Filed Pursuant to Rule 424(b)(3)

Registration Number 333-270502

PROSPECTUS

cbdMD, Inc.

13,079,394 shares of Common Stock

This prospectus relates to the sale of up to 13,079,394 shares of our common stock which may be offered by the selling stockholder, Keystone Capital Partners, LLC (“Keystone”, “Keystone Capital Partners” or the “Selling Stockholder”). The shares of common stock being offered by the Selling Stockholder are outstanding or issuable pursuant to the Common Stock Purchase Agreement dated March 2, 2023 (the “Purchase Agreement”). See “The Keystone Capital Transaction” for a description of the Purchase Agreement. Also, please refer to “Selling Stockholder” beginning on page 14. Such registration does not mean that Keystone will actually offer or sell any of these shares. We will not receive any proceeds from the sales of the above shares of our common stock by the Selling Stockholder; however we will receive proceeds under the Purchase Agreement if we sell shares to the Selling Stockholder.

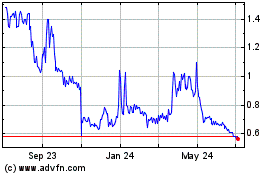

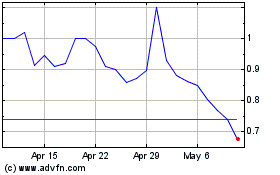

Our common stock is listed on the NYSE American, under the symbol “YCBD.” On March 28, 2023, the last reported sale price of the common stock on the NYSE American was $0.171 per share. Our 8.0% Series A Cumulative Convertible Preferred Stock, or Series A Convertible Preferred Stock, is listed on the NYSE American under the symbol “YCBDpA.” The last reported sale price of our Series A Convertible Preferred Stock on March 27, 2023 was $3.40 per share.

The Selling Stockholder is an “underwriter” within the meaning of the Securities Act of 1933. The Selling Stockholder is offering these shares of common stock. The Selling Stockholder may sell all or a portion of these shares from time to time in market transactions through any market on which our common stock is then traded, in negotiated transactions or otherwise, and at prices and on terms that will be determined by the then prevailing market price or at negotiated prices directly or through a broker or brokers, who may act as agent or as principal or by a combination of such methods of sale. The Selling Stockholder will receive all proceeds from the sale of the common stock. For additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution.”

We are an “emerging growth company” as defined by the Jumpstart Our Business Startups Act of 2012 and, as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. Please see “Prospectus Summary - Implications of Being an Emerging Growth Company.”

Investing in our common stock involves a high degree of risk. Review the risk factors beginning on page 8 of this prospectus carefully before you make an investment in our securities. You should read this prospectus, together with additional information described under the headings “Incorporation of Certain Information by Reference” and “Where You Can Find More Information,” carefully before you invest in any of our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is March 29, 2023

INDEX

| |

Page No. |

|

About This Prospectus

|

i

|

|

Cautionary Statement Regarding Forward-Looking Statements

|

ii

|

|

Prospectus Summary

|

1

|

|

The Offering

|

7

|

|

Risk Factors

|

8

|

|

Use of Proceeds

|

9

|

|

The Keystone Capital Transaction

|

9

|

|

Selling Stockholders

|

14

|

|

Plan of Distribution

|

16

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

18

|

|

Business

|

18

|

|

Description of our Capital Stock

|

18

|

|

Properties

|

20

|

|

Legal Proceedings

|

20

|

|

Directors, Executive Officers and Corporate Governance

|

20

|

|

Executive Compensation

|

20

|

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

20

|

|

Certain Relationships and Related Transactions and Director Independence

|

21

|

|

Legal Matters

|

21

|

|

Experts

|

21

|

|

Where You Can Find More Information

|

21

|

|

Incorporation of Certain Information by Reference

|

21

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”) pursuant to which the Selling Stockholder named herein may, from time to time, offer and sell or otherwise dispose of the securities covered by this prospectus. You should not assume that the information contained in this prospectus is accurate on any date subsequent to the date set forth on the front cover of this prospectus or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus is delivered or securities are sold or otherwise disposed of on a later date. It is important for you to read and consider all information contained in this prospectus, including the Information Incorporated by Reference herein, in making your investment decision. You should also read and consider the information in the documents to which we have referred you under the captions “Where You Can Find More Information” and “Incorporation of Certain Information by Reference” in this prospectus.

Neither we nor the Selling Stockholder have authorized any dealer, salesman or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any of our securities other than the securities covered hereby, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about, and to observe, any restrictions as to the offering and the distribution of this prospectus applicable to those jurisdictions.

We further note that the representations, warranties and covenants made in any agreement that is filed as an exhibit to any document that is incorporated by reference in the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

The information in this prospectus is accurate as of the date on the front cover. Information incorporated by reference into this prospectus is accurate as of the date of the document from which the information is incorporated. You should not assume that the information contained in this prospectus is accurate as of any other date.

Unless the context otherwise indicates, when used in this prospectus, the terms the “Company,” “cbdMD, “we,” “us, “our” and similar terms refer to cbdMD, Inc., a North Carolina corporation formerly known as Level Brands, Inc., and our subsidiaries CBD Industries LLC, a North Carolina limited liability company formerly known as cbdMD LLC, which we refer to as “CBDI”, Paw CBD, Inc., a North Carolina corporation which we refer to as “Paw CBD”, and cbdMD Therapeutics LLC, a North Carolina limited liability company which we refer to as “Therapeutics”. In addition, “fiscal 2021” refers to the year ended September 30, 2021, “fiscal 2022” refers to the year ended September 30, 2022, and “first quarter of fiscal 2023” refers to the three months ended December 31, 2022.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including the documents that we incorporate by reference herein, contains, and any applicable prospectus supplement or free writing prospectus including the documents we incorporate by reference therein may contain, forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, including statements regarding our future financial condition, business strategy and plans and objectives of management for future operations. Forward-looking statements include all statements that are not historical facts. In some cases, you can identify forward-looking statements by terminology such as “believe,” “will,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “might,” “approximately,” “expect,” “predict,” “could,” “potentially” or the negative of these terms or other similar expressions. Forward-looking statements appear in a number of places throughout this prospectus and include statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things, material risks associated with our overall business, material risks associated with the regulatory environment for CBD products, and material risks associated with the ownership of our securities. Discussions containing these forward-looking statements may be found, among other places, in the sections entitled “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in the documents incorporated by reference herein, including our most recent Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q, as well as any amendments thereto.

These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that could cause our actual results, levels of activity, performance or achievement to differ materially from those expressed or implied by these forward-looking statements. We discuss in greater detail, and incorporate by reference into this prospectus in their entirety, many of these risks and uncertainties under the heading “Risk Factors” contained in the applicable prospectus supplement, in any free writing prospectus we may authorize for use in connection with a specific offering, and in the documents incorporated by reference herein. These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. All forward-looking statements are qualified in their entirety by this cautionary statement.

Although we believe that the expectations reflected in the forward-looking statements contained in this prospectus are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. In light of inherent risks, uncertainties and assumptions, the future events and trends discussed in this prospectus may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which such statements were made or to reflect the occurrence of unanticipated events, except as may be required by applicable securities laws.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus or incorporated by reference. It may not contain all of the information that you should consider before investing in our securities. You should read this entire prospectus carefully, including the “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections, and the financial statements and related notes included or incorporated by reference herein. This prospectus includes forward-looking statements that involve risks and uncertainties. See “Cautionary Statement Regarding Forward-Looking Statements.”

cbdMD, Inc.

