PG&E Bond Prices Jump, While Shares Fall

June 25 2019 - 9:48AM

Dow Jones News

By WSJ City

PG&E bond prices surged in heavy trading even as shares

slipped, a divergence that some analysts said reflects uncertainty

about how much new equity the bankrupt California utility needs to

raise in order to address claims tied to past and future

wildfires.

KEY FACTS

--- PG&E shares and bonds rallied last week after it reached

its first major settlement with wildfire victims.

--- California Gov. Gavin Newsom proposed a plan for a

multibillion-dollar fund to cover liabilities.

--- About $290m of PG&E bonds changed hands, making it the

most actively traded high-yield corporate bond.

--- Its bond due 2034 hit 109.25 cents on the dollar, up from

107.5 Friday and 101.38 at the start of last week.

-- The company's stock fell 5.6% to $21.67.

Why This Matters

Ultimate recoveries on PG&E shares and bonds will depend on

how the company raises capital to offset wildfire liabilities. Some

of the funding could come from increasing charges to electricity

ratepayers and from issuance of new bonds backed by the utility's

future revenues. But the larger the size of the state wildfire fund

-- options floated by Newsom range from $10.5bn to $21bn -- the

more shareholders or bondholders will have to contribute

themselves.

A fuller story is available on WSJ.com

WSJ City: The news, the key facts and why it matters. Be deeply

informed in less than five minutes. You can find more concise

stories like this on the WSJ City app. Download now from the App

Store or Google Play, or sign up to newsletters here

http://www.wsj.com/newsletters?sub=356&mod=djemwsjcity

(END) Dow Jones Newswires

June 25, 2019 09:33 ET (13:33 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

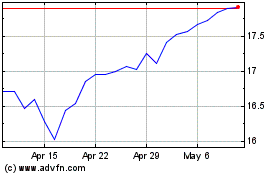

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

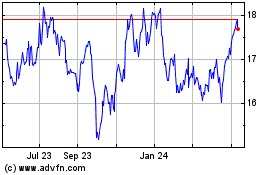

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024