Assertio Therapeutics, Inc. (NASDAQ: ASRT) today reported financial

results for the quarter ended June 30, 2019 and provided an update

on its business performance and strategic initiatives.

Second-Quarter Financial

Highlights:(unaudited)

|

|

Second Quarter 2019 |

|

(in millions, except earnings per share) |

GAAP |

Non-GAAP(1) |

|

Total Revenues |

$57.2 |

$59.3 |

|

Net Income/(Loss) |

$(13.6) |

$18.5 |

|

Earnings/(Loss) Per Share |

$(0.21) |

$0.25 |

|

Adjusted EBITDA |

- |

$36.7 |

|

(1) |

All non-GAAP measures included in this earnings release are

reconciled to the corresponding GAAP measures in the schedules

attached. |

“We continue to make steady progress toward building a leading

diversified biopharmaceutical business as we deliver strong results

and de-lever our balance sheet,” said Arthur Higgins, President and

CEO of Assertio. “We remain focused on improving our financial

position as we pursue business development opportunities across a

range of new therapeutic areas.”

Second Quarter Business Highlights:

- Neurology Franchise Net Sales: Gralise net

sales in the second quarter were $17.8 million, primarily due to

favorable year-over-year gross to net reflecting payor mix. In

August, the Company executed an agreement that provides expanded

access for Gralise through new coverage with one of the top three

Medicare Part-D insurers, representing more than 6 million lives.

Obtaining expanded Medicare Part-D access is important for Gralise

as a majority of patients with postherpetic neuralgia are more than

65 years old. In the second quarter, Zipsor net sales were $1.5

million, adversely impacted by short-dated product sales returns;

however, underlying prescription demand for Zipsor continues to

grow double digits year-over-year. CAMBIA net sales in the second

quarter were $6.8 million, primarily due to unfavorable

year-over-year gross to net reflecting payor mix. Underlying

prescription demand for CAMBIA increased mid single digits

year-over-year.

- Debt Reduction and Cash Position: As of August

7, 2019, the Company has made scheduled principal repayments of

$100.0 million in 2019, reducing the Company’s senior secured

debt to $182.5 million. The Company will make an additional $20

million principal payment before year end, reducing senior secured

debt to $162.5 million. As of June 30, 2019, the Company had cash

and cash equivalents and short-term investments of $75.5

million.

- One-Year Anniversary of Headquarters Relocation,

Reincorporation and Name Change to Assertio Therapeutics,

Inc.: Approximately one year ago, the Company completed

its reincorporation from California to Delaware and changed its

name from “Depomed, Inc.” to “Assertio Therapeutics, Inc.” In

connection with the reincorporation and name change, the Company’s

common stock began trading under a new ticker symbol “ASRT.” The

Company also completed the relocation of its corporate headquarters

from Newark, CA, to Lake Forest, IL.

| |

| Revenue

Summary: |

| (in thousands,

unaudited) |

| |

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

| Product sales, net |

|

|

|

|

|

|

|

|

Gralise |

$ |

17,800 |

|

|

$ |

13,815 |

|

|

$ |

31,078 |

|

|

$ |

28,642 |

|

|

CAMBIA |

6,758 |

|

|

8,089 |

|

|

15,566 |

|

|

14,505 |

|

|

Zipsor |

1,524 |

|

|

3,988 |

|

|

5,755 |

|

|

8,734 |

|

|

Total neurology product sales, net |

26,082 |

|

|

25,892 |

|

|

52,399 |

|

|

51,881 |

|

| |

|

|

|

|

|

|

|

|

NUCYNTA products |

(163 |

) |

|

626 |

|

|

(101 |

) |

|

18,771 |

|

|

Lazanda |

18 |

|

|

320 |

|

|

89 |

|

|

540 |

|

|

Total product sales, net |

25,937 |

|

|

26,838 |

|

|

52,387 |

|

|

71,192 |

|

| |

|

|

|

|

|

|

|

| Commercialization

agreement: |

|

|

|

|

|

|

|

|

Commercialization rights and facilitation services |

31,003 |

|

|

31,179 |

|

|

61,859 |

|

|

59,274 |

|

|

Revenue from transfer of inventory |

— |

|

|

— |

|

|

— |

|

|

55,705 |

|

| Royalties and Milestone

Revenue |

263 |

|

|

5,257 |

|

|

886 |

|

|

5,507 |

|

| |

|

|

|

|

|

|

|

| Total

revenues |

$ |

57,203 |

|

|

$ |

63,274 |

|

|

$ |

115,132 |

|

|

$ |

191,678 |

|

2019 Financial Guidance:The Company is

confirming its previous 2019 earnings guidance range and adjusting

its Neurology Franchise net sales guidance to low-single digits,

reflecting the adverse impact of Zipsor short-dated product sales

returns.

|

|

Prior 2019 Guidance |

Current 2019 Guidance |

|

Neurology FranchiseNet Sales |

Low to Mid-Single Digit Growth |

Low-Single Digit Growth |

|

GAAP Net Loss(1) |

($68) to ($58) million |

($68) to ($58) million |

|

Non-GAAPAdjusted EBITDA(1)(2) |

$118 to $128 million |

$118 to $128 million |

| (1) |

Guidance

includes $2.8 million of non-cash Collegium warrant related income

and excludes any future warrant mark-to-market adjustments, which

cannot be estimated. |

| (2) |

Guidance excludes any Collegium warrant mark-to-market

adjustments. |

Conference Call and Webcast:Assertio will host

a conference call today, Wednesday, August 7, 2019 beginning at

4:30 p.m. ET to discuss its results. This event can be accessed in

three ways:

- From the Assertio website: http://investor.assertiotx.com.

