UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2023

Commission File Number 001-39171

BROOGE ENERGY LIMITED

(Translation of registrant’s name into English)

c/o Brooge Petroleum and Gas Investment Company

FZE

P.O. Box 50170

Fujairah, United Arab Emirates

+971 9 201 6666

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

On September 29, 2023, Brooge Energy Limited

(the “Company”) issued a press release announcing unaudited financial results for the six months ended June 30, 2023.

The Company’s management will host a conference call on Monday, October 9, 2023 at 10 a.m. ET and requests that all questions be

submitted to BROG@KCSA.com by Wednesday, October 4, 2023 at 8 p.m. ET.

The full text of the

press release is furnished as Exhibit 99.1 hereto.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

BROOGE ENERGY LIMITED |

| |

|

|

| Date: September 29, 2023 |

By: |

/s/ Paul Ditchburn |

| |

|

Name: Paul Ditchburn

Title: Chief Financial Officer |

Exhibit

99.1

Brooge Energy Reports 2023 First Six

Months Revenue of USD 62.9 Million, an Increase of 122% as Compared to 2022 First Six Months

Total comprehensive income for the

period totaled USD 37.4 million or USD 0.42 per basic and diluted earnings per share

Global demand for oil storage drives

higher fixed storage rates

Management will host a conference

call on Monday, October 9th at 10 a.m. ET

NEW

YORK, Sept. 29, 2023 (GLOBE NEWSWIRE) -- Brooge Energy Ltd, (“Brooge Energy” or the “Company”) (NASDAQ: BROG),

a Cayman Islands-based infrastructure provider, which is currently engaged in clean petroleum products and biofuels and crude oil storage

and related services, announced today its financial results for the first six months ending June 30, 2023. Management will host a conference

call on Monday, October 9, 2023 at 10 a.m. ET and requests that all questions be submitted to BROG@KCSA.com by Wednesday, October 4,

2023 at 8 p.m. ET.

“Demand for oil storage remains

very strong given the current global economic environment and we are benefiting not only from our strategic location, but also from our

high-quality infrastructure and automated technology. For the first half of 2023, we are pleased to report revenue growth of 122% when

compared to the previous year’s period. Our business benefited from higher fixed storage rates resulting in a net profit of USD

37.4 million or USD 0.42 per basic and diluted share, which is 8.6 times higher than the previous corresponding period. These positive

results have been achieved while maintaining our exceptional health, safety and environment record, an achievement the Company is very

proud of,” said Paul Ditchburn, Chief Financial Officer and Chair to the Office of the Chief Executive Officer of Brooge Energy.

Financial Results for the First Six

Months Ending June 30, 2023

Gross profit for the first six months

of 2023 totaled USD 51.8 million, an increase of 191%, as compared to USD 17.8 million for the first six months of 2022. Gross profit

margin improved to 82% for the first six months of 2023 as compared to 63% for the first six months of 2022.

This gross profit increase was mainly

attributable to revenue growth, which was driven by obtaining higher storage rates. Revenue for the first six months ending June 30, 2023

totaled USD 62.9 million as compared to USD 28.4 million for the first six months ending June 30, 2022, an increase of 122% over the previous

corresponding period. Revenue primarily consists of fixed storage and handling fees, and to a less extent variable fees for ancillary

services provided under a contract with its customers. Brooge Energy provided storage capacity of 1,001,388 cbm and related services to

numerous oil traders and producers.

For the first six months ending June

30, 2023 the Company reported net profit for the period of USD 37.4 million or USD 0.42 per basic and diluted share as compared to USD

3.9 million or USD 0.04 per basic and diluted earnings per share for the first six months ending June 30, 2022.

As of June 30, 2023 the Company had

cash and cash equivalents of USD 3.7 million and a restricted bank balance of USD 15.7 million. Total equity attributable to the shareholders

totaled USD 142.5 million as of June 30, 2023 as compared to USD 105.1 million as of December 31, 2022.