Corporate Information

Our company was formed under the laws of the state of North Carolina in March 2015 under the name Level Beauty Group, Inc. In November 2016 we changed the name of our company to Level Brands, Inc. Effective May 1, 2019, we changed our name to cbdMD, Inc.

Our principal executive offices are located at 8845 Red Oak Boulevard, Charlotte, NC 28217. Our telephone number at this location is (704) 445-3060. Our corporate website address is www.cbdmd.com. The information contained in, and that can be accessed through, our websites or our various social media platforms is not incorporated into and is not a part of this prospectus.

Company Overview

We own and operate the nationally recognized CBD (cannabidiol) brands cbdMD, Paw CBD and cbdMD Botanicals. We believe that we are an industry leader producing and distributing broad spectrum CBD products and now full spectrum CBD products. Our mission is to enhance our customer’s overall quality of life while bringing cannabinoid education, awareness and accessibility of high quality and effective products to all. We source cannabinoids, including CBD, which are extracted from non-GMO hemp grown on farms in the United States. Our innovative broad spectrum formula utilizes one of the purest hemp extracts, containing CBD, CBG and CBN, while eliminating the presence of tetrahydrocannabinol (THC). Non-THC is defined as below the level of detection using validated scientific analytical methods. Our full spectrum and Delta 9 products contain a variety of cannabinoids and terpenes in addition to CBD while maintaining small amounts of THC that falls within the limits set in the 2018 Farm Act. In addition to our core brands, we also operate cbdMD Therapeutics, LLC to capture the Company’s ongoing investments in science related to its existing and future products, including research and development activities for therapeutic applications.

Our cbdMD brand of products includes an array of high-grade, premium every day and functional CBD products, including tinctures; gummies; topicals; capsules; drink mixes; and sleep, focus and calming aids. In addition we have clinical based claims and industry leading strength and concentrations to drive product efficacy.

Our Paw CBD brand of products includes a line of veterinarian-formulated products including tinctures, chews, topicals products in varying strengths and formulas. Paw CBD products have undergone the National Animal Safety Council’s rigorous audit and meet their Quality Seal standard.

Our cbdMD Botanicals brand of beauty and skincare products features facial oil and serum, toners, moisturizers, clear skin, facial masks, exfoliants and body care SKUs. cbdMD Botanicals is dedicated to creating clean CBD skin care products combining the best of Mother Nature with the precision of scientific innovation. Our products are pure botanical ingredients crafted into gentle beauty products for all skin types.

cbdMD, Paw CBD and cbdMD Botanicals products are distributed through our e-commerce websites, third party ecommerce sites, select distributors and marketing partners as well as a variety of brick and mortar retailers.

Recent Developments

cbdMD’s products were again recognized and awarded 2022 Product of the Year Awards by a national survey organized by Kantar, a global leader in research. cbdMD serves as the first CBD company to win Product of the Year in consecutive years, earning 2022 top honors in “CBD Ingestible” for its CBD Drink Mixes. cbdMD was also named as the Sleeping Beauty Award at the 2022 Daytime Beauty Awards for its sleep focused product. This fall our gummies were named Editors Picked by Healthline, a leading online provider of health information.

Our Paw brand won two Pet Innovations awards this year from Independent Innovations Awards, an independent awards association. Our cat soft chews won the Cat Product of the year while our dog calming tinctures won the Dog Product of the Year.

Management continues to be very focused on delivering positive earnings through a combination of optimizing our product portfolio, right-sizing our cost structure and investing in marketing that will provide positive return on customer acquisition.

During fiscal 2022 we rationalized a significant portion of our product portfolio all while repositioning our product set for higher efficacy and functional products. We continued to expand on our full spectrum products, launched our Delta 9 product offerings and pioneered commercializing NSF (a global health and safety organization) and NSF for Sport SKUs. More recently we launched our strongest CBD, best pricing, as well as our cbdMD Max, formulated to have clinically proven claims around pain and discomfort.

In February 2023, the Company entered into an Agreement for Advertising Placement with a360 Media, LLC (“a360”) in which a360 will provide professional media support and advertising placement in exchange for up to 6,060,606 shares of the Company’s common stock valued at $0.33 per share. A360 will receive the shares by providing the Company with a credit in the amount of $2,000,000 to be used for media support and advertising placement to the Company. The shares are 70% fully vested; 15% of the Shares shall vest upon each advertising placement accrue pro-rata as percentage of the total advertising placement; and 15% of the shares shall vest provided there are no restrictions in product categories that the Company is able to market with a360 while the Company utilizes the advertising placement. Any shares which do not vest within the term of the agreement shall be forfeited. The advertising Placement must be used by the Company prior to December 30, 2023, unless otherwise agreed in writing by both parties.

On February 26, 2023, Kevin MacDermott notified the Company that he was resigning as Principal Executive Officer and President of the Company, effective February 26, 2023. On March 1, 2023, T. Ronan Kennedy agreed to serve as the Company’s Interim Chief Executive Officer and Principal Executive Officer and resigned as Chief Operating Officer of the Company.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the JOBS Act. For so long as we remain an emerging growth company, we are permitted and currently intend to rely on the following provisions of the JOBS Act that contain exceptions from disclosure and other requirements that otherwise are applicable to companies that conduct initial public offerings and file periodic reports with the SEC. These provisions include, but are not limited to:

| |

●

|

being permitted to present only two years of audited financial statements in this prospectus and only two years of related “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our periodic reports and registration statements, including this prospectus;

|

| |

●

|

not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act;

|

| |

●

|

reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements, including in this prospectus; and

|

| |

●

|

exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

|

We will remain an emerging growth company until the earlier of:

| |

●

|

the last day of the fiscal year in which we have total annual gross revenues of $1.07 billion or more;

|

| |

●

|

the last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective registration statement;.

|

| |

●

|

the date on which we have issued more than $1.0 billion in non-convertible debt, during the previous 3-year period, issued; or

|

| |

●

|

the date on which we are deemed to be a large accelerated filer.

|

We have elected to take advantage of certain of the reduced disclosure obligations in this prospectus and may elect to take advantage of other reduced reporting requirements in our future filings with the SEC. As a result, the information that we provide to our stockholders may be different than what you might receive from other public reporting companies in which you hold equity interests.

We have elected to avail ourselves of the provision of the JOBS Act that permits emerging growth companies to take advantage of an extended transition period to comply with new or revised accounting standards until those standards apply to private companies. As a result, we will not be subject to new or revised accounting standards at the same time as other public companies that are not emerging growth companies.

The Keystone Capital Transaction

On March 2, 2023, the Company and Keystone entered into the Purchase Agreement, which provides that subject to the terms and conditions set forth therein, the Company may sell to Keystone up to 12,687,012 shares of common stock of the Company, from time to time during the term of the Purchase Agreement.

