Dominion Energy Turns to Cow Manure in Gas Pact -- Update

December 11 2019 - 7:50PM

Dow Jones News

By Ryan Dezember

Dominion Energy Inc. has struck a $200 million pact with a

renewable energy producer and the Dairy Farmers of America Inc. to

extract natural gas from cow manure.

The arrangement calls for the utility to fund construction of

organic-waste processing facilities called anaerobic digesters amid

clusters of large dairy farms, connect the facilities to natural

gas distribution pipelines and sell the gas. Vanguard Renewables,

of Wellesley, Mass., will build and operate the digesters, which

break down organic waste into usable fuel and fertilizer. Dairy

farmers, for a fee, will supply manure, and in some cases lease out

land upon which the equipment will be built.

It is the latest venture between big livestock concerns and

power producers aiming to generate pipeline-quality natural gas

from animal waste. Doing so results in gas that is more expensive

than that which has flooded the market from U.S. shale formations.

So-called biogas, however, is in high demand among consumers,

businesses and local governments eager to lower their emissions and

earn environmental plaudits. It can generate valuable and tradable

carbon offset credits for buyers, which can make producing biogas

worthwhile for companies like Dominion.

The utility, which serves 7.5 million customers in 18 states

with electricity or natural gas, in October enlarged to $500

million an existing deal to capture gas at Smithfield Foods Inc.

hog farms in five states. Last month, Perdue Farms Inc. and a

Maryland renewable energy company said they were building a

digester in Delaware to break down fat, sludge and offal from

poultry slaughterhouses into gas.

Twelve years ago, the cutting edge of utilities' efforts to

reduce emissions involved stretching tarps over manure lagoons to

trap the methane fumes so they could be funneled to a flare and

burned instead of just wafting to the clouds.

The advent of markets for carbon offset credits -- and the

urgency with which investors and governments are pushing companies

to reduce or counter their greenhouse-gas emissions -- has

increased the appeal of biogas. Demand is growing even though it

often costs many times more than gas produced by drillers, which is

about $2.25 per million British thermal units lately.

Methane, which cattle produce in abundance thanks to their

multichambered stomachs, is a particularly potent greenhouse gas.

The methane from the manure of a typical cow is roughly equivalent

to the annual emissions of a car that gets about 20 miles per

gallon and is driven 12,000 miles.

"It's an entire strategy on how we're approaching sustainability

and greenhouse-gas reductions," said Diane Leopold, co-chief

operating officer at Dominion. "We're looking to be a leader in

clean energy."

The anaerobic digesters are to be built over the next five years

around clusters of dairy farms in Georgia, Nevada, Colorado, New

Mexico and Utah. Each digester needs the manure of 20,000 to 30,000

cattle to be economical, said Ryan Childress, director of gas

business development at the utility. Dominion expects the

facilities to produce 1 billion cubic feet of gas annually. Though

just a sliver of total U.S. output, that is still enough to power

thousands of homes.

Vanguard Renewables has built five digesters in Massachusetts,

is building one in Vermont and is in the permitting stage for

another in New York. The gas has been sold to companies as well as

a city and a Vermont college. Kevin Chase, Vanguard's chief

investment officer, said the company found a receptive audience

among dairy farmers as it sought participants for the Dominion

venture.

"A lot of the dairies that we're talking to are going through

succession plans and the younger dairymen coming through are all

about being good stewards of the environment," Mr. Chase said.

"They're also looking at ways to diversify their balance

sheet."

Most digesters on dairies have been built and operated by

farmers, which had limited appeal among Dairy Farmers of America's

roughly 8,000 farm owners for the expense and operational

complexity involved, said David Darr, the cooperative's chief

strategy and sustainability officer. The prospect of having third

parties handle gas production and sales while earning fees for the

manure is more enticing, he said. Plus, the farmers get their

manure back once the methane is gone so that they can fertilize

with it.

"You still have access to those nutrients for cropping

operations," he said. "This is just to have an additional harvest,

to capture that methane that would otherwise just be emitted into

the environment."

Write to Ryan Dezember at ryan.dezember@wsj.com

(END) Dow Jones Newswires

December 11, 2019 19:35 ET (00:35 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

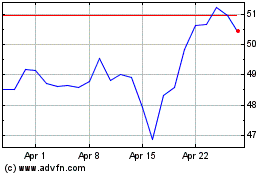

Dominion Energy (NYSE:D)

Historical Stock Chart

From Mar 2024 to Apr 2024

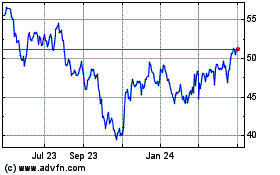

Dominion Energy (NYSE:D)

Historical Stock Chart

From Apr 2023 to Apr 2024