BASF Shares Drop After Profit Warning

December 10 2018 - 4:32AM

Dow Jones News

By Nathan Allen

BASF SE (BAS.XE) trades lower Monday morning as investors

respond to a profit warning issued after market close on

Friday.

The German chemical producer warned that it now expects a 15% to

20% decrease in 2018 earnings before interest and taxes before

special items, compared with previous guidance of a slight

decline.

Low water levels on the River Rhine are set to reduce

fourth-quarter earnings by around 200 million euros ($227.5

million) the company said. BASF also pointed to a sharp decline in

prices for isocyanate--a material used in the production of

polyurethanes--weak steam-cracker margins and lower demand from the

automotive industry.

At 0852 GMT BASF was trading 4% lower at EUR58.27 having earlier

fallen as low as EUR57.35.

Analysts at Jefferies said the headwinds were likely to continue

into the first half of 2019 and weigh on BASF's valuation.

Baader Helvea analyst Markus Mayer said consensus estimates for

the company's earnings are still far too high and need to be cut by

more than 10% for 2018, 2019 and 2020.

Write to Nathan Allen at nathan.allen@dowjones.com

(END) Dow Jones Newswires

December 10, 2018 04:17 ET (09:17 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

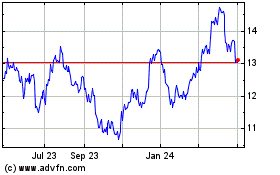

BASF (QX) (USOTC:BASFY)

Historical Stock Chart

From Aug 2024 to Sep 2024

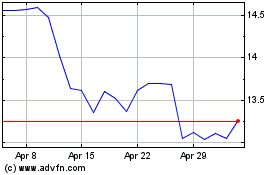

BASF (QX) (USOTC:BASFY)

Historical Stock Chart

From Sep 2023 to Sep 2024