Terex Corporation (NYSE: TEX) today announced net income for the

third quarter of 2008 of $93.8 million, or $0.96 per share,

compared to net income of $151.5 million, or $1.45 per share, for

the third quarter of 2007, a decrease in earnings per share of

33.8%. These results include a $10.1 million after-tax, or $0.10

per share, charge related to a crane repair program, and charges

associated with reductions in headcount of $2.2 million after-tax,

or $0.02 per share. All per share amounts are on a fully diluted

basis. Net sales in the third quarter of 2008 grew 14.5%, to

$2,514.6 million, versus the comparable period in 2007. The

increase in net sales versus the prior year period was favorably

impacted by acquisitions and by the translation effect of foreign

currency exchange rate changes (3.6% and 4.9%, respectively).

Excluding these effects, net sales increased 6.0% in the third

quarter of 2008 versus the prior year period, driven primarily by

strong performance in both the Cranes and Materials Processing

& Mining (MPM) segments, partially offset by lower net sales in

the Aerial Work Platforms (AWP) and Construction segments. Ron

DeFeo, Terex Chairman and Chief Executive Officer, stated, �While

we continue to make progress on our improvement initiatives, the

current environment is challenging, marked by a continued global

credit crisis and worsening economic conditions, particularly in

the U.S. and Western Europe. Input costs continue to present

challenges for us, although we expect these to moderate over time.

At this time, our price increases have not yet fully offset our

total material cost increases. We are taking aggressive actions to

better position the Company for the expected reduced net sales

levels of the next twelve months, in particular in the AWP,

Construction, and Materials Processing businesses. At the same

time, we are continuing to invest in developing markets and our

improvement initiatives, as well as increasing Cranes and Mining

capabilities to meet the growing demand in those areas.� Mr. DeFeo

continued, �We expect 2009 net sales, including the effect of

announced acquisitions, to be similar to 2008 full year net sales,

driven by continued strong results in Cranes and Mining, offset by

lower net sales in AWP, Materials Processing and Construction. The

Cranes and Mining businesses continue to grow, in particular in

developing markets, where we expect current positive trends to

continue. Beginning in the fourth quarter of 2008, for the next

twelve months we expect net sales for AWP to be down 30%-40%, for

Materials Processing to be down 15%-20% and for Construction to be

down 25%-35% versus the prior twelve month period. In light of

these overall expectations, we have taken or initiated several

actions to properly size our organization and production levels.

Additionally, we have further heightened our focus on cash

generation during this time of uncertain access to credit.� Tom

Riordan, Terex President and Chief Operating Officer, added, �We

are taking a series of actions to aggressively reduce costs and

inventories in the businesses listed below. We expect that by early

2009 we will achieve working capital levels closer to 22% of

trailing three month annualized net sales, versus the approximately

25% level we experienced at the end of the third quarter.� AWP � In

the third quarter, we reduced our global workforce by 6% compared

to June 2008. This does not include the elimination of the AWP

temporary agency workers in July 2008. In the fourth quarter, we

expect a further 18% workforce reduction, compared to June 2008, to

better align our cost structure with expected customer demand.

Additionally, temporary shutdowns of our manufacturing facilities

were implemented in the third quarter and will continue to be used

to reduce production output. We will re-evaluate our team member

levels in the first quarter of 2009 based on customer order rates

and production levels. Construction � In the third quarter, our

actions included adjusting production lines to short-time work

weeks and reducing 141 team members to match current market demand.

Further reductions are expected to occur over the next three to six

months to adjust the team member levels to meet expected customer

demand. We expect a further 17% workforce reduction across our

worldwide operations. Materials Processing � In the third quarter,

we cut production levels by 25% of the first half 2008 run rate

and, as a result, we reduced our independent contract manufacturing

staffing levels. During the fourth quarter of 2008, production

levels are projected to be reduced to roughly 50% of the first half

2008 levels, through the use of an extended winter shutdown, a

shortened work week, further independent contractor reductions and

an expected reduction of 160 team members. Roadbuilding � In the

third quarter, we reduced the workforce by 98 team members to

adjust production levels and resources to meet expected customer

demand. Facility Rationalization � In addition to the above

actions, facility plans are being reviewed to improve the

utilization of existing facilities through consolidation, transfer

or sale. Our expectation is that these changes will take place in

2009. Segment Realignment � Effective in January 2009, we will move

the Roadbuilding businesses under the Construction segment and move

the Utility Products business under the AWP segment. This will

enable us to capture market synergies and streamline our cost

structure in the U.S. Mr. Riordan continued, �We expect that these

actions will reduce our long term cost structure in line with

market requirements.� The Company is revising its estimated fourth

quarter 2008 earnings per share guidance to reflect changing market

conditions, mainly in North America and Western Europe for the AWP

and Construction segments, to between $0.80 and $0.90, resulting in

full year 2008 earnings per share guidance between $5.69 and $5.79.