Additionally, on March 2, 2023, the Company and Keystone entered into the Registration Rights Agreement, pursuant to which the Company agreed to file a registration statement with the SEC covering the resale of shares of common stock that are issued to Keystone under the Purchase Agreement.

Under the terms and subject to the satisfaction of the conditions set forth in the Purchase Agreement, the Company has the right, but not the obligation, to sell to Keystone, and Keystone is obligated to purchase, up to 12,687,012 shares of common stock. Such sales of common stock by the Company, if any, will be subject to certain limitations as set forth in the Purchase Agreement, and may occur from time to time, at the Company’s sole discretion, over a 12-month period commencing on the date that all of the conditions to the Company’s right to commence such sales are satisfied, including that the registration statement referred to above is declared effective by the SEC. We refer to this date as the “Commencement Date”. Keystone has no right to require the Company to sell any common stock to Keystone, but Keystone is obligated to make purchases as the Company directs, subject to satisfaction of the conditions set forth in the Purchase Agreement.

Upon entering into the Purchase Agreement the Company agreed to issue to Keystone 392,282 shares of common stock of the Company as the Commitment Shares as consideration for Keystone’s commitment to purchase shares of common stock upon the Company’s direction under the Purchase Agreement. The Company issued 30% of the Commitment Shares effective on the date of the Purchase Agreement. An additional 30% of the Commitment Shares will be issued to Keystone 90 days following the Commencement Date. The remaining 40% of the Commitment Shares will be issued to Keystone 180 days following the Commencement Date. The Company has also paid Keystone $35,000 for its reasonable expenses under the Purchase Agreement.

Under the Purchase Agreement, the Company may, at its discretion, from time to time from and after the Commencement Date, direct Keystone to purchase (a “Fixed Purchase”) up to the greater of (i) 100,000 shares of common stock and (ii) $50,000 on any trading day on which the closing sale price of the common stock is not below $0.10 per share on the NYSE American.

In addition to Fixed Purchases, and provided that the Company has directed Keystone to purchase the maximum allowable amount of shares of common stock in a Fixed Purchase, the Company also may, at its discretion, from time to time from and after the Commencement Date, direct Keystone to purchase additional shares of common stock on the trading day immediately following the purchase date for such Fixed Purchase (each, a “VWAP Purchase”) and, under certain circumstances set forth in the Purchase Agreement, direct Keystone to purchase additional shares of common stock on the same trading day as such VWAP Purchase (each, an “Additional VWAP Purchase”), in each case upon the terms and subject to the conditions set forth in the Purchase Agreement. We refer to the Fixed Purchase, the VWAP Purchase and the Additional VWAP Purchase, collectively as a “Purchase”.

Purchase Price for Each Purchase

There is no upper limit on the price per share that Keystone may be obligated to pay for the common stock in any of the Purchases. The purchase price per share for each Purchase is as follows:

| |

•

|

Fixed Purchase - the lesser of (i) 90% of the daily volume weighted average price of the Company’s common stock on the NYSE American, as reported by Bloomberg Financial LP using the AQR function for the five trading days immediately preceding the applicable date for such Fixed Purchase and (ii) the closing sale price of a share of common stock on the applicable date for such Fixed Purchase during the full trading day on the NYSE American on such applicable purchase date.

|

| |

•

|

VWAP Purchase - the lesser of (i) 90% of the closing sale price of the common stock on the date of the applicable VWAP Purchase and (ii) the VWAP during the applicable VWAP Purchase Period as defined under the Purchase Agreement.

|

| |

•

|

Additional VWAP Purchase - 90% of the lower of (i) the VWAP for the applicable Additional VWAP Purchase Period as defined under the Purchase Agreement during the applicable Additional VWAP purchase date for such Additional VWAP Purchase, and (ii) the closing sale price of the common stock on such applicable date of Additional VWAP Purchase for such Additional VWAP Purchase.

|

Maximum Number of Shares to be Purchased under each Applicable Purchase

Each Purchase has a maximum number of shares that may be purchased for each applicable Purchase Period.

| |

•

|

Fixed Purchase - may not exceed $50,000 or 100,000 shares.

|

| |

•

|

All Purchases combined - Keystone’s maximum purchase commitment in any single VWAP Purchase, together with any one or more Additional VWAP Purchases that are effected on the same trading day as such VWAP Purchase, may not exceed $5,000,000 in the aggregate for such VWAP Purchase and Additional VWAP Purchases.

|

| |

•

|

VWAP Purchase - lesser of (i) 300% of the number of shares directed by the Company to be purchased by Keystone pursuant to the corresponding Fixed Purchase and 30% of the trading volume in the Company’s common stock on the NYSE American during the applicable VWAP Purchase Period.

|

| |

•

|

Additional VWAP Purchase - lesser of (i) 300% of the number of shares directed by the Company to be purchased by Keystone pursuant to the corresponding Fixed Purchase and (ii) a number of shares equal to (A) 30% multiplied by (B) the trading volume of shares of common stock during the applicable Additional VWAP Purchase Period.

|

Under applicable rules of the NYSE American, in no event may the Company issue or sell to Keystone under the Purchase Agreement more than 13,079,394 shares of common stock (including the Commitment Shares), which maximum number of shares is equal to 19.99% of the Company’s shares of common stock outstanding immediately prior to the execution of the Purchase Agreement

The Purchase Agreement also prohibits the Company from directing Keystone to purchase any shares of common stock if those shares, when aggregated with all other shares of common stock then beneficially owned by Keystone and its affiliates, would result in Keystone having beneficial ownership of more than 9.99% of the outstanding shares of common stock.

The net proceeds under the Purchase Agreement to the Company will depend on the frequency of sales and the number of shares sold to Keystone and prices at which the Company sells shares to Keystone. The Company expects that any net proceeds received by the Company from such sales to Keystone will be used for working capital and general corporate purposes. Management of the Company believes that it is in the Company’s best interests to have the flexibility to sell common stock pursuant to the Purchase Agreement, subject to market conditions.

THE OFFERING

This prospectus relates to the resale by the Selling Stockholder identified in this prospectus of up to 13,079,394 shares of common stock (the “Shares”). All of the Shares, if and when sold, will be sold by the Selling Stockholder. The Selling Stockholder may sell their Shares from time to time at market prices prevailing at the time of sale, at prices related to the prevailing market price, or at negotiated prices. We will not receive any proceeds from the sale of Shares by the Selling Stockholder.

|

Issuer

|

|

cbdMD, Inc.

|

| |

|

|

|

Common Stock offered by the Selling Stockholder

|

|

Up to 13,079,394 shares of our common stock, consisting of:

up to 12,687,012 shares of common stock that we may sell to the Selling Stockholder, from time to time at our sole discretion, pursuant to the Purchase Agreement, described below; and

392,382 shares of our common stock issued or issuable to the Selling Stockholder as consideration for its commitment to purchase shares of our common stock under the Purchase Agreement (the “Commitment Shares”).

|

| |

|

|

|

Common Stock outstanding prior to this Offering1

|

|

65,547,401 shares

|

| |

|

|

|

Common Stock outstanding immediately after this Offering

|

|

78,509,080 shares, assuming the sale of 12,687,012 shares of our common stock to Keystone and issuance of the remaining outstanding commitment shares of 274,667. The actual number of shares issued will vary depending on the sales prices under this offering, but will not be greater than 13,079,394 shares (inclusive of the Commitment Shares and other shares issued in connection with the Purchase Agreement), representing 19.99% of the shares of our common stock outstanding on the date of the Purchase Agreement, in accordance with NYSE American rules, unless as otherwise set forth herein.

|

| |

|

|

|

NYSE American symbol

|

|

Our common stock is currently listed on NYSE American under the symbol “YCBD.” Our Series A Convertible Preferred Stock is currently listed on the NYSE American under the symbol “YCBDpA.”

|

| |

|

|

|

Use of proceeds

|

|

The Selling Stockholder will receive all of the proceeds from the sale of the shares offered for sale by it under this prospectus. We will not receive proceeds from the sale of the shares of our common stock by the Selling Stockholder through this prospectus. However, we may receive proceeds from the sale of our common stock to the Selling Stockholder under the Purchase Agreement.

