Registration

No. 333-249129

Filed

Pursuant to Rule 424(b)(5)

PROSPECTUS SUPPLEMENT

(to Prospectus dated October 8, 2020)

Up to $9,000,000

SOLITARIO ZINC CORP.

Shares of Common Stock

We have

entered into an At The Market Offering Agreement, or the Offering

Agreement, with H.C. Wainwright & Co., LLC, or Wainwright, as

agent. In accordance with the terms of the Offering Agreement, this

prospectus supplement, and the accompanying prospectus, we may from

time to time offer and sell shares of our common stock having an

aggregate offering price of up to $9,000,000 through the

agent.

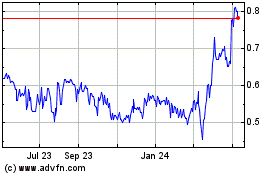

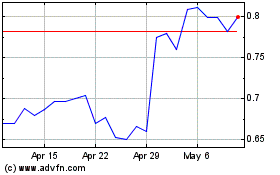

Our

shares of common stock trade on the NYSE American under the symbol

“XPL.” On January 28, 2021, the last sale price of the

shares as reported on the NYSE American was $0.73 per share. We

have applied to the NYSE American for the listing of the shares of

our common stock being offered by this prospectus supplement and

the accompanying prospectus. Listing will be subject to us

fulfilling all the listing requirements of the NYSE American and is

a condition of sales under the Offering Agreement.

Sales

of common stock, if any, under this prospectus supplement and the

accompanying prospectus may be made in transactions that are deemed

to be “at-the-market” offerings as defined in Rule

415(a)(4) under the Securities Act of 1933, as amended, or the

Securities Act. Wainwright will make all sales using commercially

reasonable efforts consistent with its normal trading and sales

practices, on mutually agreed terms between Wainwright and us.

Sales of the shares of our common stock, if any, through Wainwright

or directly to Wainwright acting as principal will be made by means

of ordinary brokers’ transactions on the NYSE American, the

existing United States trading market for our common stock, or any

other existing trading market in the United States for our common

stock, sales made to or through a market maker other than on an

exchange or otherwise, directly to the sales agent as principal, in

negotiated transactions with our prior approval at market prices

prevailing at the time of sale or at prices related to prevailing

market prices, or any other method permitted by law. If we and

Wainwright agree on any method of distribution other than sales of

shares of our common stock into the NYSE American or another

existing trading market in the United States at market prices, we

will file a further prospectus supplement providing all information

about such offering as required by Rule 424(b) under the Securities

Act. There is no arrangement for funds to be received in any

escrow, trust or similar arrangement.

Wainwright will

receive from us a commission of 3% of the gross sales price of all

shares sold through it under the Offering Agreement. In connection

with the sale of the common stock on our behalf, Wainwright may be

deemed to be an “underwriter” within the meaning of the

Securities Act and the compensation of Wainwright may be deemed to

be underwriting commissions or discounts.

As

January 28, 2021 the aggregate market value of our outstanding

voting and non-voting common equity held by non-affiliates was

$38,349,000 based on 58,108,366 shares of outstanding our common

stock outstanding, of which 52,533,278 shares were held by

non-affiliates, and the last reported sale price of our Common

Stock of $0.73 per share on January 28, 2021. Pursuant to General

Instruction I.B.6 of Form S-3, in no event will we sell securities

in a public primary offering with a value exceeding more than

one-third of our public float in any 12-month period so long as our

public float remains below $75,000,000. During the previous 12

calendar months prior to and including the date of this prospectus

supplement, we have offered $0 of our securities pursuant to

General Instruction I.B.6 of Form S-3.

Investing in our common stock involves risks including those

described in the “Risk Factors” section beginning on

page S-4 of this prospectus supplement and page 2 of the

accompanying prospectus.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these

securities or determined if this prospectus supplement and the

accompanying prospectus to which it relates are truthful or

complete. Any representation to the contrary is a criminal

offense.

H.C. Wainwright &

Co.

The date of this prospectus supplement is February 2,

2021.

TABLE OF CONTENTS

Prospectus Supplement

|

ABOUT THIS PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING

PROSPECTUS

|

S-ii

|

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

|

S-ii

|

|

PROSPECTUS SUPPLEMENT SUMMARY

|

S-1

|

|

THE OFFERING

|

S-3

|

|

RISK FACTORS

|

S-4

|

|

USE OF PROCEEDS

|

S-6

|

|

DIVIDEND POLICY

|

S-6

|

|

DILUTION

|

S-6

|

|

PLAN OF DISTRIBUTION

|

S-7

|

|

LEGAL MATTERS

|

S-8

|

|

EXPERTS

|

S-8

|

|

INFORMATION INCORPORATED BY REFERENCE

|

S-8

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

S-9

|

|

|

Page

|

|

ABOUT

THIS PROSPECTUS

|

1

|

|

ABOUT

SOLITARIO ZINC CORP.

|

1

|

|

RISK

FACTORS

|

2

|

|

FORWARD-LOOKING

STATEMENTS

|

2

|

|

RATIOS

OF EARNINGS TO FIXED CHARGES

|

2

|

|

HOW WE

INTEND TO USE THE PROCEEDS

|

3

|

|

DESCRIPTION OF THE

SECURITIES

|

3

|

|

DESCRIPTION OF

COMMON STOCK

|

3

|

|

DESCRIPTION OF

PREFERRED STOCK

|

4

|

|

DESCRIPTION OF DEBT

SECURITIES

|

5

|

|

DESCRIPTION OF

WARRANTS

|

7

|

|

DESCRIPTION OF

RIGHTS

|

8

|

|

DESCRIPTION OF

UNITS

|

8

|

|

FORMS

OF SECURITIES

|

10

|

|

PLAN OF

DISTRIBUTION

|

12

|

|

CERTAIN

PROVISIONS OF COLORADO LAW AND OF OUR AMENDED AND RESTATED ARTICLES

OF INCORPORATION, AS AMENDED, AND AMENDED AND RESTATED

BY-LAWS

|

15

|

|

INFORMATION

INCORPORATED BY REFERENCE

|

15

|

|

WHERE

YOU CAN FIND MORE INFORMATION

|

16

|

|

EXPERTS

|

16

|

|

LEGAL

MATTERS

|

16

|

We are responsible for the information contained and incorporated

by reference in this prospectus supplement, the accompanying

prospectus and any related free writing prospectus we prepare or

authorize. Neither we nor the agent has authorized anyone to

provide you with different information, and neither we nor the

agent take any responsibility for any other information that others

may give you. We are not making an offer of these securities in any

jurisdiction where the offer is not permitted. The information in

this prospectus supplement, the accompanying prospectus, the

documents incorporated by reference and any written communication

from us specifying the final terms of the offering is only accurate

as of the date of the respective documents in which the information

appears. Our business, financial condition, results of operations

and prospects may have changed since those dates. Information in

this prospectus supplement updates and modifies the information in

the accompanying prospectus.

