- Established channels with three tool providers in the Middle

East market as runs with the Drill-N-Ream® increase

- Strengthened relationship with legacy partner drove Contract

Services revenue up 46.4% over prior-year period and 23.7% over

sequential quarter

Superior Drilling Products, Inc. (NYSE American: SDPI) (“SDP” or

the “Company”), a designer and manufacturer of drilling tool

technologies, today reported preliminary financial results for the

second quarter ended June 30, 2019. Preliminary financial results

reflect the impact of the write-down of the Tronco Loan, effective

September 30, 2017. (See the “Decision to Restate Financials to

Reflect Write-down of Tronco Loan” section of this press release

for more information.)

Troy Meier, Chairman and CEO, noted, “We made great headway in

the Middle East. We now engage three oil field services companies

to represent our patented Drill-N-Ream® (DNR) well bore

conditioning tool. We expect the adoption rate to increase over the

next several months and that the success of our efforts will be

demonstrated in our results by year end.”

He added, “Domestically, our current North American channel

partner is gaining new customers even as the number of rigs has

declined, including major oil companies. Our expanded relationship

with our long-time legacy customer also drove the increase in

Contract Services revenue by increasing bit repair, expanding to

include repair and refurbishment of other drill tools and by adding

contract manufacturing of new products.”

Mr. Meier noted, “Importantly, we have a number of opportunities

that we expect to solidify over the next few months that will drive

our future growth by measurably expanding our relationship with our

long-time legacy customer.”

Second Quarter 2019 Preliminary Review ($ in thousands,

except per share amounts) (See at “Definitions” the composition of

product/service revenue categories.)

Q2 2019

Q2 2018

$Y/Y Change

% Y/Y Change

Q1 2019

$ Seq. Change

% Seq. Change

Tool Sales/Rental

$

1,000

$

2,506

$

(1,506

)

(60.1

)%

$

1,753

$

(753

)

(43.0

)%

Other Related Tool Revenue

1,573

1,547

26

1.7

%

1,691

(118

)

(7.0

)%

Tool Revenue

2,573

4,053

$

(1,480

)

(36.5

)%

3,444

$

(871

)

(25.3

)%

Contract Services

1,970

1,346

624

46.4

%

1,592

378

23.7

%

Total Revenue

$

4,543

$

5,399

$

(856

)

(15.8

)%

$

5,036

$

(493

)

(9.8

)%

When compared with the prior-year period, the increase in

Contract Services revenue was mostly the result of increased demand

of dill bit refurbishment as well as additional services provided

for repair of and refurbishment of other tools and contract

manufacturing. The durability and resiliency of the DNR has

extended its tool life, delaying the requirement for replacement

tools. This decrease in DNR tool sales was partially offset by the

increase in Contract Services revenue. The primary distributor of

the DNR in the U.S. is modestly building market share and gaining

new customers, while also facing the decline in drilling activity

in the U.S. that has resulted in fewer operating rigs. The Company

expects that the addition of new channels to market in the U.S. and

expansion in the Middle East will drive growth in tool revenue

toward the end of 2019 and into 2020 and beyond.

Second Quarter 2019 Preliminary Operating Expenses

($ in thousands)

Q2 2019

Q2 2018 restated

$ Y/Y Change

% Y/Y Change

Q1 2019 restated

$ Seq. Change

% Seq. Change

Cost of revenue

$

2,014

$

1,943

$

71

3.7

%

$

2,043

$

(29

)

(9.8

)%

As a percent of sales

44.3

%

36.0

%

40.6

%

Selling, general & administrative

$

1,816

$

1,427

$

389

27.3

%

$

2,069

$

(253

)

(12.2

)%

As a percent of sales

40.0

%

26.4

%

41.1

%

Depreciation & amortization

$

930

$

942

$

(12

)

(1.2

)%

$

1,011

$

(81

)

(8.0

)%

Total operating expenses

$

4,760

$

4,311

$

449

10.4

%

$

5,123

$

(363

)

(7.1

)%

Operating (loss) income

$

(216

)

$

1,088

$

(1,304

)

NM

$

(87

)

$

(129

)

NM

As a % of sales

(4.8

)%

20.1

%

(1.7

)%

Net (loss) income

$

(397

)

$

913

$

(1,260

)

NM

$

(246

)

$

(151

)

NM

Diluted (loss) earnings per share

$

(0.02

)

$

0.04

$

(0.06

)

NM

$

(0.01

)

$

(0.01

)

NM

Adjusted EBITDA(1)

$

1,074

$

2,133

$

(1,059

)

(49.7

)%

$

1,194

$

(120

)

(10.0

)%

The cost of revenue as a percentage of sales increased as a

result of lower absorption from the combination of reduced

production volume and increased production capacity in Texas,

international start-up investments, and a $136 thousand impairment

of obsolete inventory.

