FORM

6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of April, 2021

Commission File Number: 001-12518

Banco Santander, S.A.

(Exact name of registrant as specified in its charter)

Ciudad Grupo Santander

28660 Boadilla del Monte (Madrid) Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

Banco Santander, S.A.

TABLE OF CONTENTS

Item 1

Banco Santander, S.A., in compliance with the Securities Market legislation, hereby communicates the following:

OTHER RELEVANT INFORMATION

Starting with the financial information for the first quarter of 2021, a change in the Group’s reportable segments is to be carried out to reflect the

Bank’s new organizational structure, in line with the three strategic initiatives outlined in the 2020 Annual Report: One Santander, Digital Consumer Bank and PagoNxt.

These changes align the segment information with their management and have no impact on the Group’s accounting figures.

Attached is a presentation which contains the quarterly pro forma financial figures for 2020 to allow a comparison between 2020 and 2021, including the

aforementioned changes.

The main changes in Group’s segments are:

|

|

-

|

Creation of the new Digital Consumer Bank (DCB) segment, which includes Santander Consumer Finance (SCF),

previously included in the Europe segment and Openbank, formerly included in Santander Global Platform. The consumer finance business in the United Kingdom previously reported in the country will be reported in this new segment.

|

|

|

-

|

Elimination of the Santander Global Platform reporting segment: Openbank is now included within DCB, and

Merchant Solutions, Trade Solutions and Consumer Solutions (Superdigital and Pago Next) will be assigned accordingly to each of the three main geographic regions.

|

|

|

-

|

Creation of the PagoNxt segment, which includes the Merchant Solutions, Trade Solutions and Consumer Solutions,

previously recorded in Santander Global Platform.

|

|

|

-

|

Elimination of the Santander Global Platform reporting segment, now included under PagoNxt and Retail Banking

(mainly Openbank).

|

|

|

-

|

An adjustment of the perimeter of the Global Customer Relationship Model between Retail Banking and Santander

Corporate & Investment Banking and between Retail Banking and Wealth Management & Insurance.

|

For more information please see the attached presentation.

Boadilla del Monte (Madrid), 9 April 2021

April 2021 2020 income statements and balance sheets according to the new reporting structure All. Together.

Now.

Restricted-confidential Important information Non-IFRS and alternative

performance measures This presentation contains, in addition to the financial information prepared in accordance with International Financial Reporting Standards (“IFRS”) and derived from our financial statements, alternative performance

measures (“APMs”) as defined in the Guidelines on Alternative Performance Measures issued by the European Securities and Markets Authority (ESMA) on 5 October 2015 (ESMA/2015/1415en) and other

non-IFRS measures (“Non-IFRS Measures”). These financial measures that qualify as APMs and non-IFRS measures have been

calculated with information from Santander Group; however those financial measures are not defined or detailed in the applicable financial reporting framework nor have been audited or reviewed by our auditors. We use these APMs and non-IFRS measures when planning, monitoring and evaluating our performance. We consider these APMs and non-IFRS measures to be useful metrics for our management and investors

to compare operating performance between accounting periods, as these measures exclude items outside the ordinary course performance of our business, which are grouped in the non-IFRS line management

adjustments line and are further detailed at the end of Section 3.2 of the Economic and Financial Review in our Directors’ Report included in our Annual Report on Form 20-F for the year ended

31 December 2020. Nonetheless, these APMs and non-IFRS measures should be considered supplemental information to, and are not meant to substitute IFRS measures. Furthermore, companies in our industry and

others may calculate or use APMs and non-IFRS measures differently, thus making them less useful for comparison purposes. For further details on APMs and Non-IFRS

Measures, including its definition or a reconciliation between any applicable management indicators and the financial data presented in the consolidated financial statements prepared under IFRS, please see the 2020 Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission on 26 February 2021. This document is available on Santander’s website (www.santander.com). Underlying measures, which are included in this

presentation, are non-IFRS measures. The businesses included in each of our geographic segments and the accounting principles under which their results are presented here may differ from the included

businesses and local applicable accounting principles of our public subsidiaries in such geographies. Accordingly, the results of operations and trends shown for our geographic segments may differ materially from those of such subsidiaries.

Forward-looking statements Banco Santander, S.A. (“Santander”) advises that this presentation contains “forward-looking statements” as per the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements

may be identified by words like “expect”, “project”, “anticipate”, “should”, “intend”, “probability”, “risk”, “VaR”, “RoRAC”, “RoRWA”,

“TNAV”, “target”, “goal”, “objective”, “estimate”, “future” and similar expressions. Found throughout this presentation, they include (but are not limited to) statements on our future

business development, economic performance and shareholder remuneration policy. However, a number of risks, uncertainties and other important factors may cause actual developments and results to differ materially from our expectations. The following

important factors, in addition to others discussed elsewhere in this presentation, could affect our future results and could cause materially different outcomes from those anticipated in forward-looking statements: (1) general economic or

industry conditions of areas where we have significant operations or investments (such as a worse economic environment; higher volatility in the capital markets; inflation or deflation; changes in demographics, consumer spending, investment or

saving habits; and the effects of the COVID-19 pandemic in the global economy); (2) exposure to various market risks (particularly interest rate risk, foreign exchange rate risk, equity price risk and risks

associated with the replacement of benchmark indices); (3) potential losses from early repayments on our loan and investment portfolio, declines in value of collateral securing our loan portfolio, and counterparty risk; (4) political stability

in Spain, the United Kingdom, other European countries, Latin America and the US (5) changes in legislation, regulations, taxes, including regulatory capital and liquidity requirements, especially in view of the UK exit of the European Union

and increased regulation in response to financial crisis; (6) our ability to integrate successfully our acquisitions and related challenges that result from the inherent diversion of management’s focus and resources from other strategic

opportunities and operational matters; and (7) changes in our access to liquidity and funding on acceptable terms, in particular if resulting from credit spreads shifts or downgrade in credit ratings for the entire group or significant

subsidiaries. 2

Restricted-confidential Important information Numerous factors could affect our future results and could cause

those results deviating from those anticipated in the forward-looking statements. Other unknown or unpredictable factors could cause actual results to differ materially from those in the forward-looking statements. Forward-looking statements speak

only as of the date of this presentation and are informed by the knowledge, information and views available on such date. Santander is not required to update or revise any forward-looking statements, regardless of new information, future events or

otherwise. No offer The information contained in this presentation is subject to, and must be read in conjunction with, all other publicly available information, including, where relevant any fuller disclosure document published by Santander. Any

person at any time acquiring securities must do so only on the basis of such person’s own judgment as to the merits or the suitability of the securities for its purpose and only on such information as is contained in such public information

having taken all such professional or other advice as it considers necessary or appropriate in the circumstances and not in reliance on the information contained in this presentation. No investment activity should be undertaken on the basis of the

information contained in this presentation. In making this presentation available Santander gives no advice and makes no recommendation to buy, sell or otherwise deal in shares in Santander or in any other securities or investments whatsoever.

Neither this presentation nor any of the information contained therein constitutes an offer to sell or the solicitation of an offer to buy any securities. No offering of securities shall be made in the United States except pursuant to registration

under the U.S. Securities Act of 1933, as amended, or an exemption therefrom. Nothing contained in this presentation is intended to constitute an invitation or inducement to engage in investment activity for the purposes of the prohibition on

financial promotion in the U.K. Financial Services and Markets Act 2000. Historical performance is not indicative of future results Statements about historical performance or accretion must not be construed to indicate that future performance, share

price or future (including earnings per share) in any future period will necessarily match or exceed those of any prior period. Nothing in this presentation should be taken as a profit forecast. 3

Restricted-confidential Adapting our reporting to the new organizational structure towards the Santander of

Tomorrow –3 priorities for profitable growth 1 One Santander 2 Digital Consumer Bank (DCB) 3 PagoNxt ? New operating model leveraging our global ? Driving profitable growth in Europe and ? Our Group technology “backbone” solutions

scale to deliver a better customer experience, new markets. with payments at the core, providing supported by common culture and higher Merchant, Trade and Consumer solutions degrees of commonality, technology being one 3 regions: Europe, North

America and ? Combining our consumer finance business South America in Europe, and Openbank, our retail digital bank Primary segments Secondary segment These changes do not entail any alteration in Group figures 4

Restricted-confidential New organizational structure Primary segments Europe North America South America DCB

Spain United States Brazil SCF Chile United Kingdom Mexico Argentina Portugal Uruguay Poland Peru Corporate Other Europe Colombia Centre One Santander Secondary segments Retail Banking SCIB WM&I PagoNxt 5

Restricted-confidential Primary segments main changes “Until 2020” “From 2021 on” Other1

Other1 EUROPE Including SCF UK Excluding SCF UK Global Payments Services in the region NORTH AMERICA Global Payments Services in the region SOUTH AMERICA SGP Global Payments Services Openbank (GMS, GTS, Superdigital, Pago FX) Global DIGITAL

Divisions expenses SCF Openbank Cost CONSUMER allocation BANK to countries / Transfer UK SAN Digital (DCB) Division expenses (1) SCIB and WM rest of Europe. In addition in 2021, Global Payments Services in the region included 6

Restricted-confidential Secondary segments main changes “Until 2020” “From 2021 on” RETAIL

BANKING1 Retail Banking Retail Banking Openbank SCIB1 Corporate and Investment Banking Corporate and Investment Banking WM&I1 Private Asset Insurance Private Asset Banking Management Banking Insurance Management SGP Global Payments Services

Openbank (GMS, GTS, Superdigital, Pago FX) Global Divisions expenses Merchant Consumer Co to countries / Transfer Trade SAN Division expenses Solutions Solutions Solutions (1) Regarding the secondary segments, Global Customer Relationship

Model: recurring annual adjustment to the perimeter between Retail Banking, Santander Wealth Management & Insurance 7 (WM&I) and Santander Corporate & Investment Banking (SCIB). These changes had no impact on the geographic

businesses.

