The accompanying notes are an integral part of these financial statements

AMERISERV FINANCIAL 401(k) PROFIT SHARING PLAN

NOTES TO FINANCIAL STATEMENTS

NOTE 1 - DESCRIPTION OF PLAN

The following brief description of the Ameriserv Financial 401(k) Profit Sharing Plan (the “Plan”) is provided for general information purposes only. Participants should refer to the Plan Document for a more comprehensive description of the Plan’s provisions.

General

The Plan is a defined contribution plan covering the employees of Ameriserv Financial, Inc., and its wholly owned subsidiaries Ameriserv Financial Bank, and Ameriserv Trust and Financial Services, (the “Companies”), including members of the United Steelworkers of America, AFL-CIO-CLC, Local Union 2635-06 (the “Union”). Following the amendment to close the Ameriserv Financial Inc. defined benefit pension plan to employees hired after December 31, 2012, the Plan was amended, effective January 1, 2013. Union and non-union employees hired prior to January 1, 2013, who have attained the age of 21 and the earlier of completion of 12 consecutive months of service with at least 500 hours of service are eligible to participate, but are not eligible to receive an employer discretionary contribution until achieving 1,000 hours of service. Union and non-union employees hired and rehired after December 31, 2012, are eligible to participate upon the completion of one hour of service. The Plan includes a 401(k) before-tax savings feature, which permits participants to defer compensation under Section 401(k) of the Internal Revenue Code. It is subject to the provisions of the Employee Retirement Income Security Act of 1974 (ERISA), as amended. The Plan is not covered by the Pension Benefit Guaranty Corporation.

Investments

The Administrative Employee Committee for Retirement Plans (the “Committee”) of AmeriServ Financial Bank (the “Company”) has the responsibility to administer the AmeriServ Financial 401(k) Profit Sharing Plan. The Committee has the authority and responsibility to prudently and diligently select mutual funds or other investment vehicles for participant investment direction in the Plan. The Committee currently delegates this responsibility to AmeriServ Trust and Financial Services to assist the Committee in fulfilling its fiduciary obligations in the administration of the Plan investments.

Contributions

All eligible employees may elect to contribute, through the 401(k) feature, 1 percent to 100 percent of their base salaries each period to the maximum amount permitted by the Internal Revenue Code. On January 1, 2018 the plan was amended to allow Roth deferrals as an additional employee contribution option to all employees. Non-union employees hired or rehired after December 31, 2012, will be provided an employer matching contribution equal to 50% of the first 6% of deferred compensation in addition to a nonelective contribution of 4% of their base pay plus commissions. For non-union employees hired before December 31, 2012 the match is 50% of the first 2% of pretax 401(k) contributions with no nonelective contributions. Fulltime salaried union employees hired after December 31, 2013 receive a dollar for dollar match up to 4% plus a nonelective contribution of 4% of their total eligible compensation. All other eligible union employees will receive a nonelective contribution of 4% based on their total eligible compensation. Employees may elect to have their contributions, in 5% increments, invested in one or more of 39 mutual funds, 11 common/collective portfolios, 2 money market/cash equivalent funds, and the Ameriserv Financial, Inc. common or preferred stock administered by the Plan’s trustee. The diversified mutual fund investment options include bond and government securities funds and various U.S. and foreign stock funds. Additionally, participants can elect to have a portion of their portfolio invested in annuity insurance contracts, which are restricted based on age and minimum investment thresholds.

NOTE 1 - DESCRIPTION OF PLAN (continued)

The Companies have the right to make other discretionary contributions to the Plan. Any contribution to be made will be on an annual basis, and such contribution is allocated as a percentage of compensation of eligible participants for the year. Participants who have attained age 50 before the end of the plan year are eligible to make catch-up contributions. Participants may also contribute amounts representing distributions from other qualified defined benefit or defined contribution plans.

Participant Accounts

Each participant’s account is credited with the participant’s contribution and allocation of the company’s contribution (if applicable) plus Plan earnings. Allocations are based on participant earnings or account balances, as defined. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested balance.