ABOUT THIS PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING

PROSPECTUS

This

document is in two parts. The first part is this prospectus

supplement, which describes the terms of this offering of our

common stock and updates certain other matters relating to our

business. The second part is the accompanying prospectus, which

gives more general information, some of which applies to this

offering. To the extent the information contained in this

prospectus supplement differs or varies from the information

contained in the accompanying prospectus or any document

incorporated by reference, you should rely on the information in

this prospectus supplement. If, however, any statement in one of

these documents is inconsistent with a statement in another

document having a later date, for example, a document incorporated

by reference in this prospectus supplement, the statement in the

document having the later date modifies or supersedes the earlier

statement as our business, financial condition, results of

operations and prospects may have changed since the earlier dates.

You should read this prospectus supplement and the accompanying

prospectus as well as the additional information described under

“INFORMATION INCORPORATED BY REFERENCE” on page S-9 of

this prospectus supplement before investing in our common stock.

Also see “CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

INFORMATION” on page ii of this prospectus

supplement.

The

prospectus supplement and the accompanying prospectus are part of a

registration statement on Form S-3 (File No. 333-249129) that we

have filed with the Securities and Exchange Commission

(“SEC”) with respect to the shares offered hereby and

that became effective on October 8, 2020. This prospectus

supplement and the accompanying prospectus do not contain all of

the information set forth in the registration statement, parts of

which are omitted in accordance with the rules and regulations of

the SEC. For further information with respect to us and the shares

offered hereby, please refer to the registration statement and the

exhibits that are a part of the registration

statement.

Copies

of documents incorporated by reference in this prospectus

supplement or the accompanying prospectus are available without

charge, upon written or oral request by a person to whom this

prospectus supplement has been delivered. Requests should be made

to: Solitario Zinc Corp., 4251 Kipling Street, Suite 390, Wheat

Ridge, Colorado 80033 390; telephone number: (303) 534-1030;

Attention: James R. Maronick, CFO; email:

jmaronick@solitariocorp.com.

As used

in this prospectus supplement, unless the context requires

otherwise, the terms “Solitario,” the

“Company,” “we,” “our,” and

“us” refer to Solitario Zinc Corp. and, where the

context requires, our subsidiaries. Unless otherwise stated,

currency amounts in this prospectus are stated in U.S. dollars, or

“$.”

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This

prospectus supplement, the accompanying prospectus and the

information incorporated by reference herein and therein contains

certain forward-looking statements within the meaning of Section

27A of the Securities Act, and Section 21E of the Securities

Exchange Act of 1934, as amended, which we refer to as the Exchange

Act. Such statements are based on assumptions and expectations

which may not be realized and are inherently subject to risks,

uncertainties and other factors, many of which cannot be predicted

with accuracy and some of which might not even be anticipated.

Future events and actual results, performance, transactions or

achievements, financial and otherwise, may differ materially from

the results, performance, transactions or achievements expressed or

implied by the forward-looking statements. Risks, uncertainties and

other factors that might cause such differences, some of which

could be material, include, but are not limited to:

●

Commodity price

fluctuations, particularly for zinc;

●

The effects of

pandemics such as COVID-19 on health in our operating jurisdictions

and the world-wide, national, state and local responses to such

pandemics;

●

Political and/or

regulatory changes in our operating jurisdictions;

Our

estimates of the value and recovery of our short-term

investments;

●

Our estimates of

future exploration, development, general and administrative and

other costs;

●

Our ability to

realize a return on our investment in the Lik project in Alaska and

Florida Canyon project in Peru;

●

Our ability to

successfully identify, and execute on transactions to acquire new

mineral exploration properties and other related

assets;

●

Our estimates of

fair value of our holdings in shares of Vendetta, Vox and

Kinross;

●

Our expectations

regarding development and exploration of our properties and assets

including those subject to joint venture and shareholder

agreements;

●

Our future

financial condition or results of operations and our future

revenues and expenses;

●

Our business

strategy and other plans and objectives for future

operations;

●

Costs to own,

maintain and fund development costs for our projects and

operations;

●

Unexpected changes

in business and economic conditions, including the rate of

inflation;

●

Results of current

and future feasibility studies;

●

Changes in investor

perception of our industry;

●

Acts of God such as

floods, earthquakes and any other natural disasters;

and

●

Other risks

identified in the section entitled “Risk Factors” in

this prospectus supplement, the accompanying prospectus, in our

Annual Report on Form 10-K for the fiscal year ended December 31,

2019, or 2019 Form 10-K, each subsequently filed Quarterly Report

on Form 10-Q, and, from time to time, in other reports we file with

the SEC or in other documents that we publicly

disseminate.

This

list, together with the factors identified under the section

entitled “RISK FACTORS,” is not an exhaustive list of

the factors that may affect any of our forward-looking statements.

You should read this prospectus supplement, the accompanying

prospectus, and any documents incorporated by reference in any of

those documents completely and with the understanding that our

actual future results may be materially different from what we

expect. These forward-looking statements represent our beliefs,

expectations and opinions only as of the date on which they were

made.

Although we believe

that the expectations reflected in the forward-looking statements

are reasonable, we cannot guarantee future results, levels of

activity, performance or achievements. These forward-looking

statements involve risks, uncertainties and other factors that may

cause our actual results in future periods to differ materially

from forecasted results. We do not undertake to publicly update or

revise these forward-looking statements, whether as a result of new

information, future events or otherwise, other than to reflect a

material change in the information previously disclosed, as

required by applicable law. You should review our subsequent

reports filed from time to time with the SEC on Forms 10-K, 10-Q

and 8-K and any amendments thereto. We qualify all of our

forward-looking statements by these cautionary

statements.

Prospective investors are urged not to put undue reliance on

forward-looking statements.

|

|

|

|

|

|

PROSPECTUS

SUPPLEMENT SUMMARY

This summary highlights information incorporated by reference into

or contained elsewhere in this prospectus supplement and the

accompanying prospectus. This summary may not contain all of the

information that may be important to you. You should read carefully

all of the information contained in or incorporated by reference

into this prospectus supplement and the accompanying prospectus,

including the information set forth under the caption “Risk

Factors” beginning on page S-4 of this prospectus supplement

and in our 2019 Form 10-K, subsequently filed Quarterly Reports on

Form 10-Q, and our consolidated financial statements and the

related notes thereto incorporated by reference herein before

making a decision to purchase our shares.

Overview of Our Business

We are an exploration stage company under Industry

Guide 7, as issued by the SEC, with a focus on the acquisition of

precious and base metal properties with exploration potential and

the development or purchase of royalty interests. Currently our

primary focus is the acquisition and exploration of zinc-related

exploration mineral properties. However, we continue to evaluate

other mineral properties for acquisition. We acquire and

hold a portfolio of exploration properties for future sale, joint

venture, or to create a royalty prior to the establishment of

proven and probable reserves. Although

our mineral properties may be developed in the future by us,

through a joint venture or by a third party, we have never

developed a mineral property.

Our

current geographic focus for the evaluation of potential mineral

property assets is in North and South America; however, we have

conducted property evaluations for potential acquisition in other

parts of the world. We currently consider our carried interest in

the Florida Canyon project in Peru and our interest in the Lik

project in Alaska to be our core mineral property assets. In

addition, we have one other exploration property in Peru. We are

conducting independent exploration activities on our own and

through joint ventures operated by our partners in Peru and the

United States.