Please access the website 15 minutes prior to the start of the

call to download and install any necessary audio software.

- By telephone: Participants can access the call by dialing (877)

550-3745 (United States) or (281) 973-6277 (International)

referencing Conference ID 7769879.

- By replay: A replay of the webcast will be located under the

Investor Relations section of Assertio’s website approximately two

hours after the conclusion of the live call.

About Assertio Therapeutics, Inc.Assertio

Therapeutics is committed to providing responsible solutions to

advance patient care in the Company’s core areas of neurology,

orphan and specialty medicines. Assertio currently markets three

FDA-approved products and continues to identify, license and

develop new products that offer enhanced options for patients that

may be under served by existing therapies. To learn more about

Assertio, visit www.assertiotx.com.

“Safe Harbor” Statement under the Private Securities

Litigation Reform Act of 1995This news release contains

forward-looking statements. These statements involve inherent risks

and uncertainties that could cause actual results to differ

materially from those projected or anticipated, including risks

related to regulatory approval and clinical development of

long-acting cosyntropin, expectations regarding royalties to be

received based on sales of NUCYNTA and NUCYNTA ER, expectations

regarding potential business opportunities and other risks outlined

in the Company’s public filings with the Securities and Exchange

Commission, including the Company’s most recent annual report on

Form 10-K and subsequent Quarterly Reports on Form 10-Q. All

information provided in this news release speaks as of the date

hereof. Except as otherwise required by law, the Company undertakes

no obligation to update or revise its forward-looking

statements.

Investor and Media Contact:John B. ThomasSenior

Vice President, Investor Relations and Corporate

Communicationsjthomas@assertiotx.com

Non-GAAP Financial MeasuresTo supplement the

Company’s financial results presented on a U.S. generally accepted

accounting principles (GAAP) basis, the Company has included

information about non-GAAP revenue, non-GAAP adjusted earnings,

non-GAAP adjusted diluted earnings per share, non-GAAP adjusted

EBITDA and other non-GAAP financial measures as useful operating

metrics. The Company believes that the presentation of these

non-GAAP financial measures, when viewed with results under GAAP

and the accompanying reconciliation, provides supplementary

information to analysts, investors, lenders, and the Company’s

management in assessing the Company’s performance and results from

period to period. The Company uses these non-GAAP measures

internally to understand, manage and evaluate the Company’s

performance, and in part, in the determination of bonuses for

executive officers and employees. These non-GAAP financial measures

should be considered in addition to, and not a substitute for, or

superior to, net income or other financial measures calculated in

accordance with GAAP. Non-GAAP financial measures used by us may be

calculated differently from, and therefore may not be comparable

to, non-GAAP measures used by other companies.

Specified ItemsNon-GAAP measures presented

within this release exclude specified items. The Company considers

specified items to be significant income/expense items not

indicative of current operations, including the related tax effect.

Specified items include non-cash adjustment to Collegium agreement

revenue and cost of sales, release of NUCYNTA and Lazanda sales

reserves for products the Company is no longer selling, interest

income, interest expense, amortization, acquired in-process

research and development and non-cash adjustments related to

product acquisitions, stock-based compensation expense, non-cash

interest expense related to debt, depreciation, taxes, transaction

costs, CEO transition, restructuring costs, adjustments to net

sales related to reserves recorded prior to the Company’s exit of

opioid commercialization activities, legal costs and expenses

incurred in connection with opioid-related litigation,

investigations and regulations pertaining to the company’s

historical commercialization of opioid products, certain types of

legal settlements, disputes, fees and costs, and to adjust for the

tax effect related to each of the non-GAAP adjustments.

