ADP Modestly Misses Estimates - Ahead of Wall Street

August 31 2011 - 4:44AM

Zacks

This is Mark Vickery covering for Sheraz Mian, who is off

today.

ADP's (ADP) numbers missed

slightly this morning. The biggest private-sector check-cutter

reported a gain of 91,000 jobs in August, down from an expected

level of 100,000 jobs gained. The ADP is the premiere jobs report

prior to this Friday's Bureau of Labor Statistics (BLS) non-farm

payroll report, and this moderate miss may ding expectations for

Friday's numbers.

Also, July's numbers were revised down from 114,000 new jobs

originally reported to 109,000. So both headline numbers represent

a disappointment, although with how expectations have often been

crushed in recent months, the market may breathe a sigh of relief

that the numbers weren't worse. In fact, stock futures were up

immediately after the ADP report was announced.

The estimate for Friday's BLS report are now for a gain of 80,000

jobs in August. The main difference between the ADP and BLS reports

is that the ADP does not count government jobs but the BLS

does.

By size of firm, small businesses -- the biggest and most important

private employers in the country -- gained 58,000 jobs during the

month. Medium-sized businesses gained 30,000, and large businesses

were up 3,000. Goods producing jobs were up 11,000, services were

up 80,000 but manufacturing was down 4,000 jobs.

Any way you slice it, this marks further tepid jobs growth in the

U.S. Not always do the ADP and BLS numbers correlate, but they

usually exist within a range, particularly after revisions in later

months modify the results. An additional 91,000 jobs will not do

much to stave off fears of another recession, but they do at least

provide grist for the mill that we are growing, albeit at an anemic

pace.

Elsewhere, the Challenger Report, from firm Challenger, Gray &

Christmas, reports job cuts falling (from 16-month highs) to

51,000-plus. CEO John Challenger said on CNBC's "Squawk Box" this

morning that he sees the majority of job cuts remaining on the

Government side, but switching from State & Local jobs to the

Federal level. "Usually government is growing wildly after a

recession, with new tax revenues. That's just not happening this

time," Challenger said.

AUTOMATIC DATA (ADP): Free Stock Analysis Report

Zacks Investment Research

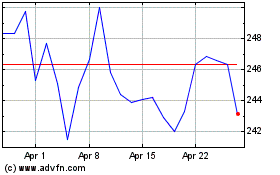

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Jul 2024 to Aug 2024

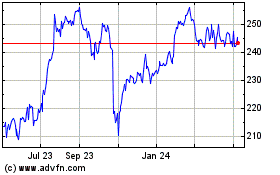

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Aug 2023 to Aug 2024