Restricted-confidential Main differences in underlying profits. Income statement of the Group does not change

2020 restated. Primary segments 2020 restated. Markets EUR mn Difference EUR mn Difference 2020 2020 restated / 2020 2020 restated / published 2020 published Europe published 2020 published 1,413 2,656 -1,243

517 517 0 1,472 1,492 -20 391 530 -139 338 338 0 2,907 2,927 -20 162 162 0 Digital 1,133 0 1,133 Other 5 24 -20 Consumer Bank SGP 0 -150 150 North America 731 731 0 2020 restated. Secondary segments EUR mn 762 762 0 Difference 2020 2020 restated / Other -20 0 -20 published 2020 published Retail Banking 4,420 4,196 225 South America 1,798 1,823 -25 2,113 2,113 0 823 868 -45 432 432 0 -116 0 -116 179 179 0 SGP 0 39 -39 Other 183 203

-20 8

Restricted-confidential Key metrics medium-term goals compared to 2020 restated Key metrics Europe North

America South America One Santander Digital Consumer Bank Medium-term Medium-term Medium-term Medium-term Medium-term 2020 2020 2020 2020 2020 goals goals goals goals goals Efficiency ratio 56% c. 45% 42% c. 40% 36% c. 35% 45% c. 40% 42% c. 39%

Underlying RoTE 3.6% 10-12% 10.5%1 11-13%1 17.7% 19-21% 11.5% c. 15% Top 3 in 6 Top 3 in 9 NPS position countries countries

Digital sales/total 44% >50% (1) Adjusted for excess capital in the US 9

Restricted-confidential â– Primary segments 10

Restricted-confidential EUROPE EUR million NEW PREVIOUS DIFFERENCES Q1’20 Q2’20 Q3’20 Q4’20

Q1’20 Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Income statement Net interest income 2,378 2,330 2,534 2,670 3,435 3,352 3,549 3,710 (1,057) (1,022) (1,015) (1,041) Net fee income 1,128 942 961 968 1,315 1,098

1,162 1,162 (186) (156) (201) (194) Gains (losses) on financial transactions * 155 213 330 171 142 216 338 188 12 (3) (8) (17) Other operating income 57 (87) 58 (134) 83 (89) 106 (74) (25) 2 (48) (61) Total income 3,718 3,398 3,883 3,675 4,974 4,577

5,155 4,987 (1,256) (1,179) (1,273) (1,312) Administrative expenses and amortisations (2,175) (2,038) (2,046) (2,015) (2,712) (2,526) (2,542) (2,534) 536 488 496 519 Net operating income 1,543 1,359 1,837 1,659 2,263 2,051 2,613 2,453 (720) (692)

(777) (793) Net loan-loss provisions (1,004) (677) (735) (927) (1,335) (877) (956) (1,131) 330 200 221 204 Other gains (losses) and provisions (236) (186) (177) (371) (195) (160) (196) (362) (41) (25) 19 (9) Profit before tax 303 496 925 361 733

1,014 1,461 959 (430) (517) (536) (598) Tax on profit (100) (136) (265) (93) (217) (275) (406) (234) 117 139 141 141 Profit from continuing operations 202 360 660 268 515 739 1,055 725 (313) (379) (395) (457) Net profit from discontinued operations

(0) 0 Consolidated profit 202 360 660 268 515 739 1,055 725 (313) (379) (395) (457) Non-controlling interests (10) (24) (32) (12) (73) (107) (108) (91) 63 83 76 79 Underlying attributable profit to the parent

193 336 628 256 443 632 947 634 (250) (296) (319) (378) NEW PREVIOUS DIFFERENCES Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Balance sheet Loans and advances to customers 568,914 574,076

563,557 563,582 680,303 684,446 673,172 675,895 (111,388) (110,370) (109,615) (112,313) Cash, central banks and credit institutions 177,430 248,198 216,860 213,561 189,610 258,158 227,581 224,793 (12,181) (9,961) (10,721) (11,232) Debt instruments

79,413 86,477 83,049 81,271 82,119 91,038 88,604 86,925 (2,707) (4,561) (5,555) (5,654) Other financial assets 60,812 54,208 53,054 48,313 60,788 54,171 53,016 48,266 24 37 38 47 Other asset accounts 42,793 40,318 39,401 35,893 47,697 45,211 45,423

41,658 (4,904) (4,893) (6,022) (5,765) Total assets 929,361 1,003,278 955,921 942,620 1,060,517 1,133,025 1,087,796 1,077,537 (131,156) (129,747) (131,875) (134,917) Customer deposits 541,719 570,736 573,108 582,353 580,842 610,021 612,844 622,826

(39,123) (39,285) (39,736) (40,473) Central banks and credit institutions 160,984 213,794 176,782 167,014 197,886 251,351 215,775 208,408 (36,902) (37,557) (38,993) (41,394) Marketable debt securities 97,370 92,312 90,102 84,201 136,012 128,570

126,016 120,166 (38,642) (36,259) (35,914) (35,965) Other financial liabilities 70,927 69,972 60,240 54,634 72,115 71,538 61,808 55,919 (1,188) (1,566) (1,568) (1,285) Other liabilities accounts 14,310 13,284 12,007 11,788 17,881 17,002 16,011

15,635 (3,571) (3,718) (4,003) (3,847) Total liabilities 885,311 960,098 912,240 899,990 1,004,736 1,078,482 1,032,454 1,022,954 (119,425) (118,384) (120,214) (122,964) Total equity 44,050 43,180 43,681 42,630 55,781 54,543 55,342 54,583 (11,730)

(11,363) (11,661) (11,953) Memorandum items: Gross loans and advances to customers ** 538,459 542,816 535,463 543,336 652,651 656,001 647,911 658,471 (114,192) (113,185) (112,448) (115,135) Customer funds 604,983 633,055 641,963 655,954 644,106

672,341 681,699 696,427 (39,123) (39,285) (39,736) (40,473) Customer deposits 528,209 549,600 554,629 562,977 567,332 588,886 594,364 603,450 (39,123) (39,285) (39,736) (40,473) Mutual funds 76,774 83,455 87,335 92,977 76,774 83,455 87,335 92,977 11

(*).- Includes exchange differences. (**).- Excluding reverse repos. (***).- Excluding repos.

Restricted-confidential Spain EUR million NEW PREVIOUS DIFFERENCES Q1’20 Q2’20 Q3’20 Q4’20

Q1’20 Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Income statement Net interest income 925 931 1,034 1,067 925 931 1,034 1,067 Net fee income 643 535 562 573 643 535 562 573 Gains (losses) on financial

transactions * 156 250 194 180 156 250 194 180 Other operating income 64 (154) 10 (188) 64 (154) 10 (188) Total income 1,789 1,562 1,800 1,632 1,789 1,562 1,800 1,632 Administrative expenses and amortisations (944) (896) (893) (873) (944) (896)

(893) (873) Net operating income 844 665 907 759 844 665 907 759 Net loan-loss provisions (628) (313) (449) (611) (628) (313) (449) (611) Other gains (losses) and provisions (104) (115) (112) (128) (104) (115) (112) (128) Profit before tax 112 237

346 20 112 237 346 20 Tax on profit (22) (77) (100) 1 (22) (77) (100) 1 Profit from continuing operations 90 160 246 20 90 160 246 20 Net profit from discontinued operations Consolidated profit 90 160 246 20 90 160 246 20 Non-controlling interests (0) 0 0 (0) (0) 0 0 (0) Underlying attributable profit to the parent 90 161 246 20 90 161 246 20 NEW PREVIOUS DIFFERENCES Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Balance sheet Loans and advances to customers 185,921 197,424 192,894 194,239 185,921 197,424 192,894 194,239 Cash, central banks and credit institutions 78,519 108,381 112,338 113,518 78,519 108,381 112,338

113,518 Debt instruments 24,458 25,100 21,766 21,654 24,458 25,100 21,766 21,654 Other financial assets 1,407 1,661 2,571 2,671 1,407 1,661 2,571 2,671 Other asset accounts 25,209 23,203 22,727 22,438 25,209 23,203 22,727 22,438 Total assets 315,515

355,769 352,296 354,521 315,515 355,769 352,296 354,521 Customer deposits 234,716 248,053 250,369 251,375 234,716 248,053 250,369 251,375 Central banks and credit institutions 20,341 46,942 47,536 48,305 20,341 46,942 47,536 48,305 Marketable debt

securities 29,503 27,377 26,141 26,068 29,503 27,377 26,141 26,068 Other financial liabilities 8,968 12,370 7,858 9,344 8,968 12,370 7,858 9,344 Other liabilities accounts 6,231 5,159 4,012 4,112 6,231 5,159 4,012 4,112 Total liabilities 299,759

339,901 335,916 339,203 299,759 339,901 335,916 339,203 Total equity 15,756 15,868 16,380 15,318 15,756 15,868 16,380 15,318 Memorandum items: Gross loans and advances to customers ** 192,490 203,811 198,951 200,735 192,490 203,811 198,951 200,735

Customer funds 293,889 311,824 316,597 320,879 293,889 311,824 316,597 320,879 Customer deposits *** 234,716 248,053 250,369 251,375 234,716 248,053 250,369 251,375 Mutual funds 59,173 63,770 66,228 69,503 59,173 63,770 66,228 69,503 12 (*).-

Includes exchange differences. (**).- Excluding reverse repos. (***).- Excluding repos.

