U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

July 2020

Commission file number: 001-36288

Akari Therapeutics, Plc

(Translation of registrant's name into English)

75/76 Wimpole Street

London W1G 9RT

United Kingdom

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form

40-F ¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulations S-T Rule 101(b)(1):_____

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulations S-T Rule 101(b)(7):_____

CONTENTS

Purchase Agreement and Registration Rights Agreement with

Aspire Capital

On June 30, 2020, Akari

Therapeutics, Plc, a public limited company incorporated under the laws of England and Wales (the “Company”), entered

into a securities purchase agreement (the “Purchase Agreement”) with Aspire Capital Fund, LLC, an Illinois limited

liability company (“Aspire Capital”), which provides that, upon the terms and subject to the conditions and limitations

set forth therein, Aspire Capital is committed to purchase up to an aggregate of $30.0 million of the Company’s American

Depositary Shares (each American Depositary Share, an “ADS”), with each ADS representing one hundred (100) ordinary

shares of the Company, par value £0.01 per share (“Ordinary Shares”), during a 30-month period. Concurrently with entering into the Purchase Agreement,

the Company also entered into a registration rights agreement with Aspire Capital (the “Registration Rights Agreement”),

in which the Company agreed to file one or more registration statements, as permissible and necessary to register under the Securities

Act of 1933, as amended (the “Securities Act”), the sale of the Company’s securities that have been and may be

issued to Aspire Capital under the Purchase Agreement.

Under the Purchase

agreement, after the Securities and Exchange Commission (the “SEC”) has declared effective the registration statement

referred to above, on any trading day selected by the Company, the Company has the right, in its sole discretion, to present Aspire

Capital with a purchase notice (each, a “Purchase Notice”), directing Aspire Capital (as principal) to purchase up

to 150,000 ADSs per business day and up to $30.0 million of the Company’s ADSs in the aggregate at a per share price (the

“Purchase Price”) equal to the lesser of:

|

|

·

|

the lowest sale price of the Company’s ADSs on the purchase date; or

|

|

|

·

|

the arithmetic average of the three (3) lowest closing sale prices for the ADSs during the ten (10) consecutive business days ending on the business day immediately preceding such Purchase Date (to be appropriately adjusted for any reorganization, recapitalization, non-cash dividend, stock split, reverse stock split or other similar transaction).

|

In addition, on any

date on which the Company submits a Purchase Notice to Aspire Capital in an amount of 150,000 ADSs, the Company also has the right,

in its sole discretion, to present Aspire Capital with a volume-weighted average price purchase notice (each, a “VWAP Purchase

Notice”) directing Aspire Capital to purchase an amount of ADSs equal to up to 30% of the aggregate shares of the Company’s

ADSs traded on its principal market on the next trading day (the “VWAP Purchase Date”), subject to a maximum number

of 250,000 ADSs. The purchase price per share pursuant to such VWAP Purchase Notice is generally 97% of the volume-weighted average

price for the Company’s ADSs traded on its principal market on the VWAP Purchase Date.

The Purchase Price

will be adjusted for any reorganization, recapitalization, non-cash dividend, stock split, or other similar transaction occurring

during the period(s) used to compute the Purchase Price. The Company may deliver multiple Purchase Notices and VWAP Purchase Notices

to Aspire Capital from time to time during the term of the Purchase Agreement, so long as the most recent purchase has been completed.

The Purchase Agreement

provides that the Company and Aspire Capital shall not effect any sales under the Purchase Agreement on any purchase date where

the closing sale price of the Company’s ADSs is less than $0.25. There are no trading volume requirements or restrictions

under the Purchase Agreement, and the Company will control the timing and amount of sales of the Company’s ADSs to Aspire

Capital. Aspire Capital has no right to require any sales by the Company, but is obligated to make purchases from the Company as

directed by the Company in accordance with the Purchase Agreement. There are no limitations on use of proceeds, financial or business

covenants, restrictions on future fundings, rights of first refusal, participation rights, penalties or liquidated damages in the

Purchase Agreement. In consideration for entering into the Purchase Agreement, concurrently with the execution of the Purchase

Agreement, the Company issued to Aspire Capital 40,760,900 Ordinary Shares of the Company (the “Commitment Shares”).

The Purchase Agreement may be terminated by the Company at any time, at its discretion, without any cost to the Company. Aspire

Capital has agreed that neither it nor any of its agents, representatives and affiliates shall engage in any direct or indirect

short-selling or hedging of the Company’s securities during any time prior to the termination of the Purchase Agreement.

Any proceeds from the Company receives under the Purchase Agreement are expected to be used for working capital and general corporate

purposes.

The Commitment Shares

were offered and sold in transactions exempt from registration under the Securities Act, in reliance on Section 4(a)(2) thereof

and Rule 506 of Regulation D thereunder. Aspire Capital represented that it was an “accredited investor,” as defined

in Regulation D, and was acquiring the Commitment Shares for investment only and not with a view towards, or for resale in connection

with, the public sale or distribution thereof. Accordingly, the Commitment Shares have not been registered under the Securities

Act and the Commitment Shares may not be offered or sold in the United States absent registration or an exemption from registration

under the Securities Act and any applicable state securities laws. Neither this Report on Form 6-K nor the exhibits attached hereto

is an offer to sell or the solicitation of an offer to buy ordinary shares or ADSs of the Company or any other securities of the

Company.

