Ameristar Casinos Reports Record Third Quarter Financial Results

LAS VEGAS, Oct. 28 /PRNewswire-FirstCall/ -- Ameristar Casinos,

Inc. (NASDAQ:ASCA) today announced record financial results for the

third quarter of 2004, reflecting the continued growth of the

company. Third Quarter Highlights * Record consolidated net

revenues of $215.7 million, representing an increase of $14.1

million, or 7.0%, over the third quarter of 2003. * Record third

quarter consolidated EBITDA (a non-GAAP financial measure which is

defined and reconciled with operating income below) of $59.2

million, representing an increase of $9.1 million, or 18.2%, over

the third quarter of 2003. * Record third quarter consolidated

operating income of $40.3 million, an increase of $6.1 million, or

17.9%, from the prior-year third quarter. * Record third quarter

net income of $16.6 million, up $4.7 million, or 39.7%, from the

third quarter of 2003. * Diluted earnings per share of $0.60 for

the third quarter of 2004, compared to $0.44 for the third quarter

of 2003. Our previously issued earnings guidance for the third

quarter of 2004 indicated a range of $0.50 to $0.53 per share.

Analysts' latest consensus estimate for the third quarter of 2004,

as reported by Thomson First Call, was $0.52. * On August 17, 2004,

our Board of Directors declared a quarterly cash dividend of $0.125

per share, which was paid on September 15, 2004 to our shareholders

of record as of August 31, 2004. * During the third quarter of

2004, we prepaid $15.0 million of long-term debt under our senior

credit facilities, further improving our total debt leverage ratio

(as defined in our senior credit agreement) from 3.49:1 at December

31, 2003 to 2.99:1 at September 30, 2004. * We extended and

improved our leadership position in market share (based on gross

gaming receipts) in our Kansas City, Council Bluffs and Vicksburg

markets during the third quarter of 2004 compared to the same

period in 2003. * We are continuing to progress toward the

completion of our pending acquisition of Mountain High Casino in

Black Hawk, Colorado. Subject to the receipt of regulatory

approval, we anticipate the closing to occur in December 2004.

Craig H. Neilsen, Chairman and CEO, stated: "We are very pleased

with our performance in the third quarter of 2004. We believe our

financial results further validate our business model and evidence

the continued successful implementation of our operating

strategies. In particular, we had significant flow-through during

the third quarter of 2004 compared to the same period in 2003, as

net revenues increased by 7.0% and EBITDA increased by 18.2%, which

demonstrates the effectiveness of our cost-containment strategies.

In addition, the major investment in slot technology we have made

over the past year, including our accelerated implementation of

coinless slot technology and the further introduction of lower

denomination slot machines, has significantly contributed to the

continued financial success we have achieved in the third quarter

of 2004. We are committed to maintaining the most advanced casino

floor in each of our markets, which we expect will result in

continued financial success for our company." Financial Results Net

Revenues Net revenues for the third quarter of 2004 increased to

$215.7 million, an increase of 7.0% compared to the third quarter

of 2003. All of our properties improved in net revenues, with

increases of 11.5% at Ameristar Vicksburg, 9.8% at Ameristar

Council Bluffs, 7.3% at Ameristar Kansas City, 4.4% at Ameristar

St. Charles and 3.4% at the Jackpot Properties. For the quarter,

Ameristar Vicksburg and Ameristar Council Bluffs further improved

their long-time market leadership positions to 44.9% and 41.3%,

respectively, with increases of 4.9 and 1.9 percentage points,

respectively, over the prior-year third quarter. Ameristar Kansas

City also maintained its market share leadership, as it increased

reported market share to 35.4%, up 0.6 percentage point over the

prior-year third quarter. The reported market share for Ameristar

St. Charles was 31.1%, which represented a decline of 0.8

percentage point compared to the third quarter of 2003. Led by a

$20.1 million (11.9%) increase in slot revenues, consolidated

casino revenues for the third quarter of 2004 increased $20.1

million, or 10.3%, from the third quarter of 2003. We believe that

the growth in slot revenues has been driven by our continued

accelerated implementation of coinless slot technology at our

Ameristar-branded properties, which are now nearly 100% coinless.

