Investor AB Posts Third Quarter Shareholder Return of 8%

October 18 2019 - 3:28AM

Dow Jones News

By Dominic Chopping

STOCKHOLM--Investor AB (INVE-B.SK) on Friday reported a sharp

drop in third-quarter profit as the valuations of its investments

fell, while its investments generated a total shareholder return of

8%.

Investor's net asset value rose to 507 Swedish kronor ($52.04)

at the end of September 2019 from SEK479 at the end of June. On an

adjusted basis, the NAV stood at SEK596. Net profit fell to

SEK20.64 billion in the third quarter from SEK25.6 billion a year

earlier.

"While the third quarter 2019 turned out strong for Investor, we

are likely entering a period of softer macroeconomic activity,"

said Chief Executive Johan Forssell.

On a macro level, leading indicators have continued to weaken

and the uncertainties relating to trade wars and Brexit linger, he

added.

"In this environment, our top priority is to secure agility in

our companies and financial flexibility at Investor."

Investor is the investment vehicle of Sweden's prominent

Wallenberg family and owns stakes in some of the country's largest

companies, including telecom giant Ericsson AB (ERIC), home

appliance manufacturer Electrolux AB (ELUX-B.SK) and lender

Skandinaviska Enskilda Banken AB (SEB-A.SK).

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

October 18, 2019 03:13 ET (07:13 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

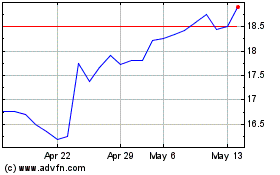

Atlas Copco (PK) (USOTC:ATLKY)

Historical Stock Chart

From Mar 2024 to Apr 2024

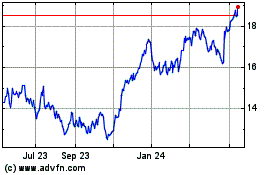

Atlas Copco (PK) (USOTC:ATLKY)

Historical Stock Chart

From Apr 2023 to Apr 2024