Bitcoin Crash Below $66,000 Stuns Market, Why A Drop To $54,930 Is Possible

June 20 2024 - 6:00PM

NEWSBTC

The Bitcoin price crash below $66,000 has taken the market by

surprise, leading to over $90 million in liquidations in a 24-hour

period. But even after dropping so much already, analysts do not

believe that the worst is over. In particular, crypto analyst Ali

Martinez has said that Bitcoin may still have a ways to go before

the crash is over, prediction another 20% decline from here.

Bitcoin Falls Below Major Pricing Band Crypto analyst Ali Martinez

posted a new analysis on X (formerly Twitter) on the Bitcoin price

that paints a rather bearish picture for the pioneer

cryptocurrency. According to Martinez, the Bitcoin crash below

$68,000 had actually pushed it below an important level. Related

Reading: Analyst Says XRP Price Is Long Overdue For Bullish Wave,

Here’s The Target The major level of importance here is the $67,890

pricing range, which the price has now fallen below. As Martinez

explains, this area is important as the “+0.5σ MVRV pricing band”

lies here. It also means that a crash below this level is very

bearish for the price, and as Martinez shows, Bitcoin has already

fallen below it. This fall puts a bearish motion in place as the

crypto analyst believes it may trigger a correction. Now, while

corrections are normal, the expectation for how far the crash will

go is what is worrying because the analyst has placed a possible

$54,930 target for the price. #Bitcoin has dropped below the +0.5σ

MVRV pricing band at $67,890, which may trigger a correction toward

the mean pricing band at $54,930. pic.twitter.com/zZvswgpUpS — Ali

(@ali_charts) June 19, 2024 Such a crash would mean that the

Bitcoin price would fall another 20% from its current level. Given

the previous crashes, this could be devastating for altcoins, whose

prices could fall another 50% if BTC were to crash below $55,000.

Navigating The Drop In Interest One interesting development for

Bitcoin is the drop in interest that has been experienced this

week. For example, the daily trading volume, according to

CoinMarketCap, fell 43.5% in the last day along. This brings the

Bitcoin daily trading volume to around $19 billion from the almost

$40 billion recorded the previous day. Related Reading: Cardano

Bucks Bears As Large Transactions Climb To $10 Billion, Can This

Drive Price To $1? This drop in trading volume indicates that

investors are taking fewer positions. With the uncertainty

surrounding the market, this comes as no surprise, given that

investors are prone to wait for the situation to improve before

taking more positions. The Crypto Fear & Greed Index has also

declined, showing that fear is growing in the market. It is now

sitting at a score of 60, which shows greed, a long way from May’s

score of 76, which showed extreme greed in the market. At the time

of writing, the Bitcoin price is holding at $65,667, with a 0.77%

gain in the last day. Featured image created with Dall.E, chart

from Tradingview.com

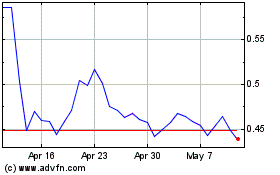

Cardano (COIN:ADAUSD)

Historical Stock Chart

From May 2024 to Jun 2024

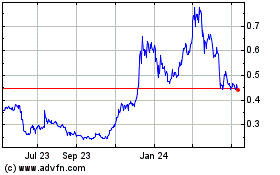

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Jun 2023 to Jun 2024