Restricted-confidential United Kingdom EUR million NEW PREVIOUS DIFFERENCES Q1’20 Q2’20 Q3’20

Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Income statement Net interest income 820 796 905 983 898 871 976 1,063 (78) (75) (71) (80) Net fee income 190 94 115 96 193 96 117 99 (4) (2) (3) (3)

Gains (losses) on financial transactions * (4) 2 15 (32) (7) (0) 16 (35) 3 2 (1) 3 Other operating income 1 (1) (0) 1 13 12 8 19 (12) (13) (8) (17) Total income 1,007 891 1,034 1,048 1,098 979 1,117 1,146 (91) (88) (82) (97) Administrative expenses

and amortisations (686) (631) (620) (601) (714) (656) (646) (626) 28 25 25 25 Net operating income 321 259 414 447 384 323 471 519 (63) (63) (57) (72) Net loan-loss provisions (178) (223) (179) (97) (191) (239) (189) (114) 13 16 10 18 Other gains

(losses) and provisions (71) (5) (30) (150) (74) (4) (36) (151) 3 (1) 7 1 Profit before tax 72 31 205 200 119 80 246 253 (46) (48) (41) (53) Tax on profit (20) (13) (55) (29) (28) (18) (61) (38) 8 6 6 9 Profit from continuing operations 52 19 149

171 91 61 184 215 (38) (43) (35) (44) Net profit from discontinued operations Consolidated profit 52 19 149 171 91 61 184 215 (38) (43) (35) (44) Non-controlling interests (0) (0) (0) 0 (6) (7) (5) (3) 6 7 5 3

Underlying attributable profit to the parent 52 19 149 171 84 54 179 212 (32) (36) (30) (41) NEW PREVIOUS DIFFERENCES Mar-20 Jun-20

Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Balance sheet Loans

and advances to customers 256,273 249,034 248,394 249,777 267,825 260,157 259,417 261,062 (11,552) (11,123) (11,023) (11,285) Cash, central banks and credit institutions 37,393 47,865 46,589 54,444 37,568 48,060 46,845 54,576 (175) (195) (256) (132)

Debt instruments 16,943 17,001 13,902 11,527 16,943 17,001 13,902 11,527 Other financial assets 1,098 1,470 1,772 712 1,103 1,475 1,776 712 (5) (5) (4) Other asset accounts 11,301 9,560 9,135 8,177 12,276 10,543 10,106 9,173 (975) (983) (971) (997)

Total assets 323,008 324,930 319,793 324,637 335,715 337,235 332,046 337,050 (12,707) (12,305) (12,254) (12,413) Customer deposits 215,044 224,233 224,356 231,921 216,059 225,223 225,347 232,923 (1,015) (989) (991) (1,002) Central banks and credit

institutions 21,406 20,682 17,154 20,587 30,185 29,157 25,606 29,302 (8,779) (8,475) (8,452) (8,715) Marketable debt securities 62,356 58,360 56,707 51,151 64,066 59,928 58,188 52,562 (1,711) (1,568) (1,481) (1,411) Other financial liabilities 2,981

2,857 2,951 2,316 3,112 3,032 3,123 2,448 (132) (175) (172) (133) Other liabilities accounts 4,958 4,493 4,369 4,508 5,071 4,616 4,540 4,624 (113) (123) (171) (116) Total liabilities 306,745 310,626 305,536 310,483 318,494 321,956 316,803 321,860

(11,749) (11,330) (11,267) (11,377) Total equity 16,263 14,304 14,257 14,154 17,220 15,279 15,243 15,189 (958) (975) (986) (1,036) Memorandum items: Gross loans and advances to customers ** 231,940 226,321 227,002 230,674 243,599 237,561 238,148

242,090 (11,658) (11,239) (11,146) (11,416) Customer funds 209,254 212,157 215,405 222,268 210,269 213,146 216,396 223,270 (1,015) (989) (991) (1,002) Customer deposits *** 202,408 204,761 207,987 214,329 203,423 205,750 208,978 215,332 (1,015)

(989) (991) (1,002) Mutual funds 6,846 7,396 7,418 7,938 6,846 7,396 7,418 7,938 13 (*).- Includes exchange differences. (**).- Excluding reverse repos. (***).- Excluding repos.

Restricted-confidential Portugal EUR million NEW PREVIOUS DIFFERENCES Q1’20 Q2’20 Q3’20

Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Income statement Net interest income 202 197 193 195 202 197 193 195 Net fee income 101 90 94 103 101 90 94 103 Gains (losses) on financial

transactions * 56 35 15 6 56 35 15 6 Other operating income (9) (5) 10 13 (9) (5) 10 13 Total income 350 317 312 317 350 317 312 317 Administrative expenses and amortisations (151) (145) (146) (149) (151) (145) (146) (149) Net operating income 199

172 166 168 199 172 166 168 Net loan-loss provisions (80) (24) (47) (42) (80) (24) (47) (42) Other gains (losses) and provisions (21) (16) 1 7 (21) (16) 1 7 Profit before tax 98 132 120 133 98 132 120 133 Tax on profit (30) (41) (37) (38) (30) (41)

(37) (38) Profit from continuing operations 68 92 83 95 68 92 83 95 Net profit from discontinued operations Consolidated profit 68 92 83 95 68 92 83 95 Non-controlling interests (0) (0) (0) (0) (0) (0) (0) (0)

Underlying attributable profit to the parent 68 92 83 95 68 92 83 95 NEW PREVIOUS DIFFERENCES Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Balance sheet Loans and advances to customers 36,291 37,082 37,604

38,058 36,291 37,082 37,604 38,058 Cash, central banks and credit institutions 5,138 8,769 6,803 5,819 5,138 8,769 6,803 5,819 Debt instruments 11,346 11,782 11,673 11,569 11,346 11,782 11,673 11,569 Other financial assets 1,552 1,530 1,491 1,487

1,552 1,530 1,491 1,487 Other asset accounts 1,684 1,659 1,732 1,475 1,684 1,659 1,732 1,475 Total assets 56,011 60,822 59,302 58,408 56,011 60,822 59,302 58,408 Customer deposits 38,882 40,038 40,179 39,881 38,882 40,038 40,179 39,881 Central banks

and credit institutions 7,974 11,584 9,734 9,974 7,974 11,584 9,734 9,974 Marketable debt securities 3,337 3,268 3,274 2,520 3,337 3,268 3,274 2,520 Other financial liabilities 301 256 265 249 301 256 265 249 Other liabilities accounts 1,666 1,784

1,820 1,643 1,666 1,784 1,820 1,643 Total liabilities 52,160 56,930 55,272 54,267 52,160 56,930 55,271 54,267 Total equity 3,851 3,892 4,031 4,141 3,851 3,892 4,031 4,141 Memorandum items: Gross loans and advances to customers ** 37,286 38,097

38,646 39,054 37,286 38,097 38,646 39,054 Customer funds 41,583 42,922 43,160 43,133 41,583 42,922 43,160 43,133 Customer deposits *** 38,882 40,038 40,179 39,881 38,882 40,038 40,179 39,881 Mutual funds 2,700 2,884 2,982 3,252 2,700 2,884 2,982

3,252 14 (*).- Includes exchange differences. (**).- Excluding reverse repos. (***).- Excluding repos.

Restricted-confidential Poland EUR million NEW PREVIOUS DIFFERENCES Q1’20 Q2’20 Q3’20 Q4’20

Q1’20 Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Income statement Net interest income 296 251 246 243 296 251 246 243 Net fee income 116 104 112 120 116 104 112 120 Gains (losses) on financial transactions * 8

21 35 26 8 21 35 26 Other operating income (56) 1 1 (1) (56) 1 1 (1) Total income 365 377 394 388 365 377 394 388 Administrative expenses and amortisations (172) (143) (161) (154) (172) (143) (161) (154) Net operating income 193 235 233 234 193 235

233 234 Net loan-loss provisions (95) (89) (65) (81) (95) (89) (65) (81) Other gains (losses) and provisions (36) (40) (32) (87) (36) (40) (32) (87) Profit before tax 62 105 136 66 62 105 136 66 Tax on profit (30) (31) (36) (32) (30) (31) (36) (32)

Profit from continuing operations 32 74 100 34 32 74 100 34 Net profit from discontinued operations Consolidated profit 32 74 100 34 32 74 100 34 Non-controlling interests (10) (23) (32) (13) (10) (23) (32)

(13) Underlying attributable profit to the parent 23 51 68 20 23 51 68 20 NEW PREVIOUS DIFFERENCES Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Balance sheet Loans and advances to customers 29,194 29,186 28,217

28,025 29,194 29,186 28,217 28,025 Cash, central banks and credit institutions 3,547 3,004 1,956 2,539 3,547 3,004 1,956 2,539 Debt instruments 8,574 12,128 13,273 14,006 8,574 12,128 13,273 14,006 Other financial assets 741 511 537 980 741 511 537

980 Other asset accounts 1,334 1,367 1,397 1,341 1,334 1,367 1,397 1,341 Total assets 43,391 46,197 45,381 46,890 43,391 46,197 45,381 46,890 Customer deposits 31,687 34,317 33,952 34,868 31,687 34,317 33,952 34,868 Central banks and credit

institutions 2,464 2,897 2,600 2,613 2,464 2,896 2,600 2,613 Marketable debt securities 2,360 2,056 1,958 2,110 2,360 2,056 1,958 2,110 Other financial liabilities 826 680 653 993 826 680 653 993 Other liabilities accounts 1,217 1,182 1,138 1,232

1,217 1,182 1,138 1,232 Total liabilities 38,554 41,131 40,301 41,816 38,554 41,131 40,301 41,816 Total equity 4,837 5,065 5,079 5,074 4,837 5,065 5,079 5,074 Memorandum items: Gross loans and advances to customers ** 30,076 30,151 29,205 29,055

30,076 30,151 29,205 29,055 Customer funds 34,661 37,623 37,606 38,889 34,661 37,623 37,606 38,889 Customer deposits *** 31,673 34,303 33,952 34,865 31,673 34,303 33,952 34,865 Mutual funds 2,988 3,320 3,653 4,023 2,988 3,320 3,653 4,023 15 (*).-

Includes exchange differences. (**).- Excluding reverse repos. (***).- Excluding repos.