In

2017 we acquired a 50% operating interest in the Lik

zinc-lead-silver property in Northwest Alaska, which is estimated

to contain a large tonnage, high-grade deposit potentially mineable

by open-pit methods. Teck American Inc., a wholly owned subsidiary

of Tech Resources Limited is a 50% partner in the Lik project, and

they act as the project manager. A Preliminary Economic Assessment

(“PEA”) was completed on the Lik deposit in

2014.

We

hold a 39% interest in the advanced, high-grade, Florida Canyon

zinc project located in northern Peru. The project has a

significant mineral resource and we are fully carried to production

by our joint venture partner Nexa Resources, Ltd.

(“Nexa”). Solitario and Nexa completed a PEA on the

Florida Canyon deposit in August 2017. Except for the 2018-2019

drilling program, Nexa has funded 100% of project expenditures

since the inception of the Florida Canyon joint venture in 2006.

The Florida Canyon project consists of 16 concessions comprising

12,600 hectares of mineral rights originally granted to Minera

Bongará S.A., our subsidiary incorporated in Peru. The

property is located in the Department of Amazonas, northern Peru.

Solitario's and Nexa’s property interests are held through

the ownership of shares in Minera Bongará S.A., a joint

operating company that holds a 100% interest in the mineral rights

and other project assets.

We are

exploring other mineral properties that may be developed in the

future by us or through a joint venture. We also from time to time

evaluate mineral assets and projects for acquisition and additional

properties on which to potentially buy a royalty.

We have

been actively involved in mineral exploration projects since 1993.

We have recorded revenue in the past

from the sale of mineral properties, including from a royalty in

January 2019 and the sale in June 2018 of our interest in the

royalty on the Yanacocha property. Future revenues from the

sale of properties or royalty interests, if any, will likely occur

on an infrequent basis (if at all). Historically we have reduced our exposure to the

costs of our exploration activities through the use of joint

ventures. We anticipate that the use of joint venture funding for

some of our exploration activities will continue for the

foreseeable future.

|

|

|

|

|

|

|

|

|

|

|

|

Corporate

Information

We were

incorporated in Colorado on November 15, 1984 under the name

Solitario Resources Corporation as a wholly-owned subsidiary of

Crown Resources Corporation, or Crown. On June 12, 2008, our

shareholders approved an amendment to the Articles of Incorporation

to change our name from Solitario Resources Corporation to

Solitario Exploration & Royalty Corp. In July 1994, we became a

publicly traded company on the Toronto Stock Exchange through our

initial public offering. On July 26, 2004, Crown completed a

spin-off of its holdings of our shares to its shareholders as part

of the acquisition of Crown by Kinross Gold Corporation.

In July 2017 we acquired Zazu Metals

Corp. and its 50% interest in the Lik project in Alaska and changed

our name to Solitario Zinc Corp. from Solitario Exploration &

Royalty Corp.

Our

website address is www.Solitarioxr.com. The information contained

in, or that can be accessed through, our website is not

incorporated by reference into this prospectus and is not part of

this prospectus supplement.

Our

common stock is listed on the NYSE American under the symbol

“XPL” and on the Toronto Stock Exchange under the

symbol “SLR.” Our principal executive offices are

located at 4251 Kipling Street, Suite 390, Wheat Ridge, Colorado

80033. Our telephone number is (303) 534-1030.

|

|

|

|

|

|

|

|

|

|

|

|

THE

OFFERING

|

|

|

|

|

|

|

|

|

Issuer

|

Solitario

Zinc Corp.

|

|

|

|

|

|

|

|

|

Size of offering

|

Up to

$9,000,000 of shares of our common stock.

|

|

|

|

|

|

|

|

|

Common stock to be outstanding after

this offering

|

Up to

70,437,133 shares, assuming a sales price of $0.73 per share, which

was the closing price of our common stock on the NYSE American on

January 28, 2021. The actual number of shares issued will vary

depending on the sales price at which shares may be sold from time

to time during this offering.

|

|

|

|

|

|

|

|

|

Plan of Distribution

|

“At-the-market”

offering that may be made from time to time through our agent, H.C.

Wainwright & Co., LLC. See “Plan of Distribution”

on page S-7 of this prospectus supplement.

|

|

|

|

|

|

|

|

|

Use of proceeds

|

We

intend to use the net proceeds from this offering for general

corporate purposes which may include operating expenses, working

capital, and potential asset or strategic acquisitions. See

“Use of Proceeds.”

|

|

|

|

|

|

|

|

|

NYSE American symbol

|

“XPL”

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Risk factors

|

An

investment in our common stock involves certain risks.

We urge

you to carefully consider all of the information described in the

section entitled “Risk Factors” beginning on page S-4

of this prospectus supplement and the risk factors incorporated by

reference from our filings with the SEC.

|

|

|

|

|

|

|

|

|

The

information above regarding the number of shares of our common

stock outstanding is based on 58,108,366 shares of common stock

outstanding as of January 28, 2021. The number of shares of our

common stock outstanding as of that date does not include 5,750,000

shares reserved for issuance under our equity compensation plan, of

which 5,558,000 at January 28, 2021 are issuable upon the exercise

of outstanding options to purchase common stock. Our outstanding

options have a weighted average exercise price of $0.48 per share

as of January 28, 2021.

|

|

|

|

|

|

|

RISK FACTORS

An investment in our common stock offered by this prospectus

supplement and the accompanying prospectus involves a high degree

of risk. You should carefully consider the following risk factors

in addition to the remainder of this prospectus supplement and the

accompanying prospectus, including the information incorporated by

reference, including under the heading “RISK FACTORS”

in the accompanying prospectus, in our 2019 Form 10-K and any

reports subsequently filed by us with the SEC before making an

investment decision. The risks and uncertainties described in these

incorporated documents and described below are not the only risks

and uncertainties that we face. Additional risks and uncertainties

not presently known to us or which we currently consider to be

immaterial may also impair our business operations. If any of these

risks actually occurs, our business, financial condition and

results of operations would suffer. In that event, the trading

price of our shares could decline, and you may lose all or part of

your investment in our shares. The risks discussed below also

include forward-looking statements, and our actual results may

differ substantially from those discussed in these forward-looking

statements. Please see the section entitled “Cautionary

Statement Regarding Forward-Looking Statements” in this

prospectus supplement.

Additional Risks Relating to the Offering and Our Common

Stock

Sales of substantial amounts of our common stock or the perception

that such sales may occur could cause the market price of our

common stock to drop significantly, even if our business is

performing well.

Future

sales of substantial amounts of our common stock, or securities

convertible or exchangeable into shares of our common stock, into

the public market, including shares of our common stock issuable

upon exercise of options and warrants, or perceptions that those

sales could occur, could adversely affect the prevailing market

price of our common stock and our ability to raise capital in the

future. Additionally, the market price of our common stock could

decline as a result of sales of shares of our common stock by, or

the perceived possibility of sales by, our existing shareholders in

the market after this offering. These sales might also make it more

difficult for us to sell equity securities at a time and price that

we deem appropriate.