|

|

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(in thousands, except per share amounts) |

|

(unaudited) |

| |

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

| Revenues: |

|

|

|

|

|

|

|

|

Product sales, net |

$ |

25,937 |

|

|

$ |

26,838 |

|

|

$ |

52,387 |

|

|

$ |

71,192 |

|

|

Commercialization agreement, net |

31,003 |

|

|

31,179 |

|

|

61,859 |

|

|

114,979 |

|

|

Royalties and milestones |

263 |

|

|

5,257 |

|

|

886 |

|

|

5,507 |

|

| Total revenues |

57,203 |

|

|

63,274 |

|

|

115,132 |

|

|

191,678 |

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

Cost of sales (excluding amortization of intangible assets) |

2,124 |

|

|

2,753 |

|

|

4,699 |

|

|

14,797 |

|

|

Research and development expenses |

1,263 |

|

|

2,180 |

|

|

3,056 |

|

|

3,708 |

|

|

Selling, general and administrative expenses |

24,755 |

|

|

31,308 |

|

|

49,800 |

|

|

60,341 |

|

|

Amortization of intangible assets |

25,443 |

|

|

25,444 |

|

|

50,887 |

|

|

50,888 |

|

|

Restructuring charges |

— |

|

|

5,814 |

|

|

— |

|

|

14,831 |

|

| Total costs and expenses |

53,585 |

|

|

67,499 |

|

|

108,442 |

|

|

144,565 |

|

| Income (loss) from

operations |

3,618 |

|

|

(4,225 |

) |

|

6,690 |

|

|

47,113 |

|

| Other (expense) income: |

|

|

|

|

|

|

|

|

Interest expense |

(14,842 |

) |

|

(17,010 |

) |

|

(31,396 |

) |

|

(35,078 |

) |

|

Other (expense) income, net |

(1,240 |

) |

|

67 |

|

|

(1,849 |

) |

|

296 |

|

| Total other expense |

(16,082 |

) |

|

(16,943 |

) |

|

(33,245 |

) |

|

(34,782 |

) |

| Net (loss) income before

income taxes |

(12,464 |

) |

|

(21,168 |

) |

|

(26,555 |

) |

|

12,331 |

|

| Income taxes (expense)