Project Update and Highlights:

The Company announced it has successfully

completed the Feasibility Study conducted by EY for its Green Ammonia Project in Abu Dhabi, United Arab Emirates, which aims to

produce up to 700,000 MT of green ammonia per annum once fully completed. Green ammonia has gained widespread recognition as an efficient

and clean carrier of green hydrogen, poised to play a crucial role in meeting global decarbonization targets by 2050. The Green Ammonia

Project is led by Brooge Energy Limited’s 100% owned subsidiary Brooge Renewable Energy, which aims to produce renewable, carbon-free

fuel using solar power. The Company recently announced that the technical study of its plant conducted by Thyssenkrupp Uhde has been completed

and delivered.

In

March 2023, Brooge Energy was awarded “Best Specialist Liquid Bulk Terminal of the

Year 2023” and

“Safe and Secure Terminal of the Year” at The Global Ports Forum Awards, a highly respected

ceremony within the global ports and terminal industry, in Dubai, UAE.

Conference Call Details

Date: Monday, October 9, 2023

Time: 10:00 a.m. Eastern Time

Webcast: https://viavid.webcasts.com/starthere.jsp?ei=1636497&tp_key=d7de7d3bfa

Dial-In Number: 1-877-425-9470 or 1-201-389-0878

UAE Toll Free: 800 035 703 290

Conference ID: 13741507

Deadline to Submit Questions: Wednesday,

October 4, 2023 at 8 p.m. ET

Email to Submit Questions: BROG@KCSA.com

Replay: 1-844-512-2921 or 1-412-317-6671

(Access ID: 13741507)

About Brooge Energy Limited

Brooge

Energy Ltd, is a Cayman Islands-based infrastructure provider now intending to focus on renewable energy infrastructures and biofuels,

next to clean petroleum products, crude oil storage and related services. The company conducts its business and operations through its

subsidiaries Brooge Renewable Energy (BRE), Brooge Petroleum and Gas Investment Company FZE (BPGIC), and Brooge Petroleum and Gas Investment

Company Phase 3 FZE. BPGIC, the Company’s primary operating subsidiary that focuses on midstream oil storage and other services,

is strategically located outside the Strait of Hormuz at the Port of Fujairah in the Emirate of Fujairah in the UAE. The Company differentiates

itself from competitors by providing customers with fast order processing times, excellent customer service and high accuracy blending

services with low product losses. For more information, please visit at www.broogeenergy.com.

Forward-Looking

Statements

This press release contains statements

that are not historical facts, including the Company’s anticipated shift towards green energy and targeted production at BRE’s

planned Green Hydrogen and Green Ammonia plant and constitute “forward-looking statements” within the meaning of the safe

harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Such statements reflect management’s current views

based on certain assumptions, and they involve risks and uncertainties. Actual results, events or performance may differ materially from

the forward-looking statements due to a number of important factors, and will be dependent upon a variety of factors, including availability

of labor and other resources needed to for completion of the new plant, timing of obtaining regulatory approvals needed with respect to

the new facility, the Company’s ability to complete construction and initiate operations of the new facility on the anticipated

timeline or at all, the Company’s ability to maintain the lease for the new facility, and other risks described in public reports

filed by Brooge Energy with the U.S. Securities and Exchange Commission. Readers are cautioned not to place undue reliance upon any forward-looking

statements, which speak only as of the date made. Brooge Energy does not undertake any obligation to update or revise the forward-looking

statements, whether as a result of new information, future events or otherwise.

Investor Contact

KCSA Strategic Communications

Valter Pinto, Managing Director

+1 212-896-1254

BROG@kcsa.com

Brooge Energy Limited

Unaudited Interim Condensed Consolidated Statement of Comprehensive

Income

Period Ended June 30, 2023

(Figures in USD)