Increased selling, general and administrative expense (SG&A)

over the prior-year periods reflected higher research and

development costs related to the Strider™ oscillation system

technology, international sales and marketing expenses,

professional fees, stock compensation expense and accrued

bonuses.

Net loss for the quarter was $397 thousand, while Adjusted

EBITDA(1), a non-GAAP measure defined as earnings before interest,

taxes, depreciation and amortization, non-cash stock compensation

expense and unusual items, was $1.1 million.

The Company believes that when used in conjunction with measures

prepared in accordance with U.S. generally accepted accounting

principles (“GAAP”), Adjusted EBITDA, which is a non-GAAP measure,

helps in the understanding of its operating performance. (1)See the

attached tables for important disclosures regarding SDP’s use of

Adjusted EBITDA, as well as a reconciliation of net loss to

Adjusted EBITDA.

Year-to-Date Preliminary Review

($ in thousands, except per share amounts)

YTD 2019 preliminary

YTD 2018 restated

$ Change

% Change

Tool Sales/Rental

$

2,753

$

4,498

$

(1,745

)

(38.8

)%

Other Related Tool Revenue

3,264

3,103

161

5.2

%

Tool Revenue

6,017

7,601

(1,584

)

(20.8

)%

Contract Services

3,562

2,398

1,164

48.5

%

Total Revenue

$

9,580

$

9,999

$

(419

)

(4.2

)%

Operating expenses

9,883

8,744

1,139

13.0

%

Operating (loss) income

(304

)

1,255

(1,559

)

NM

Net (loss) income

$

(643

)

$

895

$

(1,538

)

NM

Diluted (loss) income per share

$

(0.03

)

$

0.04

$

(0.07

)

NM

Adjusted EBITDA(1)

$

2,268

$

3,373

$

(1,105

)

(32.8

)%

Revenue in the first six months of 2019 decreased 4%, or $0.4

million, compared with 2018. Contract Services revenue grew as the

Company gained more business from a major customer under an

enhanced contract. Other Related Tool Revenue was up slightly from

the drilling activity related to deployed DNR tools. Tool

Sales/Rental declined as drilling activity in the U.S. slowed and

the primary distributor of the tool nominally increased market

share. While tool rentals increased from activity in the Middle

East, total tool sales/rental revenue declined on fewer DNR tool

sales in the U.S. Operating expenses increased $1.1 million from

the prior year due to incremental costs associated with the Middle

East expansion, addition of the Texas service center and the

development of the Strider™ oscillation system technology. Lower

revenue and higher operating expenses led to an operating loss of

$0.3 million in the first half of 2019, compared with operating

income in 2018 of $1.3 million.

Net loss for the first six months of 2019 was $0.6 million, or

$(0.03) per diluted share. Adjusted EBITDA(1) for the first six

months of 2019 was $2.3 million. Adjusted EBITDA margin was 24% in

2019, compared with 34% in 2018.

Preliminary Balance Sheet and Liquidity

The cash balance at the end of the quarter was $3.2 million and

working capital was $1.4 million. Cash provided by operations was

$0.9 million in the first half of 2019, compared with $2.1 million

in the first half of 2018.

Capital expenditures were $567 thousand in the second quarter

and were primarily for DNR tools to support the expansion in the

Middle East and deposits on two pieces of equipment.

Total debt at the end of the second quarter was $9.9 million,

down $1.0 million, or 9.2%, compared with $10.9 million at December

31, 2018. Total principal payments in 2019 on the Hard Rock note

through July 15, 2019 were $2.25 million. The remaining principal

balance on the note following the July payment was $3.75 million.

In February 2019, the Company secured a new $4.3 million credit

facility which included a $0.8 million term loan and a $3.5 million

revolver at prime plus 2% and certain fees. The credit facility

matures on February 20, 2023. At the end of the second quarter,

there was approximately $872 thousand outstanding on the revolver

with a capacity of $1.7 million based on the asset base

available.

Financial Information Is Preliminary and May Be Subject To

Change

The unaudited interim financial information presented in this

press release is preliminary. The final financial results reported

for this period may differ from the results reported in this

release as a result of the work necessary for the preparation of

financial statements taking into account the results of the

restatement of financials related to the write-down of the Tronco

Loan.

Decision to Restate Financials to Reflect Write-down of

Tronco Loan

After a thorough review and interpretation of accounting

standards that a typical bank would use for the definition of an

impaired loan and the accounting of such, the Company came to the

conclusion that it was necessary to revise its financial statements

to reflect the write-down of the note receivable, or the $7.7

million “Tronco Loan”, as of September 30, 2017. The timing of the

write-down is related to the 2017 extension of payment terms. As a

result of the restatement, the financial statements and other

financial disclosures for the periods including September 30, 2017

through March 31, 2019, for such financial information that

pertains to the Tronco Loan, should not be relied upon.

The non-cash charge primarily impacts the balance sheet and the

timing of recognition of investment income. It does not impact

revenue and operating costs, nor does it impact total cash flows

from operating, investing and financing. The Company will pursue

full repayment of the note and continues to hold the 8,267,860

shares of the Company’s common stock as collateral. Upon receiving

repayment of the note, the Company will record a recovery of the

loan.

2019 Outlook and Guidance Estimates:

Mr. Meier concluded, “We are extremely encouraged with the

progress we are making to grow the DNR’s global market share. We

expect the expansion of our channels to market in the U.S. and the

Middle East to drive growth, ramping in the second half of this

year and on into 2020. Nevertheless, we recognize the depressed

state of the North American oil & gas industry and are reducing

our outlook for this year. We have on going potential for greater

growth with continued expansion of our market share in the U.S.,

the measurable opportunity for international growth and the

introduction of the Strider Technology™ oscillation system, which

we expect to have rapid market acceptance.”

Revenue:

$19 million to $20 million

Gross margin:

58% to 61%

SG&A expenses:

$7.5 million to $8.0 million

D&A:

Approximately $3.5 million

Interest Expense:

Approximately $800 thousand

Capital Expenditures:

Approximately $3.0 to $3.5 million

Definitions and Composition of Product/Service

Revenue:

Contract Services Revenue is comprised of drill bit and other

repair and manufacturing services.

Other Related Tool Revenue is comprised of royalties and fleet

maintenance fees.

Tool Sales/Rental revenue is comprised of revenue from either

the sale of tools or tools rented to customers.

Tool Revenue is the sum of Other Related Tool Revenue and Tool

Sales/Rental revenue.

Webcast and Conference Call

The Company will host a conference call and live webcast today

at 10:00 am MT (12:00 pm ET) to review the financial and operating

results for the quarter and discuss its corporate strategy and

outlook. The discussion will be accompanied by a slide presentation

that will be made available immediately prior to the conference

call on SDP’s website at www.sdpi.com/events. A question-and-answer

session will follow the formal presentation.

The conference call can be accessed by calling (201) 689-8470.

Alternatively, the webcast can be monitored at www.sdpi.com/events.

A telephonic replay will be available from 1:00 p.m. MT (3:00 p.m.

ET) the day of the teleconference until Thursday, August 8, 2019.

To listen to the archived call, dial (412) 317-6671 and enter

conference ID number 13692056, or access the webcast replay at

www.sdpi.com, where a transcript will be posted once available.

About Superior Drilling Products, Inc.

Superior Drilling Products, Inc. is an innovative, cutting-edge

drilling tool technology company providing cost saving solutions

that drive production efficiencies for the oil and natural gas

drilling industry. The Company designs, manufactures, repairs and

sells drilling tools. SDP drilling solutions include the patented

Drill-N-Ream® well bore conditioning tool and the patented Strider™

oscillation system technology. In addition, SDP is a manufacturer

and refurbisher of PDC (polycrystalline diamond compact) drill bits

for a leading oil field service company. SDP operates a

state-of-the-art drill tool fabrication facility, where it

manufactures its solutions for the drilling industry, as well as

customers’ custom products. The Company’s strategy for growth is to

leverage its expertise in drill tool technology and innovative,

precision machining in order to broaden its product offerings and

solutions for the oil and gas industry.

Additional information about the Company can be found at:

www.sdpi.com.

Safe Harbor Regarding Forward Looking Statements

This news release contains forward-looking statements and

information that are subject to a number of risks and

uncertainties, many of which are beyond our control. All

statements, other than statements of historical fact included in

this release, regarding our strategy, future operations, success at

developing future tools, the Company’s effectiveness at executing

its business strategy and plans, financial position, estimated

revenue and losses, projected costs, prospects, plans and

objectives of management, statements regarding the Company’s intent

to restate its prior consolidated financial statements for the

Non-Reliance Periods, the estimated impact of adjustments to the

financial statements for the Non-Reliance Periods, the anticipated

timing for filing the restated financial information and related

matters, are forward-looking statements. The use of words “could,”

“believe,” “anticipate,” “intend,” “estimate,” “expect,” “may,”

