For Immediate Release

Chicago, IL – January 18, 2012 – Zacks.com announces the list of

stocks featured in the Analyst Blog. Every day the Zacks Equity

Research analysts discuss the latest news and events impacting

stocks and the financial markets. Stocks recently featured in the

blog include Wells Fargo &

Company ( WFC), JPMorgan Chase &

Co. ( JPM), Goldman Sachs Group

Inc. ( GS), Bank of America

Corporation ( BAC) and Automatic Data

Processing Inc. ( ADP).

Get the most recent insight from Zacks Equity Research with the

free Profit from the Pros newsletter:

http://at.zacks.com/?id=5513

Here are highlights from Tuesday’s Analyst

Blog:

Wells Fargo Beats by a Penny

Wells Fargo & Company’s ( WFC) fourth quarter

2011 earnings of 73 cents per share were a penny ahead of the Zacks

Consensus Estimate. Results improved from earnings of 72 cents in

the prior quarter and 61 cents in the year-ago quarter.

Wells Fargo’s results were driven by higher top line, and

improved credit quality along with strong capital ratios were

positives during the reported quarter. However, increased operating

expenses were on the downside.

Wells Fargo’s fourth quarter net income applicable to common

stock came in at $4.1 billion, modestly in line with the prior

quarter and up from $3.4 billion in the prior-year quarter.

For the full year, net income applicable to common stock was

$15.9 billion or $2.82 per share, up 28% year over year. Earnings

per share for full year also surpassed the Zacks Consensus Estimate

by a penny.

The quarter’s revenue came in at $20.6 billion, which was above

the Zacks Consensus Estimate of $20.1 billion and up 5.1%

sequentially. On a sequential basis, Wells Fargo’s commercial real

estate, credit card, commercial banking, corporate banking,

equipment finance, merchant services, insurance, international,

capital markets, asset-backed finance, corporate trust, mortgage,

asset management, government and institutional banking and real

estate capital markets and retail sales finance reported revenue

growth.

For the full year, revenue was $81.0 billion, down 4.9% from

$85.2 billion in 2010. However, this compares favorably with the

Zacks Consensus Estimate of $80.5 billion.

Furthermore, segment wise, on a sequential basis, Wholesale

Banking reported a 9.5% drop in revenues while the Community

Banking and Wealth, Brokerage and Retirement segments reported

rises of 8.1% and 11.7%, respectively.

Wells Fargo reported a reserve release of $600 million (pre

tax), attributable to improved portfolio performance. The company

also expects future reductions in the allowance should the economy

improve significantly.

Performance in Detail

Net interest income for the quarter came in at $10.9 billion, up

3.8% from the prior quarter, primarily due to growth in earning

assets and an elevated net interest margin. Additionally, net

interest margin climbed 5 basis points (bps) sequentially to 3.89%

as a result of redistribution of short-term investments into

higher-yielding assets such as securities and loans, lower deposit

costs and decreased long-term debt.

Wells Fargo’s non-interest income came in at $9.7 billion, up

6.6% from $9.1 million recorded in the prior quarter. The

sequential increase in insurance fees, mortgage banking income as

well as net gains from trading activities were partly mitigated by

decline in service charges on deposit accounts, card fees, trust

and investment fees, and net gains from equity investments.

As of December 31, 2011, total loans were $769.6 billion, up

$9.5 billion from $760.1 billion as of September 30, 2011. While

the company continued with its planned reduction in the

non-strategic/liquidating portfolios, it was more than offset by

increased balances in many loan portfolios. Average core deposits

were $864.9 billion, up 13% (annualized) from third quarter 2011

and 9% from a year ago.

However, non-interest expense at Wells Fargo was $12.5 billion,

up 6.8% from the prior quarter. The rise in expenses reflects

increased expenses on commission and incentive compensation, net

occupancy, employee benefits and equipment. However, the increase

was partially offset by lower salaries, operating losses as well as

FDIC and other assessment expenses.

Credit Quality

Credit quality continued to improve during the reported quarter.

Nonperforming assets (NPAs) continued to decline with Wells Fargo

reporting NPAs of $26.0 billion, down 3% sequentially. Non-accrual

loans decreased to $21.3 billion from $21.9 billion in the prior

quarter.

Wells Fargo’s allowance for credit losses, including the

allowance for unfunded commitments, totaled $19.7 billion as of

December 31, 2011, down from $20.4 billion as of September 30,

2011.

Net charge-offs were $2.6 billion or annualized 1.36% of average

loans, modestly flat with the prior quarter. However, provision for

credit losses increased to $2.0 billion from $1.8 billion in the

prior quarter.

As of November 30, 2011, around 724,710 active trial or

completed loan modifications had been initiated since the beginning

of 2009. Of this total, 84% were through Wells Fargo’s own

modification programs and the remainder was through the federal

government’s Home Affordable Modification Program (HAMP).

Capital Position

Wells Fargo reported improved capital ratios in the fourth

quarter. The company redeemed $5.8 billion of trust preferred

securities and repurchased 27 million shares of its common stock

and an additional estimated 6 million shares through a forward

repurchase transaction that will settle in first quarter of

2012.

