0001746109

false

0001746109

2023-08-31

2023-08-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 OR 15(d) of the Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported) |

August 31, 2023 |

Bank First Corporation

(Exact name of registrant

as specified in its charter)

| Wisconsin |

001-38676 |

39-1435359 |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

| 402 North 8th Street, Manitowoc, WI |

54220 |

| (Address of principal executive offices) |

(Zip Code) |

| Registrant’s telephone number, including area code |

(920) 652-3100 |

N/A

(Former name or former address,

if changed since last report.)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

Ticker symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

BFC |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for company with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

On August 31, 2023, Bank

First, N.A., a wholly owned subsidiary of Bank First Corporation, announced its agreement to sell its 49.8% ownership stake in UFS, LLC

(“UFS”), a leading bank technology provider specializing in digital, core, cybersecurity, managed IT, and cloud services.

Its stake will be acquired by an institution with a significant focus on tech-enabled business services, software,

and IT services companies. The firm also intends to purchase the remaining UFS ownership, establishing a 100% stake in the company. The

transaction is expected to close at the end of the third quarter.

A copy of the press release

announcing the proposed transaction is attached hereto as exhibit 99.1 and incorporated by reference herein.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

BANK FIRST CORPORATION |

| |

|

| Date: |

August 31, 2023 |

By: |

/s/ Kevin M. LeMahieu |

| |

Kevin M. LeMahieu |

| |

Chief Financial Officer |

Exhibit 99.1

NEWS

RELEASE |  |

| | |

P.O. Box 10, Manitowoc,

WI 54221-0010

For further information, contact:

Kevin M LeMahieu, Chief Financial Officer

Phone: (920) 652-3200 / klemahieu@bankfirst.com

FOR IMMEDIATE RELEASE

Bank First Agrees to Sell Minority Stake in

UFS, LLC

MANITOWOC, Wis, August 31,

2023 – Bank First, N.A. (“Bank First” or the “Bank”), the wholly-owned banking subsidiary of Bank First

Corporation (NASDAQ: BFC), announced today its agreement to sell its 49.8% stake in UFS, LLC (“UFS”), a leading bank

technology provider specializing in digital, core, cybersecurity, managed IT, and cloud services. The stake will be acquired by an institution

with a significant focus on tech-enabled business services, software, and IT sectors. Alongside Bank First's share, the firm is set to

purchase the remaining UFS ownership, establishing a 100% stake in the company.

Headquartered in Grafton, Wisconsin,

UFS was established in 1991 when it was co-founded by Bank First alongside two other community banks. Their visionary goal was to empower

and equip banks with cutting-edge technology and FinTech solutions that blend flexibility and innovation. The new partnership creates

a synergistic ownership structure to assist the company’s continued growth through access to capital, a broader market reach, and

additional resources that will benefit not only Bank First, but all UFS customers.

The Bank projects a pre-tax

gain of $40.0 million resulting from the close of this transaction, which is anticipated to occur in either late third quarter or early

fourth quarter of 2023. UFS remains steadfast in its commitment to empower its existing clientele of community banks under the leadership

of its current senior management team.

Mike Molepske, CEO of Bank

First, shared his sentiments on this milestone, “For over three decades, our alliance with UFS has been the cornerstone of many

successes. As one of the founding members of UFS, Bank First has a responsibility to ensure that success continues. We're enthusiastic

about the promising future of our enduring relationship. Entrusting UFS to this new partner not only demonstrates our confidence in their

capabilities but also our shared vision. Given the firm’s deep expertise and acumen in the areas of technology, software, and IT

services, we're confident they'll navigate UFS into even brighter horizons.”

About Bank First Corporation

Bank First Corporation provides

financial services through its subsidiary, Bank First, N.A., which was incorporated in 1894. Bank First offers loan, deposit, and treasury

management products at each of its 28 banking locations in Wisconsin. The Bank has grown through both acquisitions and de novo branch

expansion. The Company employs approximately 398 full-time equivalent staff and has assets of approximately $4.1 billion. Further information

about Bank First Corporation is available by clicking on the Shareholder Services tab at www.bankfirst.com.

About UFS

UFS is a bank technology outfitter

with a simple promise to make technology work for community banks so they can focus on banking. Partnering only with banks, regulated

like a bank, and heavily staffed with former bankers, UFS provides purpose-built technology solutions that empower banks to thrive and

achieve their own unique goals. Founded in 1991, UFS has been improving regulatory compliance, driving efficiency, and thwarting cybercrimes

with innovative solutions such as: Managed IT Services, IT Regulatory Compliance, Cybersecurity as a Service, Regulated Cloud Hosting,

Core Banking, Digital Banking and more. For more information, visit www.ufstech.com.

