Blackstone Moves to Expand Into Building Materials -- WSJ

July 16 2019 - 3:02AM

Dow Jones News

By Ben Dummett and Miriam Gottfried

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 16, 2019).

Global buyout firm Blackstone Group Inc. is in advanced talks to

buy the European distribution arm of CRH PLC, one of the world's

largest building-materials suppliers, according to people familiar

with the matter.

The sale price couldn't be learned.

The deal would cap CRH's monthslong review of the business as

the company tries to simplify its global operations and bolster

profits. It also follows CRH's move last year to sell its U.S.

distribution business to Beacon Roofing Supply Inc. for $2.63

billion.

Based in Dublin, Ireland, CRH is the largest asphalt producer in

North America as part of its global operations that span 32

countries. In 2018, the company reported a 7% gain in operating

profits to EUR3.4 billion ($3.83 billion) as its businesses

supplying construction materials such as cement, construction

accessories and architectural products generated higher

revenue.

Still, declines in revenue and operating profit in the European

distribution business, a supplier of materials to professional

builders as well as specialist heating and plumbing contractors,

were a drag on CRH's overall results.

The deal would provide Blackstone with a potential platform in

the building-materials sector. Private-equity firms often approach

a deal as part of a bigger bet to build a large-scale company in

part through further acquisitions, expecting the strategy will

generate higher returns from an ultimate sale of the business.

In 2009, Blackstone together with Greenwich, Conn.-based

Silverhawk Capital Partners created Summit Materials Inc. and

subsequently used it to acquire more than 35 companies in the

sector to establish a major U.S.-based supplier of aggregates,

concrete and asphalt. Blackstone took Summit public in 2015 in a

deal that valued the company at $1.67 billion.

Blackstone competed against Lone Star Funds and Bain Capital

among others for the CRH business. That competition underscores

private-equity investors' healthy appetite for unloved businesses

carved out of larger companies. These deals allow private-equity

firms to deploy their record amounts of cash quickly, while trying

to find turnaround opportunities to generate returns.

In May, Swedish buyout firm EQT struck a $10.1 billion deal to

acquire Nestlé SA's skin-health business.

And last year, a Carlyle Group LP-led consortium acquired the

specialty-chemicals business of Dutch paints giant Akzo Nobel NV

for EUR10.1 billion including debt.

--William Louch contributed to this article.

(END) Dow Jones Newswires

July 16, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

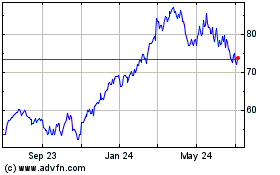

CRH (NYSE:CRH)

Historical Stock Chart

From Aug 2024 to Sep 2024

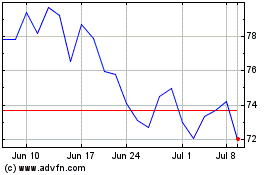

CRH (NYSE:CRH)

Historical Stock Chart

From Sep 2023 to Sep 2024