benefit |

(1,141 |

) |

|

120 |

|

|

(1,351 |

) |

|

445 |

|

| Net (loss) income |

$ |

(13,605 |

) |

|

$ |

(21,048 |

) |

|

$ |

(27,906 |

) |

|

$ |

12,776 |

|

| Basic net (loss) income per

share |

(0.21 |

) |

|

(0.33 |

) |

|

(0.43 |

) |

|

0.20 |

|

| Diluted net (loss) income per

share |

(0.21 |

) |

|

(0.33 |

) |

|

(0.43 |

) |

|

0.20 |

|

| Shares used in computing basic

net (loss) income per share |

64,480 |

|

|

63,719 |

|

|

64,405 |

|

|

63,611 |

|

| Shares used in computing

diluted net (loss) income per share |

64,480 |

|

|

63,719 |

|

|

64,405 |

|

|

64,107 |

|

| |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(in thousands) |

|

(unaudited) |

| |

| |

June 30, 2019 |

|

December 31, 2018 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

68,348 |

|

|

$ |

110,949 |

|

|

Short-term investments |

7,114 |

|

|

— |

|

|

Accounts receivable, net |

34,311 |

|

|

37,211 |

|

|

Inventories, net |

3,005 |

|

|

3,396 |

|

|

Prepaid and other current assets |

26,231 |

|

|

56,551 |

|

|

Total current assets |

139,009 |

|

|

208,107 |

|

| Property and equipment,

net |

13,050 |

|

|

13,064 |

|

| Intangible assets, net |

641,212 |

|

|

692,099 |

|

| Investments |

8,589 |

|

|

11,784 |

|

| Other long-term assets |

11,014 |

|

|

7,812 |

|

| Total assets |

$ |

812,874 |

|

|

$ |

932,866 |

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

2,188 |

|

|

$ |

6,138 |

|

|

Accrued rebates, returns and discounts |

63,808 |

|

|

75,759 |

|

|

Accrued liabilities |

19,648 |

|

|

31,361 |

|

|

Current portion of Senior Notes |

80,000 |

|

|

120,000 |

|

|

Interest payable |

9,194 |

|

|

11,645 |

|

|

Other current liabilities |

2,100 |

|

|

1,133 |

|

|

Total current liabilities |

176,938 |

|

|

246,036 |

|

| Contingent consideration

liability |

953 |

|

|

1,038 |

|

| Senior Notes |

117,527 |

|

|

158,309 |

|

| Convertible Notes |

297,550 |

|

|

287,798 |

|

| Other long-term

liabilities |

22,467 |

|

|

19,350 |

|

| Total liabilities |

615,435 |

|

|

712,531 |

|

| Commitments and

contingencies |

|

|

|

| Shareholders’ equity: |

|

|

|

|

Common stock |

6 |

|

|

6 |

|

|

Additional paid-in capital |

407,944 |

|

|

402,934 |

|

|

Accumulated deficit |

(210,506 |

) |

|

(182,600 |

) |

|

Accumulated other comprehensive loss |

(5 |

) |

|

(5 |

) |

|

Total shareholders’ equity |

197,439 |

|

|

220,335 |

|

| Total liabilities and

shareholders' equity |

$ |

812,874 |

|

|

$ |

932,866 |

|

| |

|

RECONCILIATION OF GAAP NET INCOME (LOSS) TO NON-GAAP

ADJUSTED EBITDA |

|

(in thousands) |

|

(unaudited) |

| |

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

GAAP net (loss)/income |

$ |

(13,605 |

) |

|

$ |

(21,048 |

) |

|

$ |

(27,906 |

) |

|

$ |

12,776 |

|

|

Commercialization agreement revenues (1) |

1,933 |

|

|

3,198 |

|

|

3,863 |

|

|

(49,288 |

) |

|

Commercialization agreement cost of sales (2) |

— |

|

|

— |

|

|

— |

|

|

6,200 |

|

|

NUCYNTA sales reserve (3) |

— |

|

|

— |

|

|

— |

|

|

(10,711 |

) |

|

NUCYNTA and Lazanda revenue reserves (4) |

145 |

|

|

(946 |

) |

|

12 |

|

|

(1,166 |

) |

|

Expenses for opioid-related litigation, investigations and

regulations (5) |

2,350 |

|

|

2,220 |

|

|

4,850 |

|

|

3,047 |

|

|

Intangible amortization related to product acquisitions |

25,443 |

|

|

25,444 |

|

|

50,887 |

|

|

50,888 |

|

|

Contingent consideration related to product acquisitions |

(142 |

) |

|

(260 |

) |

|

(142 |

) |

|

(462 |

) |

|

Stock-based compensation |

2,634 |

|

|

2,970 |

|

|

5,336 |

|

|

4,946 |

|

|

Interest and other income |

(172 |

) |

|

(70 |

) |

|

(673 |

) |

|

(164 |

) |

|

Interest expense |

14,842 |

|

|

17,010 |

|

|

31,396 |

|

|

35,078 |

|

|

Depreciation |

279 |

|

|

1,454 |

|

|

616 |

|

|

2,929 |

|

|

Income taxes (expense) benefit |

1,141 |

|

|

(120 |

) |

|

1,351 |

|

|

(445 |

) |

|

Restructuring and related costs (6) |

— |

|

|

6,974 |

|

|

— |

|

|

15,299 |

|

|

Other costs |

— |

|

|

(31 |

) |

|

— |

|

|

178 |

|

|

Fair value for warrants |

1,848 |

|

|

— |

|

|

3,477 |

|

|

— |

|

| Non-GAAP adjusted EBITDA |

$ |

36,696 |

|

|

$ |

36,795 |

|

|

$ |

73,067 |

|

|

$ |

69,105 |

|

| |

(1) For the period from January 8, 2018 through November 8,

2018, the adjustment relates to the non-cash value assigned to

inventory transferred to Collegium. As of the date of the

Commercialization Amendment, on November 8, 2018, the Company

ceased recognition of fixed revenues and began the recognition of

variable revenues when they become due beginning in January

2019. The adjustment for the three and six months ended June

30, 2019 relates to non-cash expense for third-party royalties,

which are expected to have no net impact for the full year period,

as well as the amortization of the contract asset.

(2) Represents the cash received for inventory transferred to

Collegium at the commencement of the Commercialization

Agreement.

(3) Represents a $12.5 million benefit related to the release of

sales reserves for which the Company is no longer financially

responsible, net of $1.8 million in royalties payable to a third

party during the three months ended March 31, 2018.

(4) Removal of the impact of revenue adjustment estimates

related to products that we are no longer commercializing.

(5) Legal costs/expenses related to opioid-related litigation,

investigations and regulations pertaining to the Company’s

historical commercialization of opioid products.

(6) Restructuring and other costs represents non-recurring costs

associated with the Company’s restructuring, reincorporation,

headquarters relocation and CEO transition.

