Record Revenue of $229.2 Million and $77.3

Million for Full Year and Fourth Quarter 2018

Amarin Corporation plc (NASDAQ:AMRN), a pharmaceutical company

focused on improving cardiovascular health, today announced

financial results for the quarter and year ended December 31, 2018

and provided an update on company operations.

Key Amarin achievements in 2018 include:

- Unprecedented positive clinical

trial: Results of the REDUCE-IT™ cardiovascular outcomes study

of Vascepa® demonstrated, compared to placebo, a 25% reduction in

major adverse cardiovascular events, with a number needed to treat

of 21, and including a 20% reduction in cardiovascular death.1

These results are the largest shown as an add-on to statin therapy

by any therapy in any studied patient population. This important

result, recognized by the Journal Watch Cardiology section of The

New England Journal of Medicine as the top story of 2018, positions

Vascepa to potentially help millions of patients.

- Revenue growth: Net total revenue, the majority of which was

recorded prior to REDUCE-IT results, reached a record level of

$229.2 million in 2018, including net total revenue of $77.3

million in the fourth quarter of 2018. The results represent

increases of approximately 27% and 44% for full year and fourth

quarter of 2018 over the corresponding periods of 2017,

respectively, primarily reflecting Vascepa prescription

growth.

- Commercialization evolution: Amarin began its transition from a

U.S. sales presence with a relatively small specialty sales team

reliant on a co-promotion partner promoting Vascepa based on

biomarker data to a broader direct sales model with more sales

representatives, more physician targets and promotion which

includes reference to cardiovascular outcomes study results.

Further promotional expansion, particularly consumer-based

promotion, is anticipated following label expansion for Vascepa

based on the REDUCE-IT study results.

- Strengthened balance sheet: At December 31, 2018, Amarin

had $249.2 million of cash and cash equivalents.

“The tremendous progress Amarin made in 2018

helps position us for further significant achievement and

accelerated revenue growth in the future,” commented John Thero,

Amarin’s president and chief executive officer. “Our

excitement regarding the REDUCE-IT study results is being

reinforced by feedback from healthcare professionals as they begin

to understand these unprecedented results and the positive impact

it could have on patient care.”

Guidance Reaffirmed

Amarin provided financial guidance for 2019 in

its press release on January 4, 2019. Amarin today reaffirms

that such earlier guidance has not changed, including its guidance

regarding its planned sNDA and expected 2019 revenue as

follows:

- sNDA Submission: Based on the unprecedented results from the

REDUCE-IT cardiovascular outcomes study, Amarin intends to submit a

supplemental new drug application (sNDA) to the U.S. Food and Drug

Administration (FDA) seeking labeling for Vascepa which reflects

the cardiovascular risk reduction results demonstrated in this

landmark study. Amarin remains on-track to submit this sNDA before

the end of the first quarter of 2019 (i.e. before the end of March

2019) with a normal 10-month regulatory review period assumed prior

to a PDUFA date. While priority review for this sNDA is not

currently assumed, after the sNDA is submitted, consistent with FDA

practices, Amarin will seek to clarify whether priority review by

the FDA is possible for this important submission. Amarin’s

sNDA will consist of over 200,000 pages of data, all of which is

undergoing extensive medical, statistical and quality review.

- 2019 Revenue: Net total revenue for 2019 is anticipated to

increase by more than 50% over 2018 to approximately $350 million,

mostly from U.S. sales of Vascepa. Amarin believes that

continued quarterly variability in revenues is likely. This

guidance assumes that the timing of the expanded label for Vascepa

which Amarin is seeking, subject to FDA approval, will not be

available until late 2019 or early 2020 such that the expanded

label has little or no impact on revenue growth in 2019.

