CalAmp Corp. (Nasdaq:CAMP), a leading provider of wireless

products, services, and solutions, today reported results for its

fiscal 2008 third quarter ended November 30, 2007. Key elements

include: Consolidated third quarter revenues of $32.1 million

within expectations; Wireless DataCom Division revenues of $23.7

million nearly 70% higher than prior year. Third quarter GAAP loss

from continuing operations of $58.9 million, or $2.49 per diluted

share, includes non-cash pre-tax charge of $65.7 million for

goodwill impairment; Adjusted basis (non-GAAP) income from

continuing operations of $67,000 or $-0- per share exceeded

guidance. Completed settlement agreement with key Direct Broadcast

Satellite (DBS) customer. Fred Sturm, CalAmp�s President and Chief

Executive Officer, commented, �Overall, operational performance in

the third quarter was within expectations. I am pleased with our

continued progress in executing our strategy to profitably grow our

Wireless DataCom business, which has been our strategic growth

initiative for the past two years. During the third quarter our

Wireless DataCom Division generated record revenues of $23.7

million driven by sequential quarter growth in our public safety,

industrial monitoring and controls and OEM businesses.

Additionally, Wireless DataCom gross margins benefited from higher

margin new products introduced in 2007.� Mr. Sturm added, �Reaching

a settlement agreement last month with a key DBS customer was an

important step in getting our Satellite Division back to

profitability. The agreement is structured in a way that reduces

CalAmp�s future cash requirements, and more closely aligns the

interests of our two companies. We are continuing to work closely

with this valued customer to requalify our products, and we expect

increasing revenues throughout fiscal year 2009.� Mr. Sturm

concluded, �The settlement agreement with this key DBS customer has

allowed CalAmp to start meaningful negotiations with our lenders to

address the previously announced noncompliance related to financial

covenants under our credit facility. We are working to resolve this

matter expeditiously, but we do not believe that the current

restriction on borrowing under the credit facility will adversely

impact our near term operations.� Fiscal 2008 Third Quarter Results

Total revenue for the fiscal 2008 third quarter was $32.1 million

compared to $59.1 million for the third quarter of fiscal 2007.

Lower sales of Satellite Division products in the latest quarter

were partially offset by higher Wireless DataCom Division revenues.

Gross profit for the fiscal 2008 third quarter was $10.0 million,

or 31.3% of revenues compared to $12.0 million or 20.4% of revenues

for the same period last year. The reduction in gross profit was

primarily the result of lower sales of Satellite Division products.

The improvement in gross margin percentage was due primarily to a

change in product mix favoring increased sales of higher margin

Wireless DataCom products. Results of operations for the fiscal

2008 third quarter as determined in accordance with U.S. Generally

Accepted Accounting Principles ("GAAP") was a net loss from

continuing operations of $58.9 million, or $2.49 per diluted share.

As a result of a significant decrease in recent business with a key

DBS customer due to a product performance issue, coupled with the

substantial decline in the Company's market capitalization, the

Company conducted an interim goodwill impairment analysis as of

November 30, 2007. This analysis indicated that goodwill in the

aggregate amount of $65.7 million was impaired, comprised of

impairments in the Satellite and Wireless DataCom divisions of

$43.2 million and $22.5 million, respectively. The Wireless DataCom

Division�s revenue and gross profit are higher in the current three

and nine-month periods than the comparable periods of the prior

year. Nonetheless, both reporting segments were determined to be

impaired because of the decline in the Company's market

capitalization. The Adjusted Basis (non-GAAP) income from

continuing operations for the fiscal 2008 third quarter was $67,000

or breakeven per diluted share compared to Adjusted Basis income

from continuing operations of $2.3 million or $0.10 per diluted

share for the same period last year. Adjusted Basis income (loss)