Corresponding full year 2008 net sales are expected to be between

$10.0 and $10.3 billion. These estimates include a total of $0.12

per share in charges through the third quarter 2008 for the crane

repair program and headcount reductions. The full year 2008

guidance does not include additional charges that may be required

to implement further cost reduction activities. Management�s

previous earnings per share guidance for the fourth quarter was

between $1.20 and $1.33 and full year 2008 earnings per share

guidance was between $6.35 and $6.65. Phil Widman, Terex Senior

Vice President and Chief Financial Officer, stated, �Given that

external access to credit remains uncertain, we must focus on our

cash management. The adjustments to production levels and

curtailment of incoming material in the AWP, Construction and

Materials Processing businesses are expected to reduce inventory

levels, and we will carefully manage incoming material in Cranes

and Mining to match the growth expectations of these businesses. We

are delaying certain capital spending projects and are not

currently purchasing shares under our previously announced share

repurchase program. However, during the third quarter, we

repurchased approximately $200 million, or 4.2 million shares, and

we remain committed to the share repurchase program when access to

the capital markets is clearer.� Mr. Widman continued, �With the

actions we are taking to reduce costs and maintain liquidity, we

expect to have sufficient flexibility to execute our key business

plans.� The Company�s acquisition of the port equipment businesses

of Fantuzzi Industries S.a.r.l. is awaiting regulatory approval and

is expected to close in the fourth quarter of 2008. Total

consideration for the transaction is Euro 215 million. Highlights

for the Third Quarter of 2008 In this press release, Terex refers

to various GAAP (U.S. generally accepted accounting principles) and

non-GAAP financial measures. These non-GAAP measures may not be

comparable to similarly titled measures being disclosed by other

companies. Terex believes that this non-GAAP information is useful

to understanding its operating results and the ongoing performance

of its underlying businesses. Certain financial measures are shown

in italics the first time referenced and are described in a

Glossary at the end of this press release. Net Sales: Net sales

reached $2,514.6 million in the third quarter of 2008, an increase

of 14.5% from $2,196.5 million in the third quarter of 2007.

Continued strong demand in the Cranes and MPM segments were the

primary drivers of the increase, partially offset by a decline in

the AWP segment. In addition, the increase in net sales versus the

prior year period was favorably impacted by approximately $107

million due to the translation effect of foreign currency exchange

rate changes, primarily due to the strength of the Euro and

Australian Dollar, partially offset by a weaker British Pound

relative to the U.S. Dollar, as well as approximately $80 million

in net sales from recent acquisitions, primarily A.S.V., Inc. and

Superior Highwall Miners, Inc. Gross Profit: Gross profit of $446.2

million, and gross margin of 17.7%, declined versus the prior year

period by 3.9% and 3.4 points, respectively, due mainly to the

weakness in the AWP and Construction segments, higher input costs,

and the $15.0 million pre-tax charge for the crane repair program.

These effects were partially offset by improvements in the Cranes,

MPM, and Roadbuilding, Utility Products and Other (RBUO) segments.

Selling, General and Administrative (SG&A): SG&A expenses

in the third quarter of 2008 increased $51.0 million versus the

prior year period and increased as a percentage of net sales to

11.1%. Approximately $9 million of the increase in SG&A

expenses was due to the translation effect of foreign currency

exchange rate changes and approximately $9 million of the increase

was due to the impact of recent acquisitions. The Company continues

to invest in support systems necessary to meet customer

expectations, as well as supply chain management, improved sales

and service capabilities in developing markets, and the Terex

Management System. Income from Operations and Operating Margin:

Income from operations was $167.2 million in the third quarter of

2008, a decrease of 29.2% versus the third quarter of 2007.

Operating margin in the third quarter of 2008 decreased to 6.6% of

net sales versus 10.8% of net sales in the comparable prior year

period. The decrease was driven primarily by volume declines in

AWP, higher input costs in AWP and Construction, the $15.0 million

pre-tax charge for the crane repair program and the $3.2 million

pre-tax charge related to the headcount reductions mentioned

earlier, and investment in the Company�s improvement initiatives.

This was partially offset by strong increases in operating profit

and operating margin in the Cranes and MPM segments. Taxes: The

effective tax rate for the third quarter of 2008 was 32.4%,

compared to 34.1% for the third quarter of 2007, as the mix of

international business, certain discrete items and the effect of

recently reduced statutory rates in several European countries had

a positive impact. The Company expects the effective tax rate for

the full year 2008 to be approximately 33.1%. Capital Structure:

Return on Invested Capital (ROIC) was 23.6% for the trailing twelve

months ended September 30, 2008 compared to 27.0% in the comparable

period ended June 30, 2008. This reflects reduced operating income

performance and the increased invested capital impact of recent

acquisitions and working capital. Net cash provided by operating

activities for the third quarter of 2008 was $21.0 million, mainly

as a result of income generation, bringing the year to date results

to a net use of cash of $35.1 million, which was essentially

unchanged from the comparable prior year period use of cash of

$34.5 million. Debt, less cash and cash equivalents, of $1,080.3

million at September 30, 2008 increased $1,000.7 million in the

first nine months of 2008, compared to $79.6 million at year end

2007, primarily due to acquisitions and share repurchases. For the

third quarter of 2008, the weighted average diluted shares

outstanding were 98.1 million. While the Company currently is not

purchasing shares under its previously announced share repurchase

program, due to the volatility in the credit markets and desire to

preserve cash, during the third quarter of 2008 the Company

repurchased approximately $200 million, or 4.2 million shares.

Total program to date purchases are approximately $562 million, or

9.8 million shares. The Company�s liquidity includes cash balances

at the end of the third quarter of $487.9 million and availability

under the Company�s revolving credit facilities of $393 million.