| | |

June 30,

2023 | | |

June 30,

2022 | |

| | |

(6 Months) | | |

(6 Months) | |

| Revenue | |

| 62,912,327 | | |

| 28,399,372 | |

| Direct costs | |

| (11,142,519 | ) | |

| (10,634,706 | ) |

| Gross profit | |

| 51,769,808 | | |

| 17,764,666 | |

| | |

| | | |

| | |

| Other income | |

| 122,516 | | |

| 23,154 | |

| General and administration expenses | |

| (11,984,485 | ) | |

| (5,690,986 | ) |

| Finance costs | |

| (10,604,446 | ) | |

| (14,577,131 | ) |

| Changes in fair value of derivative financial instruments | |

| 4,236,668 | | |

| 1,916,269 | |

| Change in estimated fair value of derivative warrant liability | |

| 3,827,570 | | |

| 4,458,069 | |

| Profit for the period | |

| 37,367,631 | | |

| 3,894,041 | |

| Other comprehensive income | |

| Nil

| | |

| Nil | |

| Total comprehensive income for the period | |

| 37,367,631 | | |

| 3,894,041 | |

| Basic and diluted earnings per share | |

| 0.42 | | |

| 0.04 | |

Brooge Energy Limited

Unaudited Interim Condensed Consolidated Statement of Financial

Position

As at June 30, 2023

(Figures in USD)

| | |

June 30,

2023 | | |

December 31,

2022 | |

| ASSETS | |

| | |

| |

| | |

| | |

| |

| Current Assets | |

| | |

| |

| Cash and cash equivalents | |

| 3,702,332 | | |

| 940,925 | |

| Restricted bank balance | |

| 7,166,795 | | |

| 7,319,056 | |

| Trade accounts receivable | |

| 17,299,953 | | |

| 5,275,047 | |

| Inventories | |

| 340,271 | | |

| 315,576 | |

| Other receivable and prepayments | |

| 1,791,122 | | |

| 724,093 | |

| Total Current Assets | |

| 30,300,473 | | |

| 14,574,697 | |

| | |

| | | |

| | |

| Non-Current Assets | |

| | | |

| | |

| Restricted bank balance | |

| 8,500,000 | | |

| 8,500,000 | |

| Property, plant and equipment | |

| 439,379,303 | | |

| 426,040,639 | |

| Derivative financial instrument | |

| 13,499,964 | | |

| 9,263,296 | |

| Advances to contractor | |

| 15,006,262 | | |

| 15,223,215 | |

| Total Non-Current Assets | |

| 476,385,529 | | |

| 459,027,150 | |

| Total Assets | |

| 506,686,002 | | |

| 473,601,847 | |

| | |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Trade and accounts payable | |

| 19,293,465 | | |

| 17,242,748 | |

| Contract liabilities | |

| 6,494,933 | | |

| 6,222,055 | |

| Other payable | |

| 74,253,965 | | |

| 74,253,965 | |

| Derivative warrant liability | |

| 418,210 | | |

| 4,245,780 | |

| Borrowings | |

| 166,096,134 | | |

| 171,696,134 | |

| Lease liabilities | |

| 6,696,445 | | |

| 6,316,342 | |

| Total Current Liabilities | |

| 273,253,152 | | |

| 279,977,024 | |

| | |

| | | |

| | |

| Non-Current Liabilities | |

| | | |

| | |

| Borrowings | |

| 1,584,536 | | |

| 1,782,603 | |

| Lease liabilities | |

| 87,011,275 | | |

| 84,557,069 | |

| Employees’ end of service benefits | |

| 284,438 | | |

| 134,200 | |

| Asset retirement obligation | |

| 2,090,278 | | |

| 2,056,259 | |

| Total Non-Current Liabilities | |

| 90,970,527 | | |

| 88,530,131 | |

| | |

| | | |

| | |

| Equity | |

| | | |

| | |

| Share capital | |

| 8,804 | | |

| 8,804 | |

| Share premium | |

| 101,777,058 | | |

| 101,777,058 | |

| Statutory reserve | |

| 680,643 | | |

| 680,643 | |

| Retained earnings | |

| (30,395,969 | ) | |

| (67,763,600 | ) |

| Shareholder’s account | |

| 70,391,787 | | |

| 70,391,787 | |

| Total Equity Attributable to the Shareholders | |

| 142,462,323 | | |

| 105,094,692 | |

| Total Liabilities and Equity | |

| 506,686,002 | | |

| 473,601,847 | |

Brooge Energy Limited

Unaudited Interim Condensed

Consolidated Statement of Cash Flows

Period Ended June 30, 2023

(Figures in USD)