In addition, we believe our continued leadership in the

introduction of new-generation, lower denomination slot machines at

our Ameristar-branded properties has contributed to the improvement

in slot revenues, due to the popularity of this segment of the slot

market. We also believe casino revenues increased, in part as a

result of our continued successful implementation of our targeted

marketing programs, which is evidenced by a 20.5% increase in rated

play at our Ameristar-branded properties when compared to the third

quarter of 2003. Promotional allowances (which are deducted in

arriving at net revenues) increased $9.7 million, or 30.5%, in the

third quarter of 2004 compared to the 2003 third quarter, in part

due to the increase in rated play. We believe the quality of our

food and beverage operations also contributed to our record third

quarter financial performance. Food and beverage revenues increased

by $2.8 million, or 10.7%, in the third quarter of 2004 compared to

the prior-year third quarter. The increase was principally

attributable to our new food and beverage venues that opened at

Ameristar Kansas City late in the third quarter of 2003 and

Ameristar Vicksburg's newly renovated Heritage Buffet, which was

completed in the fourth quarter of 2003. In the first quarter of

2005, we expect to complete a major renovation of our buffet at

Ameristar Council Bluffs, which we believe will favorably impact

future gaming and food and beverage revenues at the property.

Operating Income and EBITDA In the third quarter of 2004,

consolidated operating income increased $6.1 million, or 17.9%, to

$40.3 million and consolidated operating income margin improved 1.7

percentage points from the prior-year third quarter, to 18.7%.

Operating income margin increased at Ameristar Kansas City,

Ameristar Vicksburg and the Jackpot Properties by 3.4, 2.1 and 5.7

percentage points, respectively, when compared to the same period

in 2003. Consolidated EBITDA increased 18.2% to $59.2 million

compared to the third quarter of 2003. Additionally, consolidated

EBITDA margin in the third quarter of 2004 increased from 24.9% to

27.5%, primarily due to Ameristar Kansas City, Ameristar Vicksburg

and the Jackpot Properties, where EBITDA margin improved 5.5, 3.0

and 5.7 percentage points, respectively, from the prior-year third

quarter. The growth in EBITDA, operating income and the related

margins at these properties was principally driven by both the

increase in revenues noted above and the continued implementation

of cost-containment initiatives. Additionally, Ameristar Kansas

City had $1.3 million of non-recurring expenses in the third

quarter of 2003 related to the introduction of the "All New

Ameristar Kansas City." At Ameristar St. Charles, operating income

for the third quarter decreased $0.3 million and the related margin

dropped 1.4 percentage points to 22.3% compared to the 2003 third

quarter. Although EBITDA was flat, the property saw a decline in

EBITDA margin of 1.2 percentage points during the third quarter.

The declines in the margins and operating income were primarily the

result of higher marketing costs in a more competitive market

environment, due to the expanded facilities and increased marketing

and promotional activities of our principal competitor in the St.

Louis market. In addition, the margins and operating income were

negatively impacted by increased employee benefit costs. Ameristar

Council Bluffs increased third quarter operating income by $1.0

million and third quarter EBITDA by $1.4 million when compared to

the prior-year period. The improvements in operating income and

EBITDA occurred despite a 2% increase in the Iowa tax rate on

gaming revenues of riverboat casinos, which became effective July

1, 2004. Operating income margin decreased 0.5 percentage point to

30.1% and EBITDA margin declined 0.1 percentage point to 36.9% due

to higher health insurance costs and the aforementioned tax

increase. Corporate expense decreased $0.5 million in the third

quarter of 2004 compared to the same quarter of 2003. The decrease

in corporate expense was primarily the result of $0.9 million in

costs incurred in 2003 relating to the unsuccessful pursuit of a

corporate acquisition. Year to date, corporate expense increased

$3.0 million, or 11.4%, compared to the first nine months of 2003.

