false

0001555279

0001555279

2024-03-05

2024-03-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event

Reported): March 5, 2024

908 Devices Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-39815 |

|

45-4524096 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

645

Summer Street

Boston,

MA

02210

(Address

of principal executive offices, including zip code)

(857)

254-1500

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each

class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common Stock, par value $0.001 per share |

MASS |

The NASDAQ Global Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 ( §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

| Item

2.02 |

Results of Operations and Financial Condition. |

On March 5, 2024, 908 Devices Inc. (“908 Devices”)

announced its financial results for the fourth quarter and fiscal year ended December 31, 2023. A copy of the press release is being

furnished as Exhibit 99.1 to this Report on Form 8-K.

The information contained in Item 2.02 of this Current Report on Form 8-K

is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section and shall not be

incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the

Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: March 5, 2024 |

908 Devices Inc. |

| |

|

|

| |

By: |

/s/ Michael S. Turner |

| |

|

Name: Michael S. Turner |

| |

|

Title: Chief Legal and Administrative Officer |

Exhibit 99.1

908 Devices Reports Fourth Quarter and Full

Year 2023 Financial Results and Provides 2024 Revenue Outlook

Fourth quarter 2023 revenue increased 23% compared

to prior year, driven by handheld revenue increasing 57%

BOSTON

– March 5, 2024 – 908 Devices Inc. (Nasdaq: MASS), a pioneer of purpose-built handheld and desktop devices

for chemical and biochemical analysis, today reported financial results for the quarter and full year ended December 31, 2023.

"We made solid progress in 2023 towards our

objectives. We have continued to see sustained growth of our handheld devices servicing customers in their efforts to combat the ongoing

crisis of counterfeit drugs and opioids. For the full year we saw 28% growth in our handheld revenue and consistent year-over-year growth

each quarter. Despite near-term headwinds impacting the life science instrumentation and bioprocessing industries, we launched two additional

desktop devices in the Process Analytical Technology (PAT) space, positioning us for accelerated growth as conditions improve," said

Kevin J. Knopp, CEO and Co-founder. "We remain focused on expanding our market presence, extending our global reach, leveraging our

expanded product portfolios, and overall efficient execution and cash management as we march towards scale and profitability."

Recent Highlights

| · | Revenue of $14.4 million for the fourth quarter 2023, increasing 23% compared to the fourth quarter 2022 |

| · | Revenue of $50.2 million for the full year 2023, increasing 7% compared to the full year 2022 |

| o | Handheld revenue increased 28% compared to full year 2022 |

| o | Recurring revenue represented 33% of product and service revenues |

| · | Ended 2023 with $145.7 million in cash, cash equivalents and marketable securities, consuming $28 million in 2023 and an additional

$15 million to pay off remaining debt |

| · | Expanded international presence with MX908 handheld devices placed in 56 countries as of December 31, 2023, an additional 11

countries from December 31, 2022 |

| · | Announced a collaboration with Cellares, an integrated development and manufacturing company, to adapt our MAVERICK in-line bioprocess

analyzer to be compatible with Cellares’ Cell Shuttle system for large-scale cell therapy manufacturing |

Fourth Quarter 2023 Financial Results

Revenue was $14.4 million for the three months

ended December 31, 2023, a 23% increase over the prior year period. This was primarily driven by an increase in handheld devices

revenue. The installed base grew to 2,853 devices with 139 devices placed during the fourth quarter 2023. Recurring revenue represented

33% of total revenues in the quarter.

Gross profit was $7.3 million for the fourth quarter of 2023, compared

to $5.9 million for the corresponding prior year period. Gross margin was 51% as compared to 51% for the corresponding prior year period.

Operating expenses were $17.0 million for the

fourth quarter of 2023, compared to $16.3 million for the corresponding prior year period. This increase was driven by stock-based compensation

and an increase in commission expenses related to handheld revenues, offset in part by a reduction in general operating costs.

Net loss was $7.4 million for the fourth quarter

of 2023, narrowing from $9.8 million for the corresponding prior year period. Net loss per share was $0.23 for the fourth quarter of 2023,

compared to a net loss per share of $0.31 for the corresponding prior year period.