We did not receive any cash proceeds from the issuance of the Commitment Shares to the Selling Stockholder under the Purchase Agreement. We intend to use any proceeds from the Selling Stockholder that we receive under the Purchase Agreement for working capital and general corporate purposes. See “Use of Proceeds” on page 9 for more information.

|

| |

|

|

|

Risk factors

|

|

Investing in our securities involves a high degree of risk. As an investor you should be prepared to lose your entire investment See “Risk Factors” beginning on page 8.

|

[1] The number of shares of common stock to be outstanding prior to and after this offering excludes:

| |

●

|

a total of 8,335,000 shares of common stock issuable upon the conversion of Series A Convertible Preferred Stock;

|

| |

●

|

a total of 1,915,833 shares of common stock issuable upon the exercise of outstanding stock options with a weighted average exercise price of $3.70 per share;

|

| |

●

|

a total of 489,917 shares of common stock issuable upon the exercise of outstanding warrants with a weighted average exercise price of $4.10 per share;

|

| |

●

|

a total of up to 3,928,797 shares of common stock issuable upon meeting certain revenue vesting metrics during the 4th Marking Period ending November 2023 related to the acquisition of CBD Industries, LLC; and

|

| |

●

|

Up to a potential of 1,818,182 shares of common stock issuable to a360 based on meeting certain performance vesting metrics.

|

RISK FACTORS

You should carefully consider the following risk factors in addition to other information in this prospectus before purchasing our common stock. The risks and uncertainties described below are those that we currently deem to be material and that we believe are specific to our company, our industry and this offering. These risks and uncertainties are not the only ones facing us. Additional risks of which we are not presently aware or that we currently believe are immaterial may also harm our business and results of operations. The trading price of our common stock could decline due to the occurrence of any of these risks, and investors could lose all or part of their investment.

In evaluating the Company, its business and any investment in the Company, readers should carefully consider the following factors, together with the additional risk factors incorporated by reference from Item 1A of the Company’s Annual Report on Form 10-K as filed with the SEC on December 15, 2022 (see “Incorporation of Certain Information by Reference”).

Risks Related to this Offering

The sale or issuance of our common stock to Keystone may cause dilution and the sale of the shares of common stock acquired Keystone, or the perception that such sales may occur, could cause the price of our common stock to fall.

On March 2, 2023, we entered into the Purchase Agreement with Keystone, pursuant to which Keystone has committed to purchase up to 12,687,012 of shares of our common stock. Upon the execution of the Purchase Agreement, we issued 117,715 Commitment Shares to Keystone as consideration for its commitment to purchase shares of our common stock under the Purchase Agreement. The rest of the Commitment Shares (274,667) will be issued in the future. The remaining 12,687,012 shares of our common stock being registered for resale hereunder that may be issued under the Purchase Agreement may be sold by us to Keystone at our discretion from time to time over a 12-month period commencing after the satisfaction of certain conditions set forth in the Purchase Agreement, including that the SEC has declared effective the registration statement that includes this prospectus. The purchase price for the shares that we may sell to Keystone under the Purchase Agreement will fluctuate based on the price of our common stock. Depending on market liquidity at the time, sales of such shares may cause the trading price of our common stock to fall.

We generally have the right to control the timing and amount of any future sales of our shares to Keystone. Sales of our common stock, if any, to Keystone will depend upon market conditions and other factors to be determined by us. We may ultimately decide to sell to Keystone all, some or none of the additional shares of our common stock that may be available for us to sell pursuant to the Purchase Agreement. Therefore, sales to Keystone by us could result in substantial dilution to the interests of other holders of our common stock. Additionally, the sale of a substantial number of shares of our common stock to Keystone, or the anticipation of such sales, could make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect sales. If and when we do sell shares to Keystone, after Keystone has acquired the shares, Keystone may resell all, some or none of those shares at any time or from time to time in its discretion.

Our management might apply the net proceeds from this offering in ways with which you do not agree and in ways that may impair the value of your investment.

We currently intend to use the net proceeds from this offering for general corporate purposes. Our management has broad discretion as to the use of these proceeds and you will be relying on the judgment of our management regarding the application of these proceeds. We might apply these proceeds in ways with which you do not agree, or in ways that do not yield a favorable return. If our management applies these proceeds in a manner that does not yield a significant return, if any, on our investment of these net proceeds, it could compromise our ability to pursue our growth strategy and adversely affect the market price of our common stock.

It is not possible to predict the actual number of shares we will sell under the Purchase Agreement to the Selling Stockholder, or the actual gross proceeds resulting from those sales.

Subject to certain limitations in the Purchase Agreement and compliance with applicable law, we have the discretion to deliver notices to Keystone at any time throughout the term of the Purchase Agreement. The actual number of shares that are sold to the Selling Stockholder may depend based on a number of factors, including the market price of the common stock during the sales period. Actual gross proceeds may be nominal, which may impact our future liquidity. Because the price per share of each share sold to Keystone will fluctuate during the sales period, it is not currently possible to predict the number of shares that will be sold or the actual gross proceeds to be raised in connection with those sales.

USE OF PROCEEDS

This prospectus relates to shares of and common stock that may be offered and sold from time to time by Keystone pursuant to the Purchase Agreement. We will not receive any proceeds from the resale of shares of common stock by Keystone.

Assuming our average sales price is $0.20 (our closing price on March 10, 2023), we will receive approximately $2.5 million in gross proceeds pursuant to the Purchase Agreement. See “Plan of Distribution” elsewhere in this prospectus for more information.

We intend to use any proceeds from the Selling Stockholder that we receive under the Purchase Agreement for working capital and general corporate purposes, which include, but are not limited to, marketing, costs of this offering, operating expenses and working capital. We cannot specify with certainty all of the particular uses for the net proceeds that we will have from the sale of our shares pursuant to the Purchase Agreement. Therefore, our management will have broad discretion to determine the specific use for the net proceeds and we may use the proceeds for purposes that are not contemplated at the time of this offering.

We will incur all costs associated with this prospectus and the registration statement of which it is a part.

THE KEYSTONE CAPITAL TRANSACTION

General

On March 2, 2023, the Company and Keystone entered into the Purchase Agreement, which provides that subject to the terms and conditions set forth therein, the Company may sell to Keystone up to 12,687,012 shares of common stock of the Company, from time to time during the term of the Purchase Agreement.

