|

|

UNITED STATES

|

|

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

|

|

Washington, D.C. 20549

|

|

Under the Securities Exchange Act of 1934

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

RULE 13d-2(a)

(Amendment No.

6

)*

Twinlab Consolidated Holdings, Inc.

(Name of Issuer)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

(CUSIP Number)

David L. Van Andel

3133 Orchard Vista Drive SE

Grand Rapids, MI 49546

Telephone: (616) 234-5355

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-l(e), 240.13d-l(f) or 240.13d-l(g), check the following box.

o

Note

: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

1.

|

Names of Reporting Persons

David L. Van Andel

|

|

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

x

|

|

|

|

(b)

|

o

|

|

|

|

|

3.

|

SEC Use Only

|

|

|

|

|

4.

|

Source of Funds (See Instructions)

OO

|

|

|

|

|

5.

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

o

|

|

|

|

|

6.

|

Citizenship or Place of Organization

United States

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7.

|

Sole Voting Power

120,793,028

|

|

|

|

8.

|

Shared Voting Power

212,559,664 (1)

|

|

|

|

9.

|

Sole Dispositive Power

120,793,028

|

|

|

|

10.

|

Shared Dispositive Power

0

|

|

|

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

120,793,028

|

|

|

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

x

|

|

|

|

|

13.

|

Percent of Class Represented by Amount in Row (11)

46.7% (2)

|

|

|

|

|

14.

|

Type of Reporting Person (See Instructions)

IN

|

|

|

|

|

|

|

|

(1)

Please refer to the disclosure under Item 5(b) below.

(2)

Based on (a) 254,441,733 shares of Common Stock of the Company outstanding as reported by the Company as of November 16, 2018 and (b) 4,500,000 shares of Common Stock issuable upon the exercise of warrants.

2

|

|

1.

|

Names of Reporting Persons

Little Harbor LLC

|

|

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

x

|

|

|

|

(b)

|

o

|

|

|

|

|

3.

|

SEC Use Only

|

|

|

|

|

4.

|

Source of Funds (See Instructions)

OO

|

|

|

|

|

5.

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

o

|

|

|

|

|

6.

|

Citizenship or Place of Organization

Nevada

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7.

|

Sole Voting Power

33,168,948

|

|

|

|

8.

|

Shared Voting Power

33,168,948 (1)

|

|

|

|

9.

|

Sole Dispositive Power

33,168,948

|

|

|

|

10.

|

Shared Dispositive Power

0

|

|

|

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

33,168,948

|

|

|

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

|

|

|

|

13.

|

Percent of Class Represented by Amount in Row (11)

13.0% (2)

|

|

|

|

|

14.

|

Type of Reporting Person (See Instructions)

OO

|

|

|

|

|

|

|

|

(1)

Please refer to the disclosure under Item 5(b) below.

(2)

Based on 254,441,733 shares of Common Stock of the Company outstanding as reported by the Company as of November 16, 2018.

3

|

|

1.

|

Names of Reporting Persons.

David L. Van Andel Trust u/a dated November 30, 1993

|

|

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

x

|

|

|

|

(b)

|

o

|

|

|

|

|

3.

|

SEC Use Only

|

|

|

|

|

4.

|

Source of Funds (See Instructions)

OO

|

|

|

|

|

5.

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

o

|

|

|

|

|

6.

|

Citizenship or Place of Organization

Michigan

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7.

|

Sole Voting Power

34,791,814

|

|

|

|

8.

|

Shared Voting Power

34,791,814 (1)

|

|

|

|

9.

|

Sole Dispositive Power

34,791,814

|

|

|

|

10.

|

Shared Dispositive Power

0

|

|

|

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

34,791,814

|

|

|

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

|

|

|

|

13.

|

Percent of Class Represented by Amount in Row (11)

13.7% (2)

|

|

|

|

|

14.

|

Type of Reporting Person (See Instructions)

OO

|

|

|

|

|

|

|

|

(1)

Please refer to the disclosure under Item 5(b) below.

(2)

Based on 254,441,733 shares of Common Stock of the Company outstanding as reported by the Company as of November 16, 2018.

4

|

|

1.

|

Names of Reporting Persons

Great Harbor Capital, LLC

|

|

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

x

|

|

|

|

(b)

|

o

|

|

|

|

|

3.

|

SEC Use Only

|

|

|

|

|

4.

|

Source of Funds (See Instructions)

OO

|

|

|

|

|

5.