Prescription Growth

Normalized prescriptions for Vascepa

(prescription of 120 grams of Vascepa representing a one-month

supply) increased by 25% and 27% in 2018 compared to 2017 based on

data from Symphony Health and IQVIA, respectively, and increased by

33% and 32% in the fourth quarter of 2018 compared to the same

period in 2017, respectively. Estimated normalized Vascepa

prescriptions, based on data from Symphony Health and IQVIA,

totaled approximately 539,000 and 538,000 in the fourth quarter of

2018. Since Vascepa was made commercially available in 2013, more

than five million estimated normalized total prescriptions of

Vascepa have been reported by Symphony Health.

Sales Force Expansion

Prior to topline results from the REDUCE-IT

study which became available in September 2018, Amarin’s U.S. sales

force consisted of approximately 150 sales representatives plus

their managers. Upon learning the positive REDUCE-IT results,

Amarin proceeded to hire and train additional sales representatives

such that it currently has approximately 400 sales representatives

plus their managers in the U.S. The majority of this

increase in the U.S. sales force for Vascepa promotion occurred

during the late part of 2018 or early in 2019. Corresponding to the

increase in the size of its direct sales force, Amarin also

significantly expanded the number of healthcare professionals it

plans to call on for Vascepa education to approximately 54,000

healthcare professionals and expanded various other marketing and

medical education programs. In parallel, as previously described

and intended, the company’s co-promotion arrangement for Vascepa

reached its scheduled conclusion on December 31, 2018 such that

Amarin’s prior co-promotion partner is no longer promoting Vascepa.

Amarin believes that, while there may be some transition period

required for new sales representatives to become productive,

Vascepa revenue growth will be most cost-effectively achieved by

having this expanded Amarin sales team giving priority to Vascepa

promotion.

Scientific Publication

During 2018, Amarin supported 40 scientific

publications and presentations, up from 25 Amarin supported

scientific publications and presentations in 2017. These included

results of the REDUCE-IT study, as published in The New England

Journal of Medicine online in November 2018, which became available

in its print edition in early 2019, as well as real-world evidence

data, evaluation of multiple mechanisms of action for the active

ingredient in Vascepa and various demographic information

pertaining to cardiovascular disease.

Results from Amarin’s earlier phase 3 studies of

Vascepa, the MARINE and ANCHOR studies, resulted in multiple years

of scientific publications. Similarly, Amarin continues to analyze

the REDUCE-IT data to further assess additional scientific results.

We anticipate further scientific publication and presentation to

result from this analysis that potentially progress the

understanding of cardiovascular disease and the use of Vascepa to

further reduce the risk of major adverse cardiovascular events in

an at-risk patient population.

In early 2019, we already witnessed additional

publication of scientific study of the mechanism of action of

Vascepa and the acceptance of various scientific posters for

presentation at the upcoming American College of Cardiology’s (ACC)

68th Annual Scientific Session on March 18, 2019 in New Orleans, LA

(ACC scientific session). This includes, as previously

announced, presentation as late-breaking clinical trial data of new

data on the reduction of total major adverse cardiovascular (i.e.,

ischemic) events shown in REDUCE-IT. Amarin looks forward to all

such data being presented at ACC and intends to issue one or more

press releases describing the data once it is

public.

Financial Update

Net product revenue for the years ended December

31, 2018 and 2017 was $228.4 million and $179.8 million,

respectively. Net product revenue for the three months ended

December 31, 2018 and 2017 was $77.1 million and $53.5 million,

respectively. Increased revenue is mainly attributed to

increased Vascepa prescriptions in the U.S.

In addition, Amarin recognized licensing revenue

of $0.8 million and $1.3 million for the years ended December 31,

2018 and 2017, respectively, under agreements for the

commercialization of Vascepa outside the U.S.

Cost of goods sold for the three months ended

December 31, 2018 and 2017 was $17.5 million and $13.4 million,

respectively. Cost of goods sold for the years ended December

31, 2018 and 2017 was $54.5 million and $45.0 million,

respectively. Gross margin on product sales was approximately

77% and approximately 76% in the quarter and year ended December

31, 2018, as compared to approximately 75% in the quarter and year

ended December 31, 2017, respectively.