| |

|

RECONCILIATION OF GAAP NET INCOME/(LOSS) TO NON-GAAP

ADJUSTED EARNINGS |

|

(in thousands, except per share amounts) |

|

(unaudited) |

| |

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

GAAP net (loss)/income |

$ |

(13,605 |

) |

|

$ |

(21,048 |

) |

|

$ |

(27,906 |

) |

|

$ |

12,776 |

|

|

Commercialization agreement revenues (1) |

1,933 |

|

|

3,198 |

|

|

3,863 |

|

|

(49,288 |

) |

|

Commercialization agreement cost of sales (2) |

— |

|

|

— |

|

|

— |

|

|

6,200 |

|

|

Nucynta sales reserve (3) |

— |

|

|

— |

|

|

— |

|

|

(10,711 |

) |

|

Non-cash interest expense on debt |

6,056 |

|

|

5,390 |

|

|

12,220 |

|

|

10,808 |

|

|

Nucynta and Lazanda revenue reserves (4) |

145 |

|

|

(946 |

) |

|

12 |

|

|

(1,166 |

) |

|

Expenses for opioid-related litigation, investigations and

regulations (5) |

2,350 |

|

|

2,220 |

|

|

4,850 |

|

|

3,047 |

|

|

Intangible amortization related to product acquisitions |

25,443 |

|

|

25,444 |

|

|

50,887 |

|

|

50,888 |

|

|

Contingent consideration related to product acquisitions |

(142 |

) |

|

(260 |

) |

|

(142 |

) |

|

(462 |

) |

|

Stock-based compensation |

2,634 |

|

|

2,970 |

|

|

5,336 |

|

|

4,946 |

|

|

Restructuring and related costs (6) |

— |

|

|

6,974 |

|

|

— |

|

|

15,304 |

|

|

Other costs |

— |

|

|

(31 |

) |

|

(332 |

) |

|

178 |

|

|

Fair value for warrants |

1,848 |

|

|

— |

|

|

3,477 |

|

|

— |

|

|

Income tax effect of non-GAAP adjustments (7) |

(8,124 |

) |

|

(9,067 |

) |

|

(16,163 |

) |

|

(5,623 |

) |

| Non-GAAP adjusted

earnings |

$ |

18,538 |

|

|

$ |

14,844 |

|

|

$ |

36,102 |

|

|

$ |

36,897 |

|

| Add interest expense of

convertible debt, net of tax (8) |

1,703 |

|

|

1,703 |

|

|

3,406 |

|

|

3,406 |

|

| Numerator |

$ |

20,241 |

|

|

$ |

16,547 |

|

|

$ |

39,508 |

|

|

$ |

40,303 |

|

| Shares used in calculation

(8) |

82,411 |

|

|

82,201 |

|

|

82,336 |

|

|

82,039 |

|

| Non-GAAP adjusted diluted

earnings per share |

$ |

0.25 |

|

|

$ |

0.20 |

|

|

$ |

0.48 |

|

|

$ |

0.49 |

|

(1) For the period from January 8, 2018 through November 8,

2018, the adjustment relates to the non-cash value assigned to

inventory transferred to Collegium. As of the date of the

Commercialization Amendment, on November 8, 2018, the Company

ceased recognition of fixed revenues and will begin recognition of

variable revenues when they become due beginning in January 2019.

The adjustment for the three and six months ended June 30, 2019

relates to non-cash expense for third-party royalties, which are

expected to have no net impact for the full year period, as well as

the amortization of the contract asset.

(2) Represents the cash received for inventory transferred to

Collegium at the commencement of the Commercialization

Agreement.

(3) Represents a $12.5 million benefit related to the

release of sales reserves for which the Company is no longer

financially responsible, net of $1.8 million in royalties payable

to a third party during the three months ended March 31, 2018.

(4) Removal of the impact of revenue adjustment estimates

related to products that we are no longer commercializing.

(5) Legal costs/expenses related to opioid-related

litigation, investigations and regulations pertaining to the

Company’s historical commercialization of opioid products.

(6) Restructuring and other costs represents non-recurring costs

associated with the Company’s restructuring, reincorporation,

headquarters relocation and CEO transition.

(7) Calculated by taking the pre-tax non-GAAP adjustments

and applying the statutory tax rate.

(8) The Company uses the if-converted method to compute

diluted earnings per share with respect to its convertible

debt.

