Pacific Biosciences of California, Inc. (NASDAQ: PACB) today

announced financial results for the quarter and fiscal year ended

December 31, 2020. Reported revenue is consistent with the

Company’s press release issued on January 11, 2021.

Q4 2020 Financial Highlights

Revenue for the fourth quarter of 2020 was $27.1 million,

representing a 42% increase sequentially compared with $19.1

million for the third quarter of 2020 and a 3% decrease compared

with $27.9 million for the fourth quarter of 2019. The Company

placed 35 Sequel II/IIe systems during the fourth quarter, bringing

the total installed base of Sequel II/IIe systems up to 203 as of

December 31, 2020, compared with 168 as of September 30, 2020.

Gross profit for the fourth quarter of 2020 was $11.4 million,

representing a 61% increase sequentially compared with $7.1 million

for the third quarter of 2020 and a 12% decrease compared with

$12.9 million for the fourth quarter of 2019. Gross margin for the

fourth quarter of 2020 was 42%, compared to 37% for the third

quarter of 2020 and 46% for the fourth quarter of 2019.

Operating expenses totaled $35.4 million for the fourth quarter

of 2020, compared to $31.2 million for the third quarter of 2020

and $30.8 million for the fourth quarter of 2019. Operating

expenses for the fourth quarter of 2020, third quarter of 2020 and

fourth quarter of 2019 included non-cash stock-based compensation

of $4.8 million, $4.3 million and $3.4 million, respectively.

Net income for the fourth quarter of 2020 was $74.9 million,

compared to a net loss of $23.7 million for the third quarter of

2020 and a net loss of $0.1 million for the fourth quarter of 2019.

The increase in net income for the fourth quarter of 2020 was

primarily driven by the recognition of the $98.0 million Reverse

Termination Fee received from Illumina in January 2020 and

reflected as other income after the associated contingency clauses

lapsed on October 1, 2020.

Basic and diluted net income per share for the fourth quarter of

2020 was $0.40 per share and $0.37 per share, respectively,

compared to basic and diluted net loss of $0.14 per share and $0.00

per share for the third quarter of 2020and the fourth quarter of

2019, respectively.

The Company received $93.6 million in net proceeds from an

underwritten public offering of its common stock in November 2020.

Cash, cash equivalents and investments, excluding short-term

restricted cash and long-term restricted cash, at December 31, 2020

totaled $318.8 million, compared to $208.6 million at September 30,

2020 and $49.1 million at December 31, 2019.

Recent Company Highlights

- As separately announced, SB Management, a subsidiary of

SoftBank Group Corp., will make an investment of $900 million in

convertible senior notes to support the Company’s future growth

initiatives.

- The Company announced a multi-year collaboration with Invitae

Corporation to begin development of a production-scale

high-throughput sequencing platform leveraging the power of

PacBio’s highly accurate HiFi sequencing to expand Invitae’s whole

genome testing capabilities.

- Mark Van Oene joined PacBio as Chief Operating Officer and

Peter Fromen joined the Company as Chief Commercial Officer, both

newly established roles which expand the company’s management

strength.

- Wellcome Sanger Institute committed to purchase seven new

Sequel IIe systems to support the Darwin Tree of Life initiative,

making it one of the world’s largest SMRT sequencing

facilities.

Commenting on the announcement, Christian Henry, President and

Chief Executive Officer of Pacific Biosciences said, “Our financial

performance in the fourth quarter was above our expectations and we

were pleased that the global pandemic did not significantly impact

our business in the quarter. We are thrilled to have started the

new year with a strategic partnership with Invitae and a

transformative investment from SoftBank.”

Impact of COVID-19 Pandemic

Financial results for the twelve months of 2020 were negatively

impacted as many of our customers in multiple regions around the

world shut down operations for various periods of time in efforts

to curb the spread of the COVID-19 pandemic. This resulted in lower

product revenues of $65.4 million for the twelve months of 2020

compared to $77.7 million for the same period of 2019.

Uncertainties associated with the pandemic, including recent

resurgences in infection rates, may cause further impacts to our

operations and financial results.

Quarterly Conference Call Information

Management will host a quarterly conference call to discuss its

fourth quarter and year ended December 31, 2020 results today at

4:30 p.m. Eastern Time. Investors may listen to the call by dialing

1.888.366.7247, or if outside the U.S., by dialing +1.707.287.9330,

using Conference ID # 8096067. The call will be webcast live and

will be available for replay at Pacific Biosciences’ website at

https://investor.pacificbiosciences.com/.

