UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K/A

|

x

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended: December 31, 2020

|

|

|

|

|

|

OR

|

|

|

|

|

o

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission

file number: 0-30786

|

|

Video

River Networks, Inc.

|

|

|

|

(Exact

name of registrant as specified in its Charter)

|

|

|

Nevada

|

|

87-0627349

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

370 Amapola Ave., Suite 200A

|

|

|

|

Torrance, California

|

|

90501

|

|

(Address of principal executive

offices)

|

|

(Zip Code)

|

Registrant’s

telephone number including area code: (1) 310-895-1839

Nighthawk Systems, Inc.

(Former name or former address, if changed since

last report)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

COMMON STOCK, $0.001 PAR VALUE

Indicate by check mark if the Registrant is a well-known seasoned

issuer, as defined in Rule 405 of the Securities Act. Yes o

No x

Indicate by check mark if the Registrant is not required to file

reports pursuant to Section 13 or Section 15(d) of the Act. Yes o

No x

Indicate by check mark whether the Registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days. Yes x

No o

Indicate by check mark whether the

registrant has submitted electronically and posted on its corporate Web site,

if any, every Interactive Data File required to be submitted and posted

pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during

the preceding 12 months (or such shorter period that the registrant was

required to submit and post such files. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant

to Item 405 of Regulation S-K is not contained herein, and will not be

contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, or a non-accelerated filer. See

definition of “accelerated filer” and “larger accelerated filer” in Rule 12b-2

of the Exchange Act.

Large Accelerated Filer o

Accelerated Filer o Non-Accelerated Filer x

|

Emerging

growth company x

|

Smaller reporting

company x

|

Indicate by check mark whether the Registrant is a shell company

(as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

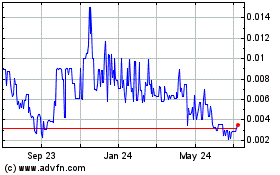

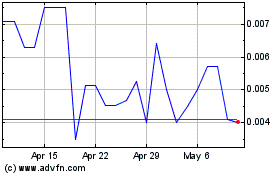

State the aggregate market value of the

voting and non-voting common equity held by non-affiliates computed by

reference to the price at which the common equity was sold, or the average bid

and asked price of such common equity, as of a specified date within the past

60 days:

As of December 31, 2020, the aggregate

market value of the Registrant’s voting and non-voting stock held by

non-affiliates of the Registrant was approximately $1,619,150 using the average

bid and ask price on that day of $0.0112 and a public float of 144,546,809

shares.

As at December 31, 2020, the number of shares of common stock issued

and outstanding was 177,922,436.

DOCUMENTS

INCORPORATED BY REFERENCE

None.

VIDEO RIVER

NETWORKS, INC.

FORM 10-K

TABLE OF

CONTENTS

|

|

|

|

|

Page

|

|

PART I

|

|

Item

1

|

|

Business

|

|

5

|

|

Item

1A

|

|

Risk

Factors

|

|

20

|

|

Item

2

|

|

Properties

|

|

42

|

|

Item

3

|

|

Legal

Proceedings

|

|

42

|

|

Item

4

|

|

Mine

Safety Disclosures.

|

|

43

|

|

|

|

|

|

|

|

PART II

|

|

Item

5

|

|

Market

for Registrant’s Common Equity and Related Stockholder Matters

|

|

43

|

|

Item

6

|

|

Selected

Financial Data

|

|

44

|

|

Item

7

|

|

Management’s

Discussion and Analysis of Financial Condition and Results of Operation

|

|

44

|

|

Item

8

|

|

Financial

Statements and Supplementary Data

|

|

53

|

|

Item

9

|

|

Changes

in and Disagreements with Accountants on Accounting and Financial Disclosure

|

|

72

|

|

Item

9A

|

|

Controls

and Procedures

|

|

73

|

|

Item

9B

|

|

Other

Information

|

|

74

|

|

|

|

|

|

|

|

PART III

|

|

Item

10

|

|

Directors

and Executive Officers and Corporate Governance

|

|

74

|

|

Item

11

|

|

Executive

Compensation

|

|

77

|

|

Item

12

|

|

Security

Ownership of Certain Beneficial Owners and Management and

Related Stockholder Matters

|

|

79

|

|

Item

13

|

|

Certain

Relationships and Related Transactions, and Director Independence

|

|

80

|

|

Item

14

|

|

Principal

Accountant Fees and Services

|

|

82

|

|

|

|

|

|

|

|

PART IV

|

|

Item

15

|

|

Exhibits

and Financial Statement Schedules

|

|

82

|

|

Signatures

|

|

|

|

84

|

|

Exhibit

|

|

|

|

85

|

Cautionary Statement Regarding Forward Looking Statements

The discussion

contained in this Annual Report on Form 10-K (“Annual Report”) contains

“forward-looking statements” within the meaning of Section 27A of the United

States Securities Act of 1933, as amended, or the Securities Act, and Section

21E of the United States Securities Exchange Act of 1934, as amended, or the

Exchange Act. Any statements about our expectations, beliefs, plans,

objectives, assumptions or future events or performance are not historical

facts and may be forward-looking. These statements are often, but not always,

made through the use of words or phrases like “anticipate,” “estimate,”

“plans,” “projects,” “continuing,” “ongoing,” “target,” “expects,” “management

believes,” “we believe,” “we intend,” “we may,” “we will,” “we should,” “we

seek,” “we plan,” the negative of those terms, and similar words or phrases. We

base these forward-looking statements on our expectations, assumptions,

estimates and projections about our business and the industry in which we

operate as of the date of this Annual Report. These forward-looking statements

are subject to a number of risks and uncertainties that cannot be predicted,

quantified or controlled and that could cause actual results to differ

materially from those set forth in, contemplated by, or underlying the

forward-looking statements. Statements in this Annual Report describe

factors, among others, that could contribute to or cause these differences.

Actual results may vary materially from those anticipated, estimated, projected

or expected should one or more of these risks or uncertainties materialize, or

should underlying assumptions prove incorrect. Because the factors discussed in

this Annual Report could cause actual results or outcomes to differ materially

from those expressed in any forward-looking statement made by us or on our

behalf, you should not place undue reliance on any such forward-looking

statement. New factors emerge from time to time, and it is not possible for us

to predict which will arise. In addition, we cannot assess the impact of each

factor on our business or the extent to which any factor, or combination of

factors, may cause actual results to differ materially from those contained in

any forward-looking statement. Except as required by law, we undertake no

obligation to publicly revise our forward-looking statements to reflect events

or circumstances that arise after the date of this Annual Report or the date of

documents incorporated by reference herein that include forward-looking

statements.

PART I

When we use the terms “NIHK,” “we,” “us,” “our,”

and “the company,” we mean Video River Networks, Inc., a Nevada corporation.

