Current Report Filing (8-k)

July 23 2020 - 12:05PM

Edgar (US Regulatory)

false

0000926282

--12-31

0000926282

2020-07-21

2020-07-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 21, 2020

ADTRAN, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

Delaware

|

000-24612

|

63-0918200

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

901 Explorer Boulevard

Huntsville, Alabama

|

|

35806-2807

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (256) 963-8000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol

|

|

Name of exchange on which registered

|

|

Common Stock, Par Value $0.01

|

|

ADTN

|

|

The NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

At a regular meeting of the Board of Directors (the “Board”) of ADTRAN, Inc. (the “Company”) held on July 21, 2020, the Board adopted certain amendments to the Company’s Bylaws (as amended, the “Bylaws”) and restated the Bylaws. The amendments to the Company’s Bylaws became effective immediately upon their adoption by the Board. The changes to the Bylaws include the following:

|

|

•

|

Article II, Section 2.1 (Meetings of Stockholders – Annual Meeting). This section has been revised to explicitly authorize holding an annual meeting of stockholders by means of remote communication, as permitted under the General Corporation Law of the State of Delaware (the “DGCL”). The default time and place for the annual meeting has been eliminated.

|

|

|

•

|

Article II, Section 2.2 (Meetings of Stockholders – Special Meetings). This section has been revised to explicitly authorize holding a special meeting of stockholders by means of remote communication, as permitted under the DGCL, and clarifying that the business to be brought before a special meeting is limited to the business that is identified in the Company’s notice of the meeting.

|

|

|

•

|

Article II, Section 2.3 (Meetings of Stockholders – List of Stockholders Entitled to Vote). This section has been revised to clarify the timing and access requirements for making available the list of stockholders entitled to vote at a meeting of stockholders, including in connection with a meeting held by means of remote communication. This section provides that where the record date for determining stockholders entitled to vote at the meeting is less than ten days prior to the date of such meeting, the stockholder list will reflect stockholders entitled to vote as of the tenth day prior to the meeting.

|

|

|

•

|

Article II, Section 2.4 (Meetings of Stockholders – Notice of Meeting). This section has been revised to (i) reflect the timing requirements for delivery of notices to stockholders of meetings under the DGCL, (ii) address the possibility of split record dates for determining stockholders entitled to notice of and to vote at stockholder meetings, (iii) allow such notices to be delivered electronically in certain circumstances, as permitted under the DGCL, and (iv) specify how stockholders may waive or be deemed to waive notice of a meeting in accordance with the DGCL.

|

|

|

•

|

Article II, Section 2.6 (Meetings of Stockholders – Quorum). This section has been revised to provide that, where a quorum is not present at a meeting of stockholders, either the chair of the meeting or the holders of a majority of the voting power of the shares present in person or represented by proxy may adjourn the meeting. This section further clarifies the business that may be transacted at an adjourned meeting at which there is a quorum present.

|

|

|

•

|

Article II, Section 2.7 (Meetings of Stockholders – Voting). This section has been revised to (i) specify the requirements for a stockholder to grant a proxy in accordance with the current provisions of the DGCL and (ii) clarify how a stockholder may revoke any proxy that is not irrevocable. This section further clarifies which individuals may serve as an inspector of voting at a meeting of stockholders and reflects the requirement under the DGCL that the inspector sign an oath.

|

|

|

•

|

Article II, Section 2.8 (Meetings of Stockholders – Action by Consent of Stockholders). This section has been revised to (i) require that the signatures of stockholders on a written consent bear the dates of signature, (ii) specify the proper method of delivery of written consents of stockholders under the DGCL (the “DGCL”) and (iii) provide a mechanism for establishing a record date when stockholders seek to take action by written consent, including by having a stockholder seeking to have stockholders take action by written consent give the Company written notice asking the Board to fix a record date.

|

|

|

•

|

Article II, 2.9 (Meetings of Stockholders – Nature of Business at Annual Meetings of Stockholders). This section has been added in order to (i) specify the only three ways in which business (other than elections of directors) may properly come before an annual meeting of stockholders and (ii) set forth procedures by which a stockholder may bring business (other than a nomination of a person for election as a director, which is governed by Article III, Section 3.4 of the Bylaws) before an annual meeting of stockholders. Among other things, in order to bring such business, the stockholder must provide written notice properly furnished to the Company not later than the close of business on the ninetieth (90th) day, nor earlier than the close of business on the one hundred twentieth (120th) day, prior to the first anniversary of the preceding year’s annual meeting, which notice period adjusts if the Company convenes the annual meeting more than thirty (30) days before or more than seventy (70) days after such anniversary date. Additionally, the stockholder must provide certain information to the Company regarding, among other things, the business to be brought before the meeting, any material interest in such business of such stockholder and certain related persons, and the intent of such stockholder and certain related persons to deliver a solicitation statement to holders of at least the percentage of the voting power reasonably believed by such stockholder or related person to be sufficient to approve or adopt the proposal. The procedural requirements of the section do not affect the rights of stockholders to request inclusion of proposals in the Company’s proxy statement under applicable rules of the Securities and Exchange Commission.

|

|

|

•

|

Article III, Section 3.2 (Board of Directors – Number of Directors). This section has been revised to eliminate language that is no longer relevant, as it addressed the size of the Board prior to the time that the size was initially fixed by the Board, and eliminate duplicative language.

