UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

| Filed

by the Registrant ☒ |

Filed

by a Party other than the Registrant ☐ |

Check

the appropriate box:

| ☒ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material under § 240.14a-12 |

| BIOTRICITY

INC. |

| (Name

of Registrant as Specified In Its Charter) |

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required. |

| ☐ |

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title

of each class of securities to which transaction applies: |

| |

|

|

| |

(2) |

Aggregate

number of securities to which transaction applies: |

| |

|

|

| |

(3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined): |

| |

|

|

| |

(4) |

Proposed

maximum aggregate value of transaction: |

| |

|

|

| |

(5) |

Total

fee paid: |

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing. |

| |

(1) |

Amount

Previously Paid: |

| |

|

|

| |

(2) |

Form,

Schedule or Registration Statement No.: |

| |

|

|

| |

(3) |

Filing

Party: |

| |

|

|

| |

(4) |

Date

Filed: |

BIOTRICITY

INC.

203

Redwood Shores Parkway, Suite 600

Redwood

City, California 94065

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

TO

BE HELD JULY 12, 2024

10:00

A.M. PACIFIC TIME

TO

THE STOCKHOLDERS OF BIOTRICITY INC.:

The

special meeting of stockholders (the “Meeting”) of Biotricity Inc. (which we refer to as “Biotricity” or the

“Company”) will be held at 203 Redwood Shores Parkway, Suite 600, Redwood City, California 94065, on July 12, 2024 at 10:00

a.m., Pacific Time. At the Meeting, the holders of the Company’s outstanding capital stock will act on the following matters:

| 1. |

To

approve the issuance of securities in one or more non-public offerings. |

This

matter is more fully described in the proxy statement accompanying this notice.

Only

holders of the Company’s common stock of record at the close of business on June 7, 2024, are entitled to notice of and to vote

at the Meeting. A proxy statement containing important information about the meeting and the matter being voted upon appears on the following

pages.

The

Board of Directors recommends that you vote “FOR” the proposal set forth in this Notice of Special Meeting of Stockholders

and the Proxy Statement.

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING

The

Company has enclosed a copy of the proxy statement, the proxy card and the Company’s annual report to stockholders for the year

ended March 31, 2023 (the “Annual Report”). The proxy statement, the proxy card and the Annual Report are also available

on the Company’s website at https://www.biotricity.com/. If you plan on attending the Special Meeting and voting your shares in

person, you will need to bring photo identification in order to be admitted to the Special meeting. To obtain directions to the Special

meeting, please call the Company at (650) 832-1626.

If

you have any questions or need assistance voting your shares of our common stock, please contact the Company at (650) 832-1626.

| BY

ORDER OF THE BOARD OF DIRECTORS |

|

| |

|

| /s/

Waqaas Al-Siddiq |

|

| Waqaas

Al-Siddiq |

|

| President,

Chief Executive Officer and Chairman of the Board of Directors |

|

Redwood,

California

June

[ ], 2024

PLEASE

NOTE: The Meeting will be held to tabulate the votes cast and to report the results of voting on the item described above. No other

business matters are planned for the meeting.

TABLE

OF CONTENTS

QUESTIONS

AND ANSWERS

The

following are some questions that you, as a stockholder of the Company, may have about the Meeting, the proposal being considered at

the Meeting, as applicable, and brief answers to those questions. These questions and answers may not address all questions that may

be important to you as a stockholder of the Company. We encourage you to read carefully the more detailed information contained elsewhere

in this proxy statement.

| Q: |

Why

am I receiving this proxy statement? |

| A: |

These

proxy materials describe the proposal on which the Company would like you to vote and also give you information on the proposal so

that you can make an informed decision. We are furnishing our proxy materials to all stockholders of record entitled to vote at the

Meeting. As a stockholder, you are invited to attend the Meeting and are entitled and requested to vote on the proposal described

in this proxy statement. |

| Q: |

When

and where is the Meeting? |

| A: |

The

Meeting will take place on July 12, 2024, starting at 10:00 a.m., Pacific Time, at 203 Redwood Shores Parkway, Suite 600, Redwood

City, California 94065. |

| Q: |

Who is entitled to vote at the Meeting?

|

| A: |

Only

stockholders who our records show owned shares of our common stock and Special Voting Preferred

Stock as of the close of business on June 7, 2024, which is the record date for the Meeting

(the “Record Date”), may vote at the Meeting. The holders of our common stock

have one (1) vote for each share of the Company’s common stock owned as of the Record

Date. On the Record Date, we had 20,396,237 shares of common stock outstanding. Additionally,

as of the Record Date there was one share of Special Voting Preferred Stock issued and outstanding,

which is held by a trustee.

The

Company was incorporated on August 29, 2012 in the State of Nevada. iMedical was incorporated on July 3, 2014 under the Canada Business

Corporations Act. On February 2, 2016, we completed the acquisition of iMedical and moved the operations of iMedical into Biotricity

Inc. through a reverse take-over (the “Acquisition Transaction”). As a result of the Acquisition Transaction, shareholders

of the Company who in general terms, were Canadian residents (for the purposes of the Income Tax Act (Canada)) received ninety-seven

(97) Exchangeable Shares in the capital of Exchangeco (as hereinafter defined) in exchange for each common share of the Company held.

In

connection with the Acquisition Transaction, on February 2, 2016, the Company entered into a Voting and Exchange Trust Agreement

(the “Trust Agreement”) with 1061806 B.C. LTD., a corporation existing under the laws of the Province of British Columbia,

1062024 B.C. LTD., a corporation existing under the laws of the Province of British Columbia (“Exchangeco”) and Computershare

Trust Company of Canada, a trust company incorporated under the laws of Canada (the “Trustee”).

Except

as otherwise required by law, the holder of the share of Special Voting Preferred Stock and the holders of the shares of the Company’s

common stock vote together as one class on all matters submitted to a vote of shareholders of the Company. The holders of the Exchangeable

Shares have voting through the trustee’s voting of the Special Voting Preferred Stock.

The

Special Voting Preferred Stock entitles the Trustee to exercise the number of votes equal to the number of Exchangeable Shares outstanding

on a one-for-one basis during the term of the Trust Agreement, which sets forth the terms and conditions under which holders of the

Exchangeable Shares are entitled to instruct the Trustee as to how to vote during any stockholder meetings of our company.

The

holder of the share of Special Voting Preferred Stock has identical rights as those of the holders of the common stock with respect

to notices, reports and the rights to attend all meetings of the Company.

As

of the Record Date 160,672 Exchangeable Shares were issued and outstanding.