Business Overview

Video River Networks, Inc. is a technology

holding firm that operates and manages a portfolio of Electric Vehicles,

Artificial Intelligence, Machine Learning and Robotics ("EV-AI-ML-R")

assets, businesses and operations in North America. The Company's current and

target portfolio businesses and assets include operations that design, develop,

manufacture and sell high-performance fully electric vehicles and design,

manufacture, install and sell Power Controls, Battery Technology, Wireless

Technology, and Residential utility meters and remote, mission-critical devices

mostly engineered through Artificial Intelligence, Machine Learning and Robotic

technologies NIHK's current technology-focused business model is a result of

our board resolution on September 15, 2020 to spin-in/off our specialty real

estate holding business to an operating subsidiary and then pivot back to being

a technology company. The Company has now returned back to its original

technology-focused businesses of Power Controls, Battery Technology, Wireless

Technology, and Residential utility meters and remote, mission-critical

devices. Prior to September 15, 2020, NIHK used to be a

specialty real estate firm, focuses on the acquisition, ownership, and

management of specialized industrial properties. Prior to its real estate

business model, the Company Power Controls Division has used wireless

technology to control both residential utility meters and remote,

mission-critical devices since 2002.

Corporate History

Video River Networks, Inc. (“NIHK,” “PubCo” or “Company”),

previously known as Nighthawk Systems Inc., a Nevada corporation, used to be a

provider of wireless and IP-based control solutions for the utility and

hospitality industries. Since 2002, the Company’s Power Controls Division has

used wireless technology to control both residential utility meters and remote,

mission-critical devices. The Set Top Box Division, acquired in

October 2007, enables hotels to provide in-room high definition television

(“HDTV”) broadcasts, integrated with video-on-demand, and customized guest

services information.

On August 14, 2009, the Company filed Form 15D,

Suspension of Duty to Report, and as a result, the Company was not required to

file any SEC forms since August 14, 2009.

On October 29, 2019, Video River Networks, Inc.

sold one (1) Special 2019 series A preferred share (one preferred share is

convertible 150,000,000 share of common stocks) of the company for an agreed

upon purchase price to Community Economic Development Capital LLC, (“CED

Capital”) a California limited liability company CED. The Special preferred

share controls 60% of the company’s total voting rights and thus, gave to CED

Capital the controlling vote power to control and dominate the affairs of the

company theretofor. Upon the closing of the transaction, the business of CED

Capital was merged into the Company and CED Capital became a wholly owned

subsidiary of the Company.

Following the completion of above mentioned

transactions, the Company added CED Capital real estate business operation to

the company’s business portfolio. CED Capital is a specialty real estate holding

company for specialized assets including, affordable housing, opportunity zones

properties, medical real estate investments, industrial and commercial real

estate, and other real estate related services.

On September 15, 2020, the Company spun-off its

specialty real estate holding business to an operating subsidiary and then

pivot back to being a technology company. A spin-off transaction Kid Castle

Educational Corporation, a company related to, and controlled by, our President

and CEO, in a stock purchase agreement with respect to the private

placement of 900,000 shares of Kid Castle preferred stock at a purchase price

of $3 in cash and a transfer of 100% interest in, and control of, Community

Economic Development Capital, LLC (a California Limited Liability Company).

The shares were issued to NIHK without registration under the

Securities Act of 1933 based upon exemptions from registration provided under

Section 4(2) of the Act and Regulation D promulgated thereunder. As at the

time of this transaction, all three businesses involved in the transaction were

controlled by Mr. Frank I Igwealor. Because both the buyer and seller in the

above acquisitions were under the control of the same person, the transaction

was classified as “common control transaction and therefore fall under

“Transactions Between Entities Under Common Control“ subsections of ASC 805-50.

Based on the September 15, 2020 transaction, NIHK thereinafter controls

approximately 55% of the voting shares of Kid Castle Educational Corporation.

Subsequent to the above spinoff, the Company has now

returned back to its original technology-focused businesses of Power Controls, Battery Technology, Wireless

Technology, and Residential utility meters and remote, mission-critical devices

in addition to a primary focus of building a portfolio businesses and assets and operations that source, design, develop, manufacture and

distribute affordable, high-performance fully electric vehicles in North

America.

Going forward, the Company intends to focus its business model to

operate and manage a portfolio of Electric Vehicles, Artificial Intelligence,

Machine Learning and Robotics (“EV-AI-ML-R”) assets, businesses and operations

in addition to its Power Controls, Battery Technology, Wireless Technology, and

Residential utility meters and remote, mission-critical devices businesses in

North America.

On December 21, 2020 the Company filed as S-1 to

raise $10 million by offering one (1) million shares of its Class B common

stock. The

Company intends to use the proceeds from the offering to: (1) acquire an

Electric Vehicle manufacturer; or (2) capitalize our planned Electric Vehicle

sourcing, designing, manufacturing and distribution operations. As at the date

of this filing, the company is yet to start selling shares of its Class B

common stock.

Following the change of control transaction listed above, the

Company appointed Mr. Frank I Igwealor as President and CEO. Our

corporate office is located at 370 Amapola Ave., Suite 200A, Torrance,

California 90501. Our telephone number is (310) 895-1839

As of December 31, 2020, we had no W-2 employee, but three of our

officers and directors provide all the services without pay until we formally

enter into employment contract with them as full-time employees.

Our Business Objectives and Growth

Strategies

Our principal business objective is to maximize stockholder

returns through a combination of (1) acquisitions and rollups, (2) attracting sustainable

long-term growth in cash flows from acquired assets, increased rents from real

estate, which we hope to pass on to stockholders in the form of increased

distributions, and (3) potential long-term appreciation in the value of our assets

and properties from capital gains upon future sale.

General – Electric Vehicles (EV) Business

The Company’s Electric Vehicles (EV) business model is a newly

created business model created in the 3rd quarter of 2020, for the purpose of

effecting a merger, capital stock exchange, asset acquisition, stock purchase,

reorganization or similar Business acquisition with one or more EV

manufacturers and related businesses, which we refer to throughout this

prospectus as our EV Business acquisition plan. We have not selected any

specific EV Business acquisition target and we have not, nor has anyone on our

behalf, initiated any substantive discussions, directly or indirectly, with any

EV Business acquisition target. We have generated minimal revenues to date and

we do not expect that we will generate significant operating revenues at the

earliest until we consummate our initial EV Business acquisition. While we may

pursue an acquisition opportunity in the Electric Vehicles, Artificial

Intelligence, Machine Learning and Robotics (“EV-AI-ML-R”) industry or sector,

we intend to focus on: (1) businesses that source, design, develop, manufacture

and distribute high-performance, affordable and fully electric vehicles; and (2)

businesses that design, manufacture, install and sell Power Controls, Battery

Technology, Wireless Technology, and Residential utility meters and remote,

mission-critical devices mostly engineered using Artificial Intelligence,

Machine Learning and Robotic technologies.