Given the Company�s ability to use partners to finance the sale of

its equipment, balance sheet exposure in the Terex Financial

Services group remained insignificant at the end of the third

quarter. The Company�s performance has led to a ratio of Debt, less

cash and cash equivalents, to Total Capitalization of 31.9% at the

end of the third quarter of 2008, which is higher than the June 30,

2008 measure of 22.3%, reflecting increased debt balances and the

share repurchase program. Working capital: Working capital as a

percent of trailing three month annualized net sales was 25.2% for

the period ended September 30, 2008, versus 23.2% for the period

ended September 30, 2007, with acquisitions contributing 0.5% of

the increase. Working capital increased in anticipation of

continued strong growth in the Cranes and Mining businesses. The

Company is adjusting production levels as appropriate in relation

to slowing end market demand for its AWP, Construction and

Materials Processing businesses, where the impact on inventory

reduction is only beginning to take effect. Backlog: Backlog for

orders deliverable during the next twelve months was $3,626.6

million at September 30, 2008, a decrease of approximately 10.6%

versus the third quarter of 2007, and a decrease of 14.2% versus

June 30, 2008. With regard to the reported backlog, Terex has not

accepted firm orders for a variety of crane types, primarily rough

terrain cranes, which have scheduled delivery after January 1,

2009. This was designed to ensure that prices for 2009 delivery

sufficiently reflect the demand environment and potential input

cost increases of the business. Production volumes for 2009 that

have not been included in the September 30, 2008 and June 30, 2008

backlog approximate $648 million and $485 million, respectively,

based on current pricing levels. The Company anticipates finalizing

pricing and resulting orders for these cranes during the fourth

quarter of 2008. The following table shows the Company�s

consolidated backlog, incorporates the Cranes backlog adjustment

and adjusts historical backlog based upon September 30, 2008

foreign exchange rates. Sept 30, 2008 � Sept 30, 2007 � % change �

June 30, 2008 � % change Consolidated Backlog $ 3,626.6 $ 4,058.1

(10.6 %) $ 4,224.8 (14.2 %) � Cranes 2009 Backlog Adjustment $

647.8 $ - � $ 484.5 � � Subtotal $ 4,274.4 $ 4,058.1 5.3 % $

4,709.3 (9.2 %) � Foreign Exchange Translation Effect (at September

30, 2008 rates) $ - $ (180.1 ) $ (364.0 ) � Adjusted Total Backlog

$ 4,274.4 $ 3,878.0 � 10.2 % $ 4,345.3 � (1.6 %) After adjusting

historical backlog based upon the September 30, 2008 foreign

exchange rates, and with the inclusion of the 2009 Cranes backlog

adjustment, consolidated backlog would have increased 10.2% on

September 30, 2008 versus September 30, 2007, and decreased 1.6%

versus June 30, 2008. AWP segment backlog decreased 60.5% as

compared to September 30, 2007, and decreased 38.7% as compared to

June 30, 2008, primarily due to softening demand, particularly in

Western Europe. AWP backlog was also impacted, but to a lesser

extent, by adjusting historical backlog based upon the September

30, 2008 foreign exchange rates. Construction segment backlog

decreased 40.2% versus the comparable prior year period and

decreased 32.8% as compared to June 30, 2008. Slowing compact

construction demand in Western Europe, combined with the easing of

some supplier constraints which allowed for increased production

levels, and backlog was also impacted, but to a lesser extent, by

adjusting historical backlog based upon the September 30, 2008

foreign exchange rates. The following table shows the Company�s

Cranes backlog, incorporates the Cranes backlog adjustment and

adjusts historical backlog based upon September 30, 2008 foreign

exchange rates. � Sept 30, 2008 � Sept 30, 2007 � % change � June

30, 2008 � % change Cranes Backlog $ 1,926.0 $ 1,741.8 10.6 % $

2,058.0 (6.4 %) � Cranes 2009 Backlog Adjustment $ 647.8 $ - � $

484.5 � � Subtotal $ 2,573.8 $ 1,741.8 47.8 % $ 2,542.5 1.2 % �

Foreign Exchange Translation Effect (at September 30, 2008 rates) $

- $ (20.9 ) $ (168.8 ) � Adjusted Total Cranes Backlog $ 2,573.8 $

1,720.9 � 49.6 % $ 2,373.7 � 8.4 % With the inclusion of the 2009

Crane backlog adjustment, described above, and adjusting for

foreign currency translation, Cranes segment backlog increased

49.6% compared to September 30, 2007 levels, and increased 8.4%

versus June 30, 2008, due primarily to strong global demand. MPM

segment backlog increased 9.9% versus September 30, 2007, and

decreased 8.8% as compared to June 30, 2008. However, after

adjusting historical backlog based upon September 30, 2008 foreign

exchange rates, backlog increased 18.9% and 1.9%, respectively, as

continued strong Mining demand was partially offset by weakening

demand for Materials Processing products. RBUO segment backlog

declined 5.3% versus September 30, 2007 and declined 3.9% as

compared to June 30, 2008, mainly due to reduced demand for North

American asphalt plants and concrete mixer trucks. The Glossary

contains further details regarding backlog. Third Quarter Segment

Performance Review Aerial Work Platforms: Net sales for the AWP

segment for the third quarter of 2008 decreased 8.9%, to $513.5

million, versus the third quarter of 2007. Excluding the

translation effect of foreign currency exchange rate changes, net

sales decreased approximately 12%. AWP customers in North America

and Western Europe significantly slowed their purchases during the

third quarter of 2008 due to the softening in construction activity

and uncertainty regarding the global economy. Management expects

that many AWP customers in these markets are reducing or deferring

their capital spending as they age their fleets in the short term,

but that they will resume normal fleet capital spending patterns

sometime over the next nine to 18 months. Demand for aerial work

platforms in developing markets remains strong, particularly in

Latin America and Asia. Demand from the rental channel has been

increasing in China and Korea, for example, and Australia remains

strong due to demand from the mining sector. However, growth in

