UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

31 OCTOBER 2019

Commission File number 001-15246

LLOYDS BANKING GROUP plc

(Translation of registrant's name into English)

25 Gresham Street

London

EC2V 7HN

United Kingdom

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b) (1) ________.

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b) (7) ________.

This report on Form 6-K shall be deemed incorporated

by reference into the company's Registration Statement on Form F-3 (File No. 333-231902) and to be a part thereof from the date

on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

FORWARD LOOKING STATEMENTS

This document contains certain forward looking

statements with respect to the business, strategy, plans and/or results of the Group and its current goals and expectations relating

to its future financial condition and performance. Statements that are not historical facts, including statements about the Group's

or its directors' and/or management's beliefs and expectations, are forward looking statements. By their nature, forward looking

statements involve risk and uncertainty because they relate to events and depend upon circumstances that will or may occur in the

future. Factors that could cause actual business, strategy, plans and/or results (including but not limited to the payment of dividends)

to differ materially from forward looking statements made by the Group or on its behalf include, but are not limited to: general

economic and business conditions in the UK and internationally; market related trends and developments; fluctuations in interest

rates, inflation, exchange rates, stock markets and currencies; any impact of the transition from IBORs to alternative reference

rates; the ability to access sufficient sources of capital, liquidity and funding when required; changes to the Group's credit

ratings; the ability to derive cost savings and other benefits including, but without limitation as a result of any acquisitions,

disposals and other strategic transactions; the ability to achieve strategic objectives; changing customer behaviour including

consumer spending, saving and borrowing habits; changes to borrower or counterparty credit quality; concentration of financial

exposure; management and monitoring of conduct risk; instability in the global financial markets, including Eurozone instability,

instability as a result of uncertainty surrounding the exit by the UK from the European Union (EU) and as a result of such exit

and the potential for other countries to exit the EU or the Eurozone and the impact of any sovereign credit rating downgrade or

other sovereign financial issues; political instability including as a result of any UK general election; technological changes

and risks to the security of IT and operational infrastructure, systems, data and information resulting from increased threat of

cyber and other attacks; natural, pandemic and other disasters, adverse weather and similar contingencies outside the Group's control;

inadequate or failed internal or external processes or systems; acts of war, other acts of hostility, terrorist acts and responses

to those acts, geopolitical, pandemic or other such events; risks relating to climate change; changes in laws, regulations, practices

and accounting standards or taxation, including as a result of the exit by the UK from the EU, or a further possible referendum

on Scottish independence; changes to regulatory capital or liquidity requirements and similar contingencies outside the Group's

control; the policies, decisions and actions of governmental or regulatory authorities or courts in the UK, the EU, the US or elsewhere

including the implementation and interpretation of key legislation and regulation together with any resulting impact on the future

structure of the Group; the ability to attract and retain senior management and other employees and meet its diversity objectives;

actions or omissions by the Group's directors, management or employees including industrial action; changes to the Group's post-retirement

defined benefit scheme obligations; the extent of any future impairment charges or write-downs caused by, but not limited to, depressed

asset valuations, market disruptions and illiquid markets; the value and effectiveness of any credit protection purchased by the

Group; the inability to hedge certain risks economically; the adequacy of loss reserves; the actions of competitors, including

non-bank financial services, lending companies and digital innovators and disruptive technologies; and exposure to regulatory or

competition scrutiny, legal, regulatory or competition proceedings, investigations or complaints. Please refer to the latest Annual

Report on Form 20-F filed with the US Securities and Exchange Commission for a discussion of certain factors and risks together

with examples of forward looking statements. Except as required by any applicable law or regulation, the forward looking statements

contained in this document are made as of today's date, and the Group expressly disclaims any obligation or undertaking to release

publicly any updates or revisions to any forward looking statements contained in this document to reflect any change in the Group’s

expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. The

information, statements and opinions contained in this document do not constitute a public offer under any applicable law or an

offer to sell any securities or financial instruments or any advice or recommendation with respect to such securities or financial

instruments.

EXPLANATORY NOTE

This report on Form 6-K contains the interim

report of Lloyds Banking Group plc, which includes the unaudited consolidated interim results for the nine months ended 30 September

2019, and is being incorporated by reference into the Registration Statement with File No. 333-231902.

BASIS OF PRESENTATION

This release covers the results of Lloyds

Banking Group plc (the Company) together with its subsidiaries (the Group) for the nine months ended 30 September 2019.