Additionally, on March 2, 2023, the Company and Keystone entered into the Registration Rights Agreement, pursuant to which the Company agreed to file a registration statement with the SEC covering the resale of shares of common stock that are issued to Keystone under the Purchase Agreement.

Under the terms and subject to the satisfaction of the conditions set forth in the Purchase Agreement, the Company has the right, but not the obligation, to sell to Keystone, and Keystone is obligated to purchase, up to 12,687,012 shares of common stock. Such sales of common stock by the Company, if any, will be subject to certain limitations as set forth in the Purchase Agreement, and may occur from time to time, at the Company’s sole discretion, over a 12-month period commencing on the date that all of the conditions to the Company’s right to commence such sales are satisfied, including that the registration statement referred to above is declared effective by the SEC. We refer to this date as the “Commencement Date”. Keystone has no right to require the Company to sell any common stock to Keystone, but Keystone is obligated to make purchases as the Company directs, subject to satisfaction of the conditions set forth in the Purchase Agreement.

Upon entering into the Purchase Agreement the Company agreed to issue to Keystone the Commitment Shares as consideration for Keystone’s commitment to purchase shares of common stock upon the Company’s direction under the Purchase Agreement. The Company issued 30% of the Commitment Shares effective on the date of the Purchase Agreement. An additional 30% of the Commitment Shares will be issued to Keystone 90 days following the Commencement Date. The remaining 40% of the Commitment Shares will be issued to Keystone 180 days following the Commencement Date. The Company has also paid Keystone $35,000 for its reasonable expenses under the Purchase Agreement.

Under the Purchase Agreement, the Company may, at its discretion, from time to time from and after the Commencement Date, direct Keystone to purchase (a “Fixed Purchase”) up to the greater of (i) 100,000 shares of common stock and (ii) $50,000 on any trading day on which the closing sale price of the common stock is not below $0.10 per share on the NYSE American.

In addition to Fixed Purchases, and provided that the Company has directed Keystone to purchase the maximum allowable amount of shares of common stock in a Fixed Purchase, the Company also may, at its discretion, from time to time from and after the Commencement Date, direct Keystone to purchase additional shares of common stock on the trading day immediately following the purchase date for such Fixed Purchase (each, a “VWAP Purchase”) and, under certain circumstances set forth in the Purchase Agreement, direct Keystone to purchase additional shares of common stock on the same trading day as such VWAP Purchase (each, an “Additional VWAP Purchase”), in each case upon the terms and subject to the conditions set forth in the Purchase Agreement. We refer to the Fixed Purchase, the VWAP Purchase and the Additional VWAP Purchase, collectively as a “Purchase”.

Purchase Price for Each Purchase

There is no upper limit on the price per share that Keystone may be obligated to pay for the common stock in any of the Purchases. The purchase price per share for each Purchase is as follows:

| |

●

|

Fixed Purchase - the lesser of (i) 90% of the daily volume weighted average price of the Company’s common stock on the NYSE American, as reported by Bloomberg Financial LP using the AQR function for the five trading days immediately preceding the applicable date for such Fixed Purchase and (ii) the closing sale price of a share of common stock on the applicable date for such Fixed Purchase during the full trading day on the NYSE American on such applicable purchase date.

|

| |

●

|

VWAP Purchase - the lesser of (i) 90% of the closing sale price of the common stock on the date of the applicable VWAP Purchase and (ii) the VWAP during the applicable VWAP Purchase Period as defined under the Purchase Agreement.

|

| |

●

|

Additional VWAP Purchase - 90% of the lower of (i) the VWAP for the applicable Additional VWAP Purchase Period as defined under the Purchase Agreement during the applicable Additional VWAP purchase date for such Additional VWAP Purchase, and (ii) the closing sale price of the common stock on such applicable date of Additional VWAP Purchase for such Additional VWAP Purchase.

|

Maximum Number of Shares to be Purchased under each Applicable Purchase

Each Purchase has a maximum number of shares that may be purchased for each applicable Purchase Period.

| |

●

|

Fixed Purchase - may not exceed $50,000 or 100,000 shares.

|

| |

●

|

All Purchases combined - Keystone’s maximum purchase commitment in any single VWAP Purchase, together with any one or more Additional VWAP Purchases that are effected on the same trading day as such VWAP Purchase, may not exceed $5,000,000 in the aggregate for such VWAP Purchase and Additional VWAP Purchases.

|

| |

●

|

VWAP Purchase - lesser of (i) 300% of the number of shares directed by the Company to be purchased Keystone pursuant to the corresponding Fixed Purchase and 30% of the trading volume in the Company’s common stock on the NYSE American during the applicable VWAP Purchase Period.

|

| |

●

|

Additional VWAP Purchase - lesser of (i) 300% of the number of shares directed by the Company to be purchased by Keystone pursuant to the corresponding Fixed Purchase and (ii) a number of shares equal to (A) 30% multiplied by (B) the trading volume of shares of common stock during the applicable Additional VWAP Purchase Period.

|

Under applicable rules of the NYSE American, in no event may the Company issue or sell to Keystone under the Purchase Agreement more than 13,079,394 shares of common stock (including the Commitment Shares), which maximum number of shares is equal to 19.99% of the Company’s shares of common stock outstanding immediately prior to the execution of the Purchase Agreement (the “Exchange Cap”).

The Purchase Agreement also prohibits the Company from directing Keystone to purchase any shares of common stock if those shares, when aggregated with all other shares of common stock then beneficially owned by Keystone and its affiliates, would result in Keystone having beneficial ownership of more than 9.99% of the outstanding shares of common stock (the “Beneficial Ownership Cap”).

The Purchase Agreement contains customary representations, warranties, covenants, indemnification and termination provisions. Keystone has covenanted not to cause or engage in any manner whatsoever, any direct or indirect short selling or hedging of the common stock. There are no limitations on use of proceeds, financial or business covenants, restrictions on future financings (other than restrictions on the Company’s ability to enter into additional “variable rate transactions” or substantially similar transactions as the transactions contemplated by the Purchase Agreement, subject to certain exceptions, during certain periods beginning prior to the applicable purchase dates for any Fixed Purchase, VWAP Purchase and Additional VWAP Purchase and ending after the dates on which such purchases are fully settled, as set forth in the Purchase Agreement), rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement. Neither the Company, nor Keystone, may assign or transfer its rights and obligations under the Purchase Agreement and no provision of the Purchase Agreement or the Registration Rights Agreement may be modified or waived by the parties.

The net proceeds under the Purchase Agreement to the Company will depend on the frequency of sales and the number of shares sold to Keystone and prices at which the Company sells shares to Keystone. The Company expects that any net proceeds received by the Company from such sales to Keystone will be used for working capital and general corporate purposes. Management of the Company believes that it is in the Company’s best interests to have the flexibility to sell common stock pursuant to the Purchase Agreement, subject to market conditions.