Selling, general and administrative expenses for

the years ended December 31, 2018 and 2017 were $227.0 million and

$134.5 million, respectively. This increase is due primarily to

increased promotional activities, including commercial spend in

preparation for and following the successful REDUCE-IT results

(announced on September 24, 2018), including pilot consumer

promotion, and increased co-promotion fees calculated on increased

gross profit resulting from higher net product revenue plus an

accrual of $16.4 million for co-promotion tail payments. The tail

co-promotion fees, which were calculated as a percentage of the

2018 co-promotion fee, are payable in 2019 through 2021. No further

expense from this prior co-promotion arrangement is anticipated

beyond 2018.

Research and development expenses for the years

ended December 31, 2018 and 2017 were $55.9 million and $47.2

million, respectively. This increase is primarily due to the

REDUCE-IT trial and related costs and the recording of $2.7 million

in expense related to the company’s previously announced strategic

collaboration with Mochida Pharmaceutical Co., Ltd.

Under U.S. GAAP, Amarin reported a net loss of

$33.7 million in the three months ended December 31, 2018, or basic

and diluted loss per share of $0.11. This net loss included $4.8

million in non-cash stock-based compensation expense. Amarin

reported a net loss of $22.5 million in the fourth quarter of 2017,

or basic and diluted loss per share of $0.08. This net loss

included $3.5 million in non-cash stock-based compensation

expense.

Under U.S. GAAP, Amarin reported a net loss of

$116.4 million for the year ended December 31, 2018, or basic and

diluted loss per share of $0.39. This net loss included $18.8

million in non-cash stock-based compensation expense. For the year

ended December 31, 2017, Amarin reported a net loss of $67.9

million, or basic and diluted loss per share of $0.25. This net

loss included $14.0 million in non-cash stock-based compensation

expense.

Excluding non-cash gains or losses for

stock-based compensation, non-GAAP adjusted net loss was $28.9

million for the fourth quarter of 2018, or non-GAAP adjusted basic

and diluted loss per share of $0.09, compared to non-GAAP adjusted

net loss of $19.0 million for the fourth quarter of 2017, or

non-GAAP adjusted basic and diluted loss per share of $0.07.

Excluding non-cash gains or losses for

stock-based compensation, non-GAAP adjusted net loss was $97.6

million for the year ended December 31, 2018, or non-GAAP adjusted

basic and diluted loss per share of $0.33, compared to non-GAAP

adjusted net loss of $53.9 million for the year ended December 31,

2017, or non-GAAP adjusted basic and diluted loss per share of

$0.20.

As of December 31, 2018, the company had $66.5

million in net accounts receivable ($86.1 million in gross accounts

receivable before allowances and reserves), which are current, and

$57.8 million in inventory. As of December 31, 2018, the company

had accounts payable and accrued expenses of $121.8 million which

increased from $84.1 million at December 31, 2017 primarily due to

the company’s growth, including supplier payments associated with

the increased levels of Vascepa inventory associated with

supporting increased revenue and the magnitude and timing of

rebates.

As of December 31, 2018, Amarin had

approximately 325.9 million ADSs and ordinary shares outstanding,

28.9 million common share equivalents of Series A Convertible

Preferred Shares outstanding and approximately 19.3 million

equivalent shares underlying stock options at a weighted-average

exercise price of $4.29, as well as 9.6 million equivalent shares

underlying restricted or deferred stock units.

Conference Call and Webcast Information

The conference call can be heard live on the

investor relations section of the company's website at

www.amarincorp.com, or via telephone by dialing 877-407-8033 within

the United States or 201-689-8033 from outside the United States. A

replay of the call will be made available for a period of two weeks

following the conference call. To hear a replay of the call, dial

877-481-4010, PIN: 43356. A replay of the call will also be

available through the company's website shortly after the call.