from continuing operations excludes the impact of amortization of

intangible assets, stock-based compensation expense and the

impairment loss, each net of tax to the extent applicable. A

reconciliation of the GAAP basis income (loss) from continuing

operations to Adjusted Basis income (loss) from continuing

operations is provided in the table at the end of this press

release. Liquidity At November 30, 2007, the Company had total cash

of $5.0 million, with $32.0 million in total outstanding debt. As

previously disclosed, the net loss reported in the first quarter of

fiscal 2008 caused the Company to become noncompliant with the

financial covenants under its bank credit agreement, and as a

result the Company cannot borrow under the working capital revolver

of this credit agreement until it is able to obtain a waiver from

its lenders and/or an amendment of the credit agreement. The

Company is in discussions with its lenders to resolve the issue. In

the near term the Company believes that it has sufficient liquidity

such that the restriction on borrowing under the revolving credit

facility will not materially affect its operations. However, if the

lenders are unwilling to agree to a waiver or an amendment or

exercise their rights to accelerate borrowings outstanding under

the credit agreement, the inability to borrow under the revolving

credit facility and/or the acceleration of such indebtedness could

materially adversely affect the Company�s financial position and

operations, including its ability to fund its currently anticipated

working capital and capital expenditure needs. Because the lenders

have the right to call the loan until such time as a waiver is

obtained, the entire $32.0 million outstanding balance of the bank

loan is classified as a current liability in the November 30, 2007

balance sheet. Net cash used in operating activities was $4.9

million for the nine months ended November 30, 2007. Inventory was

$27.7 million at the end of the third quarter, representing

annualized turns of approximately 3 times. Accounts receivable

outstanding at the end of the third quarter represents a 60 day

average collection period. Business Outlook Commenting on the

Company's business outlook, Mr. Sturm said, �Based on our current

projections, we believe fiscal 2008 fourth quarter consolidated

revenues will be in the range of $29 to $33 million, with a GAAP

basis loss from continuing operations in the range of ($0.06) to

($0.10) per diluted share. The Adjusted Basis (non-GAAP) loss from

continuing operations for the fourth quarter, which excludes

amortization of intangible assets and stock-based compensation

expense net of tax, is expected to be ($0.01) to ($0.05) per

diluted share. During the fourth quarter, we expect revenue

contributions from our Wireless DataCom Division in the range of

$20 million to $24 million.� Conference Call, Webcast and Form 10-Q

Filing A conference call and simultaneous webcast to discuss fiscal

2008 third quarter financial results and business outlook will be

held today at 4:30 p.m. Eastern / 1:30 p.m. Pacific. The live

webcast of the call is available on CalAmp's web site at

www.calamp.com. Participants are encouraged to visit the web site

at least 15 minutes prior to the start of the call to register,

download and install any necessary audio software. CalAmp's

President and CEO Fred Sturm and CFO Rick Vitelle will host the

conference call. After the live webcast, a replay will remain

available until the next quarterly conference call in the Investor

Relations section of CalAmp's web site. The reader is also referred

to the Company's Quarterly Report on Form 10-Q, filed today with

the Securities and Exchange Commission. About CalAmp Corp. CalAmp

is a leading provider of wireless communications products that

enable anytime/anywhere access to critical information, data and

entertainment content. With comprehensive capabilities ranging from

product design and development through volume production, CalAmp

delivers cost-effective high quality solutions to a broad array of

customers and end markets. CalAmp is a supplier of Direct Broadcast

Satellite (DBS) outdoor customer premise equipment to the U.S.