Conditions to Commencement and for Delivery of Fixed Purchase Notices

The Company’s ability to deliver Fixed Purchase notices to Keystone under the Purchase Agreement are subject to the satisfaction, both at the time of Commencement and at the time of delivery by the Company of any Fixed Purchase notice to Keystone, of certain conditions, all of which are entirely outside of Keystone’s control, including the following:

| |

●

|

the accuracy in all material respects of the representations and warranties of the Company included in the Purchase Agreement;

|

| |

|

|

| |

●

|

the Company having performed, satisfied and complied in all material respects with all covenants, agreements and conditions required by the Purchase Agreement to be performed, satisfied or complied with by the Company;

|

| |

|

|

| |

●

|

the registration statement that includes this prospectus (and any one or more additional registration statements filed with the SEC that include shares of common stock that may be issued and sold by the Company to Keystone under the Purchase Agreement) having been declared effective under the Securities Act by the SEC, and Keystone being able to utilize this prospectus (and the prospectus included in any one or more additional registration statements filed with the SEC under the Registration Rights Agreement) to resell all of the shares of common stock included in this prospectus (and included in any such additional prospectuses);

|

| |

|

|

| |

●

|

the SEC shall not have issued any stop order suspending the effectiveness of the registration statement that includes this prospectus (or any one or more additional registration statements filed with the SEC that include shares of common stock that may be issued and sold by the Company to Keystone under the Purchase Agreement) or prohibiting or suspending the use of this prospectus (or the prospectus included in any one or more additional registration statements filed with the SEC under the Registration Rights Agreement), and the absence of any suspension of qualification or exemption from qualification of the common stock for offering or sale in any jurisdiction;

|

| |

●

|

there shall not have occurred any event and there shall not exist any condition or state of facts, which makes any statement of a material fact made in the registration statement that includes this prospectus (or in any one or more additional registration statements filed with the SEC that include shares of common stock that may be issued and sold by the Company to Keystone under the Purchase Agreement) untrue or which requires the making of any additions to or changes to the statements contained therein in order to state a material fact required by the Securities Act to be stated therein or necessary in order to make the statements then made therein (in the case of this prospectus or the prospectus included in any one or more additional registration statements filed with the SEC under the Registration Rights Agreement, in light of the circumstances under which they were made) not misleading;

|

| |

|

|

| |

●

|

this prospectus, in final form, shall have been filed with the SEC under the Securities Act prior to Commencement, and all reports, schedules, registrations, forms, statements, information and other documents required to have been filed by the Company with the SEC pursuant to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), shall have been filed with the SEC;

|

| |

|

|

| |

●

|

trading in the common stock shall not have been suspended by the SEC or the NYSE American, the Company shall not have received any final and non-appealable notice that the listing or quotation of the common stock on the NYSE American shall be terminated on a date certain (unless, prior to such date, the common stock is listed or quoted on any other Eligible Market, as such term is defined in the Purchase Agreement), and there shall be no suspension of, or restriction on, accepting additional deposits of the common stock, electronic trading or book-entry services by DTC with respect to the common stock;

|

| |

|

|

| |

●

|

the Company shall have complied with all applicable federal, state and local governmental laws, rules, regulations and ordinances in connection with the execution, delivery and performance of the Purchase Agreement and the Registration Rights Agreement;

|

| |

|

|

| |

●

|

the absence of any statute, regulation, order, decree, writ, ruling or injunction by any court or governmental authority of competent jurisdiction which prohibits the consummation of or that would materially modify or delay any of the transactions contemplated by the Purchase Agreement or the Registration Rights Agreement;

|

| |

|

|

| |

●

|

the absence of any action, suit or proceeding before any arbitrator or any court or governmental authority seeking to restrain, prevent or change the transactions contemplated by the Purchase Agreement or the Registration Rights Agreement, or seeking material damages in connection with such transactions;

|

| |

|

|

| |

●

|

all of the shares of common stock that may be issued pursuant to the Purchase Agreement shall have been approved for listing or quotation on the NYSE American (or any Eligible Market as defined in the Purchase Agreement), subject only to notice of issuance;

|

| |

|

|

| |

●

|

no condition, occurrence, state of facts or event constituting a material adverse effect shall have occurred and be continuing;

|

| |

|

|

| |

●

|

the absence of any bankruptcy proceeding against the Company commenced by a third party, and the Company shall not have commenced a voluntary bankruptcy proceeding, consented to the entry of an order for relief against it in an involuntary bankruptcy case, consented to the appointment of a custodian of the Company or for all or substantially all of its property in any bankruptcy proceeding, or made a general assignment for the benefit of its creditors; and

|

| |

|

|

| |

●

|

the receipt by Keystone of the opinions, bring-down opinions and negative assurances from outside counsel to the Company in the forms mutually agreed to by the Company and Keystone prior to the date of the Purchase Agreement.

|

Termination of the Purchase Agreement

Unless earlier terminated as provided in the Purchase Agreement, the Purchase Agreement will terminate automatically on the earliest to occur of:

| |

●

|

the first day of the month next following the 12-month anniversary of the effective date of the registration statement that includes this prospectus (which term may not be extended by the parties);

|

| |

|

|

| |

●

|

the date on which Keystone shall have purchased an aggregate of 12,687,012 of shares of common stock pursuant to the Purchase Agreement;

|

| |

|

|

| |

●

|

the date on which the common stock shall have failed to be listed or quoted on the NYSE American or any other Eligible Market; and

|

| |

|

|

| |

●

|

the date on which the Company commences a voluntary bankruptcy case or any third party commences a bankruptcy proceeding against the Company, a custodian is appointed for the Company in a bankruptcy proceeding for all or substantially all of its property, or the Company makes a general assignment for the benefit of its creditors.

|

We have the right to terminate the Purchase Agreement at any time after Commencement, at no cost or penalty (subject to the issuance of the Commitment Shares), upon one trading day’s prior written notice to Keystone.

No Short-Selling or Hedging by Keystone

Keystone has agreed that neither it nor any of its affiliates shall engage in any direct or indirect short-selling or hedging of our common stock during any time prior to the termination of the Purchase Agreement.

Prohibition on Variable Rate Transactions

Subject to specified exceptions included in the Purchase Agreement, we are limited in our ability to enter into specified variable rate transactions during the term of the Purchase Agreement. Such transactions include, among others, the issuance of convertible securities with a conversion or exercise price that is based upon or varies with the trading price of our common stock after the date of issuance.

Effect of Performance of the Purchase Agreement on our Stockholders

All shares registered in this offering that may be issued or sold by us to Keystone under the Purchase Agreement are expected to be freely tradable. Shares registered in this offering may be sold by us to Keystone over a period of up to 12 months commencing on the date of this registration statement of which this prospectus is a part becomes effective. The resale by Keystone of a significant amount of shares registered in this offering at any given time, or the perception that these sales may occur, could cause the market price of our common stock to decline and to be highly volatile. Sales of our common stock to Keystone, if any, will depend upon market conditions and other factors to be determined by us. We may ultimately decide to sell to Keystone all, some or none of the additional shares of our common stock that may be available for us to sell pursuant to the Purchase Agreement. If and when we do sell shares to Keystone, after Keystone has acquired the shares, Keystone may resell all, some or none of those shares at any time or from time to time in its discretion. Therefore, sales to Keystone by us under the Purchase Agreement may result in substantial dilution to the interests of other holders of our common stock. In addition, if we sell a substantial number of shares to Keystone under the Purchase Agreement, or if investors expect that we will do so, the actual sales of shares or the mere existence of our arrangement with Keystone may make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect such sales. However, we have the right to control the timing and amount of any additional sales of our shares to Keystone and the Purchase Agreement may be terminated by us at any time at our discretion without any cost to us.