# # #

Forward-Looking Statements:

Certain statements contained in this press release and in other recent filings may constitute forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking

statements include, without limitation, statements relating to our projected growth, anticipated future financial performance, financial

condition, credit quality and management’s long-term performance goals, and statements relating to the anticipated effects on our

business, financial condition and results of operations from expected developments or events, our business, growth and strategies. These

statements can generally be identified by the use of the words and phrases “may,” “will,” “should,”

“could,” “would,” “goal,” “plan,” “potential,” “estimate,” “project,”

“believe,” “intend,” “anticipate,” “expect,” “target,” “aim,”

“predict,” “continue,” “seek,” “projection,” and other variations of such words and phrases

and similar expressions.

These forward-looking statements are not historical

facts, and are based upon current expectations, estimates, and projections, many of which, by their nature, are inherently uncertain

and beyond Bank First’s control. The inclusion of these forward-looking statements should not be regarded as a representation by

Bank First or any other person that such expectations, estimates, and projections will be achieved. Accordingly, Bank First cautions

shareholders and investors that any such forward-looking statements are not guarantees of future performance and are subject to risks,

assumptions, and uncertainties that are difficult to predict. Actual results may prove to be materially different from the results expressed

or implied by the forward-looking statements. A number of factors could cause actual results to differ materially from those contemplated

by the forward-looking statements including, without limitation, (1) business and economic conditions nationally, regionally and in our

target markets, particularly in Wisconsin and the geographic areas in which we operate, (2) changes in government interest rate policies,

(3) our ability to effectively manage problem credits, (4) the risks associated with Bank First’s pursuit of future acquisitions,

(5) Bank First’s ability to successful execute its various business strategies, including its ability to execute on potential acquisition

opportunities, and (6) general competitive, economic, political, and market conditions.

This communication contains

non-GAAP financial measures, such as non-GAAP adjusted net income, non-GAAP adjusted earnings per common share, adjusted earnings return

on assets, tangible book value per common share, and tangible common equity to tangible assets. Management believes such measures to be

helpful to management, investors and others in understanding Bank First's results of operations or financial position. When non-GAAP financial

measures are used, the comparable GAAP financial measures, as well as the reconciliation of the non-GAAP measures to the GAAP financial

measures, are provided. See " Non-GAAP Financial Measures" below. The non-GAAP net income measure and related reconciliation

provide information useful to investors in understanding the operating performance and trends of Bank First and also aid investors in

comparing Bank First's financial performance to the financial performance of peer banks. Management considers non-GAAP financial

ratios to be critical metrics with which to analyze and evaluate financial condition and capital strengths. While non-GAAP financial measures

are frequently used by stakeholders in the evaluation of a corporation, they have limitations as analytical tools and should not be considered

in isolation or as a substitute for analyses of results as reported under GAAP.

Further information regarding

Bank First and factors which could affect the forward-looking statements contained herein can be found in Bank First's Annual Report on

Form 10-K for the fiscal year ended December 31, 2022, and its other filings with the Securities and Exchange Commission (the “SEC”).

Many of these factors are beyond Bank First’s ability to control or predict. If one or more events related to these or other risks

or uncertainties materialize, or if the underlying assumptions prove to be incorrect, actual results may differ materially from the forward-looking

statements. Accordingly, shareholders and investors should not place undue reliance on any such forward-looking statements. Any forward-looking

statement speaks only as of the date of this press release, and Bank First undertakes no obligation to publicly update or review any forward-looking

statement, whether as a result of new information, future developments or otherwise, except as required by law. New risks and uncertainties

may emerge from time to time, and it is not possible for Bank First to predict their occurrence or how they will affect the company.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

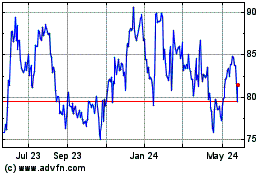

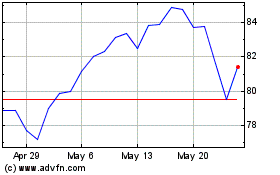

Bank First (NASDAQ:BFC)

Historical Stock Chart

From Apr 2024 to May 2024

Bank First (NASDAQ:BFC)

Historical Stock Chart

From May 2023 to May 2024