Current Report Filing (8-k)

October 04 2021 - 6:01AM

Edgar (US Regulatory)

0001171155false00011711552021-09-272021-09-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) September 27, 2021

RADIANT LOGISTICS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-35392

|

|

04-3625550

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

Triton Towers Two

700 S. Renton Village Place

Seventh Floor

Renton, Washington 98057

(Address of principal executive offices) (Zip Code)

(425) 462-1094

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $.001 Par Value

|

|

RLGT

|

|

NYSE American LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On September 27, 2021, the Board of Directors of Radiant Logistics, Inc. (the “Company”), upon recommendation of the Audit and Executive Oversight Committee, approved an amended and restated Radiant Logistics, Inc. Management Incentive Compensation Plan (the “MICP”), effective as of July 1, 2021.

The purpose of the MICP is to provide a compensation structure that properly incentivizes certain eligible employees of the Company and certain of its subsidiaries to execute on the Company’s business strategy of maximizing operational efficiencies, emphasizing customer relationships and driving long-term growth and to reinforce a positive culture that rewards entrepreneurial drive while maintaining a meaningful performance and variable based component of the Company’s compensation plan to align with the scalable nature of the Company’s overall cost structure. The MICP provides for incentive compensation that supports the Company’s variable cost-based business strategy and emphasizes pay-for-performance by tying reward opportunities to carefully determined and articulated performance goals at corporate, business unit, operating location and/or individual levels.

The MICP provides for quarterly cash incentive awards as part of the Company’s short-term incentive program, and in the case of certain participants, restricted stock unit awards and/or new performance unit awards as part of the Company’s long-term incentive plan. The quarterly cash incentive awards allow participants to participate on a pro rata basis in a quarterly profit pool calculated as a percentage of the Company’s quarterly adjusted EBITDA (earnings before interest, taxes, depreciation and amortization). The long-term incentive program portion under the MICP consists of restricted stock unit awards based on achievement of pre-established company and individual goals and vest in full on the three-year anniversary of the grant date, and beginning in fiscal 2022, will consist of performance unit awards for executive officer participants, in addition to restricted stock unit awards, which performance unit awards will be vest and be paid out based upon the achievement of three-year pre-established company and individual performance goals.

The foregoing description of the MICP does not purport to be complete and is qualified in its entirety by reference to the full text of the MICP, which is filed herewith as Exhibit 10.1 to this Current Report on Form 8-K, and is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Radiant Logistics, Inc.

|

|

|

|

|

|

|

Date: October 1, 2021

|

|

|

By:

|

|

/s/ Todd Macomber

|

|

|

|

|

|

|

Todd Macomber

|

|

|

|

|

|

|

Senior Vice President and Chief Financial Officer

|

3

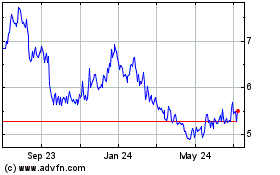

Radiant Logistics (AMEX:RLGT)

Historical Stock Chart

From May 2024 to Jun 2024

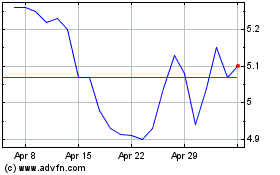

Radiant Logistics (AMEX:RLGT)

Historical Stock Chart

From Jun 2023 to Jun 2024