This increase resulted primarily from the continued growth of the

company and increased development activities. We expect this trend

to continue through the remainder of 2004 and 2005 as we seek

growth through development opportunities, including in the United

Kingdom and Pennsylvania, and through acquisition opportunities.

Depreciation and amortization expense increased to $18.9 million in

the third quarter of 2004 from $15.9 million in the third quarter

of 2003, primarily due to the increase in our depreciable assets

resulting from the completion of enhancement and renovation

projects at Ameristar Kansas City in September 2003 and Ameristar

Vicksburg in December 2003, the continued implementation of

coinless slot technology and the introduction of lower denomination

slot machines at our Ameristar-branded properties. Net Income and

Diluted Earnings Per Share For the third quarter of 2004, net

income increased 39.7% to $16.6 million, from $11.9 million for the

third quarter of 2003. Diluted earnings per share were $0.60 in the

quarter ended September 30, 2004, compared to $0.44 in the

corresponding prior-year quarter. Interest expense for the 2004

third quarter was $13.8 million, down $1.3 million from the third

quarter of 2003. The decline in interest expense was due to a

decrease in our long-term debt levels as we continued to prepay

senior debt, the termination of our interest rate swap agreement on

March 31, 2004, and lower interest rates on our senior credit

facilities year-over-year. We incurred non-operating losses on

early retirement of debt in the third quarters of 2004 and 2003 in

the amounts of $0.2 million and $0.4 million, respectively. Our

effective income tax rate for the quarter ended September 30, 2004

increased to 37.2% from 37.0% for the quarter ended September 30,

2003, due primarily to a slight increase in our effective state

income tax rate. Liquidity and Capital Resources Our financial

position remains strong, with approximately $76.2 million of cash

and cash equivalents and $68.9 million of available borrowing

capacity under our senior credit facilities as of September 30,

2004. During the third quarter of 2004, we reduced our long-term

debt by approximately $15.8 million, including the prepayment of

$15.0 million of principal under our senior credit facilities. At

September 30, 2004, our total debt was $669.7 million, representing

a decrease of $47.2 million (6.6%) from December 31, 2003. In the

fourth quarter of 2004, we expect to borrow up to an additional

$115.0 million under our senior credit facilities in order to fund

our pending acquisition of Mountain High Casino. Capital

expenditures for the third quarter of 2004 totaled $20.6 million

and included the continued acquisition of coinless slot machines,

the implementation of information technology solutions to enhance

our operating capabilities and capital projects at all of our

properties. For the year, we expect that capital expenditures will

be approximately $85 million. Planned Capital Improvement Projects

Following the closing of the Mountain High Casino acquisition, we

intend to invest approximately $90 million in capital expenditures

to improve the competitiveness of the property, as well as make

other operational enhancements. The planned capital improvements

include reconfiguration and expansion of the gaming area, the

introduction of cashless slot technology and other gaming equipment

upgrades, construction of a 300-room AAA Four Diamond-quality hotel

and additional covered parking, an upgrade of the food and beverage

outlets and the addition of a casual dining restaurant. All of

these improvements are expected to be completed during 2005, with

the exception of the hotel, which we expect will be completed by

mid-2007. We are currently planning to expand the number of gaming

positions, including the addition of poker rooms, at our Council

Bluffs and Vicksburg properties. We anticipate completion of these

gaming expansions to occur by the end of 2005. In addition, we are

currently planning a complete renovation of the hotel rooms at

Ameristar Kansas City and Ameristar Council Bluffs, which are

expected to be completed in the fall of 2005. At Ameristar St.