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

o

|

|

|

|

|

6.

|

Citizenship or Place of Organization

Delaware

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7.

|

Sole Voting Power

52,832,266

|

|

|

|

8.

|

Shared Voting Power

212,559,664 (1)

|

|

|

|

9.

|

Sole Dispositive Power

52,832,266

|

|

|

|

10.

|

Shared Dispositive Power

0

|

|

|

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

52,832,266

|

|

|

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

x

|

|

|

|

|

13.

|

Percent of Class Represented by Amount in Row (11)

20.4% (2)

|

|

|

|

|

14.

|

Type of Reporting Person (See Instructions)

OO

|

|

|

|

|

|

|

|

(1)

Please refer to the disclosure under Item 5(b) below.

(2)

Based on (a) 254,441,733 shares of Common Stock of the Company outstanding as reported by the Company as of November 16, 2018 and (b) 4,500,000 shares of Common Stock issuable upon the exercise of warrants.

5

EXPLANATORY NOTE

This Amendment No. 6 amends and supplements the Statement of Beneficial Ownership on Schedule 13D previously filed jointly by David L. Van Andel (“Van Andel”), Little Harbor LLC, a Nevada limited liability company (“LH”), the David L. Van Andel Trust u/a dated November 30, 1993, a trust formed under the laws of the State of Michigan (the “VA Trust”), and Great Harbor Capital, LLC, a Delaware limited liability company (“GH”) with the Securities and Exchange Commission (the “SEC”) on September 25, 2014 (the “Original Schedule 13D”) as amended by Amendment No. 1, filed on November 18, 2014, Amendment No. 2, filed on June 15, 2015, Amendment No. 3, filed on September 29, 2015, Amendment No. 4, filed on November 2, 2015, and Amendment No. 5, filed on February 4, 2016 (collectively with the Original Schedule 13D, the “Statement”).

Except as set forth below, all Items of the Statement remain unchanged. All capitalized terms not otherwise defined herein shall have the meanings ascribed to such terms in the Statement.

Item 1. Security and Issuer.

Item 1 of the Statement is hereby amended and restated in its entirety as follows:

This Statement relates to the common stock, par value $0.001 per share (the “Common Stock”), of Twinlab Consolidated Holdings, Inc., a Nevada corporation formerly named Mirror Me, Inc. (the “Company”). The Company’s principal executive offices are located at 4800 T-Rex Avenue, Suite 305, Boca Raton, Florida 33431.

Item 3. Source and Amount of Funds or Other Consideration.

Item 3 of the Statement is hereby amended by adding the following text as the last full paragraphs thereof:

On March 21, 2016, GH lent the Company $7,000,000 pursuant to that certain Unsecured Promissory Note, dated March 21, 2016 (the “March 2016 Note”). The March 2016 Note provided that the Company issue GH a warrant to purchase an aggregate of 3,181,816 shares of Common Stock at an exercise price of $.01 per share (the “March 2016 Warrant”).

The March 2016 Warrant is not exercisable unless and until the Company fails to pay GH the entire unamortized principal amount of the March 2016 Note and any accrued and unpaid interest thereon as of the Maturity Date (as defined in the March 2016 Note) or such earlier date as is required pursuant to an Acceleration Notice (as defined in the March 2016 Note).

The foregoing descriptions of the March 2016 Note and the March 2016 Warrant are qualified in their entirety by reference to the full text of such documents, which documents are exhibits to the Company’s Current Report on Form 8-K filed with the SEC by the Company on March 25, 2016.

On July 21, 2016, LH agreed to loan the Company up to $4,769,996 pursuant to that certain Unsecured Delayed Draw Promissory Note, dated July 21, 2016 (the “July 2016 Note”). The July 2016 Note provided that the Company issue LH a warrant to purchase an aggregate of 2,168,178 shares of Common Stock at an exercise price of $.01 per share (the “July 2016 Warrant”).

The July 2016 Warrant is not exercisable unless and until the Company fails to pay LH the entire unamortized principal amount of the July 2016 Note and any accrued and unpaid interest thereon as of the Maturity Date (as defined in the July 2016 Note) or such earlier date as is required pursuant to an Acceleration Notice (as defined in the July 2016 Note).

6

The foregoing descriptions of the July 2016 Note and the July 2016 Warrant are qualified in their entirety by reference to the full text of such documents, which documents are exhibits to the Company’s Current Report on Form 8-K filed with the SEC by the Company on July 27, 2016.