Vesting

Participants are immediately vested in their voluntary contributions plus actual earnings thereon. Vesting in the Companies’ contributions in the Plan is based on completion of credited service years. A credited service year is considered one in which the participant completed at least 1,000 hours of service. Employees become 100 percent vested after three years of credited service.

Notes Receivable from Participants

Participants may borrow from their fund accounts a minimum of $1,000 up to a maximum equal to the lesser of $50,000 or 50% of their account balance. The loans are secured by the balance in the participant’s account and bear interest rates that are commensurate with the five year AmeriServ Financial published home equity rate on the day the loan is requested. Principal and interest is paid ratably through bi-weekly payroll deductions. Interest rates on the notes receivable ranged from 2.41% to 7.25%, while the maturity dates ranged from March 16, 2020 to December 31, 2024.

Payment of Benefits

On termination of service, a participant may receive a lump sum amount equal to the vested value of his or her account or elect to defer payment until a later date. The Plan also provides for normal retirement benefits to be paid in the form of a lump sum upon reaching age 65 or termination of employment and has provisions for deferred, death, disability and retirement benefits, and hardship withdrawals.

Forfeitures

Upon termination of employment of a member who was not fully vested in his or her Employer Account, the non-vested portion shall be forfeited in the plan year of their termination and such forfeitures shall be used in the year of forfeiture as described herein. Any amounts forfeited shall be applied to restore the member’s forfeitures if, he is reemployed by the Employer or an Affiliated Employer before he has a period of Break in Service of five years and then, if available, used to pay reasonable administrative expenses of the Plan. Participant forfeitures totaled $10,510 and $4,390 during the years ended December 31, 2019 and 2018, respectively. Forfeiture balances totaling $4,402 for the year ended December 31, 2018, which included $4,390 in forfeitures and $12 in income, were used to offset administrative expenses in 2019. Forfeiture balances totaling $10,510 for the year ended December 31, 2019 was used to pay administrative expenses of the Plan in 2020.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting

The financial statements of the Plan are prepared on the accrual basis of accounting.

Accounting Estimates

The financial statements have been prepared in conformity with U.S. generally accepted accounting principles. In preparing the financial statements, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes therein and disclosures of contingent assets and liabilities. Actual results could differ from those estimates.

Valuation of Investments and Income Recognition

Investments are reported at fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The Plan’s Pension Committee determines the Plan’s valuation policies utilizing information provided by investment advisors, custodians, and insurance company. See Note 7 for discussion of Fair Value Measurements.

Purchase and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. Net appreciation (depreciation) includes the plan’s gains and losses on investments bought and sold as well as held during the year.

Notes Receivable from Participants

Notes receivable from participants are measured at their unpaid principal balance plus any accrued interest. Interest income is recorded on the accrual basis. Delinquent participant loans are reclassified as distributions based upon the terms of the plan document. No allowance for credit losses has been recorded as of December 31, 2019 or 2018. If a participant ceases to make loan repayments and the plan administrator deems the participant loan to be in default, the participant loan balance is reduced and a benefit payment is recorded.

Payment of Benefits

Benefit payments to participants are recorded upon distribution.

Excess Contributions Payable

Amounts payable to participants for contributions in excess of amounts allowed by the IRS are recorded as a liability with a corresponding reduction to contributions. There were no excess contributions payable as of December 31, 2019 and December 31, 2018.

Administrative Expenses

Certain administrative functions are performed by officers and employees of the Companies. No such officer or employee receives compensation from the Plan. Certain other administrative expenses are paid directly by the Companies. Such costs amounted to $120,058 and $127,030 for the years ended December 31, 2019 and 2018, respectively.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Reclassification of Comparative Amounts

Certain comparative amounts for the prior year have been reclassified to conform to current-year classifications. Such classifications did not affect the net increase in plan assets or net assets available for benefits.

NOTE 3 – NEW ACCOUNTING PRONOUNCEMENT

In February 2017, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2017-06, “Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965) Employee Benefit Plan Master Trust Reporting.” This update clarifies presentation requirements and provides more detailed disclosures for a plan’s interest in a Master Trust. The Plan adopted the provisions of this ASU during 2019 and the adoption did not have a material effect on the Plan's financial statements.