Full Year 2023 Financial Results

Revenue was $50.2 million for the year ended December 31,

2023, a 7% increase over the prior year period. This was primarily driven by a $8.3 million increase in handheld revenues, offset by a

$3.0 million decrease in desktop revenues and a $2.0 million decrease in contract revenues.

Gross profit was $25.3 million for 2023, compared to $26.0 million

for the corresponding prior year period. Gross margin was 50% as compared to 56% for the corresponding prior year period.

Operating expenses were $68.1 million for 2023,

compared to $61.4 million for the corresponding prior year period.

Net loss was $36.4 million for 2023, compared

to $33.6 million for the corresponding prior year period. Net loss per share was $1.13 for 2023, compared to a net loss per share of $1.07

for the corresponding prior year period.

Cash, cash equivalents and marketable securities were $145.7 million

as of December 31, 2023 with no debt outstanding.

2024 Guidance

908 Devices expects full year 2024 revenue to

be in the range of $52.0 million to $54.0 million, representing 4% to 8% growth over full year 2023.

Webcast Information

908 Devices will host a conference call to discuss the fourth quarter

and full year 2023 financial results before market open on Tuesday, March 5, 2024 at 5:30 am Pacific Time / 8:30 am Eastern Time.

A webcast of the conference call can be accessed at https://ir.908devices.com/news-events/events. The webcast will be archived

and available for replay for at least 90 days after the event.

About 908 Devices

908

Devices is revolutionizing chemical and biochemical analysis with its simple handheld and desktop devices, addressing critical-to-life

applications. The Company’s devices are used at the point-of-need to interrogate unknown and invisible materials and provide quick,

actionable answers to directly address some of the most critical problems in life sciences research, bioprocessing, pharma / biopharma,

forensics and adjacent markets. The Company is headquartered in the heart of Boston, where it designs and manufactures innovative products

that bring together the power of mass spectrometry, microfluidic sampling and separations, software automation, and machine learning.

Forward Looking Statements

This

press release includes “forward looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995. All statements other than statements of historical facts are forward-looking statements, including, without limitation, statements

regarding the Company’s future revenue and growth. Words such as “may,” “will,” “expect,” “plan,”

“anticipate,” “estimate,” “intend” and similar expressions (as well as other words or expressions

referencing future events, conditions or circumstances) are intended to identify forward-looking statements. These forward-looking statements

are based on management’s current expectations and involve known and unknown risks, uncertainties and assumptions which may cause

actual results to differ materially from any results expressed or implied by any forward-looking statement, including the risks outlined

under “Risk Factors” and elsewhere in the Company’s filings with the Securities and Exchange Commission which are available

on the SEC's website at www.sec.gov. Additional information will be made available in our annual and quarterly reports

and other filings that we make from time to time with the SEC. Although the Company believes that the expectations reflected in its forward-looking

statements are reasonable, it cannot guarantee future results. The Company has no obligation, and does not undertake any obligation,

to update or revise any forward-looking statement made in this press release to reflect changes since the date of this press release,

except as may be required by law.

Investor Contact:

Carrie Mendivil

IR@908devices.com

Media

Contact:

Barbara Russo

brusso@908devices.com

908 DEVICES INC.

Condensed Consolidated Statements of Operations

(in thousands, except share and per share amounts)

(unaudited)

