Current Report Filing (8-k)

June 09 2021 - 9:16AM

Edgar (US Regulatory)

0001375205

false

0001375205

2021-06-07

2021-06-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current

Report

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): June 7,

2021

UR-ENERGY

INC.

(Exact

name of registrant as specified in its charter)

|

Canada

|

|

001-33905

|

|

Not applicable

|

|

(State

or other jurisdiction of incorporation or

organization)

|

|

(Commission

File Number)

|

|

(I.R.S.

Employer Identification Number)

|

|

10758 W

Centennial Road, Suite

200

|

|

|

|

Littleton,

Colorado

|

|

80127

|

|

(Address

of principal executive offices)

|

|

(Zip

code)

|

Registrant’s

telephone number, including area code: (720)

981-4588

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class:

|

|

Trading Symbol

|

|

Name of each exchange on which registered:

|

|

Common stock

|

|

URG (NYSE American): URE (TSX)

|

|

NYSE American; TSX

|

Check

the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General

Instruction A.2. below):

☐

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging

growth company ☐

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange

Act. ☐

Item 1.01

Entry

Into a Material Definitive Agreement.

On June

7, 2021, Ur-Energy Inc. (the “Company”) amended and

restated the At Market Issuance Sales Agreement (the “Sales

Agreement”), dated May 29, 2020, between the Company and B.

Riley Securities, Inc. (formerly known as B. Riley FBR, Inc.)

(“B. Riley Securities”) to include Cantor Fitzgerald

& Co. (“Cantor” and together with B. Riley

Securities, the “Agents”) as a co-agent for the

Company’s at-the-market program (the “ATM

Program”). Other than the inclusion of Cantor as an

additional Agent, there were no substantive changes to the Sales

Agreement compared to the original May 29, 2020

agreement.

The

Company has no obligation to sell any shares under the Sales

Agreement, and the Company or the Agents may suspend the offering

of shares under the Sales Agreement upon notice to the other and

subject to other conditions. The Company has agreed in the Sales

Agreement to provide indemnification and contribution to the Agents

against certain liabilities, including liabilities under the

Securities Act.

The

shares will be issued pursuant to the Company’s shelf

registration statement on Form S-3 (File No. 333-238324), which was

declared effective by the U.S. Securities and Exchange Commission

(the “SEC”) on May 27, 2020. The Company filed a

prospectus supplement, on June 8, 2021, with the SEC in connection

with the ATM Program. The Company has increased the size of the ATM

Program and may now offer and sell common shares having a maximum

aggregate sales price of up to $50,000,000 from time to time

through or to the Agents, as sales agent or principal, in addition

to the amounts previously sold.

The

foregoing description of the Sales Agreement is not complete and is

qualified in its entirety by reference to the full text of the

Sales Agreement, a copy of which is filed herewith as Exhibit 1.1

to this Current Report on Form 8-K and is incorporated herein by

reference.

A

copy of the Sales Agreement has been included to provide security

holders with information regarding its terms. It is not intended to

provide any other factual information about the Company. The

representations, warranties and covenants contained in the Sales

Agreement were made solely for purposes of the ATM Program and as

of specific dates, were solely for the benefit of the parties to

the Sales Agreement, may be subject to limitations agreed upon by

the contracting parties, and may be subject to standards of

materiality applicable to the contracting parties that differ from

those applicable to security holders. Security holders are

not third-party beneficiaries under the Sales Agreement and should

not rely on the representations, warranties and covenants or any

descriptions thereof as characterizations of the actual state of

facts or condition of the Company. Moreover, information concerning

the subject matter of the representations and warranties may change

after the date of the Sales Agreement, which subsequent information

may or may not be fully reflected in the Company’s public

disclosures.

The

legal opinion of Fasken Martineau DuMoulin LLP relating to the

common shares being offered pursuant to the Sales Agreement is

filed as Exhibit 5.1 to this Current Report on Form

8-K.

Item

9.01

Financial

Statements and Exhibits.

|

Exhibit No.

|

|

Description

|

|

|

|

Amended

and Restated At Market Issuance Sales Agreement, dated as of June

7, 2021, by and among Ur-Energy Inc., B. Riley Securities, Inc. and

Cantor Fitzgerald & Co.

|

|

|

|

Opinion

of Fasken Martineau DuMoulin LLP.

|

|

|

|

Consent

of Fasken Martineau DuMoulin LLP (included in Exhibit

5.1).

|

SIGNATURE

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

Ur-Energy Inc.

|

|

|

|

|

|

|

|

Date:

June 9, 2021

|

By:

|

/s/

Penne A.

Goplerud

|

|

|

|

|

Name: Penne

A. Goplerud

|

|

|

|

|

Title: Corporate

Secretary and General Counsel

|

|

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

|

|

Amended

and Restated At Market Issuance Sales Agreement, dated as of June

7, 2021, by and among Ur-Energy Inc., B. Riley Securities, Inc. and

Cantor Fitzgerald & Co.

|

|

|

|

Opinion

of Fasken Martineau DuMoulin LLP.

|

|

|

|

Consent

of Fasken Martineau DuMoulin LLP (included in Exhibit

5.1).

|

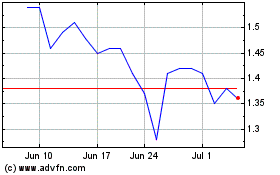

Ur Energy (AMEX:URG)

Historical Stock Chart

From Oct 2024 to Nov 2024

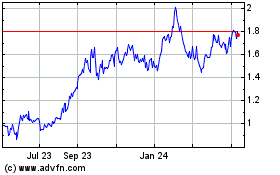

Ur Energy (AMEX:URG)

Historical Stock Chart

From Nov 2023 to Nov 2024