The

Company also has 200 shares of Series A Preferred Stock, which do not have voting rights except as required by applicable

law. The Company also has 350 shares of Series B Preferred Stock, which have the right to vote on all matters, subject

to certain limitations, as a single class, on an “as converted” basis, using a defined Stated Value of $10,000 per share and

a Conversion Price, which is initially a price of $3.50, subject to further adjustments. |

| Q: |

How

are votes counted? |

| A: |

Each

share of our common stock entitles its holder to one vote per share and the share of Special Voting Preferred Stock entitles the

holder to a number votes equal to the number of Exchangeable Shares outstanding as of the Record Date. |

| Q: |

What

am I being asked to vote on? |

| A: |

You

will be voting on the following proposal. |

| ● |

A

proposal to approve the issuance of securities in one or more non-public offerings. |

| Q: |

How

does the Company’s Board of Directors recommend that I vote on the proposal set forth in the Notice of Special meeting of Stockholders

and the Proxy Statement? |

| A: |

Our

Board of Directors recommends that you vote “FOR” the proposal set forth in the Notice of Special meeting of Stockholders

and the Proxy Statement. |

| Q: |

Do

I have dissenters’ rights if I vote against the proposal? |

| A: |

There

are no dissenters’ rights available to the Company’s stockholders with respect to the matter to be voted on at the Meeting. |

| Q: |

What

do I need to do now? |

| A: |

We

encourage you to read this entire proxy statement, and the documents we refer to in this proxy statement. Then complete, sign, date

and return, as promptly as possible, the enclosed proxy card in the accompanying reply envelope or grant your proxy electronically

over the Internet or by telephone, so that your shares can be voted at the Meeting. If you hold your shares in “street name,”

please refer to the voting instruction forms provided by your broker, bank or other nominee to vote your shares. |

| Q: |

What

quorum is required for the Meeting? |

| A: |

A

quorum will exist at the Meeting if the holders of record of a majority of the issued and outstanding shares of the Company’s

common stock and Exchangeable Shares are present in person or by proxy. Shares of the Company’s common stock that are voted

to abstain are treated as shares that are represented at the Meeting for purposes of determining whether a quorum exists. |

| Q: |

Who

will tabulate the votes? |

| A: |

The

Company has designated Securities Transfer Corporation as the Inspector of Election who will tabulate the votes. |

| Q: |

What

vote is required in order for the proposal to be approved? |

| A: |

The

following table sets forth the required vote for each proposal: |

| |

Proposal |

|

Required

Vote |

|

Page

Number

(for

more details) |

| |

|

|

|

|

|

| 1. |

Approve

the issuance of securities in one or more non-public offerings |

|

Majority

of the shares present in person or by proxy

|

|

9 |

| Q: |

What

are broker non-votes? |

| A: |

Broker

non-votes are shares held by brokers that do not have discretionary authority to vote on the matter and have not received voting

instructions from their clients. Brokers holding shares of record for customers generally are not entitled to vote on “non-routine”

matters, unless they receive voting instructions from their customers. A proposal for ratification of the appointment of Company’s

independent registered public accounting firm will be considered a “routine” matter. Accordingly, brokers will be entitled

to vote uninstructed shares only with respect to the ratification of the appointment of the independent registered public accounting

firm. |

| Q: |

How

do I vote my shares if I am a record holder? |

| A: |

If

you are a record holder of shares (that is, the shares are registered with our transfer agent in your name and not the name of your

broker or other nominee), you are urged to submit your proxy as soon as possible, so that your shares can be voted at the meeting

in accordance with your instructions. Registered stockholders may vote in person at the Meeting, or by sending a personal representative

to the Meeting with an appropriate proxy, or by one of the following methods: |

| ● |

By

Internet. https://onlineproxyvote.com/BTCY/2024; |

| |

|

| ● |

By

Telephone. 469-633-0101 |

| |

|

| ● |

By

Mail. If you received our proxy materials in the mail, you can complete, sign and date the included proxy card and return the

proxy card in the prepaid envelope provided; |

Please

note that the Internet and telephone voting facilities for registered stockholders will close at 11:59 p.m., Eastern Time, on the day

before the meeting date. For more information, please see “The Meeting—How to Vote Your Shares” below.

| Q: |

How

do I vote my shares if I hold my shares in “street name” through a bank, broker or other nominee? |

| A: |

If

you hold your shares as a beneficial owner through a bank, broker or other nominee, you should have received instructions on how

to vote your shares from your broker, bank or other nominee. Please follow their instructions carefully. You must provide voting

instructions to your bank, broker or other nominee by the deadline provided in the materials you receive from your bank, broker or

other nominee to ensure your shares are voted in the way you would like at the Meeting. Also, if you wish to vote in person at the

Meeting, you must request a legal proxy from the bank, broker or other nominee that holds your shares and present that proxy and

proof of identification at the Meeting. |

| Q: |

If

my bank, broker or other nominee holds my shares in “street name,” will such party vote my shares for me? |

| A: |

For

all “non-routine” matters, not without your direction. Your broker, bank or other nominee will be permitted to vote your

shares on any “non-routine” proposal only if you instruct your broker, bank or other nominee on how to vote. Under applicable

stock exchange rules, brokers, banks or other nominees have the discretion to vote your shares on routine matters if you fail to

instruct your broker, bank or other nominee on how to vote your shares with respect to such matters. The proposal to be voted upon

by our stockholders described in this proxy statement is “non-routine” matters, and brokers, banks and other nominees

therefore cannot vote on the proposal without your instructions. Therefore, it is important that you instruct your broker, bank or

nominee on how you wish to vote your shares. |

You

should follow the procedures provided by your broker, bank or other nominee regarding the voting of your shares of the Company’s

common stock. Without instructions, a broker non-vote will result, and your shares will not be voted, on all “non-routine”

matters.

| A: |

A

proxy is your legal designation of another person, referred to as a “proxy,” to vote shares of stock. The written document

describing the matters to be considered and voted on at the Meeting is called a “proxy statement.” Our Board of Directors

has designated Waqaas Al-Siddiq, our Chief Executive Officer and John Ayanoglou, our Chief Financial Officer, with full power of

substitution, as proxies for the Meeting. |

| Q: |

If

a stockholder gives a proxy, how are the shares voted? |

| A: |

When

proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Meeting in accordance

with the instructions of the stockholder. If no specific instructions are given on properly-executed returned proxies, however, the

shares will be voted in accordance with the recommendations of our Board of Directors as described above. If any matters not described

in this proxy statement are properly presented at the Meeting, the proxy holders will use their own judgment to determine how to

vote your shares. |

| Q: |

What

happens if I do not vote or return a proxy? |

| A: |

A

quorum will exist at the Meeting only if the holders of record of a majority of the issued and outstanding shares of the capital

stock of the Company entitled to vote at the Meeting are present in person or by proxy. Your failure to vote on the proposal, by

failing to either submit a proxy or attend the Meeting if you are a stockholder of record, may result in the failure of a quorum

to exist at the Meeting. |

| Q: |

What

happens if I abstain? |

| A: |

If

you abstain, whether by proxy or in person at the Meeting, or if you instruct your broker, bank or other nominee to abstain your

abstention will not be counted for or against the proposal, but will be counted as “present” at the Meeting in determining

whether or not a quorum exists. |

| Q: |

Can

I revoke my proxy or change my vote? |

| A: |

You

may change your vote at any time prior to the vote at the Meeting. To revoke your proxy instructions and change your vote if you

are a holder of record, you must (i) vote again on a later date on the Internet or by telephone (only your latest Internet or telephone

proxy submitted prior to the Meeting will be counted), (ii) advise our Secretary at our principal executive offices (203 Redwood

