Evergreen Closed End Funds Declare Monthly Dividends

September 18 2008 - 4:32PM

PR Newswire (US)

Evergreen announces options strategy management changes for

Evergreen International Balanced Income Fund BOSTON, Sept. 18

/PRNewswire-FirstCall/ -- Evergreen Investments today announced the

dividend declaration for Evergreen Income Advantage Fund

(AMEX:EAD), Evergreen Multi-Sector Income Fund (AMEX:ERC),

Evergreen Utilities and High Income Fund (AMEX:ERH), and Evergreen

International Balanced Income Fund (NYSE:EBI). Evergreen Income

Advantage Fund is a closed-end high-yield bond fund. The fund's

investment objective is to seek a high level of current income. The

fund may, as a secondary objective, seek capital appreciation to

the extent consistent with its investment objective. Evergreen

Income Advantage Fund declared the following monthly dividend from

ordinary income: Declaration Ex- Record Payable Dividend date

dividend date date rate/share date September October October

November $0.1094 / 18, 2008 14, 2008 16, 2008 3, 2008 share

Evergreen Multi-Sector Income Fund is a closed-end bond fund. The

fund's primary investment objective is to seek a high level of

current income consistent with limiting its overall exposure to

domestic interest rate risk. Evergreen Multi-Sector Income Fund

declared the following monthly dividend from ordinary income:

Declaration Ex- Record Payable Dividend date dividend date date

rate/share date September October October November $0.1083 / 18,

2008 14, 2008 16, 2008 3, 2008 share Evergreen Utilities and High

Income Fund is a closed-end equity and high-yield bond fund. The

fund's primary investment objective is to seek a high level of

current income and moderate capital growth, with emphasis on

providing tax-advantaged dividend income. Evergreen Utilities and

High Income Fund declared the following monthly dividend from

ordinary income: Declaration Ex- Record Payable Dividend date

dividend date date rate/share date September October October

November $0.23 / 18, 2008 14, 2008 16, 2008 3, 2008 share Evergreen

International Balanced Income Fund is a closed-end fund investing

primarily in international stocks and bonds. The fund's investment

objective is to seek to provide a high level of income. Evergreen

International Balanced Income Fund declared the following monthly

dividend from ordinary income: Declaration Ex- Record Payable

Dividend date dividend date date rate/share date September October

October November $0.1458 / 18, 2008 14, 2008 16, 2008 3, 2008 share

To make changes to your account, please contact your financial

advisor, brokerage firm, bank, or other nominee with whom your

shares are registered. If your shares are registered with the

funds' transfer agent, Computershare, please contact them directly

at 800.730.6001 or visit http://www.computershare.com/ . Evergreen

Investments, which serves as the investment adviser to Evergreen

International Balanced Income Fund (NYSE:EBI), also announced today

it will leverage the in-house talent and expertise of its

Derivatives and Alternative Strategies team, led by Tim Stevenson,

in managing the Fund's options strategy. On or about November 18,

2008, the team will replace Analytic Investors, LLC, which has

served as the sub-adviser responsible for the options strategy

since the Fund's October 2005 inception. EBI seeks to achieve its

investment objective of providing a high level of income by

investing primarily in common stocks of non-U.S. issuers and other

equity securities, and debt securities of non-U.S. issuers. In

addition, EBI employs a strategy of writing call options, primarily

on a variety of both non-U.S. and U.S. securities-based indices.

The Fund also may write options on exchange-traded funds that

represent certain indices, countries, or market sectors; on futures

contracts; and on individual securities. The options portfolio for

EBI has a notional value of $44.8 million as of June 30, 2008.

These closed-end funds are no longer offered as an initial public

offering and are only offered through broker/dealers on the

secondary market. About Evergreen Investments Evergreen Investments

is the brand name under which Wachovia Corporation (NYSE:WB)

conducts its investment management business. Wachovia Global Asset

Management is the brand name under which Evergreen Investments

conducts sales and distribution business outside of the United

States. Evergreen serves more than four million individual and

institutional investors through a broad range of investment

products. Led by 300 investment professionals, Evergreen strives to

meet client investment objectives through disciplined, team-based

asset management. Evergreen manages more than $245 billion in

assets (as of June 30, 2008). Please visit EvergreenInvestments.com

for more information about Evergreen Investments. Funds: NOT FDIC

INSURED | NOT BANK GUARANTEED | MAY LOSE VALUE DATASOURCE:

Evergreen Investments CONTACT: Shareholder Inquiries:

1-800-730-6001; or Financial Advisor Inquiries: 1-800-343-2898; or

Media Inquiries: Lauren Sawyers, +1-704-715-4561, , or Laura Fay,

+1-617-210-3867, , all for Evergreen Investments Web site:

http://www.evergreeninvestments.com/ http://www.computershare.com/

Copyright

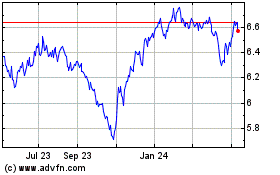

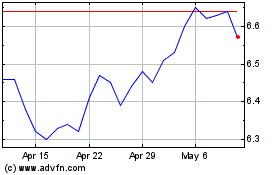

Allspring Income Opportu... (AMEX:EAD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Allspring Income Opportu... (AMEX:EAD)

Historical Stock Chart

From Jul 2023 to Jul 2024