Restricted-confidential Other Europe EUR million NEW PREVIOUS DIFFERENCES Q1’20 Q2’20 Q3’20

Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Income statement Net interest income 134 155 155 182 134 155 155 182 Net fee income 78 120 78 75 74 115 71 68 4 5 7 8 Gains (losses) on financial

transactions * (62) (95) 72 (8) (62) (95) 72 (8) Other operating income 57 72 37 40 55 72 38 41 2 (1) (1) Total income 207 251 343 290 202 246 337 282 5 4 6 8 Administrative expenses and amortisations (222) (223) (226) (238) (216) (217) (214) (217)

(6) (6) (12) (21) Net operating income (15) 28 116 52 (14) 29 123 65 (2) (7) (13) Net loan-loss provisions (23) (29) 5 (97) (23) (29) 5 (97) Other gains (losses) and provisions (4) (9) (4) (12) (4) (7) (4) (12) (2) Profit before tax (42) (10) 117

(58) (41) (7) 124 (45) (1) (4) (7) (14) Tax on profit 1 26 (36) 6 (1) 25 (38) 7 2 1 2 Profit from continuing operations (40) 15 81 (52) (42) 18 86 (38) 2 (3) (5) (14) Net profit from discontinued operations (0) 0 (0) 0 Consolidated profit (40) 15 81

(52) (42) 18 86 (38) 2 (3) (5) (14) Non-controlling interests 0 (1) (0) 1 0 (1) (0) 1 Underlying attributable profit to the parent (40) 14 81 (51) (42) 17 86 (37) 2 (3) (5) (14) NEW PREVIOUS DIFFERENCES Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Balance sheet Loans and advances to customers 61,235 61,350 56,448 53,483 61,226 61,341 56,436 53,469 8 9 12 15 Cash, central banks and credit institutions

52,832 80,178 49,174 37,241 52,765 80,113 49,076 37,044 68 65 98 197 Debt instruments 18,091 20,467 22,435 22,516 18,088 20,463 22,432 22,513 3 3 3 4 Other financial assets 56,014 49,036 46,683 42,463 55,945 48,964 46,612 42,387 68 72 71 76 Other

asset accounts 3,265 4,529 4,410 2,462 3,207 4,322 4,194 2,270 57 207 217 192 Total assets 191,437 215,560 179,150 158,165 191,232 215,204 178,750 157,682 205 357 400 483 Customer deposits 21,390 24,095 24,252 24,307 21,378 24,084 24,237 24,290 12

11 15 17 Central banks and credit institutions 108,799 131,688 99,759 85,535 108,792 131,676 99,731 85,484 7 12 27 50 Marketable debt securities (185) 1,250 2,022 2,353 (185) 1,250 2,022 2,353 Other financial liabilities 57,851 53,810 48,513 41,732

57,827 53,790 48,495 41,710 24 20 18 23 Other liabilities accounts 237 666 670 294 219 650 656 263 18 16 14 31 Total liabilities 188,093 211,510 175,215 154,221 188,033 211,451 175,142 154,099 61 59 74 122 Total equity 3,343 4,050 3,935 3,944 3,199

3,753 3,608 3,583 144 298 326 362 Memorandum items: Gross loans and advances to customers ** 46,667 44,435 41,659 43,818 46,658 44,427 41,647 43,803 8 9 12 15 Customer funds 25,597 28,529 29,195 30,786 25,585 28,518 29,180 30,768 12 11 15 17

Customer deposits *** 20,530 22,445 22,142 22,526 20,518 22,434 22,127 22,508 12 11 15 17 Mutual funds 5,067 6,084 7,053 8,260 5,067 6,084 7,053 8,260 16 (*).- Includes exchange differences. (**).- Excluding reverse repos. (***).- Excluding repos.

Restricted-confidential NORTH AMERICA EUR million NEW PREVIOUS DIFFERENCES Q1’20 Q2’20 Q3’20

Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Income statement Net interest income 2,261 2,079 2,076 2,055 2,261 2,079 2,075 2,055 Net fee income 464 405 413 402 461 400 406 394 4 5 7 8 Gains

(losses) on financial transactions * 68 138 33 12 68 138 33 12 Other operating income 148 89 162 231 146 89 163 231 2 (1) (1) Total income 2,941 2,711 2,683 2,699 2,936 2,706 2,678 2,691 5 4 6 8 Administrative expenses and amortisations (1,230)

(1,123) (1,109) (1,215) (1,224) (1,117) (1,097) (1,194) (6) (6) (13) (22) Net operating income 1,711 1,587 1,574 1,484 1,712 1,589 1,581 1,498 (2) (7) (14) Net loan-loss provisions (1,246) (1,123) (775) (773) (1,246) (1,123) (775) (773) Other gains

(losses) and provisions (14) (38) (24) (57) (14) (36) (24) (57) (2) Profit before tax 452 427 774 654 452 430 781 668 (1) (4) (7) (14) Tax on profit (114) (58) (246) (155) (116) (59) (248) (154) 2 1 2 Profit from continuing operations 337 369 528

500 336 371 533 514 2 (3) (5) (15) Net profit from discontinued operations Consolidated profit 337 369 528 500 336 371 533 514 2 (3) (5) (15) Non-controlling interests (56) (35) (89) (83) (56) (35) (89) (83)

Underlying attributable profit to the parent 282 334 439 417 280 336 444 431 2 (3) (5) (15) NEW PREVIOUS DIFFERENCES Mar-20 Jun-20

Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Balance sheet Loans

and advances to customers 135,468 133,325 122,771 120,571 135,459 133,316 122,759 120,557 8 9 12 15 Cash, central banks and credit institutions 33,241 31,001 28,506 28,666 33,173 30,936 28,408 28,469 68 65 98 197 Debt instruments 30,265 37,368

36,724 38,402 30,262 37,365 36,721 38,399 3 3 3 4 Other financial assets 18,218 20,281 17,416 15,439 18,150 20,209 17,345 15,363 68 73 71 76 Other asset accounts 23,240 22,051 21,029 20,718 23,183 21,843 20,812 20,526 57 208 217 193 Total assets

240,432 244,026 226,446 223,797 240,227 243,668 226,045 223,313 205 358 401 485 Customer deposits 117,783 113,468 108,247 102,924 117,771 113,456 108,232 102,907 12 11 15 17 Central banks and credit institutions 30,965 35,505 29,682 38,017 30,958

35,493 29,654 37,966 7 12 27 51 Marketable debt securities 42,024 43,231 39,946 36,583 42,024 43,231 39,946 36,583 Other financial liabilities 19,578 21,417 18,586 16,182 19,555 21,397 18,569 16,159 24 20 18 23 Other liabilities accounts 6,670 6,594

6,390 6,029 6,652 6,578 6,376 5,997 18 16 14 31 Total liabilities 217,021 220,214 202,851 199,735 216,960 220,155 202,777 199,613 61 59 74 122 Total equity 23,411 23,812 23,595 24,062 23,267 23,514 23,268 23,700 144 299 327 363 Memorandum items:

Gross loans and advances to customers ** 131,922 131,163 122,647 120,665 131,913 131,154 122,634 120,650 8 9 12 15 Customer funds 119,997 124,818 117,312 117,548 119,985 124,807 117,297 117,530 12 11 15 17 Customer deposits *** 101,401 104,743

96,720 96,315 101,389 104,732 96,705 96,298 12 11 15 17 Mutual funds 18,596 20,075 20,592 21,233 18,596 20,075 20,592 21,233 17 (*).- Includes exchange differences. (**).- Excluding reverse repos. (***).- Excluding repos.

Restricted-confidential United States EUR million NEW PREVIOUS DIFFERENCES Q1’20 Q2’20 Q3’20

Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Income statement Net interest income 1,462 1,429 1,406 1,348 1,462 1,429 1,406 1,348 Net fee income 250 215 218 206 250 215 218 206 Gains (losses) on

financial transactions * 46 50 12 10 46 50 12 10 Other operating income 170 108 194 237 170 108 194 237 Total income 1,929 1,801 1,830 1,801 1,929 1,801 1,830 1,801 Administrative expenses and amortisations (809) (776) (722) (772) (809) (776) (722)

(772) Net operating income 1,120 1,024 1,108 1,029 1,120 1,024 1,108 1,029 Net loan-loss provisions (972) (832) (572) (561) (972) (832) (572) (561) Other gains (losses) and provisions (6) (30) (20) (37) (6) (30) (20) (37) Profit before tax 141 163

515 431 141 163 515 431 Tax on profit (42) 7 (182) (101) (42) 7 (182) (101) Profit from continuing operations 99 170 333 330 99 170 333 330 Net profit from discontinued operations Consolidated profit 99 170 333 330 99 170 333 330 Non-controlling interests (38) (20) (74) (69) (38) (20) (74) (69) Underlying attributable profit to the parent 60 151 259 260 60 151 259 260 NEW PREVIOUS DIFFERENCES Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Balance sheet Loans and advances to customers 104,561 102,743 93,850 90,992 104,561 102,743 93,850 90,992 Cash, central banks and credit institutions 19,765 19,221 16,680 16,614 19,765 19,221 16,680 16,614

Debt instruments 15,959 16,002 14,479 14,084 15,959 16,002 14,479 14,084 Other financial assets 7,249 6,476 4,988 4,381 7,249 6,476 4,988 4,381 Other asset accounts 19,897 18,749 17,762 17,003 19,897 18,749 17,762 17,003 Total assets 167,431 163,192

147,760 143,074 167,431 163,192 147,760 143,074 Customer deposits 83,705 77,938 73,316 67,450 83,705 77,938 73,316 67,450 Central banks and credit institutions 18,105 20,991 15,665 20,989 18,105 20,991 15,665 20,989 Marketable debt securities 36,086

35,927 32,558 29,737 36,086 35,927 32,558 29,737 Other financial liabilities 7,402 6,586 5,002 4,329 7,402 6,586 5,002 4,329 Other liabilities accounts 4,254 3,930 3,846 3,369 4,254 3,930 3,846 3,369 Total liabilities 149,553 145,371 130,388 125,874

149,553 145,371 130,388 125,874 Total equity 17,878 17,821 17,373 17,200 17,878 17,821 17,373 17,200 Memorandum items: Gross loans and advances to customers ** 101,146 100,826 92,836 90,459 101,146 100,826 92,836 90,459 Customer funds 82,155 86,719

79,492 76,972 82,155 86,719 79,492 76,972 Customer deposits *** 72,884 76,213 68,962 66,385 72,884 76,213 68,962 66,385 Mutual funds 9,271 10,506 10,529 10,586 9,271 10,506 10,529 10,586 18 (*).- Includes exchange differences. (**).- Excluding

reverse repos. (***).- Excluding repos.