On December 30, 2016, GH lent the Company $2,500,000 pursuant to that certain Unsecured Promissory Note, dated December 30, 2016 (the “December 2016 Note”). The December 2016 Note provided that the Company issue GH a warrant to purchase an aggregate of 1,136,363 shares of Common Stock at an exercise price of $.01 per share (the “December 2016 Warrant”).

The December 2016 Warrant is not exercisable unless and until the Company fails to pay GH the entire unamortized principal amount of the December 2016 Note and any accrued and unpaid interest thereon as of the Maturity Date (as defined in the December 2016 Note) or such earlier date as is required pursuant to an Acceleration Notice (as defined in the December 2016 Note).

The foregoing descriptions of the December 2016 Note and the December 2016 Warrant are qualified in their entirety by reference to the full text of such documents, which documents are exhibits to the Company’s Current Report on Form 8-K filed with the SEC by the Company on January 6, 2017.

On August 30, 2017, GH lent the Company $3,000,000 pursuant to that certain Secured Promissory Note, dated August 30, 2017 (the “August 2017 Note”). The August 2017 Note provided that the Company issue GH a warrant to purchase an aggregate of 1,363,636 shares of Common Stock at an exercise price of $.01 per share (the “August 2017 Warrant”).

The August 2017 Warrant is not exercisable unless and until the Company fails to pay GH the entire unamortized principal amount of the August 2017 Note and any accrued and unpaid interest thereon as of the Maturity Date (as defined in the August 2017 Note) or such earlier date as is required pursuant to an Acceleration Notice (as defined in the August 2017 Note).

The foregoing descriptions of the August 2017 Note and the August 2017 Warrant are qualified in their entirety by reference to the full text of such documents, which documents are exhibits to the Company’s Current Report on Form 8-K filed with the SEC by the Company on September 6, 2017.

On February 6, 2018, GH lent the Company $2,000,000 pursuant to that certain Secured Promissory Note, dated February 6, 2018 (the “February 2018 Note”). The February 2018 Note provided that the Company issue GH a warrant to purchase an aggregate of 1,818,182 shares of Common Stock at an exercise price of $.01 per share (the “February 2018 Warrant”).

The February 2018 Warrant is not exercisable unless and until the Company fails to pay GH the entire unamortized principal amount of the February 2018 Note and any accrued and unpaid interest thereon as of the Maturity Date (as defined in the February 2018 Note) or such earlier date as is required pursuant to an Acceleration Notice (as defined in the February 2018 Note).

On July 27, 2018, GH lent the Company $5,000,000 pursuant to that certain Secured Promissory Note, dated July 27, 2018 (the “July 2018 Note”). The July 2018 Note provided that the Company issue GH a warrant to purchase an aggregate of 2,500,000 shares of Common Stock at an exercise price of $.01 per share (the “July 2018 Warrant”).

The July 2018 Warrant is exercisable on any business day prior to the expiration date of July 27, 2024.

On November 5, 2018, GH lent the Company $4,000,000 pursuant to that certain Secured Promissory Note, dated November 5, 2018 (the “November 2018 Note”). The November 2018 Note provided that the Company issue GH a warrant to purchase an aggregate of 2,000,000 shares of Common Stock at an exercise price of $.01 per share (the “November 2018 Warrant”).

7

The November 2018 Warrant is exercisable on any business day prior to the expiration date of November 5, 2024.

Item 5. Interest in Securities of the Issuer.

Item 5(a) of the Statement is hereby amended and restated in its entirety as follows:

(a) Van Andel beneficially owns (as defined by Rule 13d-3 under the Act) 120,793,028 shares, or 46.7% of the shares, of Common Stock outstanding as of November 16, 2018. Of such shares, 4,500,000 shares are issuable pursuant to warrants. LH beneficially owns (as defined by Rule 13d-3 under the Act) 33,168,948 shares, or 13.0% of the shares of Common Stock outstanding as of November 16, 2018. The VA Trust beneficially owns (as defined by Rule 13d-3 under the Act) 34,791,814 shares, or 13.7% of the shares of Common Stock outstanding as of November 16, 2018. GH beneficially owns (as defined by Rule 13d-3 under the Act) 52,832,266 shares, or 20.4% of the shares of Common Stock outstanding as of November 16, 2018. Of such shares, 4,500,000 shares are issuable pursuant to warrants. By virtue of his being the (i) Manager of LH; (ii) Trustee of the VA Trust and (iii) Manager of GH, Van Andel is deemed to beneficially own the shares of Common Stock owned by LH, the VA Trust and GH. Notwithstanding the foregoing, Van Andel disclaims beneficial ownership of the shares of Common Stock (i) held by LH that would exceed his percentage interests in LH and (ii) owned by Tolworthy and Golisano LLC and included in the GH Voting Agreement.