|

|

|

RECONCILIATION OF GAAP NET INCOME (LOSS) PER SHARE

TO |

|

NON-GAAP ADJUSTED EARNINGS PER SHARE |

|

(unaudited) |

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

| |

|

|

|

|

|

|

|

|

GAAP net (loss)/income per share |

$ |

(0.21 |

) |

|

$ |

(0.33 |

) |

|

$ |

(0.43 |

) |

|

$ |

0.20 |

|

|

Conversion from basic shares to diluted shares |

0.05 |

|

|

0.07 |

|

|

0.09 |

|

|

(0.05 |

) |

|

Commercialization agreement revenues |

0.02 |

|

|

0.04 |

|

|

0.05 |

|

|

(0.60 |

) |

|

Commercialization agreement cost of sales |

— |

|

|

— |

|

|

— |

|

|

0.08 |

|

|

NUCYNTA sales reserve |

— |

|

|

— |

|

|

— |

|

|

(0.13 |

) |

|

Non-cash interest expense on debt |

0.07 |

|

|

0.06 |

|

|

0.15 |

|

|

0.14 |

|

|

NUCYNTA and Lazanda revenue reserves |

— |

|

|

(0.01 |

) |

|

— |

|

|

(0.01 |

) |

|

Expenses for opioid-related litigation, investigations and

regulations |

0.03 |

|

|

0.03 |

|

|

0.06 |

|

|

0.04 |

|

|

Intangible amortization related to product acquisitions |

0.31 |

|

|

0.31 |

|

|

0.62 |

|

|

0.62 |

|

|

Contingent consideration related to product acquisitions |

— |

|

|

— |

|

|

— |

|

|

(0.01 |

) |

|

Stock based compensation |

0.03 |

|

|

0.04 |

|

|

0.06 |

|

|

0.06 |

|

|

Restructuring and related costs |

— |

|

|

0.08 |

|

|

— |

|

|

0.18 |

|

|

Change in fair value of warrants |

0.02 |

|

|

— |

|

|

0.04 |

|

|

— |

|

|

Income tax effect of non-GAAP adjustments |

(0.10 |

) |

|

(0.11 |

) |

|

(0.20 |

) |

|

(0.07 |

) |

|

Add interest expense of convertible debt, net of tax |

0.03 |

|

|

0.02 |

|

|

0.04 |

|

|

0.04 |

|

| Non-GAAP adjusted diluted

earnings per share |

$ |

0.25 |

|

|

$ |

0.20 |

|

|

$ |

0.48 |

|

|

$ |

0.49 |

|

| |

|

RECONCILATIONS OF GAAP REPORTED TO NON-GAAP ADJUSTED

INFORMATION |

|

For the three months ended June 30, 2019 |

|

(in thousands) |

|

(unaudited) |

| |

| |

Commercializationagreementrevenues |

|

ProductSales |

|

Royaltiesandmilestones |

|

Cost ofsales |

|

Researchanddevelopmentexpense |

|

Selling,general andadministrativeexpense |

|

Amortization of intangible assets |

|

Interest expense |

|

Other(Expense)Income, Net |

|

Incometaxes(expense)benefit |

|

GAAP as reported |

$ |

31,003 |

|

|

$ |

25,937 |

|

|

$ |

263 |

|

|

$ |

2,124 |

|

|

$ |

1,263 |

|

|

$ |

24,755 |

|

|

$ |

25,443 |

|

|

$ |

(14,842 |

) |

|

$ |

(1,240 |

) |

|

$ |

(1,141 |

) |

|

Commercialization agreement revenues and cost of sales |

1,933 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

NUCYNTA sales reserve |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Non-cash interest expense on debt |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

6,056 |

|

|

— |

|

|

— |

|

|

NUCYNTA and Lazanda revenue reserves |

— |

|

|

145 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Expenses for opioid-related litigation, investigations and

regulations |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(2,350 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Intangible amortization related to product acquisitions |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(25,443 |

) |

|

— |

|

|

— |

|

|

— |

|

|

Contingent consideration related to product acquisitions |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

142 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Stock based compensation |

— |

|

|

— |

|

|

— |

|

|

(50 |

) |

|

(76 |

) |

|

(2,508 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Change in fair value of warrants |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1,848 |

|

|

— |

|

|

Other costs |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Income tax effect of non-GAAP adjustments |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(8,124 |

) |

| Non-GAAP adjusted |

$ |

32,936 |

|

|

$ |

26,082 |

|

|

$ |

263 |

|

|

$ |

2,074 |

|

|

$ |

1,187 |

|

|

$ |

20,039 |

|

|

$ |

— |

|

|

$ |

(8,786 |

) |

|

$ |

608 |

|

|

$ |

(9,265 |

) |

| |

|

RECONCILATIONS OF GAAP REPORTED TO NON-GAAP ADJUSTED

INFORMATION |

|

For the six months ended June 30, 2019 |

|

(in thousands) |

|

(unaudited) |

| |

| |

Commercialization agreementrevenues |

|

ProductSales |

|

Royaltiesandmilestones |

|

Cost ofsales |

|

Researchanddevelopmentexpense |

|

Selling,generaland administrativeexpense |

|

Amortization of intangible assets |

|

Interest expense |

|

Other(Expense)Income,Net |

|

Incometaxes(expense)benefit |

|

GAAP as reported |

$ |

61,859 |

|

|

$ |

52,387 |

|

|

$ |

886 |

|

|

$ |

4,699 |

|

|

$ |

3,056 |

|

|

$ |

49,800 |

|

|

$ |

50,887 |

|

|

$ |

(31,396 |

) |

|

$ |

(1,849 |

) |

|

$ |

(1,351 |

) |

|

Commercialization agreement revenues and cost of sales |

3,863 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Non-cash interest expense on debt |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

12,220 |

|

|

— |

|

|

— |

|

|

NUCYNTA and Lazanda revenue reserves |

— |

|

|

12 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Expenses for opioid-related litigation, investigations and

regulations |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(4,850 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Intangible amortization related to product acquisitions |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(50,887 |

) |

|

— |

|

|

— |

|

|

— |

|

|

Contingent consideration related to product acquisitions |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

142 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Stock based compensation |

— |

|

|

— |

|

|

— |

|

|

(50 |

) |

|

(349 |

) |

|

(4,937 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Change in fair value of warrants |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

3,477 |

|

|

— |

|

|

Other costs |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(332 |

) |

|

— |

|

|

Income tax effect of non-GAAP adjustments |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(16,163 |