Accounting policies

Except as noted below, the accounting policies

are consistent with those applied by the Group in its 2018 Annual Report and Accounts.

The Group adopted IFRS 16 Leases from 1

January 2019 and as permitted elected to apply the standard retrospectively with the cumulative effect of initial application being

recognised at that date; as required under this option comparative information has not been restated. Upon initial application

the Group recognised a right-of-use asset of £1.7 billion (after offsetting existing lease liabilities) and a corresponding

lease obligation of £1.8 billion; there was no impact on shareholders’ equity.

The Group has also implemented the amendments

to IAS 12 Income Taxes with effect from 1 January 2019 and as a result tax relief on distributions on other equity instruments,

previously recognised in equity, is now reported within the tax charge in the income statement. Comparatives have been restated,

reducing the tax charge and increasing profit for the nine months ended 30 September 2018 by £76 million; there is no impact

on shareholders’ equity or earnings per share.

FINANCIAL REVIEW

Income statement

In the nine months to 30 September 2019

the Group reported a profit before tax of £2,947 million compared to £4,934 million in same period of 2018, representing

a decrease of £1,987 million which was largely driven by an additional £1,800 million payment protection insurance

(PPI) charge taken in the third quarter of the period.

Profit for the period, after tax, was £1,987

million reflecting an effective tax rate of 32.6 per cent, up 8.4 per cent from 24.2 per cent in prior year principally due

to non-deductible components of the additional PPI charge in the third quarter which more than offset a benefit from the release

of a deferred tax liability in the first half of 2019.

Total income, net of insurance claims fell

by £530 million, or 4 per cent, to £13,778 million in the first nine months of 2019 compared to £14,308 million

in the first nine months of 2018 with the benefit of increased other income being more than offset by both a reduction in net interest

income and an increase in insurance claims in the period.

Net interest income was £7,425 million,

down £1,713 million or 19 per cent, compared to £9,138 million in the prior year. Included within the net interest

income for the period was £1,557 million of interest expense payable to minority unit holders of the Group’s consolidated

Open-Ended Investment Companies (OEICs), representing an increase of £1,297 million from £260 million in 2018 reflecting

the strong performance of UK equity markets in the period compared to the prior year. Excluding interest expense relating to OEICs

net interest income was down £416 million reflecting a slightly lower net interest margin with the benefit of lower deposit

costs, higher current account balances and a small benefit from aligning MBNA credit card terms to other brands across the Group

being more than offset by continued pressure on asset margins. Average interest-earning banking assets also fell with growth in

targeted segments being more than offset by lower balances in the closed mortgage book and the sale of the Irish mortgage portfolio

in the first half of 2018.

Other income grew by £13,336 million

to £26,367 million in the period driven by a significant increase in net trading income which grew from £2,899 million

in the first nine months of 2018 to £16,501 million in 2019 reflecting the impact of market gains on policyholder investments

held within the Group’s insurance business.

Insurance claims were up significantly on

prior year at £20,014 million compared to £7,861 million in the first nine months of 2018 predominantly reflecting

the movements in the Group’s liabilities arising from insurance and investment contracts as markets performed well in 2019

in comparison to the prior year.

Total operating expenses increased by £1,243

million on prior year to £9,881 million compared to £8,638 million in the first nine months of 2018 with the benefit

of increased efficiency, process improvements and reduced restructuring costs reflecting the completion of both the MBNA integration

and the ring-fencing programme being more than offset by the additional PPI charges taken in 2019. The total PPI provision charge

for the period of £2,450 million included an additional charge of £1,800 million in the quarter, reflecting the significant

increase in PPI information requests (PIRs) leading up to the deadline for submission of claims on 29 August 2019, a PPI provision

linked to the Official Receiver and associated administration costs. The assessment of PIR volumes is now complete and this charge

reflects this and the most recent data in terms of quality, which remains low, averaging around 10 per cent.

The Group’s impairment charge, which

assumes an orderly exit of the UK from the European Union, was £214 million higher at £950 million compared to

£736 million in the first nine months of 2018, with the increase primarily driven by a single large corporate charge in the

third quarter and lower used car prices impacting the Group’s leasing business.