Use of Non-GAAP Adjusted Financial

Information

Included in this press release are non-GAAP

adjusted financial information as defined by U.S. Securities and

Exchange Commission Regulation G. The GAAP financial measure most

directly comparable to each non-GAAP adjusted financial measure

used or discussed, and a reconciliation of the differences between

each non-GAAP adjusted financial measure and the comparable GAAP

financial measure, is included in this press release after the

condensed consolidated financial statements.

Non-GAAP adjusted net loss was derived by taking

GAAP net loss and adjusting it for non-cash stock-based

compensation expense. Management uses these non-GAAP adjusted

financial measures for internal reporting and forecasting purposes,

when publicly providing its business outlook, to evaluate the

company’s performance and to evaluate and compensate the company’s

executives. The company has provided these non-GAAP financial

measures in addition to GAAP financial results because it believes

that these non-GAAP adjusted financial measures provide investors

with a better understanding of the company’s historical results

from its core business operations.

While management believes that these non-GAAP

adjusted financial measures provide useful supplemental information

to investors regarding the underlying performance of the company’s

business operations, investors are reminded to consider these

non-GAAP measures in addition to, and not as a substitute for,

financial performance measures prepared in accordance with GAAP.

Non-GAAP measures have limitations in that they do not reflect all

of the amounts associated with the company’s results of operations

as determined in accordance with GAAP. In addition, it should be

noted that these non-GAAP financial measures may be different from

non-GAAP measures used by other companies, and management may

utilize other measures to illustrate performance in the future.

About Amarin

Amarin Corporation plc is a rapidly growing,

innovative pharmaceutical company focused on developing

therapeutics to improve cardiovascular health. Amarin’s product

development program leverages its extensive experience in

polyunsaturated fatty acids and lipid science. Vascepa® (icosapent

ethyl) is Amarin's first FDA-approved drug and is available by

prescription in the United States, Lebanon and the United Arab

Emirates. Amarin’s commercial partners are pursuing

additional regulatory approvals for Vascepa in Canada, China and

the Middle East. For more information about Amarin, visit

www.amarincorp.com.

About Cardiovascular Disease

Worldwide, cardiovascular disease (CVD) remains

the #1 killer of men and women. In the United States CVD leads to

one in every three deaths – one death approximately every 38

seconds – with annual treatment cost in excess of $500 billion.2,

3

Multiple primary and secondary

prevention trials have shown a significant reduction of 25% to

35% in the risk of cardiovascular

events with statin therapy, leaving significant

persistent residual risk despite the achievement of target LDL-C

levels.4

Beyond the cardiovascular risk associated with

LDL-C, genetic, epidemiologic, clinical and real-world data suggest

that patients with elevated triglycerides (TG) (fats in the blood),

and TG-rich lipoproteins, are at increased risk for cardiovascular

disease. 5, 6, 7, 8

About VASCEPA® (icosapent ethyl)

Capsules

Vascepa® (icosapent ethyl) capsules are a

single-molecule prescription product consisting of the omega-3 acid

commonly known as EPA in ethyl-ester form. Vascepa is not fish oil,

but is derived from fish through a stringent and complex

FDA-regulated manufacturing process designed to effectively

eliminate impurities and isolate and protect the single molecule

active ingredient from degradation. Vascepa, known in scientific

literature as AMR101, has been designated a new chemical entity by

the FDA. Amarin has been issued multiple patents

internationally based on the unique clinical profile of Vascepa,

including the drug’s ability to lower triglyceride levels in

relevant patient populations without raising LDL-cholesterol

levels.

Indication and Usage Based on Current

FDA-Approved Label (not including REDUCE-IT results)

- Vascepa (icosapent ethyl) is

indicated as an adjunct to diet to reduce triglyceride (TG) levels

in adult patients with severe (≥500 mg/dL)

hypertriglyceridemia.