Pursuant to the terms of the Purchase Agreement, we have the right, but not the obligation, to direct Keystone to purchase up to 12,687,012 shares of our common stock, subject to certain limitations. We have registered only a portion of the shares issuable under the Purchase Agreement and, therefore, we may seek to issue and sell to Keystone under the Purchase Agreement more shares of our common stock than are offered under this prospectus. If we choose to do so, we must first register for resale under the Securities Act any such additional shares, which could cause additional substantial dilution to our stockholders. The number of shares ultimately offered for resale under this prospectus is dependent upon the number of shares we direct Keystone to purchase under the Purchase Agreement.

The following table sets forth the amount of gross proceeds we would receive from Keystone from our sale of shares of common stock to Keystone under the Purchase Agreement at varying purchase prices:

|

Assumed

Purchase Price

Per Share ($)

|

|

|

Number of Registered

Shares to be Issued if Full

Purchase (1)

|

|

|

Percentage of

Outstanding Shares

After Giving Effect

to the Issuance to

Keystone (2)

|

|

|

Gross Proceeds from

the Sale of Shares to

Keystone Under the

Purchase Agreement ($)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 0.15 |

|

|

|

13,079,394 |

|

|

|

16.63 |

%

|

|

|

1,903,051.80 |

|

| 0.20 |

(3) |

|

|

13,079,394 |

|

|

|

16.63 |

%

|

|

|

2,537,402.40 |

|

| 0.30 |

|

|

|

13,079,394 |

|

|

|

16.63 |

%

|

|

|

3,806,103.60 |

|

| 0.40 |

|

|

|

13,079,394 |

|

|

|

16.63 |

%

|

|

|

5,074,804.80 |

|

| 0.50 |

|

|

|

13,079,394 |

|

|

|

16.63 |

%

|

|

|

6,343,506.00 |

|

| 0.60 |

|

|

|

13,079,394 |

|

|

|

16.63 |

%

|

|

|

7,612,207.20 |

|

| 0.70 |

|

|

|

13,079,394 |

|

|

|

16.63 |

%

|

|

|

8,880,908.40 |

|

| 0.80 |

|

|

|

13,079,394 |

|

|

|

16.63 |

%

|

|

|

10,149,609.60 |

|

| 0.90 |

|

|

|

13,079,394 |

|

|

|

16.63 |

%

|

|

|

11,418,310.80 |

|

| 1.00 |

|

|

|

13,079,394 |

|

|

|

16.63 |

%

|

|

|

12,687,012.00 |

|

|

(1)

|

The Purchase Agreement provides that we may sell up to 12,687,012 shares of our common stock to Keystone. The number of registered shares to be issued as set forth in this column (i) gives effect to the Exchange Cap (ii) is without regard for the Beneficial Ownership Cap; and (iii) includes all of the Commitment Shares.

|

|

(2)

|

The denominator is based on 65,547,401 shares outstanding as of March 10, 2023 adjusted to include the issuance of the number of shares set forth in the adjacent column that we would have sold to Keystone, assuming the average purchase price in the first column. The numerator is based on the number of shares issuable under the Purchase Agreement at the corresponding assumed average purchase price set forth in the first column.

|

|

(3)

|

The closing sale price of our common stock on March 10, 2023.

|

SELLING STOCKHOLDER

This prospectus relates to the possible resale from time to time by Keystone Capital Partners of any or all of the shares of common stock that may be issued by us to Keystone Capital Partners under the Purchase Agreement. For additional information regarding the issuance of common stock covered by this prospectus, see the section titled “Keystone Capital Partners Committed Equity Financing” above. We are registering the shares of common stock pursuant to the provisions of the Registration Rights Agreement we entered into with Keystone Capital Partners on March 2, 2023 in order to permit the selling stockholder to offer the shares for resale from time to time. Except for the transactions contemplated by the Purchase Agreement and the Registration Rights Agreement, Keystone Capital has not had any material relationship with us within the past three years.

The table below presents information regarding the selling stockholder and the shares of common stock that it may offer from time to time under this prospectus. This table is prepared based on information supplied to us by the selling stockholder, and reflects holdings as of March 10, 2023. The number of shares in the column “Maximum Number of Shares of common stock to be Offered Pursuant to this Prospectus” represents all of the shares of common stock that the selling stockholder may offer under this prospectus. The selling stockholder may sell some, all or none of its shares in this offering. We do not know how long the selling stockholder will hold the shares before selling them, and we currently have no agreements, arrangements or understandings with the selling stockholder regarding the sale of any of the shares.

Beneficial ownership is determined in accordance with Rule 13d-3(d) promulgated by the SEC under the Exchange Act, and includes shares of common stock with respect to which the selling stockholder has voting and investment power. The percentage of shares of common stock beneficially owned by the selling stockholder prior to the offering shown in the table below is based on an aggregate of 65,547,401 shares of our common stock outstanding on March 10, 2023. Because the purchase price of the shares of common stock issuable under the Purchase Agreement is determined on each Fixed Purchase Date, with respect to a Fixed Purchase, on the applicable VWAP Purchase Date, with respect to a VWAP Purchase, and on the applicable Additional VWAP Purchase Date, with respect to an Additional VWAP Purchase, the number of shares that may actually be sold by the Company to Keystone Capital under the Purchase Agreement may be fewer than the number of shares being offered by this prospectus. The fourth column assumes the sale of all of the shares offered by the selling stockholder pursuant to this prospectus.

|

Name of Selling

Stockholder

|

|

Number of Shares of

Common Stock Owned

Prior to Offering

|

|

|

Maximum

Number of

Shares of

Common Stock

to be Offered

Pursuant

to this Prospectus

|

|

|

Number of Shares of

Common Stock Owned

After Offering

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Number(1)

|

|

|

Percent(2)

|

|

|

|

|

|

|

Number(3)

|

|

|

Percent(2)

|

|

|

Keystone Capital Partners, LLC(4)

|

|

|

117,715 |

|

|

|

* |

|

|

|

13,079,394 |

|

|

|

0 |

|

|

|

-- |

|

* Represents beneficial ownership of less than 1% of the outstanding shares of our common stock.

|

(1)

|

This number represents the shares of common stock we issued to Keystone Capital Partners as Commitment Shares in consideration for entering into the Purchase Agreement with us. In accordance with Rule 13d-3(d) under the Exchange Act, we have excluded from the number of shares beneficially owned prior to the offering all of the shares that Keystone Capital may be required to purchase under the Purchase Agreement, because the issuance of such shares is solely at our discretion and is subject to conditions contained in the Purchase Agreement, the satisfaction of which are entirely outside of Keystone Capital’s control, including the registration statement that includes this prospectus becoming and remaining effective. Furthermore, the Fixed Purchases, VWAP Purchase, or Additional VWAP Purchase, as applicable, of common stock are subject to certain agreed upon maximum amount limitations set forth in the Purchase Agreement. Also, the Purchase Agreement prohibits us from issuing and selling any shares of our common stock to Keystone Capital to the extent such shares, when aggregated with all other shares of our common stock then beneficially owned by Keystone Capital, would cause Keystone Capital’s beneficial ownership of our common stock to exceed the 19.99% Beneficial Ownership Cap.