“continue,” “predict,” “potential,” “project”, “forecast,” “should”

or “plan, and similar expressions are intended to identify

forward-looking statements, although not all forward -looking

statements contain such identifying words. These statements reflect

the beliefs and expectations of the Company and are subject to

risks and uncertainties that may cause actual results to differ

materially. These risks and uncertainties include, among other

factors, success at expansion in the Middle East, options available

for market channels in North America, commercialization of the

Strider technology, the success of the Company’s business strategy

and prospects for growth; the market success of the Company’s

specialized tools, effectiveness of its sales efforts, its cash

flow and liquidity; financial projections and actual operating

results; the amount, nature and timing of capital expenditures; the

availability and terms of capital; competition and government

regulations; the risk that the process of preparing the restated

consolidated financial statements or other subsequent events would

require the Company to make additional adjustments to its financial

statements and the time and effort required to complete the

restatement of its consolidated financial statements and file the

restated financial information, and general economic conditions.

These and other factors could adversely affect the outcome and

financial effects of the Company’s plans and described herein. The

Company undertakes no obligation to revise or update any

forward-looking statements to reflect events or circumstances after

the date hereof.

Superior Drilling Products,

Inc.

Consolidated Condensed

Statements of Operations

for the Periods Ended June 30,

2019 and 2018

(unaudited)

For the Three Months

For the Six Months

Ended

Ended June 30,

Ended June 30,

2019 preliminary

2018 restated

2019 preliminary

2018 restated

Revenue

$

4,543,442

$

5,398,923

$

9,579,788

$

9,999,216

Operating cost and expenses Cost of revenue

2,013,598

1,942,671

4,056,626

3,741,615

Selling, general, and administrative expenses

1,816,195

1,426,985

3,885,235

3,124,648

Depreciation and amortization expense

930,410

941,683

1,941,515

1,877,710

Total operating costs and expenses

4,760,203

4,311,339

9,883,376

8,743,973

Operating (loss) income

(216,761

)

1,087,584

(303,588

)

1,255,243

Other income (expense) Interest income

21,431

7,873

40,364

14,014

Interest expense

(216,241

)

(182,497

)

(394,223

)

(374,050

)

Gain (loss) on sale or disposition of assets

14,147

-

14,147

-

Total other expense

(180,663

)

(174,624

)

(339,712

)

(360,036

)

(Loss) income before income taxes

$

(397,424

)

$

912,960

$

(643,300

)

$

895,207

Income tax expense

-

-

-

-

Net (loss) income

$

(397,424

)

$

912,960

$

(643,300

)

$

895,207

Basic (loss) income earnings per common share

$

(0.02

)

$

0.04

$

(0.03

)

$

0.04

Basic weighted average common shares outstanding

25,034,580

24,535,155

25,026,384

24,535,155

Diluted (loss) income per common Share

$

(0.02

)

$

0.04

$

(0.03

)

$

0.04

Diluted weighted average common shares outstanding

25,034,580

25,140,467

25,026,384

25,140,467

Superior Drilling Products,

Inc.

Consolidated Condensed Balance

Sheets

(unaudited)

June 30, 2019preliminary

December 31, 2018restated Assets

Current assets:

Cash

$

3,214,651

$

4,264,767

Accounts receivable, net

3,092,772

2,273,189

Prepaid expenses

235,358

133,607

Inventories

1,162,504

1,003,623

Asset held for sale

258,847

-

Other current assets

220,558

-

Total current

assets

8,184,690

7,675,186

Property, plant and

equipment, net

8,172,914

8,226,009

Intangible assets, net

2,569,445

3,686,111

Other noncurrent assets

58,278

51,887

Total assets

$

18,985,327

$

19,639,193

Liabilities and

Shareholders' Equity Current

liabilities: Accounts

payable

$

780,652

$

717,721

Accrued expenses

1,197,524

631,860

Income tax payable

3,640

3,640

Current portion of long-term debt, net of discounts

4,820,299

4,578,759

Total current

liabilities

$

6,802,115

$

5,931,980

Long-term debt, less

current portion, net of discounts

5,098,326

6,296,994

Total liabilities

$

11,900,441

$

12,228,974

Stockholders' equity

Common stock (25,018,098 and

24,535,334)

25,035

25,018

Additional paid-in-capital

39,758,560

39,440,611

Accumulated deficit

(32,698,709

)

(32,055,410

)

Total stockholders' equity

$

7,084,886

$

7,410,219

Total liabilities and shareholders' equity

$

18,985,327

$

19,639,193

Superior Drilling Products,

Inc.