- The effect of Vascepa on the risk

for pancreatitis and cardiovascular mortality and morbidity in

patients with severe hypertriglyceridemia has not been

determined.

Important Safety Information for Vascepa Based

on Current FDA-Approved Label (not including REDUCE-IT results)

(Includes Data from Two 12-Week Studies (n=622) (MARINE and ANCHOR)

of Patients with Triglycerides Values of 200 to 2000 mg/dL)

- Vascepa is contraindicated in

patients with known hypersensitivity (e.g., anaphylactic reaction)

to Vascepa or any of its components.

- In patients with hepatic

impairment, monitor ALT and AST levels periodically during

therapy.

- Use with caution in patients with

known hypersensitivity to fish and/or shellfish.

- The most common reported adverse

reaction (incidence >2% and greater than placebo) was arthralgia

(2.3% for Vascepa, 1.0% for placebo). There was no reported adverse

reaction >3% and greater than placebo.

- Adverse events and product

complaints may be reported by calling 1-855-VASCEPA or the FDA at

1-800-FDA-1088.

- Patients receiving treatment with

Vascepa and other drugs affecting coagulation (e.g., anti-platelet

agents) should be monitored periodically.

- Patients should be advised to

swallow Vascepa capsules whole; not to break open, crush, dissolve,

or chew Vascepa.

FULL VASCEPA PRESCRIBING INFORMATION CAN BE

FOUND AT WWW.VASCEPA.COM.

Vascepa has been approved for use by the United

States Food and Drug Administration (FDA) as an adjunct to diet to

reduce triglyceride levels in adult patients with severe (≥500

mg/dL) hypertriglyceridemia. Nothing in this press release should

be construed as promoting the use of Vascepa in any indication that

has not been approved by the FDA.

Forward-Looking Statements

This press release contains forward-looking

statements, including expectations regarding planned scientific

presentation, publication, regulatory review and related timing

thereof, including plans to submit an sNDA before the end of March

2019 seeking an expanded indication for Vascepa in the United

States; and expectations regarding further advancement, commercial

expansion and revenue growth. These forward-looking statements are

not promises or guarantees and involve substantial risks and

uncertainties. In addition, Amarin's ability to effectively

commercialize Vascepa will depend in part on its ability to

continue to effectively finance its business, efforts of third

parties, its ability to create market demand for Vascepa through

education, marketing and sales activities, its ability to obtain an

expanded indication for Vascepa in the United States, to achieve

market acceptance of Vascepa, to receive adequate levels of

reimbursement from third-party payers, to develop and maintain a

consistent source of commercial supply at a competitive price, to

comply with legal and regulatory requirements in connection with

the sale and promotion of Vascepa and to maintain patent protection

for Vascepa. Among the factors that could cause actual results to

differ materially from those described or projected herein include

the following: uncertainties associated generally with research and

development, clinical trials and related regulatory approvals; the

risk that sales may not meet expectations and related cost may

increase beyond expectations; the risk that patents may not be

upheld in patent litigation and applications may not result in

issued patents sufficient to protect the Vascepa franchise. A

further list and description of these risks, uncertainties and

other risks associated with an investment in Amarin can be found in

Amarin's filings with the U.S. Securities and Exchange Commission,

including its most recent annual report on Form 10-K. Existing and

prospective investors are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

hereof. Amarin undertakes no obligation to update or revise the

information contained in this press release, whether as a result of

new information, future events or circumstances or otherwise.

Availability of Other Information About

Amarin

Investors and others should note that Amarin

communicates with its investors and the public using the company

website (http://www.amarincorp.com/), the investor relations

website (http://investor.amarincorp.com/), including but not

limited to investor presentations and investor FAQs, Securities and

Exchange Commission filings, press releases, public conference

calls and webcasts. The information that Amarin posts on

these channels and websites could be deemed to be material

information. As a result, Amarin encourages investors, the

media, and others interested in Amarin to review the information

that is posted on these channels, including the investor relations

website, on a regular basis. This list of channels may be

updated from time to time on Amarin’s investor relations website

and may include social media channels. The contents of

Amarin’s website or these channels, or any other website that may

be accessed from its website or these channels, shall not be deemed

incorporated by reference in any filing under the Securities Act of

1933.