developing markets has not yet reached sufficient scale to offset

the weakness in the developed markets, resulting in adjustments to

production and staffing for the segment. Additionally, production

expansion plans are being slowed. The previously announced AWP

production facility in China is continuing to be developed, albeit

at a slower pace. AWP operating margin in the third quarter of 2008

declined to 4.1% from 19.9% in the third quarter of 2007, due to

higher input costs, particularly steel, not yet recovered in

pricing actions, lower net sales volume, charges associated with

headcount reductions, and, to a lesser extent, increased costs

associated with the expansion of global sales and distribution

infrastructure. Construction: Net sales for the Construction

segment for the third quarter of 2008 increased 4.9% to $474.2

million versus the third quarter of 2007. Excluding the translation

effect of foreign currency exchange rate changes of approximately

$16 million and acquisition related net sales during the third

quarter of 2008 of approximately $49 million, net sales decreased

approximately 10% versus the prior year period. Commercial

construction remains weak in North America and continues to weaken

in Western Europe, resulting in lower net sales for compact

construction equipment. Developing market demand remains strong,

particularly in Africa, the Middle East and Eastern Europe, but is

not of significant scope to offset the weakness in developed

markets. Large infrastructure and mining projects continue to

demand rigid frame dump trucks. Construction experienced a negative

operating margin of 6.0% for the third quarter of 2008 as compared

to a positive operating margin of 3.1% for the comparable period in

2007. The operating loss was due to increased input costs combined

with lower net sales volume (excluding the impact of acquisitions).

Pricing actions have been taken to offset input cost increases and

the recent volatility in steel pricing has begun to moderate, but

slowing demand in developed markets has resulted in production cuts

and reductions in employment levels. Given the near term

performance, the Company will continue to monitor the estimated

fair value of the Construction business for purposes of determining

whether a goodwill impairment is evidenced. Cranes: Net sales for

the Cranes segment for the third quarter of 2008 increased 36.2%

versus the third quarter of 2007, to $717.4 million. Excluding the

translation effect of foreign currency exchange rate changes, net

sales increased approximately 26%. Demand remains strong for larger

capacity cranes, particularly larger capacity lattice boom crawler

cranes, tower cranes and rough terrain cranes, driven by global

infrastructure and energy projects. The market in North America

continues to remain strong for large capacity cranes, but sales of

smaller capacity cranes, including boom trucks and lower capacity

truck cranes, remain soft. Cranes operating margin increased to

12.3% during the third quarter of 2008, up from 12.0% for the

comparable prior year period. Operating results for the third

quarter of 2008 include a charge for a crane repair program of

$15.0 million. Excluding this charge, operating margin would have

been 14.4%, with the year-over-year increase primarily driven by

higher volume and favorable sales mix. Global demand continues to

be oriented towards higher margin, larger capacity cranes. Supplier

constraints in Europe for select components, such as hydraulics and

gear boxes, have improved, as have welding and assembly capacity

constraints. Demand is expected to remain strong for the

foreseeable future for larger capacity cranes, but due to the

uncertain outlook for the global economy, capacity expansion plans

are being carefully reviewed. Materials Processing & Mining:

Net sales for the MPM segment for the third quarter of 2008

increased 25.4% versus the third quarter of 2007, to $662.0

million. Excluding the translation effect of foreign currency

exchange rate changes and the impact of recent acquisitions, net

sales increased approximately 18%. The operating margin of 13.8%

was higher than the comparable 2007 operating margin of 11.3%,

driven by continued strength in the Mining business. Demand for

mining equipment remains strong despite the recent softening of

commodity pricing, as commodity prices remain well above production

costs. The increase in net sales as compared to the comparable

period in 2007 is primarily due to higher equipment sales. The

recently launched MT6300 electric drive haul truck with a capacity

of 400 tons has received a very high degree of interest from mining

customers. An order for 10 units has already been placed by an

Australian customer with commissioning of the units expected before

the end of 2008. Capacity continues to be a limiting factor to

meeting Mining product demand, particularly for hydraulic mining

excavators, along with some supplier constraints for hydraulics,

castings and gear boxes. The Company is continuing to adjust its

global manufacturing footprint to better meet demand. The Materials

Processing business experienced continued weakness in North America

during the third quarter, and demand in Western Europe slowed as

the quarter progressed. This weakness was offset by strength in the

developing markets, particularly in India, Southeast Asia and

Eastern Europe, driven by infrastructure development. As the

business moves into the seasonally slow fourth quarter of 2008 and

customers remain uncertain about the impact of the global credit

crisis, the business� production and staffing levels are being

reduced. Roadbuilding, Utility Products and Other: Net sales for

the RBUO segment for the third quarter of 2008 increased 17.7%, to

$175.3 million, versus the third quarter of 2007. Excluding the

translation effect of foreign currency exchange rate changes, net

sales increased approximately 14%. The Utility Products,

Roadbuilding and Government Programs businesses all witnessed net

sales growth. Demand for Utility Products remains favorable from

electrical utility customers. Aging utility infrastructure and the

replacement cycle of existing equipment is supporting demand.