|

|

|

•

|

Article III, Section 3.3 (Board of Directors – Election). This section has been revised to provide that, in a contested director election, directors will be elected by a plurality of the votes cast, instead of by a majority vote. In an uncontested election of directors, directors still will be elected by a majority vote. Additionally, this section has been revised to clarify that a majority of votes cast means that the number of shares voted “for” a nominee’s election exceeds the number of shares voted “against” such nominee’s election, thereby confirming that abstentions have no effect on the outcome of the election. In connection with the approval of this amendment to the Bylaws, the Board also adopted a Director Resignation Policy (the “Policy”), pursuant to which a director will be required, promptly following such person’s election or re‑election, to tender an irrevocable resignation in writing, which resignation will become effective upon such person’s failure to receive the required vote for re-election at the next meeting at which such person would face re‑election as a director and upon acceptance of the resignation by the Board. Under the terms of the Policy, the Nominating and Corporate Governance Committee of the Board (the “Committee”) will recommend to the Board whether to accept or reject the resignation offer, and the Board will then take action on the Committee’s recommendation and publicly disclose its decision and the rationale behind it expeditiously following the date of the certification of the election results.

|

|

|

•

|

Article III, Section 3.4 (Board of Directors – Nominations for Election to the Board of Directors). This section has been added in order to (i) specify the only two ways in which a person can be nominated for election to the Board and (ii) set forth the procedures by which a stockholder may nominate a person for election to the Board at an annual or special meeting of stockholders. Among other things, in order to nominate a person for election, the stockholder must provide written notice properly furnished to the Company, in the case of an annual meeting, not later than the close of business on the ninetieth (90th) day, nor earlier than the close of business on the one hundred twentieth (120th) day, prior to the first anniversary of the preceding year’s annual meeting, which notice period adjusts if the Company convenes the annual meeting more than thirty (30) days before or more than seventy (70) days after such anniversary date. Additionally, the stockholder must provide certain information to the Company regarding the nominee, the nominating stockholder and certain related persons.

|

|

|

•

|

Article III, Section 3.5 (Board of Directors – Eligibility to be a Candidate for Election as a Director and to be Seated as a Director). This section has been added to replace the director qualification section in Section 3.2 of the prior Bylaws and to provide that, in order to be eligible to be a candidate for election to the Board, the candidate must be nominated in the manner prescribed in Article III, Section 3.4 of the Bylaws (the “advance notice bylaw”) and must have previously delivered certain information to the Company. This section further provides that the chair of the meeting of stockholders has the power to determine and declare to the meeting whether a nomination was made in accordance with the advance notice bylaw and Article III, Section 3.5 of the Bylaws and no candidate for nomination is eligible to be seated as a director unless nominated and elected in accordance with the advance notice bylaw and Article III, Section 3.5 of the Bylaws.

|

|

|

•

|

Article III, Section 3.16 (Board of Directors – Powers and Duties of Committees; Quorum and Voting). This section has been revised to clarify that (i) a majority of the members of a committee of the Board shall constitute a quorum for the transaction of business and (ii) at any meeting of a committee of the Board where a quorum is present, all matters shall be determined by the affirmative vote of a majority of the committee members present at the meeting.

|

|

|

•

|

Article III, Section 3.17 (Board of Directors – Compensation of Directors). This section has been revised to provide that directors will receive such compensation as is fixed by the Board. The provision related to meeting fees has been eliminated, as the Company does not currently follow this practice.

|

|

|

•

|

Article III, Section 3.18 (Board of Directors – Action Without Meeting). This section has been revised to clarify that the Board may take action by unanimous consent by electronic transmission, and not solely by writing.

|

|

|

•

|

Article V, Section 5.1 (Capital Stock – Stock Certificates; Uncertificated Shares). This section has been revised to clarify that uncertificated shares may be evidenced by a book-entry system maintained by the registrar of such stock.

|

|

|

•

|

Article V, Section 5.2 (Capital Stock – Signatures on Stock Certificates). This section has been revised to permit any two authorized officers of the Company to sign stock certificates in accordance with the DGCL, rather than certain specified officers.

|

|

|

•

|

Article V, Section 5.8 (Capital Stock – Fixing of Record Dates). This section has been revised to specify how the Board may fix a record date when determining stockholders (i) who are entitled to notice of and to vote at meetings of stockholders and adjournments, (ii) who are entitled to take action by written consent under Article II, Section 2.8 of the Bylaws and (iii) who are entitled to receive dividends, to exercise certain rights and for all other purposes, all in accordance with the DGCL. Additionally, any stockholder seeking to have the stockholders authorize or take action by written consent must provide written notice to the Company requesting the Board to fix a record date.

|

|

|

•

|

Article VII, Section 7.5 (Miscellaneous Provisions – Conflict with Applicable Law or Certificate of Incorporation). This section has been added in order to clarify that where the Bylaws conflict with any applicable law or the Company’s Certificate of Incorporation, the conflict is to be resolved in favor of such law or the Company’s Certificate of Incorporation.

|

In addition, certain non-substantive language and conforming changes and other technical edits and updates were made to the Bylaws.

The preceding discussion of the amendments to the Company’s Bylaws is qualified in its entirety by the text of the Bylaws, which are filed as Exhibit 3.2 to this Current Report on Form 8-K and are incorporated by reference herein.

Item 9.01Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

Exhibit Number

|

Description

|

|

3.1

|

Bylaws, as amended and restated

|

|

104

|

Cover Page Interactive Data File – the cover page iXBRL tags are embedded within the Inline XBRL document

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

Date: July 23, 2020

|

ADTRAN, Inc.

By: /s/ Michael Foliano

Michael Foliano

Senior Vice President of Finance and

Chief Financial Officer

|

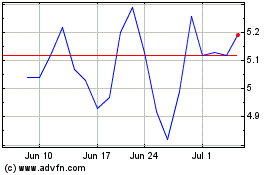

ADTRAN (NASDAQ:ADTN)

Historical Stock Chart

From Aug 2024 to Sep 2024

ADTRAN (NASDAQ:ADTN)

Historical Stock Chart

From Sep 2023 to Sep 2024