Shores Parkway, Suite 600, Redwood City, California 94065) in writing before the proxy holders vote your shares, (iii) deliver later

dated and signed proxy instructions (which must be received prior to the Meeting) or (iv) attend the Meeting and vote your shares

in person. If you hold shares in “street name,” you should refer to the instructions you received from your broker, bank

or other nominee. Attendance in and of itself at the Meeting will not revoke a proxy. For shares you hold beneficially but not of

record, you may change your vote by submitting new voting instructions to your broker or nominee or, if you have obtained a valid

proxy from your broker or nominee giving you the right to vote your shares, by attending the meeting and voting in person. |

| Q: |

If

I want to attend the Meeting, what should I do? |

| A: |

If

you wish to attend, you should come to 203 Redwood Shores Parkway, Suite 600, Redwood City, California 94065, at 10:00 a.m., Pacific

Time, on July 12, 2024. Stockholders of record as of the Record Date for the Meeting can vote in person at the Meeting. If your shares

are held in “street name,” then you must ask your broker, bank or other nominee how you can vote at the Meeting. In order

to enter the Meeting, you must present a form of photo identification acceptable to us, such as a valid driver’s license or

passport. Please note that since a street name stockholder is not the holder of record, you may not vote your shares in person at

the Meeting unless you follow your broker’s procedures for obtaining a legal proxy. Even if you plan to attend the Meeting

in person, we encourage you to complete, sign, date and return a proxy card or vote electronically over the Internet or via telephone

to ensure that your shares will be represented at the Meeting. If you attend the Meeting and vote in person, your vote by ballot

will revoke any proxy previously submitted. Please note that no management presentations or other matters are planned for the Meeting,

except as described in this proxy statement. |

| Q: |

What

should I do if I receive more than one set of voting materials? |

| A: |

You

may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards or

voting instruction cards. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting

instruction card for each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered

in more than one name, you will receive more than one proxy card. Please complete, date, sign and return (or vote via the Internet

or telephone with respect to) each proxy card and voting instruction card that you receive to ensure that all of your shares are

counted. |

| Q: |

What

is “householding”? |

| A: |

We

have adopted a procedure approved by the U.S. Securities and Exchange Commission (the “SEC”) called “householding”

for stockholders who have the same address and last name and do not participate in electronic delivery of proxy materials. In some

instances, only one copy of the proxy materials is being delivered to multiple stockholders sharing an address, unless we have received

instructions from one or more of the stockholders to continue to deliver multiple copies. This procedure reduces our printing costs

and postage fees. |

We

will deliver promptly, upon oral or written request, a separate copy of the applicable materials to a stockholder at a shared address

to which a single copy was delivered. If you wish to receive a separate copy of the proxy materials you may call us at (650) 832-1626,

or send a written request to Biotricity Inc., 203 Redwood Shores Parkway, Suite 600, Redwood City, California 94065, Attention: Chief

Executive Officer. If you have received only one copy of the proxy materials, and wish to receive a separate copy for each stockholder

in the future, you may call us at the telephone number or write us at the address listed above. Alternatively, stockholders sharing an

address who now receive multiple copies of the proxy materials may request delivery of a single copy, also by calling us at the telephone

number or writing to us at the address listed above.

| Q: |

Where

can I find the voting results of the Meeting? |

| A: |

The

Company intends to announce preliminary voting results at the Meeting and publish final results in a Current Report on Form 8-K that

will be filed with the SEC following the Meeting. All reports the Company files with the SEC are publicly available when filed |

| Q: |

What

if I have questions about lost stock certificates or need to change my mailing address? |

| A: |

You

may contact our transfer agent, Securities Transfer Corporation at (469) 633-0101, or by email at info@stctransfer.com, if you have

lost your stock certificate. You may email Securities Transfer Corporation at info@stctransfer.com if you need to change your mailing

address. |

| Q: |

Who

can help answer my additional questions about the proposal or the other matters discussed in this proxy statement? |

| A: |

If

you have questions about the proposal or other matters discussed in this proxy statement, you may contact the Company by mail at

Biotricity Inc., 203 Redwood Shores Parkway, Suite 600, Redwood City, California 94065, Attention: Chief Executive Officer. |

THE

MEETING

We

are furnishing this proxy statement to our stockholders as part of the solicitation of proxies by our Board of Directors for use at the

Meeting of stockholders to be held on July 12, 2024, or continuation thereof. We began distributing this Proxy Statement, Special meeting

notice and proxy card, or a notice of internet availability of proxy materials on or about June [ ], 2024.

Date,

Time and Place

The

Meeting of the Company’s stockholders will be held on July 12, 2024, starting at 10:00 a.m., Pacific Time, at 203 Redwood Shores

Parkway, Suite 600, Redwood City, California 94065.

Matters

to be Considered

The

purpose of the Meeting is for stockholders of the Company to consider and vote on the following proposal.

| Proposal

No. 1 |

To

approve the issuance of securities in one or more non-public offerings. |

Record

Date; Shares Outstanding and Entitled to Vote

The

close of business on June 7, 2024, has been fixed as the Record Date for determining those Company stockholders entitled to notice of

and to vote at the Meeting. As of the close of business on the Record Date for the Meeting, there were 20,396,237 shares of the

Company’s common stock, held by 145 holders of record. Each share of the Company’s common stock entitles its holder

to one vote at the Meeting on all matters properly presented at the Meeting.

Quorum

A

quorum of stockholders is necessary to hold a valid meeting. A quorum will exist at the Meeting if shares having a majority of the votes

entitled to be cast are represented in person or by proxy. Shares of the Company’s common stock that are voted to abstain are treated

as shares that are represented at the Meeting for purposes of determining whether a quorum exists. Broker non-votes do not count for

voting purposes, but are considered “present” at the meeting for purposes of determining whether a quorum exists.

Vote

Required

Approval

of stock issuance requires the affirmative vote of a majority of the shares present in person or by proxy, provided a quorum is present.

An

abstention is effectively treated as a vote cast against the stock issuance. Failures of record holders to submit a signed proxy card,

grant a proxy electronically over the Internet or by telephone or to vote in person by ballot at the Meeting will have no effect on the

outcome of the votes for such items, although such failure may contribute to a quorum not being present at such meeting. Broker non-votes

will have no effect on the outcome of the votes for the proposal.