Item 5(b) of the Statement is hereby amended and restated in its entirety as follows:

(b) Van Andel has sole power to vote or to direct the vote of 120,793,028 shares of Common Stock as to all matters other than those covered in the Golisano Voting Agreement; shared power to vote or to direct the vote of (i) 120,793,028 shares of Common Stock as to the matters covered in the Golisano Voting Agreement and (ii) 212,559,664 shares of Common Stock as to the matters covered in the GH Voting Agreement; and sole power to dispose or to direct the disposition of 120,793,028 shares of Common Stock.

LH has sole power to vote or to direct the vote of 33,168,948 shares of Common Stock, as to all matters other than those covered in the Golisano Voting Agreement, shared power to vote or to direct the vote of 33,168,948 shares of Common Stock as to the matters covered in the Golisano Voting Agreement and sole power to dispose or to direct the disposition of 33,168,948 shares of Common Stock.

The VA Trust has sole power to vote or to direct the vote of 34,791,814 shares of Common Stock, as to all matters other than those covered in the Golisano Voting Agreement, shared power to vote or to direct the vote of 34,791,814 shares of Common Stock as to the matters covered in the Golisano Voting Agreement and sole power to dispose or to direct the disposition of 34,791,814 shares of Common Stock.

GH has sole power to vote or to direct the vote of 52,832,266 shares of Common Stock, as to all matters other than those covered in the Golisano Voting Agreement; shared power to vote or to direct the vote of (i) 52,832,266 shares of Common Stock as to the matters covered in the Golisano Voting Agreement and (ii) 212,559,664 shares of Common Stock as to the matter covered in the GH Voting Agreement; and sole power to dispose or to direct the disposition of 52,832,266 shares of Common Stock.

Item 5(c) of the Statement is hereby amended and restated in its entirety as follows:

Except for the transactions described in Item 3 of this Statement, none of Van Andel, LH, the VA Trust or GH effected any transaction in the Common Stock during the past sixty days.

8

Item 7.

Materials to be Filed as Exhibits.

|

Exhibit 17

|

|

Unsecured Promissory Note, dated March 21, 2016, issued by Twinlab Consolidated Holdings, Inc. in favor of Great Harbor Capital, LLC. (Incorporated herein by reference to Exhibit 10.121 to the Current Report on Form 8-K filed with the SEC on March 25, 2016 by Twinlab Consolidated Holdings, Inc.)

|

|

|

|

|

|

Exhibit 18

|

|

Warrant, dated March 21, 2016, by and between Twinlab Consolidated Holdings, Inc. and Great Harbor Capital, LLC. (Incorporated herein by reference to Exhibit 10.122 to the Current Report on Form 8-K filed with the SEC on February 3, 2016 by Twinlab Consolidated Holdings, Inc.)

|

|

|

|

|

|

Exhibit 19

|

|

Unsecured Delayed Draw Promissory Note, dated July 21, 2016, issued by Twinlab Consolidated Holdings, Inc. in favor of Little Harbor, LLC. (Incorporated herein by reference to Exhibit 10.137 to the Current Report on Form 8-K filed with the SEC on July 27, 2016 by Twinlab Consolidated Holdings, Inc.)

|

|

|

|

|

|

Exhibit 20

|

|

Warrant, dated July 21, 2016, by and between Twinlab Consolidated Holdings, Inc. and Little Harbor, LLC. (Incorporated herein by reference to Exhibit 10.138 to the Current Report on Form 8-K filed with the SEC on July 21, 2016 by Twinlab Consolidated Holdings, Inc.)

|

|

|

|

|

|

Exhibit 21

|

|

Unsecured Promissory Note, dated December 30, 2016, issued by Twinlab Consolidated Holdings, Inc. in favor of Great Harbor Capital, LLC. (Incorporated herein by reference to Exhibit 10.146 to the Current Report on Form 8-K filed with the SEC on January 6, 2017 by Twinlab Consolidated Holdings, Inc.)

|

|

|

|

|

|

Exhibit 22

|

|

Warrant, dated December 30, 2016, by and between Twinlab Consolidated Holdings, Inc. and Great Harbor Capital, LLC. (Incorporated herein by reference to Exhibit 10.147 to the Current Report on Form 8-K filed with the SEC on January 6, 2017 by Twinlab Consolidated Holdings, Inc.)