Restricted-confidential Mexico EUR million NEW PREVIOUS DIFFERENCES Q1’20 Q2’20 Q3’20 Q4’20

Q1’20 Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Income statement Net interest income 798 650 669 707 798 650 669 707 Net fee income 211 185 189 188 211 185 189 188 Gains (losses) on financial transactions * 22

89 21 2 22 89 21 2 Other operating income (24) (18) (31) (6) (24) (18) (31) (6) Total income 1,007 905 848 891 1,007 905 848 891 Administrative expenses and amortisations (415) (341) (375) (422) (415) (341) (375) (422) Net operating income 592 565

473 469 592 565 473 469 Net loan-loss provisions (273) (291) (203) (212) (273) (291) (203) (212) Other gains (losses) and provisions (8) (6) (4) (19) (8) (6) (4) (19) Profit before tax 311 267 266 238 311 267 266 238 Tax on profit (74) (66) (66)

(53) (74) (66) (66) (53) Profit from continuing operations 237 201 200 185 237 201 200 185 Net profit from discontinued operations Consolidated profit 237 201 200 185 237 201 200 185 Non-controlling interests

(17) (15) (15) (14) (17) (15) (15) (14) Underlying attributable profit to the parent 220 186 185 171 220 186 185 171 NEW PREVIOUS DIFFERENCES Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Balance sheet Loans

and advances to customers 30,898 30,573 28,909 29,565 30,898 30,573 28,909 29,565 Cash, central banks and credit institutions 13,408 11,714 11,728 11,854 13,408 11,714 11,728 11,854 Debt instruments 14,303 21,363 22,241 24,315 14,303 21,363 22,241

24,315 Other financial assets 10,901 13,733 12,357 10,982 10,901 13,733 12,357 10,982 Other asset accounts 3,286 3,094 3,050 3,523 3,286 3,094 3,050 3,523 Total assets 72,796 80,476 78,285 80,239 72,796 80,476 78,285 80,239 Customer deposits 34,066

35,518 34,916 35,457 34,066 35,518 34,916 35,457 Central banks and credit institutions 12,853 14,502 13,989 16,977 12,853 14,502 13,989 16,977 Marketable debt securities 5,938 7,305 7,388 6,847 5,938 7,305 7,388 6,847 Other financial liabilities

12,152 14,811 13,567 11,830 12,152 14,811 13,567 11,830 Other liabilities accounts 2,398 2,648 2,530 2,628 2,398 2,648 2,530 2,628 Total liabilities 67,407 74,784 72,390 73,739 67,407 74,784 72,390 73,739 Total equity 5,389 5,693 5,895 6,500 5,389

5,693 5,895 6,500 Memorandum items: Gross loans and advances to customers ** 30,768 30,329 29,798 30,191 30,768 30,329 29,798 30,191 Customer funds 37,830 38,088 37,806 40,558 37,830 38,088 37,806 40,558 Customer deposits *** 28,505 28,519 27,743

29,912 28,505 28,519 27,743 29,912 Mutual funds 9,325 9,570 10,063 10,646 9,325 9,570 10,063 10,646 19 (*).- Includes exchange differences. (**).- Excluding reverse repos. (***).- Excluding repos.

Restricted-confidential Other North America EUR million NEW PREVIOUS DIFFERENCES Q1’20 Q2’20

Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Income statement Net interest income (0) 0 0 0 Net fee income 4 5 7 8 4 5 7 8 Gains (losses) on financial transactions * (0) (0) (0) (0)

Other operating income 2 (1) (1) (0) 2 (1) (1) Total income 5 4 6 8 5 4 6 8 Administrative expenses and amortisations (6) (6) (13) (22) (6) (6) (13) (22) Net operating income (0) (2) (7) (14) (2) (7) (14) Net loan-loss provisions (0) (0) (0) (0)

Other gains (losses) and provisions (0) (2) (0) 0 (2) Profit before tax (1) (4) (7) (14) (1) (4) (7) (14) Tax on profit 2 1 2 (0) 2 1 2 Profit from continuing operations 2 (3) (5) (15) 2 (3) (5) (15) Net profit from discontinued operations

Consolidated profit 2 (3) (5) (15) 2 (3) (5) (15) Non-controlling interests 0 0 0 0 Underlying attributable profit to the parent 2 (3) (5) (15) 2 (3) (5) (15) NEW PREVIOUS DIFFERENCES Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Balance sheet Loans and advances to customers 8 9 12 15 8 9 12 15 Cash, central banks and credit institutions 68 65 98 197 68 65 98 197 Debt instruments 3 3 3 4

3 3 3 4 Other financial assets 68 73 71 76 68 73 71 76 Other asset accounts 57 208 217 193 57 208 217 193 Total assets 205 358 401 485 205 358 401 485 Customer deposits 12 11 15 17 12 11 15 17 Central banks and credit institutions 7 12 27 51 7 12 27

51 Marketable debt securities Other financial liabilities 24 20 18 23 24 20 18 23 Other liabilities accounts 18 16 14 31 18 16 14 31 Total liabilities 61 59 74 122 61 59 74 122 Total equity 144 299 327 363 144 299 327 363 Memorandum items: Gross

loans and advances to customers ** 8 9 12 15 8 9 12 15 Customer funds 12 11 15 17 12 11 15 17 Customer deposits *** 12 11 15 17 12 11 15 17 Mutual funds 20 (*).- Includes exchange differences. (**).- Excluding reverse repos. (***).- Excluding repos.

Restricted-confidential SOUTH AMERICA EUR million NEW PREVIOUS DIFFERENCES Q1’20 Q2’20 Q3’20

Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Income statement Net interest income 3,065 2,606 2,486 2,566 3,065 2,606 2,486 2,566 Net fee income 1,077 779 848 885 1,074 774 841 878 4 5 7 8 Gains

(losses) on financial transactions * 68 363 177 158 68 363 177 158 Other operating income (42) (52) (29) (87) (43) (52) (27) (87) 2 (1) (1) Total income 4,169 3,695 3,483 3,522 4,163 3,690 3,477 3,514 5 4 6 8 Administrative expenses and

amortisations (1,492) (1,281) (1,250) (1,335) (1,486) (1,275) (1,238) (1,314) (6) (6) (12) (21) Net operating income 2,677 2,414 2,233 2,187 2,677 2,416 2,240 2,201 (2) (7) (13) Net loan-loss provisions (1,325) (1,110) (787) (702) (1,325) (1,110)

(787) (702) Other gains (losses) and provisions (142) (54) (71) (54) (142) (52) (70) (54) (2) Profit before tax 1,210 1,250 1,375 1,431 1,211 1,254 1,382 1,444 (1) (4) (7) (14) Tax on profit (414) (470) (544) (495) (416) (470) (546) (495) 2 1 2

Profit from continuing operations 796 781 832 935 795 783 837 949 2 (3) (5) (14) Net profit from discontinued operations Consolidated profit 796 781 832 935 795 783 837 949 2 (3) (5) (14) Non-controlling

interests (96) (98) (101) (141) (96) (98) (101) (141) Underlying attributable profit to the parent 700 682 731 794 698 685 736 808 2 (3) (5) (14) NEW PREVIOUS DIFFERENCES Mar-20

Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Balance sheet Loans and advances to customers 112,873 111,004 109,061 113,745 112,865 110,995 109,049 113,731 8 9 12 15 Cash, central banks and credit institutions 45,955 44,557 40,808 43,154 45,888 44,492

40,710 42,957 68 65 98 197 Debt instruments 44,699 45,236 43,340 49,303 44,696 45,233 43,336 49,300 3 3 3 4 Other financial assets 19,328 20,749 16,973 17,342 19,260 20,676 16,902 17,266 68 72 71 76 Other asset accounts 17,194 16,804 15,946 15,201

17,137 16,596 15,730 15,009 57 207 217 192 Total assets 240,049 238,349 226,128 238,746 239,844 237,993 225,728 238,263 205 357 400 483 Customer deposits 106,444 112,598 110,475 111,808 106,432 112,587 110,459 111,791 12 11 15 17 Central banks and

credit institutions 45,539 42,411 36,818 42,040 45,533 42,399 36,790 41,990 7 12 27 50 Marketable debt securities 26,951 23,973 20,728 21,280 26,951 23,973 20,728 21,280 Other financial liabilities 33,546 32,218 31,546 35,456 33,522 32,198 31,529

35,433 24 20 18 23 Other liabilities accounts 8,548 8,230 7,902 8,334 8,529 8,215 7,888 8,302 18 16 14 31 Total liabilities 221,028 219,431 207,469 218,918 220,968 219,372 207,395 218,796 61 59 74 122 Total equity 19,021 18,919 18,659 19,828 18,877

18,621 18,333 19,466 144 298 326 362 Memorandum items: Gross loans and advances to customers ** 117,622 115,747 113,594 118,784 117,614 115,738 113,582 118,769 8 9 12 15 Customer funds 148,114 149,933 146,480 153,241 148,102 149,922 146,465 153,224

12 11 15 17 Customer deposits *** 95,946 101,976 99,513 103,319 95,933 101,965 99,498 103,302 12 11 15 17 Mutual funds 52,169 47,957 46,966 49,922 52,169 47,957 46,966 49,922 21 (*).- Includes exchange differences. (**).- Excluding reverse repos.

(***).- Excluding repos.

