Statement of Changes in Beneficial Ownership (4)

November 02 2020 - 4:12PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Bennett Monty J |

2. Issuer Name and Ticker or Trading Symbol

Ashford Inc.

[

AINC

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director __X__ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

CEO and Chairman of the Board |

|

(Last)

(First)

(Middle)

14185 DALLAS PARKWAY, SUITE 1100 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

10/30/2020 |

|

(Street)

DALLAS, TX 75254

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 10/30/2020 | | A(1) | | 5593 | A | $0 (1) | 115806 | D | |

| Common Stock | | | | | | | | 18816 | I | By MJB Operating, LP |

| Common Stock | | | | | | | | 118290 | I | By MJB Investments LP |

| Common Stock | | | | | | | | 62116 | I | By Dartmore LP |

| Common Stock | | | | | | | | 13408 | I | By Reserve, LP IV |

| Common Stock | | | | | | | | 8918 | I | By Reserve, LP III |

| Common Stock | | | | | | | | 10597.5 (2) | I | By Ashford Financial Corporation |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Series D Convertible Preferred Stock (3) | $0.21 (3) | | | | | | | (3) | (3) | Common Stock | 1924957 (3) | | 9047300 | I | By MJB Investments LP |

| Series D Convertible Preferred Stock (4) | $0.21 (4) | | | | | | | (4) | (4) | Common Stock | 17021 (4) | | 80000 | I | By Trust (4) |

| Series D Convertible Preferred Stock (5) | $0.21 (5) | | | | | | | (5) | (5) | Common Stock | 32340 (5) | | 152000 | D | |

| Stock Options (right to purchase) | $61.12 | | | | | | | 2/27/2022 | 2/27/2029 | Common Stock | 90000 | | 90000 | D | |

| Stock Options (right to purchase) | $94.96 | | | | | | | 3/14/2021 | 3/14/2028 | Common Stock | 77206 | | 77206 | D | |

| Stock Options (right to purchase) | $57.71 | | | | | | | 10/3/2020 | 10/3/2027 | Common Stock | 50000 | | 50000 | D | |

| Stock Options (right to purchase) | $57.34 | | | | | | | 4/18/2020 | 4/18/2027 | Common Stock | 50000 | | 50000 | I | By MJB Operating, LP |

| Stock Options (right to purchase) | $45.59 | | | | | | | 3/31/2019 | 3/31/2026 | Common Stock | 100000 | | 100000 | I | By MJB Operating, LP |

| Stock Options (right to purchase) | $85.97 | | | | | | | 12/11/2017 | 12/11/2022 | Common Stock | 95000 | | 95000 | I | By MJB Operating, LP |

| Common Units (6) | $0.00 (6) | | | | | | | (6) | (6) | Common Stock (6) | 143.04 | | 143.04 | I | By MJB Operating, LP |

| Common Units (6) | $0.00 (6) | | | | | | | (6) | (6) | Common Stock (6) | 501.6 | | 501.6 | I | By Dartmore LP |

| Common Units (6) | $0.00 (6) | | | | | | | (6) | (6) | Common Stock (6) | 35.91 | | 35.91 | I | By MJB Investments LP |

| Common Units (6) | $0.00 (6) | | | | | | | (6) | (6) | Common Stock (6) | 109.24 | | 109.24 | I | By Reserve, LP IV |

| Common Units (6) | $0.00 (6) | | | | | | | (6) | (6) | Common Stock (6) | 78.67 | | 78.67 | I | By Reserve, LP III |

| Common Units (6) | $0.00 (6) | | | | | | | (6) | (6) | Common Stock (6) | 93.18 (2) | | 93.18 (2) | I | By Ashford Financial Corporation |

| Stock Units under Deferred Compensation Plan (7) | (7) | | | | | | | (7) | (7) | Common Stock | 195579 | | 195579 (7) | D | |

| Explanation of Responses: |

| (1) | The Reporting Person received the shares of Common Stock as payment of base salary in lieu of cash. |

| (2) | Reflects the Reporting Person's pecuniary interest in such securities held directly by Ashford Financial Corporation, of which the Reporting Person is a shareholder. The Reporting Person disclaims any beneficial interest in any other Common Units (as defined below) or any shares of the Issuer's common stock (or securities convertible into shares of the Issuer's common stock) held directly or indirectly by Ashford Financial Corporation. |

| (3) | Such 9,047,300 of Series D Convertible Preferred Stock have no expiration date and are convertible at any time and from time to time, in full or partially, into 1,924,957 shares of the Issuer's common stock at a conversion ratio equal to the liquidation preference of a share of Series D Convertible Preferred Stock, par value $25.00, divided by $117.50, subject to adjustment (the "Conversion Ratio"). |

| (4) | In connection with the transactions contemplated by the Combination Agreement, the 80,000 shares of Series B Convertible Preferred Stock beneficially owned by a trust for the benefit of one of the Reporting Person's minor children were converted on a one-for-one basis into 80,000 shares of Series D Convertible Preferred Stock. Such 80,000 shares of Series D Convertible Preferred Stock have no expiration date and are convertible at any time and from time to time, in full or partially, into 17,021 shares of the Issuer's common stock at the Conversion Ratio. |

| (5) | In connection with the transactions contemplated by the Combination Agreement, the Reporting Person received 152,000 shares of Series D Convertible Preferred Stock. Such 152,000 shares of Series D Convertible Preferred Stock have no expiration date and are convertible at any time and from time to time, in full or partially, into 32,340 shares of the Issuer's common stock at the Conversion Ratio. |

| (6) | Common units ("Common Units") in Ashford Hospitality Advisors LLC, the Issuer's operating subsidiary, owned by the Reporting Person. Common Units are redeemable for cash or, at the option of the Issuer, convertible into shares of the Issuer's common stock on a 1-for-1 basis. The Common Units have no expiration date. |

| (7) | Each Stock Unit entitles the Reporting Person to receive one share of the Issuer's common stock on the date (or dates) elected by the Reporting Person under the Ashford Inc. Amended and Restated Nonqualified Deferred Compensation Plan (originally adopted by Ashford Hospitality Trust, Inc., effective January 1, 2008) assumed by the Issuer, effective November 12, 2014. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Bennett Monty J

14185 DALLAS PARKWAY

SUITE 1100

DALLAS, TX 75254 | X | X | CEO and Chairman of the Board |

|

Signatures

|

| /s/ Monty J. Bennett | | 11/2/2020 |

| **Signature of Reporting Person | Date |

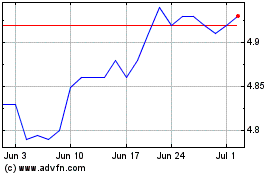

Ashford (AMEX:AINC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Ashford (AMEX:AINC)

Historical Stock Chart

From Sep 2023 to Sep 2024