Recommendations

of our Board of Directors

The

Board of Directors also recommends that you vote “FOR” the proposal set forth in the Notice of Special meeting of Stockholders

and the Proxy Statement.

Common

Stock Ownership of Directors and Executive Officers

As

of the Record Date, our directors and executive officers held an aggregate of approximately 4.6% of the shares of

the Company’s common stock entitled to vote at the Meeting.

How

to Vote Your Shares

Stockholders

of record may submit a proxy via the Internet, by telephone or by mail, or they may vote by attending the Meeting and voting in person.

| ● |

Submitting

a Proxy via the Internet: You may vote by proxy via the Internet by following the instructions provided in the notice. |

| |

|

| ● |

Submitting

a Proxy by Telephone: If you request printed copies of the proxy materials by mail, you may vote by calling the toll free number

found on the proxy card. |

| |

|

| ● |

Submitting

a Proxy by Mail: If you choose to submit a proxy for your shares by mail, simply mark the enclosed proxy card, date and sign

it, and return it in the postage paid envelope provided. |

| |

|

| ● |

Attending

the Meeting: If you are a stockholder of record, you may attend the Meeting and vote in person. In order to enter the Meeting,

you must present a form of photo identification acceptable to us, such as a valid driver’s license or passport. |

If

your shares are held in the name of a broker, bank or other nominee, you will receive instructions from the stockholder of record that

you must follow for your shares to be voted. Please follow their instructions carefully. Also, please note that if the stockholder of

record of your shares is a broker, bank or other nominee and you wish to vote in person at the Meeting, you must request a legal proxy

from the broker, bank or other nominee that holds your shares and present that proxy and proof of identification at the Meeting.

How

to Change Your Vote

If

you are the stockholder of record, you may revoke your proxy or change your vote prior to your shares being voted at the Meeting by:

| ● |

sending

a written notice of revocation or a duly executed proxy card, in either case, dated later than the prior proxy card relating to the

same shares, to Biotricity Inc., 203 Redwood Shores Parkway, Suite 600, Redwood City, California 94065, Attention: Chief Executive

Officer; |

| |

|

| ● |

submitting

a proxy at a later date by telephone or via the Internet, if you have previously voted by telephone or via the Internet in connection

with the Meeting; or |

| |

|

| ● |

attending

the Meeting and voting in person. |

If

you are the beneficial owner of shares held in the name of a broker, bank or other nominee, you may change your vote by:

| ● |

submitting

new voting instructions to your broker, bank or other nominee in a timely manner following the voting procedures received from your

broker, bank or other nominee; or |

| |

|

| ● |

attending

the Meeting and voting in person, if you have obtained a valid proxy from the broker, bank or other nominee that holds your shares

giving you the right to vote the shares. |

Attendance

at the Meeting will not, in and of itself, constitute revocation of a proxy. See the section entitled “—How to Vote Your

Shares” above for information regarding certain voting deadlines.

Counting

Your Vote

All

properly executed proxies delivered and not properly revoked will be voted at the Meeting as specified in such proxies. If you provide

specific voting instructions, your shares of the Company’s common stock will be voted as instructed. If you hold shares in your

name and sign and return a proxy card or submit a proxy by telephone or via the Internet without giving specific voting instructions,

your shares will be voted “FOR” the proposal set forth in the Notice of Special meeting of Stockholders and the Proxy Statement.

Proxies

solicited may be voted only at the Meeting and any postponement of the Meeting and will not be used for any other meeting.

PROPOSAL

NO. 1 — APPROVAL OF ISSUANCE OF SECURITIES IN ONE OR MORE NON-PUBLIC OFFERINGS

Our

common stock is currently listed on The Nasdaq Capital Market and, as such, we are subject to Nasdaq Marketplace Rules. Nasdaq Marketplace

Rule 5635(d) (“Rule 5635(d)”) requires us to obtain stockholder approval prior to the issuance of our common stock in connection

with certain non-public offerings involving the sale, issuance or potential issuance by the Company of common stock (and/or securities

convertible into or exercisable for common stock) equal to 20% or more of the common stock outstanding before the issuance. Shares of

our common stock issuable upon the exercise or conversion of warrants, options, debt instruments, preferred stock or other equity securities

issued or granted in non-public offerings, including exercise or conversion of any warrants, options, debt instruments, preferred stock

or other equity securities issued in exchange for such securities or in connection with an amendment (including amendment of any outstanding

non-convertible debt to add conversion features or exchange of such non-convertible debt for convertible securities) that would permit

exercisability or conversion below market, will also be considered shares issued in such a transaction in determining whether the 20%

limit has been reached and for which stockholder approval is sought under Proposal No.1. We may effectuate the approved offerings or

transactions in one or more transactions, subject to the limitations herein.

We

may seek to raise additional capital to implement our business strategy, to recapitalize our balance sheet and enhance our overall capitalization.

We have not determined the particular terms for such prospective offerings or recapitalizations. Because we may take actions and seek

additional capital that triggers the requirements of Rule 5635(d), we are seeking stockholder approval now, so that we will be able to

move quickly to take full advantage of any opportunities that may develop.

We

hereby submit this Proposal 1 to our stockholders for their approval of the potential issuance of shares of our common stock, or securities

convertible into our common stock, in one or more non-public capital-raising or other transactions, subject to the following limitations:

| ● |

The

maximum discount at which securities will be offered (which may consist of a share of common stock, preferred stock or securities

convertible into common stock, or any combination of our securities) will not exceed a discount of 30% below the

market price of our common stock at the time of issuance; |

| |

|

| ● |

The

aggregate number of shares issued in the offerings will not exceed 20,000,000 shares of our common stock, subject to adjustment for

any reverse stock split effected prior to the offerings (including pursuant to preferred stock, options, warrants, convertible debt

or other securities exercisable for or convertible into common stock); |

| |

|

| ● |

The

total aggregate consideration will not exceed $20,000,000.; |

| |

|

| ● |

Such

offerings will occur, if at all, on or before March 31, 2025, unless a shorter time is required by Nasdaq; and |

| |

|

| ● |

Such

other terms as the Board of Directors shall deem to be in the best interests of the Company and its stockholders, not inconsistent

with the foregoing. |

The

issuance of shares of our common stock, or other securities convertible into shares of our common stock, in accordance with any offerings

would dilute, and thereby reduce, each existing stockholder’s proportionate ownership in our common stock. The stockholders do

not have preemptive rights to subscribe to additional shares that may be issued by the Company in order to maintain their proportionate

ownership of the common stock. Because of the historic volatility of the trading of our common stock and unpredictable market factors

we are unable to predict with any accuracy the actual discount at which we will be able to offer our common stock or recapitalize our

balance sheet.