satellite television market. The Company also provides wireless

data communication solutions for the telemetry and asset tracking

markets, private wireless networks, public safety communications

and critical infrastructure and process control applications. For

additional information, please visit the Company�s website at

www.calamp.com. Forward-Looking Statement Statements in this press

release that are not historical in nature are forward-looking

statements, which involve known and unknown risks and

uncertainties. Words such as "may", "will", "expect", "intend",

"plan", "believe", "seek", "could", "estimate", "judgment",

"targeting", "should", "anticipate", "goal" and variations of these

words and similar expressions, are intended to identify

forward-looking statements. Actual results could differ materially

from those implied by such forward-looking statements due to a

variety of factors, including general and industry economic

conditions, product demand, increased competition, competitive

pricing and continued pricing declines in the DBS market, the

timing of customer approvals of new product designs, operating

costs, the Company's ability to efficiently and cost-effectively

integrate its acquired businesses, the Company�s ability to obtain

an amendment of its bank credit agreement to eliminate the event of

default under the credit agreement, the Company�s ability to

successfully requalify certain newer generation products and resume

selling these products to one of its key DBS customers, the risk

that the ultimate cost of resolving a product performance issue

with that DBS customer may exceed the amount of reserves

established for that purpose, and other risks or uncertainties that

are described in the Company's fiscal 2007 Annual Report on Form

10-K filed on May 17, 2007 with the Securities and Exchange

Commission (SEC) and in the Quarterly Report on Form 10-Q filed

today with the SEC. Although the Company believes the expectations

reflected in such forward-looking statements are based upon

reasonable assumptions, it can give no assurance that its

expectations will be attained. The Company undertakes no obligation

to update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise. CAL AMP

CORP. CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited, in

thousands except per share amounts) � � � � � Three Months Ended

Nine Months Ended � November 30, � November 30, � 2007 � � 2006 � �

2007 � � 2006 � � Revenues $ 32,061 $ 59,103 $ 111,122 $ 156,689 �

Cost of revenues � 22,033 � � 47,062 � � 100,165 � � 121,904 � �

Gross profit � 10,028 � � 12,041 � � 10,957 � � 34,785 � �

Operating expenses: Research and development 3,868 3,404 11,982

9,523 Selling 2,577 1,959 7,219 4,683 General and administrative

3,498 2,762 10,157 7,417 Intangible asset amortization 1,558 1,077

4,860 2,386 In-process research and development - - 310 6,850

Impairment loss � 65,745 � � - � � 65,745 � � - � � 77,246 � �

9,202 � � 100,273 � � 30,859 � � Operating income (loss) (67,218 )

2,839 (89,316 ) 3,926 � Non-operating income (expense), net � (622

) � (136 ) � (1,712 ) � 591 � � Income (loss) from continuing

operations before income taxes (67,840 ) 2,703 (91,028 ) 4,517 �

Income tax benefit (provision) � 8,909 � � (1,264 ) � 17,894 � �

(4,789 ) � Income (loss) from continuing operations (58,931 ) 1,439

(73,134 ) (272 ) � Loss from discontinued operations, net of tax -

(543 ) (597 ) (31,648 ) (a) � Loss on sale of discontinued

operations, net of tax � - � � - � � (935 ) � - � � Net income

(loss) $ (58,931 ) $ 896 � $ (74,666 ) $ (31,920 ) � � Basic and

diluted earnings (loss) per share: Income (loss) from continuing

operations $ (2.49 ) $ 0.06 $ (3.10 ) $ (0.01 ) Loss from

discontinued operations � - � � (0.02 ) � (0.06 ) � (1.36 ) � Total

basic and diluted earnings (loss) per share $ (2.49 ) $ 0.04 � $

(3.16 ) $ (1.37 ) � � Shares used in per share calculations: Basic

23,640 23,414 23,621 23,290 Diluted 23,640 23,679 23,621 23,290 � �

(a) Includes a goodwill and intangible asset impairment charge of

$29.8 million on discontinued operations in the quarter ended May

31, 2006. � � � � CAL AMP CORP. BUSINESS SEGMENT INFORMATION

(Unaudited, in thousands except per share amounts) � � Three Months

Ended Nine Months Ended � November 30, � November 30, � 2007 � �

2006 � � 2007 � � 2006 � Revenue Satellite Division $ 8,353 $

45,045 $ 41,235 $ 118,091 Wireless DataCom Division � 23,708 � �

14,058 � � 69,887 � � 38,598 � � Total revenue $ 32,061 � $ 59,103

� $ 111,122 � $ 156,689 � � Gross profit (loss) Satellite Division

$ 221 $ 6,514 $ (15,530 ) (a) $ 19,561 Wireless DataCom Division �

9,807 � � 5,527 � � 26,487 � � 15,224 � � Total gross profit $

10,028 � $ 12,041 � $ 10,957 � $ 34,785 � � Operating income (loss)

Satellite Division $ (44,061 ) (a)(b) $ 5,154 $ (62,356 ) (a)(b) $

14,812 Wireless DataCom Division (21,842 ) (c) (727 ) (22,988 ) (c)