Our management team is comprised of two business professionals

that have a broad range of experience in executive leadership, strategy

development and implementation, operations management, financial policy and

corporate transactions. Our management team members have worked together in

the past, at Goldstein Franklin, Inc. and other firms as executive leaders and

senior managers spearheading turnarounds, rollups and industry-focused

consolidation while generating shareholder value for many for investors and

stakeholders.

We believe that our management team is well positioned to identify

acquisition opportunities in the marketplace. Our management team's industry

expertise, principal investing transaction experience and business acumen will

make us an attractive partner and enhance our ability to complete a successful Business

acquisition. Our management believes that its ability to identify and implement

value creation initiatives has been an essential driver of past performance and

will remain central to its differentiated acquisition strategy.

Although our management team is well positioned and have

experience to identify acquisition opportunities in the marketplace, past

performance of our management team is not a guarantee either (i) of success

with respect to any EV Business acquisition we may consummate or (ii) that we

will be able to identify a suitable candidate for our initial EV Business

acquisition. You should not rely on the historical performance record of our

management team as indicative of our future performance. Additionally, in the

course of their respective careers, members of our management team have been

involved in businesses and deals that were unsuccessful. Our officers and

directors have not had management experience with EV companies in the past.

Our Business Plan

Returning back to its foremost business

model of technology focused operations, Video River Networks, Inc. (the

“Company”), a technology firm intends to operate and manage a portfolio of

Electric Vehicles, Artificial Intelligence, Machine Learning and Robotics

(“EV-AI-ML-R”) assets, businesses and operations in North America. The

Company’s current targeted portfolio businesses include those that source,

design, develop, manufacture and distribute high-performance, affordable and

fully electric vehicles; and design, manufacture, install and sell Power

Controls, Battery Technology, Wireless Technology, and Residential utility

meters and remote, mission-critical devices mostly engineered using Artificial

Intelligence, Machine Learning and Robotic technologies.

Our current technology-focused business model was a result of our

board resolution on September 15, 2020 to spin-in our specialty real estate

holding business to an operating subsidiary and then pivot back to being a

technology company. The Company has now returned back to its original

technology-focused businesses of Power Controls, Battery Technology, Wireless

Technology, and Residential utility meters and remote, mission-critical

devices. In addition to above list, the Company intends to spread its wings

into the Electric Vehicles, Artificial Intelligence, Machine Learning and

Robotics (“EV-AI-ML-R”) businesses/markets, targeting acquisition, ownership

and operation of acquired EV-AI-ML-R businesses or portfolio of EV-AI-ML-R

businesses.

Video River Networks, Inc., prior to September 15, 2020, used to

be a specialty real estate holding company, focuses on the acquisition,

ownership, and management of specialized industrial properties. The Company’s

real estate business objective is to maximize stockholder returns through a

combination of (1) distributions to our stockholders, (2) sustainable long-term

growth in cash flows from increased rents, which we hope to pass on to

stockholders in the form of increased distributions, and (3) potential long-term

appreciation in the value of our properties from capital gains upon future

sale. As a real estate holding company, the Company is engaged primarily in

the ownership, operation, management, acquisition, development and

redevelopment of predominantly multifamily housing and specialized industrial

properties in the United States.

Having partially freed itself from the day-to-day operation of the

real estate operations, the Company now returns to its technology root with a

primary purpose of acquiring Electric Vehicles manufacturer or doing a joint

venture (JV) with Electric Vehicles businesses that source, design, develop,

manufacture and distribute high-performance, affordable and fully electric

vehicles; and design, manufacture, install and sell Power Controls, Battery

Technology, Wireless Technology, and Residential utility meters and remote,

mission-critical devices mostly engineered using Artificial Intelligence,

Machine Learning and Robotic technologies.

Business Strategy and Deal Origination

We have not finalized an acquisition target yet,

but making progress in identifying several potential candidates from which we

intend to pick those that meet our criteria for acquisition. Our acquisition and value creation strategy will be to

identify, acquire and, after our initial EV Business acquisition, build an EV

company that source, design, develop, manufacture and distribute

high-performance, affordable and fully electric vehicles that

suit the experience of our management team and can benefit from their

operational expertise. Our Business acquisition strategy will leverage our

management team's network of potential transaction sources, where we believe a

combination of our relationships, knowledge and experience could effect a

positive transformation or augmentation of existing businesses to improve their

overall value proposition.

Our management team's

objective is to generate attractive returns and create value for our

shareholders by applying our disciplined strategy of underwriting intrinsic worth

and implementing changes after making an acquisition to unlock value. While our

approach is focused on the EV-AI-ML-R industries where we have differentiated insights,

we also have successfully driven change through a comprehensive value creation

plan framework. We favor opportunities where we can accelerate the target's

growth initiatives. As a management team we have successfully applied this

approach over approximately 16 years and have deployed capital successfully in

a range of market cycles.

We plan to utilize the network and Finance industry

experience of our Chief Executive Officer and our management team in seeking an

initial EV Business acquisition and employing our Business acquisition strategy

described below. Our CEO is a top financial professional with designations that

include, CPA, CMA, and CFM. He’s very knowledgeable in the fields of corporate

law, real estate, lending, turnarounds and restructuring. Over the course of

their careers, the members of our management team have developed a broad

network of contacts and corporate relationships that we believe will serve as a

useful source of EV acquisition opportunities. This network has been developed

through our management team's extensive experience:

·

investing in and operating a wide range of businesses;

·

growing brands through repositioning, increasing household

penetration and geographic expansion; expanding into new distribution channels,

such as e-Commerce, in an increasingly omni-channel world;

·

identifying lessons learned and applying solutions across

product portfolios and channels;

·

sourcing, structuring, acquiring, operating, developing,

growing, financing and selling businesses;

·

developing relationships with sellers, financing providers,

advisors and target management teams; and

·

executing transformational transactions in a wide range of

businesses under varying economic and financial market conditions.

In addition, drawing on their extensive investing

and operating experience, our management team anticipates tapping four major sources

of deal flow:

·

directly identifying potentially attractive undervalued

situations through primary research into EV industries and companies;

·

receiving information from our management team's global

contacts about a potentially attractive situation;

·

leads from investment bankers and advisors regarding

businesses seeking a combination or added value that matches our strengths; and

·

inbound opportunities from a company or existing stakeholders

seeking a combination, including corporate divestitures.

We expect this network will provide our

management team with a robust flow of EV acquisition opportunities. In

addition, we anticipate that target EV Business candidates will be brought to

our attention by various unaffiliated sources, which may include investment

market participants, private equity groups, investment banking firms,

consultants, accounting firms and large business enterprises. Upon completion

of this offering, members of our management team will communicate with their

network of relationships to articulate the parameters for our search for a

target company and a potential Business acquisition and begin the process of

pursuing and reviewing potential leads.