We may sell additional equity or debt securities in the future to

fund our operations, which may result in dilution to our

shareholders and impose restrictions on our business.

In

order to raise additional funds to support our operations, we may

sell additional equity or debt securities, which, in the case of

equity securities, would result in dilution to all of our

shareholders or, in the case of debt securities, impose restrictive

covenants that adversely impact our business. The sale of other

incurrence of indebtedness would result in increased fixed payment

obligations and could also result in restrictive covenants, such as

limitations on our ability to incur additional debt and certain

operating restrictions that could adversely impact our ability to

conduct our business. We have an effective shelf registration

statement from which additional shares of common stock and other

securities can be offered. We cannot assure you that we will be

able to sell shares or other securities in any other offering at a

price per share that is equal to or greater than the price per

share paid by investors in this offering. If the price per share at

which we sell additional shares of our common stock or related

securities in future transactions is less than the price per share

in this offering, investors who purchase our common stock in this

offering will suffer a dilution of their investment. If we are

unable to expand our operations or otherwise capitalize on our

business opportunities, our business, financial condition and

results of operations could be materially adversely

affected.

Purchasers in this offering will likely experience immediate and

substantial dilution in the book value of their

investment.

The

shares of common stock sold in this offering, if any, will be sold

from time to time at various prices. However, the expected offering

price per share of common stock may be substantially higher than

the net tangible book value per share of common stock. Therefore,

if you purchase shares of our common stock in this offering, your

interest will be diluted to the extent of the difference between

the price per share you pay and the net tangible book value per

share of common stock. Assuming that the sale of an aggregate

amount of $9,000,000 of shares of our common stock in this offering

at an assumed offering price of $0.73 per share, which was the last

reported sale price of our common stock on the NYSE American on

January 28, 2021, and based on our net tangible book value as of

September 30, 2020, if you purchase shares of common stock in this

offering you will suffer substantial and immediate dilution of

$0.27 per share in the net tangible book value of the share common

stock. The future exercise of outstanding options or warrants and

other instruments that are convertible or exercisable into common

stock, if any, will result in further dilution of your investment.

See the section entitled “Dilution” below for a more

detailed discussion of the dilution you will incur if you purchase

shares of our common stock in this offering.

Our management will have broad discretion in the use of the net

proceeds from this offering and may allocate the net proceeds from

this offering in ways that you and other shareholders may not

approve.

Our

management will have broad discretion in the use of the net

proceeds, including for any of the purposes described in the

section entitled “Use of Proceeds,” and you will not

have the opportunity as part of your investment decision to assess

whether the net proceeds are being used appropriately. All of the

net proceeds will be used at the discretion of management to fund

working capital and for general corporate purposes. The failure of

our management to use these funds effectively could have a material

adverse effect on our business, cause the market price of our

common stock to decline and delay the exploration or development at

any of our mines or exploration projects. Pending their use, we

intend to invest the net proceeds in a variety of capital

preservation instruments, including short-term, investment-grade,

interest-bearing instruments and U.S. government securities. These

investments may not yield a favorable return to our

stockholders.

The common stock offered hereby will be sold in

“at-the-market” offerings, and investors who buy shares

at different times will likely pay different prices.

Investors who

purchase shares in this offering at different times will likely pay

different prices, and so may experience different outcomes in their

investment results. We will have discretion, subject to market

demand, to vary the timing, prices, and numbers of shares sold, and

there is no minimum or maximum sales price. Investors may

experience a decline in the value of their shares as a result of

share sales made at prices lower than the prices they

paid.

The actual number of shares we will issue under the Offering

Agreement, at any one time or in total, is uncertain.

Subject

to certain limitations in the Offering Agreement and compliance

with applicable law, we have the discretion to deliver a sales

notice to Wainwright at any time throughout the term of the

Offering Agreement. The number of shares that are sold by

Wainwright after delivering a sales notice will fluctuate based on

the market price of our common stock during the sales period and

limits we set with Wainwright. Because the price per share of each

share sold will fluctuate based on the market price of our common

stock during the sales period, it is not possible at this stage to

predict the number of shares that will be ultimately

issued.

It is not possible to predict the aggregate proceeds resulting from

sales made under the Offering Agreement.

Subject

to certain limitations in the sales agreement and compliance with

applicable law, we have the discretion to deliver a placement

notice to Wainwright at any time throughout the term of the

Offering Agreement. The number of shares that are sold through

Wainwright after delivering a placement notice will fluctuate based

on a number of factors, including the market price of our common

stock during the sales period, any limits we may set with

Wainwright in any applicable placement notice and the demand for

our common stock. Because the price per share of each share sold

pursuant to the Offering Agreement will fluctuate over time, it is

not currently possible to predict the aggregate proceeds to be

raised in connection with sales under the sales

agreement.

USE OF PROCEEDS

We may

issue and sell shares of our common stock having aggregate sales

proceeds of up to $9,000,000 from time to time. Because there is no

minimum offering amount required as a condition of this offering,

the actual total public offering amount, commissions and proceeds

to us, if any, are not determinable at this time. There can be no

assurance that we will sell any shares under or fully utilize the

Offering Agreement with the agent as a source of

financing.

We

intend to use the net proceeds from this offering for working

capital, general corporate purposes, which may include operating

expenses, working capital and potential asset or strategic

acquisitions.

The

expected use of the net proceeds from the sale of common stock

offered by this prospectus supplement represents our intentions

based upon our current plans and business conditions. The amounts

and timing of our actual expenditures may vary significantly

depending on numerous factors and, as a result, our management will

retain broad discretion over the allocation of the net proceeds

from this offering. Until we use the net proceeds from this

offering for the purposes described above, we may invest them in a

variety of capital preservation investments, including short-term,

investment-grade, interest-bearing instruments and U.S. government

securities.

DIVIDEND POLICY

We have not paid a dividend in our history and do

not anticipate paying a dividend in the foreseeable future.

However, at the present time, we are not a party to any

agreement that would limit our ability to pay

dividends.

DILUTION

If you

purchase any of the shares of common stock offered by this

prospectus supplement, you will experience dilution to the extent

of the difference between the price per share of common stock you

pay in this offering and the net tangible book value per share of

our common stock immediately after this offering. Our net tangible

book value as of September 30, 2020 was approximately $24,008,000,

or $0.41 per share of common stock. Net tangible book value per

share represents our total tangible assets (which excludes

intangible assets such as deferred taxes), less our total

liabilities, divided by the aggregate number of shares of our

common stock outstanding as of September 30, 2020.

After

giving effect to the assumed sale of an aggregate of $9,000,000 of

shares of common stock in this offering at the assumed public

offering price of $0.73 per share (the closing sales of our common

stock on the NYSE American on January 28, 2021), and after

deducting the commissions and other estimated offering expenses

payable by us, our as adjusted net tangible book value as of

September 30, 2020 would have been approximately $32,638,000, or

$0.46 per share. This amount represents an immediate increase in

net tangible book value of $0.05 per share to existing stockholders

as a result of this offering and immediate dilution of

approximately $0.27 per share to new investors purchasing our

common stock in this offering.