References

1 Bhatt DL, Steg PG, Miller M, Brinton EA,

Jacobson TA, Ketchum SB, Doyle RT, Juliano RA, Jiao L, Granowitz C,

Tardif JC, Ballantyne CM, for the REDUCE-IT Investigators.

Cardiovascular Risk Reduction with Icosapent Ethyl for

Hypertriglyceridemia. N Engl J Med 2019;380:11-22.

2 American Heart Association. 2018.

Disease and Stroke Statistics-2018 Update.

3 American Heart Association. 2017.

Cardiovascular disease: A costly burden for America projections

through 2035.

4 Ganda OP, Bhatt DL, Mason RP, et al. Unmet

need for adjunctive dyslipidemia therapy in hypertriglyceridemia

management. J Am Coll Cardiol. 2018;72(3):330-343.

5 Budoff M. Triglycerides and triglyceride-rich

lipoproteins in the causal pathway of cardiovascular disease. Am J

Cardiol. 2016;118:138-145.

6 Toth PP, Granowitz C, Hull M, et al. High

triglycerides are associated with increased cardiovascular events,

medical costs, and resource use: A real-world administrative claims

analysis of statin-treated patients with high residual

cardiovascular risk. J Am Heart Assoc. 2018;7(15):e008740.

7 Nordestgaard BG. Triglyceride-rich

lipoproteins and atherosclerotic cardiovascular disease - New

insights from epidemiology, genetics, and biology. Circ Res.

2016;118:547-563.

8 Nordestgaard BG, Varbo A. Triglycerides and

cardiovascular disease. Lancet. 2014;384:626–635.

Amarin Contact Information

Investor Relations:

Elisabeth SchwartzInvestor Relations and Corporate

CommunicationsAmarin Corporation plcIn U.S.: +1 (908)

719-1315investor.relations@amarincorp.com (investor

inquiries)PR@amarincorp.com (media inquiries)

Lee M. Stern Solebury Trout In U.S.: +1 (646)