Acquisition/Business

acquisition Criteria

Consistent with this strategy, we have identified

the following general criteria and guidelines that we believe are important in

evaluating prospective target EV businesses. We will use these criteria and

guidelines in evaluating acquisition opportunities. While we intend to acquire EV

companies that we believe exhibit one or more of the following characteristics,

we may decide to enter into our initial EV Business acquisition with a target EV

business that does not meet these criteria and guidelines. We intend to acquire

EV companies that source, design, develop, manufacture and distribute

high-performance, affordable and fully electric vehicles:

·

have potential for significant growth, or can act as an

attractive EV acquisition platform, following our initial EV Business

acquisition;

·

have demonstrated market segment, category and/or cost

leadership and would benefit from our extensive network and insights;

·

provide operational platform and/or infrastructure for variety

of EV models and/or services, with the potential for revenue, market share,

footprint and/or distribution improvements;

·

are at the forefront of EV evolution around changing consumer

trends;

·

offer marketing, pricing and product mix optimization

opportunities across distribution channels;

·

are fundamentally sound companies that could be underperforming

their potential and/or offer compelling value;

·

offer the opportunity for our management team to partner with

established target management teams or business owners to achieve

long-term strategic and operational excellence, or, in some cases, where

our access to accomplished executives and the skills of the management of

identified targets warrants replacing or supplementing existing management;

·

exhibit unrecognized value or other characteristics,

desirable returns on capital and a need for capital to achieve the company's

growth strategy, that we believe have been misevaluated by the marketplace

based on our analysis and due diligence review; and

·

will offer an attractive risk-adjusted return for our

shareholders.

These criteria are not intended to be exhaustive.

Any evaluation relating to the merits of a particular initial EV Business

acquisition may be based, to the extent relevant, on these general guidelines

as well as other considerations, factors and criteria that our management may

deem relevant. In the event that we decide to enter into our initial EV

Business acquisition with a target EV Business that does not meet the above

criteria and guidelines, we will disclose that the target EV Business does not

meet the above criteria in our shareholder communications related to our

initial EV Business acquisition.

Acquisition/Business acquisition Process

In evaluating a

prospective target EV business, we expect to conduct a thorough due diligence

review that will encompass, among other things, meetings with incumbent

management and employees, document reviews, inspection of EV manufacturing facilities,

as well as a review of financial and other information. We will also utilize

our operational and capital allocation experience.

In order to execute

our business strategy, we intend to:

Assemble a team of EV

industry and financial experts: For each potential transaction, we

intend to assemble a team of EV industry and financial experts to supplement

our management's efforts to identify and resolve key issues facing a target EV

Business. We intend to construct an operating and financial plan that optimizes

the potential to grow shareholder value. With extensive experience investing in

both healthy and underperforming businesses, we expect that our management will be able to demonstrate to the target EV business

and its stakeholders that we have the resources and expertise to lead the

combined company through complex and potentially turbulent market conditions

and provide the strategic and operational direction necessary to grow the

business in order to maximize cash flows and improve the overall strategic

prospects for the company.

Conduct rigorous

research and analysis: Performing

disciplined, fundamental research and analysis is core to our strategy, and we

intend to conduct extensive due diligence to evaluate the impact that a

transaction may have on a target EV Business.

Business

acquisition driven by trend analysis: We intend to

understand the underlying purchase and industry behaviors that would enhance a

potential transaction's attractiveness. We have extensive experience in

identifying and analyzing evolving industry and consumer trends, and we expect

to perform macro as well as bottoms-up analysis on consumer and industry

trends.

Acquire the target

company at an attractive price relative to our view of intrinsic

value: Combining rigorous analysis as well as input from industry and

financial experts, our management team intends to develop its view of the

intrinsic value of a potential Business acquisition. In doing so, our

management team will evaluate future cash flow potential, relative industry

valuation metrics and precedent transactions to inform its view of intrinsic

value, with the intention of creating a Business acquisition at an attractive

price relative to its view of intrinsic value.

Implement

operational and financial structuring opportunities: Our

management team has the ability to structure and execute a Business acquisition

that will establish a capital structure that will support the growth in

shareholder value and give it the flexibility to grow organically and/or

through strategic acquisitions. We intend to also develop and implement

strategies and initiatives to improve the business' operational and financial

performance and create a platform for growth.

Seek strategic

acquisitions and divestitures to further grow shareholder

value: Our management team intends to analyze the strategic direction

of the company, including evaluating potential non-core asset sales to

create financial and/or operational flexibility for the company to engage in

organic and/or inorganic growth. Our management team intends to evaluate strategic

opportunities and chart a clear path to take the EV business to the next level

after the Business acquisition.

After the initial

EV Business acquisition, our management team intends to apply a rigorous

approach to enhancing shareholder value, including evaluating the experience

and expertise of incumbent management and making changes where appropriate,

examining opportunities for revenue enhancement, cost savings, operating

efficiencies and strategic acquisitions and divestitures and developing and implementing

corporate strategies and initiatives to improve profitability and

long-term value. In doing so, our management team anticipates evaluating

corporate governance, opportunistically accessing capital markets and other

opportunities to enhance liquidity, identifying acquisition and divestiture

opportunities and properly aligning management and board incentives with

growing shareholder value. Our management team intends to pursue

post-merger initiatives through participation on the board of directors,

through direct involvement with company operations and/or calling upon a stable

of former managers and advisors when necessary.

Strategic Approach

to Management. We intend to approach the management of a company as

strategy consultants would. This means that we approach business with

performance-based metrics based on strategic and operational goals, both

at the overall company level and for specific divisions and functions.

Corporate Governance and Oversight. Active

participation as board members can include many activities ranging from

conducting monthly or quarterly board meetings to chairing standing

(compensation, audit or investment committees) or special committees, replacing

or supplementing company management teams when necessary, adding outside

directors with industry expertise which may or may not include members of our

own board of directors, providing guidance on strategic and operational issues

including revenue enhancement opportunities, cost savings, brand repositioning,

operating efficiencies, reviewing and testing annual budgets, reviewing

acquisitions and divestitures and assisting in the accessing of capital markets

to further optimize financing costs and fund expansion.

Direct Operational

Involvement. Our management team members, through ongoing board service,

intend to actively engage with company management. These activities may

include: (i) establishing an agenda for management and instilling a sense of

accountability and urgency; (ii) aligning the interest of management with

growing shareholder value; (iii) providing strategic planning and management

consulting assistance, particularly in regards to re-invested capital and

growth capital in order to grow revenues, achieve more optimal operating scale

or eliminate costs; (iv) establishing measurable key performance metrics; and

(v) complementing product lines and brands while growing market share in

attractive market categories. These skill sets will be integral to shareholder

value creation.