| | |

Three Months Ended | | |

Year Ended | |

| | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenue: | |

| | | |

| | | |

| | | |

| | |

| Product revenue | |

$ | 11,436 | | |

$ | 8,272 | | |

$ | 40,214 | | |

$ | 37,499 | |

| Service revenue | |

| 2,915 | | |

| 2,129 | | |

| 9,645 | | |

| 6,976 | |

| Contract revenue | |

| — | | |

| 1,242 | | |

| 370 | | |

| 2,377 | |

| Total revenue | |

| 14,351 | | |

| 11,643 | | |

| 50,229 | | |

| 46,852 | |

| Cost of revenue: | |

| | | |

| | | |

| | | |

| | |

| Product cost of revenue | |

| 5,191 | | |

| 4,501 | | |

| 18,428 | | |

| 16,010 | |

| Service cost of revenue | |

| 1,885 | | |

| 1,161 | | |

| 6,380 | | |

| 4,420 | |

| Contract cost of revenue | |

| — | | |

| 59 | | |

| 99 | | |

| 399 | |

| Total cost of revenue | |

| 7,076 | | |

| 5,721 | | |

| 24,907 | | |

| 20,829 | |

| Gross profit | |

| 7,275 | | |

| 5,922 | | |

| 25,322 | | |

| 26,023 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 5,444 | | |

| 4,662 | | |

| 21,904 | | |

| 17,526 | |

| Selling, general and administrative | |

| 11,544 | | |

| 11,598 | | |

| 46,176 | | |

| 43,879 | |

| Total operating expenses | |

| 16,988 | | |

| 16,260 | | |

| 68,080 | | |

| 61,405 | |

| Loss from operations | |

| (9,713 | ) | |

| (10,338 | ) | |

| (42,758 | ) | |

| (35,382 | ) |

| Other income: | |

| | | |

| | | |

| | | |

| | |

| Other income, net | |

| 2,282 | | |

| 547 | | |

| 6,148 | | |

| 1,819 | |

| Loss from operations before income taxes | |

| (7,431 | ) | |

| (9,791 | ) | |

| (36,610 | ) | |

| (33,563 | ) |

| Benefit for income taxes | |

| 2 | | |

| — | | |

| 211 | | |

| — | |

| Net loss | |

$ | (7,429 | ) | |

$ | (9,791 | ) | |

$ | (36,399 | ) | |

$ | (33,563 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share attributable to common stockholders | |

$ | (0.23 | ) | |

$ | (0.31 | ) | |

$ | (1.13 | ) | |

$ | (1.07 | ) |

| Weighted average common shares outstanding | |

| 32,440,312 | | |

| 31,749,993 | | |

| 32,239,394 | | |

| 31,492,531 | |

908 DEVICES INC.

Condensed Consolidated Balance Sheets

(in thousands)

(unaudited)

| | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash, cash equivalents and marketable securities | |

$ | 145,682 | | |

$ | 188,422 | |

| Accounts receivable, net | |

| 8,989 | | |

| 10,033 | |

| Inventory | |

| 14,938 | | |

| 12,513 | |

| Prepaid expenses and other current assets | |

| 4,181 | | |

| 4,658 | |

| Total current assets | |

| 173,790 | | |

| 215,626 | |

| Operating lease, right-of-use assets | |

| 6,233 | | |

| 3,956 | |

| Property and equipment, net | |

| 3,342 | | |

| 3,083 | |

| Goodwill | |

| 10,367 | | |

| 10,050 | |

| Intangible, net | |

| 7,860 | | |

| 8,488 | |

| Other long-term assets | |

| 1,389 | | |

| 1,384 | |

| Total assets | |

$ | 202,981 | | |

$ | 242,587 | |

| Liabilities and Stockholders' Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 9,904 | | |

$ | 10,244 | |

| Deferred revenue | |

| 10,629 | | |

| 7,514 | |

| Operating lease liabilities | |

| 2,016 | | |

| 1,468 | |

| Total current liabilities | |

| 22,549 | | |

| 19,226 | |

| Long-term debt, net of discount and current portion | |

| 3,929 | | |

| 15,000 | |

| Deferred revenue, net of current portion | |

| 8,571 | | |

| 3,040 | |

| Other long-term liabilities | |

| 2,441 | | |

| 14,722 | |

| Total liabilities | |

| 37,490 | | |

| 51,988 | |

| Total stockholders' equity | |

| 165,491 | | |

| 190,599 | |

| Total liabilities and stockholders' equity | |

$ | 202,981 | | |

$ | 242,587 | |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

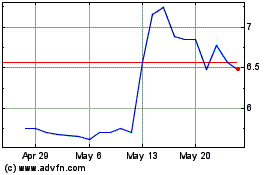

908 Devices (NASDAQ:MASS)

Historical Stock Chart

From Apr 2024 to May 2024

908 Devices (NASDAQ:MASS)

Historical Stock Chart

From May 2023 to May 2024