Restricted-confidential Brazil EUR million NEW PREVIOUS DIFFERENCES Q1’20 Q2’20 Q3’20 Q4’20

Q1’20 Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Income statement Net interest income 2,270 1,813 1,756 1,786 2,270 1,813 1,756 1,786 Net fee income 869 614 664 677 869 614 664 677 Gains (losses) on financial

transactions * 14 247 93 114 14 247 93 114 Other operating income (17) (23) 21 (32) (17) (23) 21 (32) Total income 3,137 2,651 2,534 2,544 3,137 2,651 2,534 2,544 Administrative expenses and amortisations (1,004) (835) (805) (897) (1,004) (835)

(805) (897) Net operating income 2,133 1,816 1,729 1,648 2,133 1,816 1,729 1,648 Net loan-loss provisions (1,066) (843) (569) (540) (1,066) (843) (569) (540) Other gains (losses) and provisions (127) (31) (68) (36) (127) (31) (68) (36) Profit before

tax 940 942 1,092 1,072 940 942 1,092 1,072 Tax on profit (368) (408) (481) (436) (368) (408) (481) (436) Profit from continuing operations 571 533 611 636 571 533 611 636 Net profit from discontinued operations Consolidated profit 571 533 611 636

571 533 611 636 Non-controlling interests (55) (55) (61) (68) (55) (55) (61) (68) Underlying attributable profit to the parent 517 478 550 568 517 478 550 568 NEW PREVIOUS DIFFERENCES Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Balance sheet Loans and advances to customers 65,663 61,572 59,820 63,974 65,663 61,572 59,820 63,974 Cash, central banks and credit institutions 30,070 29,805

28,219 31,466 30,070 29,805 28,219 31,466 Debt instruments 37,932 35,652 33,312 37,655 37,932 35,652 33,312 37,655 Other financial assets 5,885 7,190 5,984 6,877 5,885 7,190 5,984 6,877 Other asset accounts 12,410 11,947 11,421 10,600 12,410 11,947

11,421 10,600 Total assets 151,960 146,166 138,757 150,573 151,960 146,166 138,757 150,573 Customer deposits 64,578 69,202 69,485 70,083 64,578 69,202 69,485 70,083 Central banks and credit institutions 32,812 26,379 20,064 26,350 32,811 26,379

20,064 26,350 Marketable debt securities 16,278 14,207 12,047 11,901 16,278 14,207 12,047 11,901 Other financial liabilities 19,126 17,968 19,416 23,536 19,126 17,968 19,416 23,536 Other liabilities accounts 6,654 6,282 6,004 6,157 6,654 6,282 6,004

6,157 Total liabilities 139,448 134,037 127,017 138,026 139,448 134,037 127,017 138,026 Total equity 12,512 12,128 11,740 12,547 12,512 12,129 11,740 12,547 Memorandum items: Gross loans and advances to customers ** 69,041 64,859 62,926 67,424

69,041 64,859 62,926 67,424 Customer funds 98,212 97,585 95,586 100,351 98,212 97,585 95,586 100,351 Customer deposits *** 54,244 58,730 58,571 61,627 54,244 58,730 58,571 61,627 Mutual funds 43,969 38,856 37,015 38,725 43,969 38,856 37,015 38,725

22 (*).- Includes exchange differences. (**).- Excluding reverse repos. (***).- Excluding repos.

Restricted-confidential Chile EUR million NEW PREVIOUS DIFFERENCES Q1’20 Q2’20 Q3’20 Q4’20

Q1’20 Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Income statement Net interest income 448 425 420 494 448 425 420 494 Net fee income 92 74 74 94 92 74 74 94 Gains (losses) on financial transactions * 13 92 51

18 13 92 51 18 Other operating income (1) (6) (12) (12) (1) (6) (12) (12) Total income 553 584 532 594 553 584 532 594 Administrative expenses and amortisations (230) (228) (223) (219) (230) (228) (223) (219) Net operating income 322 356 310 375 322

356 310 375 Net loan-loss provisions (163) (183) (154) (94) (163) (183) (154) (94) Other gains (losses) and provisions 1 (2) 13 4 1 (2) 13 4 Profit before tax 160 171 169 285 160 171 169 285 Tax on profit (21) (42) (43) (49) (21) (42) (43) (49)

Profit from continuing operations 138 129 125 236 138 129 125 236 Net profit from discontinued operations Consolidated profit 138 129 125 236 138 129 125 236 Non-controlling interests (41) (43) (39) (73) (41)

(43) (39) (73) Underlying attributable profit to the parent 97 86 86 163 97 86 86 163 NEW PREVIOUS DIFFERENCES Mar-20 Jun-20

Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Balance sheet Loans

and advances to customers 36,542 38,037 38,360 39,381 36,542 38,037 38,360 39,381 Cash, central banks and credit institutions 9,322 8,709 6,513 5,836 9,322 8,709 6,513 5,836 Debt instruments 3,850 5,958 6,615 8,365 3,850 5,958 6,615 8,365 Other

financial assets 13,176 13,306 10,747 10,221 13,176 13,306 10,747 10,221 Other asset accounts 3,429 3,311 3,029 3,076 3,429 3,311 3,029 3,076 Total assets 66,319 69,321 65,265 66,880 66,319 69,321 65,265 66,880 Customer deposits 27,205 28,534 26,835

28,362 27,205 28,534 26,835 28,362 Central banks and credit institutions 9,217 11,822 12,525 11,611 9,217 11,822 12,525 11,611 Marketable debt securities 10,475 9,593 8,553 9,247 10,475 9,593 8,553 9,247 Other financial liabilities 13,661 13,501

11,427 11,162 13,661 13,501 11,427 11,162 Other liabilities accounts 1,202 1,276 1,258 1,519 1,202 1,276 1,258 1,519 Total liabilities 61,760 64,727 60,597 61,902 61,760 64,727 60,597 61,902 Total equity 4,559 4,594 4,668 4,978 4,559 4,594 4,668

4,978 Memorandum items: Gross loans and advances to customers ** 37,550 39,115 39,413 40,593 37,550 39,115 39,413 40,593 Customer funds 33,939 35,913 34,886 37,873 33,939 35,913 34,886 37,873 Customer deposits *** 27,041 28,385 26,788 28,330 27,041

28,385 26,788 28,330 Mutual funds 6,898 7,528 8,098 9,543 6,898 7,528 8,098 9,543 23 (*).- Includes exchange differences. (**).- Excluding reverse repos. (***).- Excluding repos.

Restricted-confidential Argentina EUR million NEW PREVIOUS DIFFERENCES Q1’20 Q2’20 Q3’20

Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Income statement Net interest income 241 261 218 192 241 261 218 192 Net fee income 76 56 70 71 76 56 70 71 Gains (losses) on financial transactions *

23 10 18 11 23 10 18 11 Other operating income (22) (17) (32) (48) (22) (17) (32) (48) Total income 318 310 274 226 318 310 274 226 Administrative expenses and amortisations (186) (153) (152) (141) (186) (153) (152) (141) Net operating income 132

157 122 85 132 157 122 85 Net loan-loss provisions (75) (57) (46) (48) (75) (57) (46) (48) Other gains (losses) and provisions (14) (18) (17) (22) (14) (18) (17) (22) Profit before tax 44 82 59 15 44 82 59 15 Tax on profit (9) (7) (7) 3 (9) (7) (7)

3 Profit from continuing operations 34 75 52 18 34 75 52 18 Net profit from discontinued operations Consolidated profit 34 75 52 18 34 75 52 18 Non-controlling interests (0) (0) (0) (0) (0) (0) (0) (0)

Underlying attributable profit to the parent 34 75 52 18 34 75 52 18 NEW PREVIOUS DIFFERENCES Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Balance sheet Loans and advances to customers 4,485 4,721 4,502

4,151 4,485 4,721 4,502 4,151 Cash, central banks and credit institutions 3,395 2,986 3,082 3,048 3,395 2,986 3,082 3,048 Debt instruments 2,226 2,659 2,111 1,897 2,226 2,659 2,111 1,897 Other financial assets 77 68 64 59 77 68 64 59 Other asset

accounts 824 840 826 832 824 840 826 832 Total assets 11,006 11,275 10,584 9,988 11,006 11,275 10,584 9,988 Customer deposits 8,305 8,134 7,605 7,179 8,305 8,134 7,605 7,179 Central banks and credit institutions 675 1,043 982 840 675 1,043 982 840

Marketable debt securities 87 76 23 20 87 76 23 20 Other financial liabilities 631 651 614 657 631 651 614 657 Other liabilities accounts 388 365 376 359 388 365 376 359 Total liabilities 10,086 10,269 9,600 9,056 10,086 10,269 9,600 9,056 Total

equity 920 1,006 984 931 920 1,006 984 931 Memorandum items: Gross loans and advances to customers ** 4,724 4,970 4,746 4,395 4,724 4,970 4,746 4,395 Customer funds 9,569 9,669 9,421 8,795 9,569 9,669 9,421 8,795 Customer deposits *** 8,305 8,134

7,605 7,179 8,305 8,134 7,605 7,179 Mutual funds 1,264 1,535 1,816 1,616 1,264 1,535 1,816 1,616 24 (*).- Includes exchange differences. (**).- Excluding reverse repos. (***).- Excluding repos.