378-2992lstern@soleburytrout.com

| |

| CONSOLIDATED BALANCE SHEET DATA |

| (U.S. GAAP) |

| Unaudited* |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

December 31, 2018 |

|

December 31, 2017 |

| |

|

|

|

|

|

(in thousands) |

|

ASSETS |

|

|

|

|

| Current

Assets: |

|

|

|

|

| Cash and

cash equivalents |

|

$ |

249,227 |

|

|

$ |

73,637 |

|

|

Restricted cash |

|

|

1,500 |

|

|

|

600 |

|

| Accounts

receivable, net |

|

|

66,523 |

|

|

|

45,318 |

|

|

Inventory |

|

|

57,802 |

|

|

|

30,260 |

|

| Prepaid

and other current assets |

|

|

2,945 |

|

|

|

3,455 |

|

| Total

current assets |

|

|

377,997 |

|

|

|

153,270 |

|

| Property,

plant and equipment, net |

|

|

63 |

|

|

|

28 |

|

| Other

long-term assets |

|

|

174 |

|

|

|

174 |

|

|

Intangible asset, net |

|

|

7,480 |

|

|

|

8,126 |

|

|

TOTAL ASSETS |

|

$ |

385,714 |

|

|

$ |

161,598 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

(DEFICIT) |

|

|

|

|

| Current

Liabilities: |

|

|

|

|

| Accounts

payable |

|

$ |

37,632 |

|

|

$ |

25,155 |

|

| Accrued

expenses and other current liabilities |

|

|

84,171 |

|

|

|

58,902 |

|

| Current

portion of exchangeable senior notes, net of discount |

|

|

— |

|

|

|

481 |

|

| Current

portion of long-term debt from royalty-bearing instrument |

|

|

34,240 |

|

|

|

22,348 |

|

| Deferred

revenue, current |

|

|

1,220 |

|

|

|

1,644 |

|

| Total

current liabilities |

|

|

157,263 |

|

|

|

108,530 |

|

| Long-Term

Liabilities: |

|

|

|

|

|

Exchangeable senior notes, net of discount |

|

|

— |

|

|

|

28,992 |

|

| Long-term

debt from royalty-bearing instrument |

|

|

46,108 |

|

|

|

70,834 |

|

| Deferred

revenue, long-term |

|

|

19,490 |

|

|

|

17,192 |

|

| Other

long-term liabilities |

|

|

10,523 |

|

|

|

1,150 |

|

| Total

liabilities |

|

|

233,384 |

|

|

|

226,698 |

|

|

Stockholders’ Equity (Deficit): |

|

|

|

|

| Preferred

Stock |

|

|

21,850 |

|

|

|

24,364 |

|

| Common

stock |

|

|

246,663 |

|

|

|

208,768 |

|

|

Additional paid-in capital |

|

|

1,282,762 |

|

|

|

977,866 |

|

| Treasury

stock |

|

|

(10,413 |

) |

|

|

(4,229 |

) |

|

Accumulated deficit |

|

|

(1,388,532 |

) |

|

|

(1,271,869 |

) |

| Total

stockholders’ equity (deficit) |

|

|

152,330 |

|

|

|

(65,100 |

) |

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY

(DEFICIT) |

|

$ |

385,714 |

|

|

$ |

161,598 |

|

| * Unaudited as standalone schedule; copied from consolidated

financial statements. |

|

|

|

| |

|

|

|

| |

| CONSOLIDATED STATEMENTS OF OPERATIONS

DATA |

| (U.S. GAAP) |

| |

| |

|

Unaudited |

|

Unaudited* |

| |

|

Three months ended December 31, |

|

Twelve months ended December 31, |

| |

|

(in thousands, except per share

amounts) |

|

(in thousands, except per share

amounts) |

|

|

|

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

|

|

2017 |

|

| Product revenue, net |

$ |

77,085 |

|

|

$ |

53,482 |

|

|

$ |

228,371 |

|

|

$ |

179,825 |

|

| Licensing revenue |

|

245 |

|

|

|

384 |

|

|

|

843 |

|

|

|

1,279 |

|

| Total revenue, net |

|

77,330 |

|

|

|

53,866 |

|

|

|

229,214 |

|

|

|

181,104 |

|

| Less: Cost of goods sold |

|

17,509 |

|

|

|

13,432 |

|

|

|

54,543 |

|

|

|

44,952 |

|

| Gross margin |

|

59,821 |

|

|

|

40,434 |

|

|

|

174,671 |

|

|

|

136,152 |

|

| Operating expenses: |

|

|

|

|

|

|

|

| Selling, general and administrative (1) |

|

79,686 |

|

|

|

35,639 |

|

|

|

226,996 |

|

|

|