Roadbuilding net sales increased during the third quarter of 2008

as compared to the third quarter of 2007 due to strong sales from

the Brazilian operation combined with moderate sales growth in the

U.S. This sales growth was partially offset by lower concrete mixer

truck sales. Due to the low level of road building and

infrastructure funding in the U.S., the Company remains cautious

regarding the sales outlook for Roadbuilding, and management

continues to execute cost containment strategies within this

business. The Company will continue to monitor the estimated fair

value of the Roadbuilding business for purposes of determining

whether goodwill impairment is evidenced. RBUO operating margin was

2.4% in the third quarter of 2008 versus an operating loss of 1.7%

for the comparable period in 2007. Increased volume for Utility

Products and the Brazilian based road building operation

contributed to stronger margins for the third quarter of 2008. A

bad debt charge of approximately $4 million was incurred in the

comparable period in 2007, for the Company�s re-rental operation, a

business that has since been wound down. Corporate / Eliminations:

The loss from operations of $9.5 million for the third quarter of

2008 is down from the prior year period and reflects continued

investment in improvement initiatives. This includes marketing

programs, the people, systems and support to create leading supply

chain management and manufacturing capabilities, and the necessary

training to maximize the impact of the Terex Business System. Safe

Harbor Statement This press release contains forward-looking

information based on the current expectations of Terex Corporation.

Because forward-looking statements involve risks and uncertainties,

actual results could differ materially. Such risks and

uncertainties, many of which are beyond the control of Terex,

include among others: Our business is highly cyclical and weak

general economic conditions may affect the sales of our products

and financial results; our business is sensitive to fluctuations in

interest rates and government spending; our business is very

competitive and may be affected by pricing, product initiatives and

other actions taken by competitors; a material disruption to one of

our significant facilities; our retention of key management

personnel; the financial condition of suppliers and customers, and

their continued access to capital; our continued access to capital

and ability to obtain parts and components from suppliers on a

timely basis at competitive prices; our ability to timely

manufacture and deliver products to customers; the need to comply

with restrictive covenants contained in our debt agreements; our

business is global and subject to changes in exchange rates between

currencies, as well as international politics, particularly in

developing markets; the effects of changes in laws and regulations;

possible work stoppages and other labor matters; compliance with

applicable environmental laws and regulations; product liability

claims and other liabilities arising out of our business;

investigations by the Securities and Exchange Commission (SEC) and

the Department of Justice; our implementation of a global

enterprise system and its performance; our ability to successfully

integrate acquired businesses; and other factors, risks and

uncertainties that are more specifically set forth in our public

filings with the SEC. Actual events or the actual future results of

Terex may differ materially from any forward-looking statement due

to these and other risks, uncertainties and significant factors.

The forward-looking statements speak only as of the date of this

presentation. Terex expressly disclaims any obligation or

undertaking to release publicly any updates or revisions to any

forward-looking statement included in this presentation to reflect

any changes in expectations with regard thereto or any changes in

events, conditions, or circumstances on which any such statement is

based. Terex Corporation is a diversified global manufacturer with

2007 net sales of over $9.1 billion. Terex operates in five

business segments: Terex Aerial Work Platforms, Terex Construction,

Terex Cranes, Terex Materials Processing & Mining, and Terex

Roadbuilding, Utility Products and Other. Terex manufactures a

broad range of equipment for use in various industries, including

the construction, infrastructure, quarrying, surface mining,

shipping, transportation, refining and utility industries. Terex

offers a complete line of financial products and services to assist

in the acquisition of Terex equipment through Terex Financial

Services. More information on Terex can be found at www.terex.com.