The

following table illustrates this dilution on a per share basis. The

as-adjusted information below is illustrative only and will adjust

based on the actual price to the public and the actual

number of shares sold pursuant to this prospectus supplement. The

shares sold in this offering, if any, will be sold from time to

time at various prices.

|

Assumed public

offering price per share

|

|

$0.73

|

|

Net

tangible book value per share as of September 30, 2020

(unaudited)….

|

$0.41

|

|

|

Increase

in net tangible book value per share attributable to this

offering

|

$0.05

|

|

|

As-adjusted net

tangible book value per share after this

offering

|

|

$0.46

|

|

Dilution per share

to new investors participating in this offering

|

|

$0.27

|

A $0.10

increase in the assumed public offering price of $0.73 per share

(the closing sales of our common stock on the NYSE American on

January 28, 2021), to $0.83 per share would increase the

as-adjusted net tangible book value by $0.06 per share and would

increase the dilution to new investors by $0.36 per share, after

deducting commissions and offering expenses payable by us in

connection with this offering. A $0.10 decrease in the assumed

public offering price of $0.73 per share (the closing sales price

of our common stock on the NYSE American on January 28, 2021), to

$0.63 per share would increase the dilution to new investors by

$0.18 per share, after deducting commissions and offering expenses

payable by us in connection with this offering.

The per

share data appearing above is based on 58,108,366 shares of common

stock outstanding as of September 30, 2020, and

excludes:

●

5,698,000 shares of

common stock issuable upon the exercise of stock options

outstanding as of September 30, 2020, with a weighted-average

exercise price of $0.49 per share; and

●

1,438 additional

shares of common stock reserved for future issuance under our

omnibus stock and incentive plan as of September 30,

2020.

To the

extent that outstanding options are exercised, investors purchasing

our common stock in this offering will experience further dilution.

In addition, we may choose to raise additional capital because of

market conditions or strategic considerations, even if we believe

that we have sufficient funds for our current or future operating

plans. To the extent that additional capital is raised through the

sale of equity or convertible debt securities, the issuance of

these securities could result in further dilution to our

stockholders.

PLAN OF DISTRIBUTION

We have

entered into an At The Market Offering Agreement with Wainwright,

under which we may issue and sell our common stock having an

aggregate gross sales price of up to $9,000,000 from time to time

through Wainwright acting as agent. The Offering

Agreement provides that sales of our common stock, if any, under

this prospectus supplement may be made in sales deemed to be

“at-the-market” equity offerings as defined in Rule

415(a)(4) promulgated under the Securities Act. If we and

Wainwright agree on any method of distribution other than sales of

shares of our common stock into the NYSE American or another

existing trading market in the United States at market prices, we

will file a further prospectus supplement providing all information

about such offering as required by Rule 424(b) under the Securities

Act. No sales will be made in Canada or into any trading market in

Canada.

Wainwright will

offer the common stock subject to the terms and conditions of the

Offering Agreement on a daily basis or as otherwise agreed upon by

us and Wainwright on any day that: (i) is a trading day for the

NYSE American; (ii) we have instructed Wainwright to make such

sales; and (iii) we have satisfied the conditions under Section 6

of the Offering Agreement. We will designate the maximum amount of

common stock to be sold through Wainwright on a daily basis.

Subject to the terms and conditions of the Offering Agreement,

Wainwright will use its commercially reasonable efforts to sell on

our behalf all of the common stock so designated or determined. We

or Wainwright may suspend the offering of common stock being made

through Wainwright under the Offering Agreement upon proper notice

to the other party.

We will

pay Wainwright commissions, in cash, for its services in acting as

agent in the sale of our common stock. Wainwright will be entitled

to a placement fee of 3% of the gross sales price of the shares

sold. Because there is no minimum offering amount required as a

condition of this offering, the actual total public offering

amount, commissions and proceeds to us, if any, are not

determinable at this time. We have also agreed to reimburse

Wainwright for certain specified expenses, including the fees and

disbursements of its legal counsel, in an amount not to exceed

$50,000, as provided in the Offering Agreement. Additionally,

pursuant to the terms of the Offering Agreement, we agreed to

reimburse Wainwright for the fees and disbursements of its legal

counsel in connection with Wainwright’s ongoing diligence,

drafting and other filing requirements arising from the

transactions contemplated by the Offering Agreement in an amount

not to exceed $2,500 in the aggregate per calendar quarter. We

estimate that the total expenses for the offering, excluding

compensation and reimbursements payable to Wainwright under the

terms of the Offering Agreement, will be approximately

$75,000.

Settlement for

sales of common stock will occur at 10:00 a.m. (New York City

time), or at some other time that is agreed upon by us and

Wainwright in connection with a particular transaction, on the

second trading day following sale of the shares, in return for

payment of the net proceeds to us. Sales of our common stock as

contemplated in this prospectus supplement will be settled through

the facilities of The Depository Trust Company or by such other

means as we and Wainwright may agree upon. There is no arrangement

for funds to be received in an escrow, trust or similar

arrangement.

Wainwright has

agreed to use its commercially reasonable efforts consistent with

its normal trading and sales practices and applicable law and

regulations to sell on our behalf all of the common stock requested

to be sold by us, subject to the conditions set forth in the

Offering Agreement. In connection with the sale of the common stock

on our behalf, Wainwright may be deemed to be an

“underwriter” within the meaning of the Securities Act

and the compensation of Wainwright may be deemed to be underwriting

commissions or discounts. We have agreed to provide indemnification

and contribution to Wainwright against certain civil liabilities,

including liabilities under the Securities Act.

The

offering of our common stock pursuant to the Offering Agreement

will terminate upon the earlier of (i) the issuance and sale of all

of the common stock subject to the Offering Agreement, and (ii) the

termination of the Offering Agreement as permitted therein. We may

terminate the Offering Agreement at any time upon ten business

days’ prior notice.

Wainwright and its

affiliates may in the future provide various investment banking,

commercial banking and other financial services for us and our

affiliates, for which services they may in the future receive

customary fees, although we have no current agreements to do so. To

the extent required by Regulation M, Wainwright will not engage in

any market making activities involving our common stock while the

offering is ongoing under this prospectus supplement.

We have

applied to list the shares of common stock sold in this offering on

the NYSE American, and approval for such listing is a condition for

sales under the Offering Agreement.

This

prospectus in electronic format may be made available on a website

maintained by Wainwright and Wainwright may distribute this

prospectus electronically.

LEGAL MATTERS

The

validity of the shares of common stock offered by this prospectus

supplement will be passed upon for us by Polsinelli PC, Denver,

Colorado. Certain legal matters will be passed upon for the agent

by Ellenoff Grossman & Schole LLP, New York, New

York.

EXPERTS

Our

financial statements as of December 31, 2019 and for each of the

two years then-ended included in our Annual Report on Form 10-K for

the year ended December 31, 2019 has been incorporated by reference

in this prospectus in reliance upon the reports of Plante &

Moran PLLC, Denver, Colorado, our independent registered public

accounting firm for those years.

These

financial statements have been incorporated herein by reference

upon the authority of said firms as experts in accounting and

auditing.