134,549 |

|

| Research and development (1) |

|

11,906 |

|

|

|

11,947 |

|

|

|

55,900 |

|

|

|

47,158 |

|

| Total operating expenses |

|

91,592 |

|

|

|

47,586 |

|

|

|

282,896 |

|

|

|

181,707 |

|

| Operating loss |

|

(31,771 |

) |

|

|

(7,152 |

) |

|

|

(108,225 |

) |

|

|

(45,555 |

) |

| Interest expense, net |

|

(1,611 |

) |

|

|

(2,240 |

) |

|

|

(7,798 |

) |

|

|

(9,337 |

) |

| Other (expense) income, net |

|

(192 |

) |

|

|

(26 |

) |

|

|

(326 |

) |

|

|

74 |

|

| Loss from operations before taxes |

|

(33,574 |

) |

|

|

(9,418 |

) |

|

|

(116,349 |

) |

|

|

(54,818 |

) |

| Provision for income taxes (2) |

|

(96 |

) |

|

|

(13,047 |

) |

|

|

(96 |

) |

|

|

(13,047 |

) |

| Net loss |

$ |

(33,670 |

) |

|

$ |

(22,465 |

) |

|

$ |

(116,445 |

) |

|

$ |

(67,865 |

) |

| Loss per share: |

|

|

|

|

|

|

|

| Basic |

$ |

(0.11 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.39 |

) |

|

$ |

(0.25 |

) |

| Diluted |

$ |

(0.11 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.39 |

) |

|

$ |

(0.25 |

) |

| Weighted average shares outstanding: |

|

|

|

|

|

|

|

| Basic |

|

314,183 |

|

|

|

270,906 |

|

|

|

297,237 |

|

|

|

270,652 |

|

| Diluted |

|

314,183 |

|

|

|

270,906 |

|

|

|

297,237 |

|

|

|

270,652 |

|

| |

|

|

|

|

|

|

|

|

| * Unaudited as standalone schedule; copied from

consolidated financial statements. |

| |

|

|

|

|

|

|

|

|

| (1) Excluding non-cash stock-based compensation,

selling, general and administrative expenses were $211,088 and

$122,711 for 2018 and 2017, respectively, and research and

development expenses were $53,002 and $45,036, respectively, for

the same periods. Excluding non-cash stock-based compensation as

well as co-promotion fees paid to the company's U.S. co-promotion

partner, selling, general and administrative expenses were $164,267

and $100,204 for 2018 and 2017, respectively. |

| |

|

|

|

|

|

|

|

|

| (2) Included in the provision for the year ended

December 31, 2017 is non-cash tax expense related to increases in

our valuation allowance against deferred tax assets. |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

| |

RECONCILIATION OF NON-GAAP NET

LOSS |

| |

Unaudited |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

Three months ended December 31, |

|

Twelve months ended December 31, |

| |

|

|

(in thousands, except per share

amounts) |

|

(in thousands, except per share

amounts) |

| |

|

|

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

|

|

2017 |

|

| |

Net loss for EPS1 - GAAP |

$ |

(33,670 |

) |

|

$ |

(22,465 |

) |

|

$ |

(116,445 |

) |

|

$ |

(67,865 |

) |

| |

|

Non-cash

stock-based compensation expense |

|

4,775 |

|

|

|

3,489 |

|

|

|

18,806 |

|

|

|

13,960 |

|

| |

Adjusted net loss for EPS1 - non-GAAP |

$ |

(28,895 |

) |

|

$ |

(18,976 |

) |

|

$ |

(97,639 |

) |

|

$ |

(53,905 |

) |

| |

|

|

|

|

|

|

|

|

|

| |

1basic and diluted |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Loss per share: |

|

|

|

|

|

|

|

| |

Basic and diluted - non-GAAP |

$ |

(0.09 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.33 |

) |

|

$ |

(0.20 |

) |

| |

|

|

|

|

|

|

|

|

|

| |

Weighted average shares: |

|

|

|

|

|

|

|

| |

Basic and

diluted |

|

314,183 |

|

|

|

270,906 |

|

|

|

297,237 |

|

|

|

270,652 |

|

| |

|

|

|

|

|

|

|

|

|

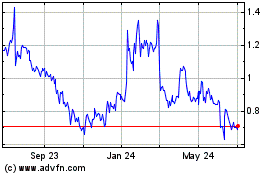

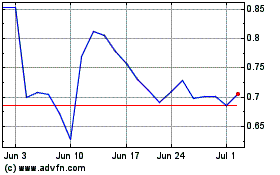

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Apr 2023 to Apr 2024