Charles, we are currently designing planned capital improvements,

which include a 300-room all-suite hotel, 20,000 square feet of

meeting facilities, a new entertainment pavilion and an additional

parking garage. We expect to begin construction on these

improvements in the first half of 2005, and we believe they will

further strengthen the competitive position of the property. We

expect the return on our investment from these development projects

to be similar to that of other projects we have completed in the

recent past. Outlook Based on our preliminary results of operations

to date in October 2004 and our outlook for the remainder of the

quarter, we currently estimate operating income of $33 million to

$35 million, EBITDA of $52 million to $54 million (given

anticipated depreciation expense of $19 million), interest expense

of $14 million and diluted earnings per share of $0.41 to $0.45 for

the fourth quarter of 2004. Gaming regulatory authorities in Iowa,

Mississippi and Missouri currently publish, on a monthly basis,

gross gaming revenue, market share and other financial information

with respect to the gaming facilities, including Ameristar's, that

operate within their respective jurisdictions. Because various

factors in addition to our gross gaming revenue (including changes

in operating costs, promotional allowances and other expenses)

influence our operating income, EBITDA and diluted earnings per

share, such reported information, as it relates to Ameristar, may

not be indicative of the results of our operations for such periods

or for future periods. Conference Call We will hold a conference

call to discuss our third quarter results and guidance for the

fourth quarter at 3:00 p.m. Eastern Time on October 28, 2004. The

call can be accessed live by calling (800) 967-7185. It can be

replayed until November 4, 2004 at 1:00 a.m. Eastern Time by

calling (888) 203-1112 and using the access code number 961941.

Forward-Looking Information This press release contains certain

forward-looking information that generally can be identified by the

context of the statement or the use of forward-looking terminology,

such as "believes," "estimates," "anticipates," "intends,"

"expects," "plans," "is confident that" or words of similar

meaning, with reference to Ameristar or our management. Similarly,

statements that describe our future plans, objectives, strategies,

financial results or position, operational expectations or goals

are forward-looking statements. It is possible that our

expectations may not be met due to various factors, many of which

are beyond our control, and we therefore cannot give any assurance

that such expectations will prove to be correct. For a discussion

of relevant factors, risks and uncertainties that could materially

affect our future results, attention is directed to "Item 1.

Business - Risk Factors" and "Item 7. Management's Discussion and

Analysis of Financial Condition and Results of Operations" in our

Annual Report on Form 10-K for the year ended December 31, 2003 and

"Item 2. Management's Discussion and Analysis of Financial

Condition and Results of Operations" in our Quarterly Report on

Form 10-Q for the quarter ended June 30, 2004. About Ameristar

Ameristar Casinos, Inc. is a leading Las Vegas-based gaming and

entertainment company known for its premier properties

characterized by innovative architecture, state-of-the-art casino

floors and superior dining, lodging and entertainment offerings.

Ameristar's focus on the total entertainment experience and the

highest quality guest service has earned it a leading market share

position in each of the five markets in which it operates. Founded

in 1954 in Jackpot, Nevada, Ameristar recently marked its 10th

anniversary as a public company. The company has a portfolio of six

casinos: Ameristar Kansas City; Ameristar St. Charles (greater St.

Louis); Ameristar Council Bluffs (Omaha, Nebraska and southwestern

Iowa); Ameristar Vicksburg (Jackson, Mississippi and Monroe,

Louisiana); and Cactus Petes and the Horseshu in Jackpot, Nevada

(Idaho and the Pacific Northwest). Visit Ameristar Casinos' Web

site at http://www.ameristar.com/ (which shall not be deemed to be

incorporated in or a part of this news release). AMERISTAR CASINOS,

INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Amounts in Thousands, Except Per Share Data) (Unaudited) Three

Months Nine Months Ended September 30, Ended September 30, 2004

2003 2004 2003 REVENUES: Casino $215,001 $194,865 $642,216 $566,752

Food and beverage 28,828 26,034 86,073 74,109 Rooms 6,959 6,602

20,019 18,123 Other 6,370 5,833 17,785 16,271 257,158 233,334

766,093 675,255 Less: Promotional allowances 41,507 31,806 126,074

90,381 Net revenues 215,651 201,528 640,019 584,874 OPERATING

EXPENSES: Casino 94,768 89,382 285,716 260,043 Food and beverage

16,314 15,730 47,342 43,760 Rooms 1,706 1,651 4,912 4,712 Other

4,244 3,307 10,736 9,216 Selling, general and administrative 39,321

41,227 115,555 111,216 Depreciation and amortization 18,888 15,888

54,016 46,666 Impairment loss 100 147 196 687 Total operating

expenses 175,341 167,332 518,473 476,300 Income from operations

40,310 34,196 121,546 108,574 OTHER INCOME (EXPENSE): Interest

income 69 71 157 282 Interest expense (13,806) (15,115) (43,029)