TEREX CORPORATION AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENT

OF OPERATIONS (unaudited) (in millions, except per share data) � �

Three MonthsEnded September 30, Nine MonthsEnded September 30, 2008

� 2007 2008 � 2007 � Net sales $ 2,514.6 $ 2,196.5 $ 7,813.2 $

6,551.4 Cost of goods sold � (2,068.4 ) � (1,732.2 ) � (6,201.8 ) �

(5,168.0 ) Gross profit 446.2 464.3 1,611.4 1,383.4 Selling,

general and administrative expenses � (279.0 ) � (228.0 ) � (817.0

) � (661.9 ) Income from operations 167.2 236.3 794.4 721.5 Other

income (expense) Interest income 4.4 4.5 18.5 11.4 Interest expense

(26.4 ) (14.6 ) (76.2 ) (43.5 ) Loss on early extinguishment of

debt --- --- --- (12.5 ) Other income (expense) � net � (6.5 ) �

3.8 � � 1.6 � � 6.4 � Income before income taxes 138.7 230.0 738.3

683.3 Provision for income taxes � (44.9 ) � (78.5 ) � (244.9 ) �

(243.4 ) Net income $ 93.8 � $ 151.5 � $ 493.4 � $ 439.9 � PER

COMMON SHARE: Basic $ 0.98 � $ 1.48 � $ 4.97 � $ 4.29 � Diluted $

0.96 � $ 1.45 � $ 4.89 � $ 4.20 � � Weighted average number of

shares outstanding in per share calculation Basic � 96.1 � � 102.6

� � 99.2 � � 102.5 � Diluted � 98.1 � � 104.6 � � 101.0 � � 104.7 �

TEREX CORPORATION AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE

SHEET (unaudited) (in millions, except par value) � � September 30,

2008 December 31, 2007 Assets � Current assets Cash and cash

equivalents $ 487.9 $ 1,272.4 Trade receivables (net of allowance

of $67.3 and $62.5 at September 30, 2008 and December 31, 2007,

respectively) 1,300.8 1,195.8 Inventories 2,449.3 1,934.3 Deferred

taxes 147.2 166.3 Other current assets � 218.0 � � 208.1 � Total

current assets 4,603.2 4,776.9 Long-term assets Property, plant and

equipment � net 485.0 419.4 Goodwill 950.4 699.0 Deferred taxes

87.9 143.1 Other assets � 359.6 � � 277.9 � � Total assets $

6,486.1 � $ 6,316.3 � � Liabilities and Stockholders� Equity

Current liabilities Notes payable and current portion of long-term

debt $ 35.0 $ 32.5 Trade accounts payable 1,219.9 1,212.9 Accrued

compensation and benefits 185.1 194.8 Accrued warranties and

product liability 148.2 132.0 Customer advances 139.6 181.8 Other

current liabilities � 446.7 � � 421.3 � Total current liabilities

2,174.5 2,175.3 Non-current liabilities Long-term debt, less

current portion 1,533.2 1,319.5 Retirement plans and other � 475.5

� � 478.3 � Total liabilities � 4,183.2 � � 3,973.1 � Commitments

and contingencies Stockholders� equity Common stock, $.01 par value

� authorized 300.0 shares; issued 107.0 and 106.2 shares at

September 30, 2008 and December 31, 2007, respectively 1.1 1.1

Additional paid-in capital 1,037.1 1,004.1 Retained earnings

1,778.1 1,284.7 Accumulated other comprehensive income 86.5 256.6

Less cost of shares of common stock in treasury � 13.1 and 5.9

shares at September 30, 2008 and December 31, 2007, respectively �

(599.9 ) � (203.3 ) Total stockholders� equity � 2,302.9 � �

2,343.2 � � Total liabilities and stockholders� equity $ 6,486.1 �

$ 6,316.3 � TEREX CORPORATION AND SUBSIDIARIES CONDENSED

CONSOLIDATED STATEMENT OF CASH FLOWS (unaudited) (in millions) �

Nine Months Ended September 30, 2008 � 2007 Operating Activities

Net income $ 493.4 $ 439.9 Adjustments to reconcile net income to

cash used in operating activities: Depreciation 56.2 46.9

Amortization 17.7 7.3 Deferred taxes 23.7 (3.3 ) Loss on early

extinguishment of debt --- 3.2 Gain on sale of assets (1.8 ) (5.7 )

Stock-based compensation 46.5 49.1 Excess tax benefit from

stock-based compensation (7.2 ) (20.3 ) Changes in operating assets

and liabilities (net of effects of acquisitions and divestitures):

Trade receivables (122.1 ) (185.6 ) Inventories (530.1 ) (454.9 )

Trade accounts payable 42.6 97.4 Accrued compensation and benefits

(30.3 ) (16.6 ) Income taxes payable 50.4 18.4 Accrued warranties

and product liability 22.4 10.0 Customer advances (33.9 ) 50.7

Other, net � (62.6 ) � (71.0 ) Net cash used in operating

activities � (35.1 ) � (34.5 ) Investing Activities Acquisition of

businesses, net of cash acquired (478.1 ) --- Capital expenditures

(91.6 ) (73.7 ) Investments in and advances to affiliates --- (0.9

) Proceeds from sale of assets � 20.4 � � 12.1 � Net cash used in

investing activities � (549.3 ) � (62.5 ) Financing Activities

Principal repayments of long-term debt --- (200.0 ) Excess tax

benefit from stock-based compensation 7.2 20.3 Proceeds from stock

options exercised 2.3 9.4 Net borrowings under revolving line of

credit agreements 204.6 137.6 Share repurchases (395.5 ) (71.6 )