(6,487 ) (d) Corporate expenses � (1,315 ) � (1,588 ) � (3,972 ) �

(4,399 ) � Total operating income (loss) $ (67,218 ) $ 2,839 � $

(89,316 ) $ 3,926 � � � (a) Includes charges for estimated product

warranty and related costs in the three and nine-month periods

ended November 30, 2007 of $0.1 million and $17.9 million,

respectively. � (b) Includes a Satellite Division goodwill

impairment charge of $43.2 million. � (c) Includes a Wireless

DataCom Division goodwill impairment charge of $22.5 million. � (d)

Includes a charge of $6.8 million in the quarter ended May 31, 2006

for the write-off of in-process research and development costs

associated with the acquisition of Dataradio. CONSOLIDATED BALANCE

SHEETS (Unaudited - In thousands) � � November 30, February 28, �

2007 � 2007 Assets Current assets: Cash and cash equivalents $

5,036 $ 37,537 Accounts receivable, net 21,715 38,439 Inventories

27,744 25,729 Deferred income tax assets 7,638 4,637 Prepaid

expenses and other current assets � 13,166 � � 7,182 � � Total

current assets 75,299 113,524 � Equipment and improvements, net

5,461 6,308 � Deferred income tax assets, less current portion

9,949 - � Goodwill 35,039 90,001 � Other intangible assets, net

25,982 18,643 � Other assets � 4,288 � � 1,227 � � $ 156,018 � $

229,703 � Liabilities and Stockholders' Equity Current liabilities:

Current portion of long-term debt $ 32,048 $ 2,944 Accounts payable

10,990 26,186 Accrued payroll and employee benefits 3,207 3,478

Accrued warranty costs 9,551 1,295 Other accrued liabilities 10,601

2,799 Deferred revenue � 4,626 � � 1,935 � � Total current

liabilities � 71,023 � � 38,637 � � Long-term debt, less current

portion - 31,314 � Deferred income tax liabilities - 7,451 � Other

non-current liabilities 5,469 1,050 � Stockholders' equity: Common

stock 236 236 Additional paid-in capital 141,058 139,175 Retained

earnings (accumulated deficit) (61,666 ) 13,000 Accumulated other

comprehensive loss � (102 ) � (1,160 ) � Total stockholders' equity

� 79,526 � � 151,251 � � $ 156,018 � $ 229,703 � � � � CAL AMP

CORP. CONSOLIDATED CASH FLOW STATEMENTS (Unaudited - In thousands)

� Nine Months Ended � November 30, � 2007 � � 2006 � Cash flows

from operating activities: Net loss $ (74,666 ) $ (31,920 )

Depreciation and amortization 7,469 5,027 Stock-based compensation

expense 1,605 1,614 Write-off of in-process research and

development costs 310 6,850 Impairment loss 65,745 29,848 Excess

tax benefit from stock-based compensation (64 ) (392 ) Deferred tax

assets, net (23,296 ) 3,555 Loss on sale of discontinued

operations, net of tax 935 - Gain on sale of investment (331 ) -

Changes in operating working capital 18,080 (2,973 ) Other � 25 � �

84 � � Net cash provided (used) by operating activities � (4,188 )

� 11,693 � � Cash flows from investing activities: Capital

expenditures (1,106 ) (2,112 ) Proceeds from sale of property and

equipment 8 16 Proceeds from sale of investment 1,045 - Proceeds

from sale of discontinued operations 4,000 - Acquisition of Aircept

(19,315 ) - Acquisition of SmartLink (7,944 ) - Cash restricted for

repayment of debt (3,340 ) - Acquisition of Dataradio net of cash

acquired - (48,047 ) Acquisition of TechnoCom product line (703 )

(2,478 ) Proceeds from Vytek escrow distribution � - � � 480 � �

Net cash used in investing activities � (27,355 ) � (52,141 ) �

Cash flows from financing activities: Proceeds from long-term debt

- 38,000 Debt repayments (2,210 ) (11,416 ) Proceeds from stock

option exercises 206 1,130 Excess tax benefit from stock-based

compensation � 64 � � 392 � � Net cash provided (used) by financing

activities � (1,940 ) � 28,106 � � Effect of exchange rate changes

on cash � 982 � � (157 ) � Net change in cash and cash equivalents

(32,501 ) (12,499 ) � Cash and cash equivalents at beginning of

period � 37,537 � � 45,783 � � Cash and cash equivalents at end of

period $ 5,036 � $ 33,284 � CAL AMP CORP. NON-GAAP EARNINGS

RECONCILIATION (Unaudited, in thousands except per share amounts) �

� � Non-GAAP Earnings Reconciliation "GAAP" refers to financial

information presented in accordance with Generally Accepted

Accounting Principles in the United States. This press release

includes historical non-GAAP financial measures, as defined in

Regulation G promulgated by the Securities and Exchange Commission.