|

|

(2)

|

Applicable percentage ownership is based on 65,547,401 shares of our common stock outstanding as of March 10, 2023.

|

|

(3)

|

Assumes the sale of all shares being offered pursuant to this prospectus.

|

|

(4)

|

The business address of Keystone Capital Partners, LLC is 139 Fulton Street, Suite 412, New York, NY 10038. Keystone Capital Partners, LLC’s principal business is that of a private investor. Ranz Group, LLC, a Delaware limited liability company, is the managing member of Keystone Capital Partners, LLC and the beneficial owner of 97% of the membership interests in Keystone Capital Partners, LLC. Fredric G. Zaino is the managing member of Ranz Group, LLC and has sole voting control and investment discretion over securities beneficially owned directly by Keystone Capital, LLC and indirectly by Ranz Group, LLC. We have been advised that none of Mr. Zaino, Ranz Group, LLC or Keystone Capital Partners, LLC is a member of the Financial Industry Regulatory Authority, or FINRA, or an independent broker-dealer, or an affiliate or associated person of a FINRA member or independent broker-dealer. The foregoing should not be construed in and of itself as an admission by Mr. Zaino as to beneficial ownership of the securities beneficially owned directly by Keystone Capital Partners, LLC and indirectly by Ranz Group, LLC.

|

PLAN OF DISTRIBUTION

The shares of common stock offered by this prospectus are being offered by the selling stockholder, Keystone Capital Partners, LLC. The shares may be sold or distributed from time to time by the selling stockholder directly to one or more purchasers or through brokers, dealers, or underwriters who may act solely as agents at market prices prevailing at the time of sale, at prices related to the prevailing market prices, at negotiated prices, or at fixed prices, which may be changed. The sale of the shares of our common stock offered by this prospectus could be effected in one or more of the following methods:

| |

●

|

ordinary brokers’ transactions;

|

| |

●

|

transactions involving cross or block trades;

|

| |

●

|

through brokers, dealers, or underwriters who may act solely as agents;

|

| |

●

|

“at the market” into an existing market for our common stock;

|

| |

●

|

in other ways not involving market makers or established business markets, including direct sales to purchasers or sales effected through agents;

|

| |

●

|

in privately negotiated transactions; or

|

| |

●

|

any combination of the foregoing.

|

In order to comply with the securities laws of certain states, if applicable, the shares may be sold only through registered or licensed brokers or dealers. In addition, in certain states, the shares may not be sold unless they have been registered or qualified for sale in the state or an exemption from the state’s registration or qualification requirement is available and complied with.

Keystone Capital Partners, LLC is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act.

Keystone Capital has informed us that it intends to use one or more registered broker-dealers to effectuate all sales, if any, of our common stock that it has acquired and may in the future acquire from us pursuant to the Purchase Agreement. Such sales will be made at prices and at terms then prevailing or at prices related to the then current market price. Each such registered broker-dealer will be an underwriter within the meaning of Section 2(a)(11) of the Securities Act. Keystone Capital has informed us that each such broker-dealer will receive commissions from Keystone Capital that will not exceed customary brokerage commissions.

Brokers, dealers, underwriters or agents participating in the distribution of the shares of our common stock offered by this prospectus may receive compensation in the form of commissions, discounts, or concessions from the purchasers, for whom the broker-dealers may act as agent, of the shares sold by the selling stockholder through this prospectus. The compensation paid to any such particular broker-dealer by any such purchasers of shares of our common stock sold by the selling stockholder may be less than or in excess of customary commissions. Neither we nor the selling stockholder can presently estimate the amount of compensation that any agent will receive from any purchasers of shares of our common stock sold by the selling stockholder.

We know of no existing arrangements between the selling stockholder or any other stockholder, broker, dealer, underwriter or agent relating to the sale or distribution of the shares of our common stock offered by this prospectus.

We may from time to time file with the SEC one or more supplements to this prospectus or amendments to the registration statement of which this prospectus forms a part to amend, supplement or update information contained in this prospectus, including, if and when required under the Securities Act, to disclose certain information relating to a particular sale of shares offered by this prospectus by the selling stockholder, including the names of any brokers, dealers, underwriters or agents participating in the distribution of such shares by the selling stockholder, any compensation paid by the selling stockholder to any such brokers, dealers, underwriters or agents, and any other required information.

We will pay the expenses incident to the registration under the Securities Act of the offer and sale of the shares of our common stock covered by this prospectus by the selling stockholder. As consideration for its irrevocable commitment to purchase our common stock under the Purchase Agreement, we have issued to Keystone Capital 117,715 shares of our common stock as Commitment Shares, of the up to 392,382 shares of our common stock we shall issue in as Commitment Shares in accordance with the Purchase Agreement. We have also paid to Keystone Capital $35,000 in cash as reimbursement for the reasonable, out-of-pocket expenses incurred by Keystone Capital, including the legal fees and disbursements of Keystone Capital’s legal counsel, in connection with its due diligence investigation of the Company and in connection with the preparation, negotiation and execution of the Purchase Agreement.

We also have agreed to indemnify Keystone Capital and certain other persons against certain liabilities in connection with the offering of shares of our common stock offered hereby, including liabilities arising under the Securities Act or, if such indemnity is unavailable, to contribute amounts required to be paid in respect of such liabilities. Keystone Capital has agreed to indemnify us against liabilities under the Securities Act that may arise from certain written information furnished to us by Keystone Capital specifically for use in this prospectus or, if such indemnity is unavailable, to contribute amounts required to be paid in respect of such liabilities. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers, and controlling persons, we have been advised that in the opinion of the SEC this indemnification is against public policy as expressed in the Securities Act and is therefore, unenforceable.

We estimate that the total expenses for the offering will be approximately $70,000.

Keystone Capital has represented to us that at no time prior to the date of the Purchase Agreement has Keystone Capital or its agents, representatives or affiliates engaged in or effected, in any manner whatsoever, directly or indirectly, any short sale (as such term is defined in Rule 200 of Regulation SHO of the Exchange Act) of our common stock or any hedging transaction, which establishes a net short position with respect to our common stock. Keystone Capital has agreed that during the term of the Purchase Agreement, neither Keystone Capital, nor any of its agents, representatives or affiliates will enter into or effect, directly or indirectly, any of the foregoing transactions.

We have advised the selling stockholder that it is required to comply with Regulation M promulgated under the Exchange Act. With certain exceptions, Regulation M precludes the selling stockholder, any affiliated purchasers, and any broker-dealer or other person who participates in the distribution from bidding for or purchasing, or attempting to induce any person to bid for or purchase any security which is the subject of the distribution until the entire distribution is complete. Regulation M also prohibits any bids or purchases made in order to stabilize the price of a security in connection with the distribution of that security. All of the foregoing may affect the marketability of the securities offered by this prospectus.

This offering will terminate on the date that all shares of our common stock offered by this prospectus have been sold by the selling stockholder.

Our common stock and Series A Convertible Preferred Stock are currently listed on the NYSE American under the symbols “YCBD” and “YCBDpA”, respectively.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS