Current Report Filing (8-k)

December 02 2019 - 2:37PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF

REPORT: December 2, 2019

US Nuclear Corp.

(EXACT NAME OF REGISTRANT AS SPECIFIED

IN CHARTER)

|

|

|

|

|

|

|

Delaware

|

|

000-54617

|

|

45-4535739

|

|

(STATE OR OTHER JURISDICTION OF

INCORPORATION OR ORGANIZATION)

|

|

(COMMISSION FILE NO.)

|

|

(IRS EMPLOYEE IDENTIFICATION NO.)

|

7051 Eton Avenue

Canoga Park, CA 91303

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

(818) 883-7043

(ISSUER TELEPHONE NUMBER)

N/A

(FORMER NAME OR FORMER ADDRESS, IF CHANGED

SINCE LAST REPORT)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

|

¨

|

Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting

Material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter. ☒

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

SECTION 1 – REGISTRANT'S

BUSINESS AND OPERATIONS

Item 1.01 Entry into a Material Definitive

Agreement

On November 25, 2019, US

Nuclear Corp., a Delaware corporation (the “Corporation”) closed on a Securities Purchase Agreement (the “SPA”)

with YA II PN, Ltd., a Cayman Islands limited company (“YA”). Pursuant to the terms of the SPA, YA purchased

$500,000 of debentures convertible into shares of common stock under Section 4 of the “Convertible Debenture” attached

at Exhibit A to the SPA. In connection with the purchase of the Convertible Debenture, the Corporation issued a warrant to

YA for the purchase of 333,333 shares of common stock in the Corporation at an exercise price of $1.50/share (the “Warrant”).

The Warrant terminates on November 25, 2022. The shares subject to the Warrant (the “Warrant Shares”) are on

reserve with the transfer agent for the Corporation. Unless otherwise registered at the time of exercise, the Warrant Shares

are restricted securities subject to restrictions against public resale. The SPA, Convertible Debenture and Warrant were

authorized by consent resolution of the Board of Directors as being in the best interests of the Corporation. There is no

material relationship between the Corporation or its affiliates and YA or its affiliates. The reader is directed to Item

9.01(d) for review of the SPA, Convertible Debenture and Warrant.

SECTION 9 – FINANCIAL STATEMENTS

AND EXHIBITS

Item 9.01 Financial Statement and Exhibits.

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto

duly authorized.

U.S. Nuclear, Inc.

By: /s/ Robert Goldstein

Name: Robert Goldstein

Title: Chief Executive Officer and President

Dated: December 2, 2019

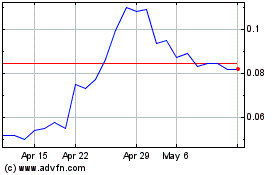

US Nuclear (QB) (USOTC:UCLE)

Historical Stock Chart

From Mar 2024 to Apr 2024

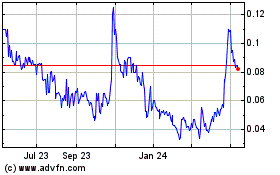

US Nuclear (QB) (USOTC:UCLE)

Historical Stock Chart

From Apr 2023 to Apr 2024