ArborCrowd Exits Sioux Falls Multifamily Portfolio Investment, Exceeds Initially Targeted Internal Rate of Return

May 18 2020 - 12:00PM

Business Wire

Real estate crowdfunding platform’s diligent

asset management approach generates strong profits for investors in

challenging market environment

ArborCrowd (the “Company”), the first crowdfunding platform

launched by a real estate institution, announced today that it has

exited its investment in the Sioux Falls Multifamily Portfolio, a

collection of Class B apartment communities located in Sioux Falls,

S.D. This strategic decision generated a net internal rate of

return (IRR) of over 16 percent, exceeding the original targeted

net IRR of 12 to 14 percent.

The Company’s decision to exit the 707-unit Sioux Falls

Multifamily Portfolio investment was based on a number of factors,

including changes the sponsor sought to make to the business plan

that could have materially impacted the initially projected returns

and investment horizon. These changes were determined to be too

much of a deviation from the original business plan, and the

Company was able to negotiate an exit from the investment that

generated strong profits for investors in a challenging market

environment.

“What sets ArborCrowd apart from our competitors is not only our

approach to sourcing and underwriting investment opportunities, but

also our commitment to active asset management and our unique

ability to identify and mitigate potential risks,” said Adam

Kaufman, Co-Founder and COO of ArborCrowd. “Our longstanding

philosophy of responsible investing doesn’t stop when we commit

capital to a deal – we closely monitor and continually evaluate

each investment throughout its lifecycle. This approach is

particularly important as we enter an economic and real estate

downcycle.”

The exit from the Sioux Falls Multifamily Portfolio after a

13-month period came well ahead of the initially projected three-

to five-year hold period. The outsized IRR generated by the sale

marks the third ArborCrowd investment to exceed its targeted IRR.

The other two investments – the Southern States Multifamily

Portfolio and Quarry Station Apartments – were realized ahead of

schedule in 2018 and 2019, respectively.

Kaufman added, “Now more than ever, it’s incumbent upon real

estate crowdfunding platforms to work even harder on behalf of

investors to monitor the performance of current investments and to

rigorously evaluate new deals they bring to the crowd – especially

as the real estate industry at large works to determine how the

current market environment will impact asset valuations. At this

point in time, we believe it is irresponsible to not take a pause

before introducing new offerings to the crowd until the initial

impact of the current economic challenges are better known.”

About ArborCrowd

ArborCrowd is the first real estate crowdfunding platform

launched by a real estate institution, opening up an exclusive

network to a new class of investors. As part of The Arbor Family of

Companies, which includes Arbor Realty Trust (NYSE: ABR), a leading

publicly traded commercial mortgage real estate investment trust,

ArborCrowd is backed by more than 30 years of leadership

experience. ArborCrowd reviews more than 500 deals a year from its

proprietary network and only chooses the ones that survive its

rigorous underwriting process. ArborCrowd prefunds capital to a

deal prior to launching the offering to investors. This ensures the

deal closes and allows ArborCrowd to offer investors accurate and

detailed information about the property. Additionally, ArborCrowd

chooses to present one deal at a time, so there is no guessing what

property investors will actually own.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200518005545/en/

Media: Megan Kivlehan – 646-677-1807

ArborCrowd@icrinc.com

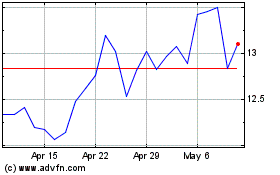

Arbor Realty (NYSE:ABR)

Historical Stock Chart

From Aug 2024 to Sep 2024

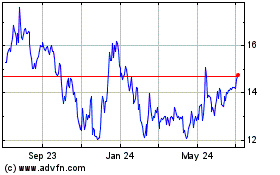

Arbor Realty (NYSE:ABR)

Historical Stock Chart

From Sep 2023 to Sep 2024