Other, net � (1.5 ) � 4.6 � Net cash used in financing activities �

(182.9 ) � (99.7 ) Effect of Exchange Rate Changes on Cash and Cash

Equivalents � (17.2 ) � 36.6 � Net Decrease in Cash and Cash

Equivalents (784.5 ) (160.1 ) Cash and Cash Equivalents at

Beginning of Period � 1,272.4 � � 676.7 � Cash and Cash Equivalents

at End of Period $ 487.9 � $ 516.6 � TEREX CORPORATION AND

SUBSIDIARIES SEGMENT RESULTS DISCLOSURE (in millions) (unaudited) �

� Third Quarter Year-to-Date 2008 � 2007 2008 � 2007 � % of � % of

� % of � % of Net sales Net sales Net sales Net sales Consolidated

Net sales $ 2,514.6 � $ 2,196.5 � $ 7,813.2 � $ 6,551.4 � Gross

profit $ 446.2 17.7 % $ 464.3 21.1 % $ 1,611.4 20.6 % $ 1,383.4

21.1 % SG&A � 279.0 � 11.1 % � 228.0 � 10.4 % � 817.0 � 10.5 %

� 661.9 � 10.1 % Income from operations $ 167.2 6.6 % $ 236.3 10.8

% $ 794.4 10.2 % $ 721.5 11.0 % � AWP Net sales $ 513.5 � $ 563.9 �

$ 1,772.8 � $ 1,751.9 � Gross profit $ 78.6 15.3 % $ 161.3 28.6 % $

427.9 24.1 % $ 502.6 28.7 % SG&A � 57.3 � 11.2 % � 49.1 � 8.7 %

� 174.7 � 9.9 % � 144.1 � 8.2 % Income from operations $ 21.3 4.1 %

$ 112.2 19.9 % $ 253.2 14.3 % $ 358.5 20.5 % � Construction Net

sales $ 474.2 � $ 452.1 � $ 1,543.4 � $ 1,362.4 � Gross profit $

36.0 7.6 % $ 62.6 13.8 % $ 176.0 11.4 % $ 184.5 13.5 % SG&A �

64.4 � 13.6 % � 48.8 � 10.8 % � 183.7 � 11.9 % � 140.9 � 10.3 %

Income(loss) from operations $ (28.4 ) (6.0 %) $ 13.8 3.1 % $ (7.7

) (0.5 %) $ 43.6 3.2 % � Cranes Net sales $ 717.4 � $ 526.6 � $

2,159.4 � $ 1,571.9 � Gross profit $ 148.1 20.6 % $ 110.4 21.0 % $

473.2 21.9 % $ 313.0 19.9 % SG&A � 59.9 � 8.3 % � 47.2 � 9.0 %

� 172.6 � 8.0 % � 140.0 � 8.9 % Income from operations $ 88.2 12.3

% $ 63.2 12.0 % $ 300.6 13.9 % $ 173.0 11.0 % � MPM Net sales $

662.0 � $ 527.8 � $ 1,907.8 � $ 1,438.7 � Gross profit $ 154.0 23.3

% $ 107.6 20.4 % $ 451.6 23.7 % $ 310.1 21.6 % SG&A � 62.6 �

9.5 % � 47.8 � 9.1 % � 180.9 � 9.5 % � 140.8 � 9.8 % Income from

operations $ 91.4 13.8 % $ 59.8 11.3 % $ 270.7 14.2 % $ 169.3 11.8

% � RBUO Net sales $ 175.3 � $ 148.9 � $ 535.8 � $ 496.5 � Gross

profit $ 29.2 16.7 % $ 21.8 14.6 % $ 84.2 15.7 % $ 72.0 14.5 %

SG&A � 25.0 � 14.3 % � 24.3 � 16.3 % � 70.9 � 13.2 % � 68.0 �

13.7 % Income(loss) from operations $ 4.2 2.4 % $ (2.5 ) (1.7 %) $

13.3 2.5 % $ 4.0 0.8 % � Corporate/Eliminations Net sales $ (27.8 )

$ (22.8 ) $ (106.0 ) $ (70.0 ) Loss from operations $ (9.5 ) 34.2 %

$ (10.2 ) 44.7 % $ (35.7 ) 33.7 % $ (26.9 ) 38.4 % GLOSSARY In an

effort to provide investors with additional information regarding

the Company�s results, Terex refers to various GAAP (U.S. generally

accepted accounting principles) and non-GAAP financial measures

which management believes provides useful information to investors.

These non-GAAP measures may not be comparable to similarly titled

measures being disclosed by other companies. In addition, the

Company believes that non-GAAP financial measures should be

considered in addition to, and not in lieu of, GAAP financial

measures. Terex believes that this non-GAAP information is useful

to understanding its operating results and the ongoing performance

of its underlying businesses. Management of Terex uses both GAAP

and non-GAAP financial measures to establish internal budgets and

targets and to evaluate the Company�s financial performance against

such budgets and targets. The amounts described below are

unaudited, are reported in millions of U.S. dollars, and are as of

or for the period ended September 30, 2008, unless otherwise

indicated. Backlog is defined as firm orders that are expected to

be filled within one year. The disclosure of backlog aids in the

analysis of the Company�s customers� demand for product, as well as

the ability of the Company to meet that demand. The backlog of

Terex�s business is not necessarily indicative of sales to be

recognized in a specified future period. � Sept 30, 2008 � Sept 30,

2007 � % change June 30, 2008 � % change � � Consolidated Backlog $

3,626.6 $ 4,058.1 (10.6 %) $ 4,224.8 (14.2 %) � AWP $ 256.9 $ 649.8

(60.5 %) $ 419.4 (38.7 %) � Construction $ 437.6 $ 731.6 (40.2 %) $

651.5 (32.8 %) � Cranes (1) $ 1,926.0 $ 1,741.8 10.6 % $ 2,058.0

(6.4 %) � MPM $ 871.3 $ 792.5 9.9 % $ 955.6 (8.8 %) � RBUO $ 134.8

$ 142.4 (5.3 %) $ 140.3 (3.9 %) (1) � Terex has not accepted firm

orders for a variety of crane types, primarily rough terrain

cranes, that have scheduled delivery after January 1, 2009. This

was designed to ensure that prices for 2009 delivery sufficiently

reflect the demand environment and potential input cost increases

of the business. Production volumes for which firm orders have not

yet been accepted and that have not been included in backlog

approximate $648 million for September 30, 2008, and $485 million

at June 30, 2008. Debt is calculated using the Consolidated Balance

Sheet amounts for Notes payable and current portion of long-term

debt plus Long-term debt, less current portion. It is a measure

that aids in the evaluation of the Company's financial condition.