M&A Expertise

and Add-On Acquisitions. Our management team

has expertise in identifying, acquiring and integrating synergistic,

margin-enhancing and transformational businesses. We intend to, wherever

possible, utilize M&A as a strategic tool to strengthen the financial

profile of an EV business we acquire, as well as its competitive positioning.

We would seek to enter into accretive Business acquisitions where our

management team or an acquired company's management team can seamlessly

transition to working together as one organization and team.

Access to Portfolio

Company Managers and Advisors. Through their

combined 32+ year history of investing in and controlling businesses, our

management team members have developed strong professional relationships with

former company managers and advisors. When appropriate, we intend to bring in

outside directors, managers or consultants to assist in corporate governance

and operational turnaround activities. The use of supplemental advisors should

provide additional resources to management to address time intensive issues

that may be delaying an organization from realizing its full potential

shareholder returns.

Our acquisition

criteria, due diligence processes and value creation methods are not intended

to be exhaustive. Any evaluation relating to the merits of a particular initial

EV Business acquisition may be based, to the extent relevant, on these general

guidelines as well as other considerations, factors and criteria that our

management may deem relevant. In the event that we decide to enter into our initial

EV Business acquisition with a target EV Business that does not meet the above

criteria and guidelines, we will disclose that the target EV Business does not

meet the above criteria in our shareholder communications related to our initial

EV Business acquisition, which, as discussed in this prospectus, would be in

the form of tender offer documents or proxy solicitation materials that we

would file with the SEC.

Sourcing of

Potential Business acquisition Targets

We believe that the

operational and transactional experience of our management team and their

respective affiliates, and the relationships they have developed as a result of

such experience, will provide us with a substantial number of potential Business

acquisition targets. These individuals and entities have developed a broad

network of contacts and corporate relationships around the world. This network

has grown through sourcing, acquiring and financing

businesses and maintaining relationships with sellers, financing sources and

target management teams. Our management team members have significant

experience in executing transactions under varying economic and financial

market conditions. We believe that these networks of contacts and relationships

and this experience will provide us with important sources of investment

opportunities. In addition, we anticipate that target EV Business candidates

may be brought to our attention from various unaffiliated sources, including

investment market participants, private equity funds and large business

enterprises seeking to divest noncore assets or divisions.

Other Acquisition

Considerations

We are not

prohibited from pursuing an initial EV Business acquisition with a company that

is affiliated with our sponsor, officers or directors. In the event we seek to

complete our initial EV Business acquisition with a company that is affiliated

with our officers or directors, we, or a committee of independent directors,

will obtain an opinion from an independent investment banking firm or another

independent firm that commonly renders valuation opinions for the type of

company we are seeking to acquire or an independent accounting firm that our initial

EV Business acquisition is fair to our company from a financial point of view.

Unless we complete

our initial EV Business acquisition with an affiliated entity, or our Board of

Directors cannot independently determine the fair market value of the target EV

Business or businesses, we are not required to obtain an opinion from an

independent investment banking firm, another independent firm that commonly

renders valuation opinions for the type of company we are seeking to acquire or

from an independent accounting firm that the price we are paying for a target

is fair to our company from a financial point of view. If no opinion is

obtained, our shareholders will be relying on the business judgment of our

Board of Directors, which will have significant discretion in choosing the

standard used to establish the fair market value of the target or targets, and

different methods of valuation may vary greatly in outcome from one another.

Such standards used will be disclosed in our tender offer documents or proxy

solicitation materials, as applicable, related to our initial EV Business

acquisition.

Members of our

management team may directly or indirectly own our ordinary shares and/or

private placement warrants following this offering, and, accordingly, may have

a conflict of interest in determining whether a particular target EV Business

is an appropriate business with which to effectuate our initial EV Business

acquisition. Further, each of our officers and directors may have a conflict of

interest with respect to evaluating a particular Business acquisition if the

retention or resignation of any such officers and directors was included by a target

EV Business as a condition to any agreement with respect to our initial EV

Business acquisition.

In the future any

of our directors and our officers may have additional, fiduciary or contractual

obligations to other entities pursuant to which such officer or director is or

will be required to present acquisition opportunities to such entity.

Accordingly, subject to his or her fiduciary duties, if any of our officers or

directors becomes aware of an acquisition opportunity which is suitable for an

entity to which he or she has then current fiduciary or contractual

obligations, he or she will need to honor his or her fiduciary or contractual

obligations to present such acquisition opportunity to such entity, and only

present it to us if such entity rejects the opportunity. We do not believe,

however, that any fiduciary duties or contractual obligations of our directors

or officers would materially undermine our ability to complete our Business

acquisition.

Real Estate strategy

Our Real Estate strategy includes the following components:

|

|

·

|

Owning Specialized Real Estate Properties and Assets

for Income. We

intend to primarily acquire economic development real estates, and multifamily

housing properties. We expect to hold acquired properties for investment and

to generate stable and increasing rental income from leasing these properties

to licensed growers.

|

|

|

·

|

Owning Specialized Real Estate Properties and Assets

for Appreciation. We intend to primarily lease our

acquired properties under long-term, triple-net leases. However, from time to

time, we may elect to sell one or more properties if we believe it to be in

the best interests of our stockholders. Accordingly, we will seek to acquire

properties that we believe also have potential for long-term appreciation in

value.

|

|

|

·

|

Affordable Housing. Our motto

is: “acquire distressed/troubled properties, secure generous government

subsidies, empower low-income families, and generate above-market returns to

investors.”

|

|

|

·

|

Preserving Financial Flexibility on our Balance

Sheet. We

intend to maintain a conservative capital structure, in order to provide us

flexibility in financing our growth initiatives.

|

As

of December 31, 2020, we owned one investment property in California, and we

expect to continue to expand to other real estate asset classes including single

and multifamily properties. We believe an intense focus on operations is

necessary to realize consistent, sustained earnings growth. Ensuring tenants’ satisfaction,

increasing rents as market conditions allow, maximizing rent collections,

maintaining property occupancy at optimal levels, and controlling operating

costs comprise our principal strategies to maximize property financial results.

We believe a web-based property management and revenue management systems

strengthen on-site operations and allow us to quickly adjust rental rates as

local market conditions change. Lease terms are generally staggered based on

vacancy exposure by property type so lease expirations are matched to each

property's seasonal rental patterns. We generally offer leases ranging from

twelve to fifteen months with individual property marketing plans structured to

respond to local market conditions. In addition, we conduct ongoing customer

service surveys to help ensure timely response to tenants' changing needs and a

high level of satisfaction.

Our Affordable Housing Target Markets

Our multifamily affordable housing target market is focused on

urban and suburban neighborhoods in California, Nevada and Maryland and other

highly urbanized states. We are also open to acquiring properties in

opportunity zone multifamily properties that includes most urban neighborhoods

of the United States, including underserved suburbs of major cities across the

country.