The

issuance of shares of common stock in one or more non-public offerings could have an anti-takeover effect. Such issuance could dilute

the voting power of a person seeking control of the Company, thereby deterring or rendering more difficult a merger, tender offer, proxy

contest, election of members to the Board of Directors or an extraordinary corporate transaction opposed by the Company.

It

is possible that if we conduct a non-public stock offering, some of the shares we sell could be purchased by one or more investors who

could acquire a large block of our common stock. This would concentrate voting power in the hands of one or a few stockholders who could

exercise greater influence on our operations or the outcome of matters put to a vote of stockholders in the future.

We

cannot determine the actual net proceeds of the offerings or results of recapitalizations until they are completed, but as discussed

above, the aggregate dollar amount of the non-public offerings will be no more than $20,000,000 and the maximum shares or common

stock to be issued will be no more than 20,000,000 common shares. Any net proceeds will be used for general corporate purposes,

which may include debt repayment. We currently have no arrangements or understandings regarding any specific transaction with investors,

so we cannot predict whether we will be successful should we seek to raise capital through any offerings or recapitalize.

Vote

Required

The

affirmative vote of a majority of the votes cast for this proposal is required to approve the issuance of securities in one or more non-public

offerings, as required by and in accordance with Nasdaq Marketplace Rule 5635(d).

OUR

BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE

“FOR”

THE ISSUANCE OF SECURITIES IN ONE OR MORE NON-PUBLIC OFFERINGS

DIRECTORS,

OFFICERS AND KEY EMPLOYEES

Set

forth below are the Company’s Directors, and Executive Officers and key employees as of March 31, 2024, together with an overview

of their professional experience and expertise.

| Name |

|

Age |

|

Position |

| Waqaas

Al-Siddiq |

|

39 |

|

President,

Chief Executive Officer and

Chairman

of the Board of Directors |

| David

A. Rosa |

|

59 |

|

Director |

| Ronald

McClurg |

|

65 |

|

Director |

| Chester

White |

|

59 |

|

Director |

| John

Ayanoglou |

|

58 |

|

Chief

Financial Officer |

Waqaas

Al-Siddiq: President, Chief Executive Officer and Chairman of the Board of Directors. Waqaas Al-Siddiq is the founder of iMedical

and has been its Chairman and Chief Executive Officer since inception in July 2014. Prior to that, from July 2010 through July 2014,

he was the Chief Technology Officer of Sensor Mobility Inc., a Canadian private company engaged in research and development activities

within the remote monitoring segment of preventative care and that was acquired by iMedical in August 2014. Mr. Al-Siddiq also provided

consulting services with respect to technology strategy during this time. Mr. Al-Siddiq serves as a member of the Board of Directors

as he is the founder of iMedical and his current executive position with the Company. We also believe that Mr. Al-Siddiq is qualified

due to his experience as an entrepreneur and raising capital.

David

Rosa: Director. Mr. Rosa has been a director of the Company since May 3, 2016. In addition, he is a director and Chairman of

the board for Neuro Event Labs, a privately held company based in Finland that is developing a diagnostic epilepsy video technology.

He currently also serves as the CEO and President of NeuroOne, a medical technology company, having served in various capacities since

October 2016. He was the CEO and President of Sunshine Heart, a publicly-held early-stage medical device company, from October 2009 through

November 2015. From 2008 to November 2009, Mr. Rosa served as CEO of Milksmart, a company that specializes in medical devices for animals.

From 2004 to 2008, Mr. Rosa served as the Vice President of Global Marketing for Cardiac Surgery and Cardiology at St. Jude Medical.

He is a member of the Board of Directors of QXMedical, a Montreal-based medical device company, and other privately-held companies. We

believe Mr. Rosa is qualified to serve as a director due to his senior leadership experience in the medical device industry, and his

expertise in market development, clinical affairs, commercialization and public and private financing as well as his strong technical,

strategic and global operating experience.

Ronald

McClurg: Director. Mr. McClurg has served as Chief Financial Officer of NeuroOne Medical Technologies Corp. since 2021. He is

a senior financial executive with experience leading the finance, administrative and IT functions in private and public companies. From

2003 to 2019, Mr. McClurg was the Vice President, Finance & Administration and Chief Financial Officer for Incisive Surgical, Inc.

Prior to 2002, Mr. McClurg serviced as Chief Financial Officer of several publicly-held companies. We believe that Mr. McClurg is qualified

to serve as a director due to his extensive background in corporate finance.

Chester

White: Director. Mr. White has 35 years investment management and financial advisory experience investing in and advising emerging

growth technology companies in the technology segments including AI, Robotics, Genetics, Mobility, FinTech, MedTech, GreenTech, Internet/Cloud

and EnablingTech. He is recognized as one of the top Wallstreet analysts covering the Internet and Cloud segment speaking at industry

forums and public venues such as CNBC and CNN. From 1986 to 1996 he served as a VP of Investment at Paine Webber (acquired by UBS) and

Dean Witter (acquire by Morgan Stanley). He began his institutional investment career as a sell side analyst in 1996 at LH Friend and

SVP of emerging technology equity research at Wells Fargo. He went on to become an MD of Technology Investment Banking at MCF & Co.

and Managing Director of Griffin Partners LLC. In 2014 he founded Helios Alpha Fund, LP, an emerging growth technology hedge fund focused

on sustainability and innovation. Chet has an MBA from University of Southern California; B.S. in Finance, University of Maryland, Stanford

/ Coursera Machine Learning, Member of SF CFA Society.

John

Ayanoglou: Chief Financial Officer. Mr. Ayanoglou has served as our Chief Financial Officer since 2017 and has served as Chief

Financial Officer of four other companies during his career, three of which were publicly-listed. Mr. Ayanoglou currently serves as a

director of DX Mortgage Investment Corporation (2019), Green Sky Labs (2020) and Omega Wealthguard (2020). From 2011 to 2017, Mr. Ayanoglou

served as Executive Vice President of Build Capital. Prior to this, he served as Chief Financial Officer and Senior Vice President of

Equitable Group Inc. (TSX: ETC) and its wholly owned subsidiary, Equitable Bank, Canada’s 9th largest financial institution,

during the global banking crisis of 2008 to 2011. Mr. Ayanoglou also served as CFO, Vice President and Corporate Secretary of Xceed Mortgage

Corporation (TSX: XMC), from 2004 to 2008. He launched his career in financial services while providing advisory services to clients

at PricewaterhousCoopers LLP and working for Scotiabank and TD Bank. He is a chartered accountant and a member of CPA Canada. He received

his ICD.D designation from the Institute of Corporate Directors at the Rotman School of Business.

There

are no family relationships among any of our current officers and directors.

CORPORATE

GOVERNANCE

The

business and affairs of the Company are managed under the direction of our Board of Directors, which is comprised of Mr. Al-Siddiq, Mr.

Rosa, Mr. McClurg and Mr. White.

