Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

August 08 2019 - 6:08AM

Edgar (US Regulatory)

Free Writing Prospectus

Filed Pursuant to Rule 433

Registration Statement No. 333-233042

Dated August 7, 2019

Supplementing the

Preliminary Prospectus Supplements

Dated August 6, 2019

(To the Prospectus Dated August 6, 2019)

PRICING TERM SHEET

August 7, 2019

Mesa Laboratories, Inc.

Offerings of

375,000 shares of Common Stock

and

$150,000,000 Aggregate Principal Amount of

1.375% Convertible Senior Notes due 2025

The information in this pricing term sheet supplements the preliminary prospectus supplement, dated August 6, 2019 (the “Common Stock Offering Preliminary Prospectus Supplement”), of Mesa Laboratories, Inc. (the “Issuer”), relating to an offering of common stock, no par value per share (the “Common Stock”), of the Issuer (the “Common Stock Offering”), and the preliminary prospectus supplement, dated August 6, 2019 (the “Notes Offering Preliminary Prospectus Supplement,” and, together with the Common Stock Offering Preliminary Prospectus Supplement, the “Preliminary Prospectus Supplements”), of the Issuer, relating to an offering of the Issuer’s 1.375% Convertible Senior Notes due 2025 (the “Notes Offering”). The information in this pricing term sheet supersedes the information in the Preliminary Prospectus Supplements to the extent inconsistent with the information in the Preliminary Prospectus Supplements. Terms used, but not defined, in this pricing term sheet have the respective meanings set forth in the applicable Preliminary Prospectus Supplement. As used in this pricing term sheet, “Issuer,” “we,” “our” and “us” refer to Mesa Laboratories, Inc. and not to its subsidiaries.

The Common Stock Offering and the Notes Offering are separate offerings that are being made pursuant to separate prospectus supplements. The closing of the Common Stock Offering is not conditioned upon the closing of the Notes Offering, and the closing of the Notes Offering is not conditioned upon the closing of the Common Stock Offering.

Common Stock Offering

|

Issuer

|

|

Mesa Laboratories, Inc.

|

|

|

|

|

|

Shares Offered

|

|

375,000 shares of Common Stock (or, if the underwriters of the Common Stock Offering fully exercise their option to purchase additional shares of Common Stock, 431,250 shares of Common

|

1

|

|

|

Stock).

|

|

|

|

|

|

Public Offering Price

|

|

$210.00 per share of Common Stock.

|

|

|

|

|

|

Ticker / Exchange

|

|

MLAB / The Nasdaq Global Select Market (“NASDAQ”).

|

|

|

|

|

|

Underwriting Discount

|

|

$12.60 per share of Common Stock, and $4,725,000 in the aggregate (or $5,433,750 in the aggregate, if the underwriters of the Common Stock Offering fully exercise their option to purchase additional shares of Common Stock).

|

|

|

|

|

|

Trade Date

|

|

August 8, 2019.

|

|

|

|

|

|

Settlement Date

|

|

August 12, 2019.

|

|

|

|

|

|

Use of Proceeds

|

|

The Issuer estimates that the net proceeds from the Common Stock Offering will be approximately $73.9 million (or approximately $85.0 million, if the underwriters of the Common Stock Offering fully exercise their option to purchase additional shares of Common Stock), after deducting the underwriting discounts and other estimated offering expenses payable by the Issuer.

|

|

|

|

|

|

|

|

The Issuer intends to use the net proceeds from the Common Stock Offering and the Notes Offering to continue its acquisition strategy and for general corporate purposes. Consistent with the Issuer’s growth strategy, the Issuer evaluates opportunities to acquire complementary businesses on an ongoing basis. As of the date of this pricing term sheet, the Issuer has not entered into any agreement to acquire any business that has not been previously disclosed. Pending use of the net proceeds as described above, the Issuer intends to invest the net proceeds in highly liquid cash equivalents or U.S. government securities. If the aggregate net proceeds exceed the amount the Issuer uses to fund acquisitions, the Issuer intends to use such excess proceeds for general corporate purposes, which may include repaying amounts borrowed under the Credit Facility.

|

|

|

|

|

|

|

|

See “Use of Proceeds” in the Common Stock Offering Preliminary Prospectus Supplement for a more complete description of the intended use of proceeds.

|

|

|

|

|

|

Joint Book-Running Managers

|

|

Jefferies LLC

|

|

|

|

J.P. Morgan Securities LLC

|

|

|

|

Evercore Group L.L.C.

|

2

|

Lead Manager

|

|

Janney Montgomery Scott LLC

|

Notes Offering

|

Issuer

|

|

Mesa Laboratories, Inc.

|

|

|

|

|

|

Notes

|

|

1.375% convertible senior notes due 2025 (the “Notes”).