Restricted-confidential Other South America EUR million NEW PREVIOUS DIFFERENCES Q1’20 Q2’20

Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Income statement Net interest income 106 107 91 94 106 107 91 94 Net fee income 40 34 40 43 37 29 33 35 4 5 7 8 Gains (losses) on financial

transactions * 18 14 16 14 18 15 16 15 Other operating income (2) (6) (5) 5 (4) (5) (3) 5 2 (1) (1) Total income 162 149 143 157 157 145 137 149 5 4 6 8 Administrative expenses and amortisations (72) (65) (70) (78) (66) (59) (57) (57) (6) (6) (12)

(21) Net operating income 90 85 73 79 91 86 80 93 (2) (7) (13) Net loan-loss provisions (21) (27) (19) (20) (21) (27) (19) (19) Other gains (losses) and provisions (2) (2) 1 (0) (2) (1) 1 (0) (2) Profit before tax 67 55 55 59 68 59 62 73 (1) (4) (7)

(14) Tax on profit (15) (12) (13) (14) (17) (13) (15) (14) 2 1 2 Profit from continuing operations 52 43 43 45 51 46 48 59 2 (3) (5) (14) Net profit from discontinued operations Consolidated profit 52 43 43 45 51 46 48 59 2 (3) (5) (14) Non-controlling interests 0 0 0 0 0 0 0 0 Underlying attributable profit to the parent 52 43 43 45 51 46 48 59 2 (3) (5) (14) NEW PREVIOUS DIFFERENCES Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Balance sheet Loans and advances to customers 6,183 6,674 6,380 6,239 6,175 6,666 6,368 6,224 8 9 12 15 Cash, central banks and credit institutions 3,169 3,056 2,993 2,803 3,101 2,991 2,895 2,607 68 65 98 197

Debt instruments 691 967 1,301 1,386 688 964 1,298 1,382 3 3 3 4 Other financial assets 190 185 177 185 122 112 107 109 68 72 71 76 Other asset accounts 531 706 670 692 474 499 454 500 57 207 217 192 Total assets 10,764 11,588 11,522 11,306 10,560

11,231 11,122 10,822 205 357 400 483 Customer deposits 6,356 6,727 6,550 6,184 6,344 6,716 6,534 6,167 12 11 15 17 Central banks and credit institutions 2,835 3,167 3,247 3,239 2,829 3,156 3,220 3,188 7 12 27 50 Marketable debt securities 112 97 105

112 112 97 105 112 Other financial liabilities 127 98 89 101 104 78 71 78 24 20 18 23 Other liabilities accounts 304 308 264 298 286 292 250 267 18 16 14 31 Total liabilities 9,735 10,398 10,255 9,934 9,674 10,339 10,181 9,812 61 59 74 122 Total

equity 1,030 1,190 1,267 1,372 886 892 941 1,010 144 298 326 362 Memorandum items: Gross loans and advances to customers ** 6,308 6,803 6,510 6,373 6,299 6,794 6,497 6,358 8 9 12 15 Customer funds 6,394 6,765 6,587 6,222 6,382 6,754 6,572 6,205 12

11 15 17 Customer deposits *** 6,356 6,727 6,550 6,184 6,344 6,716 6,534 6,167 12 11 15 17 Mutual funds 38 38 37 38 38 38 37 38 25 (*).- Includes exchange differences. (**).- Excluding reverse repos. (***).- Excluding repos.

Restricted-confidential DIGITAL CONSUMER BANK EUR million NEW PREVIOUS) DIFFERENCES Q1’20 Q2’20

Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Income statement Net interest income 1,088 1,054 1,048 1,073 1,088 1,054 1,048 1,073 Net fee income 192 163 211 205 192 163 211 205 Gains

(losses) on financial transactions * (12) 3 8 17 (12) 3 8 17 Other operating income 23 (6) 42 57 23 (6) 42 57 Total income 1,291 1,214 1,309 1,352 1,291 1,214 1,309 1,352 Administrative expenses and amortisations (596) (552) (585) (596) (596) (552)

(585) (596) Net operating income 695 662 724 756 695 662 724 756 Net loan-loss provisions (331) (200) (222) (204) (331) (200) (222) (204) Other gains (losses) and provisions 40 23 (20) 6 40 23 (20) 6 Profit before tax 404 485 482 558 404 485 482 558

Tax on profit (107) (129) (125) (133) (107) (129) (125) (133) Profit from continuing operations 297 356 357 424 297 356 357 424 Net profit from discontinued operations 0 (0) Consolidated profit 297 356 357 424 297 356 357 424 Non-controlling interests (63) (83) (76) (79) (63) (83) (76) (79) Underlying attributable profit to the parent 234 273 281 345 234 273 281 345 NEW PREVIOUS) DIFFERENCES Mar-20

Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Balance sheet Loans and advances to customers 112,162 111,187 110,498 113,257 112,162 111,187 110,498 113,257 Cash, central banks and credit institutions 21,581 19,568 20,533 21,754 21,581 19,568 20,533

21,754 Debt instruments 2,710 4,565 5,559 5,660 2,710 4,565 5,559 5,660 Other financial assets 45 36 33 30 45 36 33 30 Other asset accounts 5,107 5,243 6,400 6,149 5,107 5,243 6,400 6,149 Total assets 141,605 140,599 143,023 146,851 141,605 140,599

143,023 146,851 Customer deposits 48,772 49,260 49,996 51,399 48,772 49,260 49,996 51,399 Central banks and credit institutions 37,155 37,704 39,151 41,567 37,155 37,704 39,151 41,567 Marketable debt securities 38,642 36,259 35,914 35,965 38,642

36,259 35,914 35,965 Other financial liabilities 1,275 1,675 1,655 1,370 1,275 1,675 1,655 1,370 Other liabilities accounts 3,633 3,789 4,088 3,940 3,633 3,789 4,088 3,940 Total liabilities 129,478 128,687 130,803 134,241 129,478 128,687 130,803

134,241 Total equity 12,128 11,912 12,220 12,610 12,128 11,912 12,220 12,610 Memorandum items: Gross loans and advances to customers ** 114,970 114,006 113,335 116,083 114,970 114,006 113,335 116,083 Customer funds 49,226 49,797 50,566 52,058 49,226

49,797 50,566 52,058 Customer deposits *** 48,772 49,260 49,996 51,399 48,772 49,260 49,996 51,399 Mutual funds 453 536 570 658 453 536 570 658 26 (*).- Includes exchange differences. (**).- Excluding reverse repos. (***).- Excluding repos.

Restricted-confidential SANTANDER GLOBAL PLATFORM (primary segment) EUR million NEW PREVIOUS) DIFFERENCES

Q1’20 Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Income statement Net interest income 31 32 33 33 (31) (32) (33) (33) Net fee income 13 18 24 26 (13) (18) (24) (26)

Gains (losses) on financial transactions * 0 (0) (0) (0) Other operating income 1 (6) (9) (4) (1) 6 9 4 Total income 45 44 48 55 (45) (44) (48) (55) Administrative expenses and amortizations (71) (77) (114) (119) 71 77 114 119 Net operating income

(26) (33) (66) (65) 26 33 66 65 Net loan-loss provisions (0) (1) (1) (1) 1 1 1 Other gains (losses) and provisions (1) (6) (1) (3) 1 6 1 3 Profit before tax (27) (40) (68) (68) 27 40 68 68 Tax on profit 14 11 20 7 (14) (11) (20) (7) Profit from

continuing operations (13) (28) (48) (62) 13 28 48 62 Net profit from discontinued operations Consolidated profit (13) (28) (48) (62) 13 28 48 62 Non-controlling interests 0 0 1 0 (1) Underlying attributable

profit to the parent (13) (28) (48) (62) 13 28 48 62 NEW PREVIOUS) DIFFERENCES Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Balance sheet Loans and advances to customers 791 834 907 973 (791)

(834) (907) (973) Cash, central banks and credit institutions 9,423 9,737 10,008 10,917 (9,423) (9,737) (10,008) (10,917) Debt instruments 10 10 10 14 (10) (10) (10) (14) Other financial assets 205 218 213 230 (205) (218) (213) (230) Other asset

accounts 318 766 812 769 (318) (766) (812) (769) Total assets 10,747 11,566 11,949 12,901 (10,747) (11,566) (11,949) (12,901) Customer deposits 9,674 9,998 10,290 10,961 (9,674) (9,998) (10,290) (10,961) Central banks and credit institutions 144 171

212 274 (144) (171) (212) (274) Marketable debt securities Other financial liabilities 134 149 122 130 (134) (149) (122) (130) Other liabilities accounts 98 103 112 156 (98) (103) (112) (156) Total liabilities 10,051 10,420 10,736 11,521 (10,051)

(10,420) (10,736) (11,521) Total equity 696 1,146 1,212 1,381 (696) (1,146) (1,212) (1,381) Memorandum items: Gross loans and advances to customers ** 794 838 911 979 (794) (838) (911) (979) Customer funds 10,127 10,534 10,860 11,619 (10,127)

(10,534) (10,860) (11,619) Customer deposits *** 9,674 9,998 10,290 10,961 (9,674) (9,998) (10,290) (10,961) Mutual funds 453 536 570 658 (453) (536) (570) (658) 27 (*).- Includes exchange differences. (**).- Excluding reverse repos. (***).-

Excluding repos.

Restricted-confidential CORPORATE CENTRE EUR million NEW PREVIOUS DIFFERENCES Q1’20 Q2’20 Q3’20

Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Income statement Net interest income (304) (354) (371) (345) (304) (354) (371) (345) Net fee income (9) (6) (11) (3) (9) (6) (11) (3) Gains (losses)

on financial transactions * 14 64 104 104 14 64 104 104 Other operating income (5) (18) 6 (8) (5) (18) 6 (8) Total income (304) (313) (271) (252) (304) (313) (271) (252) Administrative expenses and amortisations (85) (82) (82) (80) (85) (82) (82)

(80) Net operating income (389) (395) (353) (333) (389) (395) (353) (333) Net loan-loss provisions (3) (8) (16) (4) (3) (8) (16) (4) Other gains (losses) and provisions (20) (370) (12) (9) (20) (370) (12) (9) Profit before tax (413) (773) (381)

(345) (413) (773) (381) (345) Tax on profit (524) 585 52 (44) (524) 585 52 (44) Profit from continuing operations (937) (188) (330) (389) (937) (188) (330) (389) Net profit from discontinued operations Consolidated profit (937) (188) (330) (389)

(937) (188) (330) (389) Non-controlling interests (94) 94 (0) 0 (94) 94 (0) 0 Underlying attributable profit to the parent (1,031) (94) (330) (389) (1,031) (94) (330) (389) NEW PREVIOUS DIFFERENCES Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Mar-20 Jun-20 Sep-20 Dic-20 Balance sheet Loans and advances to customers 5,989 5,205 4,827 5,044 5,989 5,205 4,827 5,044 Cash, central banks and credit institutions 46,314 48,530 63,947

61,173 46,314 48,530 63,947 61,173 Debt instruments 1,292 1,340 2,100 1,918 1,292 1,340 2,100 1,918 Other financial assets 3,745 2,058 2,067 1,645 3,745 2,058 2,067 1,645 Other asset accounts 131,526 115,303 114,295 112,807 131,526 115,303 114,295

112,807 Total assets 188,866 172,436 187,236 182,587 188,866 172,436 187,236 182,587 Customer deposits 740 770 1,074 825 740 770 1,074 825 Central banks and credit institutions 27,484 19,119 42,654 38,554 27,484 19,119 42,654 38,555 Marketable debt

securities 56,906 63,010 57,866 57,240 56,906 63,010 57,866 57,240 Other financial liabilities 803 1,901 1,143 493 803 1,901 1,143 493 Other liabilities accounts 8,917 8,225 7,645 9,443 8,917 8,225 7,645 9,443 Total liabilities 94,849 93,024 110,382

106,556 94,849 93,024 110,382 106,556 Total equity 94,017 79,412 76,854 76,031 94,017 79,412 76,854 76,031 Memorandum items: Gross loans and advances to customers ** 6,135 5,367 5,008 5,224 6,135 5,367 5,008 5,224 Customer funds 751 786 1,089 837

751 786 1,089 837 Customer deposits *** 740 770 1,074 825 740 770 1,074 825 Mutual funds 11 17 15 12 11 17 15 12 28 (*).- Includes exchange differences. (**).- Excluding reverse repos. (***).- Excluding repos.