) |

| Non-GAAP adjusted |

$ |

65,722 |

|

|

$ |

52,399 |

|

|

$ |

886 |

|

|

$ |

4,649 |

|

|

$ |

2,707 |

|

|

$ |

40,155 |

|

|

$ |

— |

|

|

$ |

(19,176 |

) |

|

$ |

1,296 |

|

|

$ |

(17,514 |

) |

| |

|

RECONCILATIONS OF GAAP REPORTED TO NON-GAAP ADJUSTED

INFORMATION |

|

For the three months ended June 30, 2018 |

|

(in thousands) |

|

(unaudited) |

| |

| |

Commercializationagreementrevenues |

|

ProductSales |

|

Royaltiesandmilestones |

|

Cost ofsales |

|

Researchanddevelopmentexpense |

|

Selling,generalandadministrativeexpense |

|

RestructuringCharges |

|

Amortizationofintangibleassets |

|

Interest expense |

|

Other (Expense) Income, Net |

|

Income taxes (expense) benefit |

|

GAAP as reported |

$ |

31,179 |

|

|

$ |

26,838 |

|

|

$ |

5,257 |

|

|

$ |

2,753 |

|

|

$ |

2,180 |

|

|

$ |

31,308 |

|

|

$ |

5,814 |

|

|

$ |

25,444 |

|

|

$ |

(17,010 |

) |

|

$ |

67 |

|

|

$ |

120 |

|

|

Commercialization agreement revenues and cost of sales |

3,198 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Non-cash interest expense on debt |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

5,390 |

|

|

— |

|

|

— |

|

|

NUCYNTA and Lazanda revenue reserves |

— |

|

|

(946 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Expenses for opioid-related litigation, investigations and

regulations |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(2,220 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Intangible amortization related to product acquisitions |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(25,444 |

) |

|

— |

|

|

— |

|

|

— |

|

|

Contingent consideration related to product acquisitions |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

260 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Stock based compensation |

— |

|

|

— |

|

|

— |

|

|

(16 |

) |

|

(14 |

) |

|

(2,940 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Restructuring and other costs |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

31 |

|

|

(6,974 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Income tax effect of non-GAAP adjustments |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(9,067 |

) |

| Non-GAAP adjusted |

$ |

34,377 |

|

|

$ |

25,892 |

|

|

$ |

5,257 |

|

|

$ |

2,737 |

|

|

$ |

2,166 |

|

|

$ |

26,439 |

|

|

$ |

(1,160 |

) |

|

$ |

— |

|

|

$ |

(11,620 |

) |

|

$ |

67 |

|

|

$ |

(8,947 |

) |

| |

|

RECONCILATIONS OF GAAP REPORTED TO NON-GAAP ADJUSTED

INFORMATION |

|

For the six months ended June 30, 2018 |

|

(in thousands) |

|

(unaudited) |

| |

| |

Commercializationagreementrevenues |

|

ProductSales |

|

Royaltiesandmilestones |

|

Cost ofsales |

|

Researchanddevelopmentexpense |

|

Selling,generalandadministrativeexpense |

|

RestructuringCharges |

|

Amortizationofintangibleassets |

|

Interestexpense |

|

Other(Expense)Income,Net |

|

Incometaxes(expense)benefit |

|

GAAP as reported |

114,979 |

|

|

71,192 |

|

|

5,507 |

|

|

14,797 |

|

|

3,708 |

|

|

60,341 |

|

|

14,831 |

|

|

50,888 |

|

|

(35,078 |

) |

|

296 |

|

|

445 |

|

|

Commercialization agreement revenues and cost of sales |

(49,288 |

) |

|

|

|

— |

|

|

(6,200 |

) |

|

— |

|

|

— |

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

NUCYNTA sales reserve |

— |

|

|

(10,711 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Non-cash interest expense on debt |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

10,808 |

|

|

— |

|

|

— |

|

|

NUCYNTA and Lazanda revenue reserves |

— |

|

|

(1,166 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Expenses for opioid-related litigation, investigations and

regulations |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(3,047 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Intangible amortization related to product acquisitions |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

(50,888 |

) |

|

— |

|

|

— |

|

|

— |

|

|

Contingent consideration related to product acquisitions |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

462 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Stock based compensation |

— |

|

|

— |

|

|

— |

|

|

(30 |

) |

|

(67 |

) |

|

(4,849 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Restructuring and other costs |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(178 |

) |

|

(15,304 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Income tax effect of non-GAAP adjustments |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(5,623 |

) |

| Non-GAAP adjusted |

65,691 |

|

|

59,315 |

|

|

5,507 |

|

|

8,567 |

|

|

3,641 |

|

|

52,729 |

|

|

(473 |

) |

|

— |

|

|

(24,270 |

) |

|

296 |

|

|

(5,178 |

) |

| |

|

SECOND-QUARTER RECONCILIATION OF GAAP to NON-GAAP

REVENUES |

|

(in thousands) |

|

(unaudited) |

| |

| |

Three Months

Ended June 30, |

|

Six Months

Ended June 30, |

| |

2019 |

|

2018 |

|

2019 |

|

2018(1) |

| Total

revenues (GAAP basis) |

$ |

57.2 |

|

|

$ |

63.3 |

|

|

$ |

115.1 |

|

|

$ |

191.7 |

|

|

Non-cash adjustment to commercialization agreement

revenues(2) |

2.1 |

|

|

2.2 |

|

|

3.9 |

|

|

(48.7 |

) |

|

Release of NUCYNTA sales reserves(3) |

— |

|

|

— |

|

|

— |

|

|

(12.5 |

) |

| Total revenues (non-GAAP basis) |

$ |

59.3 |

|

|

$ |

65.5 |

|

|

$ |

119.0 |

|

|

$ |

130.5 |

|

(1) Year-to-date 2018 total GAAP revenues include one-time items

described in our quarterly report on Form 10-Q for the six months

ended June 30, 2018.