|

|

|

|

|

|

Principal Amount

|

|

$150,000,000 (or $172,500,000, if the underwriters fully exercise their option to purchase additional Notes) aggregate principal amount of Notes.

|

|

|

|

|

|

Public Offering Price

|

|

100% of the principal amount of the Notes, plus accrued interest, if any, from the Settlement Date.

|

|

|

|

|

|

Ticker / Exchange for Common Stock

|

|

MLAB / NASDAQ.

|

|

|

|

|

|

Trade Date

|

|

August 8, 2019.

|

|

|

|

|

|

Settlement Date

|

|

August 12, 2019.

|

|

|

|

|

|

Underwriting Discount

|

|

3.00% of the principal amount of the Notes, and $4,500,000 in the aggregate (or $5,175,000 in the aggregate, if the underwriters of the Notes Offering fully exercise their option to purchase additional Notes).

|

|

|

|

|

|

Maturity Date

|

|

August 15, 2025, unless earlier repurchased or converted.

|

|

|

|

|

|

Stated Interest Rate

|

|

1.375% per annum.

|

|

|

|

|

|

Interest Payment Dates

|

|

February 15 and August 15 of each year, beginning on February 15, 2020.

|

|

|

|

|

|

Record Dates

|

|

February 1 and August 1.

|

|

|

|

|

|

Last Reported Sale Price per Share of Common Stock on NASDAQ on August 7, 2019

|

|

$222.01.

|

|

|

|

|

|

Conversion Premium

|

|

Approximately 35% above the Public Offering Price per share of Common Stock in the Common Stock Offering.

|

|

|

|

|

|

Initial Conversion Price

|

|

Approximately $283.50 per share of Common Stock.

|

3

|

Initial Conversion Rate

|

|

3.5273 shares of Common Stock per $1,000 principal amount of Notes.

|

|

|

|

|

|

No Optional Redemption

|

|

The Issuer will not have the right to redeem the Notes before the Maturity Date.

|

|

|

|

|

|

Use of Proceeds

|

|

The Issuer estimates that the net proceeds from the Notes Offering will be approximately $145.4 million (or approximately $167.2 million, if the underwriters of the Notes Offering fully exercise their option to purchase additional Notes) after deducting the underwriting discounts and other estimated offering expenses payable by the Issuer.

|

|

|

|

|

|

|

|

The Issuer intends to use the net proceeds from the Notes Offering and the Common Stock Offering to continue its acquisition strategy and for general corporate purposes. Consistent with the Issuer’s growth strategy, the Issuer evaluates opportunities to acquire complementary businesses on an ongoing basis. As of the date of this pricing term sheet, the Issuer has not entered into any agreement to acquire any business that has not been previously disclosed. Pending use of the net proceeds as described above, the Issuer intends to invest the net proceeds in highly liquid cash equivalents or U.S. government securities. If the aggregate net proceeds exceed the amount the Issuer uses to fund acquisitions, the Issuer intends to use such excess proceeds for general corporate purposes, which may include repaying amounts borrowed under the Credit Facility.

|

|

|

|

|

|

|

|

See “Use of Proceeds” in the Notes Offering Preliminary Prospectus Supplement for a more complete description of the intended use of proceeds.

|

|

|

|

|

|

Joint Book-Running Managers

|

|

Jefferies LLC

|

|

|

|

J.P. Morgan Securities LLC

|

|

|

|

Wells Fargo Securities, LLC

|

|

|

|

|

|

CUSIP / ISIN Numbers

|

|

59064R AA7 / US59064RAA77.

|

|

|

|

|

|

Increase to Conversion Rate in Connection with a Make-Whole Fundamental Change

|

|

If a make-whole fundamental change occurs and the conversion date for the conversion of a Note occurs during the related make-

|

4

|

|

|

whole fundamental change conversion period, then, subject to the provisions described in the Notes Offering Preliminary Prospectus Supplement under the caption “Description of Notes—Conversion Rights—Increase in Conversion Rate in Connection with a Make-Whole Fundamental Change,” the conversion rate applicable to such conversion will be increased by a number of shares set forth in the table below corresponding (after interpolation, as described below) to the effective date and the stock price of such make-whole fundamental change:

|

|

|

|

Stock Price

|

|

|

Effective Date

|

|

$210.00

|

|

$250.00

|

|

$283.50

|

|

$325.00

|

|

$375.00

|

|

$425.00

|

|

$500.00

|

|

$600.00

|

|

$700.00

|

|

$800.00

|

|

$950.00

|

|

$1,200.00

|

|

|

August 12, 2019

|

|

1.2346

|

|

0.9499

|

|

0.7270

|

|

0.5349

|

|

0.3799

|

|

0.2755

|

|

0.1751

|

|

0.0979

|

|

0.0541

|

|

0.0282

|

|

0.0084

|

|

0.0000

|

|

|

August 15, 2020

|

|

1.2346

|

|

0.9323

|

|

0.7026

|

|

0.5075

|

|

0.3527

|

|

0.2506

|

|

0.1545

|

|

0.0829

|

|

0.0437

|

|

0.0213

|

|

0.0052

|

|

0.0000

|

|

|

August 15, 2021

|

|

1.2346

|

|

0.9023

|

|

0.6656

|

|

0.4681

|

|

0.3154

|

|

0.2174

|

|

0.1285

|

|

0.0649

|

|

0.0318

|

|

0.0140

|

|

0.0022

|

|

0.0000

|

|

|

August 15, 2022

|

|

1.2346

|

|

0.8559

|

|

0.6120

|

|

0.4136

|

|

0.2658

|

|

0.1748

|

|

0.0965

|

|

0.0444

|

|

0.0194

|

|

0.0067

|

|

0.0004

|

|

0.0000

|

|

|

August 15, 2023

|

|

1.2346

|

|

0.7855

|

|

0.5326

|

|

0.3361

|

|

0.1983

|

|

0.1200

|

|

0.0587

|

|

0.0229

|

|

0.0078

|

|

0.0012

|

|

0.0003

|

|

0.0000

|

|

|

August 15, 2024

|

|

1.2346

|

|

0.6711

|

|

0.4049

|

|

0.2164

|

|

0.1034

|

|

0.0508

|

|

0.0193

|

|

0.0055

|

|

0.0008

|

|

0.0006

|

|

0.0003

|

|

0.0000

|

|

|

August 15, 2025

|

|

1.2346

|

|

0.4727

|

|

0.0000

|

|

0.0000

|

|

0.0000

|

|

0.0000

|

|

0.0000

|

|

0.0000

|

|

0.0000

|

|

0.0000

|

|

0.0000

|

|

0.0000

|

|

If such effective date or stock price is not set forth in the table above, then:

·

if such stock price is between two stock prices in the table above or the effective date is between two dates in the table above, then the number of additional shares will be determined by a straight-line interpolation between the numbers of additional shares set forth for the higher and lower stock prices in the table above or the earlier and later dates in the table above, based on a 365- or 366-day year, as applicable; and

·

if the stock price is greater than $1,200.00 (subject to adjustment in the same manner as the stock prices set forth in the column headings of the table above are adjusted, as described in the Notes Offering Preliminary Prospectus Supplement under the caption “Description of Notes—Conversion Rights—Increase in Conversion Rate in Connection with a Make-Whole Fundamental Change—Adjustment of Stock Prices and Number of Additional Shares”), or less than $210.00 (subject to adjustment in the same manner), per share, then no additional shares will be added to the conversion rate.

Notwithstanding anything to the contrary, in no event will the conversion rate be increased to an amount that exceeds 4.7619 shares of Common Stock per $1,000 principal amount of Notes, which amount is subject to adjustment in the same manner as, and at the same time and for the same events for which, the conversion rate is required to be adjusted pursuant to the provisions described in the Notes Offering Preliminary Prospectus Supplement under the caption “Description of Notes—Conversion Rights—Conversion Rate Adjustments—Generally.”

* * *

The Issuer has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) for the offerings to which this communication relates. Before you invest, you should read the applicable Preliminary Prospectus Supplement and the prospectus in that registration statement and other documents the Issuer has filed with the SEC for more complete information about the Issuer and the offerings. You may get these documents free by visiting EDGAR on the SEC website at

www.sec.gov

. Alternatively,

5

the Issuer, any underwriter, or any dealer participating in the applicable offering will arrange to send you the applicable Preliminary Prospectus Supplement and the prospectus upon request to: Jefferies LLC, 520 Madison Avenue, 12th Floor, New York, NY 10022, Attention: Prospectus Department, or by telephone at (877) 547-6340, or by email to Prospectus_Department@Jefferies.com; or J.P. Morgan Securities LLC, Attention: c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, or by telephone at (866) 803-9204.

You should rely only on the information contained or incorporated by reference in the applicable Preliminary Prospectus Supplement, as supplemented by this pricing term sheet, in making an investment decision with respect to the applicable offering.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

6

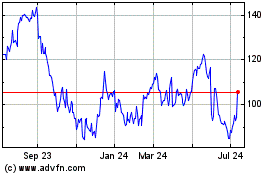

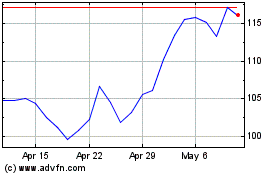

Mesa Laboratories (NASDAQ:MLAB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mesa Laboratories (NASDAQ:MLAB)

Historical Stock Chart

From Apr 2023 to Apr 2024