Restricted-confidential â– Secondary segments 29

Restricted-confidential RETAIL BANKING EUR million NEW PREVIOUS DIFFERENCES Q1’20 Q2’20 Q3’20

Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Income statement Net interest income 8,004 7,272 7,280 7,500 7,885 7,141 7,148 7,371 120 131 133 128 Net fee income 2,058 1,536 1,707 1,685 2,024

1,495 1,671 1,661 34 42 36 24 Gains (losses) on financial transactions * 100 442 336 255 50 403 294 215 50 40 41 40 Other operating income 9 (179) 108 (90) 13 (179) 113 (88) (5) (1) (4) (2) Total income 10,171 9,071 9,431 9,349 9,972 8,859 9,226

9,159 199 212 205 190 Administrative expenses and amortisations (4,632) (4,191) (4,183) (4,280) (4,526) (4,084) (4,058) (4,179) (106) (107) (125) (101) Net operating income 5,538 4,880 5,248 5,069 5,445 4,775 5,168 4,980 93 105 81 89 Net loan-loss

provisions (3,890) (2,862) (2,465) (2,415) (3,889) (2,846) (2,463) (2,410) (1) (16) (2) (5) Other gains (losses) and provisions (343) (219) (267) (409) (338) (218) (267) (407) (5) (1) (1) (1) Profit before tax 1,306 1,799 2,516 2,246 1,218 1,711

2,438 2,163 87 88 78 83 Tax on profit (433) (557) (883) (652) (416) (536) (867) (632) (17) (21) (15) (20) Profit from continuing operations 873 1,242 1,633 1,594 802 1,175 1,571 1,531 71 67 62 64 Net profit from discontinued operations Consolidated

profit 873 1,242 1,633 1,594 802 1,175 1,571 1,531 71 67 62 64 Non-controlling interests (180) (202) (258) (281) (168) (193) (249) (273) (12) (9) (10) (9) Underlying attributable profit to the parent 693 1,040

1,375 1,313 634 982 1,322 1,258 59 58 53 55 (*).- Includes exchange differences. 30

Restricted-confidential CORPORATE & INVESTMENT BANKING EUR million NEW PREVIOUS DIFFERENCES Q1’20

Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Income statement Net interest income 677 705 771 765 671 713 788 781 6 (9) (17) (16) Net fee income 402 405 360 375 404 406 361

379 (2) (1) (2) (3) Gains (losses) on financial transactions * 156 254 199 62 165 259 204 62 (9) (5) (5) (1) Other operating income 61 46 44 51 60 48 44 51 1 (2) Total income 1,297 1,410 1,373 1,253 1,300 1,426 1,397 1,274 (4) (16) (24) (21)

Administrative expenses and amortisations (528) (499) (488) (523) (536) (507) (496) (530) 8 8 8 6 Net operating income 769 910 885 730 764 919 901 744 5 (8) (16) (14) Net loan-loss provisions (6) (239) (40) (185) (4) (245) (41) (176) (1) 6 2 (9)

Other gains (losses) and provisions (15) (28) (20) (72) (15) (28) (20) (72) Profit before tax 748 644 825 472 745 646 839 496 3 (3) (14) (23) Tax on profit (220) (179) (240) (134) (218) (179) (242) (143) (1) 2 9 Profit from continuing operations 528

465 585 339 527 467 597 353 2 (2) (12) (14) Net profit from discontinued operations Consolidated profit 528 465 585 339 527 467 597 353 2 (2) (12) (14) Non-controlling interests (34) (30) (31) (23) (36) (30)

(32) (23) 2 (1) 1 Underlying attributable profit to the parent 494 434 554 316 491 437 565 330 4 (3) (11) (14) (*).- Includes exchange differences. 31

Restricted-confidential WEALTH MANAGEMENT & INSURANCE EUR million NEW PREVIOUS DIFFERENCES Q1’20

Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Income statement Net interest income 109 93 92 100 132 104 104 113 (23) (11) (12) (13) Net fee income 308 269 279 296 320 279

290 306 (11) (10) (10) (10) Gains (losses) on financial transactions * 20 22 16 43 21 22 17 43 (1) (1) Other operating income 113 78 86 106 113 78 86 106 Total income 550 462 474 545 586 482 498 568 (36) (21) (24) (23) Administrative expenses and

amortisations (237) (212) (207) (216) (244) (220) (215) (227) 7 8 7 12 Net operating income 313 250 266 329 342 263 283 341 (29) (13) (16) (12) Net loan-loss provisions (6) (6) (11) (5) (7) (5) (10) (6) (1) 1 Other gains (losses) and provisions (1)

(2) (3) 7 (1) (3) (4) 7 1 1 Profit before tax 307 242 252 331 334 255 269 342 (28) (13) (17) (10) Tax on profit (74) (56) (60) (82) (82) (59) (65) (84) 8 4 5 2 Profit from continuing operations 232 186 193 249 252 195 204 257 (20) (9) (12) (8) Net

profit from discontinued operations Consolidated profit 232 186 193 249 252 195 204 257 (20) (9) (12) (8) Non-controlling interests (11) (8) (9) (11) (11) (9) (9) (11) 1 1 1 1 Underlying attributable profit to

the parent 222 179 184 238 240 186 195 246 (19) (8) (11) (7) (*).- Includes exchange differences. 32

PAGONxt EUR million NEW PREVIOUS DIFFERENCES Q1’20 Q2’20 Q3’20 Q4’20 Q1’20 Q2’20

Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Income statement Net interest income 0 (1) 0 (0) (1) Net fee income 94 78 88 103 94 78 88 103 Gains (losses) on financial transactions * 3 (1) (3) (1) 3 (1) (3) (1) Other operating

income 5 (2) (5) (1) 5 (2) (5) (1) Total income 101 75 81 100 101 75 81 100 Administrative expenses and amortisations (95) (92) (113) (142) (95) (92) (113) (142) Net operating income 5 (18) (33) (42) 5 (18) (33) (42) Net loan-loss provisions (4) (3)

(3) (2) (4) (3) (3) (2) Other gains (losses) and provisions 7 (6) (1) (2) 7 (6) (1) (2) Profit before tax 8 (26) (37) (46) 8 (26) (37) (46) Tax on profit (9) (1) 3 (9) (9) (1) 3 (9) Profit from continuing operations (1) (27) (34) (55) (1) (27) (34)

(55) Net profit from discontinued operations Consolidated profit (1) (27) (34) (55) (1) (27) (34) (55) Non-controlling interests 0 0 1 0 1 Underlying attributable profit to the parent (1) (27) (33) (55) (1)

(27) (33) (55) (*).- Includes exchange differences. 33

SANTANDER GLOBAL PLATFORM (secondary segment) EUR million NEW PREVIOUS DIFFERENCES Q1’20 Q2’20

Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Q1’20 Q2’20 Q3’20 Q4’20 Income statement Net interest income 103 112 104 98 (103) (112) (104) (98) Net fee income 115 109 111 114 (115) (109) (111) (114) Gains

(losses) on financial transactions * 42 33 32 38 (42) (33) (32) (38) Other operating income 0 (4) (10) (3) 4 10 3 Total income 260 250 238 247 (260) (250) (238) (247) Administrative expenses and amortizations (186) (183) (222) (225) 186 183 222 225

Net operating income 74 67 16 21 (74) (67) (16) (21) Net loan-loss provisions (5) (14) (5) (15) 5 14 5 15 Other gains (losses) and provisions 2 (6) (2) (4) (2) 6 2 4 Profit before tax 71 46 10 3 (71) (46) (10) (3) Tax on profit (19) (18) (5) (17) 19

18 5 17 Profit from continuing operations 52 28 5 (14) (52) (28) (5) 14 Net profit from discontinued operations Consolidated profit 52 28 5 (14) (52) (28) (5) 14 Non-controlling interests (9) (8) (7) (8) 9 8 7

8 Underlying attributable profit to the parent 43 20 (3) (22) (43) (20) 3 22 (*).- Includes exchange differences. 34

Thank You. Our purpose is to help people and businesses prosper. Our culture is based on believing that

everything we do should be:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Banco Santander, S.A.

|

|

|

|

|

|

Date: April 9, 2021

|

|

By:

|

|

/s/ Pedro de Mingo Kaminouchi

|

|

|

|

|

|

Name:

|

|

Pedro de Mingo Kaminouchi

|

|

|

|

|

|

Title:

|

|

Head of Regulatory Compliance

|

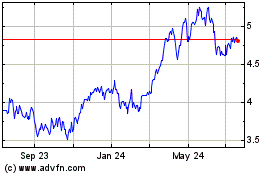

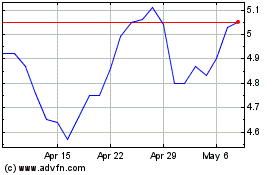

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Apr 2023 to Apr 2024