FINANCIAL REVIEW (continued)

Balance sheet and capital

The Group’s total assets as at 30

September 2019 were £858,543 million representing an increase on 31 December 2018 of £60,945 million. Financial assets

at amortised cost of £518,993 million were up £22,614 million from £496,379 million driven by a £17,943

million increase in loans and advances to customers largely attributable to growth in customer reverse repurchase agreements. The

Group experienced lending growth in targeted segments, including the open mortgage book, SME and Motor Finance which was offset

by reductions in the closed mortgage book and Global Corporates and Financial Institutions. The open mortgage book grew by £6.1 billion

driven by a £3.7 billion acquisition of the Tesco Bank’s residential mortgage book in the third quarter and £2.4 billion

of organic growth. Financial assets at fair value through profit or loss increased £8,424 million compared to the year-end

to £166,953 million with increases in policyholder investments reflecting both market gains and the acquisition of Zurich’s

UK workplace pensions and savings business. Other assets were £22,248 million higher at £61,865 million from £39,617

million at 31 December 2018 and included an increase in assets arising from reinsurance contracts held of £14,827 million,

increases in settlement balances of £4,341 million and a £1,345 million increase in property, plant and equipment

and other intangible assets as the Group recognised a right-of-use asset of £1,716 million upon the adoption of IFRS 16 on

1 January 2019.

The Group’s total liabilities as at

30 September 2019 were £810,416 million, up £63,017 million from £747,399 million at 31 December 2018. Customer

deposits of £420,916 million increased £2,850 million compared to the year-end with growth in retail current accounts

and commercial deposits being partly offset by reductions in wealth and retail savings. Debt securities in issue increased £12,368

million to £103,536 million at the period end compared to £91,168 million at 31 December 2018 as the Group diversified

funding sources. Liabilities arising from insurance and investment contracts were £34,091 million higher than at 31 December

2018 at £146,818 million reflecting both a £22 billion increase as part of the Zurich UK workplace pensions and savings

business acquisition and £12 billion underlying increase as related policyholder assets performed well in 2019. Other liabilities

grew by £7,000 million to £32,542 million and included increases in settlement balances of £3,701 million and

the recognition of a £1,813 million lease liability as the Group adopted IFRS 16.

Total equity of the Group decreased to £48,127

million from £50,199 million at 31 December 2018 as dividends and distributions on other equity instruments, the impact of

the Group’s share buyback programme and the redemption of other equity instruments offset total comprehensive income for

the period of £2,566 million. In September 2019 the Group announced the cancellation of the remaining c. £650 million

of the 2019 share buyback programme. In addition the Group recently received notification from the UK Prudential Regulation Authority

(PRA) that its Pillar 2A capital requirement has reduced from c.2.7 per cent to c.2.6 per cent of common equity tier 1 capital.

The Group’s common equity tier 1 capital

ratio reduced to 13.5 per cent (31 December 2018: 14.6 per cent), partly reflecting reductions in shareholders’ equity. The

tier 1 capital ratio reduced to 16.3 per cent (31 December 2018: 18.2 per cent), reflecting the reduction in common equity and

a net redemption of tier 1 capital instruments, and the total capital ratio reduced to 21.4 per cent (31 December 2018: 22.9

per cent).

Risk-weighted assets increased by £2,704

million, or 1 per cent, to £209,070 million at 30 September 2019, compared to £206,366 million at 31 December 2018,

driven primarily by the implementation of IFRS 16, mortgage model updates and the acquisition of the Tesco mortgage portfolio,

offset in part through further optimisation of the Commercial Banking portfolio.

The Group’s UK leverage ratio reduced

to 4.9 per cent (31 December 2018: 5.5 per cent).

Outlook

In the first nine months of 2019 the Group

made strategic progress and delivered a solid financial performance in a challenging environment. The Group will maintain its prudent

approach to growth and risk whilst continuing to focus on reducing costs and investing in the business. Although continued economic

uncertainty could further impact the outlook, the Group remains well placed to support its customers and continue to help Britain

prosper.

CONSOLIDATED INCOME STATEMENT

|

|

|

Nine

months

|

|

Nine

months

|

|

|

|

ended

|

|

ended

|

|

|

|

30 Sept

|

|

30 Sept

|

|

|

|

|

2019

|

|

|

|

20181

|

|

|

|

|

|

£m

|

|

|

|

£m

|

|

|

|

|

|

(unaudited)

|

|

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income

|

|

|

7,425

|

|

|

|

9,138

|

|

|

Other income

|

|

|

26,367

|

|

|

|

13,031

|

|

|

Total income

|

|

|

33,792

|

|

|

|

22,169

|

|

|

Insurance claims

|

|

|

(20,014

|

)

|

|

|

(7,861

|

)

|

|

Total income, net of insurance claims

|

|

|

13,778

|

|

|

|

14,308

|

|

|

Total operating expenses

|

|

|

(9,881

|

)

|

|

|

(8,638

|

)

|

|

Trading surplus

|

|

|

3,897

|

|

|

|

5,670

|

|

|

Impairment

|

|

|

(950

|

)

|

|

|

(736

|

)

|

|

Profit before tax

|

|

|

2,947

|

|

|

|

4,934

|

|

|

Taxation

|

|

|

(960

|

)

|

|

|

(1,194

|

)

|

|

Profit for the period

|

|

|

1,987

|

|

|

|

3,740

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit attributable to ordinary shareholders

|

|

|

1,572

|

|

|

|

3,348

|

|

|

Profit attributable to other equity holders

|

|

|

361

|

|

|

|

309

|

|

|

Profit attributable to equity holders

|

|

|

1,933

|

|

|

|

3,657

|

|

|

Profit attributable to non-controlling interests

|

|

|

54

|

|

|

|

83

|

|

|

Profit for the period

|

|

|

1,987

|

|

|

|

3,740

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share

|

|

|

2.2

|

p

|

|

|

4.7

|

p

|

|

1

|

Restated. See basis of presentation.

|

CONSOLIDATED BALANCE SHEET

|

|

|

At 30 Sept

|

|

At 31 Dec

|

|

|

|

2019

|

|

2018

|

|

|

|

£m1

|

|

£m

|

|

|

|

(unaudited)

|

|

(audited)

|

|

Assets

|

|

|

|

|

|

Cash and balances at central banks

|

|

|

52,790

|

|

|

|

54,663

|

|

|

Financial assets at fair value through profit or loss

|

|

|

166,953

|

|

|

|

158,529

|

|

|

Derivative financial instruments

|

|

|

30,639

|

|

|

|

23,595

|

|

|

Financial assets at amortised cost

|

|

|

518,993

|

|

|

|

496,379

|

|

|

Financial assets at fair value through other comprehensive income

|

|

|

27,303

|

|

|

|

24,815

|

|

|

Other assets

|

|

|

61,865

|

|

|

|

39,617

|

|

|

Total assets

|

|

|

858,543

|

|

|

|

797,598

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

Deposits from banks

|

|

|

33,131

|

|

|

|

30,320

|

|

|

Customer deposits

|

|

|

420,916

|

|

|

|

418,066

|

|

|

Financial liabilities at fair value through profit or loss

|

|

|

26,441

|

|

|

|

30,547

|

|

|

Derivative financial instruments

|

|

|

28,617

|

|

|

|

21,373

|

|

|

Debt securities in issue

|

|

|

103,536

|

|

|

|

91,168

|

|

|

Liabilities arising from insurance and investment contracts

|

|

|

146,818

|

|

|

|

112,727

|

|

|

Subordinated liabilities

|

|

|

18,415

|

|

|

|

17,656

|

|

|

Other liabilities

|

|

|

32,542

|

|

|

|

25,542

|

|

|

Total liabilities

|

|

|

810,416

|

|

|

|

747,399

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ equity

|

|

|

42,530

|

|

|

|

43,434

|

|

|

Other equity interests

|

|

|

5,406

|

|

|

|

6,491

|

|

|

Non-controlling interests

|

|

|

191

|

|

|

|

274

|

|

|

Total equity

|

|

|

48,127

|

|

|

|

50,199

|

|

|

Total equity and liabilities

|

|

|

858,543

|

|

|

|

797,598

|

|

|

1

|

Reflects adoption of IFRS 16. See basis of presentation.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of

1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorised.

|

LLOYDS BANKING GROUP plc

|

|

|

|

|

|

|

By:

|

/s/ W Chalmers

|

|

|

Name:

|

William Chalmers

|

|

|

Title:

|

Chief Financial Officer

|

|

|

|

|

|

|

Dated:

|

31 October 2019

|

|

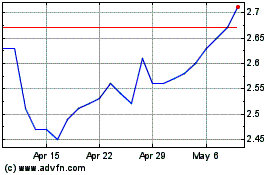

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Mar 2024 to Apr 2024

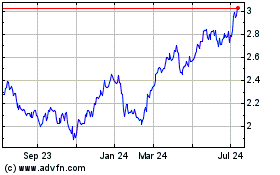

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Apr 2023 to Apr 2024