Research Driven Approach to Investments – The

Company believes that successful real estate investment decisions and portfolio

growth begin with extensive regional economic research and local market

knowledge. The Company continually assesses markets where the Company

operates, as well as markets where the Company considers future investment

opportunities by evaluating markets and focusing on the following strategic

criteria:

|

|

|

|

•

|

Major metropolitan areas that have regional population in

excess of one million;

|

|

|

|

|

•

|

Constraints on new supply driven by: (i) low availability of

developable land sites where competing housing could be economically built;

(ii) political growth barriers, such as protected land, urban growth

boundaries, and potential lengthy and expensive development permit processes;

and (iii) natural limitations to development, such as mountains or waterways;

|

|

|

|

|

•

|

Rental demand enhanced by affordability of rents relative to

costs of for-sale housing; and

|

|

|

|

|

•

|

Housing demand based on job growth, proximity to jobs, high

median incomes and the quality of life including related commuting factors.

|

Recognizing

that all real estate markets are cyclical, the Company regularly evaluates the

results of its regional economic, and local market research, and adjusts the

geographic focus of its portfolio accordingly. The Company seeks to

increase its portfolio allocation in markets projected to have the strongest

local economies and to decrease allocations in markets projected to have

declining economic conditions. Likewise, the Company also seeks to

increase its portfolio allocation in markets that have attractive property valuations

and to decrease allocations in markets that have inflated valuations and low

relative yields.

Multifamily

Property Operations – The Company intends to manage its multifamily

properties by focusing on activities that may generate above-average rental growth,

tenant retention/satisfaction and long-term asset appreciation. The

Company intends to achieve this by utilizing the strategies set forth below:

|

|

|

|

•

|

Property Management – Oversee

delivery and quality of the housing provided to our tenants and manage the

properties financial performance.

|

|

|

|

|

•

|

Capital Preservation – The

Company's asset management services are responsible for the planning,

budgeting and completion of major capital improvement projects at the

Company’s multifamily properties.

|

|

|

|

|

•

|

Business Planning and Control – Comprehensive

business plans are implemented in conjunction with significant investment

decisions. These plans include benchmarks for future financial performance

based on collaborative discussions between on-site managers, the operations

leadership team, and senior management.

|

|

|

|

|

•

|

Development and Redevelopment – The

Company focuses on acquiring and developing apartment multifamily properties

in supply constrained markets, and redeveloping its existing multifamily properties

to improve the financial and physical aspects of the Company’s multifamily

properties.

|

Maintaining a Diversified Portfolio and

Allocating Capital to Accretive Investment Opportunities.

We believe greater portfolio diversification, as defined by

geographic concentration, location within a market (i.e., urban or suburban)

and property quality (i.e., A or B), reduces the volatility of our same-store

growth throughout the real estate cycle, appeals to a wider renter and investor

audience and lessens the market risk associated with owning a homogenous

portfolio.

We are focused on increasing our presence in markets with

favorable job formation, high propensity to rent, low single-family home

affordability, and a favorable demand/supply ratio for multifamily housing.

Portfolio investment decisions consider internal analyses and third-party

research.

Our operating focus is on balancing occupancy and rental rates to

maximize our revenue while exercising tight cost control to generate the highest

possible return to our shareholders. Revenue is maximized by attracting

qualified prospects to our properties, cost-effectively converting these

prospects into new tenants and keeping our tenants satisfied so they will renew

their leases upon expiration. While we believe that it is our high-quality,

well-located assets that bring our customers to us, it is the customer service

and superior value provided by our on-site personnel that keeps them renting

with us and recommending us to their friends.

We use technology to engage our tenants, stakeholder and customers

in the way that they want to be engaged. Many of our tenants would utilize our

web-based tenant portal and app which allows them to sign and renew their

leases, review their accounts and make payments, provide feedback and make

service requests on-line or with mobile devices.

Market Opportunity

The Industrial Real Estate Sub-Market

The

industrial real estate sub-market continues to perform well in this real estate

cycle. According to CBRE Group, Inc., the U.S. industrial property vacancy rate

declined to 4.3% in the fourth quarter of 2018, reflecting the 35th consecutive

quarter of positive net absorption. Nearly 30.0 million square feet of

industrial real estate were absorbed in 2018, which resulted in the highest net

asking rents since CBRE Group, Inc. began tracking this metric in 1989.

We believe this supply/demand dynamic creates significant

opportunity for owners of industrial facilities, particularly those focused on

niche categories, as options are limited for tenants requiring specialized

buildings. We intend to capitalize on this opportunity by purchasing

specialized industrial real estate assets that are critical to the medical-use

cannabis industry.

Our

Financing Strategy

As part of our plan to finance our

activities, we utilize proceeds from debt and equity offerings and refinancing

to extend maturities, pay down existing debt, fund development and

redevelopment activities, and acquire rental properties. We use mortgage with

reasonable terms on all our acquisitions.

We intend to meet our long-term liquidity

needs through cash flow from operations and the issuance of equity and debt

securities, including common stock, preferred stock and long-term notes. Where

possible, we also may issue limited partnership interests in our Operating

Partnership to acquire properties from existing owners seeking a tax-deferred

transaction. We expect to issue equity and debt securities at times when we

believe that our stock price is at a level that allows for the reinvestment of

offering proceeds in accretive property acquisitions. We may also issue common

stock to permanently finance properties that were previously financed by debt

securities. However, we cannot assure you that we will have access to the

capital markets at times and on terms that are acceptable to us. Our ability to

access the capital markets and to obtain other financing arrangements is also

significantly limited by our focus on serving the medical-use cannabis

industry. Our investment guidelines initially provide that our aggregate

borrowings (secured and unsecured) will not exceed 50% of the cost of our

tangible assets at the time of any new borrowing, subject to our board of

directors' discretion.

We may file a shelf registration

statement, which would subsequently be declared effective by the SEC, which may

permit us, from time to time, to offer and sell common stock, preferred stock,

warrants and other securities to the extent necessary or advisable to meet our

liquidity needs.

Portfolio Management

Our portfolio management strategy involves

the allocation of investment capital to enhance rent growth and increase

long-term capital values through portfolio design, emphasizing land value as

well as location and submarket. We target geographic diversification in our

portfolio in order to reduce the volatility of our rental revenue and to reduce

the risk of undue concentration in any particular market. Similarly, we seek

price point diversification by owning multifamily properties that offer

properties at rents below those asked by competitive new building supply.

Acquisitions and Dispositions

Acquisitions and developments may be

financed from various sources of capital, which may include retained cash flow,

issuance of additional equity and debt, sales of properties and joint venture

arrangements. In addition, the Company may acquire properties in transactions

that include Operating Partnership (OP) Units as consideration for the acquired

properties. Such transactions may, in certain circumstances, enable the

sellers to defer, in whole or in part, the recognition of taxable income or

gain that might otherwise result from the sales.