INFORMATION INCORPORATED BY REFERENCE

The SEC

allows us to incorporate by reference information into this

prospectus supplement. This means we can disclose information to

you by referring you to another document we filed or will file with

the SEC. This prospectus supplement incorporates by reference the

following documents (other than any portion of the respective

filings furnished, rather than filed, under the applicable SEC

rules) that we have filed or will file with the SEC (File No.

001-34857) but have not included or delivered with this prospectus

supplement:

●

Our Annual Report

on Form 10-K for the fiscal year ended December 31, 2019, as

amended;

●

Our Quarterly

Report on Form 10-Q for the quarterly period ended March 31, 2020,

as amended;

●

Our Quarterly

Report on Form 10-Q for the quarterly period ended June 30,

2020;

●

Our Quarterly

Report on Form for the quarterly period ended September 30,

2020;

●

Our Current Reports

on Form 8-K filed with the SEC on April 23, 2020, June 18, 2020,

and December 18, 2020;

●

Our Definitive

Proxy Statement on Schedule 14A filed April 28, 2020 (solely those

portions that were incorporated by reference into Part III of our

Annual Report on Form 10-K for the year ended December 31,

2019);

●

The description of

our common stock contained in our registration statement on Form

8-A, which was filed with the SEC on August 9, 2006, including any

amendment or report filed for the purpose of updating such

description; and

●

All documents, or

portions thereof, filed by us subsequent to the date of this

prospectus supplement under Section 13(a), 13(c), 14 or 15 of the

Exchange Act, prior to the termination of this

offering.

Documents, or

portions thereof, furnished or deemed furnished by us are not

incorporated by reference into this prospectus supplement or the

accompanying prospectus. Information that we file later with the

SEC will automatically update and supersede the previously filed

information. For information with regard to other documents

incorporated by reference in the accompanying prospectus, see

“Incorporation by Reference” in the accompanying

prospectus.

We will

make those documents available to you without charge upon your oral

or written request. Requests for those documents should be directed

to:

Solitario

Zinc Corp.

Attn:

Corporate Secretary

4251

Kipling Street, Suite 390

Wheat

Ridge, Colorado 80033

(303)

534-1030

WHERE YOU CAN FIND MORE INFORMATION

We are

subject to the information requirements of the Exchange Act, which

means that we are required to file reports, proxy statements, and

other information with the SEC. The SEC maintains an Internet

website at www.sec.gov where you can access reports, proxy

information and registration statements, and other information

regarding registrants that file electronically with the SEC through

the EDGAR system.

We have

filed a registration statement on Form S-3 to register the shares

to be issued pursuant to this prospectus supplement. As allowed by

SEC rules, this prospectus supplement does not contain all of the

information you can find in the registration statement or the

exhibits to the registration statement because some parts of the

registration statement are omitted in accordance with the rules and

regulations of the SEC. You may obtain a copy of the registration

statement from the SEC or from the SEC’s

website.

Our

filings with the SEC, as well as additional information about us,

are also available to the public through our website at

www.Solitarioxr.com and are made as soon as reasonably

practicable after such material is filed with or furnished to the

SEC. Information contained on, or that can be accessed through, our

website is not incorporated into this prospectus supplement or our

other securities filings and does not form a part of this

prospectus supplement.

Prospectus

$12,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Rights

Units

This

prospectus provides you with a general description of the

securities that Solitario Zinc Corp. may offer and sell, from time

to time, either individually or in units. Each time we sell

securities pursuant to this prospectus we will provide a prospectus

supplement that will contain specific information about the terms

of any securities we offer and the specific manner in which we will

offer such securities. The prospectus supplement will also contain

information, where appropriate, about material United States

federal income tax consequences relating to, and any listing on a

securities exchange of, the securities covered by the prospectus

supplement. The prospectus supplement may also add, update or

change information contained in this prospectus. You should read

this prospectus and the applicable prospectus supplement carefully

before you invest in our securities.

We may

offer these securities in amounts, at prices and on terms

determined at the time of offering. We may sell the securities

directly to you, through agents we select, or through underwriters

and dealers we select. If we use agents, underwriters or dealers to

sell the securities, we will name them and describe their

compensation in a prospectus supplement.

Our

common stock is listed on the NYSE American under the symbol

“XPL.” On September 28, 2020, the closing price for our

common stock as reported on the NYSE American was $0.40 per share.

Our principal executive offices are located at 4251 Kipling Street,

Suite 390, Wheat Ridge, Colorado 80033.

Investing

in our securities involves a high degree of risk. You should review

carefully the risks and uncertainties described under the heading

“Risk Factors” contained in this prospectus beginning

on page 2 and the applicable prospectus supplement, and under

similar headings in the other documents that are incorporated by

reference into this prospectus.

The date of this prospectus is October 8, 2020.

Table of Contents

|

|

|

Page

|

|

ABOUT

THIS PROSPECTUS

|

|

1

|

|

ABOUT

SOLITARIO ZINC CORP.

|

|

1

|

|

RISK

FACTORS

|

|

2

|

|

FORWARD-LOOKING

STATEMENTS

|

|

2

|

|

RATIOS

OF EARNINGS TO FIXED CHARGES

|

|

2

|

|

HOW WE

INTEND TO USE THE PROCEEDS

|

|

3

|

|

DESCRIPTION OF THE

SECURITIES

|

|

3

|

|

DESCRIPTION OF

COMMON STOCK

|

|

3

|

|

DESCRIPTION OF

PREFERRED STOCK

|

|

4

|

|

DESCRIPTION OF DEBT

SECURITIES

|

|

5

|

|

DESCRIPTION OF

WARRANTS

|

|

7

|

|

DESCRIPTION OF

RIGHTS

|

|

8

|

|

DESCRIPTION OF

UNITS

|

|

8

|

|

FORMS

OF SECURITIES

|

|

10

|

|

PLAN OF

DISTRIBUTION

|

|

12

|

|

CERTAIN

PROVISIONS OF COLORADO LAW AND OF OUR AMENDED AND RESTATED ARTICLES

OF INCORPORATION, AS AMENDED, AND AMENDED AND RESTATED

BY-LAWS

|

|

15

|

|

INFORMATION

INCORPORATED BY REFERENCE

|

|

15

|

|

WHERE

YOU CAN FIND MORE INFORMATION

|

|

16

|

|

EXPERTS

|

|

16

|

|

LEGAL

MATTERS

|

|

16

|

ABOUT THIS PROSPECTUS

This

prospectus is part of a registration statement filed with the

Securities and Exchange Commission, or the SEC, utilizing a shelf

registration process. Under this shelf registration process, we may

sell any combination of the securities described in this

prospectus, either individually or in units, in one or more

offerings, up to a total dollar amount of $12,000,000.

This

prospectus provides you with a general description of the

securities we may offer. Each time we sell securities, we will

provide a prospectus supplement that will contain specific

information about the terms of that specific offering. The

prospectus supplement may also add, update or change information

contained in this prospectus. You should read this prospectus and

the applicable prospectus supplement together with the additional

information described under the heading “Where You Can Find

More Information.”