NOTE 4 - PLAN TERMINATION

Although it has not expressed any intent to do so, the Companies have the right, under the Plan, to discontinue their contributions at any time and to terminate the Plan subject to the provisions of ERISA. In the event of termination of the Plan, participants will become 100 percent vested in their accounts.

NOTE 5 - TAX STATUS

The Internal Revenue Service has determined and informed the Companies that the Plan is designed in accordance with applicable sections of the Internal Revenue Code (IRC) by letter dated March 9, 2017. The plan has been amended since receiving the opinion letter, the prototype sponsor and the Plan administrator believe that the Plan is designed and is currently being operated in compliance with the applicable requirements of the IRC. The plan administrator has analyzed the tax positions taken by the plan, and has concluded that as of December 31, 2019, there are no uncertain positions taken or expected to be taken that would require recognition of a liability or disclosure in the financial statements. The plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The Plan Administrator believes it is no longer subject to income tax examinations for years prior to 2016.

NOTE 6 – PARTY-IN-INTEREST TRANSACTIONS

Certain Plan investments are shares of common/collective funds that are managed by the Trustee of the Plan. The balance of these funds is $18,150,874 and $16,388,272 representing 50% and 52% of net assets available for benefits as of December 31, 2019 and 2018, respectively. These managed common/collective funds do not include the publicly traded Federated Capital Preservations Fund as a party-in-interest fund. The Plan also invests in the Plan Sponsor’s common and preferred stock. At December 31, 2019 and 2018, the Plan held 117,091 and 144,438 shares of AmeriServ Financial, Inc. common stock and 15,666 and 21,154 shares of AmeriServ Financial Capital Trust preferred stock respectively. Dividends in the amount of $11,533 and $8,101 were received on common stock for the years ended December 31, 2019 and 2018, respectively. In addition, dividends in the amount of $38,827 and $46,975 were received on preferred stock for the years ended December 31, 2019 and 2018, respectively. These transactions qualify as related party transactions. All other transactions which may be considered parties-in-interest transactions relate to normal Plan management and administrative services and related payment of administrative expenses as discussed in Note 2.

NOTE 7 - FAIR VALUE MEASUREMENTS

The Plan provides enhanced disclosures about assets and liabilities carried at fair value. Disclosures follow a hierarchal framework that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities and lowest priority to unobservable inputs. The three levels of the fair value hierarchy are described below:

Level I:

Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets that the Plan has the ability to access.

Level II:

Inputs to the valuation methodology include quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in inactive markets; inputs other than quoted prices that are observable for the asset or liability; inputs that are derived principally from or corroborated by observable market data by correlation or other means. If the asset or liability has a specified (contractual) term, the Level II input must be observable for substantially the full term of the asset or liability.

Level III:

Inputs to the valuation methodology are unobservable and significant to the fair value measurement.

The asset’s or liability’s fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs.

The following is a description of the valuation methodologies used for assets measured at fair value. There have been no changes in the methodologies used for the years ending December 31, 2019 and 2018.

Common and preferred stocks: Valued at the closing price reported on the active market on which the individual securities are traded.

Mutual funds: Valued at the daily closing price as reported by the fund. Mutual funds held by the Plan are open-end mutual funds that are registered with the Securities and Exchange Commission. These funds are required to publish their daily net asset value (NAV) and to transact at that price. The mutual funds held by the Plan are deemed to be actively traded.

Common/Collective Trusts: Valued at the NAV of shares held by the plan at year end adjusted for any cash held for liquidity purposes and any fees imposed by the fund. The net asset value per unit is determined by dividing the net assets by the number of units outstanding on the day of valuation. In accordance with the terms of the Plan of Trust, the net asset value of the fund is determined daily. Units are issued and redeemed daily, at the daily net asset value. Also the net investment income and realized and unrealized gains on investments are not distributed.

Money Market: These investments attempt to stabilize (NAV of its shares at $1.00) by valuing their portfolio securities using the amortized cost method. A market-based NAV per share is calculated on a periodic basis. The issuers do not guarantee that the NAV will always remain at $1.00 per share. Shares can be redeemed on a same day basis but only directly from the issuer.