The Tier 1 leverage ratio was 9.03% as of December 31, 2011, up

from 8.97% as of September 30, 2011. The Tier 1 common equity ratio

was an estimated 7.49% as of December 31, 2011 under the Basel III

capital proposals. Tier 1 capital ratio was 11.33% as of December

31, 2011 compared with 11.26% as of September 30, 2011.

Moreover, book value per share improved to $24.64 from $24.13 in

the prior quarter and $22.49 in the prior-year quarter.

Wachovia Integration Update

Wells Fargo’s Wachovia merger integration remained on track with

the company finally completing the conversion of retail bank store

(North Carolina integration in mid-October 2011). Over 50 million

accounts were converted.

Peer Performance

However, one of the peers of Wells Fargo, JPMorgan

Chase & Co.’s ( JPM) fourth quarter earnings per share

of 90 cents marginally missed the Zacks Consensus Estimate of 92

cents. Results were worse than $1.12 earned in the prior-year

quarter.

Results for the reported quarter were primarily hurt by a

substantial decrease in revenue, which more than offset a slowdown

in provision for credit losses and lower non-interest expense.

After a long time, JPMorgan missed expectations as it buckled under

the weakness in the wider economy and the fundamental pressures on

the banking sector.

Close on the heels of Wells Fargo, the other major banks,

namely Goldman Sachs Group Inc. ( GS)

will report on January 18 and Bank of America

Corporation ( BAC) on January 19.

Our Take

In December 2011, Wells Fargo agreed to purchase investment

boutique firm EverKey Global Partners, in an effort to broaden its

investment capabilities and provide strategies to meet the needs of

its clients. The two companies have signed a definitive agreement

in this context. However, the terms of the deal were not

disclosed.

The acquisition of EverKey serves a strategic fit for Wells

Fargo for offering a greater range of investment strategies to its

clients and deliver value to investors. It also reflects its focus

on the multi-boutique business model.

Going forward, we believe that strategic acquisitions will help

expand Wells Fargo’s business and improve its profitability. Its

solid business model, strong capital position and expanded business

through the Wachovia acquisition and its integration, expected

expense management and improved credit quality will also support

its profit figures. Yet, a sluggish economic recovery and its

impact on revenue might somewhat limit its growth.

Wells Fargo currently retains a Zacks #3 Rank, which translates

into a short-term Hold’ rating. Considering the fundamentals, we

also maintain a “Neutral” recommendation on the stock.

ADP Reaches India

Automatic Data Processing Inc. ( ADP)

recently marked its entry into the lucrative Indian market with the

acquisition of Ma Foi Consulting Solutions Ltd, an Indian human

resource and payroll management company. The acquired company was

previously a part of Ma Foi Randstad, an Indian subsidiary of

RANDSTAND HOLDINGS. Though the financial details of the deal were

not disclosed, ADP stated that it will incorporate Ma Foi’s 200

associates.

ADP will now manage Ma Foi’s extensive Indian clientele,

including both domestic and multinational companies. The

acquisition is a strategic fit for the company as it will

facilitate further expansion in developing markets. Through this

acquisition, ADP will gain access to the growing market of human

resource business process outsourcing (HR BPO) in India.

Incidentally, Ma Foi and ADP have enjoyed a healthy business

relationship since 2009 for the marketing and operations of ADP

Streamline, ADP’s multi-country payroll and human resource

service.

Want more from Zacks Equity Research? Subscribe to the free

Profit from the Pros newsletter: http://at.zacks.com/?id=5515.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous coverage is provided for a universe of 1,150 publicly

traded stocks. Our analysts are organized by industry which gives

them keen insights to developments that affect company profits and

stock performance. Recommendations and target prices are six-month

time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today:

http://at.zacks.com/?id=5517

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leon Zacks. As a PhD from MIT Len knew

he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment Research is through our

free daily email newsletter; Profit from the Pros. In short, it's

your steady flow of Profitable ideas GUARANTEED to be worth your

time! Register for your free subscription to Profit from the Pros

at http://at.zacks.com/?id=5518.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

AUTOMATIC DATA (ADP): Free Stock Analysis Report

BANK OF AMER CP (BAC): Free Stock Analysis Report

GOLDMAN SACHS (GS): Free Stock Analysis Report

JPMORGAN CHASE (JPM): Free Stock Analysis Report

WELLS FARGO-NEW (WFC): Free Stock Analysis Report

To read this article on Zacks.com click here.

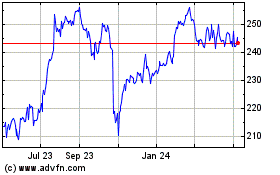

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From May 2024 to Jun 2024

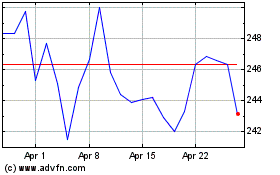

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Jun 2023 to Jun 2024