We have not authorized anyone to provide you with

any information or to make any representations other than those

contained in this prospectus, any applicable prospectus supplement

or any free writing prospectuses prepared by or on behalf of us or

to which we have referred you. We take no responsibility for, and

can provide no assurance as to the reliability of, any other

information that others may give you. We will not make an offer to

sell these securities in any jurisdiction where the offer or sale

is not permitted. You should assume that the information appearing

in this prospectus and any applicable prospectus supplement to this

prospectus is accurate as of the date on the respective covers of

such documents, and that any information incorporated by reference

is accurate only as of the date of the document incorporated by

reference, regardless of the time of delivery of this

prospectus, such prospectus supplement, or any sale or issuance of

a security, unless we indicate

otherwise. Our business, financial condition, results of operations

and prospects may have changed materially

since those dates. You should rely only on

the information contained or incorporated by reference in this

prospectus or any accompanying prospectus

supplement.

Unless the context otherwise requires, all references to

“Solitario,” “the Company,”

“we,” “our,” “us” or “our

company” in this prospectus refer to Solitario Zinc Corp., a

Colorado corporation.

ABOUT SOLITARIO ZINC CORP.

Solitario is an exploration stage company under

Industry Guide 7, as issued by the SEC, with a focus on the

acquisition of precious and base metal properties with exploration

potential and the development or purchase of royalty interests.

Currently our primary focus is the acquisition and exploration of

zinc-related exploration mineral properties. However, we continue

to evaluate other mineral properties for acquisition. We

acquire and hold a portfolio of exploration properties for future

sale, joint venture, or to create a royalty prior to the

establishment of proven and probable reserves. Although our mineral properties may be developed

in the future by us, through a joint venture or by a third party,

we have never developed a mineral property.

Our

current geographic focus for the evaluation of potential mineral

property assets is in North and South America; however, we have

conducted property evaluations for potential acquisition in other

parts of the world. We currently consider our carried interest in

the Florida Canyon project in Peru and our interest in the Lik

project in Alaska to be our core mineral property assets. In

addition, we have one other exploration property in Peru. We are

conducting independent exploration activities on our own and

through joint ventures operated by our partners in Peru and the

United States.

We are

exploring other mineral properties that may be developed in the

future by us or through a joint venture. We may also evaluate

mineral properties to potentially buy a royalty.

We have

been actively involved in mineral exploration since 1993.

We have recorded revenue in the past

from the sale of mineral properties, including from a royalty in

January 2019 and the sale in June 2018 of our interest in the

royalty on the Yanacocha property. Future revenues from the

sale of properties or royalty interests, if any, will likely occur

on an infrequent basis (if at all). Historically we have reduced our exposure to the

costs of our exploration activities through the use of joint

ventures. Although we anticipate that the use of joint venture

funding for some of our exploration activities will continue for

the foreseeable future, we can provide no assurance that these or

other sources of capital will be available in sufficient amounts to

meet our needs, if at all.

Corporate Information

We were

incorporated in Colorado on November 15, 1984 under the name

Solitario Resources Corporation as a wholly-owned subsidiary of

Crown Resources Corporation, or Crown. On June 12, 2008, our

shareholders approved an amendment to the Articles of Incorporation

to change our name from Solitario Resources Corporation to

Solitario Exploration & Royalty Corp. In July 1994, Solitario

became a publicly traded company on the Toronto Stock Exchange

through its initial public offering. On July 26, 2004, Crown

completed a spin-off of its holdings of our shares to its

shareholders as part of the acquisition of Crown by Kinross Gold

Corporation. In July 2017 Solitario

acquired Zazu Metals Corp. and its 50% interest in the Lik project

in Alaska and changed its name to Solitario Zinc Corp. from

Solitario Exploration & Royalty Corp.

Our

website address is www.Solitarioxr.com. The information contained

in, or that can be accessed through, our website is not

incorporated by reference into this prospectus and is not part of

this prospectus.

Our

common stock is listed on the NYSE American under the symbol

“XPL” and on the Toronto Stock Exchange under the

symbol “SLR.” Our principal executive offices are

located at 4251 Kipling Street, Suite 390, Wheat Ridge, Colorado

80033. Our telephone number is (303) 534-1030.

RISK FACTORS

Investing in our

securities involves a high degree of risk. Please see the risk

factors under the heading “Risk Factors” in our Annual

Report on Form 10-K for the year ended December 31, 2019, on

file with the SEC, and those risk factors identified in reports

subsequently filed with the SEC, including our Quarterly Report on

Form 10-Q for the quarter ended June 30, 2020, which are

incorporated by reference into this prospectus. Before you invest

in our securities, you should carefully consider these risks as

well as other information we include or incorporate by reference

into this prospectus and the applicable prospectus supplement. The

risks and uncertainties we have described are not the only ones

facing our company. Additional risks and uncertainties not

presently known to us or that we currently deem immaterial may also

affect our business operations. The occurrence of any of these

risks might cause you to lose all or part of your investment in the

offered securities. The discussion of risks includes or refers to

forward-looking statements; you should read the explanation of the

qualifications and limitations on such forward-looking statements

discussed elsewhere in this prospectus.

FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995 that

involve risks and uncertainties, as well as assumptions that, if

they never materialize or prove incorrect, could cause our results

to differ materially from those expressed or implied by such

forward-looking statements. All statements other than statements of

historical fact are statements that could be deemed forward-looking

statements, including any projections of financing needs, revenue,

expenses, earnings or losses from operations, or other financial

items; any statements of the plans, strategies and objectives of

management for future operations; any statements concerning

exploration and development plans and timelines; any statements of

expectation or belief; any statements regarding the impact to our

business from the COVID-19 global crisis; and any statements of

assumptions underlying any of the foregoing. In addition, forward

looking statements may contain the words “believe,”

“anticipate,” “expect,”

“estimate,” “intend,” “plan,”

“project,” “will be,” “will

continue,” “will result,” “seek,”

“could,” “may,” “might,” or any

variations of such words or other words with similar

meanings.

The

forward-looking statements included in this prospectus represent

our estimates as of the date of this prospectus. We specifically

disclaim any obligation to update these forward-looking statements

in the future, except as required by law. These forward-looking

statements should not be relied upon as representing our estimates

or views as of any date subsequent to the date of this

prospectus.

RATIOS OF EARNINGS TO FIXED CHARGES

If we

offer debt securities and/or preference equity securities under

this prospectus, then we will, at that time, and if required by the

rules promulgated by the SEC, provide a ratio of earnings to fixed

charges and/or ratio of combined fixed charges and preference

dividends to earnings, respectively, in the applicable prospectus

supplement for such offering.

HOW WE INTEND TO USE THE

PROCEEDS

Unless

otherwise provided in the applicable prospectus supplement, we

intend to use the net proceeds from the sale of the securities

under this prospectus to fund exploration and development of our

mineral properties, and for general corporate purposes, including

capital expenditures and working capital. We may use a portion of

our net proceeds to invest in or acquire additional mineral

property assets or royalty interests. We will set forth in the

prospectus supplement our intended use for the net proceeds

received from the sale of any securities. Pending the application

of the net proceeds, we intend to invest the net proceeds in

investment-grade, interest-bearing securities.