NOTE 7 - FAIR VALUE MEASUREMENTS (continued)

The methods described above may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

The following tables sets forth by level, within the fair value hierarchy, the Plan’s assets at fair value as of December 31, 2019 and 2018:

NOTE 7 – FAIR VALUE MEASUREMENTS (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2018

|

|

Level I

|

|

|

Level II

|

|

|

Level III

|

|

|

Total

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mutual Funds

|

|

|

$

|

9,432,392

|

|

|

$ -

|

|

|

$ -

|

|

$

|

9,432,392

|

|

Common Stock Of

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AmeriServ Financial, Inc.

|

|

|

582,085

|

|

|

-

|

|

|

-

|

|

|

582,085

|

|

Preferred Stock Of

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AmeriServ Financial Capital Trust

|

|

|

644,562

|

|

|

-

|

|

|

-

|

|

|

644,562

|

|

Money Market Funds/Cash

Equivalents

|

|

|

1,589,574

|

|

|

-

|

|

|

-

|

|

|

1,589,574

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets In The Fair Value

Hierarchy

|

|

|

12,248,613

|

|

|

-

|

|

|

-

|

|

|

12,248,613

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments Measured At Net

Asset Value (a)

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

17,617,309

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments, at fair value

|

|

$

|

12,248,613

|

|

$

|

-

|

|

$

|

-

|

|

$

|

29,865,922

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Investments that were measured at net asset value per share (or its equivalent) have not been classified in the fair value hierarchy. These amounts are being presented in the tables above to permit reconciliation of the fair value hierarchy to the amounts presented in the statement of net assets available for benefits.

Investments measured at net asset value per share and excluded from the fair value hierarchy include common/collective funds in the amounts of $19,427,922 and $17,617,309 at December 31, 2019 and 2018, respectively. The fair value of these investments is measured using the net asset value per share practical expedient. These investments can be redeemed for general purposes daily and without any restrictions on the timing of the redemption. There are no unfunded commitments associated with these investments. The primary investment objective of these common/collective funds is to either provide capital appreciation and income, capital appreciation and total return or income while minimizing principal volatility. Included in the common/collective funds at December 31, 2019 and 2018 were $1,277,048 and $1,229,037 respectively, of investments in the Federated Capital Preservation Fund. Plan level initiated redemption transactions within this fund require a twelve month redemption notice in order to withdraw at full book value. Plan level initiated transactions with less than a twelve month redemption notice may incur an adjustment to book value.

NOTE 8 - FAIR VALUE OF FINANCIAL INSTRUMENTS

Financial instruments are defined as cash, evidence of ownership interest in an entity, or a contract which creates an obligation or right to receive or deliver cash or another financial instrument from/to a second entity on potentially favorable or unfavorable terms. Fair value is defined as the amount at which a financial instrument could be exchanged in a current transaction between willing parties other than in a forced liquidation or sale. If a quoted market price is available for a financial instrument, the estimated fair value would be calculated based upon the market price per trading unit of the instrument.

Investments in mutual funds, money market funds, annuities, notes receivable from participants, common/collective funds, AmeriServ Financial, Inc. common stock and AmeriServ Financial Capital Trust preferred stock, contributions receivable, accrued interest receivable, cash and cash equivalents and excess contributions payable would be considered financial instruments. At December 31, 2019 and 2018, the carrying amounts of these financial instruments approximate fair value.

NOTE 9 – RISKS AND UNCERTAINTIES

The Plan invests in various investment securities. Investment securities are exposed to various risks such as interest rate, market, and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the Statement of Net Assets Available for Benefits.

NOTE 10– FULLY BENEFIT-RESPONSIVE INVESTMENT CONTRACT

The plan allows for participants to invest in individual fully benefit-responsive investment contracts with a variety of insurance companies. The guaranteed investment contract issuers are contractually obligated to repay the principal and a specified interest rate that is guaranteed to the Plan. The crediting rate is based on a formula established by the contract issuer and generally has a minimum and a maximum rate. The guaranteed investment contract does not permit the insurance company to terminate the agreement prior to the scheduled maturity date.

