Calamp Corp. - Current report filing (8-K)

March 03 2008 - 1:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 29, 2008

____________________

Exact Name of Registrant as

Specified in Its Charter: CALAMP CORP.

___________________________________

DELAWARE 0-12182 95-3647070

_____________________________ ____________ _____________

State or Other Jurisdiction of Commission I.R.S. Employer

Incorporation or Organization File Number Identification No.

Address of Principal Executive Offices: 1401 N. Rice Avenue

Oxnard, CA 93030

_________________________

Registrant's Telephone Number, Including

Area Code: (805) 987-9000

_________________________

Former Name or Former Address,

if Changed Since Last Report: Not applicable

_____________________________

|

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 425 under the Exchange Act

(17 CFR 240.14.a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

ITEM 1.01. Entry into a Material Definitive Agreement

On February 29, 2008, CalAmp Corp. (the "Company") entered into the

Fourth Amendment and Waiver to the Credit Agreement dated May 26, 2006 (the

"Amended Agreement") with Bank of Montreal, as administrative agent, and

certain other banks that are parties thereto. Pursuant to the Amended

Agreement, the banks agreed to waive the financial covenant violations that

existed for the first three quarters of fiscal 2008.

The Amended Agreement provides that cash proceeds of $3.8 million from

the August 2007 sale of the Company's TelAlert software business that has

been held in escrow by the banks will be applied to reduce borrowings under

the term loan, which will leave an outstanding principal balance of

approximately $27.5 million. The interest rate on the term loan was also

increased by 0.5% as a result of this amendment, and giving effect to this

change, the term loan now bears interest at 7.1%. Term loan principal

payments of $750,000 are due on the last day of each calendar quarter during

2008, and a principal payment of $1,250,000 is due on March 31, 2009. In

addition, any collections of the scheduled $140,000 per month on a note

receivable from the buyer of the TelAlert software business must be applied

to reduce the term loan principal. The Amended Agreement has a termination

date of June 30, 2009, at which time all outstanding borrowings under the

credit agreement are due and payable. In the event all outstanding

obligations under the Amended Agreement are not paid in full by December 31,

2008, an exit fee of $500,000 will be due and payable to the banks on June

30, 2009, except that if the Company receives cash of at least $5,000,000 as

a result of issuing equity or subordinated debt by December 31, 2008, then

the exit fee will be reduced to $300,000.

The Amended Agreement also makes available $1 million for borrowings

under a working capital revolving loan. Borrowings under the revolver would

bear interest at the Bank of Montreal's prime rate plus 2% or LIBOR plus 3%.

The financial covenants with which the Company had been noncompliant

were eliminated as a result of this amendment, and were replaced with new

covenants that require minimum levels of consolidated earnings before

interest, taxes, depreciation and amortization (EBITDA) and Wireless DataCom

Division revenues. In addition, the Amended Agreement contains a provision

by which an event of default would occur if a certain key customer of the

Company's Satellite Division does not grant final authorization/clearance

for shipment of new generation products by June 30, 2008.

ITEM 9.01. Financial Statements and Exhibits

(c) Exhibits

10.1 Fourth Amendment and Waiver to Credit Agreement dated

February 29, 2008 between CalAmp Corp., Bank of Montreal

and other lenders party thereto.

99.1 Press release of the Registrant dated February 29, 2008

announcing the amendment of the bank credit agreement.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as

amended, the Registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

CALAMP CORP.

March 3, 2008 By:/s/ Richard K. Vitelle

___________________ _________________________

Date Richard K. Vitelle,

Vice President-Finance

(Principal Financial Officer)

|

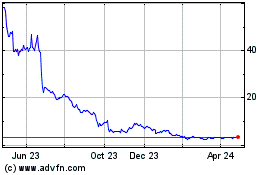

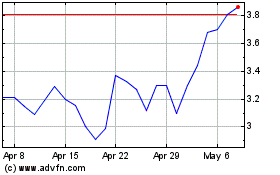

CalAmp (NASDAQ:CAMP)

Historical Stock Chart

From May 2024 to Jun 2024

CalAmp (NASDAQ:CAMP)

Historical Stock Chart

From Jun 2023 to Jun 2024