quarter ended September 30,

2023. All forward-looking statements contained in this press release speak only as of the date on which they were made. Cara Therapeutics

undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they

were made, except as required by law.

Financial tables follow

| CARA THERAPEUTICS, INC. |

| CONDENSED BALANCE SHEETS |

| (in thousands) |

| (unaudited) |

| | |

September 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 62,875 | | |

$ | 63,741 | |

| Marketable securities | |

| 15,666 | | |

| 81,658 | |

| Accounts receivable, net - related party | |

| 3,351 | | |

| 3,260 | |

| Inventory, net | |

| 3,266 | | |

| 2,383 | |

| Income tax receivable | |

| 697 | | |

| 697 | |

| Other receivables | |

| 1,682 | | |

| 496 | |

| Prepaid expenses | |

| 12,658 | | |

| 16,267 | |

| Restricted cash | |

| 408 | | |

| 408 | |

| Total current assets | |

| 100,603 | | |

| 168,910 | |

| Operating lease right-of-use assets | |

| 7,108 | | |

| 1,551 | |

| Marketable securities, non-current | |

| 4,747 | | |

| 11,350 | |

| Property and equipment, net | |

| 1,380 | | |

| 426 | |

| Restricted cash, non-current | |

| 1,500 | | |

| - | |

| Total assets | |

$ | 115,338 | | |

$ | 182,237 | |

| | |

| | | |

| | |

| Liabilities and stockholders’ equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 22,384 | | |

$ | 21,540 | |

| Operating lease liabilities, current | |

| 497 | | |

| 1,918 | |

| Total current liabilities | |

| 22,881 | | |

| 23,458 | |

| | |

| | | |

| | |

| Operating lease liabilities, non-current | |

| 6,815 | | |

| - | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| - | | |

| - | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock | |

| - | | |

| - | |

| Common stock | |

| 54 | | |

| 53 | |

| Additional paid-in capital | |

| 738,435 | | |

| 726,630 | |

| Accumulated deficit | |

| (652,408 | ) | |

| (566,232 | ) |

| Accumulated other comprehensive loss | |

| (439 | ) | |

| (1,672 | ) |

| Total stockholders’ equity | |

| 85,642 | | |

| 158,779 | |

| Total liabilities and stockholders’ equity | |

$ | 115,338 | | |

$ | 182,237 | |

| CARA

THERAPEUTICS, INC. |

| CONDENSED STATEMENTS

OF OPERATIONS |

| (amounts in thousands,

except share and per share data) |

| (unaudited) |

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Collaborative revenue |

|

$ |

2,471 |

|

|

$ |

7,443 |

|

|

$ |

10,631 |

|

|

$ |

15,446 |

|

| Commercial supply revenue |

|

|

1,252 |

|

|

|

3,370 |

|

|

|

5,843 |

|

|

|

8,160 |

|

| Royalty revenue |

|

|

167 |

|

|

|

- |

|

|

|

415 |

|

|

|

- |

|

| License and milestone fees |

|

|

910 |

|

|

|

- |

|

|

|

910 |

|

|

|

15,000 |

|

| Clinical compound revenue |

|

|

66 |

|

|

|

- |

|

|

|

165 |

|

|

|

- |

|

| Total revenue |

|

|

4,866 |

|

|

|

10,813 |

|

|

|

17,964 |

|

|

|

38,606 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of goods sold |

|

|

1,558 |

|

|

|

3,055 |

|

|

|

5,566 |

|

|

|

5,136 |

|

| Research and development |

|

|

25,451 |

|

|

|

24,691 |

|

|

|

80,095 |

|

|

|

65,869 |

|

| General and administrative |

|

|

6,755 |

|

|

|

6,912 |

|

|

|

21,191 |

|

|

|

23,829 |

|

| Total operating expenses |

|

|

33,764 |

|

|

|

34,658 |

|

|

|

106,852 |

|

|

|

94,834 |

|

| Operating loss |

|

|

(28,898 |

) |

|

|

(23,845 |

) |

|

|

(88,888 |

) |

|

|

(56,228 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income, net |

|

|

866 |

|

|

|

665 |

|

|

|

2,712 |

|

|

|

1,093 |

|

| Net loss |

|

$ |

(28,032 |

) |

|

$ |

(23,180 |

) |

|

$ |

(86,176 |

) |

|

$ |

(55,135 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted |

|

$ |

(0.52 |

) |

|

$ |

(0.43 |

) |

|

$ |

(1.59 |

) |

|

$ |

(1.03 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted |

|

|

54,235,695 |

|

|

|

53,726,123 |

|

|

|

54,038,239 |

|

|

|

53,616,753 |

|

MEDIA CONTACT:

Annie Spinetta

6 Degrees

973-768-2170

aspinetta@6degreespr.com

INVESTOR CONTACT:

Iris Francesconi, Ph.D.

Cara Therapeutics

203-406-3700

investor@caratherapeutics.com

v3.23.3

Cover

|

Nov. 13, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 13, 2023

|

| Entity File Number |

001-36279

|

| Entity Registrant Name |

CARA THERAPEUTICS, INC.

|

| Entity Central Index Key |

0001346830

|

| Entity Tax Identification Number |

75-3175693

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

4 Stamford Plaza

|

| Entity Address, Address Line Two |

107 Elm Street

|

| Entity Address, Address Line Three |

9th Floor

|

| Entity Address, City or Town |

Stamford

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06902

|

| City Area Code |

203

|

| Local Phone Number |

406-3700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

CARA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

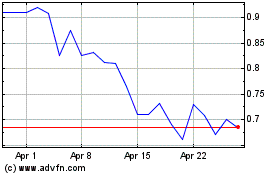

Cara Therapeutics (NASDAQ:CARA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cara Therapeutics (NASDAQ:CARA)

Historical Stock Chart

From Apr 2023 to Apr 2024