Code

of Ethics

We

adopted a Code of Business Conduct and Ethics as of April 12, 2016, that applies to, among other persons, our principal executive officers,

principal financial officer, principal accounting officer or controller, and persons performing similar functions. Our Code of Business

Conduct and Ethics is available on our website www.biotricity.com.

Involvement

in Certain Legal Proceedings

Except

as disclosed in the bios above, the Company’s Directors and Executive Officers have not been involved in any of the following events

during the past ten years:

| 1. |

any

bankruptcy petition filed by or against such person or any business of which such person was a general partner or executive officer

either at the time of the bankruptcy or within two years prior to that time; |

| |

|

| 2. |

any

conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor

offenses); |

| |

|

| 3. |

being

subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction,

permanently or temporarily enjoining him from or otherwise limiting his involvement in any type of business, securities or banking

activities or to be associated with any person practicing in banking or securities activities; |

| |

|

| 4. |

being

found by a court of competent jurisdiction in a civil action, the Securities and Exchange Commission or the Commodity Futures Trading

Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended,

or vacated; |

| |

|

| 5. |

being

subject of, or a party to, any federal or state judicial or administrative order, judgment decree, or finding, not subsequently reversed,

suspended or vacated, relating to an alleged violation of any federal or state securities or commodities law or regulation, any law

or regulation respecting financial institutions or insurance companies, or any law or regulation prohibiting mail or wire fraud or

fraud in connection with any business entity; or |

| |

|

| 6. |

being

subject of or party to any sanction or order, not subsequently reversed, suspended, or vacated, of any self-regulatory organization,

any registered entity or any equivalent exchange, association, entity or organization that has disciplinary authority over its members

or persons associated with a member. |

Board

Committees

The

Company’s Board of Directors has established three standing committees: an audit committee, a nominating and corporate governance

committee and a compensation committee, which are described below.

Audit

Committee

The

Audit Committee, among other things, is responsible for:

| ● |

selecting

a qualified firm to serve as the independent registered public accounting firm to audit our financial statements; |

| |

|

| ● |

helping

to ensure the independence and performance of the independent registered public accounting firm; |

| |

|

| ● |

discussing

the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and the

independent accountants, our interim and year-end operating results; |

| |

|

| ● |

developing

procedures for employees to submit concerns anonymously about questionable accounting or audit matters; |

| |

|

| ● |

reviewing

our policies on risk assessment and risk management; |

| |

|

| ● |

reviewing

related party transactions; |

| |

|

| ● |

obtaining

and reviewing a report by the independent registered public accounting firm at least annually, that describes our internal quality-control

procedures, any material issues with such procedures, and any steps taken to deal with such issues when required by applicable law;

and |

| |

|

| ● |

approving

(or, as permitted, pre-approving) all audit and all permissible non-audit services, other than de minimis non-audit services, to

be performed by the independent registered public accounting firm. |

The

Board has affirmatively determined that each member of the Audit Committee meets the additional independence criteria applicable to audit

committee members under SEC rules and the NASDAQ Stock Market. The Board of Directors has adopted a written charter setting forth the

authority and responsibilities of the Audit Committee. The Board has affirmatively determined that each member of the Audit Committee

is financially literate, and that Ronald McClurg meets the qualifications of an Audit Committee financial expert. The Audit Committee

consists of Ronald McClurg, David A. Rosa and Chester White. Ronald McClurg is the chairman of the Audit Committee. Norman Betts was

the chairman of the Audit Committee until his resignation from the Board in August 2022. During the fiscal year ended March 31, 2024,

the Audit Committee met 4 times.

Compensation

Committee

The

functions of the compensation committee include:

| ● |

reviewing

and approving, or recommending that our Board approve, the compensation of our executive officers; |

| |

|

| ● |

reviewing

and recommending that our Board approve the compensation of our directors; |

| |

|

| ● |

reviewing

and approving, or recommending that our Board approve, the terms of compensatory arrangements with our executive officers; |

| |

|

| ● |

administering

our stock and equity incentive plans; |

| |

|

| ● |

selecting

independent compensation consultants and assessing conflict of interest compensation advisers; |

| |

|

| ● |

reviewing

and approving, or recommending that our Board approve, incentive compensation and equity plans; and; |

| |

|

| ● |

reviewing

and establishing general policies relating to compensation and benefits of our employees and reviewing our overall compensation philosophy. |

The

Board has adopted a written charter setting forth the authority and responsibilities of the Compensation Committee. The Compensation

Committee consists of David Rosa. Dave Rosa is the chairman of the Compensation Committee. During the fiscal year ended March 31, 2024,

the Compensation Committee met 2 times.

Nominating

and Corporate Governance Committee

The

Nominating and Corporate Governance Committee, among other things, is responsible for:

| ● |

identifying

and screening individuals qualified to become members of the Board, consistent with the criteria approved by the Board; |

| |

|

| ● |

making

recommendations to the Board regarding the selection and approval of the nominees for director to be submitted to a stockholder vote

at the special meeting of stockholders; |

| |

|

| ● |

developing

and recommending to the Board a set of corporate governance guidelines applicable to the Company, to review these principles at least

once a year and to recommend any changes to the Board; |

| |

|

| ● |

overseeing

the Company’s corporate governance practices and procedures, including identifying best practices and reviewing and recommending

to the Board for approval any changes to the documents, policies and procedures in the Company’s corporate governance framework,

including its certificate of incorporation and by-laws; and |

| |

|

| ● |

developing

subject to approval by the Board, a process for an annual evaluation of the Board and its committees and to oversee the conduct of

this annual evaluation. |

The

Board of Directors has adopted a written charter setting forth the authority and responsibilities of the Nominating and Corporate Governance

Committee. The Nominating and Corporate Governance Committee consists of David Rosa, with Mr. Rosa serving as chairman. During the fiscal

year ended March 31, 2024, the Nominating and Corporate Governance Committee met 2 times.

Section

16(a) Beneficial Ownership Reporting Compliance

Section

16(a) of the Securities Exchange Act requires that our directors and executive officers and persons who beneficially own more than 10%

of our common stock (referred to herein as the “reporting persons”) file with the SEC various reports as to their ownership

of and activities relating to our common stock. Such reporting persons are required by the SEC regulations to furnish us with copies

of all Section 16(a) reports they file. Based solely on our review of copies of the reports filed with the SEC and the written representations

of our directors and executive officers, we believe that all reporting requirements for fiscal year 2024 were complied with by each person

who at any time during the 2024 fiscal year was a director or an executive officer or held more than 10% of our common stock, except

John Ayanoglou has filed a Form 4 report late related to the granting of warrants granted on various dates pursuant to the Company’s

agreement to compensate him.