The foregoing is a

summary description of certain terms of the Purchase Agreement and the Registration Rights Agreement and, by its nature, is incomplete,

and is qualified in its entirety by reference to the copies of the Purchase Agreement and Registration Rights Agreement filed herewith

as Exhibits 10.1 and 4.1, respectively, to this Report on Form 6-K, which are incorporated herein by reference. All readers are

encouraged to read both the Purchase Agreement and the Registration Rights Agreement.

The Purchase Agreement

contains customary representations and warranties, covenants, conditions to closing and indemnification provisions that the parties

made to, and solely for the benefit of, each other in the context of all of the terms and conditions of such agreement and in the

context of the specific relationship between the parties. The provisions of the Purchase Agreement, including the representations

and warranties contained therein, are not for the benefit of any party other than the parties to such agreement or parties expressly

permitted to rely on such provisions and are not intended for investors and the public to obtain factual information about the

current state of affairs of the parties thereto. Rather, investors and the public should look to other disclosures contained in

the Company’s filings with the Securities and Exchange Commission.

Cautionary Note Regarding Forward-Looking

Statements

This Report on Form

6-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995. You should not place undue reliance upon the Company’s forward looking statements. Except as required by law, the Company

undertakes no obligation to revise or update any forward looking statements in order to reflect any event or circumstance that

may arise after the date of this Report. These forward-looking statements reflect our current views about our plans, intentions,

expectations, strategies and prospects, which are based on the information currently available to us and on assumptions we have

made. Although we believe that our plans, intentions, expectations, strategies and prospects as reflected in or suggested by those

forward-looking statements are reasonable, we can give no assurance that the plans, intentions, expectations or strategies will

be attained or achieved. Furthermore, actual results may differ materially from those described in the forward-looking statements

and will be affected by a variety of risks and factors that are beyond our control. Such risks and uncertainties for our company

include, but are not limited to: needs for additional capital to fund our operations, our ability to continue as a going concern;

uncertainties of cash flows and inability to meet working capital needs; an inability or delay in obtaining required regulatory

approvals for nomacopan and any other product candidates, which may result in unexpected cost expenditures; our ability to obtain

orphan drug designation in additional indications; risks inherent in drug development in general; uncertainties in obtaining successful

clinical results for nomacopan and any other product candidates and unexpected costs that may result therefrom; difficulties enrolling

patients in our clinical trials; our ability to enter into collaborative, licensing, and other commercial relationships and on

terms commercially reasonable to us; failure to realize any value

of nomacopan and any other product candidates developed and being developed in light of inherent risks and difficulties involved

in successfully bringing product candidates to market; inability to develop new product candidates and support existing product

candidates; the approval by the FDA and EMA and any other similar foreign regulatory authorities of other competing or superior

products brought to market; risks resulting from unforeseen side effects; risk that the market for nomacopan may not be as large

as expected; risks associated with the impact of the outbreak of coronavirus; risks associated with the SEC investigation; inability

to obtain, maintain and enforce patents and other intellectual property rights or the unexpected costs associated with such enforcement

or litigation; inability to obtain and maintain commercial manufacturing arrangements with third party manufacturers or establish

commercial scale manufacturing capabilities; the inability to timely source adequate supply of our active pharmaceutical ingredients

from third party manufacturers on whom the company depends; unexpected cost increases and pricing pressures and risks and other

risk factors detailed in our public filings with the U.S. Securities and Exchange Commission, including our most recently filed

Annual Report on Form 20-F filed with the SEC. Except as otherwise noted, these forward-looking statements speak only as of the

date of this Report and we undertake no obligation to update or revise any of these statements to reflect events or circumstances

occurring after this Report. We caution investors not to place considerable reliance on the forward-looking statements contained

in this Report.

Press Release

On July 1, 2020, the

Company issued a press release announcing that it has entered into the Purchase Agreement with Aspire Capital. A copy of the press

release is attached as Exhibit 99.1 to this Current Report on Form 6-K and is incorporated herein by reference.

The information contained

in this Report and in Exhibits 4.1 and 10.1 are hereby incorporated by reference into all effective registration statements filed

by the Company under the Securities Act of 1933.

Exhibits

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

4.1

|

|

Registration Rights Agreement, dated June 30, 2020, between Akari Therapeutics, Plc and Aspire Capital Fund, LLC

|

|

|

|

|

|

10.1

|

|

Securities Purchase Agreement, dated June 30, 2020 between Akari Therapeutics, Plc and Aspire Capital Fund, LLC

|

|

|

|

|

|

99.1

|

|

Press

Release dated July 1, 2020, titled “Akari Therapeutics, Plc Announces $30.0 Million Securities Purchase

Agreement”

|

Signature(s)

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

Akari Therapeutics, Plc

|

|

|

(Registrant)

|

|

|

|

|

|

Date: July 1, 2020

|

By:

|

/s/ Clive Richardson

|

|

|

Name:

|

Clive Richardson

|

|

|

|

Chief Executive Officer

and Chief Operating Officer

|

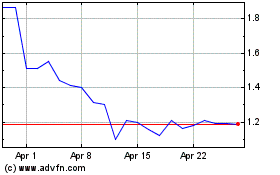

Akari Therapeutics (NASDAQ:AKTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

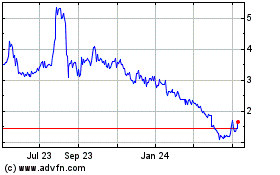

Akari Therapeutics (NASDAQ:AKTX)

Historical Stock Chart

From Apr 2023 to Apr 2024