Wells Fargo Closed-End Funds Declare Monthly Distributions

December 28 2018 - 4:20PM

Business Wire

The Wells Fargo Income Opportunities Fund (NYSE American: EAD),

the Wells Fargo Multi-Sector Income Fund (NYSE American: ERC), and

the Wells Fargo Utilities and High Income Fund (NYSE American: ERH)

have each announced a distribution.

Ticker Fund name

Distribution per share

Frequency

Change from

prior distribution

EAD* Wells Fargo Income Opportunities Fund $

0.06021 Monthly -$0.00032 ERC* Wells Fargo

Multi-Sector Income Fund $ 0.10349 Monthly -$0.00071 ERH Wells

Fargo Utilities and High Income Fund $ 0.07500 Monthly –

The following dates apply to today’s distribution declaration

for each fund:

Declaration date December 28, 2018 Ex-dividend

date January 15, 2019 Record date January 16, 2019 Payable date

February 1, 2019

*This fund makes distributions in accordance with a managed

distribution plan that provides for the declaration of monthly

distributions (in the case of the Wells Fargo Income Opportunities

Fund and the Wells Fargo Multi-Sector Income Fund) to common

shareholders of the fund at an annual minimum fixed rate of 8% for

the Wells Fargo Income Opportunities Fund and 9% for the Wells

Fargo Multi-Sector Income Fund based on the fund’s average monthly

net asset value (NAV) per share over the prior 12 months. Under the

managed distribution plan, distributions are sourced from income

and also may be sourced from paid-in capital and/or capital gains.

The fund’s distributions in any period may be more or less than the

net return earned by the fund on its investments and therefore

should not be used as a measure of performance or confused with

yield or income. Distributions in excess of fund returns will cause

the fund’s NAV to decline. Investors should not draw any

conclusions about the fund’s investment performance from the amount

of its distribution or from the terms of its managed distribution

plan.

The Wells Fargo Income Opportunities Fund is a closed-end

high-yield bond fund. The fund’s investment objective is to seek a

high level of current income. The fund may, as a secondary

objective, seek capital appreciation to the extent it is consistent

with its investment objective.

The Wells Fargo Multi-Sector Income Fund is a closed-end income

fund. The fund’s investment objective is to seek a high level of

current income consistent with limiting its overall exposure to

domestic interest rate risk.

The Wells Fargo Utilities and High Income Fund is a closed-end

equity and high-yield bond fund. The fund’s investment objective is

to seek a high level of current income and moderate capital growth,

with an emphasis on providing tax-advantaged dividend income.

The final determination of the source of all distributions is

subject to change and is made after year-end. Each fund will send

shareholders a Form 1099-DIV for the calendar year that will tell

shareholders how to report these distributions for federal income

tax purposes.

For more information on Wells Fargo’s closed-end funds, please

visit our website.

These closed-end funds are no longer engaged in initial

public offerings, and shares are available only through

broker/dealers on the secondary market. Unlike an open-end

mutual fund, a closed-end fund offers a fixed number of shares for

sale. After the initial public offering, shares are bought and sold

through broker/dealers in the secondary marketplace, and the market

price of the shares is determined by supply and demand, not by NAV,

and is often lower than the NAV. A closed-end fund is not required

to buy its shares back from investors upon request.

High-yield, lower-rated bonds may contain more risk due to the

increased possibility of default. Foreign investments may contain

more risk due to the inherent risks associated with changing

political climates, foreign market instability, and foreign

currency fluctuations. Risks of international investing are

magnified in emerging or developing markets. Funds that concentrate

their investments in a single industry or sector may face increased

risk of price fluctuation over more diversified funds due to

adverse developments within that industry or sector. Small- and

mid-cap securities may be subject to special risks associated with

narrower product lines and limited financial resources compared

with their large-cap counterparts. When interest rates rise, the

value of debt securities tends to fall. When interest rates

decline, interest that a fund is able to earn on its investments in

debt securities also may decline, but the value of those securities

may increase. Changes in market conditions and government policies

may lead to periods of heightened volatility in the debt securities

market and reduced liquidity for certain fund investments. Interest

rate changes and their impact on the funds and their NAVs can be

sudden and unpredictable.

The use of leverage results in certain risks, including, among

others, the likelihood of greater volatility of the NAV and the

market price of common shares. Derivatives involve additional

risks, including interest rate risk, credit risk, the risk of

improper valuation, and the risk of noncorrelation to the relevant

instruments they are designed to hedge or to closely track. There

are numerous risks associated with transactions in options on

securities. Illiquid securities may be subject to wide fluctuations

in market value and may be difficult to sell.

Wells Fargo Asset Management (WFAM) is the trade name for

certain investment advisory/management firms owned by Wells Fargo

& Company. These firms include but are not limited to Wells

Capital Management Incorporated and Wells Fargo Funds Management,

LLC. Certain products managed by WFAM entities are distributed by

Wells Fargo Funds Distributor, LLC (a broker/dealer and Member

FINRA).

This material is for general informational and educational

purposes only and is NOT intended to provide investment advice or a

recommendation of any kind—including a recommendation for any

specific investment, strategy, or plan.

319095 12-18

Some of the information contained herein may include

forward-looking statements about the expected investment activities

of the funds. These statements provide no assurance as to the

funds’ actual investment activities or results. Readers must make

their own assessment of the information contained herein and

consider such other factors as they may deem relevant to their

individual circumstances.

INVESTMENT PRODUCTS: NOT FDIC INSURED ● NO BANK GUARANTEE ●

MAY LOSE VALUE

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181228005210/en/

Shareholder inquiries1-800-730-6001

Financial advisor inquiries1-888-877-9275

Media contacts:Robert

Julavits917-260-2448robert.w.julavits@wellsfargo.com

Sarah Kerr917-260-1582skerr@wellsfargo.com

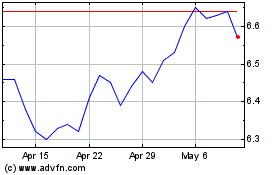

Allspring Income Opportu... (AMEX:EAD)

Historical Stock Chart

From Oct 2024 to Nov 2024

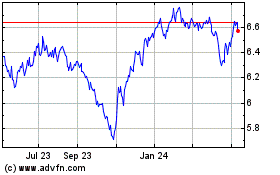

Allspring Income Opportu... (AMEX:EAD)

Historical Stock Chart

From Nov 2023 to Nov 2024