About Pacific Biosciences

Pacific Biosciences of California, Inc. (NASDAQ: PACB), is

empowering life scientists with highly accurate long-read

sequencing. The company’s innovative instruments are based

on Single Molecule, Real-Time (SMRT®) Sequencing technology,

which delivers a comprehensive view of genomes,

transcriptomes, and epigenomes, enabling access to the

full spectrum of genetic variation in any organism. Cited in

thousands of peer-reviewed publications,

PacBio® sequencing systems are in use by scientists

around the world to drive discovery in human biomedical

research, plant and animal sciences, and microbiology.

Forward-Looking Statements

All statements in this press release that are not historical are

forward-looking statements, including, among other things, our

preliminary financial results for the fourth quarter ended December

31, 2020, including our revenue, instrument revenue, consumable

revenue and service and other revenue and our installed instruments

during the quarter, customer interest in SMRT Sequencing with HiFi

reads, sales momentum, the impact of COVID-19 on our business, and

other future events. You should not place undue reliance on

forward-looking statements because they involve known and unknown

risks, uncertainties, changes in circumstances and other factors

that are, in some cases, beyond Pacific Biosciences’ control and

could cause actual results to differ materially from the

information expressed or implied by forward-looking statements made

in this press release. Factors that could materially affect actual

results can be found in Pacific Biosciences’ most recent filings

with the Securities and Exchange Commission, including Pacific

Biosciences’ most recent reports on Forms 8-K, 10-K and 10-Q, and

include those listed under the caption “Risk Factors.” Pacific

Biosciences undertakes no obligation to revise or update

information in this press release to reflect events or

circumstances in the future, even if new information becomes

available.

The condensed consolidated financial statements that follow

should be read in conjunction with the notes set forth in the

Pacific Biosciences’ Annual Report on Form 10-K when filed with the

Securities and Exchange Commission.

Contact:Trevin

Rard650.521.8450ir@pacificbiosciences.com

Pacific Biosciences of California,

Inc.Unaudited Quarterly Condensed Consolidated

Statement of Operations (amounts in thousands, except per

share amounts)

| |

|

Three Months Ended |

| |

|

December 31, 2020 |

|

September 30, 2020 |

|

December 31, 2019 |

| Revenue: |

|

|

|

|

|

|

|

|

|

|

Product revenue |

|

$ |

23,626 |

|

|

$ |

15,749 |

|

|

$ |

24,551 |

|

|

Service and other revenue |

|

|

3,510 |

|

|

|

3,333 |

|

|

|

3,379 |

|

|

Total revenue |

|

|

27,136 |

|

|

|

19,082 |

|

|

|

27,930 |

|

| Cost of Revenue: |

|

|

|

|

|

|

|

|

|

|

Cost of product revenue |

|

|

12,550 |

|

|

|

9,228 |

|

|

|

11,985 |

|

|

Cost of service and other revenue |

|

|

3,185 |

|

|

|

2,790 |

|

|

|

3,013 |

|

|

Total cost of revenue |

|

|

15,735 |

|

|

|

12,018 |

|

|

|

14,998 |

|

|

Gross profit |

|

|

11,401 |

|

|

|

7,064 |

|

|

|

12,932 |

|

| Operating Expense: |

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

17,425 |

|

|

|

16,467 |

|

|

|

14,273 |

|

|

Sales, general and administrative |

|

|

17,953 |

|

|

|

14,772 |

|

|

|

16,576 |

|

|

Total operating expense |

|

|

35,378 |

|

|

|

31,239 |

|

|

|

30,849 |

|

| |

|

|

|

|

|

|

|

|

|

| Operating loss |

|

|

(23,977 |

) |

|

|

(24,175 |

) |

|

|

(17,917 |

) |

|

Gain from Reverse Termination Fee from Illumina |

|

|

98,000 |

|

|

|

— |

|

|

|

— |

|

|

Gain from Continuation Advances from Illumina |

|

|

— |

|

|

|

— |

|

|

|

18,000 |

|

|

Interest expense |

|

|

— |

|

|

|

— |

|

|

|

(678 |

) |

|

Other income, net |

|

|

912 |

|

|

|

467 |

|

|

|

504 |

|

| Net income (loss) |

|

$ |

74,935 |

|

|

$ |

(23,708 |

) |

|

$ |

(91 |

) |

| |

|

|

|

|

|

|

|

|

|

| Net income (loss) per

share |

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.40 |

|

|

$ |

(0.14 |

) |

|

$ |

(0.00 |

) |

|

Diluted |

|

$ |

0.37 |

|

|

$ |

(0.14 |

) |

|

$ |

(0.00 |

) |

| Weighted average shares

outstanding used in calculating net income (loss) per share |

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

186,013 |

|

|

|

166,862 |

|

|

|

153,051 |

|

|

Diluted |

|

|

203,822 |

|

|

|

166,862 |

|

|

|

153,051 |

|

Pacific Biosciences of California,

Inc.Unaudited Twelve Months Ended Condensed

Consolidated Statement of Operations (amounts in

thousands, except per share amounts)

