British Banks Face Ban on Unarranged Overdraft Charges

December 18 2018 - 6:21AM

Dow Jones News

By Adam Clark

U.K. banks will be banned from charging higher prices for

unarranged overdrafts, under new proposals from the Financial

Conduct Authority to clamp down on expensive lending.

The FCA said Tuesday that overdrafts had become a

"dysfunctional" market with people living in deprived areas most

likely to be penalized by higher fees. The regulator noted that in

2017, companies made more than 2.4 billion pounds ($3.0 billion)

from overdrafts.

Under the new rules, banks will only be able to charge a single

interest rate on overdrafts, with no fixed fees. Lenders will also

have to advertise their overdraft rates in a standardized manner

and will be pressured to do more to identify customers in financial

difficulty.

"Today we are proposing to make the biggest intervention in the

overdraft market for a generation. These changes would provide

greater protection for the millions of people who use an overdraft,

particularly the most vulnerable," FCA Chief Executive Andrew

Bailey said.

The FCA also reiterated proposals outlined in May in the

home-collected credit sector, which would prevent companies from

offering new loans or refinancing during home visits apart from at

the customer's request. The FCA previously said it expects its

home-collected credit proposals to save customers more than GBP34

million a year.

Consultations on the proposed measures remain open until March

18. The FCA intends to consider feedback before publishing policy

statements in June.

Write to Adam Clark at adam.clark@dowjones.com;

@AdamDowJones

(END) Dow Jones Newswires

December 18, 2018 06:06 ET (11:06 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

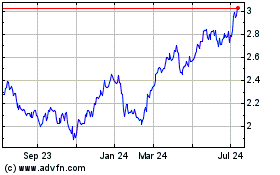

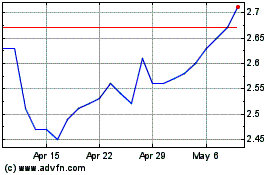

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Aug 2024 to Sep 2024

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Sep 2023 to Sep 2024