U.S. Companies' Cash Piles Set to Shrink in 2019 -- Moody's

November 14 2019 - 7:45PM

Dow Jones News

U.S. companies outside the financial sector are expected to hold

less cash this year than in 2018 as they repay debt and return cash

to shareholders, according to Moody's Investors Service.

Cash holdings are set to decrease to $1.56 trillion at the end

of 2019, compared with $1.69 trillion in 2018, it said.

Technology companies remain the biggest holders of cash. Apple

Inc., Alphabet Inc., Amazon.com Inc., Cisco Systems Inc., Facebook

Inc., Oracle Corp. and Microsoft Corp. are expected to hold a

combined $638 billion in cash through 2019, a decline of 1% for the

seven companies compared with the prior year, Moody's said.

Revenue, cash flow from operations, capital spending and

investments for research and development are set to rise at those

technology companies, while share buybacks and debt are expected to

fall, according to Richard Lane, a Moody's senior vice

president.

Cash allocation policies at those technology firms aren't

representative of what other large U.S. companies are planning to

do, Mr. Lane said. "These companies do not alter their strategy

because of tax reform or the economic outlook."

Other firms might adjust their strategy to hoard cash again in

the face of heightened uncertainty because of trade tensions,

Britain's planned exit from the European Union and political

unrest, Mr. Lane said.

Write to Nina Trentmann at Nina.Trentmann@wsj.com

(END) Dow Jones Newswires

November 14, 2019 19:30 ET (00:30 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

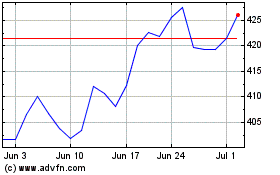

Moodys (NYSE:MCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Moodys (NYSE:MCO)

Historical Stock Chart

From Apr 2023 to Apr 2024