When evaluating potential acquisitions, we

consider a wide variety of factors, including:

• whether it is located in

a high barrier-to-entry market;

• population growth, cost

of alternative housing, overall potential for economic growth and the tax and

regulatory environment of the community in which the property is located;

• geographic location,

including proximity to jobs, entertainment, transportation, and our existing

communities which can deliver significant economies of scale;

• construction quality,

condition and design of the property;

• current and projected

cash flow of the property and the ability to increase cash flow;

• ability of the

property’s projected cash flows to exceed our cost of capital;

• potential for capital

appreciation of the property;

• ability to increase the

value and profitability of the property through operations and redevelopment;

• terms of resident

leases, including the potential for rent increases;

• occupancy and demand by

tenants for properties of a similar type in the vicinity;

• prospects for liquidity

through sale, financing, or refinancing of the property; and

• competition from

existing multifamily communities and the potential for the construction of new

multifamily properties in the area.

Our Acquisition Process and Underwriting

Criteria

We identify property acquisition

opportunities primarily through relationships developed over time by our

officers with former borrowers, current joint venture partners, real estate

investors and brokers. We are interested in acquiring the following types of

properties:

•

Class B or better

properties with strong and stable cash flows in markets where we believe there

exists opportunity for rental growth and further value creation;

•

Class B or better

properties that offer significant potential for capital appreciation through

repositioning or rehabilitating the asset to drive rental growth;

•

properties available

at opportunistic prices providing an opportunity for a significant appreciation

in value; and

•

development of Class A

properties in markets where we believe we can generate significant returns from

the operation and if appropriate, sale of the development.

We regularly monitor our assets to

increase the quality and performance of our portfolio. Factors we consider in

deciding whether to dispose of a property include:

•

current market price

for an asset compared to projected economics for that asset;

•

potential increases in

new construction in the market area;

•

areas with low job

growth prospects;

•

markets where we do

not intend to establish a long-term concentration; and

•

operating

efficiencies.

Additionally, as part of our strategy, the

Company purchases properties at various stages of occupancy and completion and

may acquire land parcels to hold and/or sell as well as options to buy more

land in the future. The Company may also seek to acquire properties by

providing mezzanine financing/equity and/or purchasing defaulted or distressed

debt that encumbers desirable properties.

The Company has done an extensive

positioning planning of its portfolio into urban and highly walkable, close-in

suburban communities. The Company targets properties and primarily located in

markets and submarkets it believes will remain attractive long-term because

they are primarily located in the urban and high-density suburban areas noted

above.

Environmental, Social and Governance

(“ESG”)

We endeavor to provide a richly diverse

work environment that employs the highest performers, cultivates the best ideas

and creates the widest possible platform for success. We are committed to

elevating and supporting the core values of diversity and inclusion, “Total

Well-Being” (which brings together physical, financial, career, social and

community well-being into a cohesive whole), and environmental, social and

governance (“ESG”), which includes sustainability and social responsibility, by

actively engaging in these areas. Each member of the executive team maintains

an annual goal related to these core values, which is evaluated by the

Company’s Board of Trustees. Our goal is to create and sustain an inclusive

environment where diversity will thrive, employees will want to work and

tenants will want. We are committed to providing our employees with

encouragement, guidance, time and resources to learn and apply the skills

required to succeed in their jobs. We provide many classroom and on-line

training courses to assist our employees in interacting with prospects and

tenants as well as extensive training for our customer service specialists in

maintaining our properties and improvements, equipment and appliances. We

actively promote from within and many senior corporate and property leaders

have risen from entry level or junior positions. We monitor our employees’

engagement by surveying them annually and find most employees say they are

proud to work at the Company, value one another as colleagues, believe in our

mission and values and feel their skills meet their job requirements.

We have a commitment to sustainability and

consider the environmental impacts of our business activities. Sustainability

and social responsibility are key drivers of our focus on creating the best

properties for tenants operate, work and play. We have a dedicated in-house

team that initiates and applies sustainable practices in all aspects of our business, including investment activities,

development, property operations and property management activities. With its

high density, multifamily housing is, by its nature, an environmentally

friendly property type. Our recent acquisition and development activities have

been primarily concentrated in pedestrian-friendly urban and close-in suburban

locations near public transportation. When developing and renovating our

properties, we strive to reduce energy and water consumption by investing in

energy saving technology while positively impacting the experience of our

tenants and the value of our assets. We continue to implement a combination of

irrigation, lighting, HVAC and renewable energy improvements at our properties

that will reduce energy and water consumption. For 2020, we continue to have

an express company-wide goal for Total Well-Being, which includes enhanced ESG

efforts. Employees, including our executives, will have their performance against

our various Total Well-Being goals evaluated as part of our annual

performance review process.

Buyouts of Joint Venture Partners

From time to time, we acquire our joint

venture partner's equity interest in projects and as a result, these properties

are wholly-owned by us.

Risk Management

As of December 31, 2020, we owned three

properties. We embraced portfolio diversification at acquisitions as our main

risk management strategy. We will continue to diversify the investment size and

location of our portfolio of properties in order to manage our portfolio-level

risk. Over the long term, we intend that no single property will exceed 25% of

our total assets and that no single tenant will exceed 30% of our total assets.

We expect that single tenants will occupy

our properties pursuant to triple-net lease arrangements in general and,

therefore, the success of our investments will be materially dependent on the

financial stability of these tenants. We expect the success of our future

tenants, and their ability to make rent payments to us, to significantly depend

on the projected growth and development of the applicable state market; as many

of these state markets have a very limited history, and other state markets are

still forming their regulations, issuing licenses and otherwise establishing

the market framework, significant uncertainty exists as to whether these

markets will develop in the way that we or our future tenants project.

We intend to evaluate the credit quality

of our future tenants and any guarantors on an ongoing basis by reviewing,

where available, the publicly filed financial reports, press releases and other

publicly available industry information regarding our future tenants and any

guarantors. In addition, we intend to monitor the payment history data for all

of our future tenants and, in some instances, we monitor our future tenants by

periodically conducting site visits and meeting with the tenants to discuss

their operations. In many instances, we will generally not be entitled to

financial results or other credit-related data from our future tenants. See the

section "Risks Related to Our Business" under Item 1A, "Risk

Factors."