| | |

June 30,

2023 | | |

June 30,

2022 | |

| | |

(6 Months) | | |

(6 Months) | |

| Cash Flow from Operating Activities | |

| | |

| |

| | |

| | |

| |

| Profit for the period | |

| 37,367,631 | | |

| 3,894,041 | |

| | |

| | | |

| | |

| Adjustments for: | |

| | | |

| | |

| Depreciation of property, plant and equipment | |

| 6,325,285 | | |

| 6,244,880 | |

| Interest on borrowings | |

| 8,952,688 | | |

| 9,225,972 | |

| Interest on lease liabilities | |

| 1,543,341 | | |

| 1,515,936 | |

| Provision for employees’ end of services benefits | |

| 180,867 | | |

| 108,179 | |

| Change in estimated fair value of derivative warrant liability | |

| (3,827,570 | ) | |

| (4,458,069 | ) |

| Changes in fair value of derivative financial instruments | |

| (4,236,668 | ) | |

| (1,916,269 | ) |

| Asset retirement obligation - accretion expense | |

| 34,019 | | |

| 32,930 | |

| Expected credit losses of trade accounts receivables | |

| 3,313,538 | | |

| Nil | |

| Write-off of trade accounts receivables | |

| 927,519 | | |

| Nil | |

| | |

| | | |

| | |

| Changes in operating assets and liabilities | |

| | | |

| | |

| Increase in trade accounts and other receivable and prepayments | |

| (17,332,992 | ) | |

| (5,640,482 | ) |

| Increase in inventories | |

| (24,695 | ) | |

| (27,006 | ) |

| (Decrease) / Increase in trade accounts and other payable | |

| (5,920,283 | ) | |

| 17,004,529 | |

| Increase in contract liabilities | |

| 272,878 | | |

| 2,458,296 | |

| Payment of employees’ end of services benefits | |

| (30,629 | ) | |

| Nil

| |

| Net cash flows generated from operating activities | |

| 27,544,929 | | |

| 28,442,937 | |

| | |

| | | |

| | |

| Cash Flow from Investing Activities | |

| | | |

| | |

| | |

| | | |

| | |

| Amount withdrawn from restricted bank account | |

| 152,261 | | |

| 3,106,502 | |

| Purchase and capitalization of property, plant and equipment | |

| (7,530,827 | ) | |

| (15,489,367 | ) |

| Net cash flows used in investing activities | |

| (7,378,566 | ) | |

| (12,382,865 | ) |

| | |

| | | |

| | |

| Cash Flow from Financing Activities | |

| | | |

| | |

| | |

| | | |

| | |

| Proceeds from borrowings | |

| Nil | | |

| 3,105,092 | |

| Repayment of borrowings | |

| (7,198,067 | ) | |

| (7,728,288 | ) |

| Payment of lease liabilities | |

| (2,503,822 | ) | |

| (3,056,444 | ) |

| Interest paid on borrowings | |

| (7,703,067 | ) | |

| (8,241,981 | ) |

| Movement in shareholder’s account | |

| Nil

| | |

| (574,868 | ) |

| Net cash flows used in financing activities | |

| (17,404,956 | ) | |

| (16,496,489 | ) |

| | |

| | | |

| | |

| Net change in cash and cash equivalents | |

| 2,761,407 | | |

| (436,417 | ) |

| Cash and cash equivalents at beginning of the period | |

| 940,925 | | |

| 1,452,316 | |

| Cash and cash equivalents at end of the period | |

| 3,702,332 | | |

| 1,015,899 | |

5

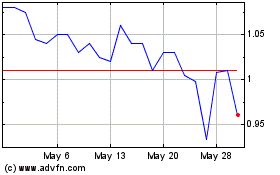

Brooge Energy (NASDAQ:BROG)

Historical Stock Chart

From Apr 2024 to May 2024

Brooge Energy (NASDAQ:BROG)

Historical Stock Chart

From May 2023 to May 2024