Management believes that these contracts meet the fully benefit-responsive investment contract criteria and therefore are reported at contract value. Contract value is the relevant measure for fully benefit-responsive investment contracts because this is the amount received by participants if they were to initiate permitted transactions under the terms of the Plan. Contract value represents contributions made under the contract, plus earnings, less participant withdrawals, and administrative expenses. Participants may ordinarily direct the withdrawal or transfer of all or a portion of their investment at contract value.

The Plan's ability to receive amounts due is dependent on the issuer's ability to meet its financial obligations. The issuer's ability to meet its contractual obligations may be affected by future economic and regulatory developments.

Certain events might limit the ability of the Plan to transact at contract value with the issuer. Such events include (1) amendments to the Plan documents (including complete or partial Plan termination or merger with another plan), (2) changes to the Plan's prohibition on competing investment options or deletion of equity wash provisions, (3) bankruptcy of the Plan sponsor or other Plan sponsor events (for example, divestitures or spin-offs of a subsidiary) that cause a significant withdrawal from the Plan, (4) the failure of the trust to qualify

NOTE 10 – FULLY BENEFIT-RESPONSIVE INVESTMENT CONTRACT (continued)

for exemption from federal income taxes or any required prohibited transaction exemption under ERISA, or (5) premature termination of the contract. No events are probable of occurring that might limit the ability of the Plan to transact at contract value with the contract issuers and that also would limit the ability of the plan to transact at contract value with the participants.

In addition, certain events allow the issuer to terminate the contract with the Plan and settle at an amount different from contract value. Such events include (1) an uncured violation of the Plan's investment guidelines, (2) a breach of material obligation under the contract, (3) a material misrepresentation, (4) a material amendment to the agreement without the consent of the issuer.

NOTE 11 – SUBSEQUENT EVENTS

On March 11, 2020, the World Health Organization declared the outbreak of COVID-19 as a pandemic. The rapidly developing pandemic has generated significant uncertainty in the global economy and volatility in financial markets. The COVID-19 pandemic has affected and may continue to affect the market price of AmeriServ Financial Inc. common stock and other Plan assets. Due to the ongoing economic uncertainty and volatility caused by COVID-19, the resulting financial impact to the Plan cannot be reasonably estimated.

Following this declaration, the U.S. Federal government passed the “Coronavirus Aid, Relief, and Economic Security (CARES) Act” on March 27, 2020. The CARES Act allows eligible plan participants to request penalty-free distributions of up to $100,000 before December 31, 2020 for qualifying reasons associated with the COVID-19 pandemic, permits increasing the limit for plan loans, permits suspension of loan payments due for up to one year, and permits individuals to stop receiving 2020 required minimum distributions. The Plan has implemented these changes.

|

|

|

|

|

|

|

|

|

|

AMERISERV FINANCIAL 401(k) PROFIT SHARING PLAN

|

|

SCHEDULE H, LINE 4i - SCHEDULE OF ASSETS (HELD AT END OF YEAR)

|

|

EMPLOYER IDENTIFICATION NUMBER 25-0851535

|

|

PLAN NUMBER – 002

|

|

DECEMBER 31, 2019

|

|

|

|

|

|

|

|

|

|

(a)

|

(b) Identity of issue, borrower, lessor,

|

(c) Description of investment

|

|

(d) Cost

|

|

(e) Current

|

|

|

or similar party

|

including maturity date,

|

|

|

|

Value

|

|

|

|

rate of interest, collateral,

|

|

|

|

|

|

|

|

|

par or maturity value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

|

|

|

|

|

*

|

AmeriServ Financial, Inc.

|

AmeriServ Financial, Inc.

|

|

N/R

|

$

|

491,782

|

|

|

|

|

|

|

|

|

|

|

Total Common Stock

|

|

|

|

|

491,782

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock

|

|

|

|

|

|

|

*

|

AmeriServ Financial, Inc.