Corporate

Information

We are

an “emerging growth company,” as defined in Section 2(a) of the Securities

Act of 1933, as amended, or the Securities Act, as modified by the Jumpstart

Our Business Startups Act of 2012, or the JOBS Act. As such, we are eligible to

take advantage of certain exemptions from various reporting requirements that

are applicable to other public companies that are not “emerging growth

companies” including, but not limited to, not being required to comply

with the auditor attestation requirements of Section 404 of the

Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, reduced disclosure

obligations regarding executive compensation in our periodic reports and proxy

statements, and exemptions from the requirements of holding a

non-binding advisory vote on executive compensation and shareholder

approval of any golden parachute payments not previously approved. If some

investors find our securities less attractive as a result, there may be a less

active trading market for our securities and the prices of our securities may

be more volatile.

In addition, Section 107 of the JOBS Act also provides that

an “emerging growth company” can take advantage of the extended

transition period provided in Section 7(a)(2)(B) of the Securities Act for

complying with new or revised accounting standards. In other words,

an “emerging growth company” can delay the adoption of certain

accounting standards until those standards would otherwise apply to private

companies. We intend to take advantage of the benefits of this extended

transition period.

We will remain an

emerging growth company until the earlier of (1) the last day of the fiscal

year (a) following the fifth anniversary of the completion of this offering,

(b) in which we have total annual gross revenue of at least $1.07 billion,

or (c) in which we are deemed to be a large accelerated filer, which means the

market value of our ordinary shares that is held by non-affiliates exceeds

$700 million as of the prior June 30th, and (2) the date on

which we have issued more than $1.0 billion in non-convertible debt

securities during the prior three-year period. References herein

to “emerging growth company” shall have the meaning associated with

it in the JOBS Act.

Plan of Operations

While our major focus is to find, acquire and manage an EV

business, our real estate portfolio is still alive and must figure in our plan

of operation. As of the date of this S-1 Registration, we have two available-for-sale real estate properties with a carrying

amount of $970,148. We bought three single family residences (SFR) with a

cost/carrying amount of $1,452,897, in Los Angeles in 2019. We bought a fourth

property in June 2020. During the nine months ended December 31, 2020, we sold

two of the four properties for a total amount of $1,205,000. In the next

twelve months, we plan on selling the remaining two properties and adding the

proceeds obtained from the sales to the Proceeds from this Offering to finance

our electric vehicles business plan.

The Company will continue to evaluate its projected expenditures

relative to its available cash and to seek additional means of financing in

order to satisfy the Company’s working capital and other cash requirements.

Upon completion of the acquisition of an Electric Vehicles manufacturer or doing a joint venture (JV) with

Electric Vehicles businesses that source, design, develop, manufacture and

distribute high-performance, affordable and fully electric vehicles, our

strategy will subsequently include distribution of the electric vehicles and related product lines to retailers and

consumers across North America.

Summary of Risk Factors

This offering involves substantial risk. Our ability to execute

our business strategy is also subject to certain risks. The risks described

under the heading “Risk Factors” included elsewhere in this prospectus may

cause us not to realize the full benefits of our business plan and strategy or

may cause us to be unable to successfully execute all or part of our strategy.

There are a number of potential difficulties that we might face,

including the following:

|

|

●

|

Competitors may develop alternatives that render our products

redundant or unnecessary;

|

|

|

●

|

We may not obtain and maintain sufficient protection of our

electric vehicles models;

|

|

|

●

|

Our electric vehicles products may not become widely accepted by

consumers and merchants; and

|

|

|

●

|

We may not be able to raise sufficient additional funds to fully

implement our business plan and grow our business.

|

|

|

Some of the most significant challenges and risks include the

following:

|

|

●

|

Our Auditor has expressed substantial doubt as to our ability to

continue as a going concern.

|

|

|

●

|

Our limited operating history does not afford investors a

sufficient history on which to base an investment decision.

|

|

|

●

|

Our revenues will be dependent upon acceptance of our Electric

Vehicle brand/models and product line by consumers and distributors. The

failure of such acceptance will cause us to curtail or cease operations.

|

|

|

●

|

We cannot be certain that we will obtain patents for our product

line or that such patents will protect us. Infringement or misappropriation

claims (or claims for indemnification resulting from such claims) against us

may be asserted or prosecuted, regardless of their merit, and any such

assertions or prosecutions may adversely affect our business and/or our operating

results.

|

|

|

●

|

The availability of a large number of authorized but unissued

shares of Common Stock may, upon their issuance, lead to dilution of existing

stockholders.

|

|

|

●

|

Our stock is thinly traded, sale of your holding may take a

considerable amount of time.

|

Before you invest in our common stock, you should carefully

consider all the information in this prospectus, including matters set forth

under the heading “Risk Factors.”

Real Estate Industry Regulation

Generally, the ownership and operation of

real properties are subject to various laws, ordinances and regulations,

including regulations relating to zoning, land use, water rights, wastewater,

storm water runoff and lien sale rights and procedures. These laws, ordinances

or regulations, such as the Comprehensive Environmental Response and

Compensation Liability Act and its state analogs, or any changes to any such

laws, ordinances or regulations, could result in or increase the potential

liability for environmental conditions or circumstances existing, or created by

tenants or others, on our properties. Laws related to upkeep, safety and

taxation requirements may result in significant unanticipated expenditures,

loss of our properties or other impairments to operations, any of which would

adversely affect our cash flows from operating activities.

Our property management activities, to the

extent we are required to engage in them due to lease defaults by tenants or

vacancies on certain properties, will likely be subject to state real estate

brokerage laws and regulations as determined by the particular real estate

commission for each state.

Insurance

We carry comprehensive general liability

coverage on our communities, with limits of liability customary within the

multi-family properties industry to insure against liability claims and related

defense costs. We are also insured, with limits of liability customary within

the real estate industry, against the risk of direct physical damage in amounts

necessary to reimburse us on a replacement cost basis for costs incurred to

repair or rebuild each property, including loss of rental income during the

reconstruction period.

Our primary lines of insurance coverage

are property, general liability and workers’ compensation. We believe that our

insurance coverages adequately insure our multifamily properties against the

risk of loss attributable to fire, earthquake, hurricane, tornado, flood,

terrorism and other perils, and adequately insure us against other risk. Our coverage includes deductibles, retentions and limits that

are customary in the industry. We have established loss prevention, loss

mitigation, claims handling and litigation management procedures to manage our

exposure.

Seasonality

Our business has not been, and we do not

expect it to become subject to, material seasonal fluctuations.

Employees

As

of December 31, 2020, we had 3 non-W2 staff considered to be part of our

management team. Those three include our sole officer, Frank I Igwealor and

Director, Patience Ogbozor. We have not experienced any work stoppages, and we

consider our relations with our officers to be good.

Going

Concern

We

are dependent upon the receipt of capital investment and other financing to

fund our ongoing operations and to execute our business plan. If continued

funding and capital resources are unavailable at reasonable terms, we may not

be able to implement our plan of operations. We may be required to obtain

alternative or additional financing, from financial institutions or otherwise,

in order to maintain and expand our existing operations. The failure by us to