Company Further Rationalizes Expense Structure,

Positioning Acacia to Leverage Strategic Partnership with Starboard

Value to Pursue Investment Opportunities

Acacia Research Corporation (“we”, "Acacia" or "the Company")

(Nasdaq: ACTG) today reported results for the three and 12-month

periods ended December 31, 2019.

Clifford Press, Chief Executive Officer, stated, “We finished

2019 with a substantially expanded capital base, leaner cost

structure, and the opportunity to build an exceptional platform for

investing in unique transactions. We are gratified that our

shareholders strongly endorsed our strategic partnership with

Starboard Value, an ideal partner for Acacia as we work to leverage

our substantial net tax assets and implement our absolute return

investment strategy. We continue to build out our investment team

and the opportunity to put this exceptional platform to work is

only enhanced by current market conditions.”

Al Tobia, President and Chief Investment Officer, added, “Our

next area of focus is to leverage the Starboard partnership to

pursue investment opportunities with greater scale and flexibility

that can systematically grow Acacia’s book value. As we actively

explore a wide range of investment opportunities that include new

revenue streams, royalty streams, intellectual property and other

undervalued assets, we are prudently managing our cash. Acacia

maintains a unique position, with strong capitalization and

significant expertise to identify, evaluate, and monetize a wide

range of asset classes. We expect 2020 will be a year of growth as

we take concrete steps to turn this position, and our

relationships, into tangible value.”

Full-Year 2019 Financial Summary:

- Cash and short-term investments totaled $168.3 million as of

December 31, 2019, an increase from $165.5 million as of December

31, 2018.

- Gross revenues were $11.2 million.

- General and administrative expenses declined 12.6% as new

management rationalized the company’s cost structure, including

reducing rent and duplicative salaries.

- Operating loss was $23.4 million.

- GAAP net loss to common shareholders was $17.4 million or

$(0.35) per basic share.

Fourth Quarter Financial Summary:

- Gross revenues were $688,000.

- Operating loss was $7.4 million.

- GAAP net income to common shareholders was $327,000 or $0.01

per basic share.

Investor Conference Call:

The Company will host a conference call today, Thursday, March

12, 2020, to discuss these results and provide a business update at

11 a.m. ET/ 8 a.m. PT.

To access the live call, please dial (800) 367-2403 (U.S. and

Canada) or (334) 777-6978 (international) and reference conference

ID 5163391. The conference call will also be simultaneously

webcasted on the investor relations section of the Company’s

website at http://acaciaresearch.com under the events and

presentations tab. Following the conclusion of the live call, a

replay of the webcast will be available on the Company's website

for at least 30 days.

About Acacia Research Corporation

Founded in 1993, Acacia Research Corporation (ACTG) invests in

Intellectual Property Assets and partners with inventors and patent

owners to realize the financial value in their patented inventions.

Acacia bridges the gap between invention and application,

facilitating efficiency and delivering monetary rewards to the

patent owner.

Information about Acacia Research Corporation and its

subsidiaries is available at www.acaciaresearch.com.

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995

This news release contains forward-looking statements within the

meaning of the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1995. These statements are based upon our

current expectations and speak only as of the date hereof. Our

actual results may differ materially and adversely from those

expressed in any forward-looking statements as a result of various

factors and uncertainties, including the ability to successfully

implement our strategic plan, the ability to successfully build out

a new leadership team within a certain timeframe, the ability to

streamline financial reporting, the ability to successfully develop

licensing programs and attract new business, changes in demand for

current and future intellectual property rights, legislative,

regulatory and competitive developments addressing licensing and

enforcement of patents and/or intellectual property in general,

general economic conditions and the success of our investments. Our

Annual Report on Form 10-K, recent and forthcoming Quarterly

Reports on Form 10-Q, recent Current Reports on Form 8-K, and any

amendments to the forgoing, and other SEC filings discuss some of

the important risk factors that may affect our business, results of

operations and financial condition. We undertake no obligation to

revise or update publicly any forward-looking statements for any

reason.

The results achieved in the most recent quarter are not

necessarily indicative of the results to be achieved by us in any

subsequent quarters, as it is currently anticipated that Acacia

Research Corporation’s financial results will vary, and may vary

significantly, from quarter to quarter. This variance is expected

to result from a number of factors, including risk factors

affecting our results of operations and financial condition

referenced above, and the particular structure of our licensing

transactions, which may impact the amount of inventor royalties and

contingent legal fees expenses we incur from period to period.

ACACIA RESEARCH CORPORATION UNAUDITED CONSOLIDATED

BALANCE SHEETS (In thousands, except share and per share

data)

December 31,

December 31,

2019

2018

ASSETS

Current assets:

Cash and cash equivalents

$

57,359

$

128,809

Trading securities - debt

93,843

33,642

Trading securities - equity

17,140

3,012

Accounts receivable

511

32,884

Prepaid expenses and other

current assets

2,912

3,125

Total current assets

171,765

201,472

Long-term restricted cash

35,000

-

Investment at fair value

1,500

7,459

Other investments

-

8,195

Patents, net of accumulated

amortization

7,814

6,587

Leased right-of-use assets

1,264

-

Other non-current assets

818

236

Total assets

$

218,161

$

223,949

LIABILITIES, REDEEMABLE

CONVERTIBLE PREFERRED STOCK, AND STOCKHOLDERS' EQUITY

Current liabilities:

Accounts payable

$

1,765

$

3,698

Accrued expenses and other

current liabilities

7,265

4,299

Accrued compensation

507

350

Royalties and contingent legal

fees payable

2,178

22,688

Total current liabilities

11,715

31,035

Series A warrant liabilities

3,568

-

Series A embedded derivative

liabilities

17,974

-

Long-term lease liabilities

1,264

-

Other long-term liabilities

593

1,674

Total liabilities

35,114

32,709

Series A redeemable convertible

preferred stock, par value $100 per share; 350,000 shares

authorized, issued and outstanding as of December 31, 2019; no

shares authorized, issued or outstanding as of December 31,

2018

8,089

-

Stockholders' equity:

Preferred stock, par value $0.001

per share; 10,000,000 shares authorized; no shares issued or

outstanding

-

-

Common stock, par value $0.001

per share; 100,000,000 shares authorized; 50,370,987 and 49,639,319

shares issued and outstanding as of December 31, 2019 and December

31, 2018, respectively

50

50

Treasury stock, at cost,

2,919,828 shares as of December 31, 2019 and December 31, 2018

(39,272

)

(39,272

)

Additional paid-in capital

652,003

651,156

Accumulated deficit

(439,656

)

(422,541

)

Total Acacia Research Corporation

stockholders' equity

173,125

189,393

Noncontrolling interests

1,833

1,847

Total stockholders' equity

174,958

191,240

Total liabilities, redeemable

convertible preferred stock, and stockholders' equity

$

218,161

$

223,949

ACACIA RESEARCH CORPORATION UNAUDITED CONSOLIDATED

STATEMENTS OF OPERATIONS (In thousands, except share and per

share data)

Three Months Ended

Years Ended

December 31,

December 31,

2019

2018

2019

2018

Revenues

$

688

$

49,203

$

11,246

$

131,506

Portfolio operations:

Inventor royalties

192

11,002

4,944

35,168

Contingent legal fees

4

11,756

591

31,501

Patent acquisition expenses

-

-

-

4,000

Litigation and licensing expenses

- patents

1,160

1,689

7,803

8,866

Amortization of patents

857

11,560

3,194

27,120

Other portfolio expenses

1,581

400

1,756

2,602

Total portfolio operations

3,794

36,407

18,288

109,257

Net portfolio income (loss)

(3,106

)

12,796

(7,042

)

22,249

General and administrative

expenses

4,328

2,754

16,376

18,728

Impairment of patent-related

intangible assets

-

-

-

28,210

Operating income (loss)

(7,434

)

10,042

(23,418

)

(24,689

)

Other income (expense):

Change in fair value of

investment, net

277

(5,142

)

9,899

(59,103

)

Loss on sale of investment

(1,083

)

(15,390

)

(9,230

)

(19,095

)

Impairment of other

investment

-

-

(8,195

)

(1,000

)

Gain on disposal of other

investment

-

-

2,000

-

Other expense

(32

)

(629

)

(32

)

(629

)

Change in fair value of the

Series A warrant and embedded derivative

4,518

-

4,518

-

Interest income and other

2,241

149

5,505

847

Total other income (expense)

5,921

(21,012

)

4,465

(78,980

)

Loss before income taxes

(1,513

)

(10,970

)

(18,953

)

(103,669

)

Income tax benefit (expense)

2,147

(397

)

1,824

(1,179

)

Net income (loss) including

noncontrolling interests in subsidiaries

634

(11,367

)

(17,129

)

(104,848

)

Net (income) loss attributable to

noncontrolling interests in subsidiaries

-

(2

)

14

(181

)

Net income (loss) attributable to

Acacia Research Corporation

$

634

$

(11,369

)

$

(17,115

)

$

(105,029

)

Less: Accretion of redeemable

preferred stock

(307

)

-

(307

)

-

Net income (loss) attributable to common

stockholders - basic

$

327

$

(11,369

)

$

(17,422

)

$

(105,029

)

Basic net income (loss) per

common share

$

0.01

$

(0.23

)

$

(0.35

)

$

(2.10

)

Weighted average number of shares

outstanding - basic

49,875,750

49,639,172

49,764,002

49,969,062

Add: Accretion of redeemable

preferred stock

307

-

307

-

Less: Mark-to-market adjustment

for preferred stock embedded derivative

(3,258

)

-

(3,258

)

-

Net loss attributable to common

stockholders - diluted

$

(2,624

)

$

(11,369

)

$

(20,373

)

$

(105,029

)

Diluted net income (loss) per

common share

$

(0.05

)

$

(0.23

)

$

(0.40

)

$

(2.10

)

Weighted average number of shares

outstanding - diluted

54,406,835

49,639,172

50,896,773

49,969,062

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200312005240/en/

Acacia Research Investor Contact: FNK IR Rob Fink,

646-809-4048 rob@fnkir.com

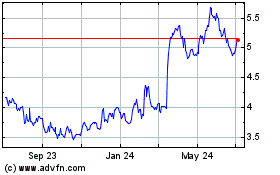

Acacia Research Technolo... (NASDAQ:ACTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

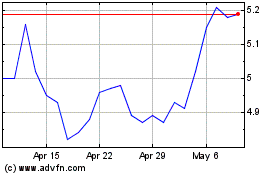

Acacia Research Technolo... (NASDAQ:ACTG)

Historical Stock Chart

From Apr 2023 to Apr 2024