(48,344) Loss on early retirement of debt (202) (415) (673) (415)

Other 50 126 (46) 160 INCOME BEFORE INCOME TAX PROVISION 26,421

18,863 77,955 60,257 Income tax provision 9,820 6,979 30,434 22,186

NET INCOME $16,601 $11,884 $47,521 $38,071 EARNINGS PER SHARE:

Basic $0.61 $0.45 $1.76 $1.44 Diluted $0.60 $0.44 $1.71 $1.41

WEIGHTED AVERAGE SHARES OUTSTANDING: Basic 27,107 26,489 26,986

26,376 Diluted 27,779 27,297 27,744 27,025 AMERISTAR CASINOS, INC.

AND SUBSIDIARIES SUMMARY CONSOLIDATED FINANCIAL DATA (Dollars in

Thousands) (Unaudited) Three Months Nine Months Ended September 30,

Ended September 30, 2004 2003 2004 2003 Consolidated cash flow

information Cash flows provided by operations $28,071 $26,110

$124,276 $112,126 Cash flows used in investing $(22,447) $(17,711)

$(72,608) $(60,732) Cash flows used in financing $(19,100)

$(29,180) $(53,686) $(60,507) Net revenues Ameristar St. Charles

$68,883 $66,005 $209,332 $191,842 Ameristar Kansas City 59,520

55,480 174,160 159,832 Ameristar Council Bluffs 44,229 40,285

129,056 116,753 Ameristar Vicksburg 26,364 23,643 81,289 70,924

Jackpot Properties 16,655 16,115 46,182 45,523 Consolidated net

revenues $215,651 $201,528 $640,019 $584,874 Operating income

(loss) Ameristar St. Charles $15,380 $15,644 $51,147 $46,301

Ameristar Kansas City 12,111 9,365 33,487 31,230 Ameristar Council

Bluffs 13,317 12,339 38,388 33,718 Ameristar Vicksburg 6,241 5,109

20,972 16,301 Jackpot Properties 3,501 2,462 7,054 7,516 Corporate

and other (10,240) (10,723) (29,502) (26,492) Consolidated

operating income $40,310 $34,196 $121,546 $108,574 EBITDA (1)

Ameristar St. Charles $21,542 $21,423 $68,825 $63,696 Ameristar

Kansas City 17,228 12,977 47,780 41,158 Ameristar Council Bluffs

16,312 14,903 46,883 41,271 Ameristar Vicksburg 9,124 7,471 29,427

23,436 Jackpot Properties 4,476 3,414 9,888 10,436 Corporate and

other (9,484) (10,104) (27,241) (24,757) Consolidated EBITDA

$59,198 $50,084 $175,562 $155,240 Operating income margins (2)

Ameristar St. Charles 22.3% 23.7% 24.4% 24.1% Ameristar Kansas City

20.3% 16.9% 19.2% 19.5% Ameristar Council Bluffs 30.1% 30.6% 29.7%

28.9% Ameristar Vicksburg 23.7% 21.6% 25.8% 23.0% Jackpot

Properties 21.0% 15.3% 15.3% 16.5% Consolidated operating income

margin 18.7% 17.0% 19.0% 18.6% AMERISTAR CASINOS, INC. AND

SUBSIDIARIES SUMMARY CONSOLIDATED FINANCIAL DATA - CONTINUED

(Unaudited) Three Months Nine Months Ended September 30, Ended

September 30, 2004 2003 2004 2003 EBITDA margins (1) Ameristar St.