Consolidated Statements of

Cash Flows

For the Periods Ended June 30,

2019 and 2018

(unaudited)

June 30, 2019preliminary

June 30, 2018restated Cash Flows From Operating

Activities Net (loss) income

$

(643,300

)

$

895,207

Adjustments to reconcile net loss to net cash provided by operating

activities: Depreciation and amortization

expense

1,941,515

1,877,711

Amortization of debt discount and deferred loan cost

6,178

31,281

Share based compensation expense

317,967

240,344

Income tax expense

-

-

Impairment of

inventories

-

41,396

Loss (gain) on sale of assets

(14,147

)

-

Changes in operating assets and liabilities:

Accounts receivable

(819,583

)

(541,556

)

Inventories

(158,881

)

211,368

Prepaid expenses and other current assets

(328,700

)

(41,223

)

Accounts payable and accrued expenses

628,595

(621,631

)

Net Cash Provided By Operating Activities

$

929,644

$

2,092,897

Cash Flows From Investing Activities

Purchases of property, plant and equipment

(957,192

)

(131,716

)

Proceeds from sale of fixed assets

-

-

Net Cash Used In Investing Activities

(957,192

)

(131,716

)

Cash Flows From Financing Activities

Principal payments on debt

(2,895,957

)

(1,252,463

)

Proceeds from debt borrowings

1,071,578

-

Principal payments on revolving loans

(437,922

)

-

Prroceeds from revolving loans

1,309,836

-

Debt issuance costs

(70,103

)

-

Net Cash Used In Financing Activities

(1,022,568

)

(1,252,463

)

Net (Decrease) Increase in

Cash

(1,050,116

)

708,718

Cash at Beginning of Period

4,264,767

2,375,179

Cash at End of Period

$

3,214,651

$

3,083,897

Supplemental information: Cash

paid for interest

$

466,976

$

340,891

Acquisition of equipment by issuance of note payable

$

59,262

$

-

Superior Drilling Products,

Inc.

Adjusted EBITDA(1)

Reconciliation

(unaudited)

Three Months Ended June 30,

2019preliminary June 30, 2018restated

March 31, 2019restated GAAP

net (loss) income

$

(397,424

)

$

912,960

$

(245,876

)

Add back: Depreciation and amortization

930,410

941,683

1,011,105

Inventory write off

136,000

-

-

Interest expense, net

194,810

174,624

159,049

Share-based compensation

136,115

103,327

181,852

Net non-cash compensation

88,200

-

88,200

Gain on disposition of assets

(14,147

)

-

-

Income tax expense (benefit)

-

-

-

Non-GAAP adjusted EBITDA(1)

$

1,073,964

$

2,132,594

$

1,194,330

GAAP Revenue

$

4,543,442

$

5,398,923

$

5,036,346

Non-GAAP Adjusted EBITDA Margin

23.6

%

39.5

%

23.7

%

Six Months

Ended June 30, 2019preliminary June 30,

2018restated GAAP net (loss)

income

$

(643,300

)

$

895,207

Add back: Depreciation and amortization

1,941,515

1,877,711

Impairment of assets

136,000

-

Share-based compensation

317,967

240,344

Net non-cash compensation

176,400

-

Interest expense, net

353,859

360,036

(Gain) loss on disposition of assets

(14,147

)

-

Income tax expense (benefit)

-

-

Non-GAAP Adjusted EBITDA(1)

$

2,268,294

$

3,373,298

GAAP Revenue

$

9,579,788

$

9,999,216

Non-GAAP Adjusted EBITDA Margin

23.7

%

33.7

%

(1) Adjusted EBITDA represents net income adjusted for income

taxes, interest, depreciation and amortization and other items as

noted in the reconciliation table. The Company believes Adjusted

EBITDA is an important supplemental measure of operating

performance and uses it to assess performance and inform operating

decisions. However, Adjusted EBITDA is not a GAAP financial

measure. The Company’s calculation of Adjusted EBITDA should not be

used as a substitute for GAAP measures of performance, including

net cash provided by operations, operating income and net income.

The Company’s method of calculating Adjusted EBITDA may vary

substantially from the methods used by other companies and

investors are cautioned not to rely unduly on it.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190731006001/en/

For more information, contact investor relations: Deborah

K. Pawlowski, Kei Advisors LLC (716) 843-3908,

dpawlowski@keiadvisors.com

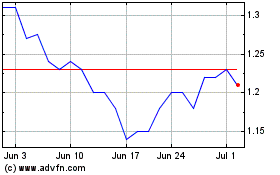

Superior Drilling Products (AMEX:SDPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Superior Drilling Products (AMEX:SDPI)

Historical Stock Chart

From Apr 2023 to Apr 2024