CalAmp believes that its presentation of historical non-GAAP

financial measures provides useful supplementary information to

investors. The presentation of historical non-GAAP financial

measures is not meant to be considered in isolation from or as a

substitute for results prepared in accordance with accounting

principles generally accepted in the United States. � In this press

release, CalAmp reports the non-GAAP financial measures of Adjusted

Basis Income (Loss) from Continuing Operations and Diluted Income

(Loss) from Continuing Operations Per Share. CalAmp uses these

non-GAAP financial measures to enhance the investor's overall

understanding of the financial performance and future prospects of

CalAmp's core business activities. Specifically, CalAmp believes

that a report of Adjusted Basis Income (Loss) from Continuing

Operations and Diluted Income (Loss) from Continuing Operations Per

Share provides consistency in its financial reporting and

facilitates the comparison of results of core business operations

between its current and past periods. � The reconciliation of the

GAAP Basis Income (Loss) from Continuing Operations to Adjusted

Basis Income (Loss) from Continuing Operations is as follows: �

Three Months Ended Nine Months Ended � November 30, � November 30,

� 2007 � � 2006 � 2007 � � 2006 � � GAAP Basis Income (Loss) from

Continuing Operations $ (58,931 ) $ 1,439 $ (73,134 ) $ (272 ) �

Adjustments to reconcile to Adjusted Basis Income (Loss) from

Continuing Operations: Amortization of intangible assets, net of

tax 952 623 2,968 1,381 Stock-based compensation expense, net of

tax 353 313 980 934 In-process R&D, net of tax in fiscal 2008 -

- 189 6,850 Impairment loss, net of tax on deductible portion

57,693 - 57,693 - � � � � � � � � Adjusted Basis Income (Loss) from

Continuing Operations $ 67 � $ 2,375 $ (11,304 ) $ 8,893 � �

Adjusted Basis Income (Loss) from Continuing Operations per diluted

share $ - $ 0.10 $ (0.48 ) $ 0.38 � Weighted average common shares

outstanding on diluted basis 23,640 23,679 23,621 23,290 �

Reconciling items that are not treated as tax deductible in

computing the GAAP basis income tax provision (in-process research

and development in fiscal 2007 and the nondeductible portion of the

impairment charge in fiscal 2008) are not tax-effected in the

Non-GAAP Earnings Reconciliation. The remaining reconciling items

are tax-effected using an adjusted year-to-date effective income

tax rate that is computed by excluding from pretax income (loss)

those reconciling items that are not treated as tax deductible in

computing the GAAP basis income tax provision. The computation of

the adjusted year-to-date effective income tax rate is as follows:

� � Nine Months Ended November 30, � 2007 � � 2006 � Pretax income

(loss) from continuing operations, as reported $ (91,028 ) $ 4,517

Add back nondeductible items: In-process research and development

in fiscal 2007 - 6,850 Nondeductible portion of impairment loss

45,056 � - � � Pretax income (loss) from continuing operations

before nondeductible items (45,972 ) 11,367 Income tax benefit

(provision) as reported 17,894 � (4,789 ) � Year-to-date effective

income tax rate as adjusted 38.9 % 42.1 %

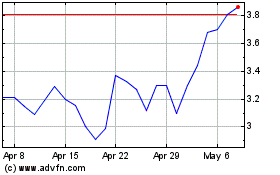

CalAmp (NASDAQ:CAMP)

Historical Stock Chart

From May 2024 to Jun 2024

CalAmp (NASDAQ:CAMP)

Historical Stock Chart

From Jun 2023 to Jun 2024