Charles 31.3% 32.5% 32.9% 33.2% Ameristar Kansas City 28.9% 23.4%

27.4% 25.8% Ameristar Council Bluffs 36.9% 37.0% 36.3% 35.3%

Ameristar Vicksburg 34.6% 31.6% 36.2% 33.0% Jackpot Properties

26.9% 21.2% 21.4% 22.9% Consolidated EBITDA margin 27.5% 24.9%

27.4% 26.5% (1) EBITDA is earnings before interest, taxes,

depreciation and amortization. EBITDA is presented solely as a

supplemental disclosure because management believes that it is a

widely used measure of operating performance in the gaming industry

and a principal basis for the valuation of gaming companies. Our

credit agreement also requires the use of EBITDA as a measure of

compliance with our principal debt covenants. In addition,

management uses property-level EBITDA (EBITDA before corporate

expense) as the primary measure of our operating properties'

performance, including the evaluation of operating personnel.

EBITDA margin is EBITDA as a percentage of net revenues. EBITDA

should not be construed as an alternative to income from operations

(as determined in accordance with GAAP) as an indicator of our

operating performance, or as an alternative to cash flows from

operating activities (as determined in accordance with GAAP) as a

measure of liquidity, or as an alternative to any other measure

determined in accordance with GAAP. We have significant uses of

cash flows, including capital expenditures, interest payments,

taxes and debt principal repayments, which are not reflected in

EBITDA. It should also be noted that not all gaming companies that

report EBITDA calculate EBITDA in the same manner as we do. (2)

Operating income margin is operating income as a percentage of net

revenues. RECONCILIATION OF OPERATING INCOME (LOSS) TO EBITDA

(Dollars in Thousands) (Unaudited) The following table sets forth a

reconciliation of operating income (loss), a GAAP financial

measure, to EBITDA, a non-GAAP financial measure. Three Months Nine

Months Ended September 30, Ended September 30, 2004 2003 2004 2003

Ameristar St. Charles: Operating income $15,380 $15,644 $51,147

$46,301 Depreciation and amortization 6,162 5,779 17,678 17,395

EBITDA $21,542 $21,423 $68,825 $63,696 Ameristar Kansas City:

Operating income $12,111 $9,365 $33,487 $31,230 Depreciation and

amortization 5,117 3,612 14,293 9,928 EBITDA $17,228 $12,977

$47,780 $41,158 Ameristar Council Bluffs: Operating income $13,317

$12,339 $38,388 $33,718 Depreciation and amortization 2,995 2,564

8,495 7,553 EBITDA $16,312 $14,903 $46,883 $41,271 Ameristar

Vicksburg: Operating income $6,241 $5,109 $20,972 $16,301

Depreciation and amortization 2,883 2,362 8,455 7,135 EBITDA $9,124

$7,471 $29,427 $23,436 Jackpot Properties: Operating income $3,501

$2,462 $7,054 $7,516 Depreciation and amortization 975 952 2,834

2,920 EBITDA $4,476 $3,414 $9,888 $10,436 Corporate and other:

Operating loss $(10,240) $(10,723) $(29,502) $(26,492) Depreciation

and amortization 756 619 2,261 1,735 EBITDA $(9,484) $(10,104)

$(27,241) $(24,757) Consolidated: Operating income $40,310 $34,196

$121,546 $108,574 Depreciation and amortization 18,888 15,888

54,016 46,666 EBITDA $59,198 $50,084 $175,562 $155,240

http://www.newscom.com/cgi-bin/prnh/20040930/LATH017LOGO

http://photoarchive.ap.org/ DATASOURCE: Ameristar Casinos, Inc.

CONTACT: Tom Steinbauer, Senior Vice President of Finance, Chief

Financial Officer of Ameristar Casinos, Inc., +1-702-567-7000 Web

site: http://www.ameristar.com/

Copyright

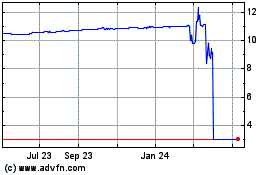

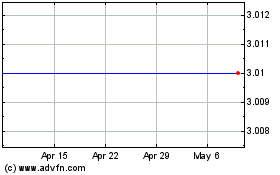

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From May 2024 to Jun 2024

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Jun 2023 to Jun 2024