DESCRIPTION OF THE SECURITIES

We may

offer, from time to time, in one or more offerings, up to

$12,000,000 of the following securities:

●

senior

debt securities;

●

subordinated

debt securities;

●

any

combination of the foregoing securities.

The

aggregate initial offering price of the offered securities that we

may issue will not exceed $12,000,000. Until such time as the

aggregate market value of the voting and non-voting common equity

held by non-affiliates of the Company is $75 million or more, the

aggregate market value of securities sold by or on behalf of the

Company pursuant to this registration statement during the period

of 12 calendar months immediately prior to, and including, a sale

under this registration statement will be no more than one-third of

the aggregate market value of the voting and non-voting common

equity held by non-affiliates of the Company. If we issue debt

securities at a discount from their principal amount, then, for

purposes of calculating the aggregate initial offering price of the

offered securities issued under this prospectus, we will include

only the initial offering price of the debt securities and not the

principal amount of the debt securities.

This

prospectus contains a summary of the general terms of the various

securities that we may offer. The prospectus supplement relating to

any particular securities offered will describe the specific terms

of the securities, which may be in addition to or different from

the general terms summarized in this prospectus. Because the

summary in this prospectus and in any prospectus supplement does

not contain all of the information that you may find useful, you

should read the documents relating to the securities that are

described in this prospectus or in any applicable prospectus

supplement. Please read “Where You Can Find More

Information” to find out how you can obtain a copy of those

documents.

The

applicable prospectus supplement will also contain the terms of a

given offering, the initial offering price and our net proceeds.

Where applicable, a prospectus supplement will also describe any

material United States federal income tax consequences relating to

the securities offered and indicate whether the securities offered

are or will be quoted or listed on any quotation system or

securities exchange.

DESCRIPTION OF COMMON STOCK

The

following summary of certain rights and terms of our common stock

does not purport to be complete. You should refer to our Articles,

and our By-laws, both of which are included as exhibits to the

registration statement we have filed with the SEC in connection

with this offering. The summary below is also qualified by

provisions of applicable law.

General Terms

We are

authorized to issue 100,000,000 shares of common stock. On

September 28, 2020, we had 58,107,466 shares of common stock

outstanding and approximately 3,200 stockholders of record. Except

as otherwise provided by any series of preferred stock that may

later be created, holders of our common stock have exclusive voting

rights for the election of directors and for all other purposes.

Holders of our common stock are entitled to one vote per share on

all matters to be voted upon by our stockholders. Neither our

Articles nor our By-laws authorize cumulative voting. The holders

of our common stock are entitled to receive dividends, if any, as

may be declared from time to time by our board of directors out of

funds legally available for the payment of dividends, subject to

the rights of any series of preferred stock. In the event of a

liquidation, dissolution or winding up of Solitario, the holders of

our common stock are entitled to share ratably in all assets

remaining after payment of the preferential amounts, if any, to

which the holders of our preferred stock, if any, are entitled. Our

common stock has no preemptive, conversion or other subscription

rights. There are no redemption or sinking fund provisions

applicable to our common stock. All of our outstanding shares of

common stock are fully paid and non-assessable.

Our Board of Directors

Our

board of directors currently has six members. Our Articles and our

By-laws provide that the number of directors shall be fixed from

time to time by resolution adopted by the vote of a majority of the

directors then in office, but shall in no event be less than three

(except that there need be only as many directors as there are

stockholders in the event the outstanding shares are held of record

by fewer than three stockholders) nor more than nine. Our Articles

provide that, upon the first election of directors by the

stockholders after an increase in the number of directors to nine

or more, the board of directors shall be divided into three nearly

equal classes, with each classes’ term expiring on a

staggered basis. Vacancies and newly created directorships may be

filled by a majority of the directors then in office, though less

than a quorum. Directors may be removed with or without cause by

the affirmative vote of a majority of the outstanding shares

of capital stock entitled to vote generally in the election of

directors cast at a meeting of the stockholders called for that

purpose. If a director is elected by a voting group of

stockholders, only the stockholders of that voting group may

participate in the vote to remove that director.

Transfer Agent and Registrar

The

transfer agent and registrar for our common stock in the United

States is Computershare Trust Company, N.A. and in Canada is

Computershare Investor Services Inc.

NYSE MKT and Toronto Stock Exchange

Our

common stock is listed for quotation on the NYSE MKT under the

symbol “XPL” and on the Toronto Stock Exchange under

the symbol “SLR.”

DESCRIPTION OF PREFERRED STOCK

We are

authorized to issue 10,000,000 shares of preferred stock. As of the

date of this prospectus, no shares of our preferred stock were

outstanding. The following summary of certain provisions of our

preferred stock does not purport to be complete. You should refer

to our Amended and Restated Articles of Incorporation, as amended,

or the Articles, and our amended and restated by-laws, or the

By-laws, both of which are included as exhibits to the registration

statement we have filed with the SEC in connection with this

offering. The summary below is also qualified by provisions of

applicable law.

General Terms

Our

board of directors may, without further action by our stockholders,

from time to time, direct the issuance of shares of preferred stock

in series and may, at the time of issuance, determine the rights,

preferences and limitations of each series, including voting

rights, dividend rights and redemption and liquidation preferences.

Satisfaction of any dividend preferences of outstanding shares of

preferred stock would reduce the amount of funds available for the

payment of dividends on shares of our common stock (although we do

not anticipate paying any dividends to the holders of our common

stock in the foreseeable future). Holders of shares of preferred

stock may be entitled to receive a preference payment in the event

of any liquidation, dissolution or winding-up of our company before

any payment is made to the holders of shares of our common stock.

In some circumstances, the issuance of shares of preferred stock

may render more difficult or tend to discourage a merger, tender

offer or proxy contest, the assumption of control by a holder of a

large block of our securities or the removal of incumbent

management as discussed below. Upon the affirmative vote of our

board of directors, without stockholder approval, we may issue

shares of preferred stock with voting and conversion rights which

could adversely affect the holders of shares of our common

stock.

If we

offer a specific series of preferred stock under this prospectus,

we will describe the terms of the preferred stock in the prospectus

supplement for such offering and will file a copy of the articles

of amendment to the Articles establishing the terms of the

preferred stock with the SEC. To the extent required, this

description will include:

●

the

title and stated value;

●

the

number of shares offered, the liquidation preference per share and

the purchase price;

●

the

dividend rate(s), period(s) and/or payment date(s), or method(s) of

calculation for such dividends;

●

whether

dividends will be cumulative or non-cumulative and, if cumulative,

the date from which dividends will accumulate;

●

the

procedures for any auction and remarketing, if any;

●

the

provisions for a sinking fund, if any;

●

the

provisions for redemption, if applicable;

●

any

listing of the preferred stock on any securities exchange or

market;

●

whether

the preferred stock will be convertible into our common stock, and,

if applicable, the conversion price (or how it will be calculated)

and conversion period;

●

whether

the preferred stock will be exchangeable into debt securities, and,

if applicable, the exchange price (or how it will be calculated)

and exchange period;

●

voting

rights, if any, of the preferred stock;

●

a