|

AmeriServ Financial Capital Trust

|

N/R

|

|

426,106

|

|

|

|

|

|

|

|

|

|

|

Total Preferred Stock

|

|

|

|

|

426,106

|

|

|

|

|

|

|

|

|

|

|

Mutual Funds

|

|

|

|

|

Oppenheimer

|

Int. Small Mid

|

|

N/R

|

|

259,259

|

|

|

Calvert

|

Calvert Social Equity

|

|

N/R

|

|

210,513

|

|

|

Blackrock

|

Blackrock Mid cap

|

|

N/R

|

|

80,101

|

|

|

Dodge & Cox

|

Balanced Fund

|

|

N/R

|

|

167,152

|

|

|

Federated

|

Inst’l High-Yield Bond Fd

|

|

N/R

|

|

48,462

|

|

|

Fidelity

|

Intl Small Cap Opp Fd

|

|

N/R

|

|

239

|

|

|

Fidelity

|

Sel Softward & Comp #28

|

|

N/R

|

|

557,733

|

|

|

Fidelity

|

Low-Priced Stock Fund

|

|

N/R

|

|

580,054

|

|

|

Fidelity

|

Add Growth- Oppz

|

|

N/R

|

|

383,923

|

|

|

John Hancock III

|

Disc Value Mid Cap

|

|

N/R

|

|

60,533

|

|

|

Loomis Sayles

|

Bond Fund

|

|

N/R

|

|

59,551

|

|

|

Natixis Loomis Sayles

|

Limited Term

|

|

N/R

|

|

166,065

|

|

|

Oakmark

|

Investor Fund

|

|

N/R

|

|

492,768

|

|

|

Oakmark

|

International Fund

|

|

N/R

|

|

163,915

|

|

|

Oppenheimer

|

Global Opp - I

|

|

N/R

|

|

171,523

|

|

|

Pimco

|

GNMA Fund – Inst

|

|

N/R

|

|

72,564

|

|

|

Pimco

|

Income Instl Fd #1821

|

|

N/R

|

|

113,861

|

|

|

Pimco

|

Total Return Fund #35

|

|

N/R

|

|

116,507

|

|

|

Primecap

|

Odyssey Aggr Grwth Fd

|

|

N/R

|

|

1,313,770

|

|

|

T. Rowe Price

|

Capital Appreciation

|

|

N/R

|

|

2,049,284

|

|

|

T. Rowe Price

|

Financial Services

|

|

N/R

|

|

133,965

|

|

|

T. Rowe Price

|

Health Sciences Fd #114

|

|

N/R

|

|

832,188

|

|

|

T. Rowe Price

|

Retire 2020

|

|

N/R

|

|

62,220

|

|

|

T. Rowe Price

|

Retire 2030

|

|

N/R

|

|

123,999

|

|

|

T. Rowe Price

|

Retire 2035

|

|

N/R

|

|

248,663

|

|

|

T. Rowe Price

|

Retire 2040

|

|

N/R

|

|

158,685

|

|

|

T. Rowe Price

|

Retire 2045

|

|

N/R

|

|

64,776

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE H, LINE 4i - SCHEDULE OF ASSETS (HELD AT END OF YEAR)

|

|

EMPLOYER IDENTIFICATION NUMBER 25-0851535

|

|

PLAN NUMBER – 002

|

|

DECEMBER 31, 2019 (continued)

|

|

|

|

|

|

|

|

|

|

(a)