Board

Diversity

The

table below provides certain highlights of the diversity characteristics of our directors:

| Board

Diversity Matrix (As of June 18, 2024) |

| Total

Number of Directors - 4 |

|

|

|

|

|

|

|

|

| |

|

Female |

|

Male |

|

Non-Binary |

|

Did

Not

Disclose

Gender |

| Part

I: Gender Identity |

|

|

|

|

|

|

|

|

| Directors |

|

|

|

4 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Part

II: Demographic Background |

|

|

|

|

|

|

|

|

| African

American or Black |

|

|

|

|

|

|

|

|

| Alaskan

Native or Native American |

|

|

|

|

|

|

|

|

| Asian |

|

|

|

1 |

|

|

|

|

| Hispanic

or Latinx |

|

|

|

|

|

|

|

|

| Native

Hawaiian or Pacific Islander |

|

|

|

|

|

|

|

|

| White |

|

|

|

3 |

|

|

|

|

| Two

or More Races or Ethnicities |

|

|

|

|

|

|

|

|

| LGBTQ+ |

|

|

|

|

|

|

|

|

| Did

Not Disclose Demographic Background |

|

|

|

|

|

|

|

|

EXECUTIVE

COMPENSATION

ITEM

11. EXECUTIVE COMPENSATION

Summary

Compensation Table

The

following table set forth certain information as to the compensation paid to the executive officers of the Company and iMedical, its

predecessor, for the fiscal years ended March 31, 2024 and March 31, 2023.

Name and Principal

Position | |

Fiscal Year | | |

Salary | | |

Bonus | | |

Stock Awards | | |

Option/Warrant Awards(1) | | |

Non-Equity Incentive Plan Compensation | | |

All Other Compensation | | |

Total | |

| Waqaas Al-Siddiq | |

| 2024 | | |

$ | 480,000 | | |

$ | 240,000 | | |

| | | |

$ | 522,153 | | |

| | | |

$ | 12,000 | | |

$ | 1,254,153 | |

| Chief Executive Officer | |

| 2023 | | |

$ | 480,000 | | |

$ | 240,000 | | |

| | | |

$ | 428,757 | | |

| | | |

$ | 12,000 | | |

$ | 1,160,757 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| John Ayanoglou | |

| 2024 | | |

$ | 300,000 | | |

$ | 250,000 | | |

| | | |

$ | - | | |

| | | |

$ | 12,000 | | |

$ | 562,000 | |

| Chief Financial Officer | |

| 2023 | | |

$ | 293,750 | | |

$ | - | | |

| | | |

$ | 232,537 | | |

| | | |

$ | 12,000 | | |

$ | 538,287 | |

| (1) |

Amounts

shown as option awards for Mr. Ayanoglou were granted as warrants, while he was not a member of the Company’s options program. |

Narrative

Disclosure to Summary Compensation Table

Employment

Agreements

Waqaas

Al-Siddiq

We

entered into an employment agreement with Mr. Al-Siddiq dated as of April 10, 2020. Pursuant to the Employment Agreement, Mr. Al-Siddiq

(“Executive”) will continue to serve as the Corporation’s Chief Executive Officer. The term of the Employment Agreement

is for 12 months unless it is earlier terminated pursuant to its terms and it shall be automatically renewed for successive one year

periods until the Executive or the Company delivers to the other party a written notice of their intent not to renew the employment term

at least 30 days prior to the expiration of the then effective employment term. During the term of the Employment Agreement, Executive

salary was initially $390,000, subject to any increase approved by the Company’s board. For the year ended March 31, 2024, Mr.

Al-Sidddiq’s salary was $480,000 per annum. Under the Employment Agreement, the Executive is eligible to earn a cash and/or equity

bonus of up to 50% of his then annual salary. In the event that the Executive is terminated without just cause or terminates for good

reason (as these terms are defined in the Employment Agreement), the Executive will be entitled to a severance payment equal to 12 months

of salary paid on a monthly basis and accrued but unused vacation. Mr. Al-Siddiq is also compensated through period, approved option

grants.

This

summary is qualified in all respects by the actual terms of the employment agreement, which was filed as Exhibit 10.1 to our current

report on Form 8-K on April 13, 2020

John

Ayanoglou

In

connection with Mr. Ayanoglou’s official appointment as Chief Financial Officer effective as of October 27, 2017, the Company agreed

to pay Mr. Ayanoglou an initial base salary of $200,000, subject to approved increases and an approved cash or equity bonus. Mr. Ayanoglou’s

base salary for calendar 2021 and 2022 is set at $300,000. In addition, the Company agreed to grant Mr. Ayanoglou warrants to purchase

200,000 shares of the Company’s common stock, during each year of his tenure, granted in equal quarterly installments starting

with the first fiscal quarter of employment. The warrants vest monthly on a pro-rata basis over a period of 12 months, with the same

10-year term and the same rights and protections as executive options awarded under the Company’s 2016 Equity Incentive Plan.

OUTSTANDING

EQUITY AWARDS AT FISCAL YEAR-END

The

following table provides information about the number of outstanding equity awards held by our named executive officers at March 31,

2024.

| | |

Option

awards(1) | | |

| | |

Stock

awards | |

| Name | |

Number

of securities underlying unexercised options

(#) exercisable | | |

Number

of securities underlying unexercised options

(#) unexercisable | | |

Equity incentive plan awards: Number

of securities underlying unexercised unearned options

(#) | | |

Option exercise price

($) | | |

Option expiration date | | |

Number of shares or

units of

stock that have

not vested (#) | | |

Market value

of shares or

units of

stock that

have not

vested as

of 12/31/15 ($) | | |

Equity incentive plan awards: Number of unearned shares, units

or other rights that

have not vested (#) | | |

Equity incentive plan awards: Market or

payout value

of unearned shares, units

or other rights that

have not vested ($) | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Waqaas

Al-Siddiq | |

| 850,019 | | |

| 83,352 | | |

| - | | |

| $

4.86 to $13.2 | | |

| July

2026 to March 2033 | | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| John

Ayanoglou | |

| 236,216 | | |

| - | | |

| - | | |

| $

2.69 to $14.40 | | |

| December

2028 to December 2032 | | |

| - | | |

| - | | |

| - | | |

| - | |

| (1) |

Amounts

shown as option awards for Mr. Ayanoglou were granted as warrants, having the same expiration term and rights that are the same or

similar to other executive options, while he was not a member of the Company’s options program. |

DIRECTOR

COMPENSATION

The

following table sets forth a summary of the compensation for our non-employee directors during the fiscal years ended March 31, 2024

and March 31, 2023.

| Name | |

Year | | |

Fees Earned

or Paid

in Cash | | |

Stock Awards | | |

Option Awards | | |

Non-Equity Incentive

Plan Compensation | | |

Nonqualified Deferred Compensation Earnings | | |

All

Other Compensation | | |

Total | |

| Ronald

McClurg | |

| 2024 | | |

$ | 16,000 | | |

| - | | |

| 16,617 | | |

| - | | |

| - | | |

| - | | |

$ | 32,617 | |

| | |

| 2023 | | |

$ | 14,667 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | 14,667 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| David

A. Rosa | |

| 2024 | | |

$ | 60,000 | | |

| | | |

| | | |

| - | | |

| | | |

| - | | |

$ | 60,000 | |

| | |

| 2023 | | |

$ | 58,000 | | |

| | | |

| | | |

| - | | |

| | | |

| - | | |

$ | 58,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Chester

White (2) | |

| 2024 | | |

$ | | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | - | |

| | |

| 2023 | | |

$ | | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Steve

Salmon (3) | |

| 2024 | | |

$ | | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | - | |

| | |

| 2023 | | |

$ | 2,000 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | 2,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Dr.

