By Jason Zweig

When you point your finger at somebody, make sure to step away

from the mirror.

The professional money managers blaming individual investors and

index funds for the phenomenal rise of speculative stocks should

remember that.

Among this year's hottest stocks, few are favorites of

individual investors, and index funds aren't their main buyers.

Who's driving them up? Professional stock pickers -- the very

people pointing the finger at everyone else.

Let's look at Zoom Video Communications Inc., the

teleconferencing company whose stock is up more than 660% so far

this year. Given the popularity of its service and the stock's

scorching performance, you might expect Zoom is a darling among

individual investors and traders.

Yet, on the Robinhood app used by millions of individual

traders, Zoom was only the 49th widest-owned stock this week,

according to the online broker's tally of most-popular

holdings.

In fact, of the 25 stocks with market values above $10 billion

that have the hottest returns so far this year, only two -- Moderna

Inc. and Peloton Interactive Inc. -- are among the 25 most-popular

stocks on Robinhood. They are up more than 288% and 375%,

respectively, in 2020.

The biggest performance chasers? Big institutions, whose

ownership of scalding-hot stocks has boomed this year, even as

these shares become wildly expensive by traditional yardsticks.

Some of that is natural; as a company's market value grows, it

becomes eligible for ownership at funds that can't hold small

stocks. Then again, professional investors, just like many

amateurs, can't resist a hot stock.

At the end of 2019, institutions owned 49% of cloud-computing

firm Fastly Inc.'s shares. By October, after the stock ran up more

than 540% and was trading in excess of 47 times revenues,

institutions owned almost 62%. Right on cue, the stock lost more

than one-quarter of its market value this Thursday on a

disappointing earnings report.

Now let's zoom in on Zoom. From the end of 2019 through

September, institutions cumulatively bought almost 80 million

shares, according to FactSet, while the stock price was rising

roughly sevenfold. That took institutional ownership from less than

52% in December to 55% in September.

That includes index funds, those autopilot portfolios that seek

to match the return of a market average. However, index funds

accounted for only 19% of institutional buying over the period.

Active managers, who purportedly work hard to analyze what

companies are worth, did almost all the buying -- even as Zoom was

soaring far beyond conventional notions of where a stock should

trade.

By this week, Zoom was priced at 690 times the company's

earnings over the past 12 months and 203 times what analysts are

guessing it will earn in the next 12.

Among the institutional buyers were three dozen "value

investors," whose mission is to find the cheapest stocks. All told,

they bought about 547,000 shares of Zoom, accounting for less than

0.4% of its total market value.

Those are tiny stakes. But that might be the point.

With index funds capturing investors' imaginations and dollars,

stock pickers need to do something -- anything -- to set themselves

apart.

Small bets on scorching-hot stocks make sense for many fund

managers. If they bet wrong, their returns won't suffer much. If

they bet right, the payoff on even tiny bets, can add significantly

to a fund's overall return.

Let's say a fund puts only 0.5% of its assets in a stock that's

been on fire. Now imagine that stock goes so cold that it loses

100% of its market value. Assuming the rest of the fund's

investments stay steady, the fund will lose a barely noticeable

0.5%. What if, on the other hand, the hot stock heats up tenfold

from here? Assuming the rest of the portfolio stays constant, that

would add 4.5 percentage points to the fund's overall return -- a

huge payoff on a small bet.

Consider Hodges Capital Management Inc. of Dallas, a

value-investing firm that managed $976 million according to a

regulatory filing in July, including $665 million in several mutual

funds.

The firm's latest disclosure of its holdings shows that, as of

June 30, Hodges had small positions in several hot stocks trading

at prices that traditional value investors might regard as

unreasonable.

Hodges didn't respond to requests for comment.

The firm's Hodges Fund has outperformed the S&P 500 by 13

percentage points since June 30. Its Blue Chip Equity Income and

Small Cap funds have also done better than their peers. In the long

run, however, only Small Cap has slightly outperformed its

benchmark; the others have lagged behind the indexes over the past

10 years, often badly.

In his June letter to investors, portfolio manager Craig Hodges

wrote: "We are not changing our core investing discipline, which is

designed to seek out quality companies running great businesses

with excellent management teams that are trading at reasonable

prices."

As of June 30, along with 0.06% in Zoom, Hodges had 0.05% of its

assets in Novavax Inc., a high-flying pharmaceutical company that

has no earnings; 1.25% in Snap Inc., parent of the Snapchat app,

which also has no earnings but recently traded at more than 20

times its revenues, or twice as much as its peers; and 0.5% in 2U

Inc., an online education company with a hot stock and no

earnings.

In an update to its holdings as of Sept. 30, filed on Thursday,

Hodges reported selling all or most of its shares in 2U, Novavax

and Zoom, while keeping nearly its entire stake in Snap. It added a

1% position in DraftKings Inc., the sports-betting company whose

stock was up nearly 500% for the year in early October, but which

has since fallen by almost one-third. Hodges also put 0.5% of its

assets in Waitr Holdings Inc., a food-delivery firm whose shares

had risen about 1,600% in 2020 by early August -- but which have

since lost nearly 40%.

The firm's June letter says it will "rigorously look for

bargains." Like so many of its peers, it seems to be finding them

in the strangest places nowadays.

Write to Jason Zweig at intelligentinvestor@wsj.com

(END) Dow Jones Newswires

October 16, 2020 11:21 ET (15:21 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

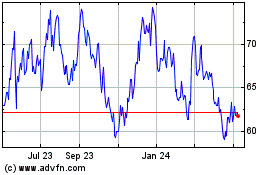

Zoom Video Communications (NASDAQ:ZM)

Historical Stock Chart

From Aug 2024 to Sep 2024

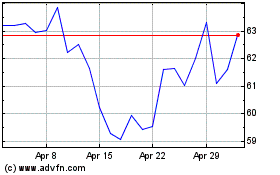

Zoom Video Communications (NASDAQ:ZM)

Historical Stock Chart

From Sep 2023 to Sep 2024