|

|

|

|

|

|

Exhibit 23

|

|

Secured Promissory Note, dated August 30, 2017, issued by Twinlab Consolidated Holdings, Inc., Twinlab Consolidation Corporation, Twinlab Holdings, Inc., ISI Brands Inc., Twinlab Corporation, Nutrascience Labs, Inc., Nutrascience Labs IP Corporation, Organic Holdings LLC, Reserve Life Organics, LLC, Resvitale, LLC, Re-Body, LLC, Innovitamin Organics, LLC, Organics Management LLC, Cocoawell, LLC, Fembody, LLC, Reserve Life Nutrition, LLC, Innovita Specialty Distribution LLC, and Joie Essance, LLC in favor of Great Harbor Capital, LLC. (Incorporated herein by reference to Exhibit 10.171 to the Current Report on Form 8-K filed with the SEC on September 6, 2017 by Twinlab Consolidated Holdings, Inc.)

|

|

|

|

|

|

Exhibit 24

|

|

Warrant, dated August 30, 2017, by and between Twinlab Consolidated Holdings, Inc. and Great Harbor Capital, LLC. (Incorporated herein by reference to Exhibit 10.172 to the Current Report on Form 8-K filed with the SEC on September 6, 2017 by Twinlab Consolidated Holdings, Inc.)

|

|

|

|

|

|

Exhibit 25

|

|

Secured Promissory Note, dated July 27, 2018, issued by Twinlab Consolidated Holdings, Inc., Twinlab Consolidation Corporation, Twinlab Holdings, Inc., ISI Brands Inc., Twinlab Corporation, Nutrascience Labs, Inc., Nutrascience Labs IP Corporation, Organic Holdings LLC, Reserve Life Organics, LLC, Resvitale, LLC, Re-Body, LLC, Innovitamin Organics, LLC, Organics Management LLC, Cocoawell, LLC, Fembody, LLC, Reserve Life Nutrition, LLC, Innovita Specialty Distribution LLC, and Joie Essance, LLC in favor of Great Harbor Capital, LLC. (Incorporated herein by reference to Exhibit 10.178 to the Quarterly Report on Form 10-Q filed with the SEC on November 19, 2018 by Twinlab Consolidated Holdings, Inc.)

|

|

|

|

|

|

Exhibit 26

|

|

Warrant, dated July 27, 2018, by and between Twinlab Consolidated Holdings, Inc. and Great Harbor Capital, LLC. (Incorporated herein by reference to Exhibit 10.179 to the Quarterly Report on Form 10-Q filed with the SEC on November 19, 2018 by Twinlab Consolidated Holdings, Inc.)

|

9

Signatures

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

Dated:

|

January 24, 2019

|

|

By:

|

/s/ David L. Van Andel

|

|

|

|

|

David L. Van Andel

|

10

Signatures

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

|

|

LITTLE HARBOR LLC

|

|

|

|

|

|

|

|

Dated:

|

January 24, 2019

|

|

By:

|

/s/ David L. Van Andel

|

|

|

|

|

|

David L. Van Andel

Manager

|

11

Signatures

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

DAVID L. VAN ANDEL TRUST U/A DATED NOVEMBER 30, 1993

|

|

|

|

|

Dated:

|

January 24, 2019

|

|

By:

|

/s/ David L. Van Andel

|

|

|

|

|

David L. Van Andel

Trustee

|

|

|

|

|

|

|

|

12

Signatures

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

|

GREAT HARBOR CAPITAL, LLC

|

|

|

|

|

|

|

Dated:

|

January 24, 2019

|

|

By:

|

/s/ David L. Van Andel

|

|

|

|

|

David L. Van Andel

Manager

|

|

|

|

|

|

|

13

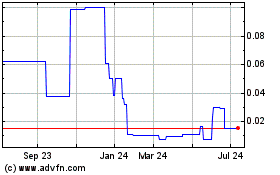

Twinlab Consolidated (PK) (USOTC:TLCC)

Historical Stock Chart

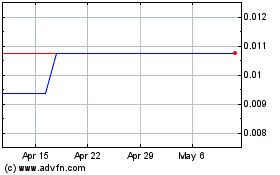

From Mar 2024 to Apr 2024

Twinlab Consolidated (PK) (USOTC:TLCC)

Historical Stock Chart

From Apr 2023 to Apr 2024