Norman M. Betts (4) | |

| 2024 | | |

$ | | | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | - | |

| | |

| 2023 | | |

$ | 2,000 | | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | 2,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Patricia

Kennedy (5) | |

| 2024 | | |

$ | - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | - | |

| | |

| 2023 | | |

$ | 14,000 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | 14,000 | |

| (1) |

Mr.

McClurg was appointed to the board on May 2, 2022. |

| (2) |

Mr.

White was appointed to the board on August 11, 2022. |

| (3) |

Mr.

Salmon resigned from the board on May 2, 2022. |

| (4) |

Mr.

Betts resigned from the board on August 4, 2022. |

| (5) |

Ms.

Kennedy resigned from the board on August 4, 2022. |

TRANSACTIONS

WITH RELATED PERSONS

None.

STOCK

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT OF BIOTRICITY INC.

The

following table shows the beneficial ownership of our common stock as of June 7, 2024, held by (i) each person known to us to be the

beneficial owner of more than five percent of our common stock; (ii) each director; (iii) each executive officer; and (iv) all directors,

director nominees and executive officers as a group.

Beneficial

ownership is determined in accordance with the rules of the SEC, and generally includes voting power and/or investment power with respect

to the securities held. Shares of common stock subject to options and warrants currently exercisable or which may become exercisable

within 60 days of June 7, 2024 are deemed outstanding and beneficially owned by the person holding such options or warrants for purposes

of computing the number of shares and percentage beneficially owned by such person, but are not deemed outstanding for purposes of computing

the percentage beneficially owned by any other person. Except as indicated in the footnotes to this table, the persons or entities named

have sole voting and investment power with respect to all shares of our common stock shown as beneficially owned by them.

The

following table assumes 20,556,909 shares are outstanding as of June 18, 2024, consisting of 20,396,237 shares of common stock and 160,672

Exchangeable Share common stock equivalents. The percentages below assume the exchange by all of the holders of Exchangeable Shares of

iMedical for an equal number of shares of our common stock in accordance with the terms of the Exchangeable Shares. Unless otherwise

indicated, the address of each beneficial holder of our common stock is our corporate address.

| Name of Beneficial Owner | |

Shares of Common Stock

Beneficially Owned | | |

% of Shares of

Common Stock

Beneficially Owned | |

| Waqaas Al-Siddiq (1) | |

| 1,652,774 | | |

| 7.56 | % |

| John Ayanoglou (2) | |

| 243,161 | | |

| 1.11 | % |

| David A. Rosa (2) | |

| 145,047 | | |

| * | |

| Chester White | |

| 127,612 | | |

| * | |

| Ronald McClurg | |

| 13,720 | | |

| * | |

| | |

| | | |

| | |

| All directors and executive officers as a group | |

| 2,182,314 | | |

| 9.98 | % |

*

Less than 1%

| (1) |

Includes an option to purchase an aggregate of 867,384 of the

Company’s shares. |

| |

|

| (2) |

Includes warrants that were granted during 2017 to 2023, that

are exercisable within 60 days of June 18, 2024. |

HOUSEHOLDING

OF MATERIALS

In

some instances, only one copy of the proxy materials is being delivered to multiple Stockholders sharing an address, unless the Company

has received instructions from one or more of the Stockholders to continue to deliver multiple copies. The Company will deliver promptly,

upon oral or written request, a separate copy of the applicable materials to a Stockholder at a shared address to which a single copy

was delivered. If you wish to receive a separate copy of the proxy materials you may call the Company at (650) 832-1626, or send a written

request to Biotricity Inc., 203 Redwood Shores Parkway, Suite 600, Redwood City, California 94065, Attention: Chief Executive Officer.

If you wish to receive a separate copy of the proxy materials, and wish to receive a separate copy for each stockholder in the future,

you may call the Company at the telephone number or write the Company at the address listed above. Alternatively, stockholders sharing

an address who now receive multiple copies of the proxy materials may request delivery of a single copy, also by calling the Company

at the telephone number or writing to the Company at the address listed above.

OTHER

MATTERS

The

Board of Directors knows of no other matter before the Meeting other than the matters identified in this proxy statement. However, if

any other matter properly comes before the Meeting, it is the intention of the persons named in the proxy solicited by the Board to vote

the shares represented by them in accordance with their best judgment.

ANNUAL

REPORT

Upon

written request to Biotricity Inc., 203 Redwood Shores Parkway, Suite 600, Redwood City, California 94065, Attention: Chief Executive

Officer, the Company will provide without charge to each person requesting a copy of the Company’s 2023 Annual Report, including

financial statements filed therewith. The Company will furnish a requesting Stockholder with any exhibit not contained therein upon specific

request. In addition, this proxy statement as well as the Company’s 2023 Annual Report, are available on the Company’s website

at https://www.biotricity.com/.

| BY

ORDER OF THE BOARD OF DIRECTORS |

|

| |

|

| /s/

Waqaas Al-Siddiq |

|

| Waqaas

Al-Siddiq |

|

| President,

Chief Executive Officer and Chairman of the Board of Directors |

|

If

you would like to request documents from the Company, please do so by July 7, 2024 to receive them before the Meeting. If you request

any documents from the Company, the Company will provide them, without charge, by first class mail or equally prompt means, within one

business day of receipt of such request (not including exhibits to the information that is incorporated by reference unless such exhibits

are specifically incorporated by reference into the information that this proxy statement incorporates). A list of stockholders will

be available for inspection by stockholders of record during business hours at the Company’s corporate headquarters at 203 Redwood

Shores Parkway, Suite 600, Redwood City, California 94065, for five business days prior to the Meeting and will also be available for

review at the Meeting.

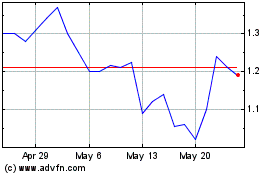

Biotricity (NASDAQ:BTCY)

Historical Stock Chart

From May 2024 to Jun 2024

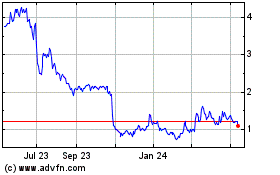

Biotricity (NASDAQ:BTCY)

Historical Stock Chart

From Jun 2023 to Jun 2024