| |

|

Twelve Months Ended December 31, |

| |

|

2020 |

|

2019 |

| Revenue: |

|

|

|

|

|

|

|

Product revenue |

|

$ |

65,424 |

|

|

$ |

77,742 |

|

|

Service and other revenue |

|

|

13,469 |

|

|

|

13,149 |

|

|

Total revenue |

|

|

78,893 |

|

|

|

90,891 |

|

| Cost of Revenue: |

|

|

|

|

|

|

|

Cost of product revenue |

|

|

35,424 |

|

|

|

44,771 |

|

|

Cost of service and other revenue |

|

|

10,903 |

|

|

|

11,544 |

|

|

Total cost of revenue |

|

|

46,327 |

|

|

|

56,315 |

|

|

Gross profit |

|

|

32,566 |

|

|

|

34,576 |

|

| Operating Expense: |

|

|

|

|

|

|

|

Research and development |

|

|

64,152 |

|

|

|

59,630 |

|

|

Sales, general and administrative |

|

|

72,799 |

|

|

|

75,491 |

|

|

Total operating expense |

|

|

136,951 |

|

|

|

135,121 |

|

| |

|

|

|

|

|

|

| Operating loss |

|

|

(104,385 |

) |

|

|

(100,545 |

) |

|

Gain from Reverse Termination Fee from Illumina |

|

|

98,000 |

|

|

|

— |

|

|

Gain from Continuation Advances from Illumina |

|

|

34,000 |

|

|

|

18,000 |

|

|

Interest expense |

|

|

(267 |

) |

|

|

(2,611 |

) |

|

Other income, net |

|

|

2,055 |

|

|

|

1,022 |

|

| Net income (loss) |

|

$ |

29,403 |

|

|

$ |

(84,134 |

) |

| |

|

|

|

|

|

|

| Net income (loss) per

share |

|

|

|

|

|

|

|

Basic |

|

$ |

0.18 |

|

|

$ |

(0.55 |

) |

|

Diluted |

|

$ |

0.17 |

|

|

$ |

(0.55 |

) |

| Weighted average shares

outstanding used in calculating net income (loss) per share |

|

|

|

|

|

|

|

Basic |

|

|

165,187 |

|

|

|

152,527 |

|

|

Diluted |

|

|

174,970 |

|

|

|

152,527 |

|

Pacific Biosciences of California,

Inc.Unaudited Condensed Consolidated Balance

Sheets (amounts in thousands)

| |

|

December 31, |

|

December 31, |

| |

|

2020 |

|

2019 |

| Assets |

|

|

|

|

|

Cash and investments |

|

$ |

318,814 |

|

|

$ |

49,099 |

|

|

Accounts receivable |

|

|

16,837 |

|

|

|

15,266 |

|

|

Inventory |

|

|

14,230 |

|

|

|

13,312 |

|

|

Prepaid and other current assets |

|

|

4,870 |

|

|

|

3,069 |

|

|

Property and equipment, net |

|

|

24,899 |

|

|

|

30,070 |

|

|

Operating lease right-of-use assets, net |

|

|

29,951 |

|

|

|

32,827 |

|

|

Restricted cash |

|

|

4,336 |

|

|

|

4,300 |

|

|

Other long-term assets |

|

|

43 |

|

|

|

42 |

|

| Total

Assets |

|

$ |

413,980 |

|

|

$ |

147,985 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and

Stockholders' Equity |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

3,579 |

|

|

$ |

8,368 |

|

|

Accrued expenses |

|

|

17,350 |

|

|

|

13,242 |

|

|

Deferred revenue |

|

|

10,290 |

|

|

|

9,561 |

|

|

Operating lease liabilities |

|

|

41,999 |

|

|

|

45,801 |

|

|

Notes payable |

|

|

— |

|

|

|

15,871 |

|

|

Other liabilities |

|

|

5,271 |

|

|

|

225 |

|

|

Stockholders' equity |

|

|

335,491 |

|

|

|

54,917 |

|

| Total Liabilities and

Stockholders' Equity |

|

$ |

413,980 |

|

|

$ |

147,985 |

|

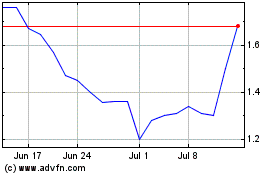

Pacific Biosciences of C... (NASDAQ:PACB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pacific Biosciences of C... (NASDAQ:PACB)

Historical Stock Chart

From Apr 2023 to Apr 2024