(2) The adjustments for the three and six months ended June 30,

2019 relate to non-cash adjustments for third-party royalties,

which were a net expense but are expected to have no net impact for

the full year period, the amortization of the contract asset, and

the impact of revenue adjustment estimates related to products that

we are no longer commercializing. For the three months ended

June 30, 2018 the adjustment relates to non-cash adjustments

for third party royalties and for the six months ended June 30,

2018 the adjustment relates primarily to the non-cash value

assigned to inventory transferred to Collegium.

(3) Represents a $12.5 million benefit related to the release of

sales reserves for which the Company is no longer financially

responsible.

|

|

|

FULL-YEAR 2019 NON-GAAP GUIDANCE

RECONCILATION |

|

(in millions) |

|

(unaudited) |

| |

| |

Earnings (1) |

| |

Low End |

High End |

|

GAAP |

$ |

(68 |

) |

|

$ |

(58 |

) |

| Specified

Items(2) |

$ |

186 |

|

|

$ |

186 |

|

| Non-GAAP |

$ |

118 |

|

|

$ |

128 |

|

| |

|

|

|

|

|

|

|

(1) GAAP net income guidance refers to GAAP net income and

non-GAAP earnings guidance refers to non-GAAP adjusted EBITDA.

(2) For purposes of this forward-looking reconciliation, a

description of the categories of specified items included in this

reconciliation are detailed in the tables above.

SENIOR SECURED NOTE COVENANT

DISCLOSURES

The Company was in compliance with its covenants, including the

Senior Secured Debt Leverage Ratio and Net Sales covenants, with

respect to the Company’s senior secured notes as of June 30,

2019. Set forth below are additional disclosures that the

Company is required to make in connection with the senior secured

notes.

RECONCILIATION OF GAAP NET INCOME (LOSS)

TO NON-GAAP ADJUSTED EBITDAFor the Rolling Twelve

Month Period Ended June 30, 2019(in

thousands)(unaudited)

The below reconciliation is presented to disclose the

calculation of Adjusted EBITDA (as defined in our senior secured

notes) on a rolling 12 month basis to support covenant compliance

in connection with our senior secured notes.

| |

Twelve Month Period |

| |

Ended June 30, 2019 |

|

|

(unaudited) |

|

GAAP net (loss)/income |

$ |

(3,774 |

) |

|

Commercialization agreement revenues (1) |

27,987 |

|

|

Nucynta and Lazanda revenue reserves (2) |

(384 |

) |

|

Expenses for opioid-related litigation, investigations and

regulations (3) |

9,700 |

|

|

Intangible amortization related to product acquisitions |

101,773 |

|

|

Contingent consideration related to product acquisitions |

(195 |

) |

|

Stock-based compensation |

10,829 |

|

|

Purdue Litigation |

(62,000 |

) |

|

Interest and other income |

(1,706 |

) |

|

Interest expense |

65,199 |

|

|

Depreciation |

(382 |

) |

|

Income taxes (expense) benefit |

2,863 |

|

|

Restructuring and related costs (4) |

5,965 |

|

|

Other costs |

(55 |

) |

|

Fair value for warrants |

3,477 |

|

| Adjusted EBITDA |

$ |

159,297 |

|

(1) The adjustment for the twelve months ended June 30,

2019 relates to non-cash expense for third-party royalties, which

are expected to have no net impact for the full year period, as

well as the amortization of the contract asset.

(2) Removal of the impact of revenue adjustment estimates

related to products that we are no longer commercializing.

(3) Legal costs/expenses related to opioid-related litigation,

investigations and regulations pertaining to the Company’s

historical commercialization of opioid products.

(4) Restructuring and other costs represents non-recurring costs

associated with the Company’s restructuring, reincorporation,

headquarters relocation and CEO transition.

Additional Covenant Disclosures

Long-acting cosyntropin has not yet been launched for commercial

sale and therefore no revenue in respect of this product was

recognized by the Company as of June 30, 2019.

During the rolling twelve month period ended June 30, 2019,

the Company collected $128.2 million in cash receipts, net of cash

payments made, in connection with the Company’s Commercialization

Agreement with Collegium.

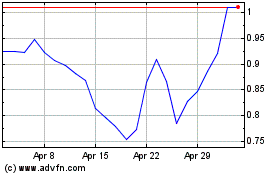

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From Apr 2023 to Apr 2024