ADP Matches Estimates in 2Q - Analyst Blog

January 25 2012 - 7:45AM

Zacks

Automatic Data Processing

Inc. (ADP) reported second quarter 2012 earnings of 68

cents per share, in line with the Zacks Consensus Estimate.

Earnings per share increased 9.7% year over year on the back of

strong revenue growth.

Revenue

Revenues increased 7.4% year over

year to $2.58 billion and was in line with the Zacks Consensus

Estimate. Organic growth was 6.0% in the quarter. The

better-than-expected result was driven by strong new business

sales, improving client retention and incremental revenue from

recent acquisitions.

Employer Services revenue increased

7.0% year over year (5.0% organically) to $1.83 billion. The number

of employees on clients' payrolls in the United States grew 2.8% in

the quarter on a same-store-sales basis.

PEO Services revenue spiked 15.5%

year over year to $413.8 million in the second quarter. Dealer

Services revenue climbed 6.9% year over year to $412.6 million.

Interest on funds held for clients

declined 9% year over year to $117.9 million, due to a decline of

50 bps in the average interest yield to 3.0%, partially offset by a

6.0% increase in average client funds balances to $15.6

billion.

Operating

Performance

Total expenses in the reported

quarter increased 7.5% year over year to $2.10 billion, due to

higher operating expenses (up 11.4% year over year) and selling,

general & administrative expense (up 1.3% year over year).

The company reported pre-tax

earnings of $513.7 million, up 6.0% on year-over-year basis.

However, pre-tax margin declined 20 basis points (bps) year over

year to 19.9% in the reported quarter.

Employer Services' pre-tax margin

declined 120 bps on a year-over-year basis. PEO Services pre-tax

margin improved 20 bps, while Dealer Services pre-tax margin

enhanced 220 bps year over year in the reported quarter.

Net income increased 7.6% year over

year to $333.8 million. Net margin, however, remained flat at 12.9%

in the quarter.

Balance Sheet

As of December 31, 2011, cash and

cash equivalents (including short-term marketable securities) were

$1.36 billion, compared with $1.27 billion as of September 30,

2011. Long-term debt decreased to $25.5 million at the end of

second quarter from $26.0 million in the prior quarter. ADP

purchased 6.3 million shares for $305.0 million during the reported

quarter.

Guidance

For fiscal 2012, ADP expects total

revenue to increase in the range of 7.0%-9.0%. EPS is expected to

increase 8%-9% over the year-ago earnings per share of $2.52. The

Zacks Consensus Estimate for fiscal 2012 is pegged at $2.74 per

share.

Employer Services is expected to

grow approximately 7% and pre-tax margins to expand 30 bps. The

company expects pays per control to increase approximately 2.5%

(prior outlook 2.0%) for fiscal 2012.

PEO Services revenue is forecasted

to improve 17.0%. Pre-tax margin is expected to grow slightly on a

year-over-year basis. For fiscal 2012, ADP expects Dealer Services

revenue to increase in the 9.0%-10.0% range (prior forecast 8%-9%)

with a pre-tax margin expansion of at least 50 bps.

The company expects interest on

funds held for clients to decline $45.0 million-$55.0 million or

8%-10% from $540.1 million in fiscal 2011. However, the company

expects 6%-7% increase in the average client fund balances.

Our

Recommendation

We believe that ADP will continue

to outperform the broader market based on strong new business

sales, diversified product portfolio, improving customer retention,

accretive acquisitions, strong balance sheet and

shareholder-friendly programs (aggressive share buybacks, dividend)

over the long term.

However, increasing competition

from Paychex Inc. (PAYX) and

Insperity Inc. (NSP) and a gloomy

macro outlook in North America and Europe are major headwinds in

the near term. Additionally, higher unemployment rates and low

interest rates remain concerns for the company’s payroll processing

business.

We have a Neutral recommendation on

ADP over the long term. Currently, ADP has a Zacks #4 Rank, which

implies a Sell rating on a short-term basis.

AUTOMATIC DATA (ADP): Free Stock Analysis Report

INSPERITY INC (NSP): Free Stock Analysis Report

PAYCHEX INC (PAYX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

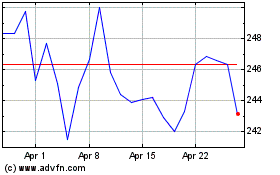

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From May 2024 to Jun 2024

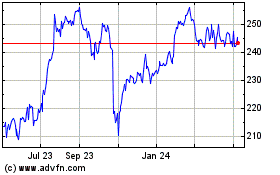

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Jun 2023 to Jun 2024