|

(b) Identity of issue, borrower, lessor,

|

(c) Description of investment

|

|

(d) Cost

|

|

(e) Current

|

|

|

or similar party

|

including maturity date,

|

|

|

|

Value

|

|

|

|

rate of interest, collateral,

|

|

|

|

|

|

|

|

|

par or maturity value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

Retire 2050

|

|

N/R

|

|

21,384

|

|

|

T. Rowe Price

|

Retire 2055

|

|

N/R

|

|

2,935

|

|

|

T. Rowe Price

|

Retire 2060

|

|

N/R

|

|

15,646

|

|

|

T. Rowe Price

|

Intl Discovery - I

|

|

N/R

|

|

8,972

|

|

|

TIAA Cref

|

Real Estate Securities Fd

|

|

N/R

|

|

115,770

|

|

|

Vanguard

|

Equity Income

|

|

N/R

|

|

352,998

|

|

|

Vanguard

|

Small Cap Index-Sig

|

|

N/R

|

|

108,386

|

|

|

Vanguard

|

Institutional Index

|

|

N/R

|

|

2,576,124

|

|

|

Vanguard

|

Mid Cap

|

|

N/R

|

|

123,279

|

|

|

Vanguard

|

Total Bond Market Index

|

|

N/R

|

|

86,741

|

|

|

Vanguard

|

Emerging Markets Index

|

|

N/R

|

|

59,576

|

|

|

Virtus Kar

|

Sm Cap Growth

|

|

N/R

|

|

340,839

|

|

|

|

|

|

|

|

|

|

Total Mutual Funds

|

|

|

|

|

12,504,923

|

|

|

|

|

|

|

|

|

|

|

Common / Collective Funds

|

|

|

|

|

|

|

*

|

Pathroad Tactical Balance Growth & Income

|

|

N/R

|

|

6,849,052

|

|

*

|

Pathroad Tactical Capital Appreciation & Income

|

|

N/R

|

|

6,196,720

|

|

*

|

Pathroad Conservative Fixed Income

|

|

N/R

|

|

95,383

|

|

*

|

Pathroad Tactical Conservative Growth & Income

|

|

N/R

|

|

1,320,706

|

|

*

|

Pathroad Tactical Intermediate-Term Fixed Income

|

|

N/R

|

|

179,685

|

|

*

|

Pathroad Tactical Long-Term Equity

|

|

N/R

|

|

2,766,927

|

|

*

|

Pathroad Strategic Balanced Growth & Income

|

|

N/R

|

|

70,209

|

|

*

|

Pathroad Strategic Conservative Growth & Income

|

|

N/R

|

|

553,427

|

|

*

|

Pathroad Strategic Capital Appreciation & Income

|

|

N/R

|

|

4,515

|

|

*

|

Pathroad Strategic Long-Term Equity

|

|

N/R

|

|

114,250

|

|

|

Federated Capital Preservation

|

|

N/R

|

|

1,277,048

|

|

|

|

|

|

|

|

|

|

|

Total Common/Collective Funds

|

|

|

|

19,427,922

|

|

|

|

|

|

|

|

|

|

|

Money Market Funds

|

|

|

|

|

|

|

Goldman Sachs Financial Square Gov’t Fund

|

|

N/R

|

|

1,886,880

|

|

|

Goldman Sachs Financial Treasury Obligations

|

|

N/R

|

|

472,302

|

|

|

|

|

|

|

|

|

|

|

Total Money Market Funds

|

|

|

2,359,182

|

|

|

Annuity Insurance Contracts

|

N/R

|

|

800,371

|

|

|

|

|

|

|

* Participant Loans

|

|

|

-

|

|

565,829

|

|

|

|

Interest rates ranging from 2.41% to 7.25%

Maturity dates ranging from 3/16/20 to 12/31/2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

* Party-in-Interest

|

|

|

$ 36,576,115

|

|

|

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Trustees of the AmeriServ Financial 401(k) Profit Sharing Plan have duly caused this annual report to be signed on its behalf by the undersigned thereunto duly authorized.

Dated: June 26, 2020

Ameriserv Financial 401(k) Profit Sharing Plan

AmeriServ Trust and Financial Services Company, as Trustee

By

/s/ Kathleen Wallace

Kathleen Wallace, Senior Vice President

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Trustees of AmeriServ Financial 401(k) Profit Sharing Plan

Johnstown, Pennsylvania

We consent to the incorporation by reference in the Registration Statement Nos. 333-67600 and 333-176869 on Forms S-8 of AmeriServ Financial, Inc. of our report dated June 26, 2020, relating to our audits of the financial statements and supplemental schedule, which appears in this Annual Report on Form 11-K of the AmeriServ Financial 401(k) Profit Sharing Plan for the year ended December 31, 2019.

/s/ S.R. Snodgrass, P.C.

Cranberry Township, Pennsylvania

June 26, 2020

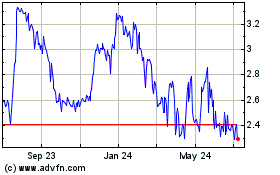

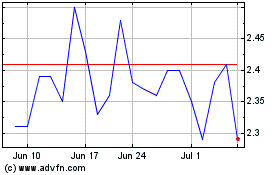

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Aug 2024 to Sep 2024

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Sep 2023 to Sep 2024