Long term debt, less current portion � $1,533.2 Notes payable and

current portion of long-term debt 35.0 � Debt $1,568.2 EBITDA is

defined as earnings before interest, taxes, depreciation and

amortization. The Company calculates this by adding the amount of

depreciation and amortization expenses that have been deducted from

Income from operations back into Income from operations to arrive

at EBITDA. Depreciation and amortization amounts reported in the

Consolidated Statement of Cash Flows include amortization of debt

issuance costs that are recorded in Other income (expense) - net

and, therefore, are not included in EBITDA. Terex believes that

disclosure of EBITDA will be helpful to those reviewing its

performance, as EBITDA provides information on Terex�s ability to

meet debt service, capital expenditure and working capital

requirements, and is also an indicator of profitability. � � Three

months ended September 30, � Nine months ended September 30, 2008 �

2007 2008 � 2007 Income from operations $ 167.2 $ 236.3 $ 794.4 $

721.5 Depreciation 19.8 16.4 56.2 46.9 Amortization 7.2 1.2 17.7

7.3 Bank fee amortization not included in Income from operations

(0.8 ) (0.5 ) (2.4 ) (1.5 ) EBITDA $ 193.4 � $ 253.4 � $ 865.9 � $

774.2 � Gross Margin is defined as the ratio of Gross Profit to Net

Sales. Net Operating Profit After Tax (NOPAT) is calculated by

multiplying Income from operations by a figure equal to one minus

the effective tax rate of the Company. The effective tax rate is

equal to the (Provision for)/benefit from Income taxes divided by

Income before income taxes for the respective quarter. Operating

Margin is defined as the ratio of Income from Operations to Net

Sales. Return on Invested Capital, or ROIC, is calculated by Terex

by dividing the sum of the last four quarters� Net Operating Profit

After Tax (as defined above) by the average of the sum of Total

stockholders� equity plus Debt (as defined above) less Cash and

cash equivalents for the last five quarters ended Consolidated

Balance Sheets. ROIC is calculated by using the last four quarters�

NOPAT, as this represents the most recent twelve month period at

any given point of determination. In order for the denominator of

the ROIC ratio to properly match the operational period reflected

in the numerator, Terex includes the average of five quarter�s

ending balance sheet amounts so that the denominator includes the

average of the opening through ending balances (on a quarterly

basis) over the same time period as the numerator (four quarters of

average invested capital). Terex management and the Board of

Directors use ROIC as one of the primary measures to assess

operational performance, including in connection with certain

compensation programs. Terex utilizes ROIC as a unifying metric

because our management believes that it measures how effectively we

invest our capital and provides a better measure to compare

ourselves to peer companies to assist in assessing how we drive

operational improvement. ROIC measures return on the full

enterprise-wide amount of capital invested in our business, as

opposed to another metric such as return on shareholder�s equity

that only incorporates book equity, and is thus a more accurate and

descriptive measure of our performance. Terex also believes that

adding Debt less Cash and cash equivalents to Total stockholders�

equity provides a better comparison across similar businesses

regarding total capitalization, and that ROIC highlights the level

of value creation as a percentage of capital invested. � Sep 08 � �

Jun 08 � Mar 08 � Dec 07 � Sep 07 Provision for income taxes $ 44.9

$ 116.8 $ 83.2 $ 62.0 Divided by: Income before income taxes �

138.7 � � � 353.1 � � 246.5 � � 236.0 � Effective tax rate 32.4 %

33.1 % 33.8 % 26.3 % � Income from operations 167.2 370.9 256.3

239.9 Multiplied by: 1 minus Effective tax rate 67.6 % 66.9 % 66.2

% 73.7 % Net operating profit after tax $ 113.0 � � $ 248.1 � $

169.7 � $ 176.8 � � Debt (as defined above) $ 1,568.2 $ 1,355.9 $

1,373.4 $ 1,352.0 $ 705.6 Less: Cash and cash equivalents � (487.9

) � � (590.0 ) � (604.2 ) � (1,272.4 ) � (516.6 ) Debt less Cash

and cash equivalents $ 1,080.3 � � $ 765.9 � $ 769.2 � $ 79.6 � $

189.0 � � Total stockholders� equity $ 2,302.9 � � $ 2,664.6 � $

2,538.1 � $ 2,343.2 � $ 2,254.4 � � Debt less Cash and cash

equivalents plus Total stockholders� equity $ � 3,383.2 � � $

3,430.5 � $ 3,307.3 � $ 2,422.8 � $ 2,443.4 � � NOPAT (4 qtrs) $

707.6 Avg Net Debt plus Equity (5 qtr ends) $ 2,997.4 � ROIC 23.6 %

Total Capitalization is a measure that aids in the evaluation of

the Company�s balance sheet. It is an integral component of certain

financial metrics that are often used to evaluate the Company�s

valuation, liquidity and overall health. Total capitalization as of

September 30, 2008 is defined as the sum of: Total stockholders�

equity; and Debt (as defined above); Less: Cash and cash

equivalents. � � � Total stockholders' equity � $ 2,302.9 Debt (as

defined above) 1,568.2 less: Cash and cash equivalents (487.9 ) �

Total Capitalization $ 3,383.2 � Trailing Three Month Annualized

Net Sales is calculated using the net sales for the quarter

multiplied by four. � � � Third Quarter Net Sales � $ 2,514.6 x 4

Trailing Three Month Annualized Sales $ 10,058.4 Working Capital is

calculated using the Consolidated Balance Sheet amounts for Trade

receivables (net of allowance) plus Inventories less Trade accounts

payable. The Company views excessive working capital as an

inefficient use of resources, and seeks to minimize the level of

investment without adversely impacting the ongoing operations of

the business. As of September 30, 2008, working capital was: � � �

Inventories � $ 2,449.3 Trade Receivables, net 1,300.8 Less: Trade

Accounts Payable (1,219.9 ) Total Working Capital $ 2,530.2 �

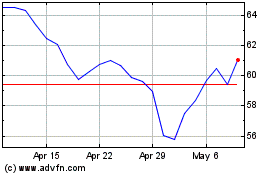

Terex (NYSE:TEX)

Historical Stock Chart

From Apr 2024 to May 2024

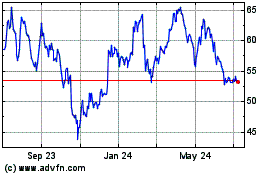

Terex (NYSE:TEX)

Historical Stock Chart

From May 2023 to May 2024